Real Tips About Statement Of Retained Earnings Formula Profit And Loss Account Format For Travel Agency

Financial analysis cont… today’s session is emphasizing on ‘statement of change in equity & statement of cash flows’.

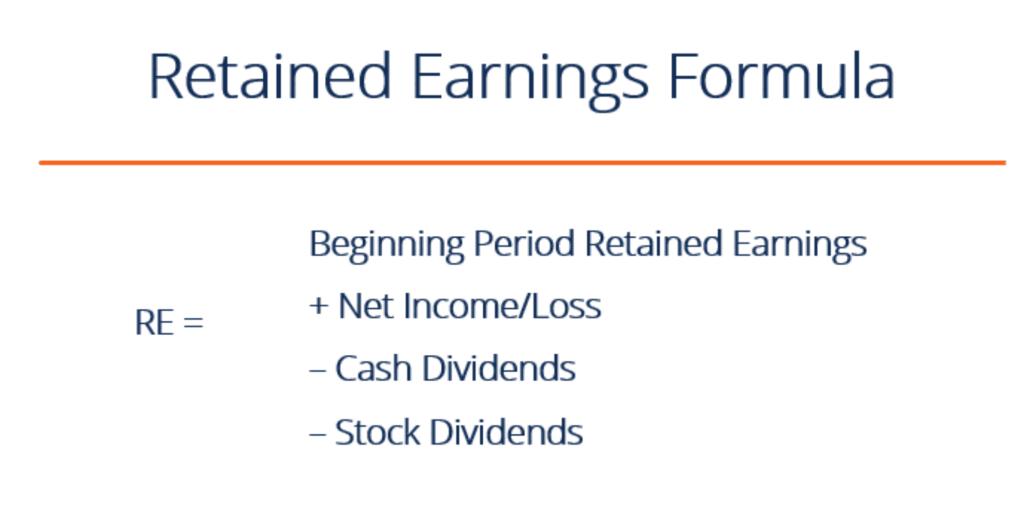

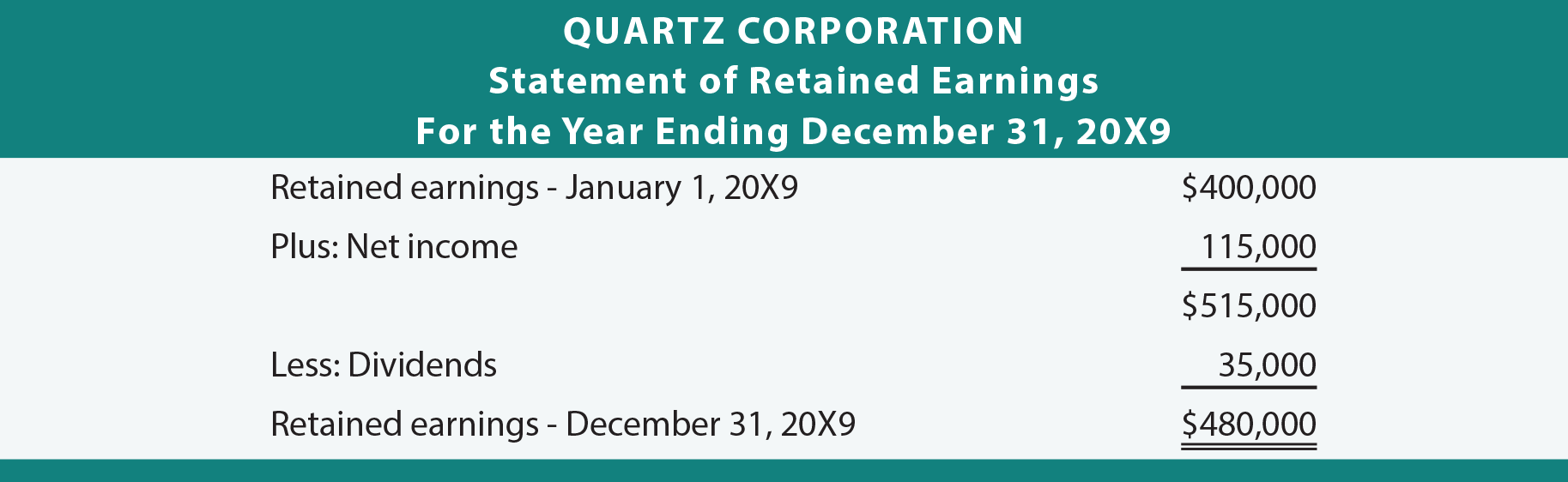

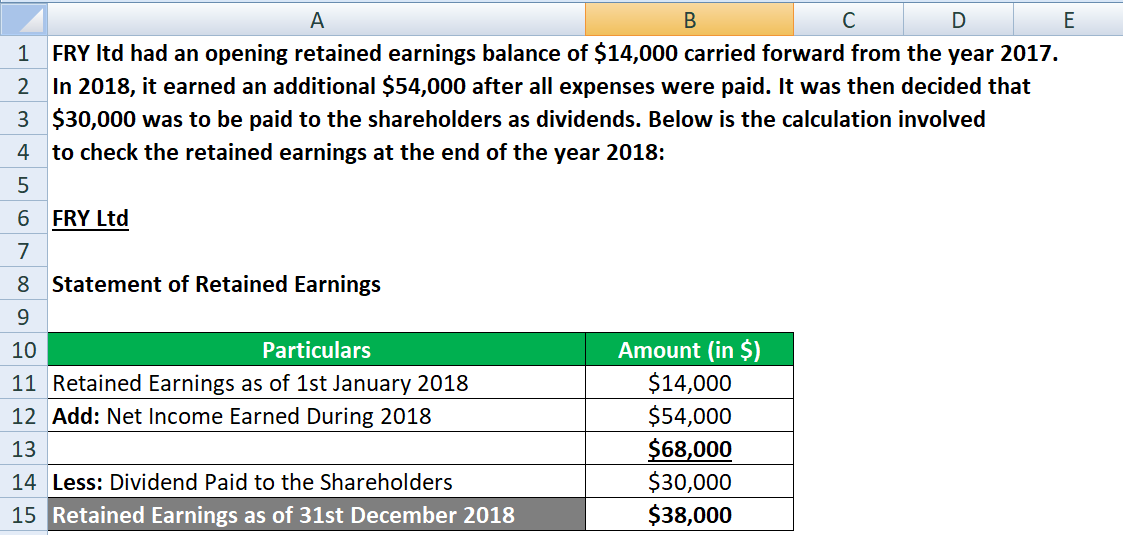

Statement of retained earnings formula. Beginning retained earnings corrected for adjustments, plus net income, minus dividends, equals ending retained earnings. Just like the statement of shareholder’s equity , the statement of retained is a basic reconciliation. The purpose of the retained earnings statement is to show how much profit the company has earned and reinvested.

Terms similar to the retained earnings formula the retained earnings formula is also known as the retained earnings equation and the retained earnings calculation. This statement provides a clear picture of a company's financial actions and goals by describing the changes in retained earnings over a given period. Key takeaways retained earnings (re) are the amount of net income left over for the business after it has paid out dividends to its shareholders.

Retained earnings are a good source of funds to expand, modernize, and replace the firm's assets and aspects of its operations. Here’s the basic formula for calculating retained earnings: Retained earnings are calculated by subtracting distributions to shareholders from net income.

A statement of retained earnings details the changes in a company's retained earnings balance over a specific period, usually a year. Take net income / (loss) from profit and loss statement. The retained earnings formula is fairly straightforward:

How to calculate retained earnings. What is the statement of retained earnings equation? This is less any dividends that have been.

A retained earnings statement has all the information you need. Thus, to calculate retained earnings on the balance sheet, you need three items as per the retained earnings formula: Accounting software can calculate retained earnings.

The decision to retain the earnings or. Adds increases to the account from net income (or decreases due to a net loss) Your accounting software will handle this calculation for you when it generates your company’s balance sheet, statement of retained earnings and other financial.

Here are a few steps to reading (and understanding) a retained earnings statement: It reconciles the beginning balance of net income or loss for the period, subtracts dividends paid to shareholders and provides the ending balance of retained earnings. In most cases, it is shown in the entity’s balance sheet, statement of change in equity, as well as a statement of retained earnings.

Here is the formula to calculate: It will generate the balance sheet, retained earnings statement, and similar financials. The structure/formula of the statement of retained earnings is:

Retained earnings = r e + n i − d where: The retained earnings formula is: A statement of retained earnings is a financial statement that shows how the retained earnings have changed during the financial period and provide details of the beginning balance of retained earnings, ending balance, and.

:max_bytes(150000):strip_icc()/statement-of-retained-earnings-final-8500839aff40433dba054ce0af9f9f42.png)