Supreme Info About Profit And Loss Ratio Formula How Does A Balance Sheet Look Like

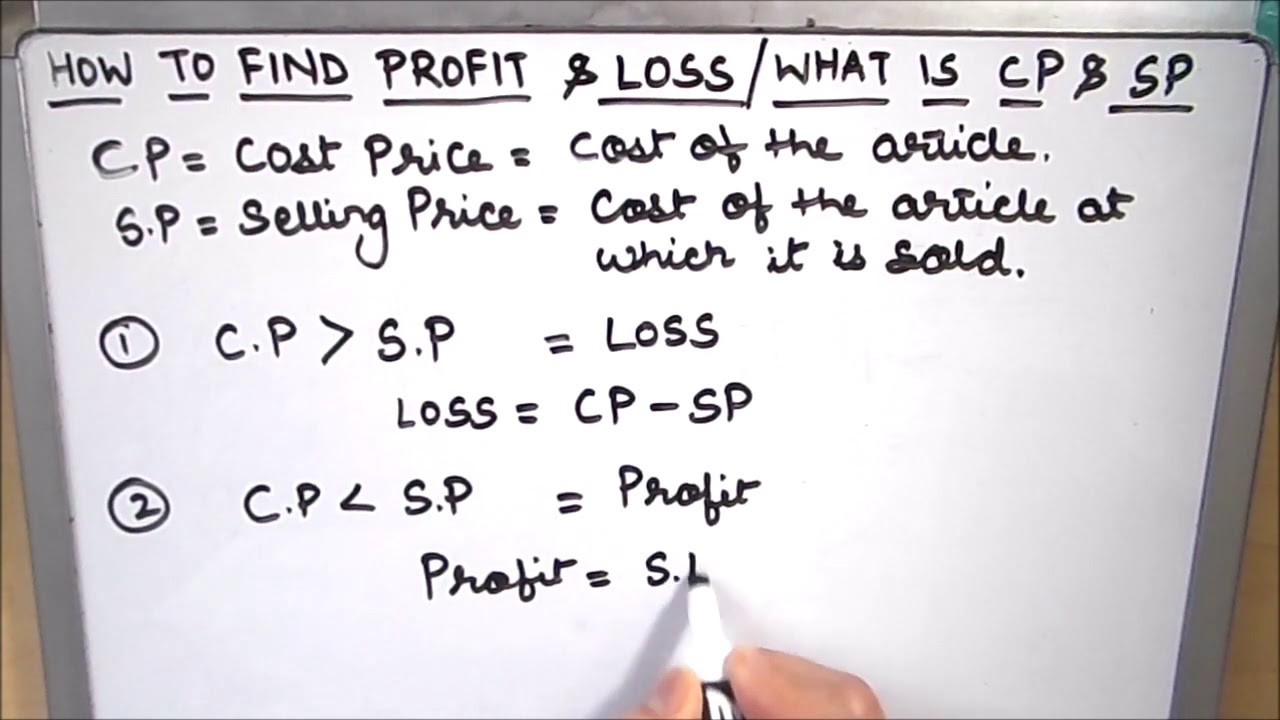

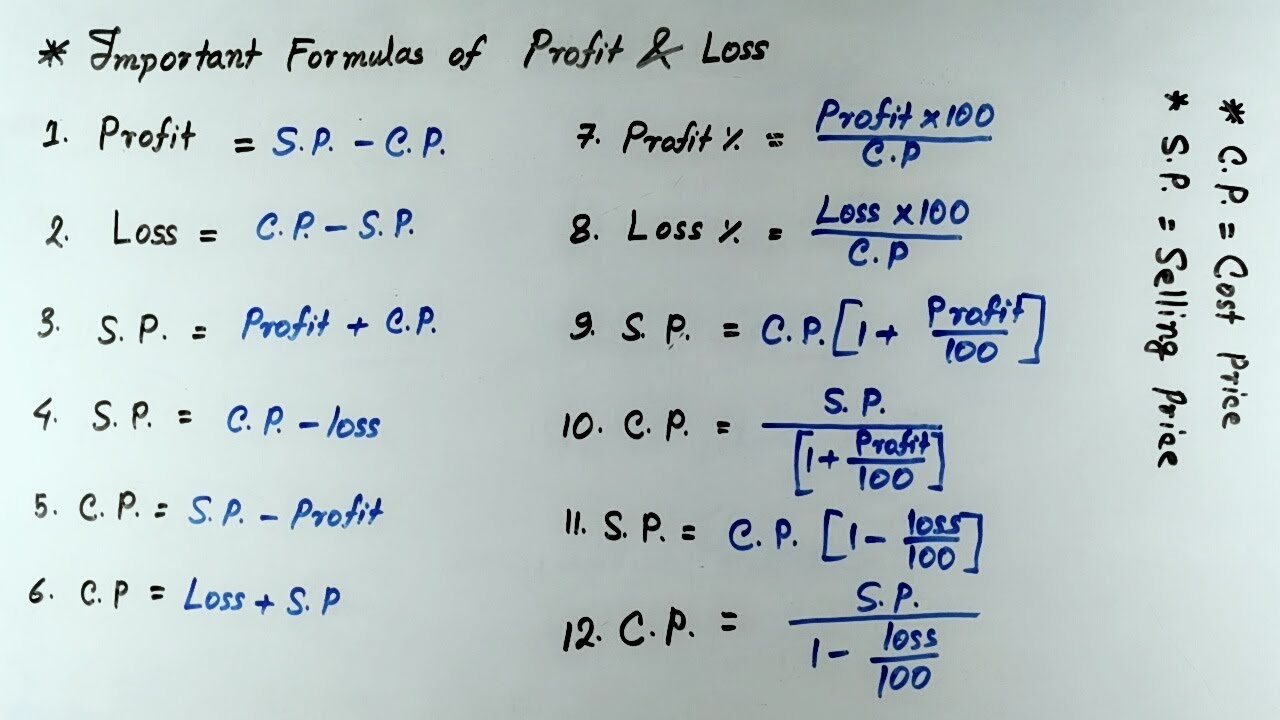

The profit or gain is equal to the selling price minus the cost price.

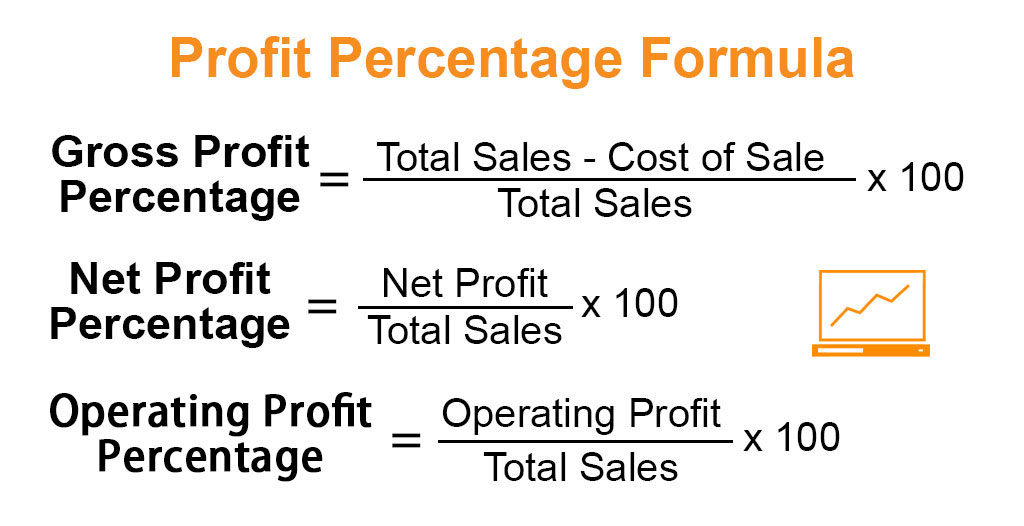

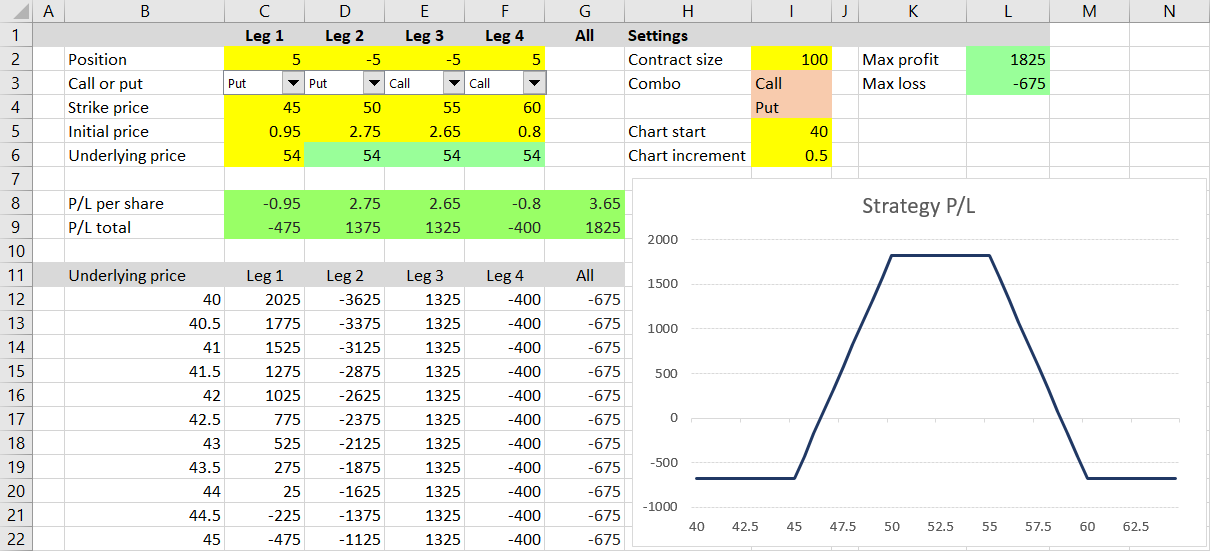

Profit and loss ratio formula. A p&l statement is also known as: The profit and loss formula is a mathematical formula that is used to calculate the selling price of a product and to determine how profitable a company is. In this article we will discuss about the classification of profit and loss account ratios in.

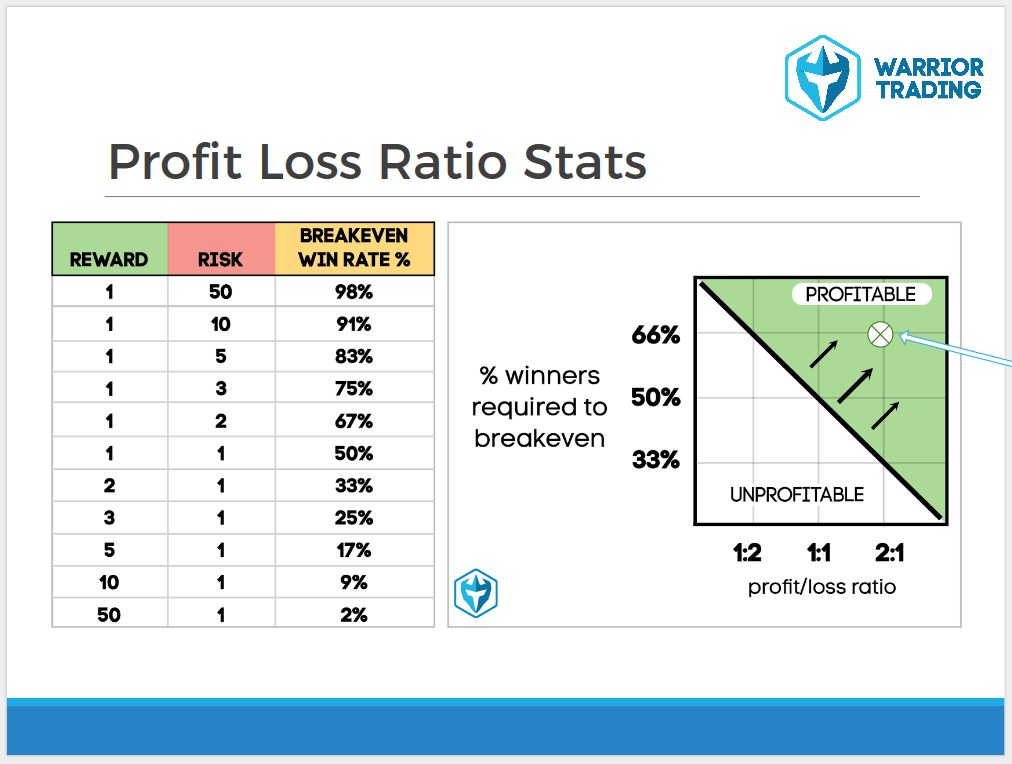

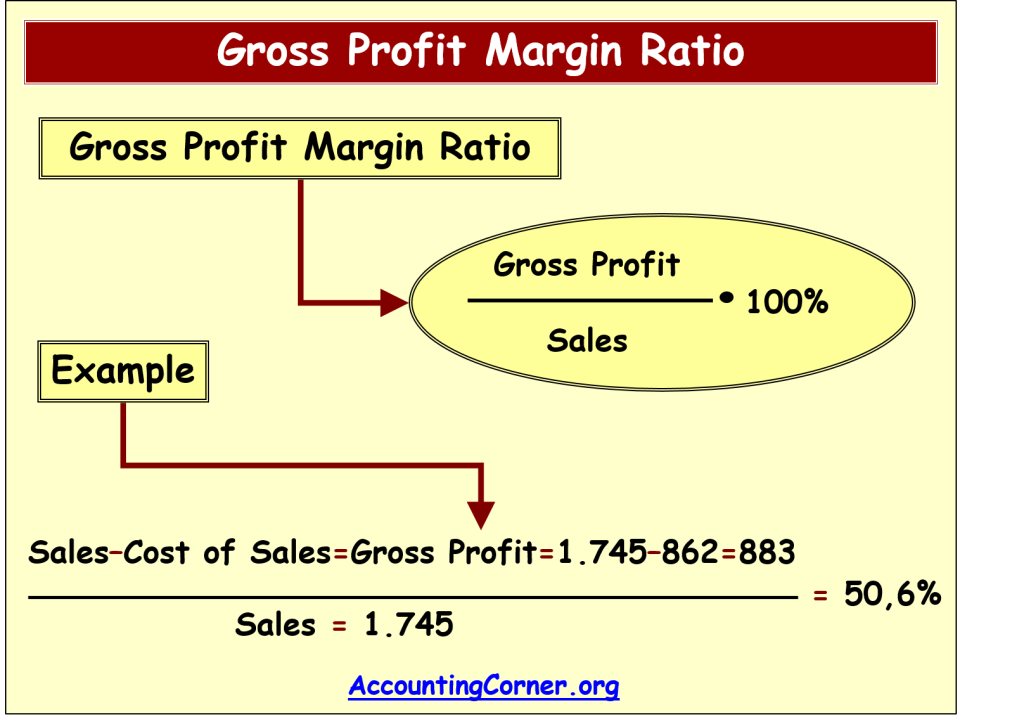

8 rows loss percentage (l%) = (loss / cost price) × 100. Profitability ratios help determine and evaluate the company’s ability to generate the income against the expenses it incurs and consider the different elements of the balance. Gross profit margin = ($20.32 billion ÷ $29.06 billion) ×.

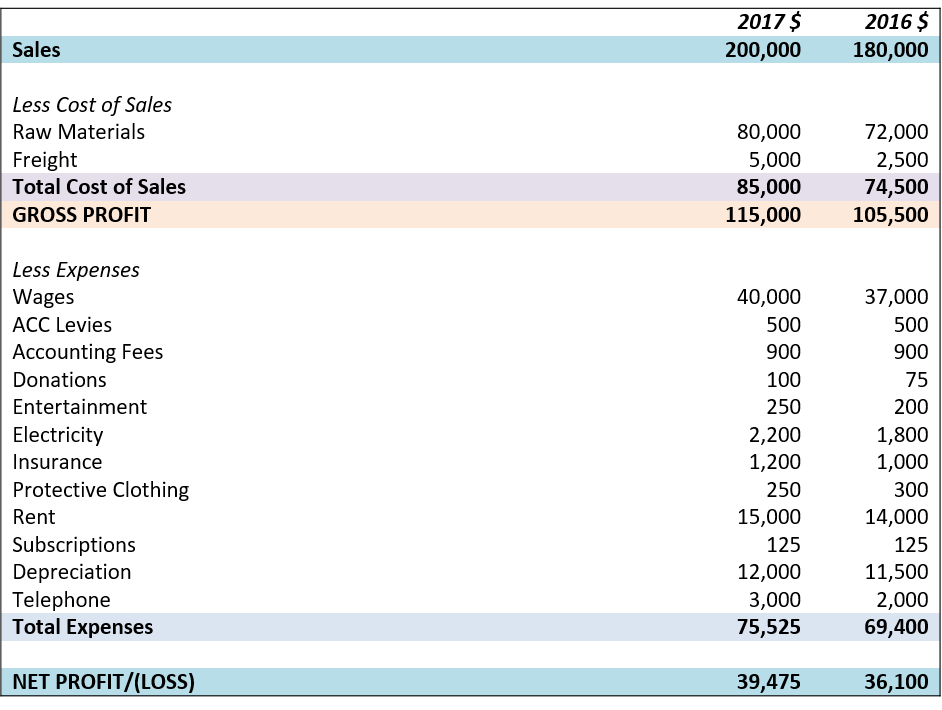

The insurance company used 65% of its premiums to pay for claims. Common profitability financial ratios include the following: The figures from the below.

The formula for loss ratio is expressed as the summation of losses incurred due to policyholders’ claims/benefits and other adjustment expenses during the given. Net profit ratio calculator. In the formula, net profit is calculated by subtracting the total expenses from total revenues.

The profit/loss ratio acts like a scorecard for an active trader whose primary motive is to maximize trading gains. A profit/loss ratio is a measure of the ability of a particular trading system to generate profit instead of loss and is based on a percentage basis. The loss ratio is calculated as ($60,000,000 + $5,000,000) / ($100,000,000) x 100 = 65%.

This ratio measures how fast a company sells its goods and receives cash to pay off its creditors. Income statement statement of earnings statement of operations statement of income. We will use the cost of goods.

We can use the following general mathematics formula to determine percent profit or loss. Why is the profit and loss statement. Determine the price of the investment.

The profit margins for starbucks would therefore be calculated as: = (gain or loss/previous value*100) which equals percent gain or loss. The net profit for the year is $4.2 billion.

Classification of profit and loss account ratios | accounting article shared by: The profit and loss account is split into several sections, which include revenue (sales), the direct cost of sales, gross profit, expenses and net profit. Profit and loss percentage is the profit and loss represented in the form of percentage and the formula for these are discussed as follows:

The profit in the profit and loss. Income statement the p&l or income statement, like the cash flow statement, shows changes in accounts over a set period of time. Profit and loss formulas.

:max_bytes(150000):strip_icc()/TermDefinitions_Profit_Loss_Ratio-c8ef191e850a41baa6cd27fa4f98d9be.jpg)

![Best Reversal Indicator [MT4/MT5] Signals the Key Points of Trend](https://wp.fxssi.com/wp-content/uploads/2018/10/profit-ratio-formula.png)