Best Tips About Purpose Of Cash Budget Lansing Companys 2017 Income Statement

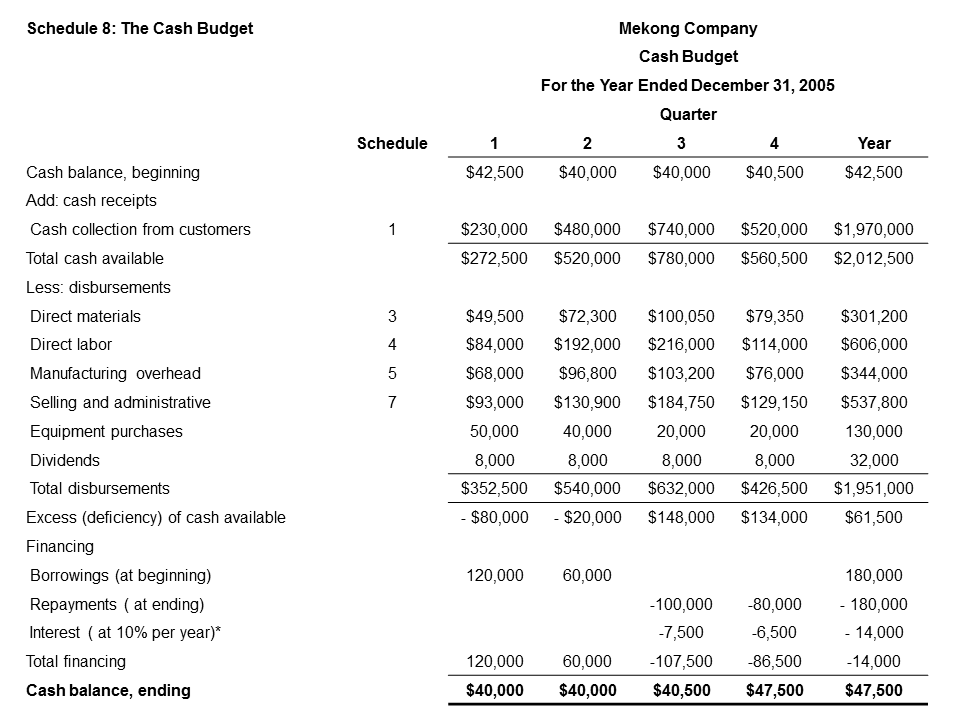

The primary purpose in preparing a cash budget is to know the cash position at the end of each month or quarter.

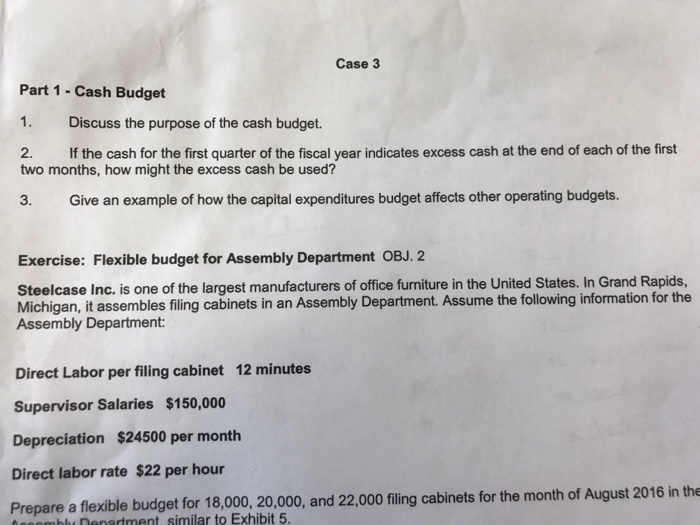

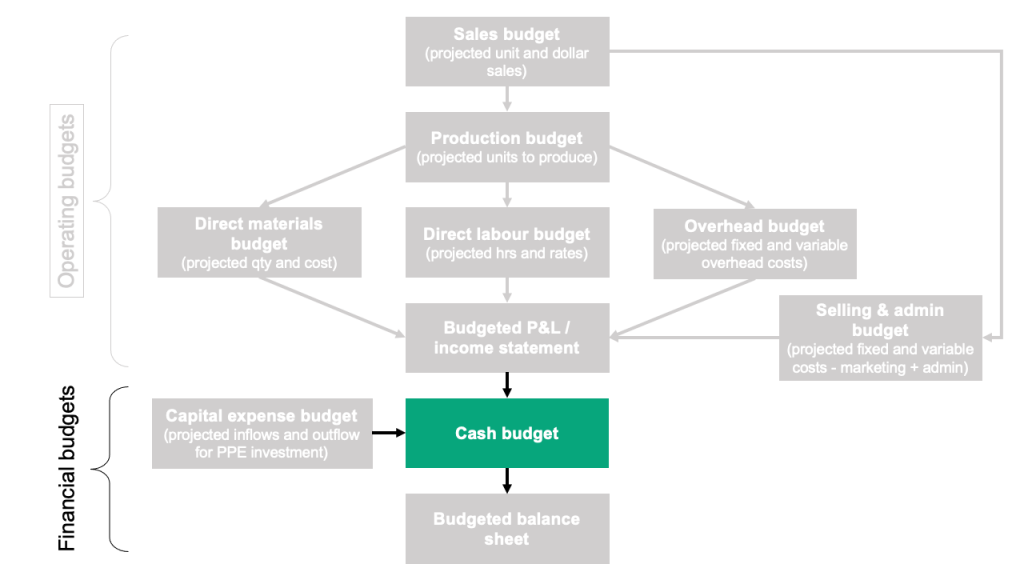

Purpose of cash budget. Provides information about various sources of cash receipts and the use of cash 2. A cash budget is a document produced to help a business manage their cash flow. This is because the company can decide on any financing.

A cash budget is a document that estimates a business' cash flows over certain periods, such as weekly, monthly or annually. A cash budget is an estimation of the cash flowsof a business over a specific period of time. this could be for a weekly, monthly, quarterly, or annual budget. It applies to companies and individuals, although it may.

A cash budget is prepared in advance and shows all the planned monthly cash incomings. What is a cash budget? Based on the forecasted balances, finance.

Cash flow reflects the actual movement of cash in and out of a business, providing a. The primary objective of a cash budget is to forecast future cash balances in order to identify potential deficits and surpluses. A cash budget will prevent these cash flow issues from happening by forecasting actual cash transactions, allowing you to prepare ahead of time.

Its primary purpose is to. This budget is used to ascertain whether company. A cash budget details a company's cash inflow and outflow during a specified budget period, such as a month, quarter or year.

Introduction a cash budget is a financial planning tool that forecasts a business’s cash inflows and outflows over a specific period. A cash budget details the anticipated cash receipts and cash disbursements for the time period covered in the budget. Your cash flow budget (sometimes called a “cash flow forecast”) does not need to be complex.

Cash budgets are often used to assess whether the entity. The cash budget includes the. The following are the merits of the cash budget:

What is a cash budget? The cash budget provides a company. What is a cash budget?

The main purpose of a cash budget is to help manage incoming and outgoing cash flow to make informed decisions about how best to utilize its resources. This budget is used to assess whether the entity has sufficient cash to continue operating over the given time frame. A cash budget is a budget or plan of expected cash receipts and disbursements during the period.

These cash inflows and outflows include revenues collected,. You can keep the information in an excel spreadsheet. A cash flow budget allows for the monitoring of receipts and payments in the business that will highlight when cash may be short so that action can be taken.

:max_bytes(150000):strip_icc()/cashbudget-resized-1e57d018a48848828a0d06e7ca92dbf5.jpg)