Ace Tips About Sony Financial Statements 2019 Archer Daniels Midland

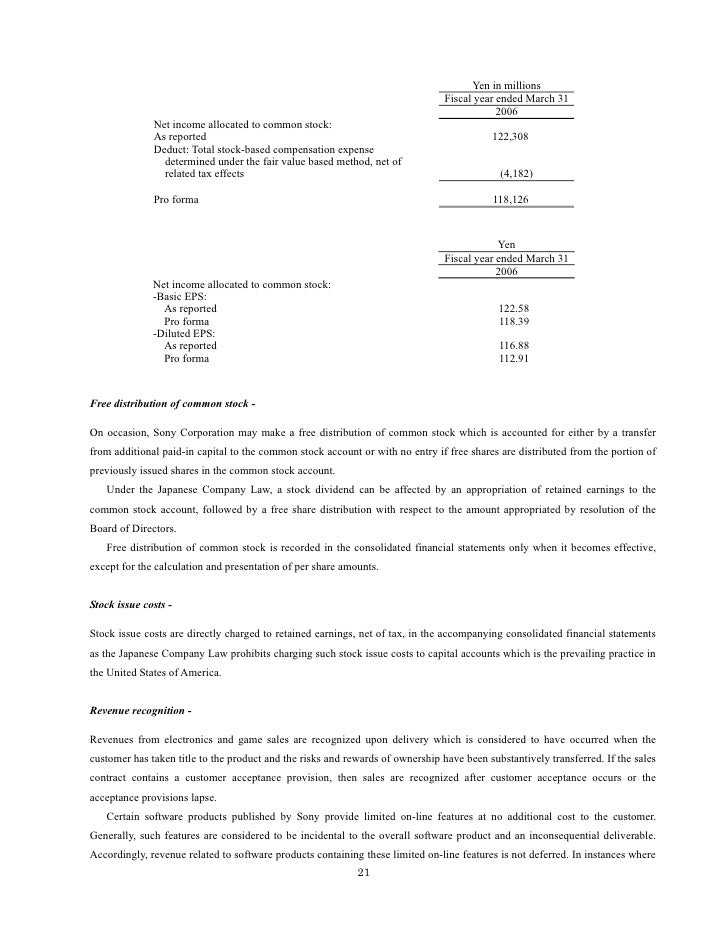

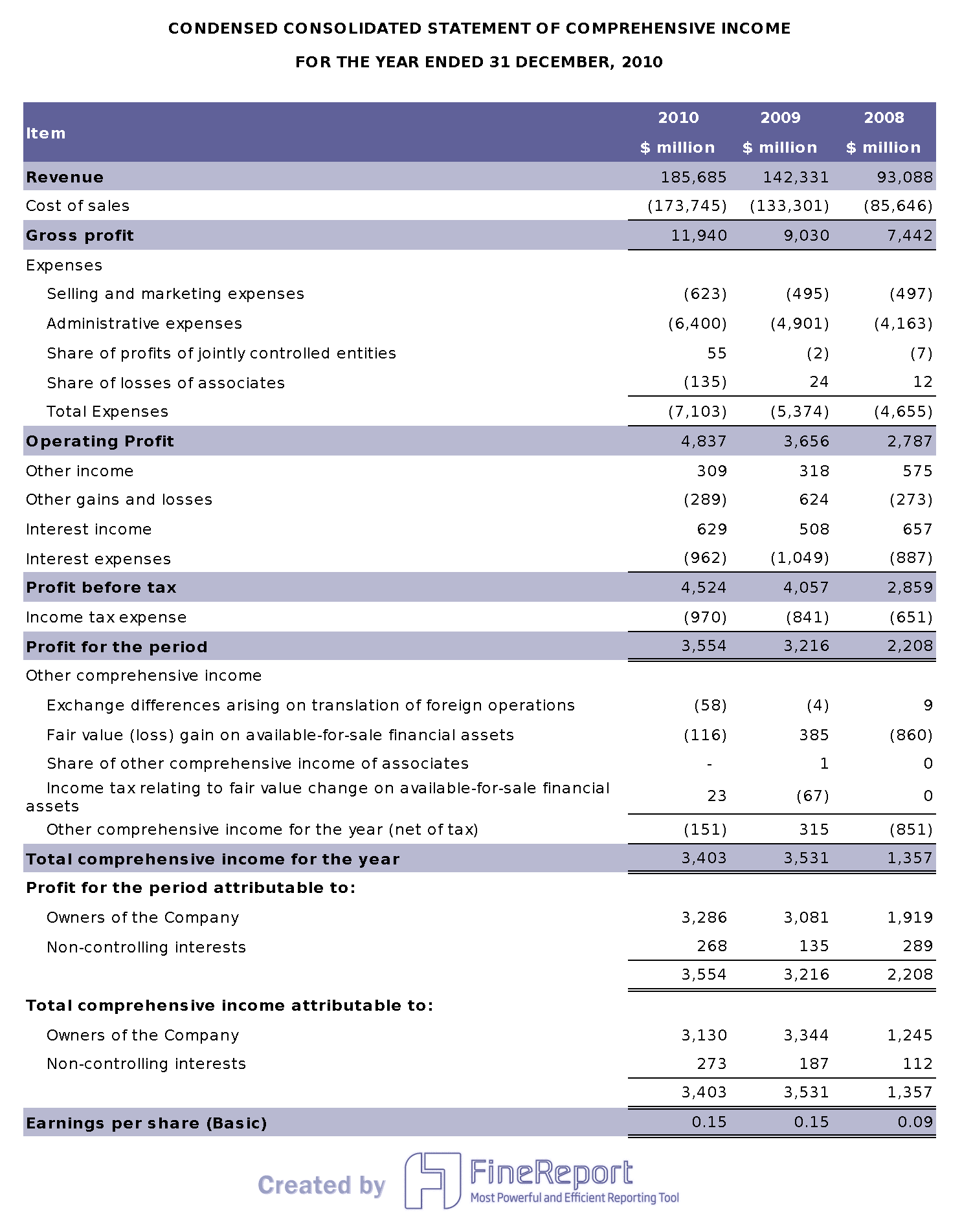

Get the detailed quarterly/annual income statement for sony group corporation (sony).

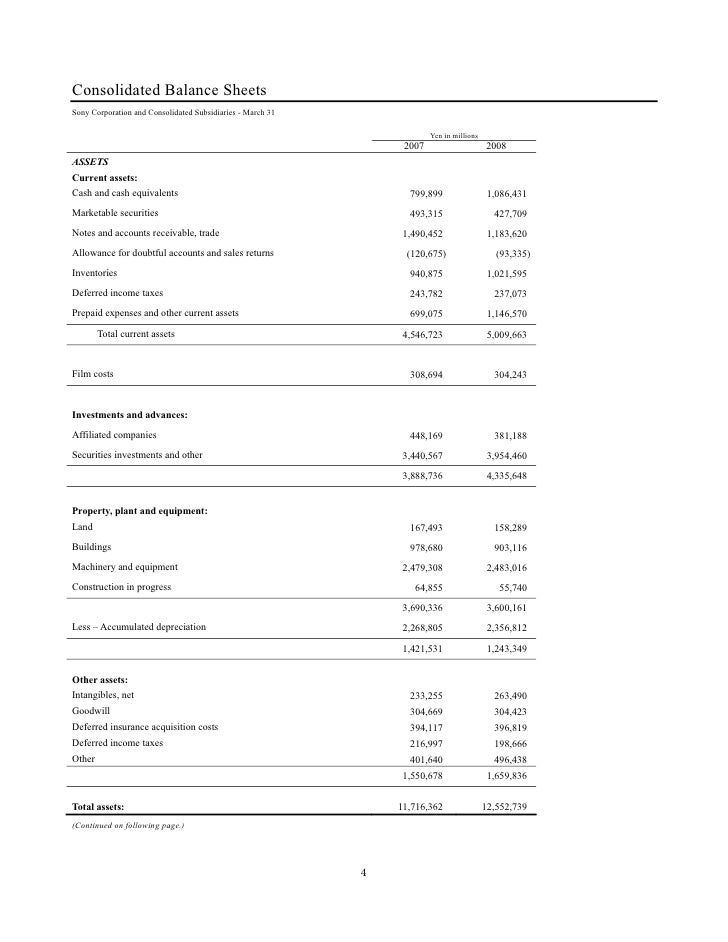

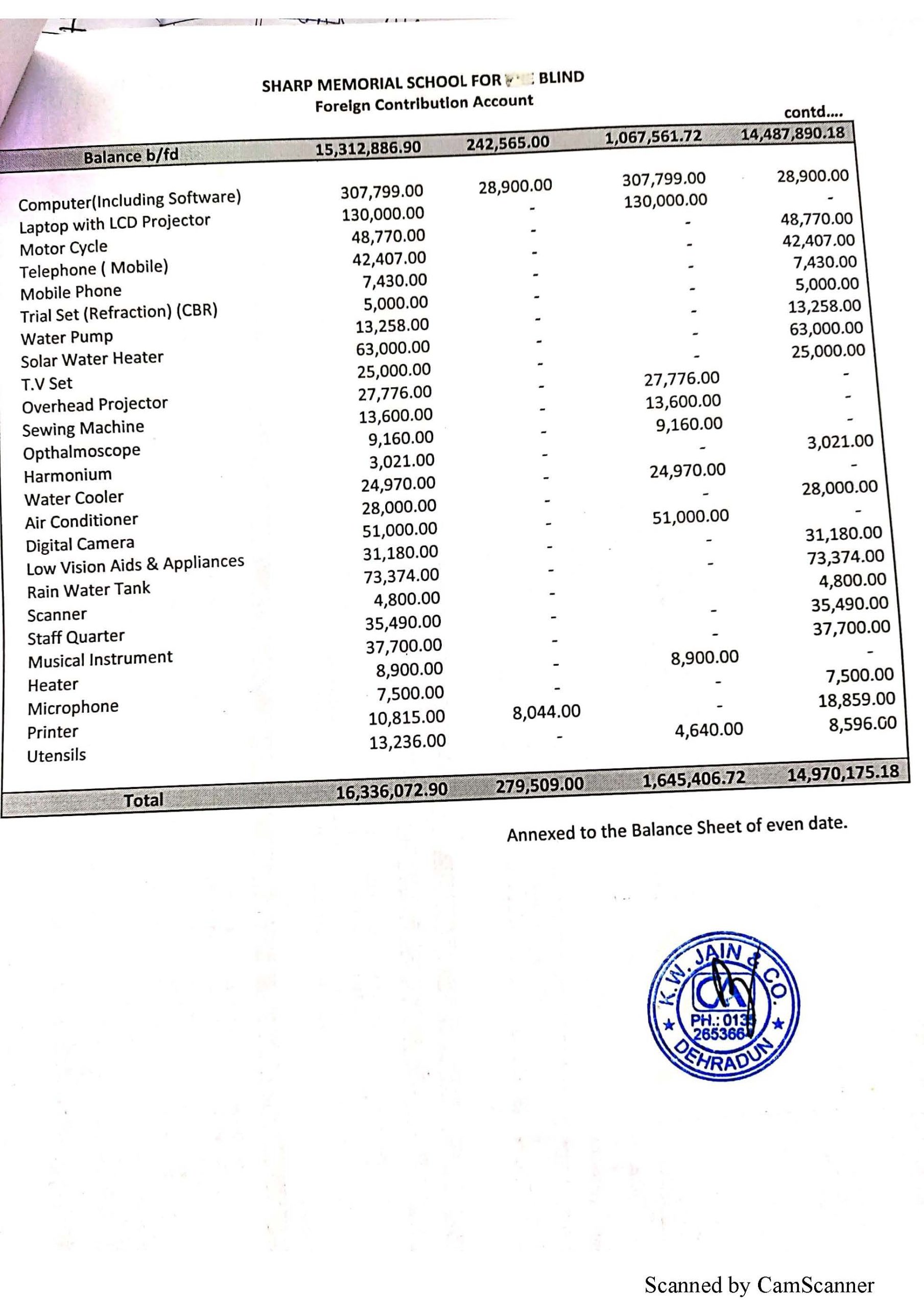

Sony financial statements 2019. Emi represented less than 1% of (i) sony’s total assets as of march 31, 2019 (after excluding emi’s intangibles and goodwill) and (ii) sony’s total sales and operating revenue for the fiscal year ended march 31, 2019. Djia s&p 500 global dow nasdaq technology compare to open 91.25 prior close 91.99. Financials are provided by nasdaq data link and sourced from audited reports submitted to the securities and exchange commission (sec).

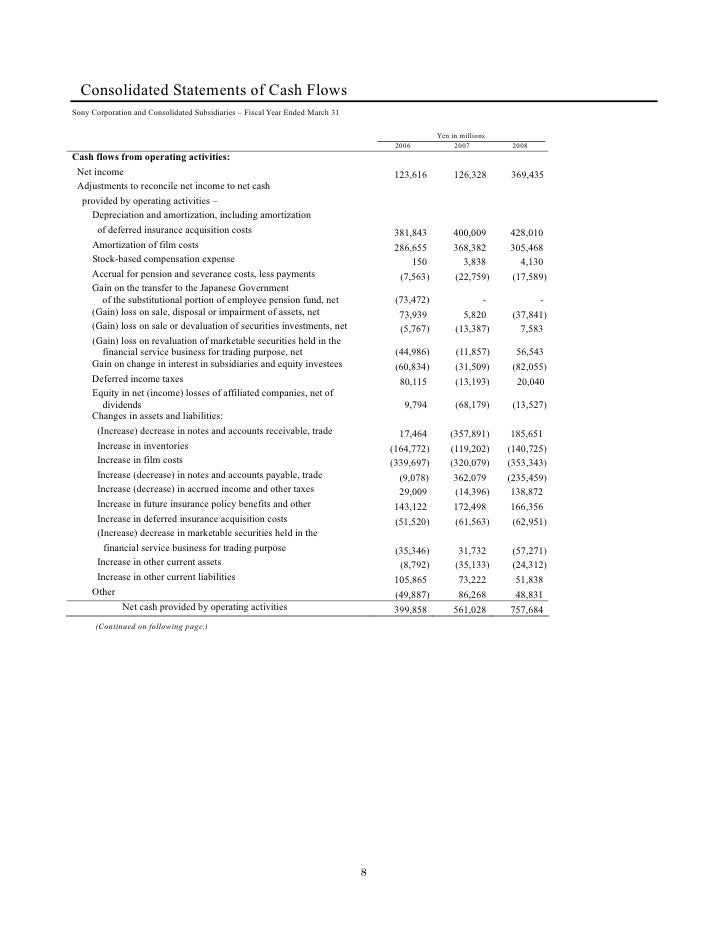

Q2 fy2019 consolidated financial results october 30, 2019 sony corporation. * on may 19, 2020, sony financial holdings inc.’s (sfh’s) significant subsidiaries―sony life insurance co., ltd. Quarterly financial statements for the third quarter ended december 31, 2019 and outlook for the fiscal year ending.

Emi music publishing acquisition is discussed. * on august 11, 2020, sony financial holdings inc.’s (sfh’s) significant subsidiaries—sony life insurance co., ltd. (sony life), sony assurance inc.

Find out the revenue, expenses and profit or loss over the last fiscal year. Income statements, balance sheets, cash flow statements and key ratios. 124 mcev results for sony life as of march 31, 2019 sony assurance financial data sony assurance performance indicators sony bank financial data (consolidated).

2016, 2017, 2018, and 2019. Q3 fy2019 consolidated financial results february 4, 2020 sony corporation. This paper tends to recognize the financial health and performance of pepsico using its financial statement analysis for the years;

Sony group corporation financial statements and consolidated financial results for the fiscal year ended march 31, 2021. News ratings calendar company financials funds and etfs official sony group corporation press release sony : 3 m ytd 1 y 3 y $ % advanced charting compare compare to benchmark:

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)