Build A Info About Deferred Revenue In Income Statement Free Personal Financial Template

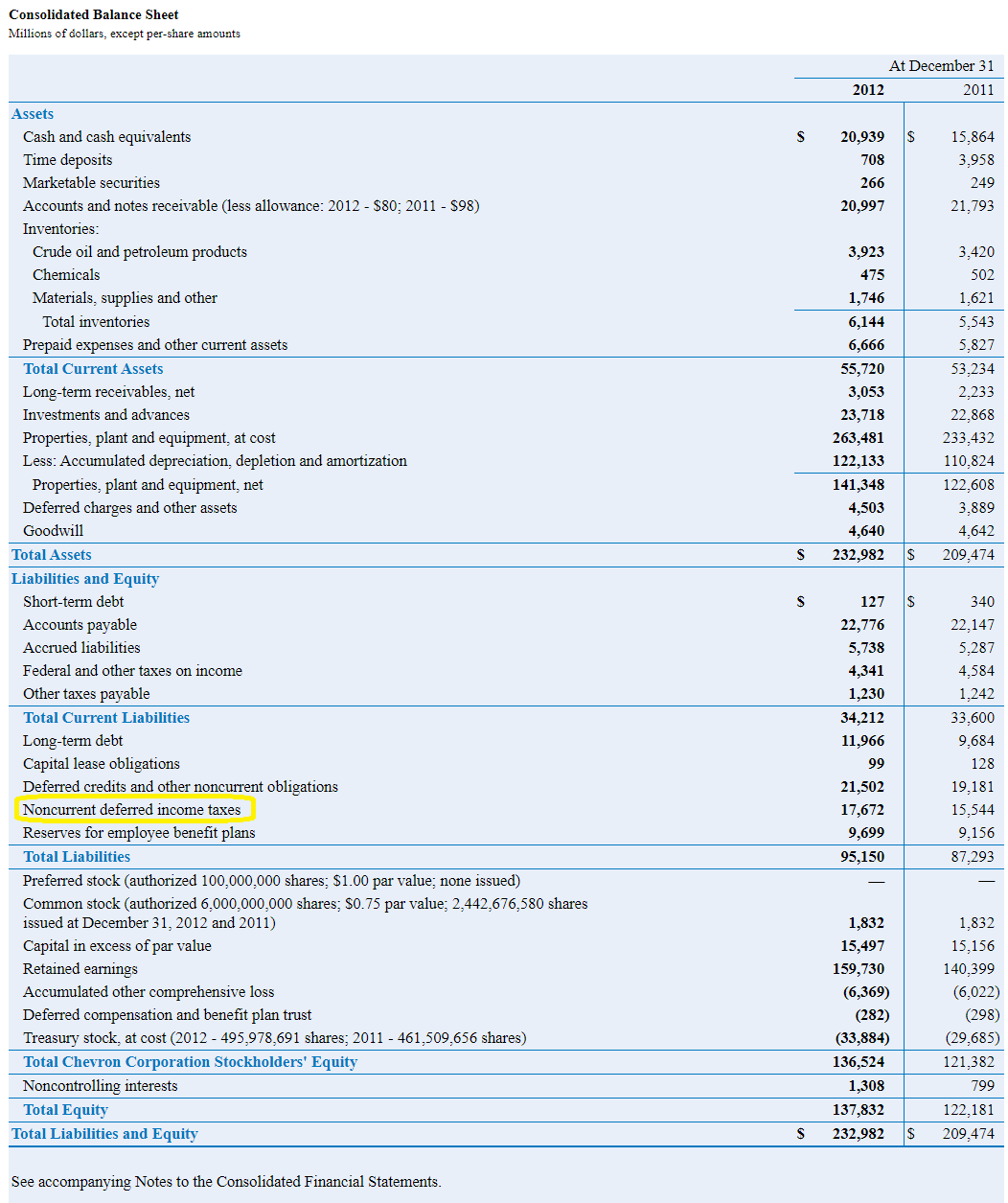

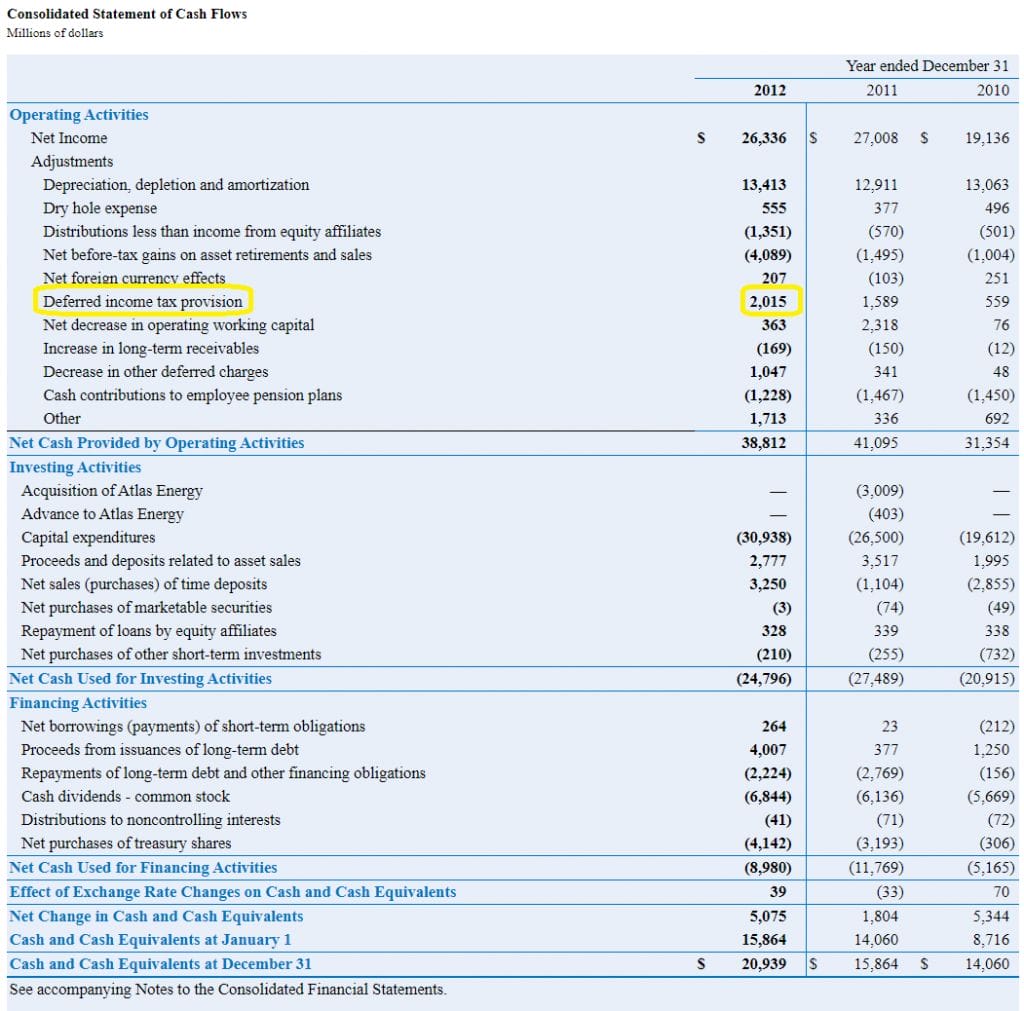

From a tax perspective, deferred revenue allows businesses to defer revenue recognition on their income statement until the goods or services are delivered.

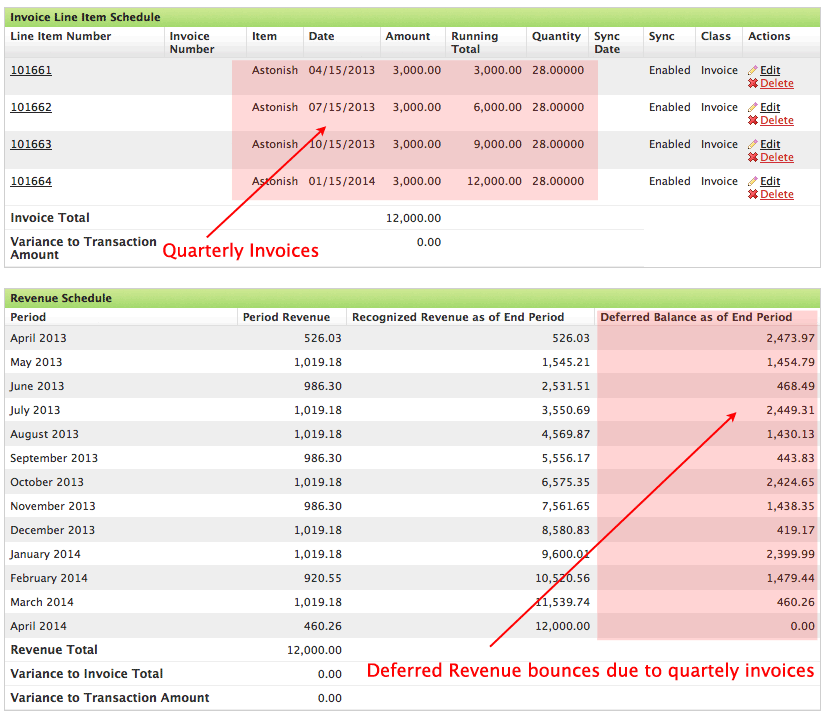

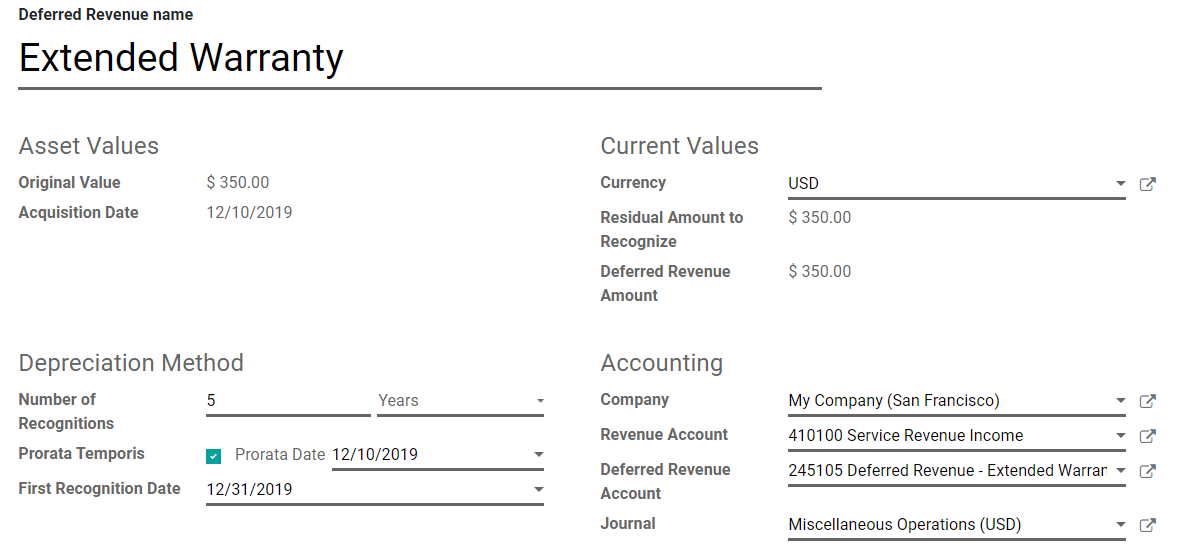

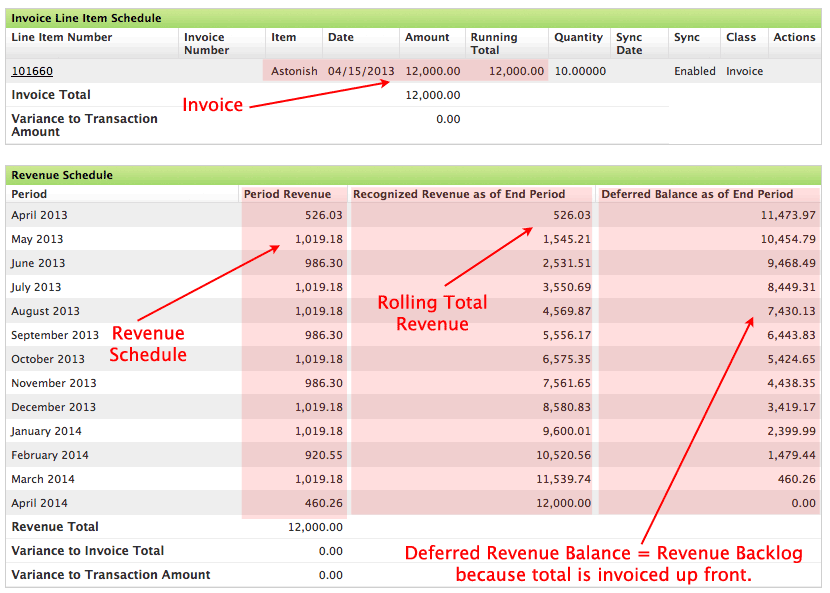

Deferred revenue in income statement. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web design project, collecting a year of rent payments upfront, or a. Find the answer back to questions how is deferred revenue reflected on the cash flow statement? Each month throughout the subscription period, the business will recognize 1/12th of the deferred revenue as earned revenue on the income statement.

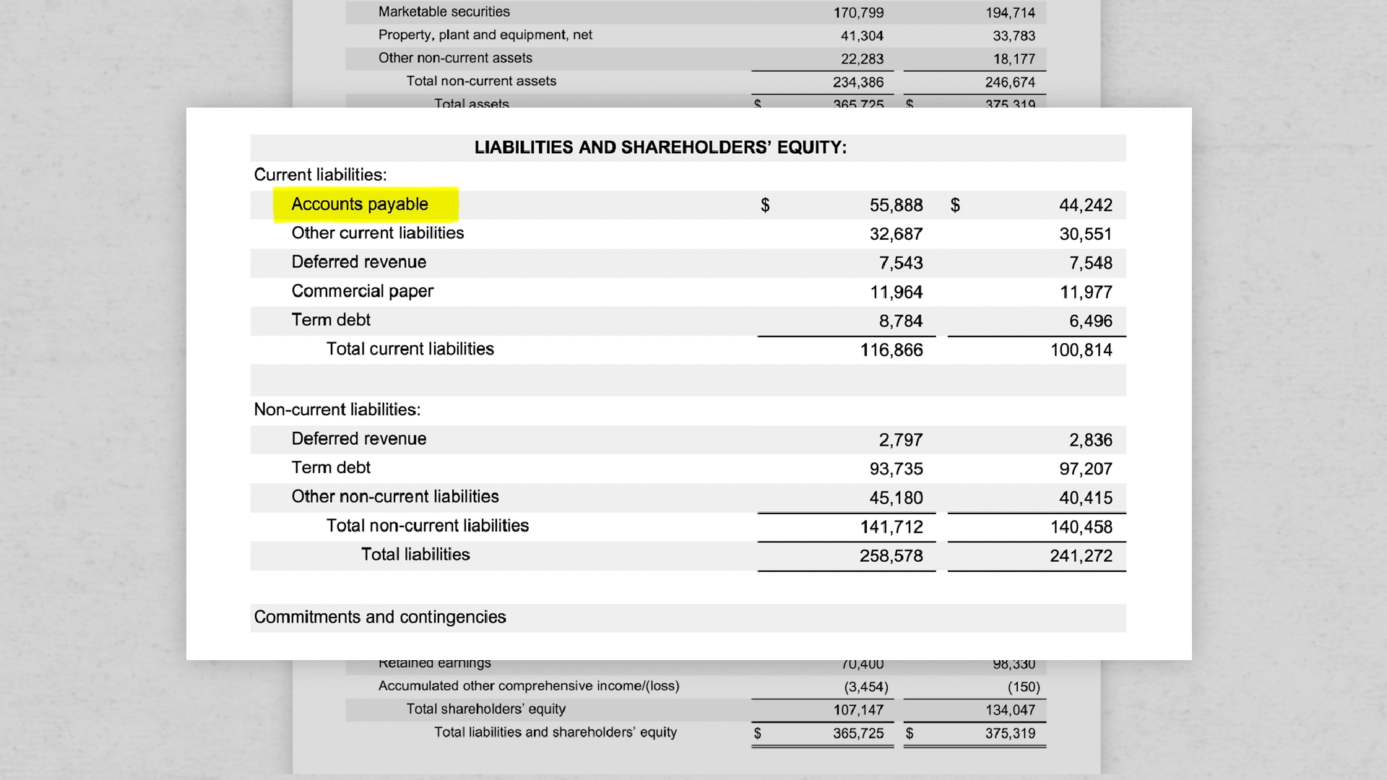

Deferred revenue is sometimes called unearned revenue, deferred income, or unearned income. It's what accountants refer to as deferred revenue, also called unearned revenue or unearned income. Once they are fulfilled, the previously deferred revenue is recognized as earned and transferred to the income statement as revenue.

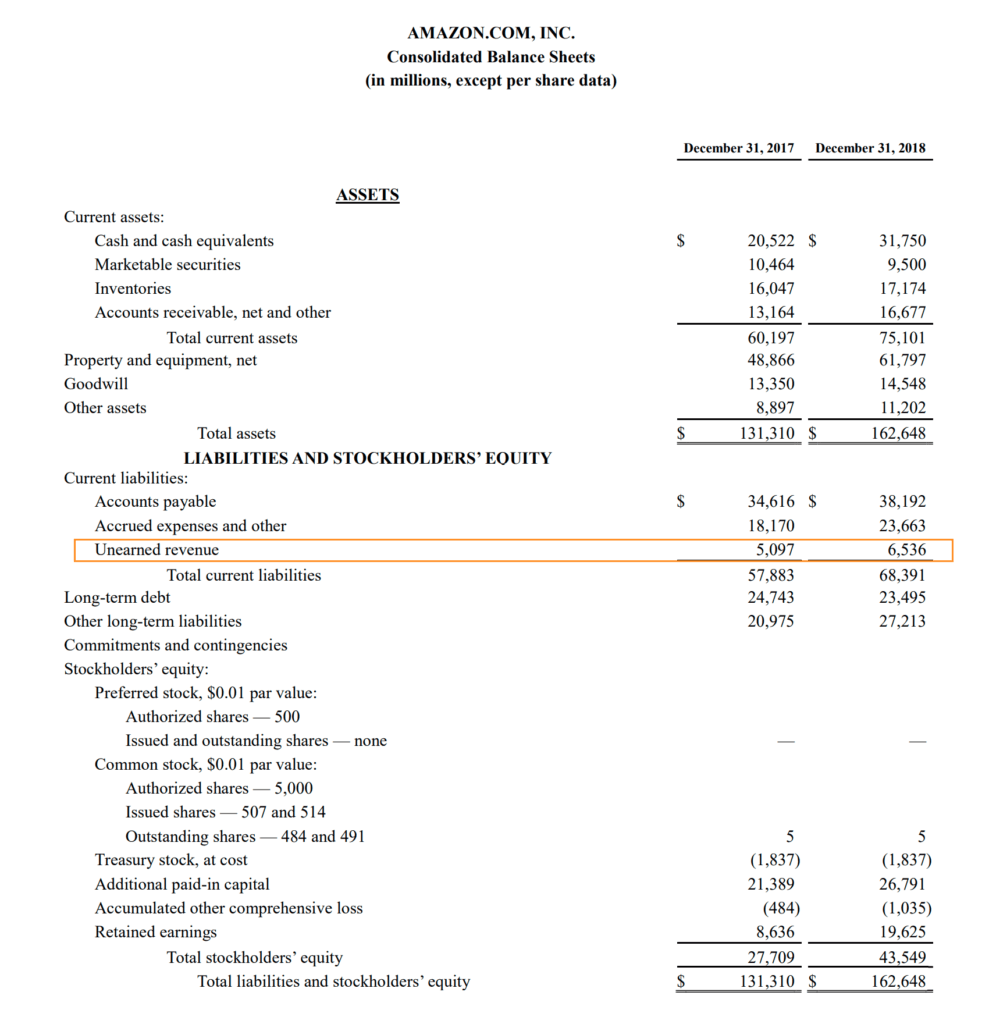

A magazine company receiving full payment for an annual subscription must deliver one year’s worth of magazines to earn the revenue. Since deferred revenues are not considered revenue until they are earned, they are not reported on the income statement. Accounting for deferred revenue.

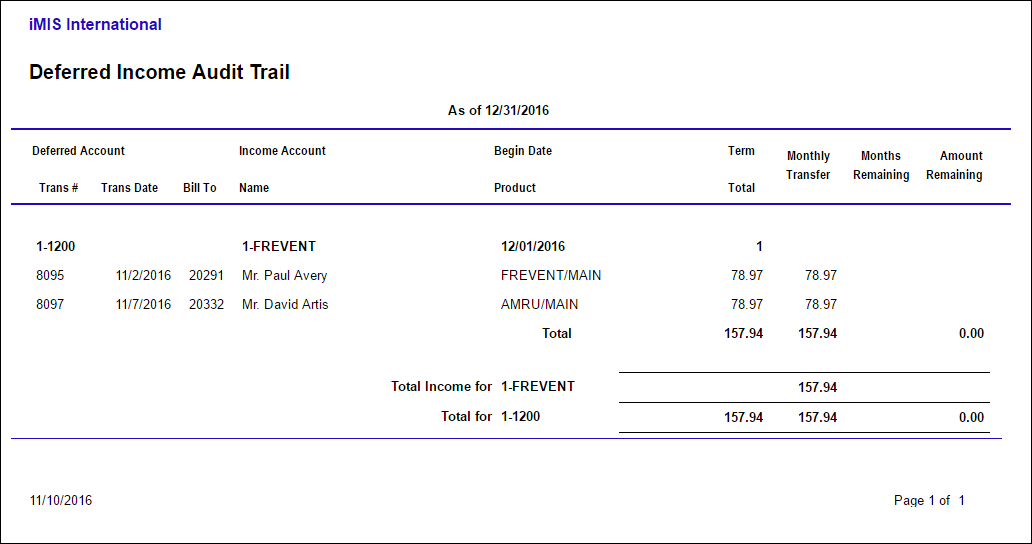

Cash inflows are recorded under the operating section of the cash flow statement only when cash is received. Examples include advance premiums received by the insurance companies for prepaid insurance policies, etc. Fy 2023 reconciliation between consolidated income statement and adjusted consolidated income statement:

Deferred revenue is not recognized as revenue on the income statement until earned under accrual accounting standards. On august 31, the company would record revenue of $100 on the income statement. As the income is earned, the liability is decreased and recognized as income.

Because deferred revenue indicates goods or services you owe to your customers, it is a liability. However, this does impact the cash flow statement because there is no cash inflow to record. Deferred revenue remains a liability because the company has not yet delivered the product.

Deferred revenue represents payments received by a company in advance of delivering its goods or performing its services. Here is an example for a $1,000. Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future.

A common example of deferred revenue, online retailers typically charge a customer's credit or debit card before shipping that customer's order. On the balance sheet, money received for the upcoming good or service is shown as a debit to cash. As you deliver goods or perform services, parts of the deferred revenue become earned revenue.

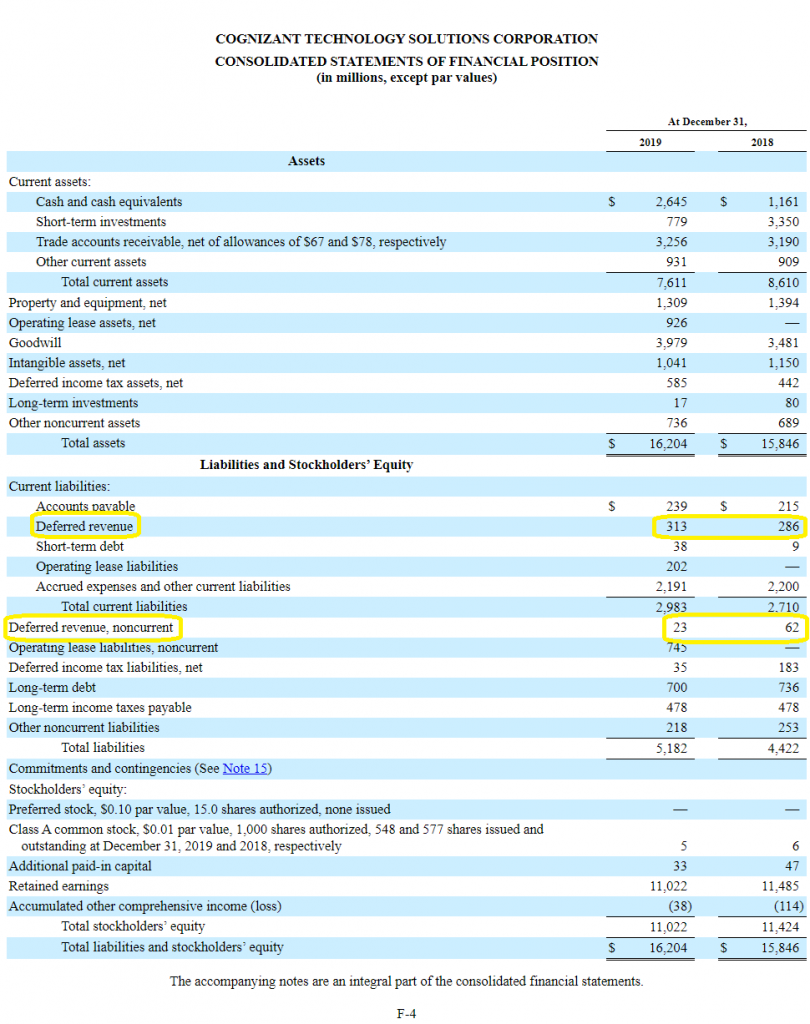

The first income tax month is 6 april to 5 may inclusive, the second income tax month is 6 may to 5 june inclusive, and so on. Deferred revenue is considered a liability on the balance sheet until the goods or services are provided. As deferred revenue is recognized, it debits the deferred revenue account and credits your income statement.

When a deposit or other deferred revenue is received from a customer, the deposit is recorded by debiting the bank account and crediting deferred revenue, which is a liability. Yes, you can still record deferred revenue as a liability on the balance sheet even if you haven’t yet received the cash. Cash flow statement although you haven't earned deferred revenue yet, it's still cash that.

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg)