Outrageous Tips About Statement Of Financial Position And Balance Sheet Insurance Agency Statements

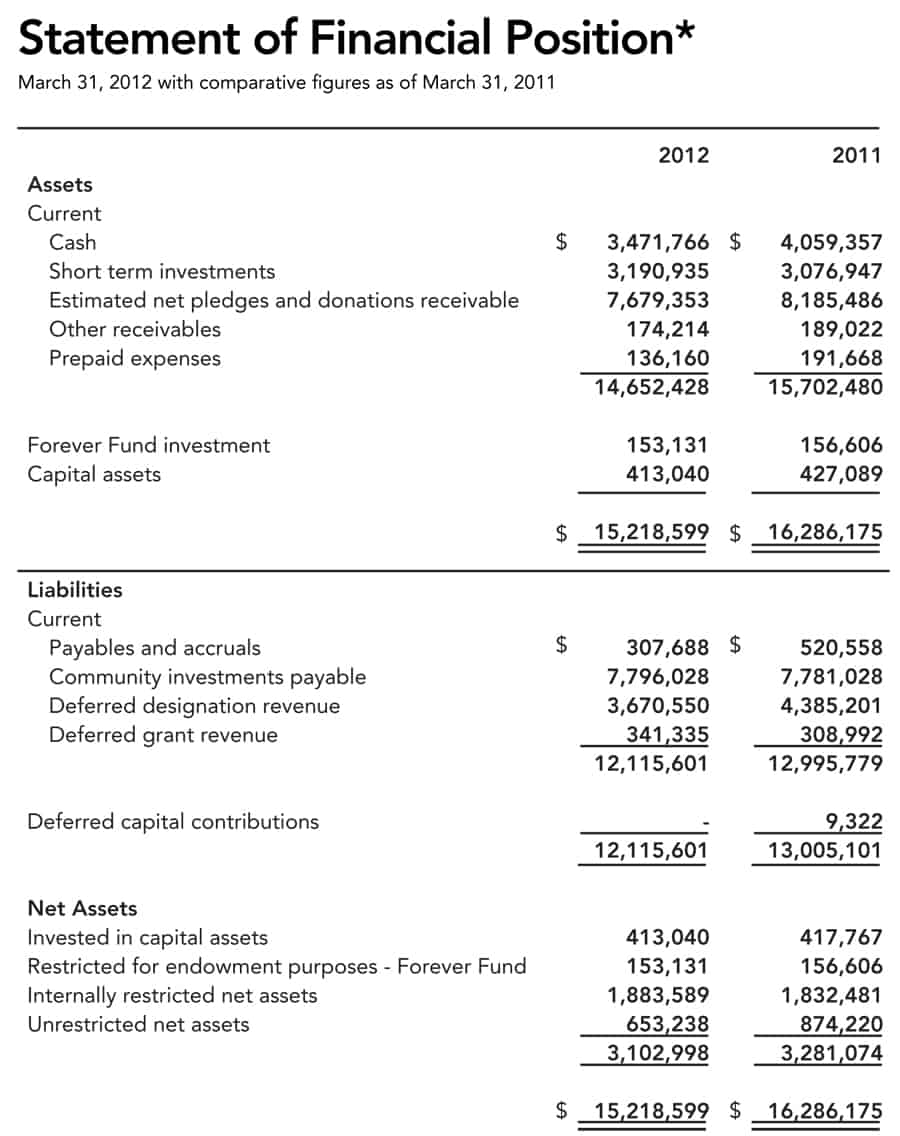

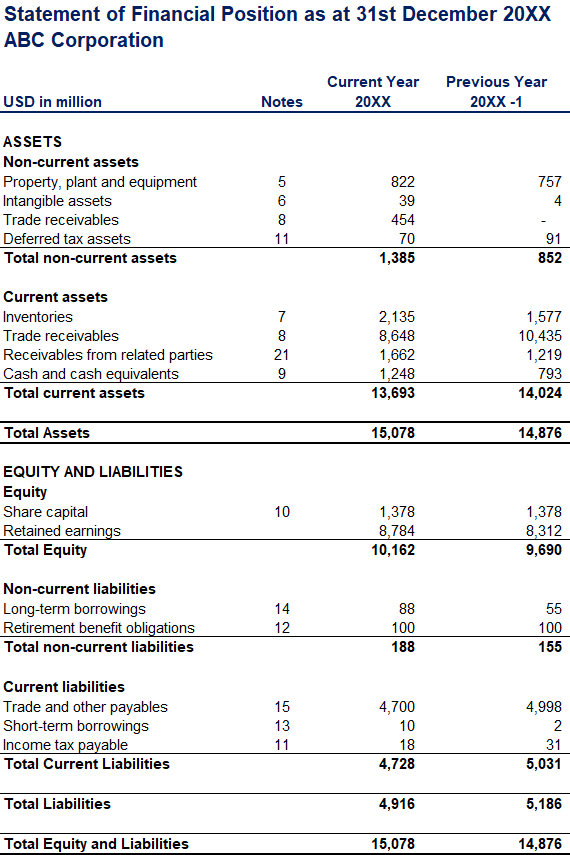

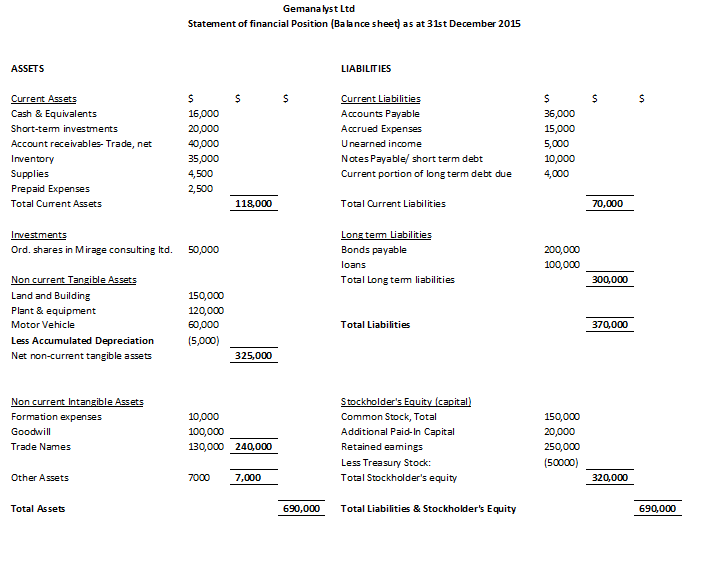

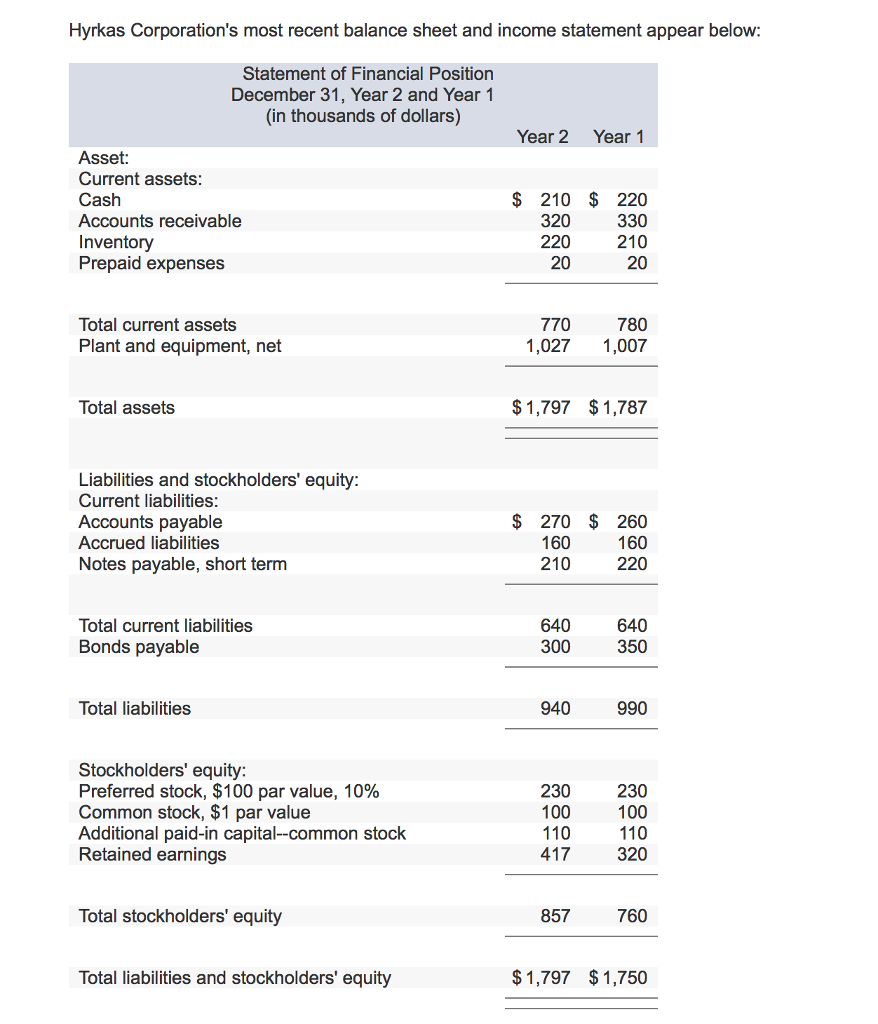

The statement of financial position, also commonly known as the balance sheet, serves as a snapshot of a company's financial position at a specific point in time.

Statement of financial position and balance sheet. And the third states the date of the report. It is comprised of three main components: This financial statement thus becomes a way for calculating rates of returns on invested assets and for evaluating a business’ capital structure.

Interest rate contracts related to fair value hedges (all as recorded in the consolidated statement of financial position). A typical balance sheet starts with a heading which consists of three lines. This chapter provides an overview of the key elements of balance sheets prepared under the nfp reporting model, including the statement’s format, organization, and contents.

The first line presents the name of the company; Assets , liabilities and equity. The main purpose of the statement of financial position is to provide a concise summary of a company's assets, liabilities, and equity.

In relation to the financial statement, a balance sheet's information reflects activity over a set financial period. Our dividend proposals are a reflection of the strong 2023 financials, our growth prospects in 2024 and balance sheet strength.”. Statement of financial position helps users of financial statements to assess the financial soundness of an entity in terms of liquidity risk,.

The statement of financial position has a number of important business calculations. They are prepared at the end of an accounting period and are used to assess the financial health and stability of a company. Statement of financial position, also known as the balance sheet, gives the understanding to its users about the business’s financial status at a particular point in time by showing the details of the company’s assets along with its liabilities and owner’s capital.

A balance sheet shows the financial position or condition of the company; The overall aim of a balance sheet is to get the assets and capital employed to match, thus balancing the sheet. The balance sheet is one of the three core financial statements that are used to evaluate a business.

It is called the balance sheet as the net assets should equal the total equity. A statement of financial position is another name for your company’s balance sheet. Thus, it is also called statement of financial position.

The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it. You can think of it like a snapshot of what the business looked like on that day in time.

Intermediate financial accounting 1 (arnold and kyle) chapter 4: Assets = capital + liabilities (please compare this with sofp’s format below later!) before we look at the format, some slight explanations on the definitions of assets and liabilities are as follow: The balance sheet and statement of financial position are both financial statements that provide information about a company's assets, liabilities, and shareholders' equity.

Statement of financial position/balance sheet The balance sheet. A company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth).

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)