Smart Tips About Equipment Expense Income Statement Bench Financial

At the end of the second year, on the december income statement, the depreciation expense line item still shows a monthly depreciation of $1,000.

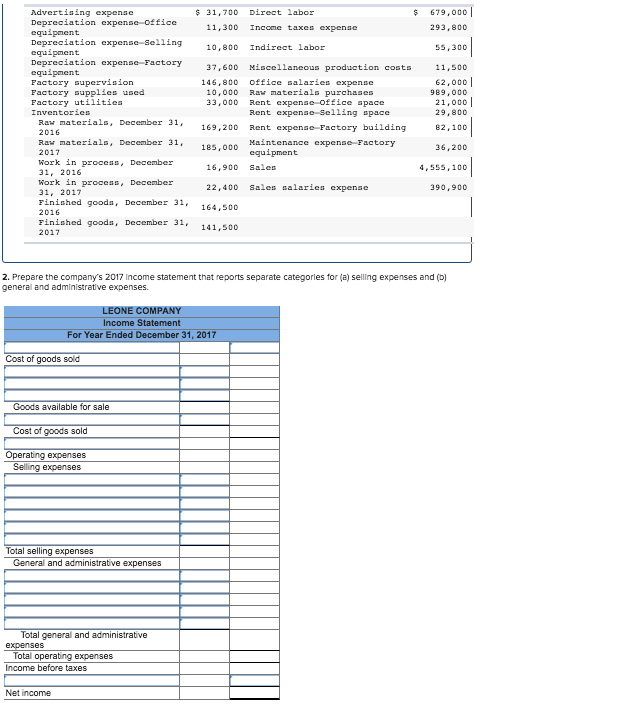

Equipment expense income statement. The way you report equipment depends on whether you buy it or lease it and the type of lease arrangement you use. Property, plant and equipment: The depreciation expense is used to reduce the value of the net balance and it flows to the income statement as an expense.

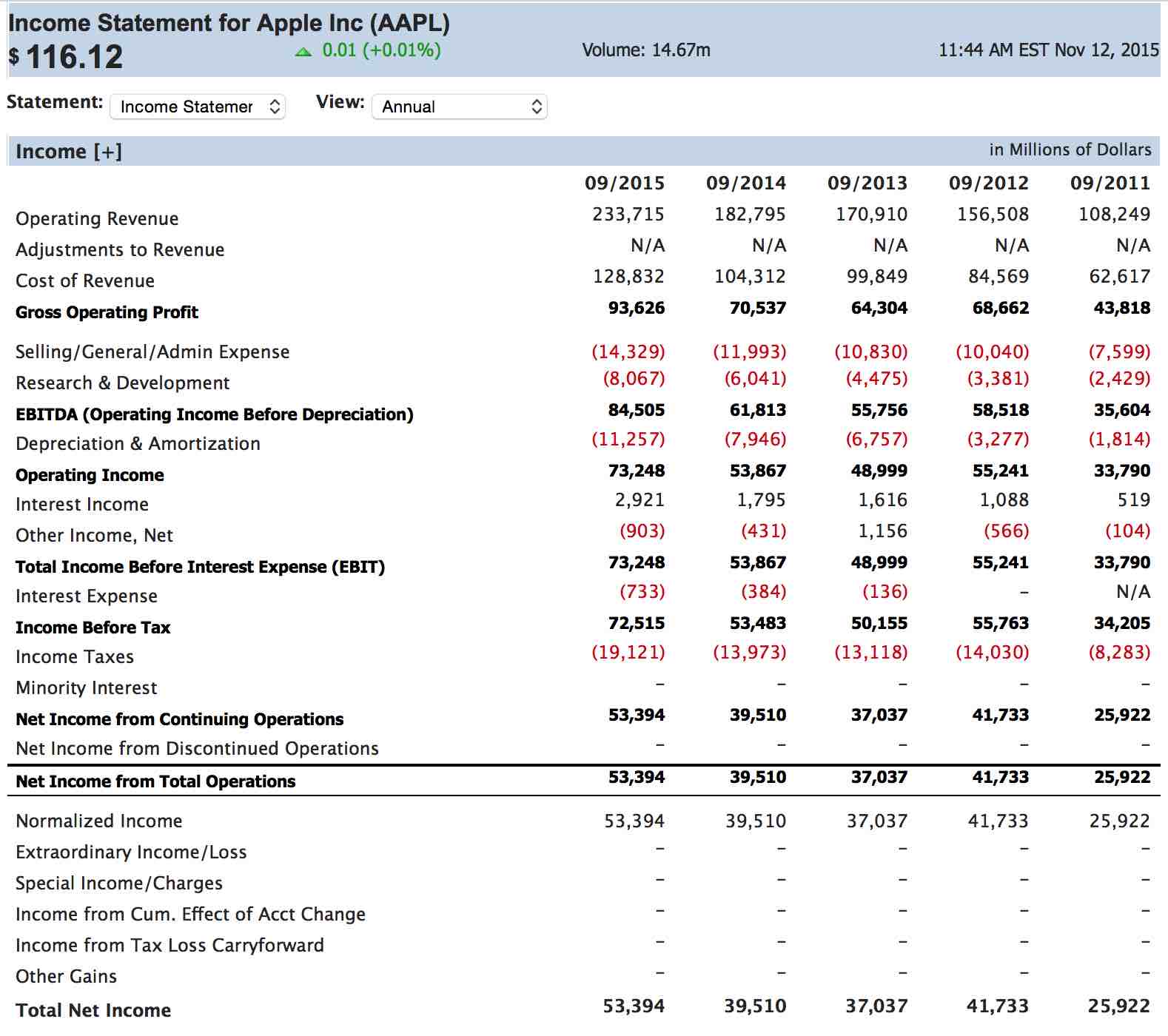

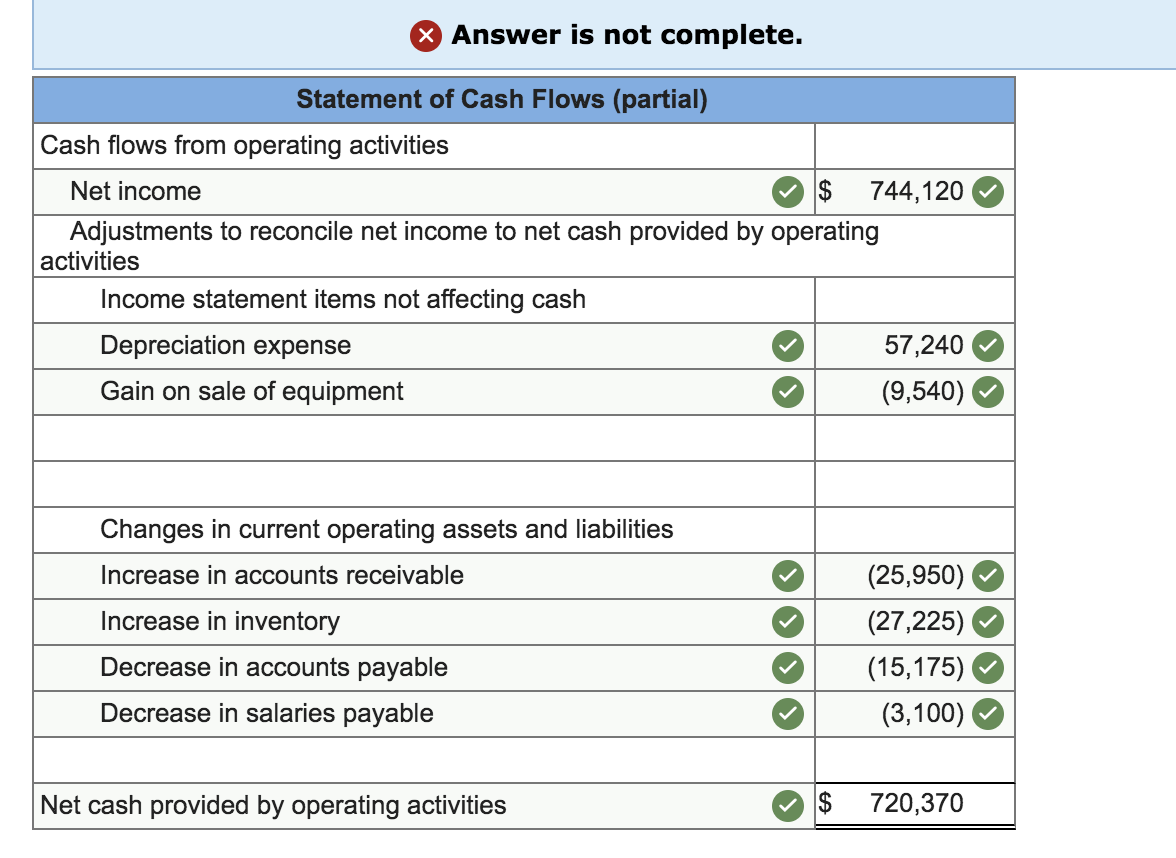

Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). An income statement is a financial report detailing a company’s income and expenses over a reporting period. The income statement is important to internal and external users.

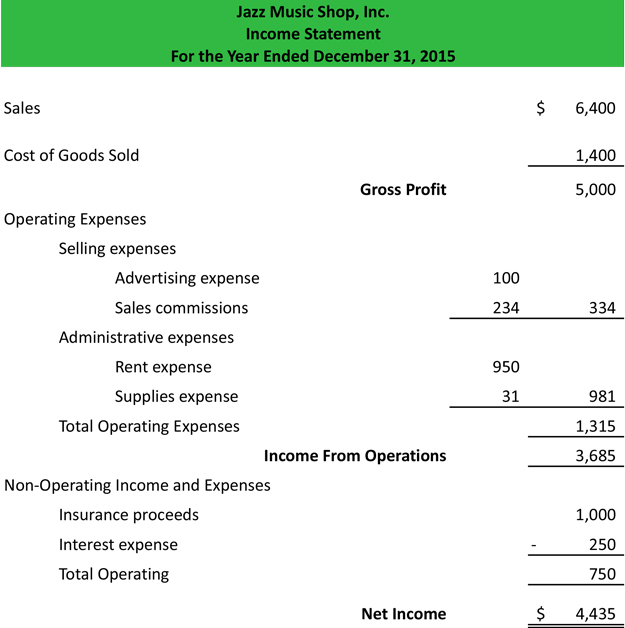

Sales on credit) or cash. This cost is charged to expense as. It consists of revenue from the sale of.

You can obtain it by dividing the total cost of $48,000 by its useful life of 48 months. It is accounted for when companies record the loss in value of their fixed assets through depreciation. It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually.

The depreciation rate of the equipment is $1,000 per month. Instead, record an asset purchase entry on your business balance sheet and cash flow statement. An income statement is another name for a profit and loss statement (p&l).

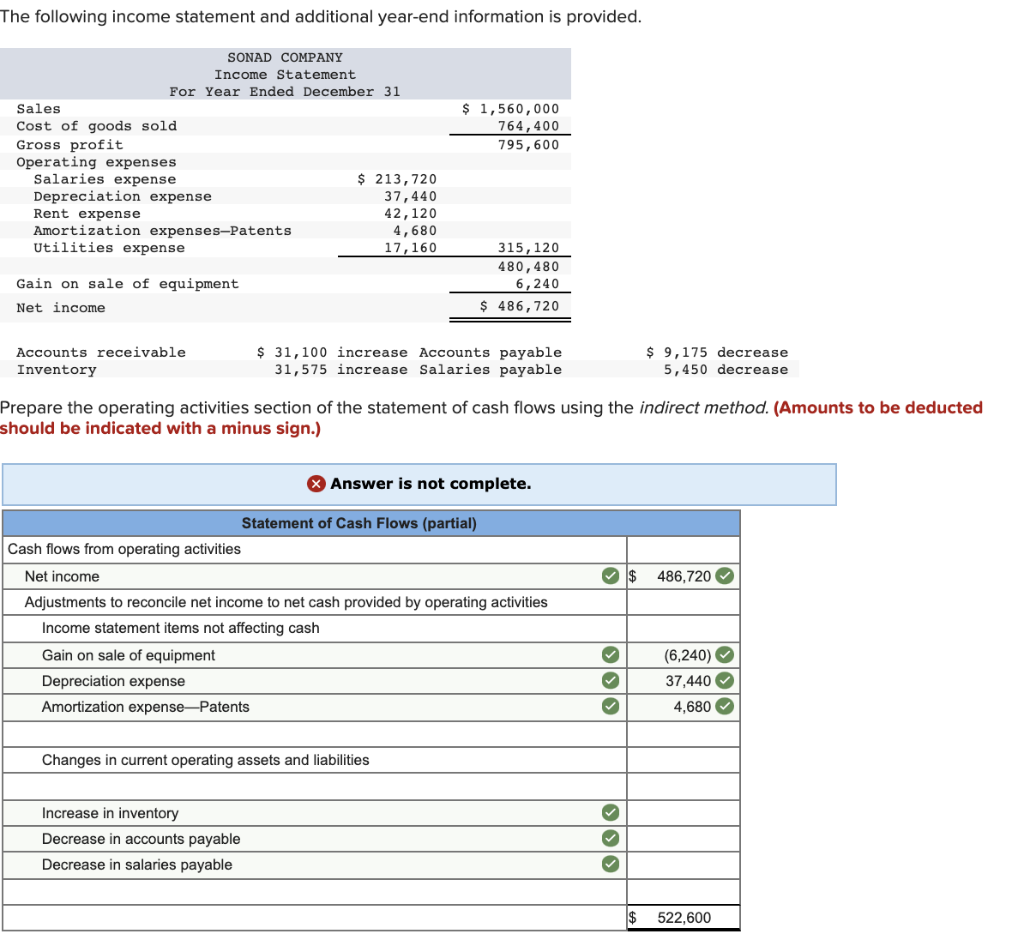

Operating expenses include rent, equipment, inventory costs, marketing,. February 24, 2022 this article is tax professional approved how profitable is your business? Other expenses there are other expenses that could fall under either capital expenditures or operating expenses, depending on the specific item.

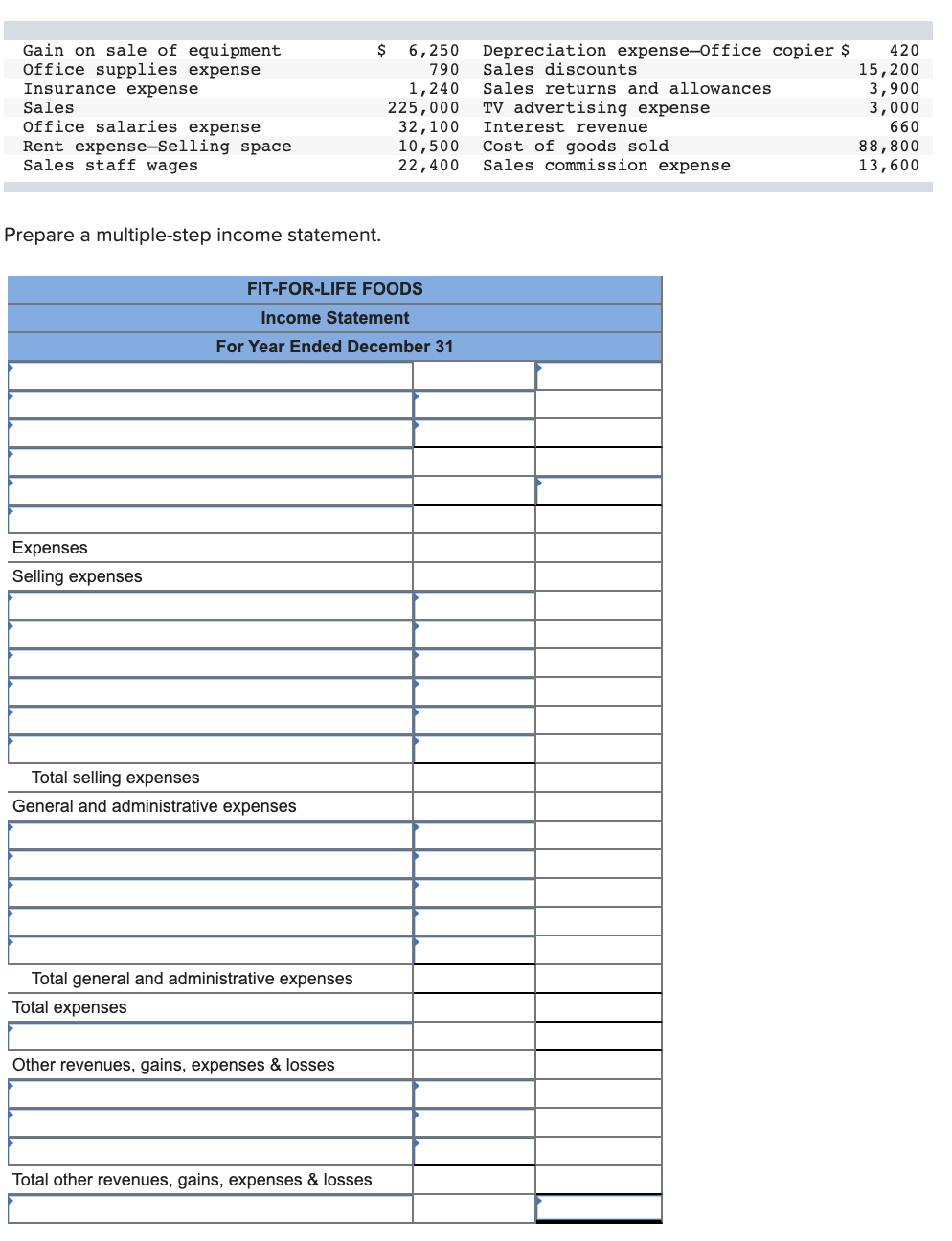

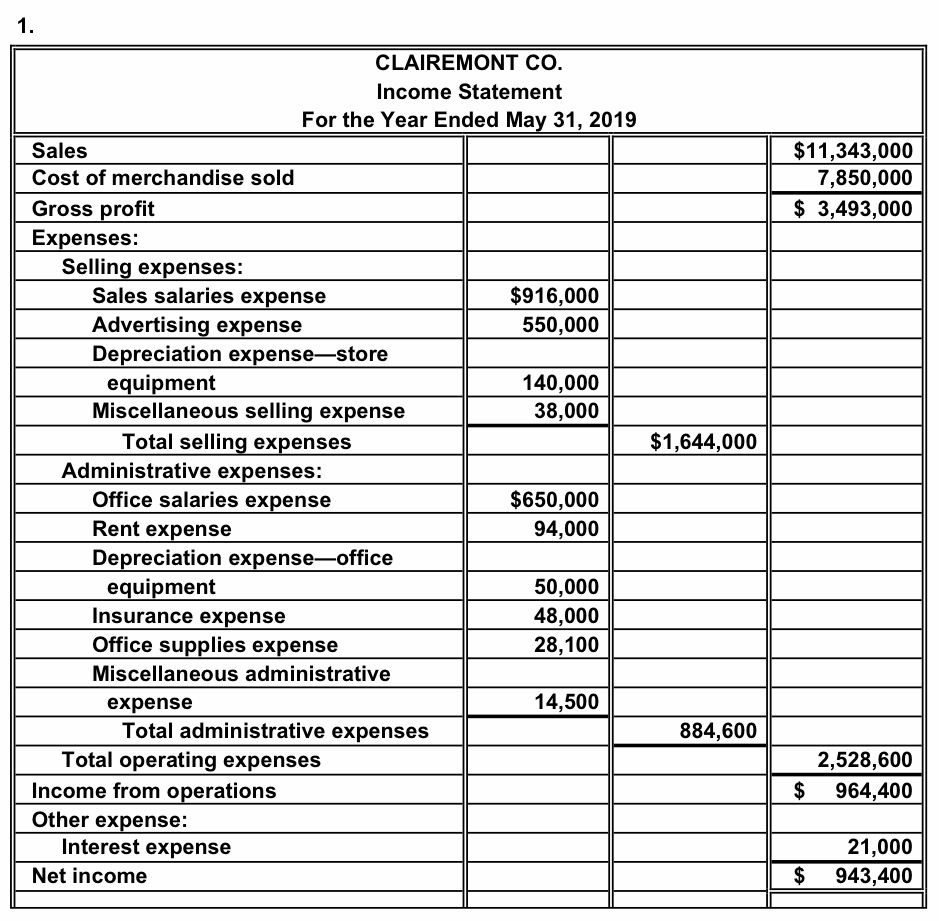

Here’s how to put one together, how to read one, and why income statements are so important to running your business. The business also gained $1,500 from the sale of. When preparing an income statement, revenues will always come before expenses in the presentation.

Depreciation expense is an income statement item. Learn more what is an income statement? Office equipment expense is usually classified within the selling, general and administrative grouping of expenses in the income statement.

What is equipment rental expense? Revenue minus expenses equals profit or loss. Purchase of equipment accounting.

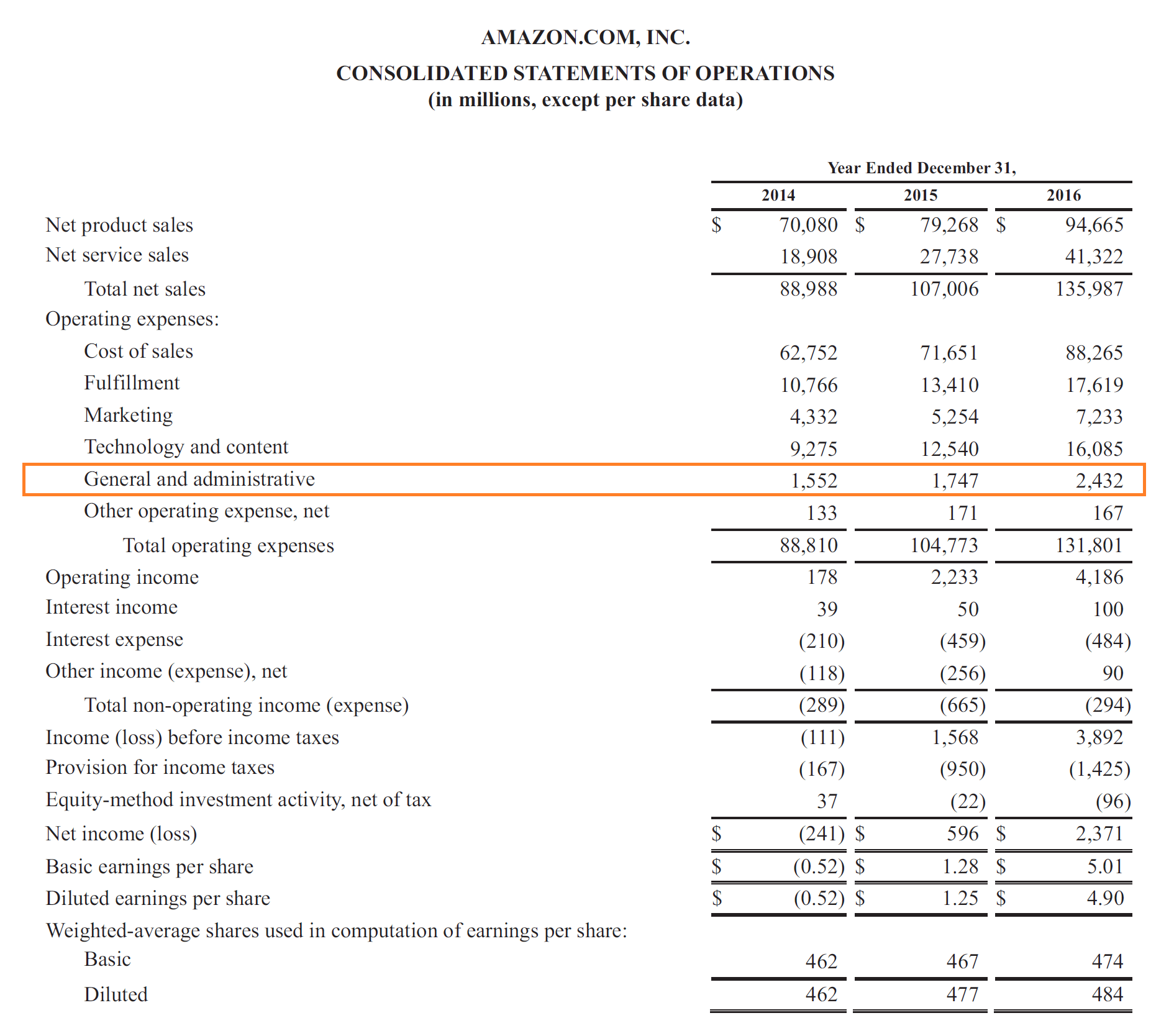

The only way to really know is to create an income statement. Common examples for retailers and manufacturers include investment income, interest expense, and the gain or loss on the sale of equipment that had been used in the business. Total property, plant and equipment :

:max_bytes(150000):strip_icc()/SampleIncomeStatement-6c65ce80044e44cea6f20a48e8072f9e.png)