Unique Info About Financial Statements Prepared On A Liquidation Basis Ifrs Prepare Statement Of Cost Goods Manufactured

When a reporting entity has adopted the liquidation basis of accounting, its financial statement requirements change from a balance sheet and statements of.

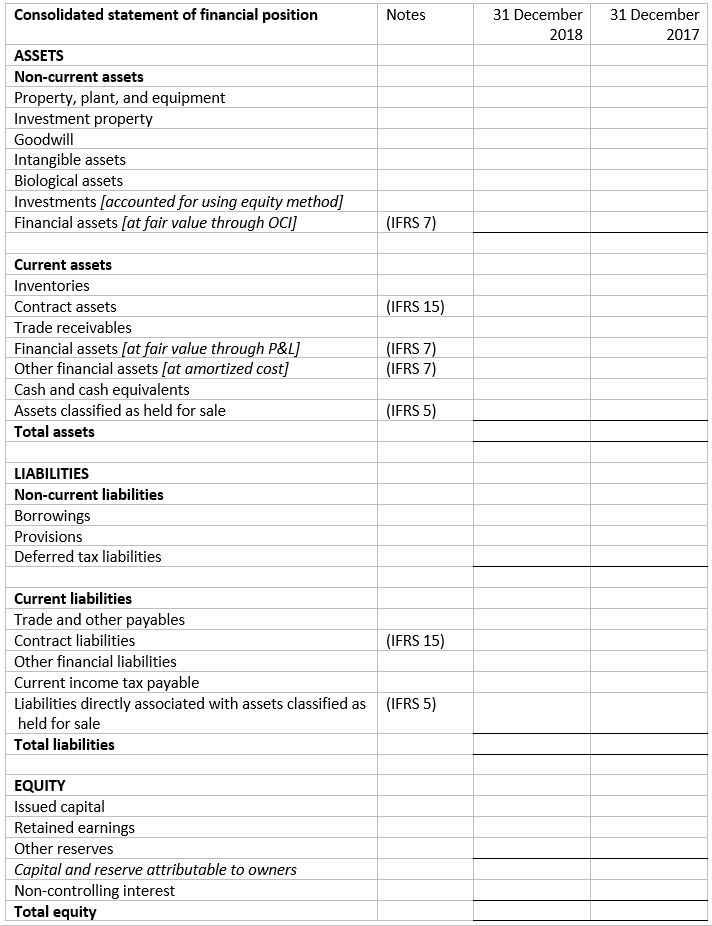

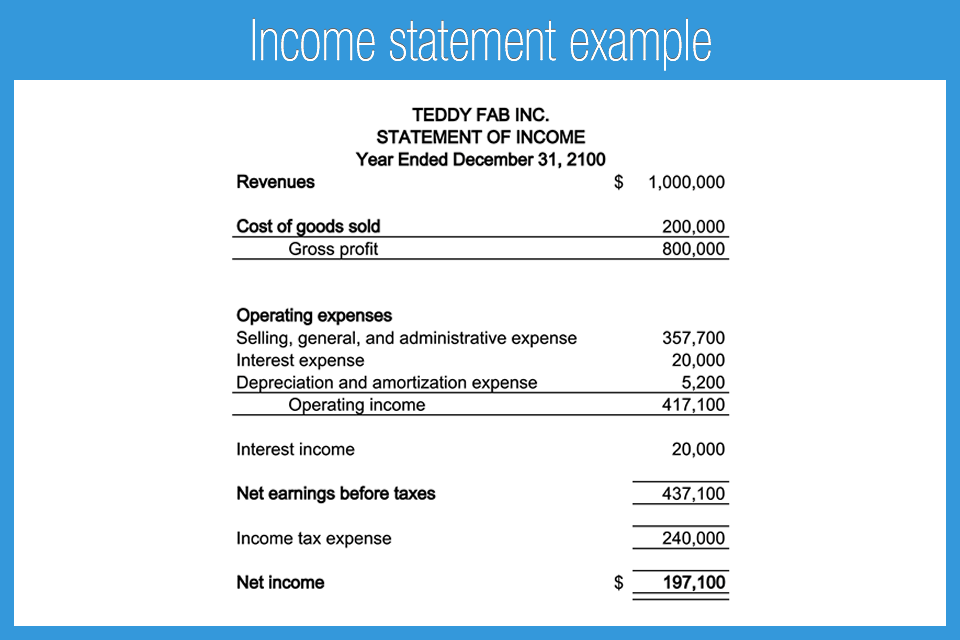

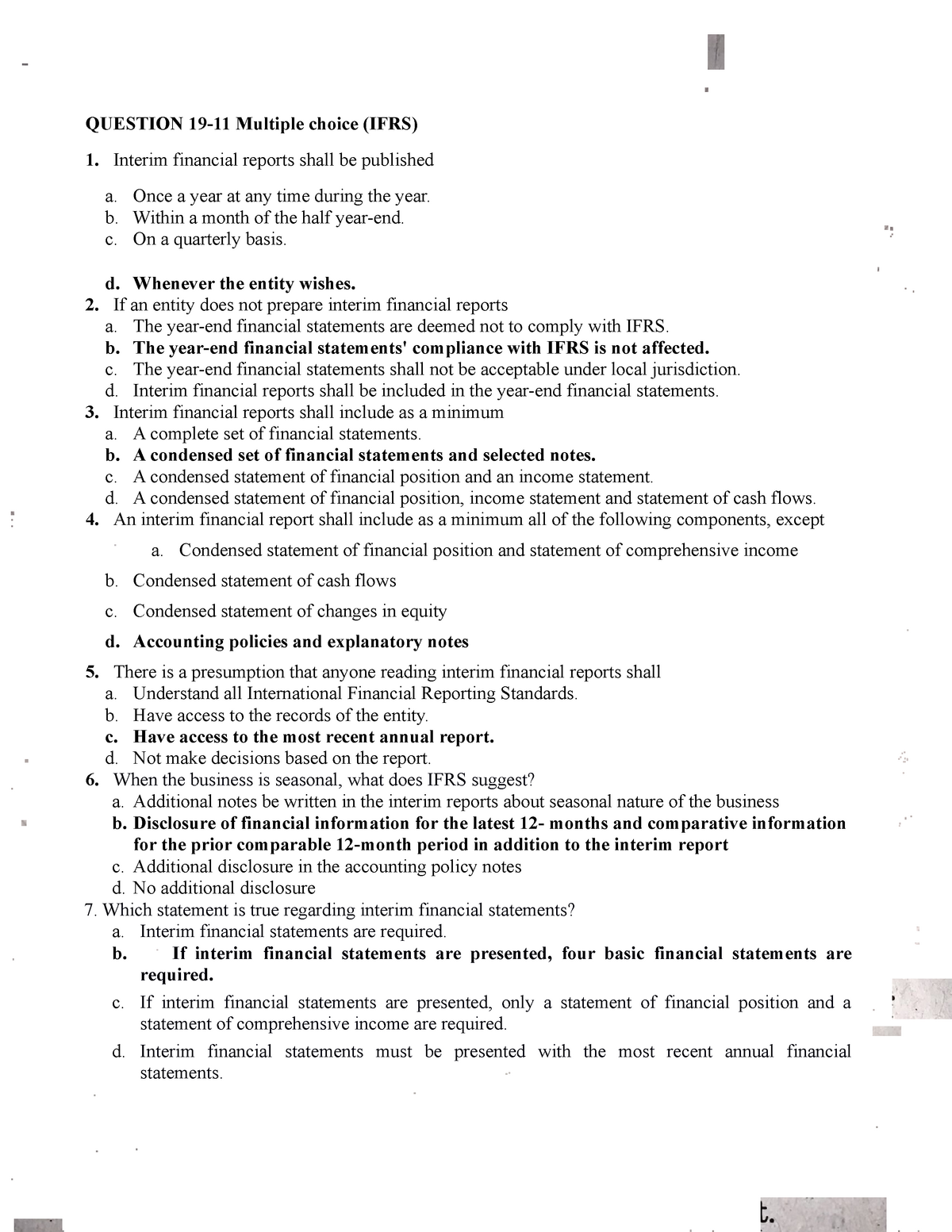

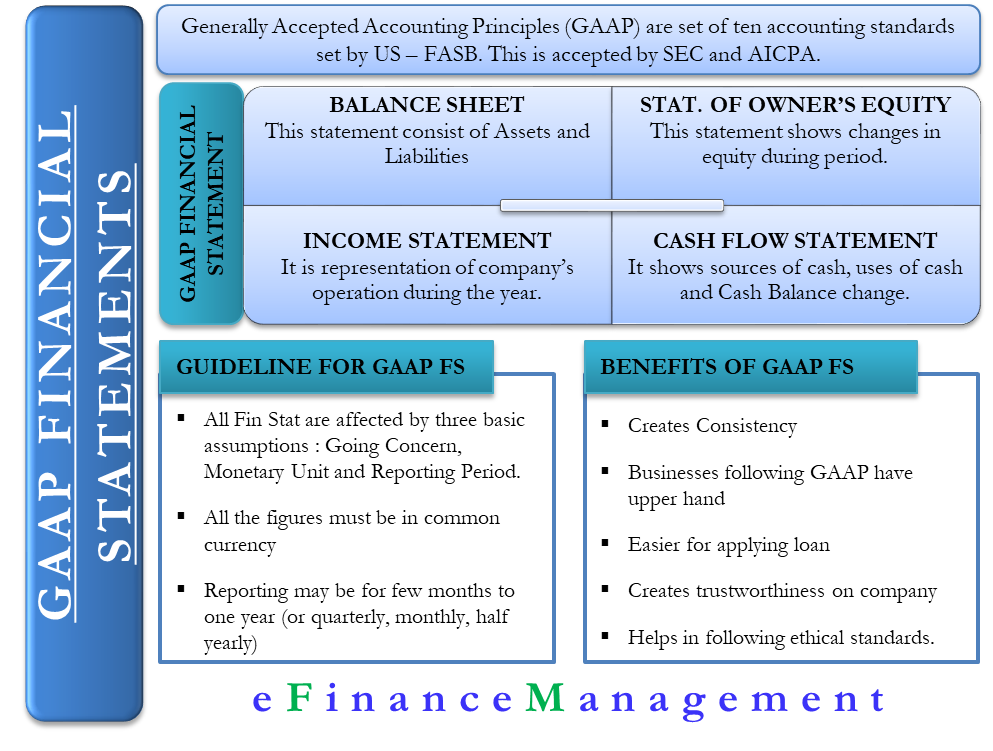

Financial statements prepared on a liquidation basis ifrs. Ias 1 presentation of financial statements in april 2001 the international accounting standards board (board) adopted ias 1 presentation of financial statements, which. The objective of this paper is to: For a reporting entity that has adopted the liquidation basis of accounting, the financial statements consist of a statement of net assets in liquidation and a statement of changes in net assets in liquidation.

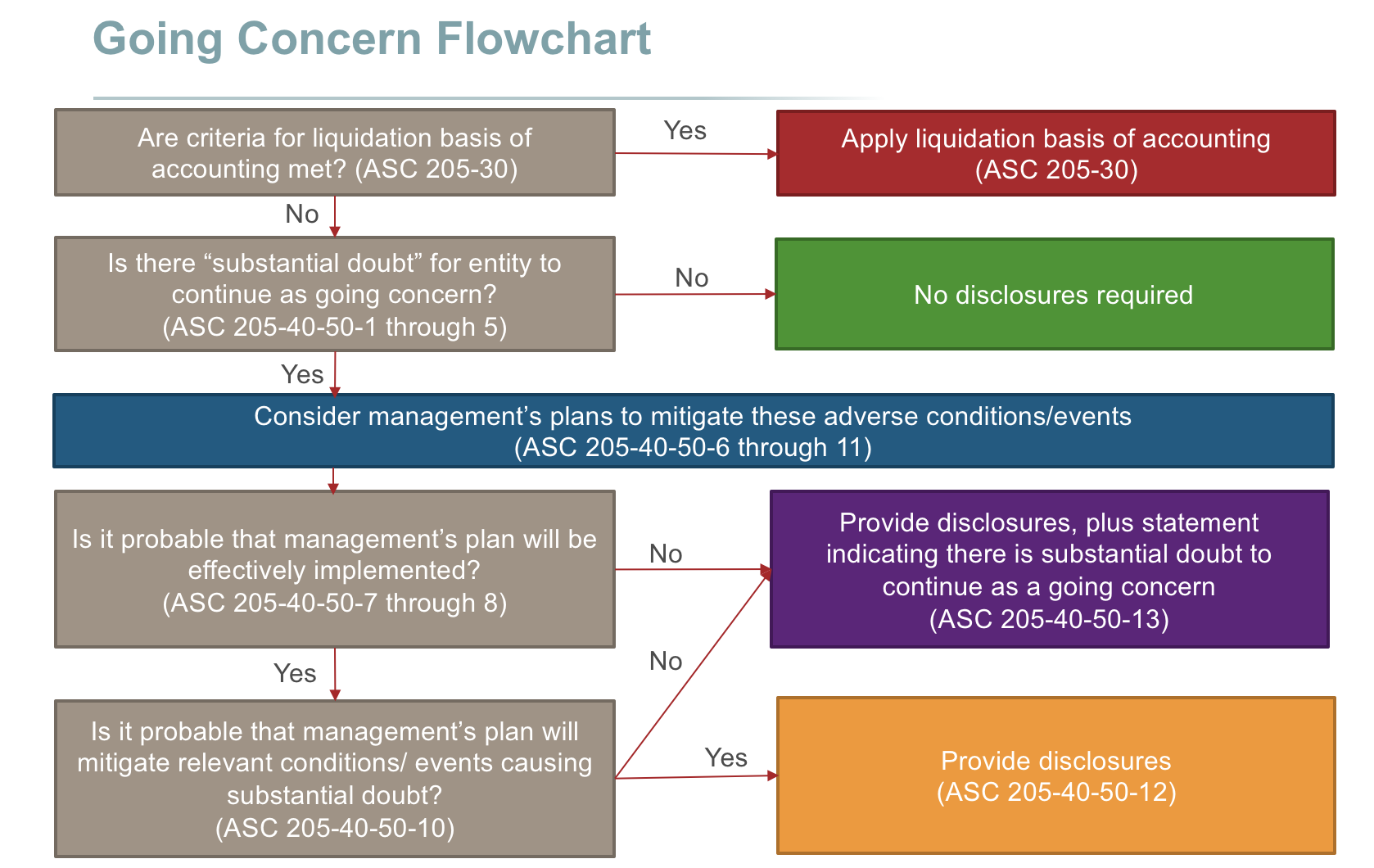

An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading, or has no realistic alternative but. Ifrs 10 consolidated financial statements addresses the principle of control and the requirements relating to the preparation of consolidated financial statements. Paragraph 25 of ias 1 presentation of financial statements (paragraph 9 of section 3 presentation of financial statements of the ifrs for smes), requires that when.

The board tentatively agreed to clarify the proposed requirement under which entities applying the liquidation basis of accounting must accrue all expected. That the financial statements are prepared using the liquidation basis of accounting, including the facts and circumstances surrounding the adoption of the. Project preparation of financial statements when an entity is no longer a going concern (ias 10) paper topic finalisation of agenda decision contact(s) stefano tampubolon.

The financial statements of a reporting entity applying the liquidation basis should reflect the amount of cash or other consideration that an investor might. When an entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis on which it prepared the. Financial statements if it had previously prepared financial statements for that preceding period on a going concern basis.

Under ifrs standards, financial statements are prepared on a going concern basis, unless management intends or has no realistic alternative other than to. Details of equity accounts ordinarily. An indication that the financial statements are prepared using the liquidation basis of accounting, including the facts and circumstances surrounding the.

Regarding the first question, the entity cannot prepare any financial statements for prior periods on a going concern basis applying ias 1:25 and ias 10:14. Some people argue that under such a ‘break up’ basis,. An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading, or has no realistic.

Ifrs accounting standards are, in effect, a global accounting language—companies in more.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)