One Of The Best Info About Notes Receivable On Balance Sheet Analysis Of Financial Statements Leopold Bernstein Pdf

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it.

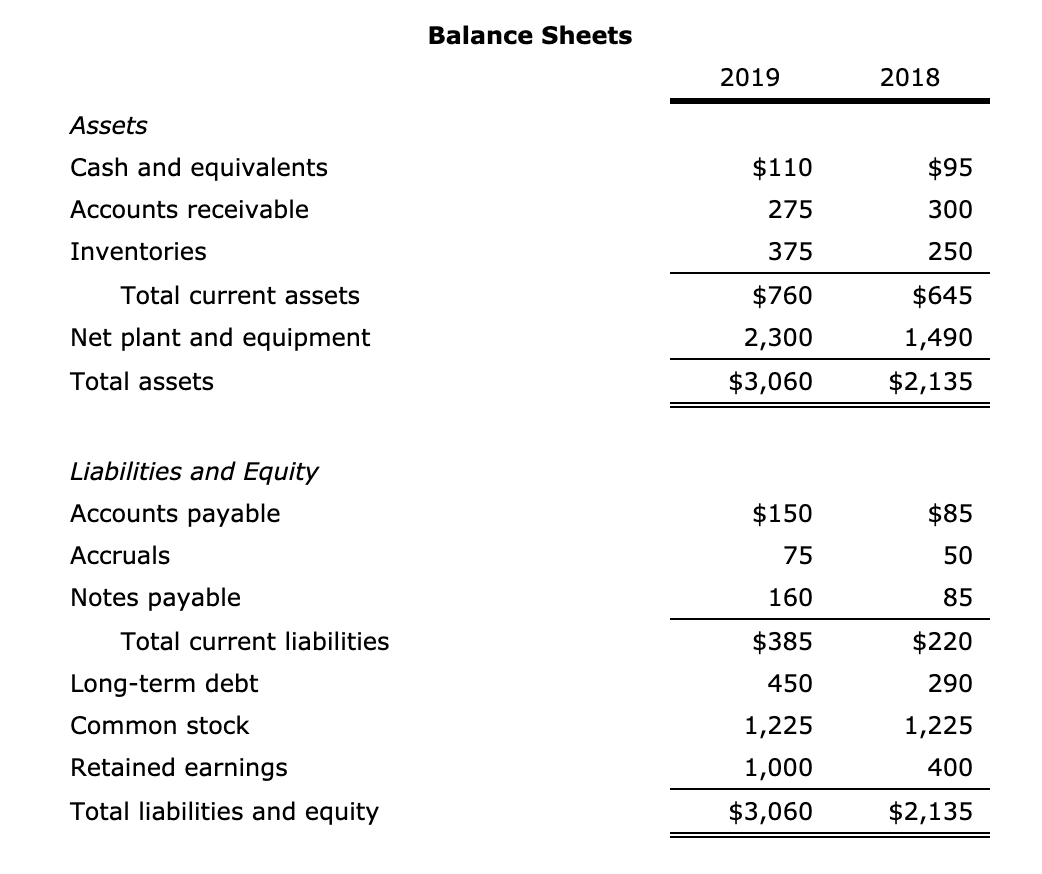

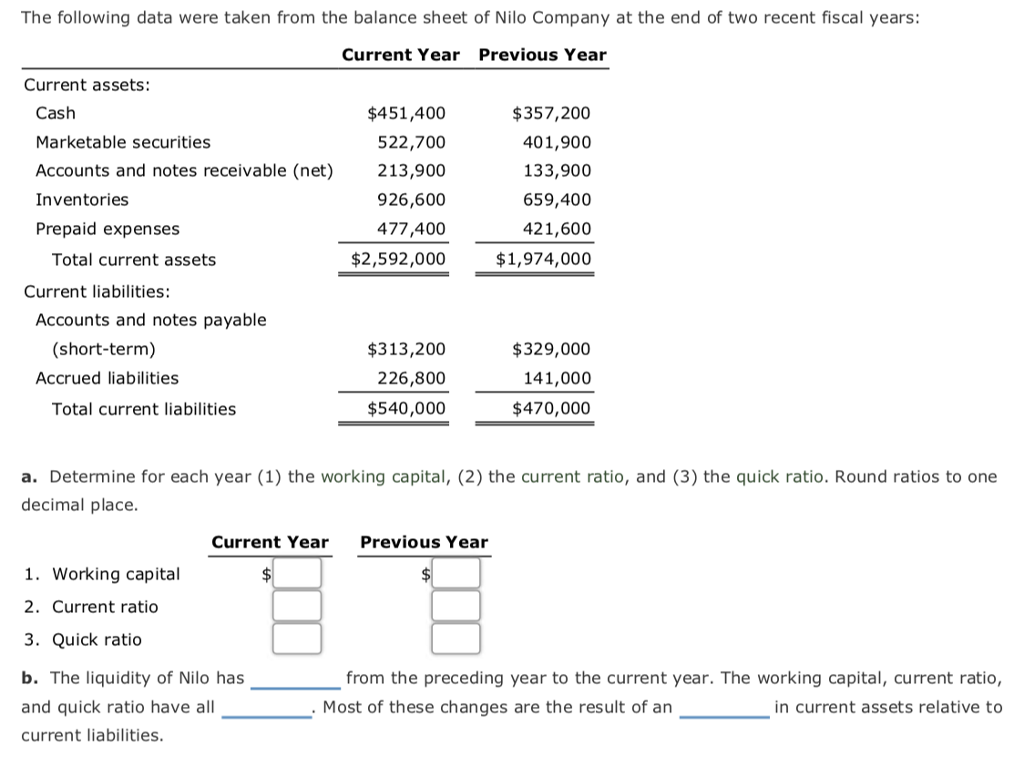

Notes receivable on balance sheet. The remaining principal of the note receivable is reported in the noncurrent asset section entitled investments. If a company has delivered products or services but not yet received payment, it's an account receivable. Any portion of the notes receivable that is not due within one year of the balance sheet date is reported.

Accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Notes receivable on balance sheet is a financial asset in the form of a recordable promise to collect money that is owed to a business. If a note has a duration of longer than one year, and the maker does not pay interest on the note during the first year, it is customary to add the unpaid interest.

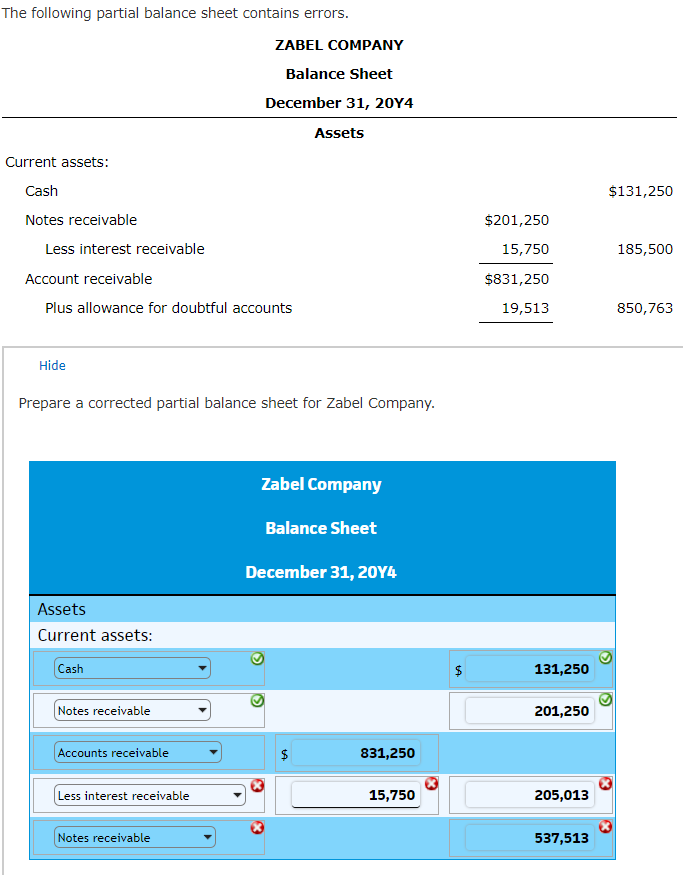

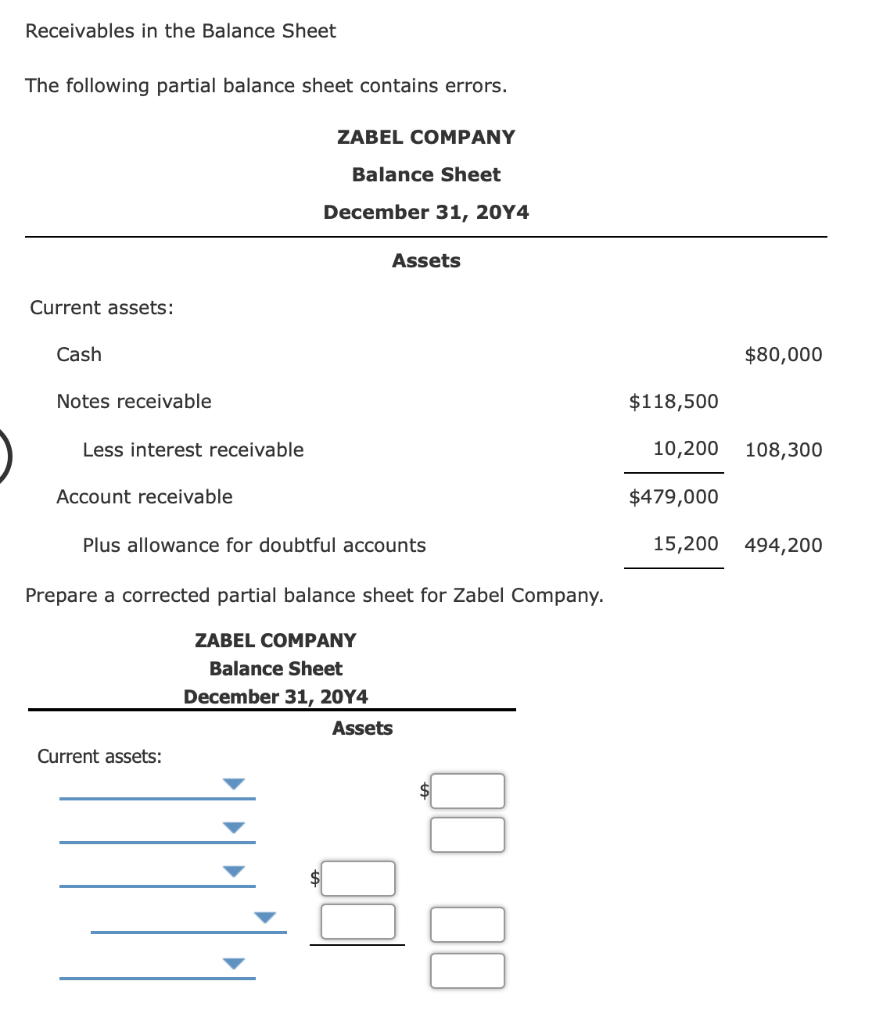

Waterways increases (debit) as does interest revenue (credit) for 12 months of interest computed as $250,000 ×. To license fee receivable 1307000 4. Notes and accounts receivable from officers, employees, or affiliated companies are required to be disclosed separately on the balance sheet.

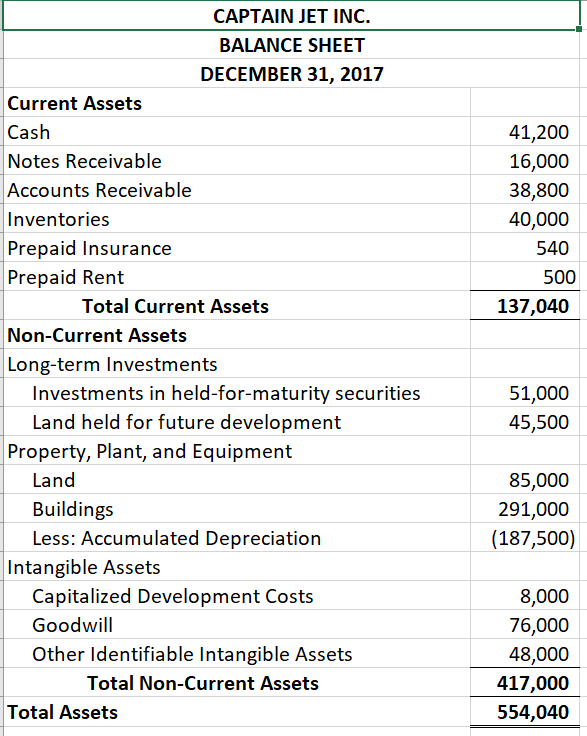

Notes payable appear as liabilities on a balance sheet. Use a financial calculator to compute the present value of the note. Specifically, a note receivable is a written promise to receive money at a future date.

What are notes receivable? The contracts typically outline the terms of payment, payment dates and interest rates. Fund balance $26,200 (adjustment) 7.

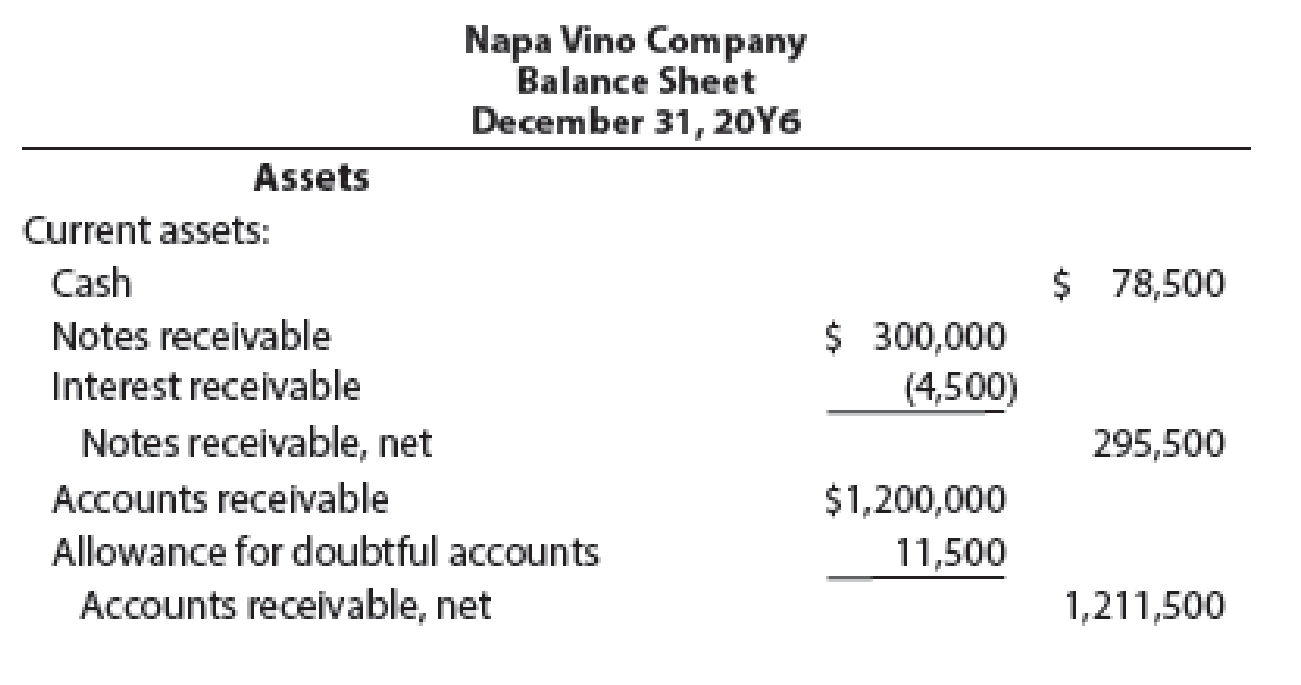

Stated rate more than market rate: These notes can be issued at a prem They're important financial components that allow accountants or other financial experts to understand the liquidity position of a company.

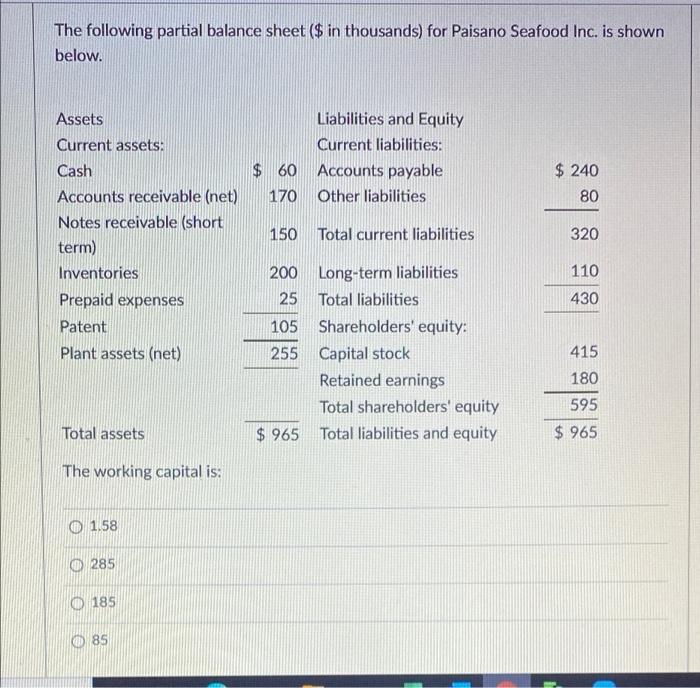

For accounting purposes, a payee records a note receivable as an asset on its balance sheet and the related interest income on its income statement. Applicable to both ifrs and aspe determine the present value (pv) of future cash flows, to record the note receivable at its fair value. Unlike accounts receivable, notes receivable involve a formal written agreement or promissory note.

It is an accounting entry that reflects a loan, debt or other amount of money due and payable to the business. The notes receivable is an account on the balance sheet usually under the current assets section if its life is less than a year. However, since the holder is contingently liable for paying the maturity value to the bank, it may be appropriate to use a contra account, notes receivable—discounted. for example 1, this journal entry would be made as follows:

Waterways increases (debit), and sales revenue increases (credit) for the principal amount of $250,000. If pv = face value, the note is equal to market rate if pv > face value, the note is at a premium A written promissory note gives the holder, or bearer, the right to receive the amount outlined in the legal agreement.

At the end of year 3, the notes receivable balance is $10,000 for both methods, so the same entry is recorded for the receipt of the cash. Accounts receivable and notes receivable both show up on a company's balance sheet as assets. Definition of accrued interest on notes receivable accrued interest on notes receivable is the amount of interest the lender has earned, but the lender has not yet received it.