Awe-Inspiring Examples Of Tips About Commission Expense In Income Statement Deloitte Big 4 Accounting Firms

They are considered a part of the costs incurred to generate revenue and are.

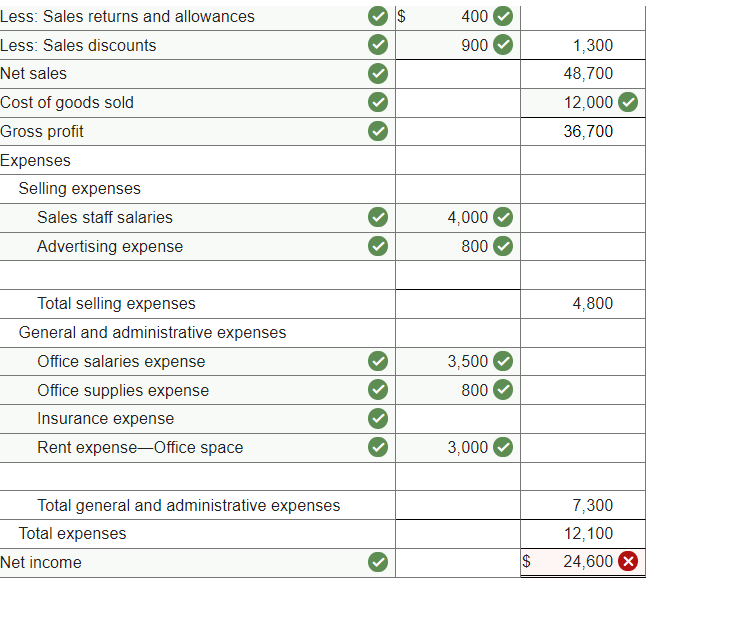

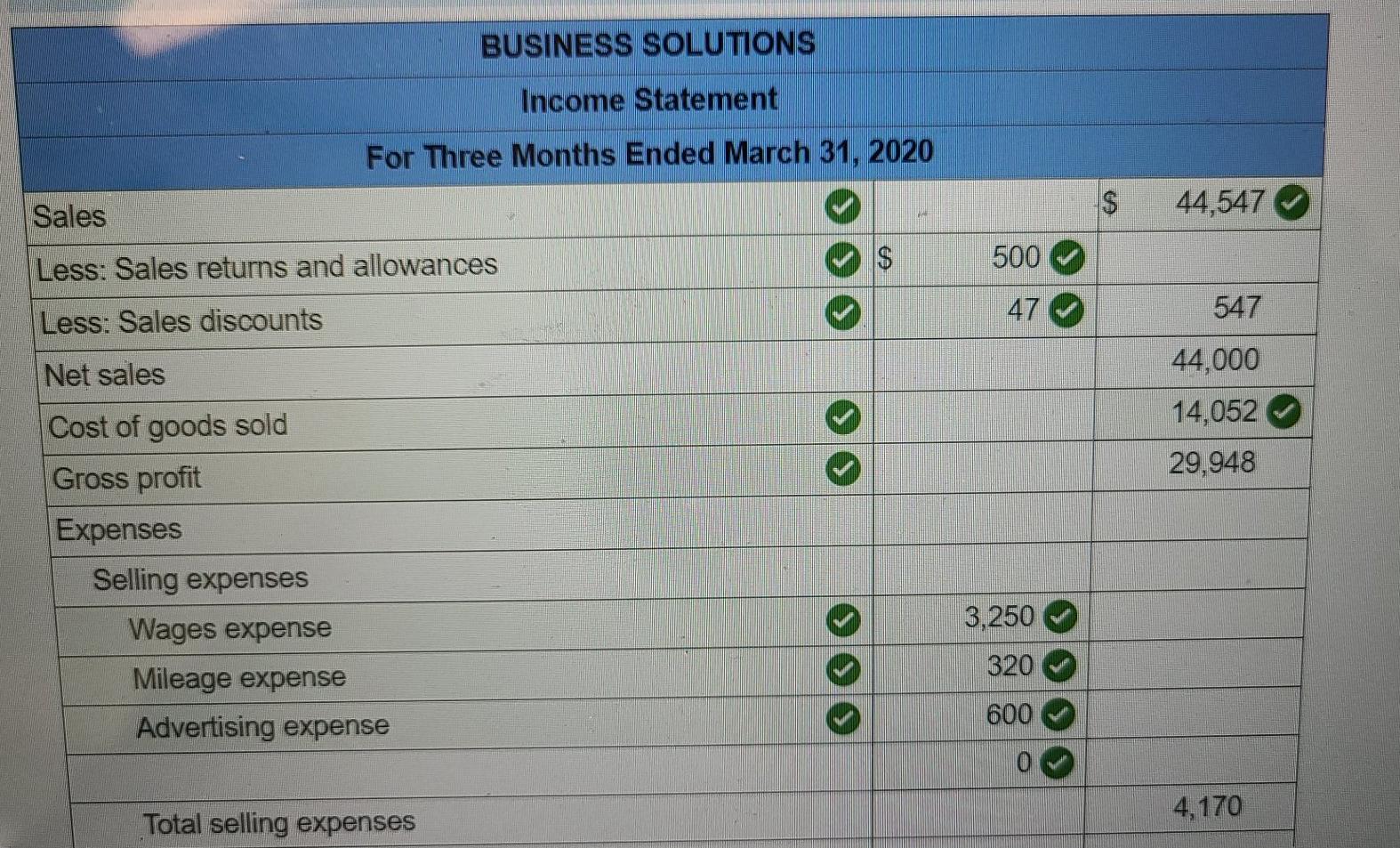

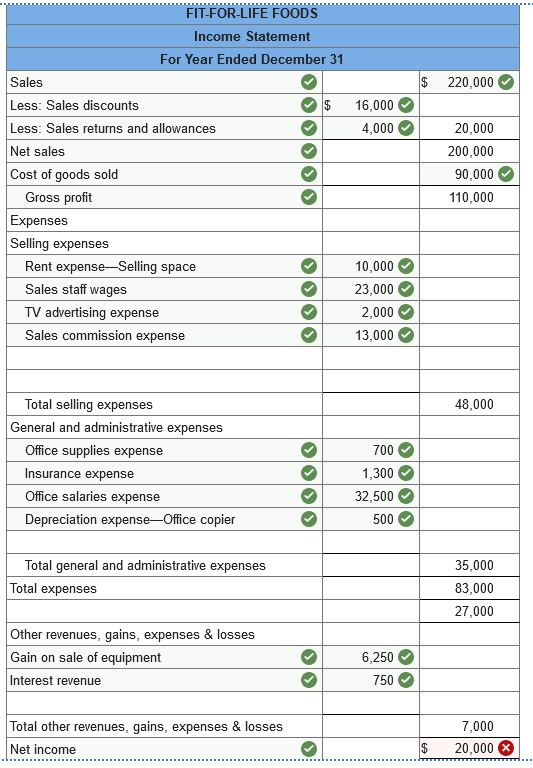

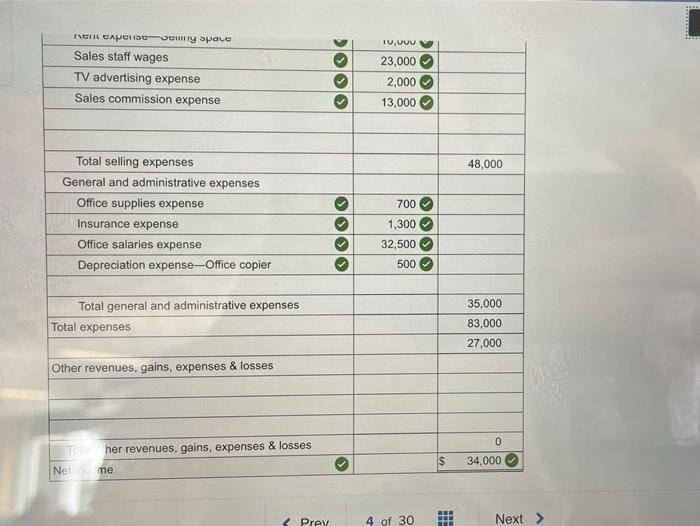

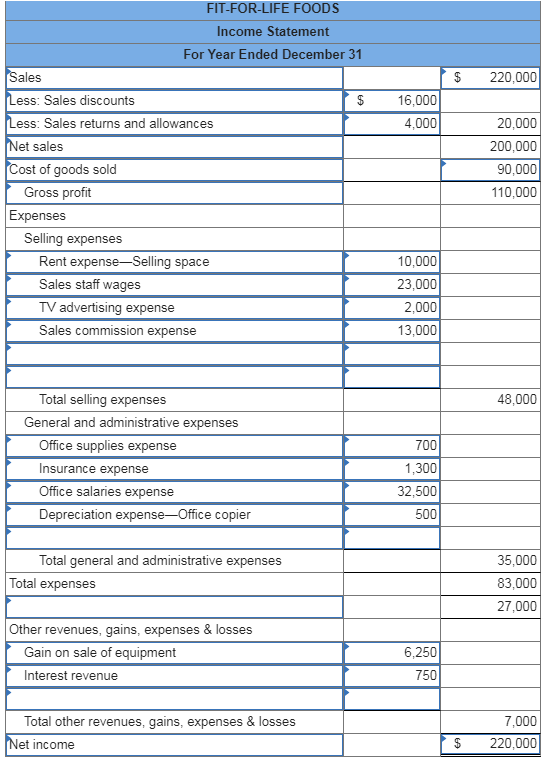

Commission expense in income statement. This means that commissions are situated after the cost of goods sold. A selling expense account shown on the income statement in order to match this expense to the related sales. Sales commissions are typically reported as a selling expense on the income statement.

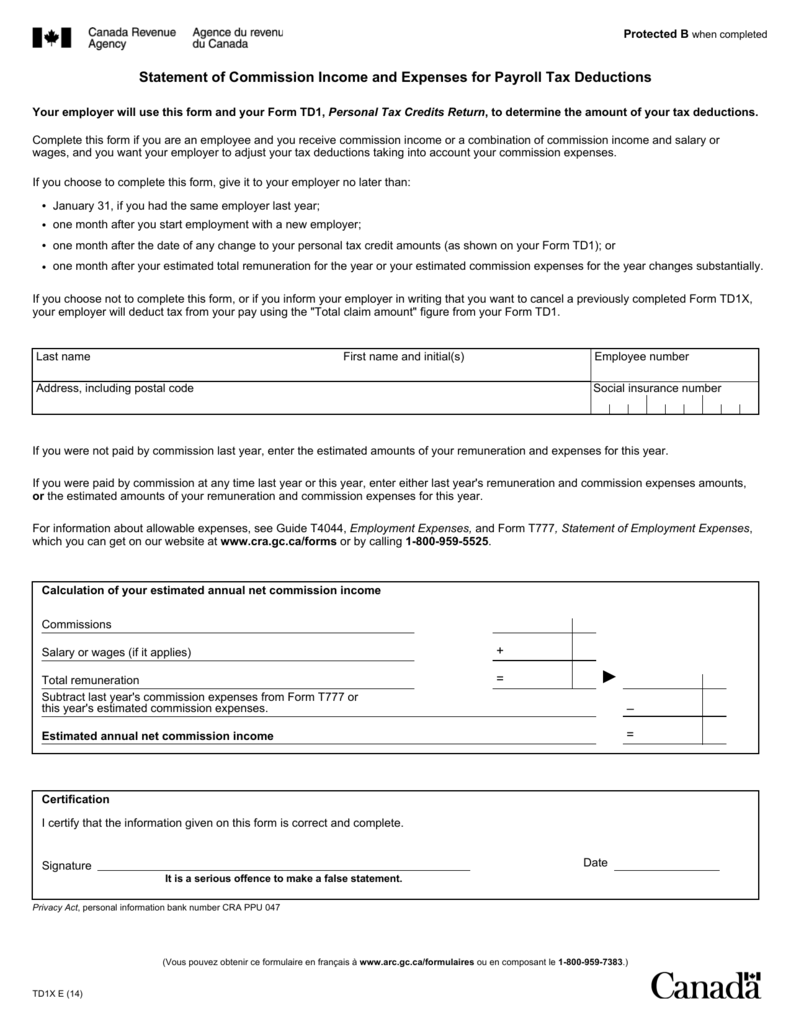

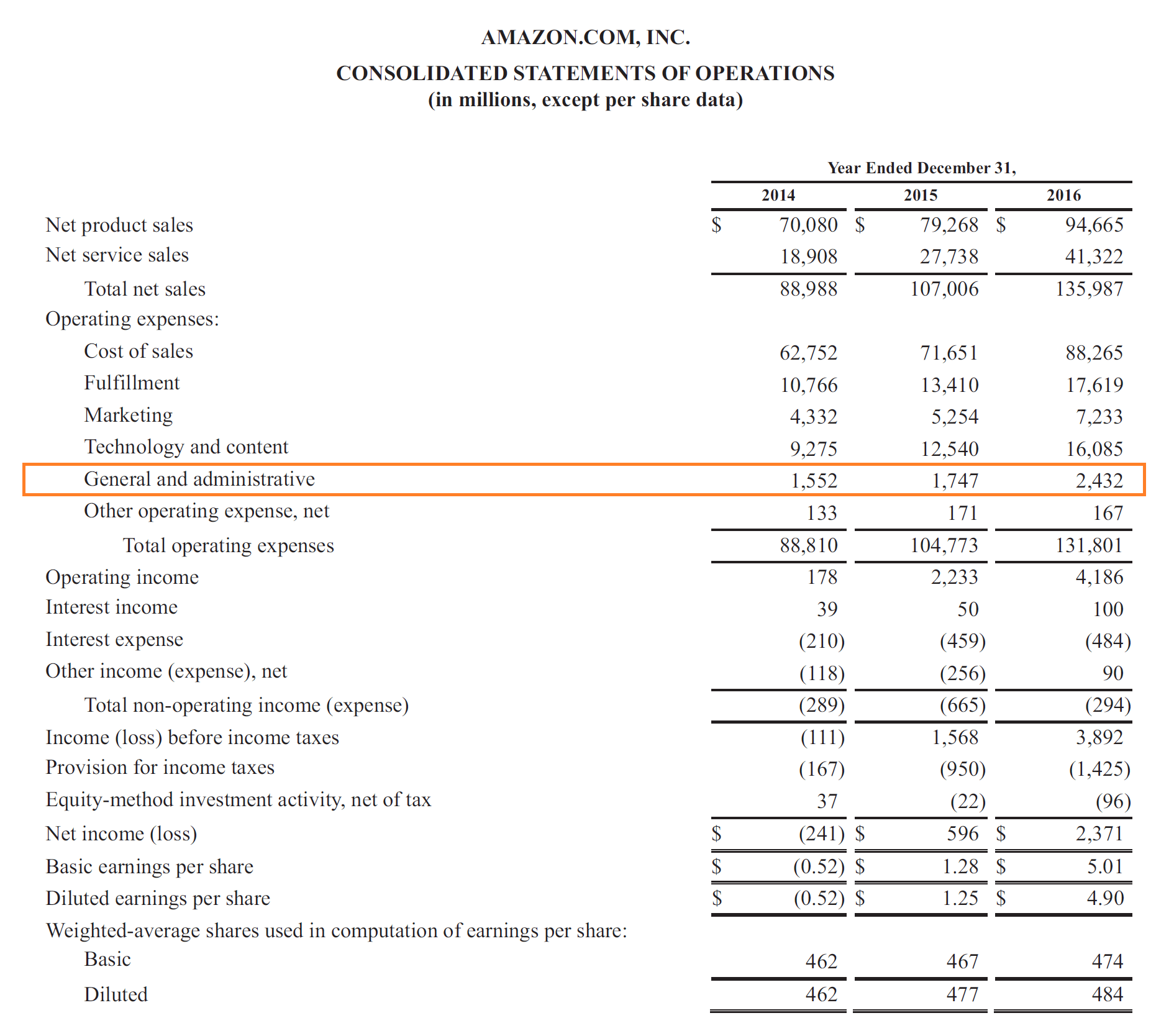

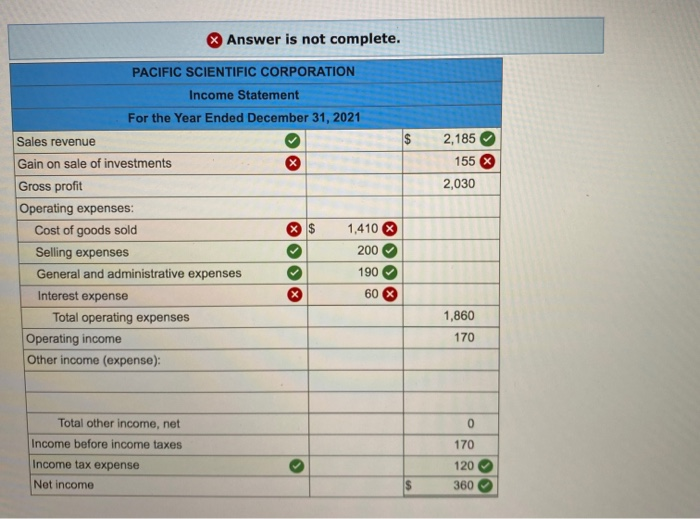

Sales commissions are considered to be operating expenses and are presented on the income statement as sg&a expenses. Definition commission income refers to fees earned by brokers and agents in making a sale or closing a deal. Write “sales commissions expense” and the amount of the expense as a line item in the operating expenses section of your income statement at the end of the accounting.

Combines a guaranteed income with variable earnings for performance. View the latest jtchy financial statements, income statements and financial ratios. You must report sales commissions as part of the operating expenses on your income statement.

It is the primary revenue account of real estate brokers, stock. Revenue, expenses, gains, and losses. How to record sales commissions as income?

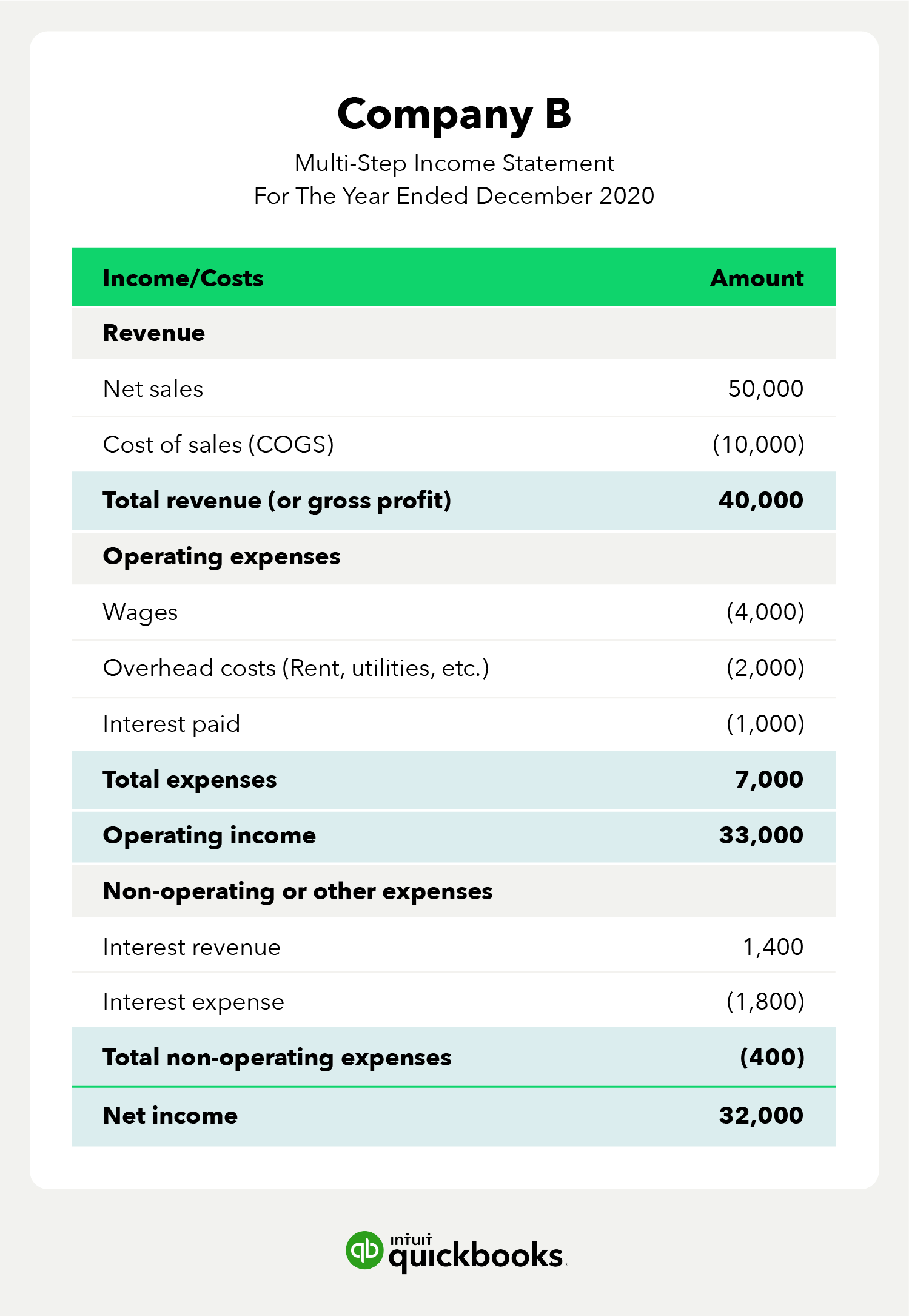

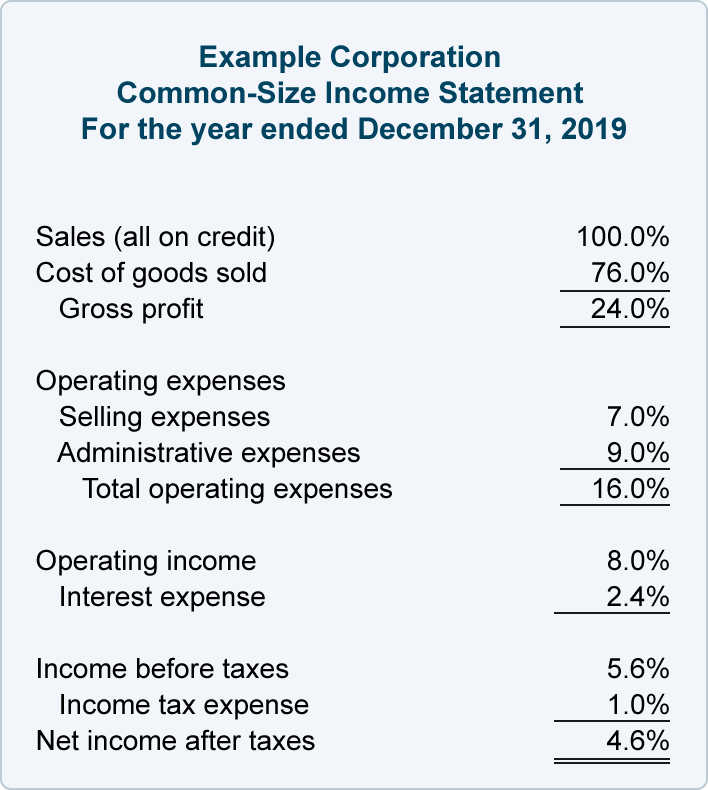

The income statement focuses on four key items: It shows how much was slated to be. Sales commissions appear on the income statement, typically listed as an operating expense.

What is the impact of asc 606 on sales commissions?. Adr annual stock financials by marketwatch. Sales commissions paid out are classified as a selling expense, and so are reported on the income statement within the operating expenses section.

If a company has earned the commissions but has. How are sales commissions reported on the income statement? Jianpu technology inc.

Sales commissions are typically reported as an operating expense on the income statement. Your annual salary is $40,000. Under the accrual basis of accounting, the commissions do not have to be received in order to be reported as revenues.

Commissions expense definition under the accrual basis of accounting this income statement account reports the amount of commissions expense that pertains to the. How to record sales commissions as an expense? If the sales are related to the company's main activities, the commissions are reported on the company's income statement as commission expense, or as part of the.

Based on accrual accounting, you must report all. The commissions expense is an account on an income statement generated with the accrual method of accounting. Consider business xyz that earned $25,000 from the sale of goods and $3,000 as revenue from training personnel.