Breathtaking Info About Salary Paid In Advance Balance Sheet What Are Retained Earnings On The

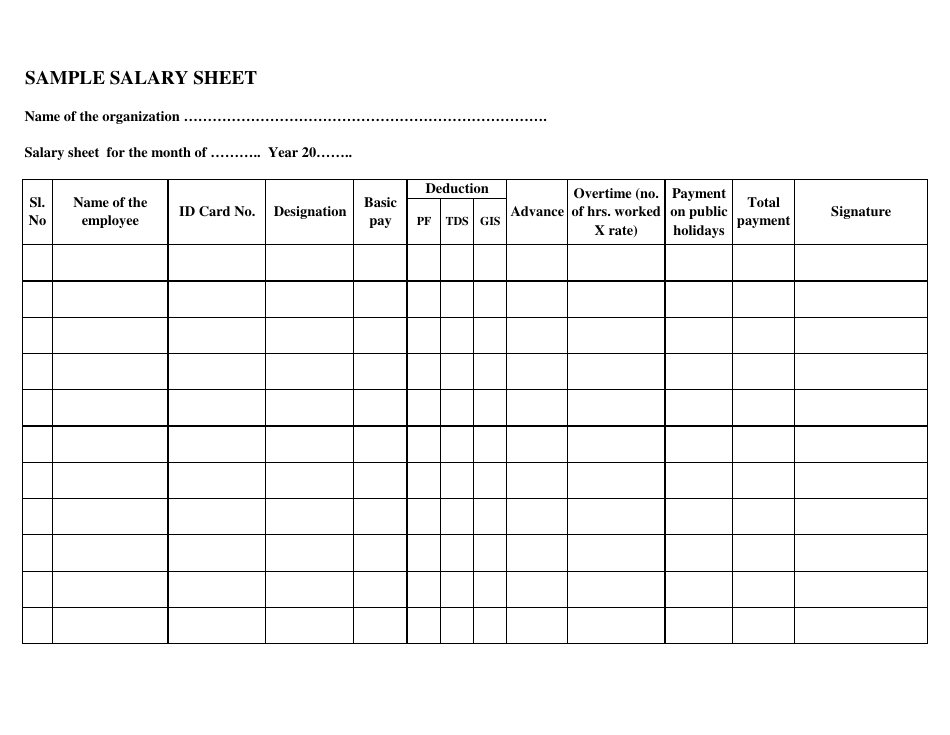

Salary paid in advance journal entry.

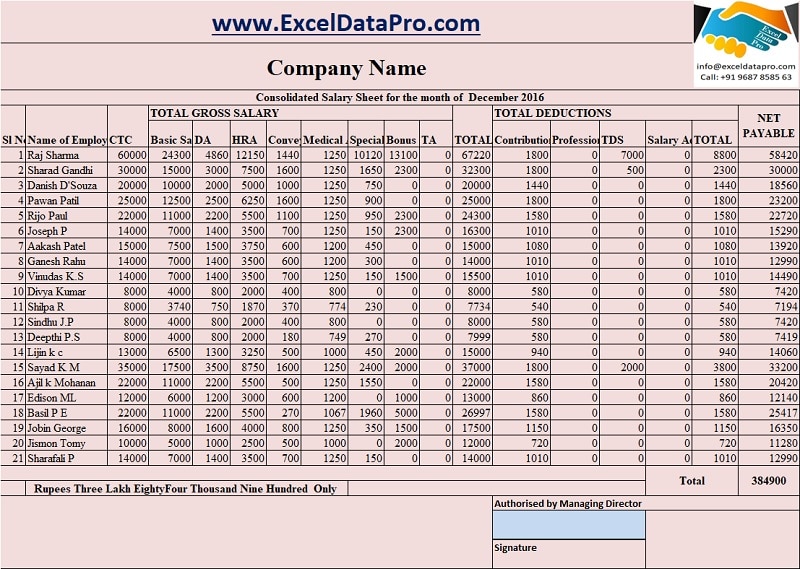

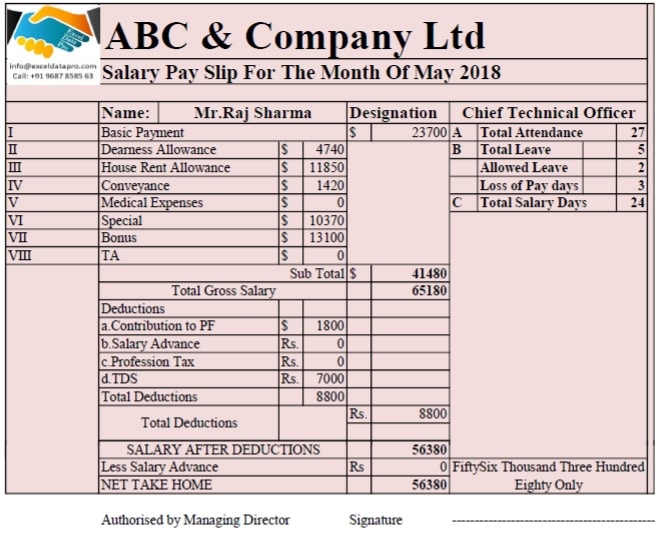

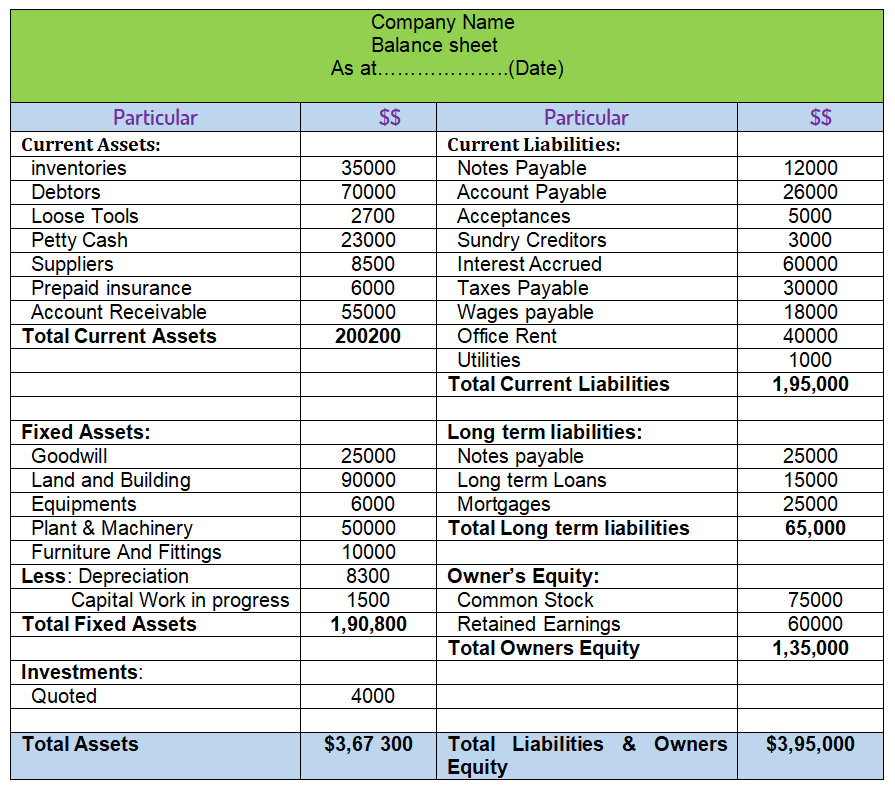

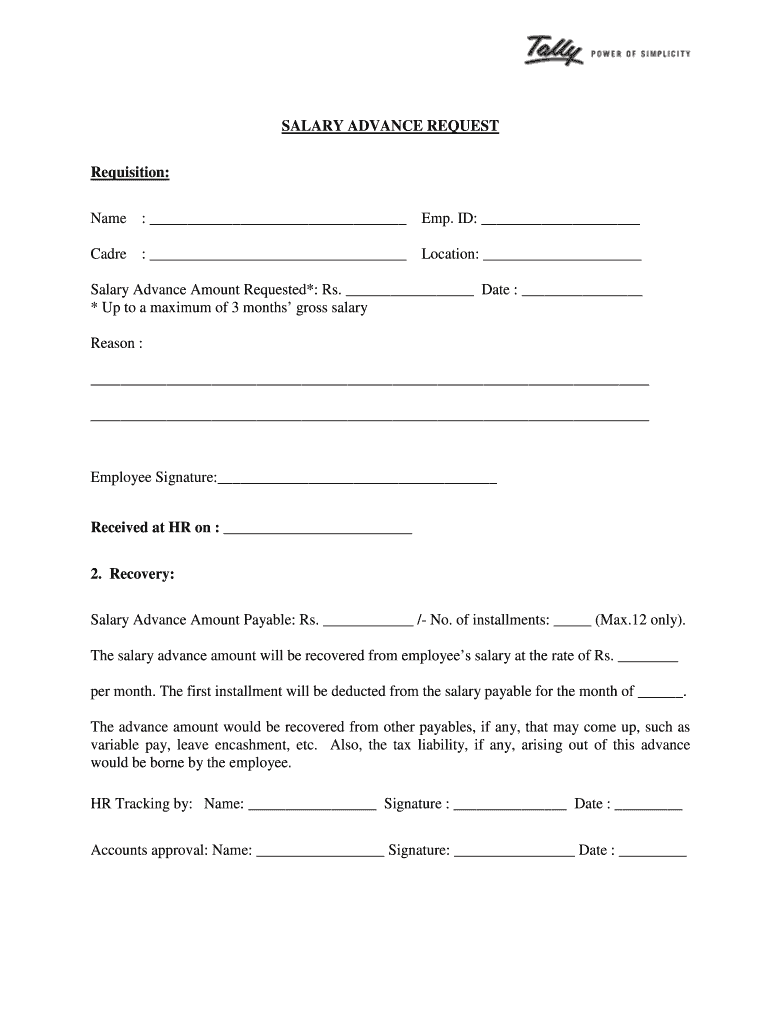

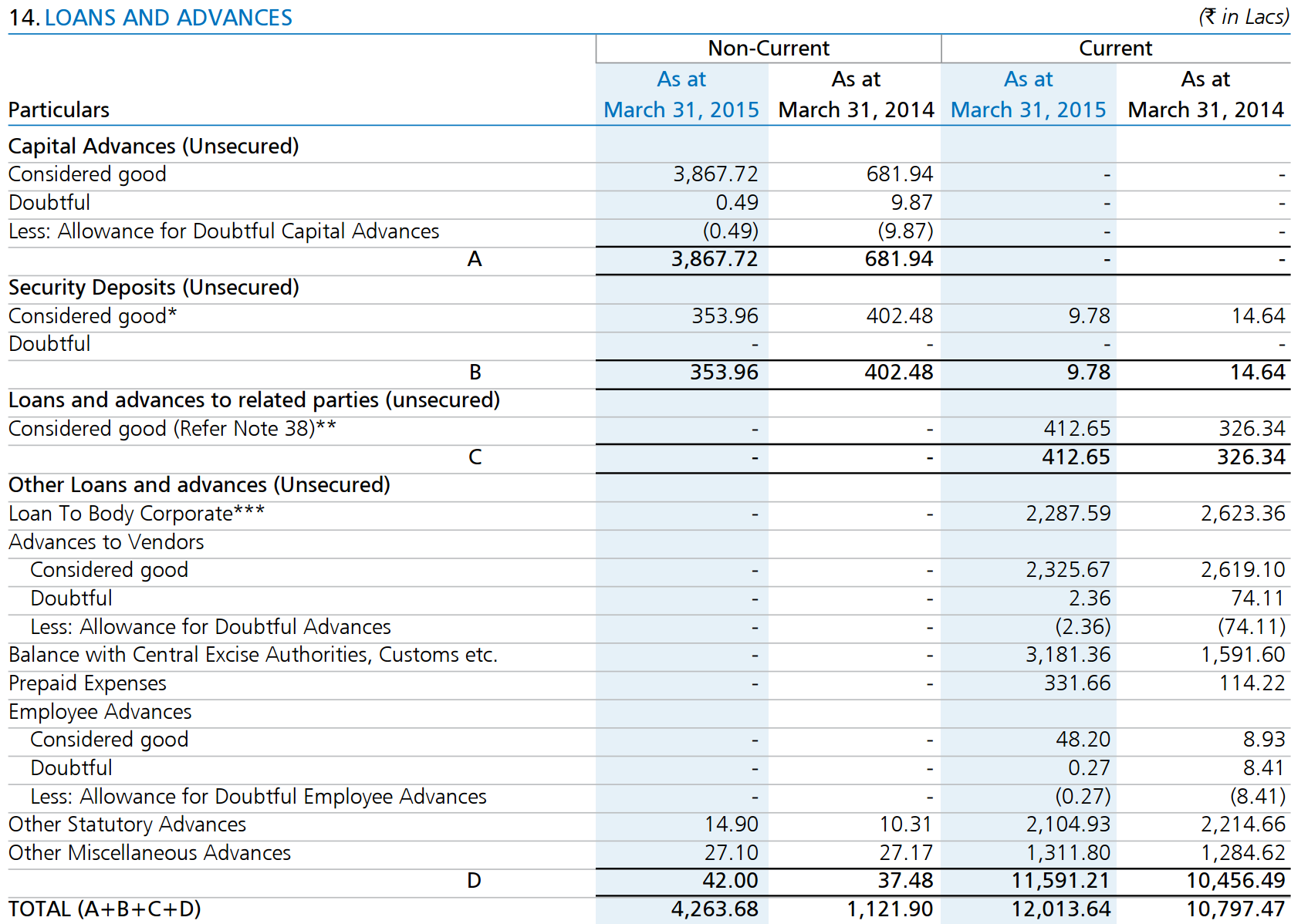

Salary paid in advance in balance sheet. Advance payments are recorded as assets on a company's balance sheet. It is the amount of salary paid by an entity in. Because the company expects to be paid back by the employee and the payback period is normally less than a year, the company usually treats an advance to the employee as a.

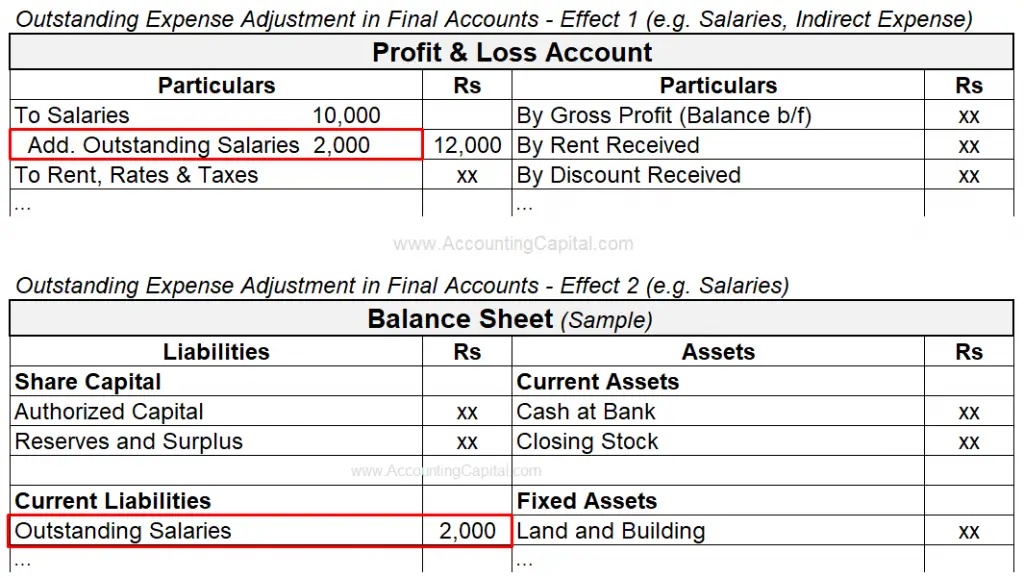

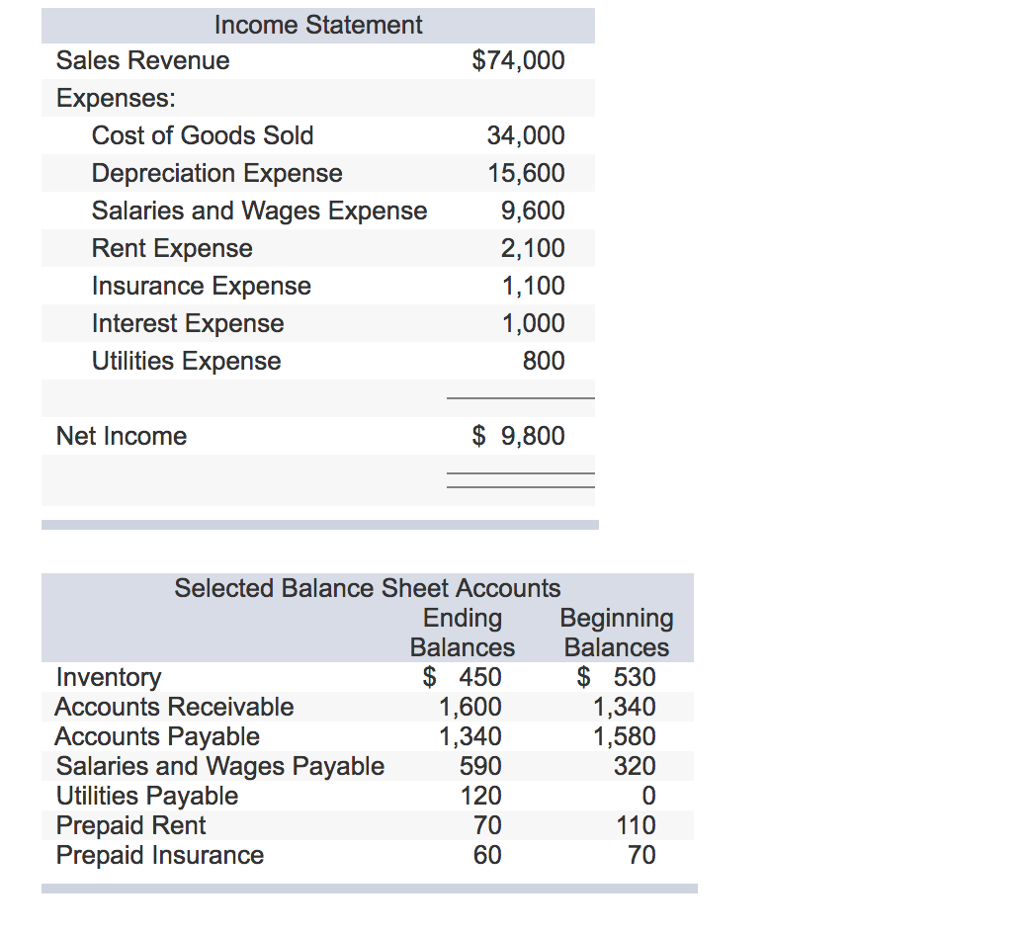

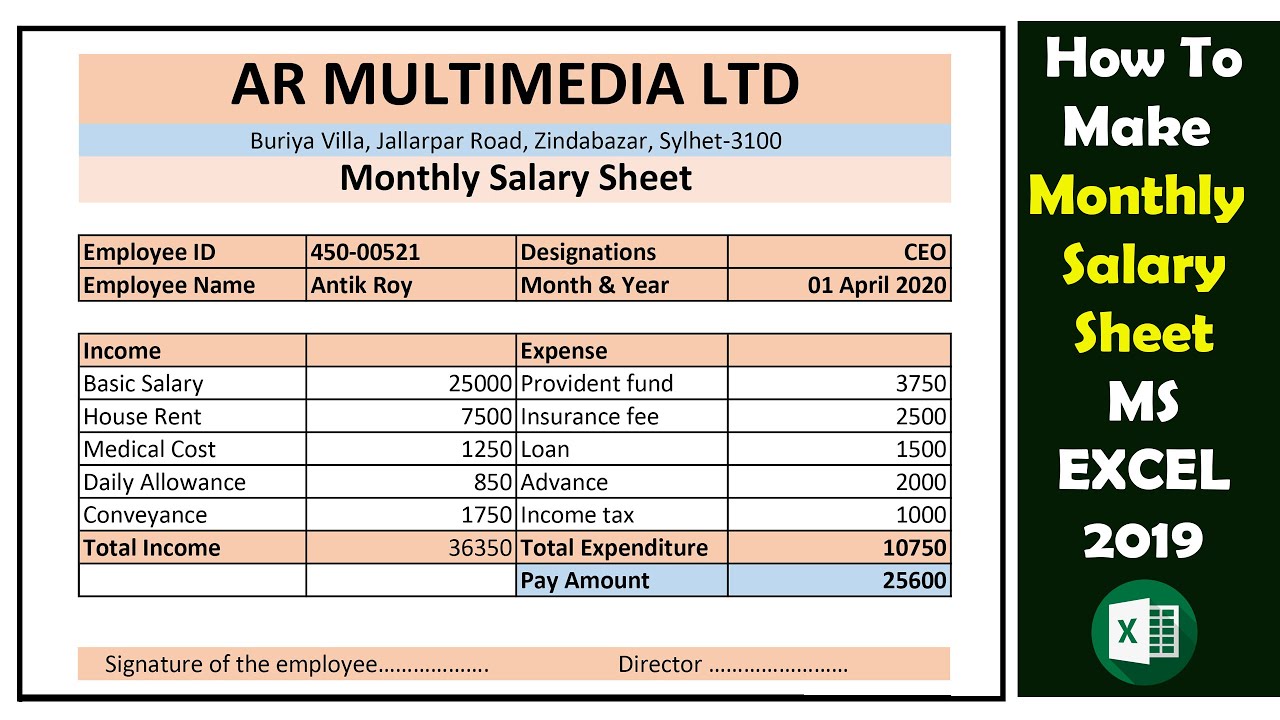

Journal entry for salary paid in advance. A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. These amounts affect the bottom line of your income statement, which affects the assets and.

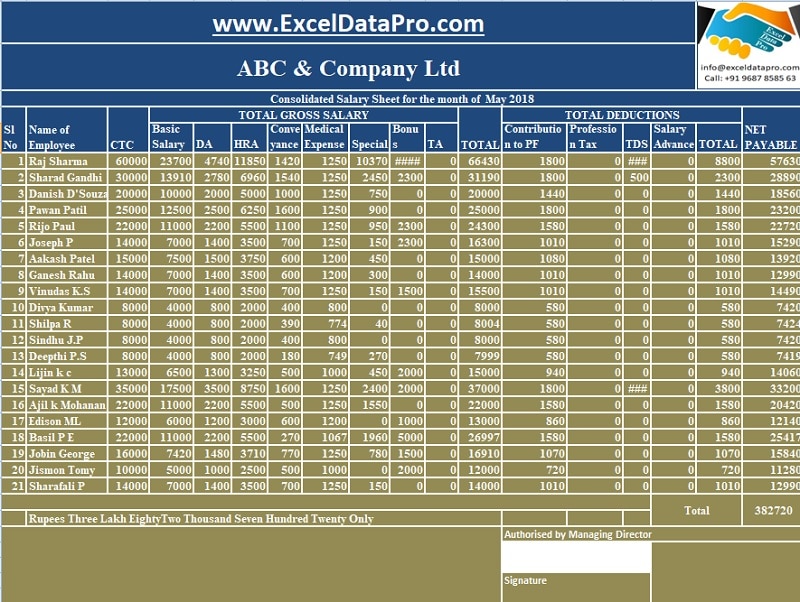

The salary expense $ 11,000 will appear on the income statement and cash $ 11,000 will deduct from the cash account on balance sheet. It is further shown under the head current asset in the balance sheet. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable.

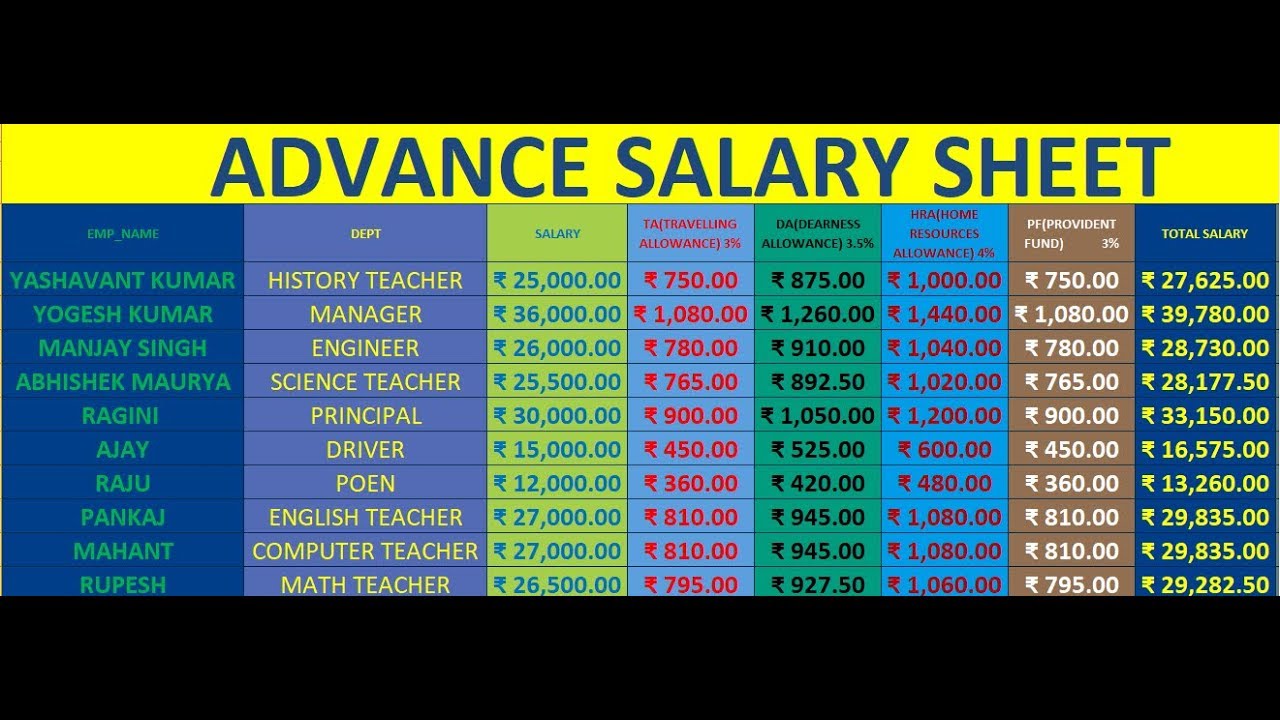

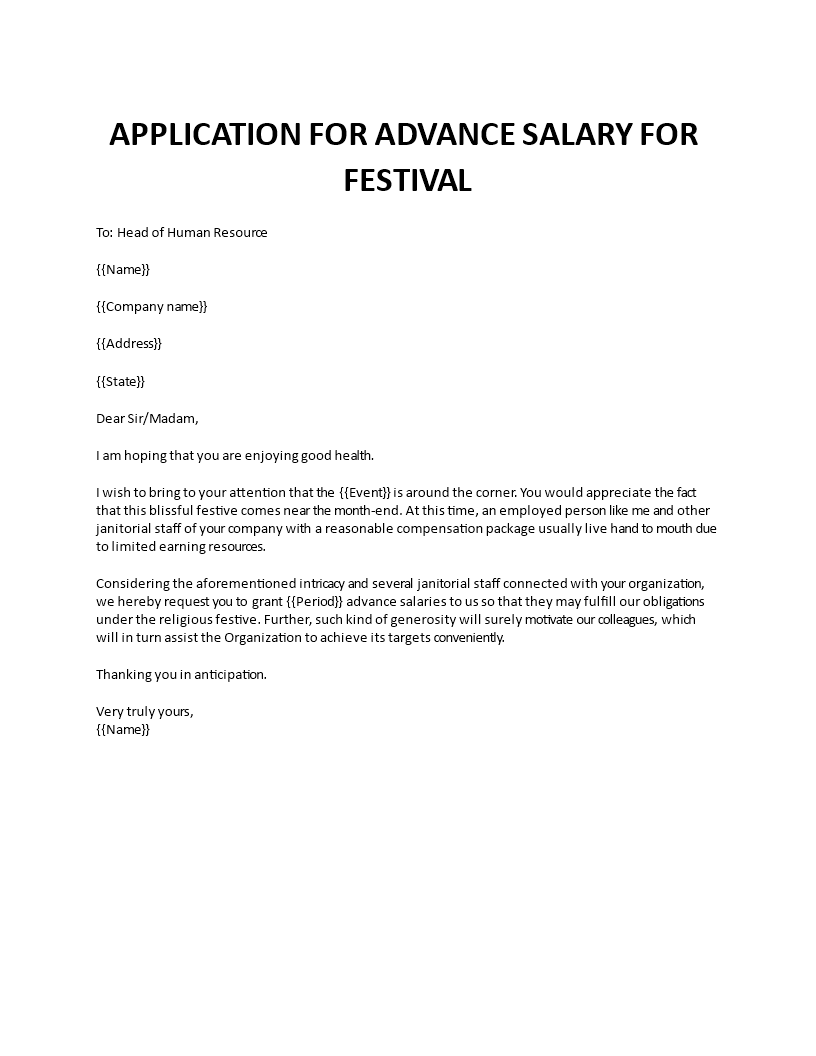

Advance to employees represents the amount of money that an employee owes to a. Where does revenue received in advance go on a balance sheet? Salary paid in advance is also known as prepaid salary (it is a prepaid expense ).

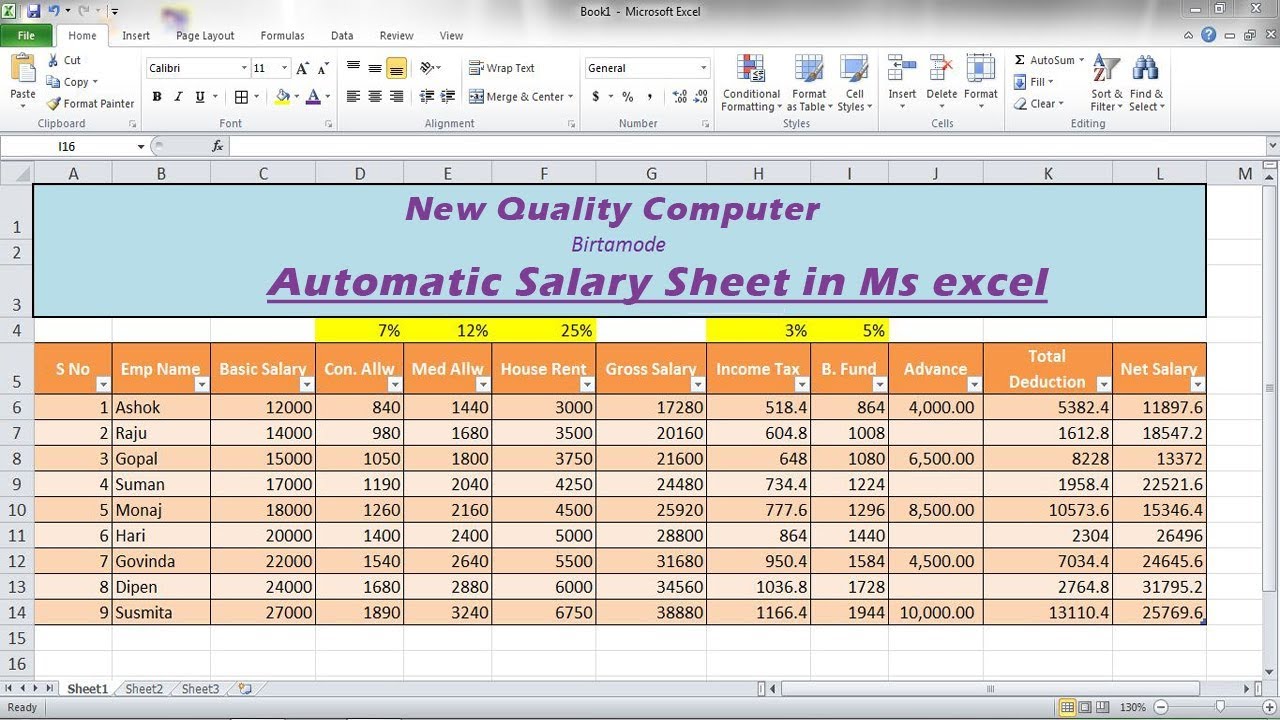

As such, it is recorded as a current asset in the company's balance sheet. Advances salary are reported as current assets on the balance sheet instead of expenses. If an income that belongs to a future accounting period is received in the current accounting period it is considered as income received in advance, also known as unearned income.

Salaries are paid to on the 26th of every month and. Director’s remuneration is the amount paid to the directors of a company either in cash or by using the company’s property with approval from the shareholders and board of. Journal entry for income received in advance.

Another example is the company is paying the salary to its staff for the month of january 2021, in february 2021. Hence prepaid salary (or) salary paid in advance is treated as adjustment entry. Paid rent of $5000 for february 2022 in advance.

Be noted the payment was made in cash. On january 1 st, 2022, xyz co. Prepaid is debited in journal entry and is shown in assets side of balance sheet.

The debiting of salaries payable in the above journal entry removes the salary payable liability on the balance sheet. On jan 1st, 2022, xyz co. In this case, the company needs to accrue the salary expenses.

Definition of revenue received in advance. The weekly payroll processing will result in a credit of $100 to advance to employees (thereby reducing by $100 the amount credited to net payroll payable). Under the accrual basis of accounting, revenues received in.