Breathtaking Info About Depreciation Statement Of Financial Position Balance Sheet For Dummies Pdf

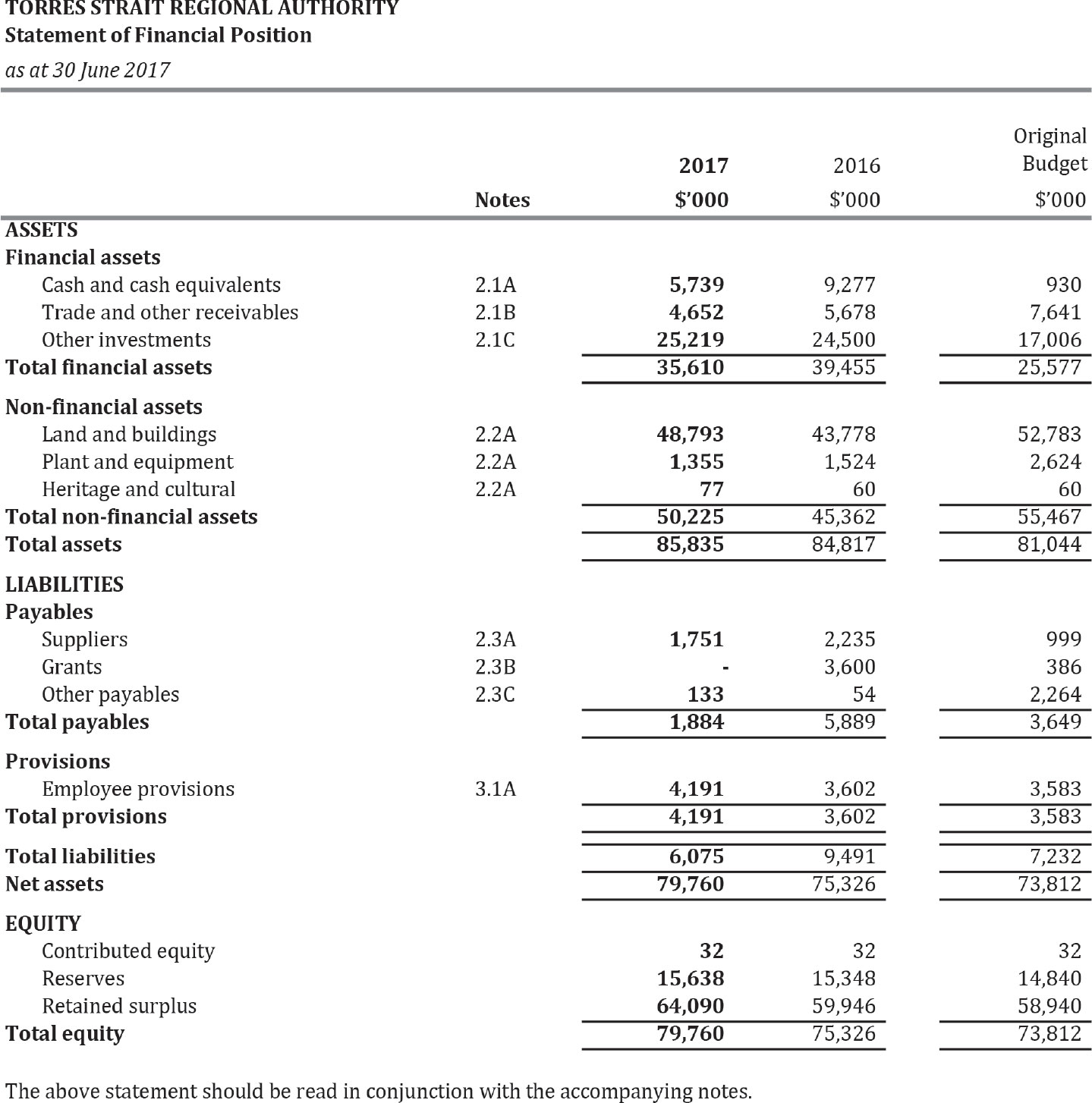

This module focuses on the presentation of the statement of financial position applying section 4 statement of financial position of the ifrs for smes standard.

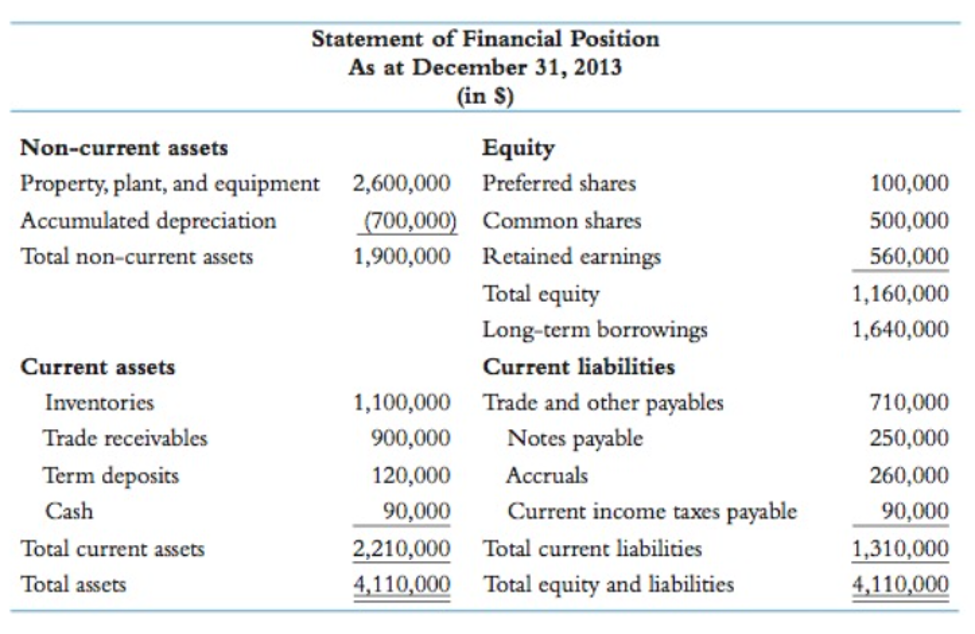

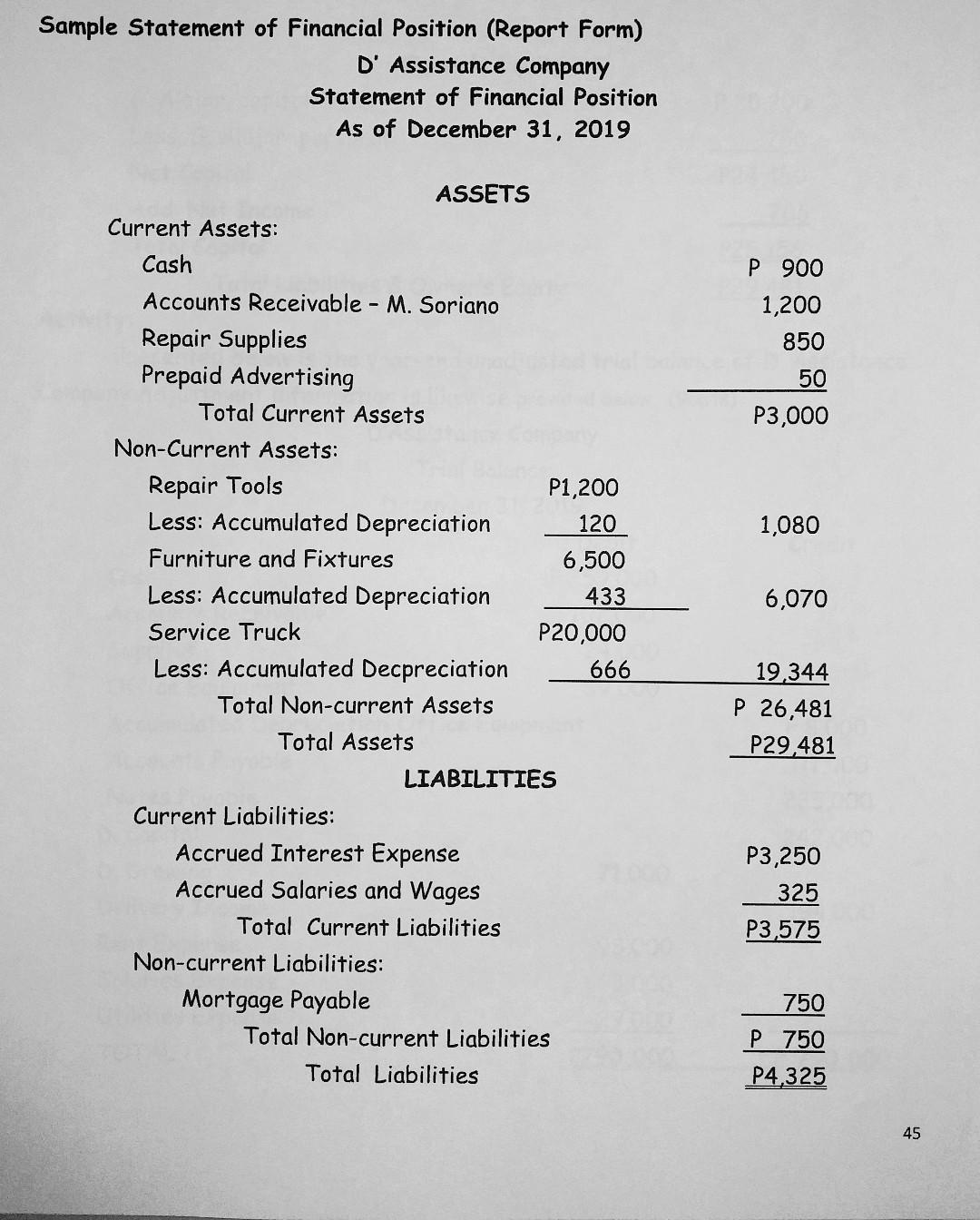

Depreciation statement of financial position. Ifrs ias 16 defines ppe as tangible items that: Plant accumulated depreciation at 1 november 20x6 : Statement of financial position, also known as the balance sheet, presents the financial position of an entity at a given date.

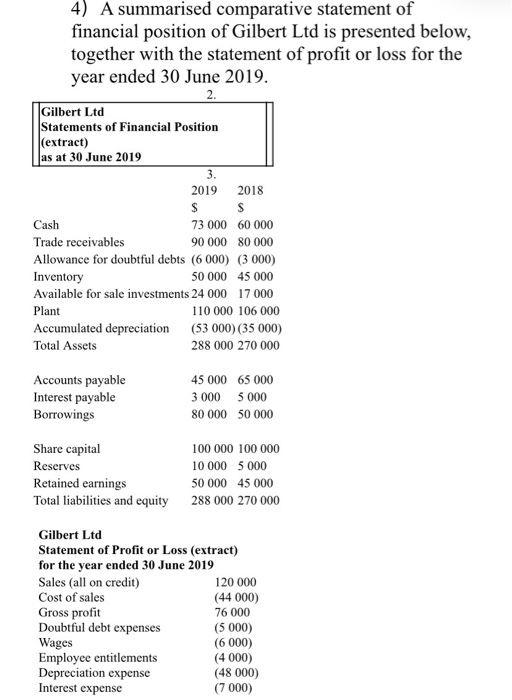

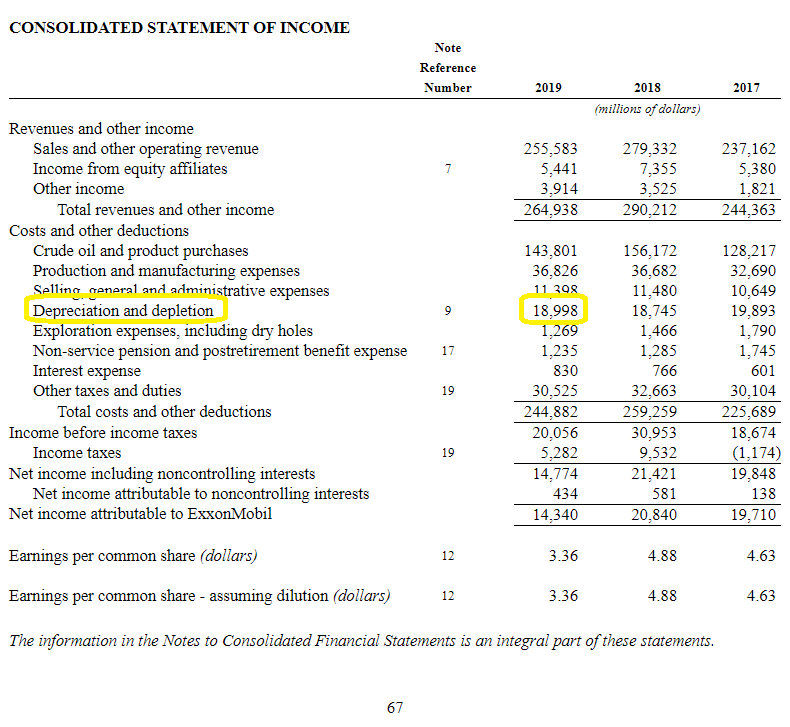

How to calculate depreciation expense. The standard requires a complete set of financial statements to comprise a statement of financial position, a statement of profit or loss and other comprehensive income, a. Accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date.

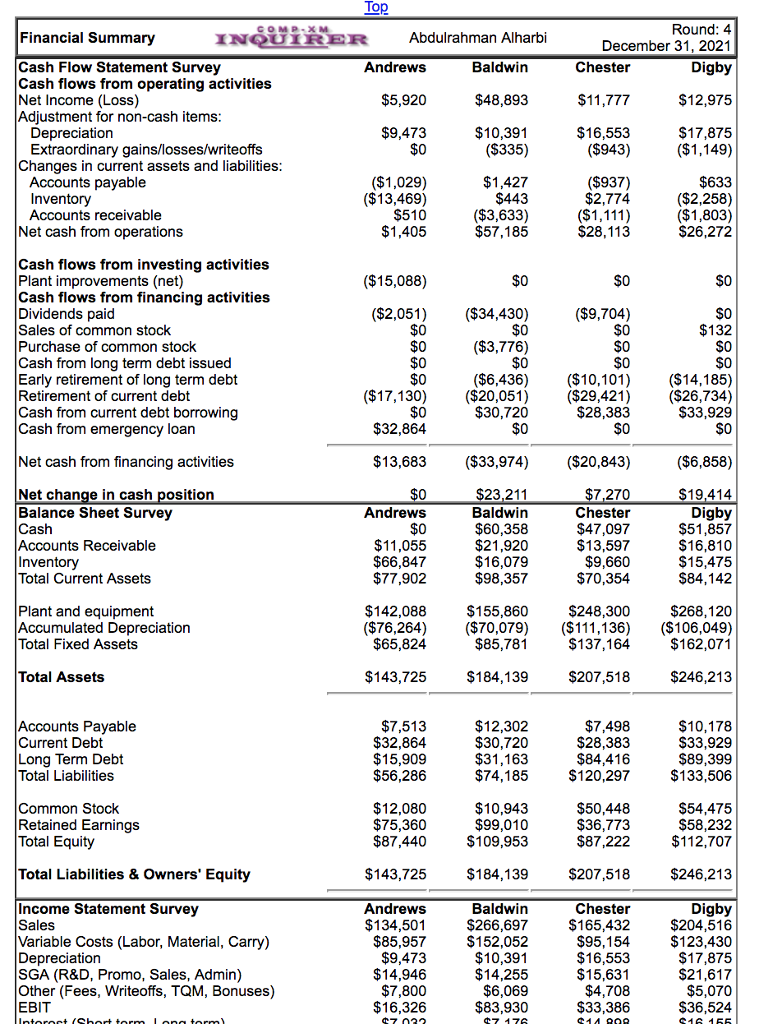

The statement of financial position (balance sheet under aspe), reports a businesses assets, liabilities and shareholders’ equity at a specific date (at a point in time). Depreciation's impact on financial statements. It introduces the subject and reproduces the official text along with explanatory notes and examples.

This is known as depreciation, and it is the source of. This includes rental property and property. This brief article looks at how to prepare a consolidated statement of financial position.

Buildings accumulated depreciation at 1 november 20x6 : Preparing a consolidated statement of financial position. Fixed assets lose value over time.

It is comprised of three main components: Depreciation significantly affects a company's financial statements and performance metrics. Depreciation is an amount that reflects the loss in value of a company's fixed asset.