Awe-Inspiring Examples Of Tips About Forecasting Prepaid Expenses A Financial Statement That Summarizes Company Revenue And Is

Strategically managing prepaid expenses enables businesses to optimize cash flow and budgeting.

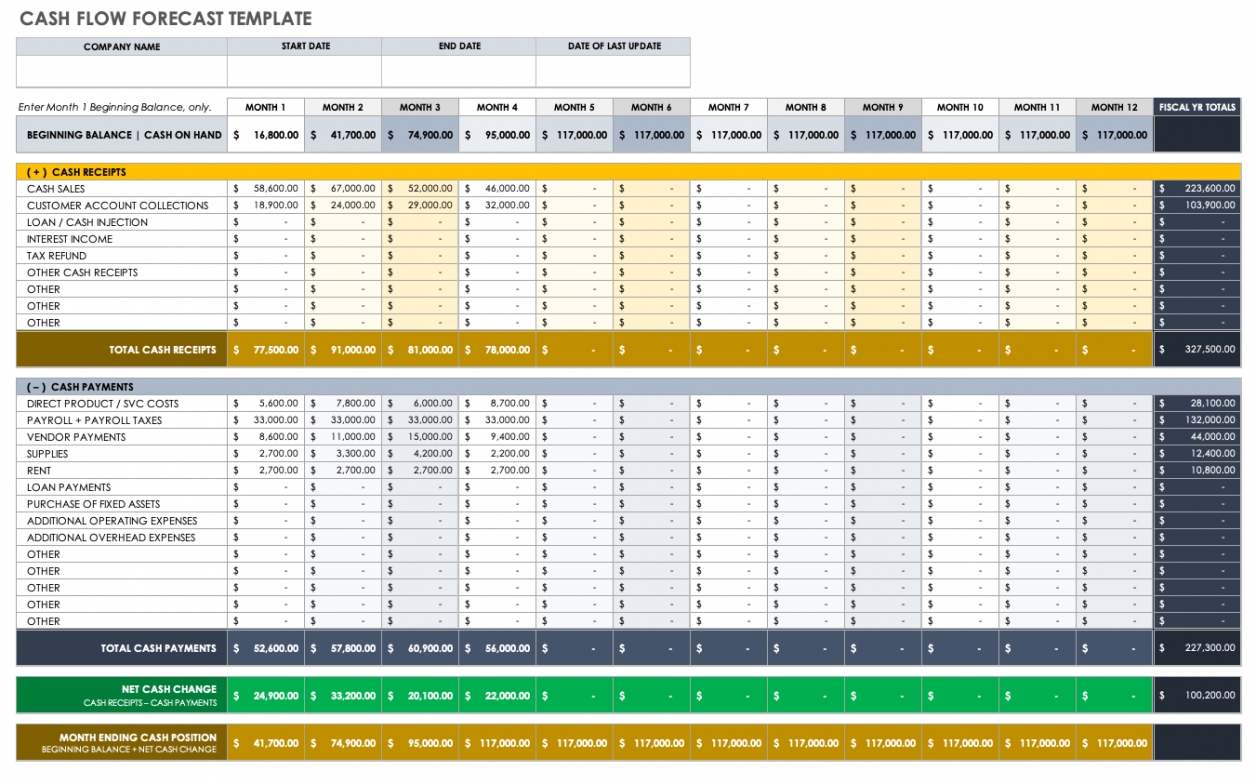

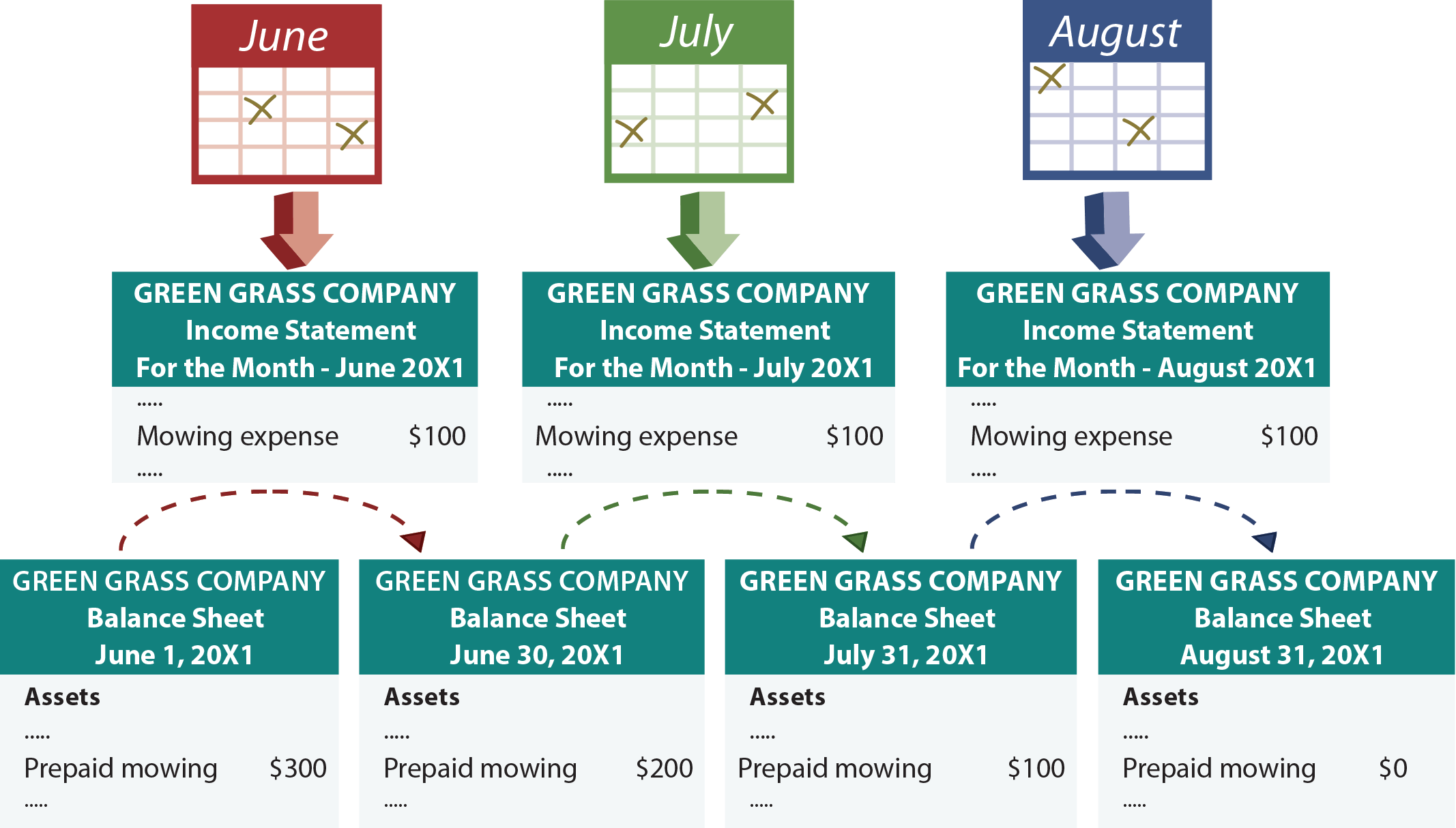

Forecasting prepaid expenses. 12 december, 2022 5min brett johnson, avp, global enablement check your ar score table of content key takeaways introduction what is a prepaid expense? However, in a complete financial model, all three financial statements are forecasted. Expense forecasting using the revenue forecast simply involves establishing a percentage relationship between the revenue and the expense.

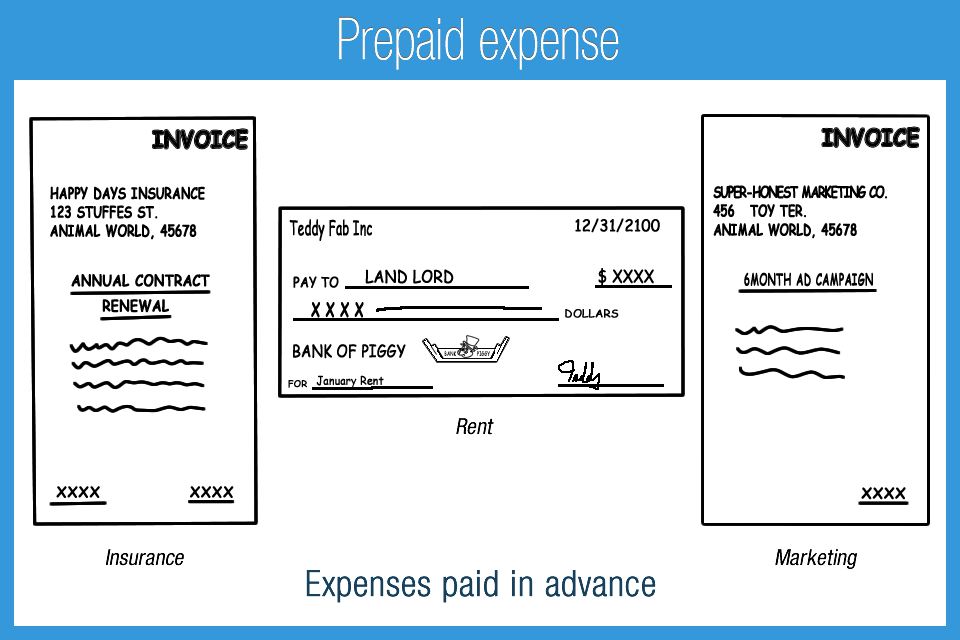

Nvda) today reported revenue for the fourth quarter ended january 28, 2024, of $22.1 billion, up 22% from the previous quarter and up 265% from a year ago. Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). Prepaid expenses are future expenses paid in advance, like insurance or rent, recorded as assets on the balance sheet.

The most common types of prepaid expenses are prepaid rent and prepaid insurance. These costs are built into the saas pricing strategy.

But there is a floor. For example, if you itemize, your agi is $100,000 and your. Incorporating prepaid expenses into financial forecasting can significantly enhance a business’s ability to project future financial conditions accurately.

This facilitates more informed budgeting and forecasting, empowering organizations to plan for expenses and allocate resources effectively. However, they aid in budget stability as the expense is spread over future periods. As the benefits of the expenses are recognized, the related asset account is decreased and expensed.

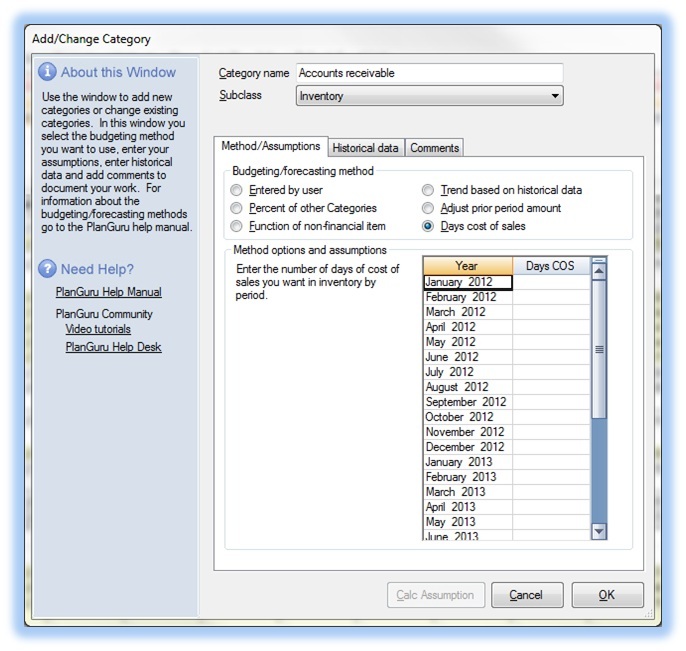

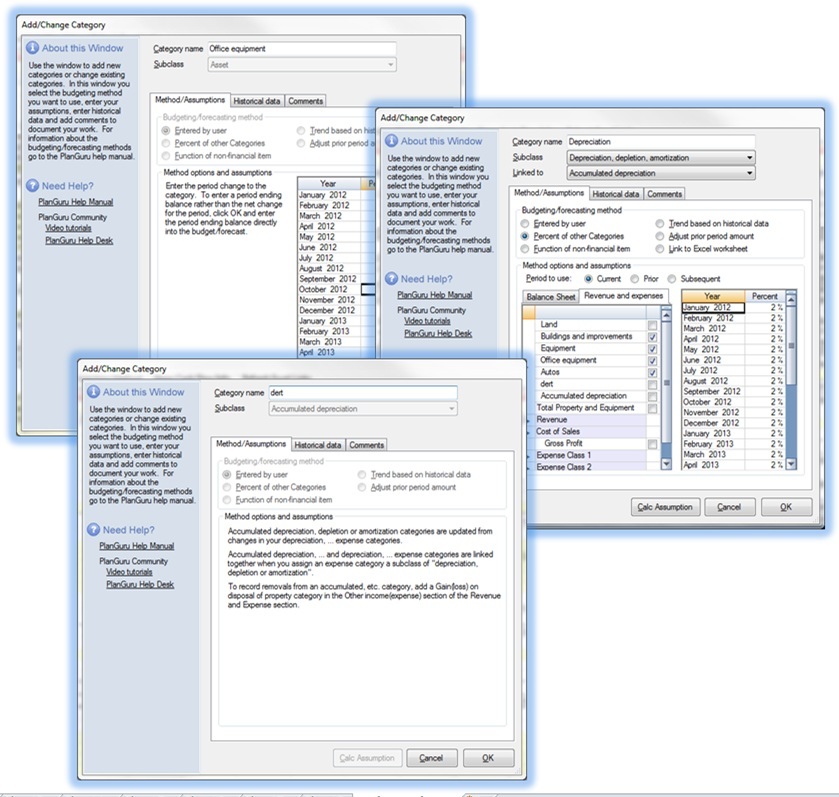

What is an example of prepaid expenses? You’ll also see an example of how to check your work, how to tell when you’ve linked something incorrectly, and what to do with more “random” line items. In the operating assumptions section of a model, the ratio between prepaid expense and operating expenses (or sg&a) will be calculated for historical periods.

In this tutorial, you will learn which income statement line items should be linked to balance sheet accounts such as accounts receivable, prepaid expenses, and deferred revenue. If prepaid expenses comprise expenses predominantly classified as sg&a, grow with sg&a. Cash flow predictability:

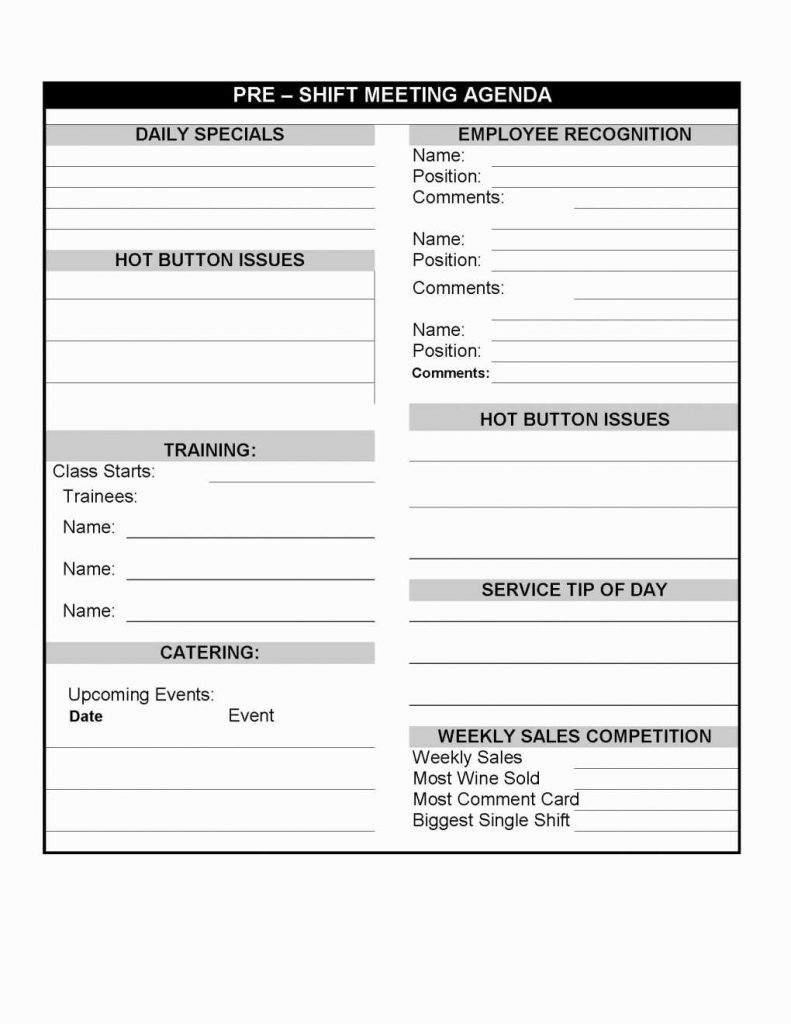

What is the accounting treatment of prepaid expenses? Prepaid expenses include rent, taxes, software, legal retainer services, and other costs. Optimizing cash flow and budgeting through prepaid expense management:

With prepaid expenses, businesses gain better visibility into future financial obligations. If you aren’t sure, grow with revenue. Are prepaid expenses debits or credits?

$1,000 credit (decrease) prepaid expenses: Common examples of prepaid expenses lease contracts software subscriptions or saas insurance premiums 4. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-04-59546336082445fa8db2dd9bbfcf58cb.jpg)