Sensational Tips About Difference Between Cash Flow Statement And Forecast Income Adjusted Trial Balance

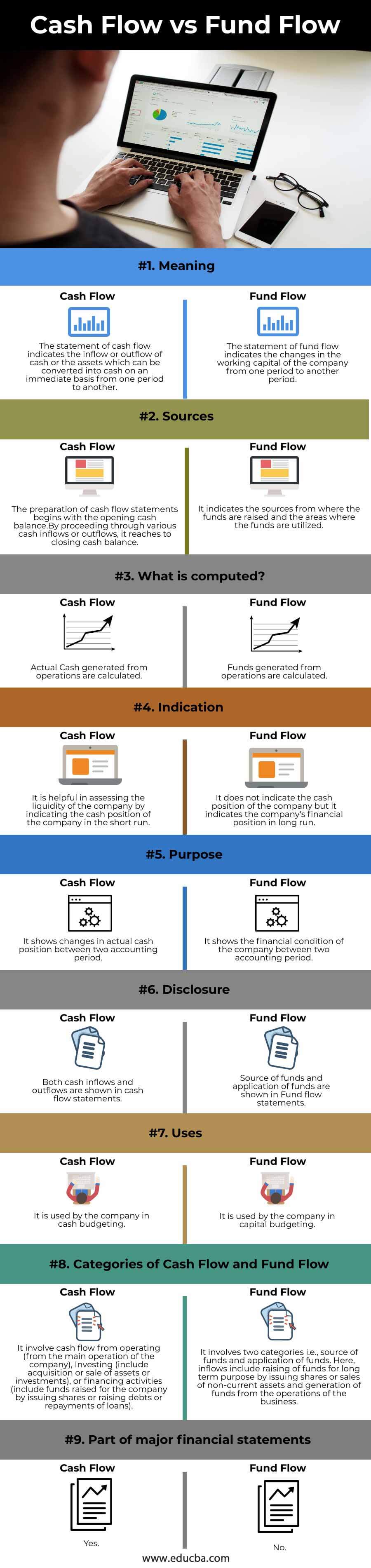

The difference between a cash flow forecast and a cash flow statement is that a cash flow forecast or projection is looking into the future to predict future cash flows.

Difference between cash flow statement and cash flow forecast. A cash flow projection is all about predicting your money needs in advance. The cfs measures how well a company. From the income statement, we use forecast net income and add back the forecast depreciation.

The cash flow statement is a financial statement. A cash flow forecast is only different from a cash flow statement in that the forecast is predicting the future of your cash flow while the statement is showing what happened in the past. Unlike a profit & loss forecast, your cash flow forecast measures how much actual cash is moving into and out of your business.

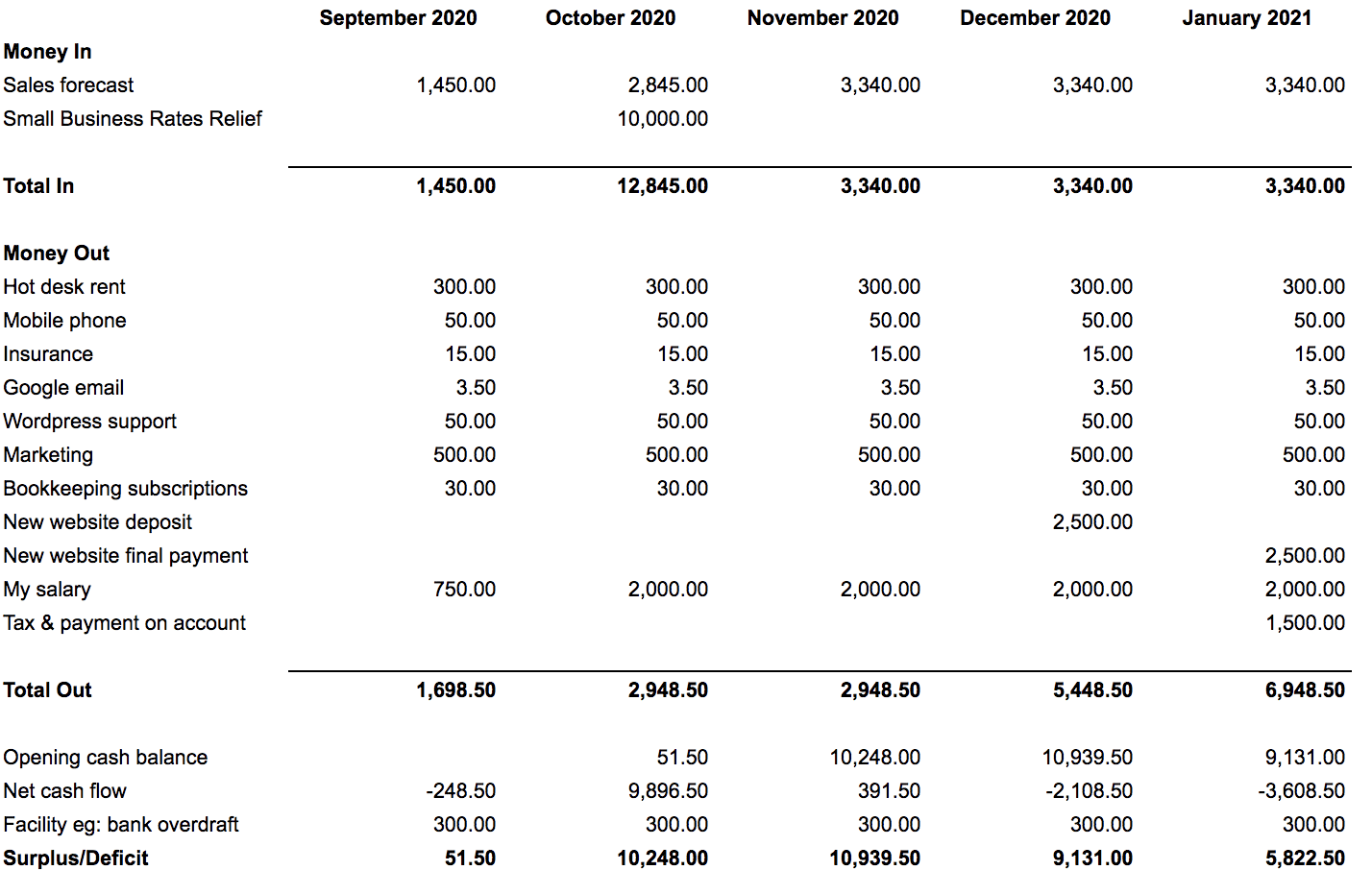

At its simplest, cash flow forecasting is about monitoring the dollars that flow in and out of a business. How to forecast your cash flow and build a cash flow statement. Your cash flow forecast predicts how much cash you will receive each month and how much cash you will spend each month to predict how much money you’ll have in the bank at the end of every month.

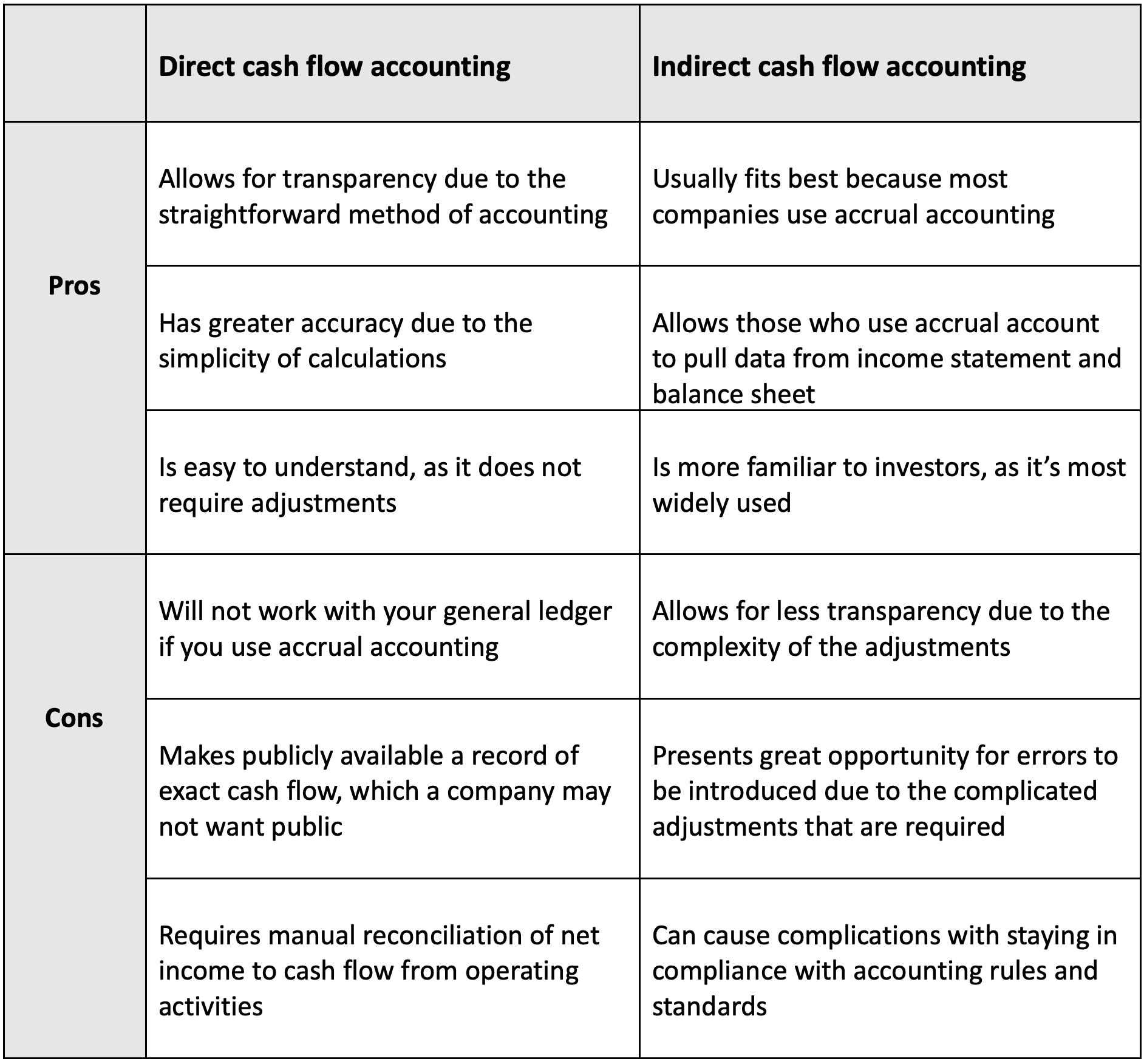

Your cash flow statement takes inputs. In the direct cash flow forecasting method, calculating cash flow is simple. What is a cash flow statement?

A cash flow forecast provides estimates of a company’s future revenue and expenses. Cash flow forecasts serve different purposes for different business leaders. Forecasting cash flow and cash balance.

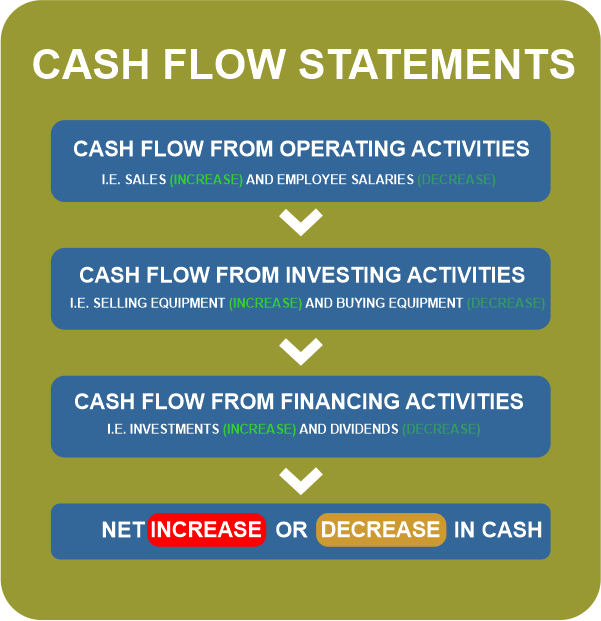

This video explains that concept of cash flow, how it can be. The cash flow statement shows the cash inflows and outflows for a company during a period. What is the difference between a cash flow statement and a cash flow forecast?

Just subtract the amount of cash you plan on spending in a month from the amount of cash you plan on receiving. Key takeaways cash flow is the movement of money in and out of a company. Whereas a cash flow statement is a report of actual transactions that have already taken place.

Fact checked by ariel courage the cash flow statement and the income statement are integral parts of a corporate balance sheet. Learn about the difference between a cash flow forecast and a cash flow statement in this video. How is the cash flow statement important for cash flow forecasting?

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. This will be your “net cash flow”. The cash flow statement or statement of cash flows.

Both cash flow statement and cash flow forecast only deal with cash. The first step in our cash flow forecast is to forecast cash flows from operating activities, which can be derived from the balance sheet and the income statement. Neither cash flow statement nor cash flow forecast show the profitability of a business.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)