Formidable Info About Notes Payable Financial Statement Sap P&l Account Type

![[Solved] The following financial statements and ad SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2021/02/60225803e72ed_1612863490510.jpg)

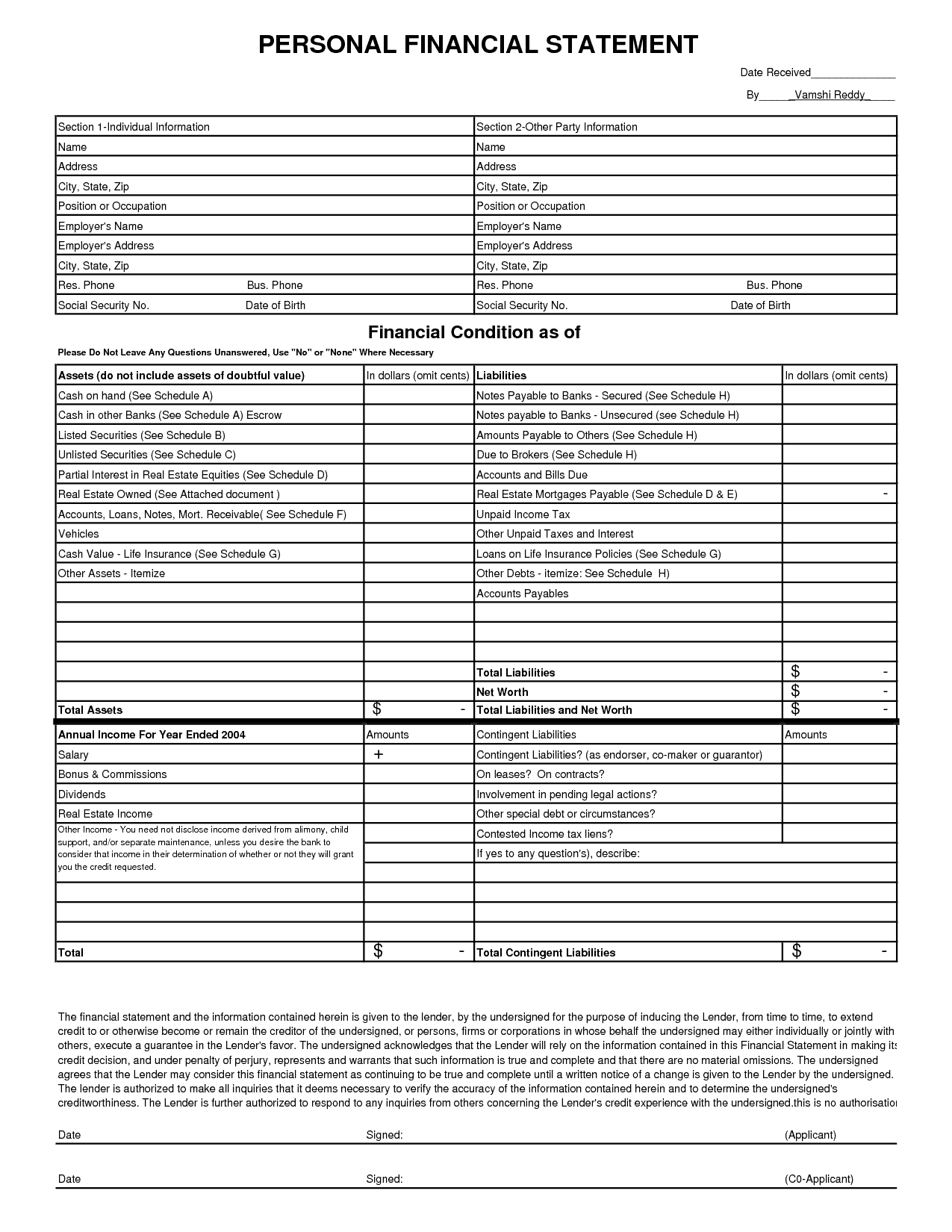

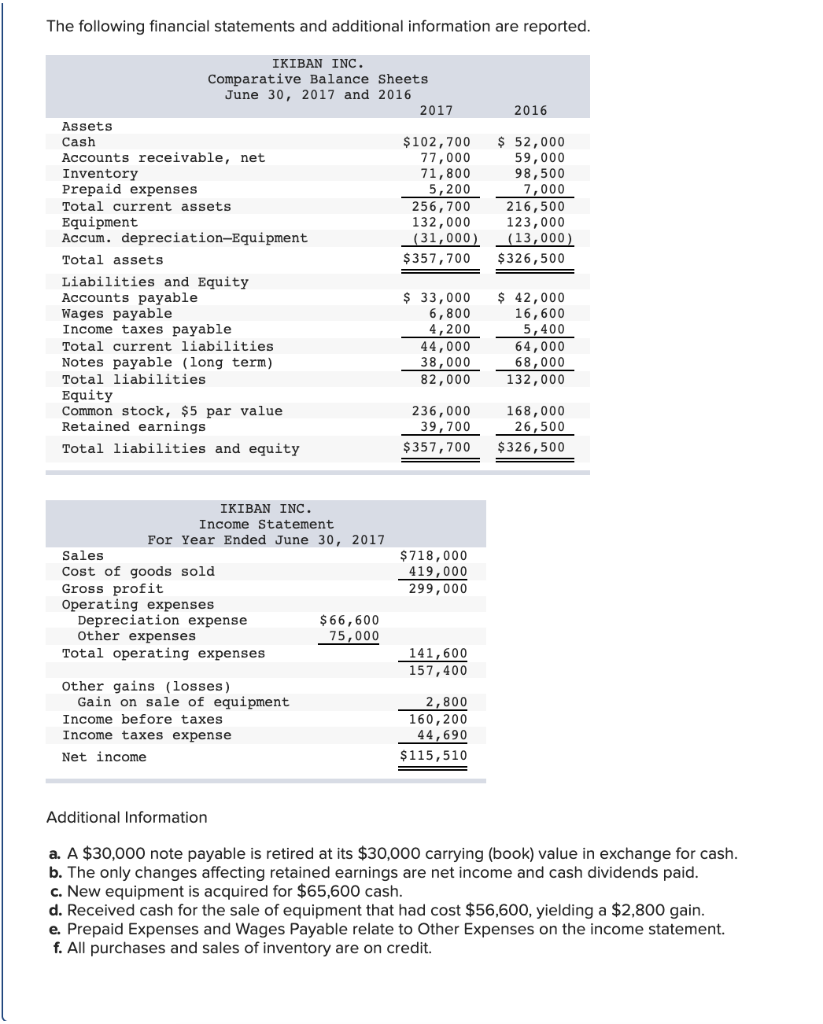

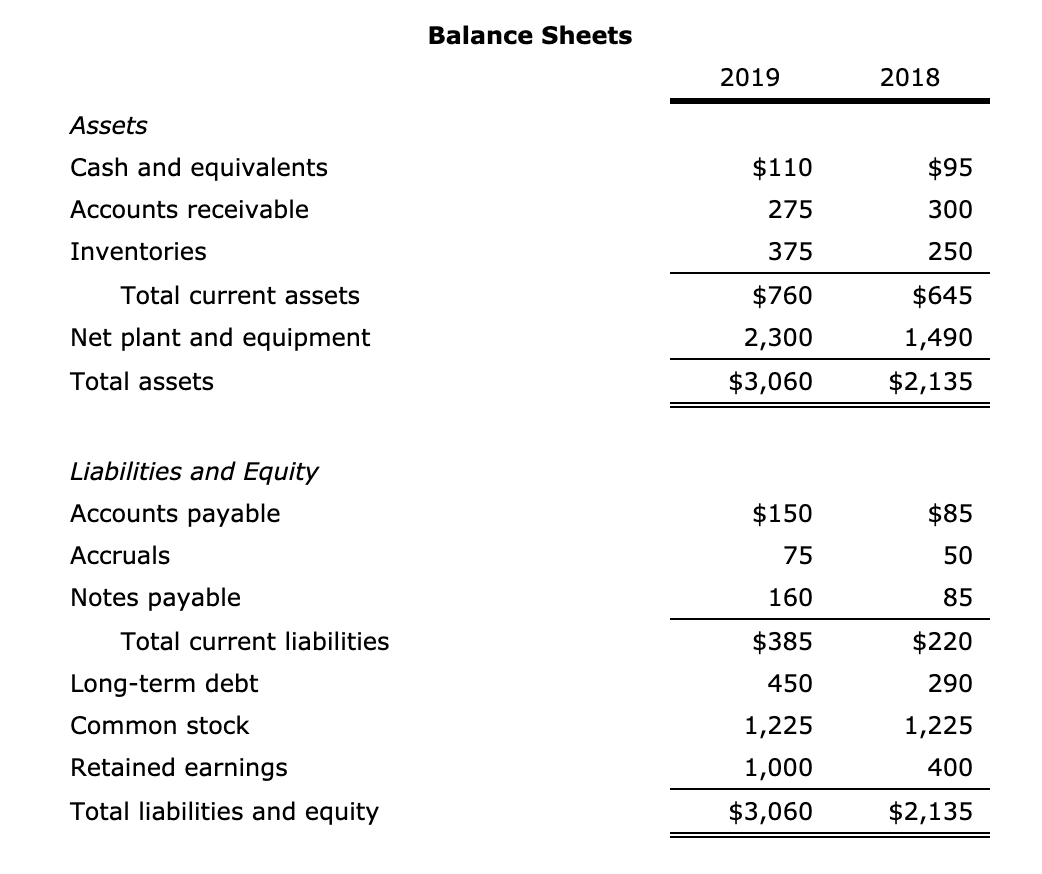

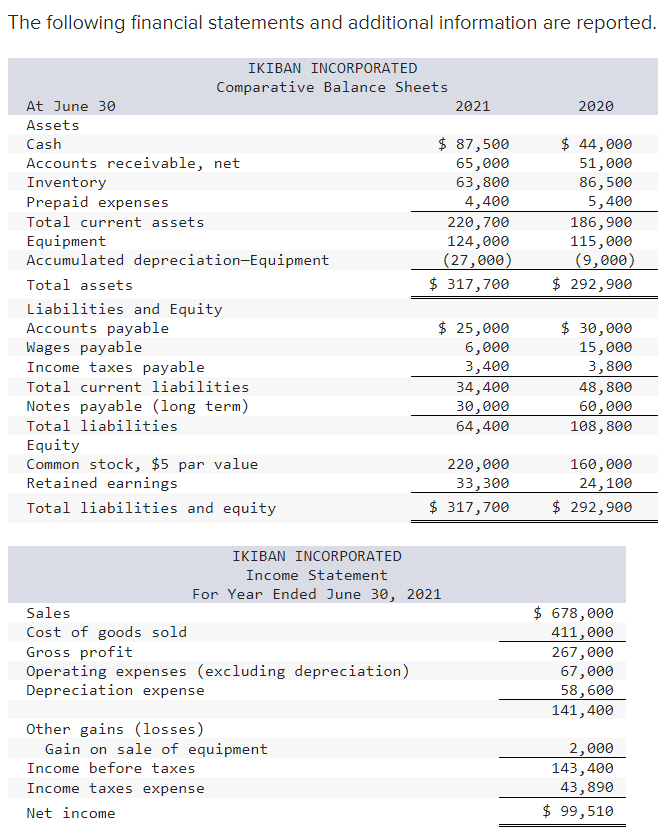

Introduction to financial statements, where the amounts come from, accrual method of accounting.

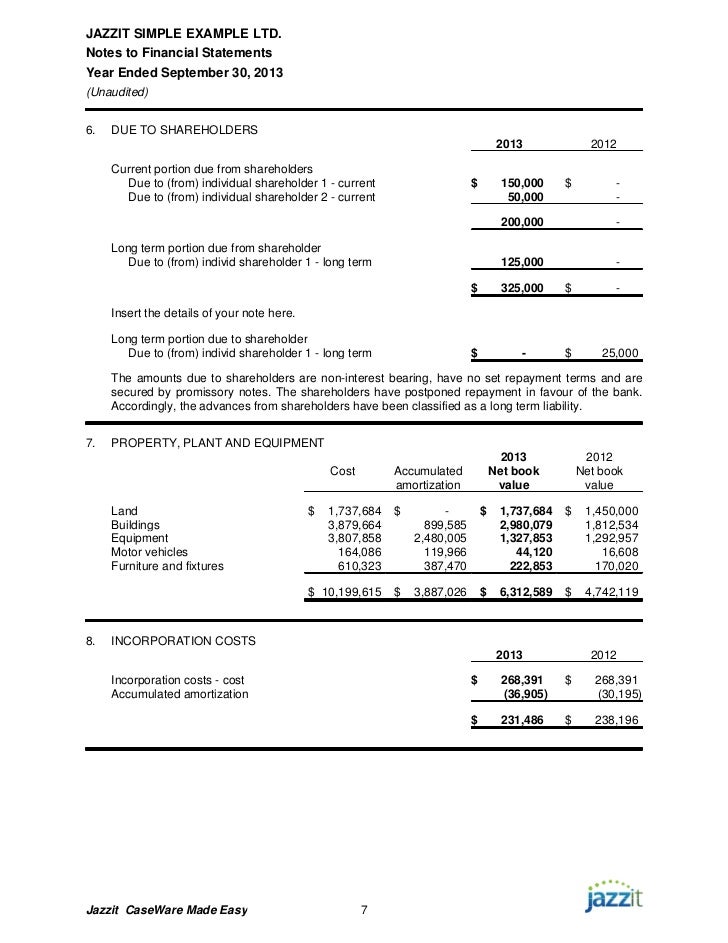

Notes payable financial statement. 11.3 accounts and notes payable publication date: In your notes payable account, the record typically specifies the principal amount, due date, and interest. A note payable is a written promissory note that guarantees payment of a specific sum of money by a particular date.

In the financial statements of a business, a note payable is a liability since it is the amount a business owes to someone else. Notes and accounts payable indicate a company’s financial obligation to settle its debt. When the debt is long‐term (payable after one year) but.

Monthly payments will be $1,625.28. Notes payable are liabilities and represent amounts owed by a business to a third party. Notes payable is a written agreement in which a borrower promises to pay back an amount of money, usually with interest, to a lender within a certain time frame.

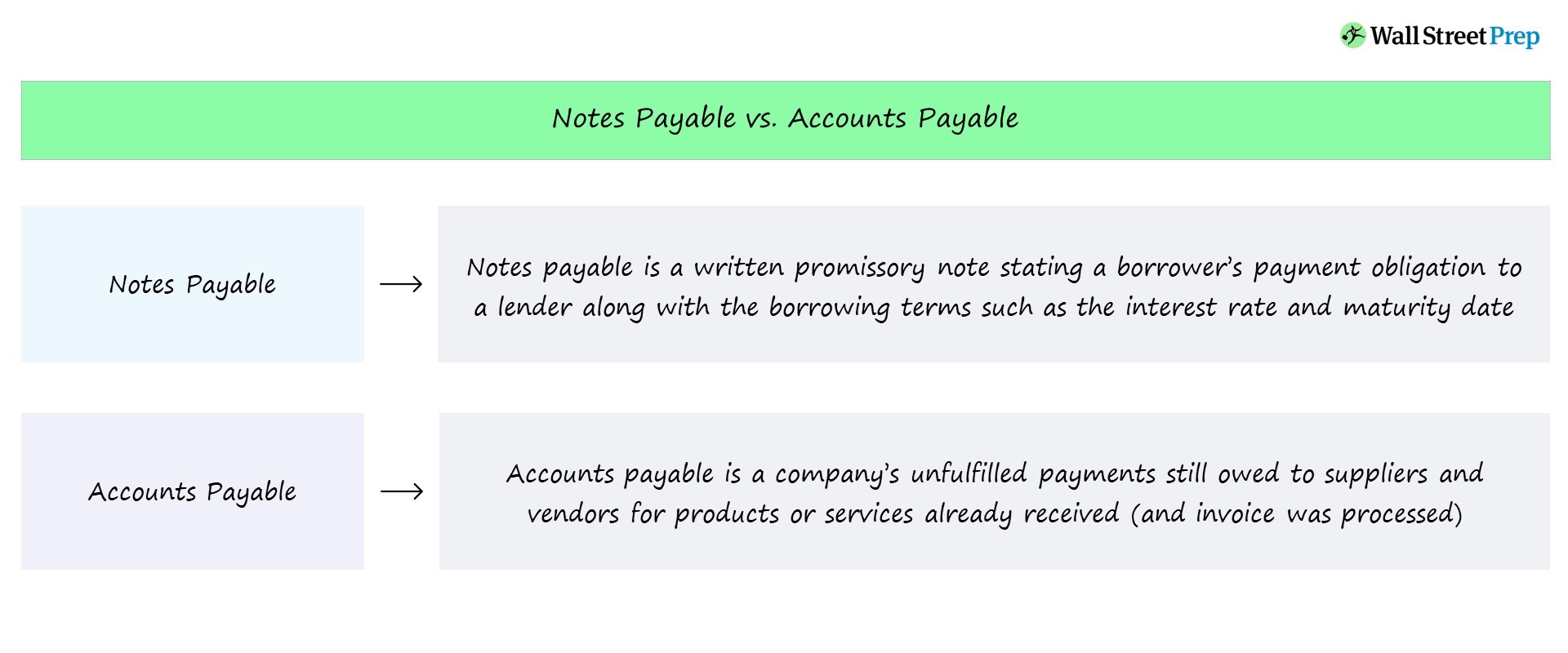

Notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date. Notes payable is a written promissory note stating a borrower’s payment obligation to a lender along with the associated borrowing terms (e.g. Notes payable appear as liabilities on a balance sheet.

Based on the amount of time this money has. The two are used to record different types of transactions. A notes payable is a liability account in which a borrower records a written promise to repay a lender.

Notes payable is a general ledger liability account in which a company records the face amounts of the promissory notes that it has issued. Both notes payable and accounts payable appear as liabilities account. Notes payable, also known as promissory notes or debt obligations, are financial instruments that represent a company’s or individual’s borrowing arrangement.

This blog will help you understand what notes payables are, who signs the. The balance sheet how to account for notes payable when a company borrows money under a note payable, it debits a cash account for the amount of cash. The impact of promissory notes or notes payable appears in the company’s financial statements.

Statement of stockholders' equity, statement of. Notes payable vs. A company taking out a loan or a financial.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)