Brilliant Info About Prepaid Inventory On Balance Sheet Preparing An Income Statement

Prepayments are commonly used as.

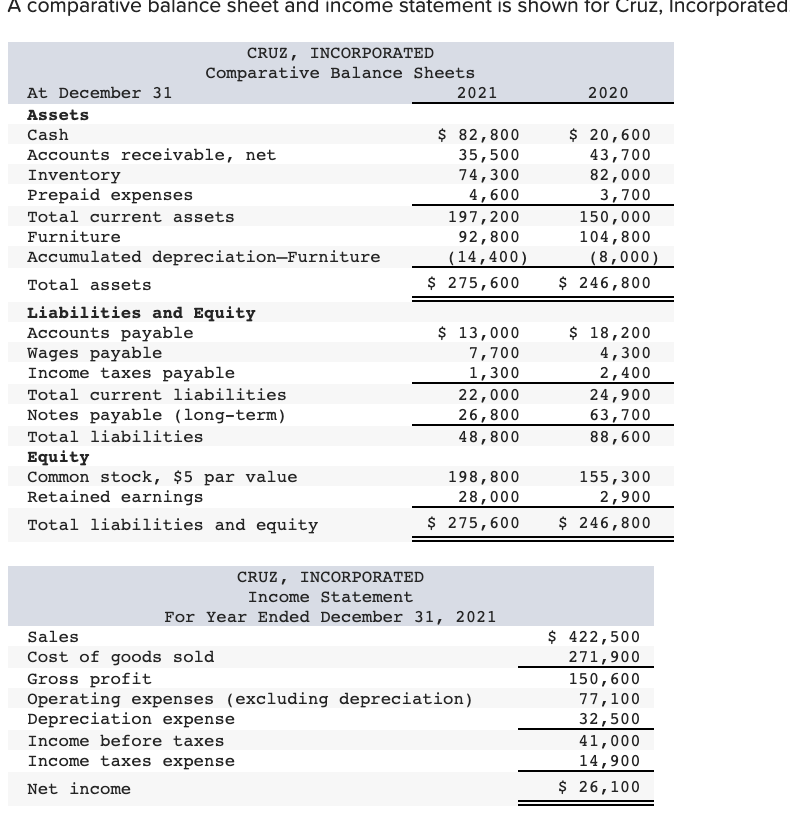

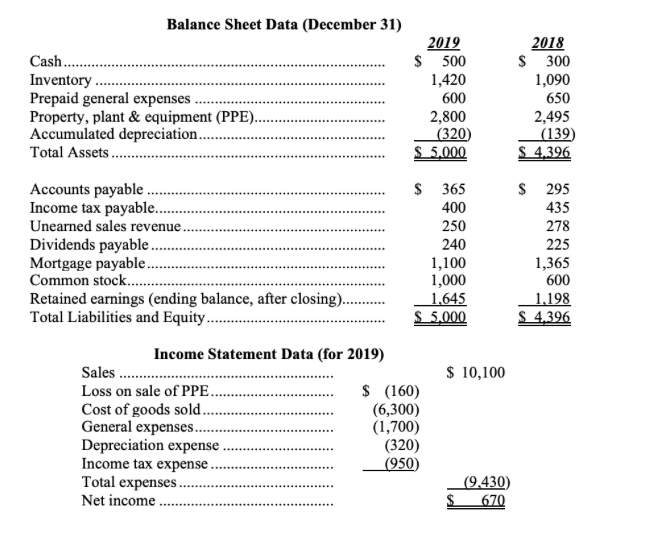

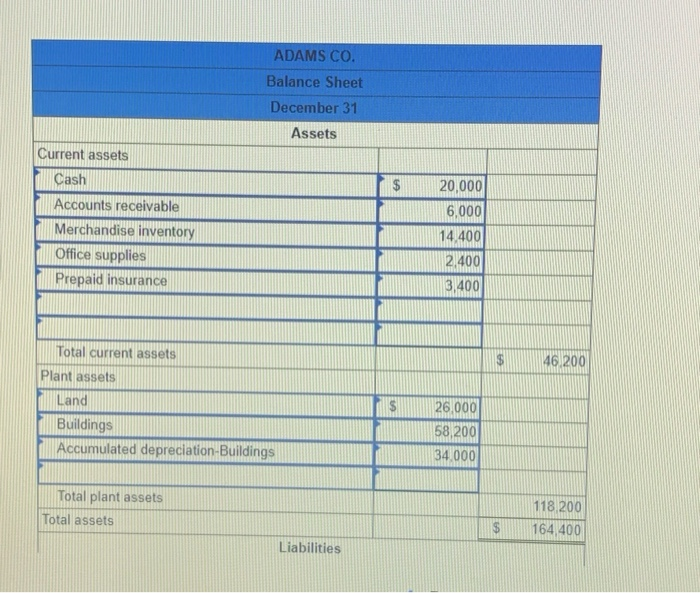

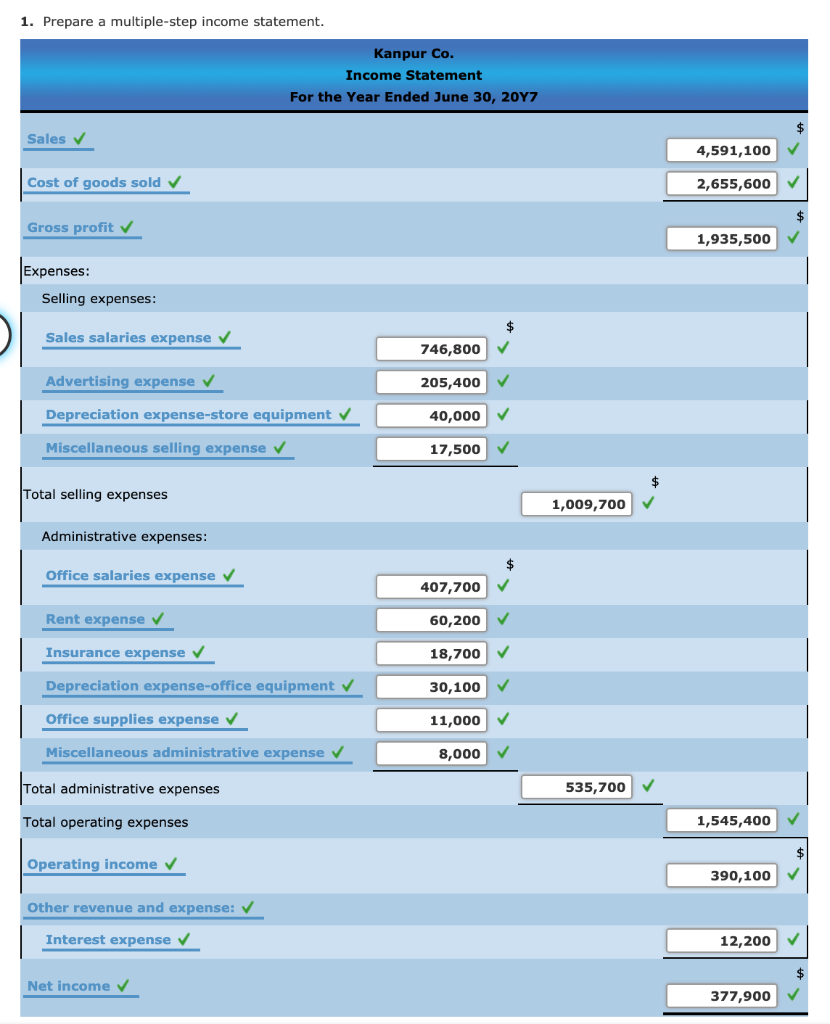

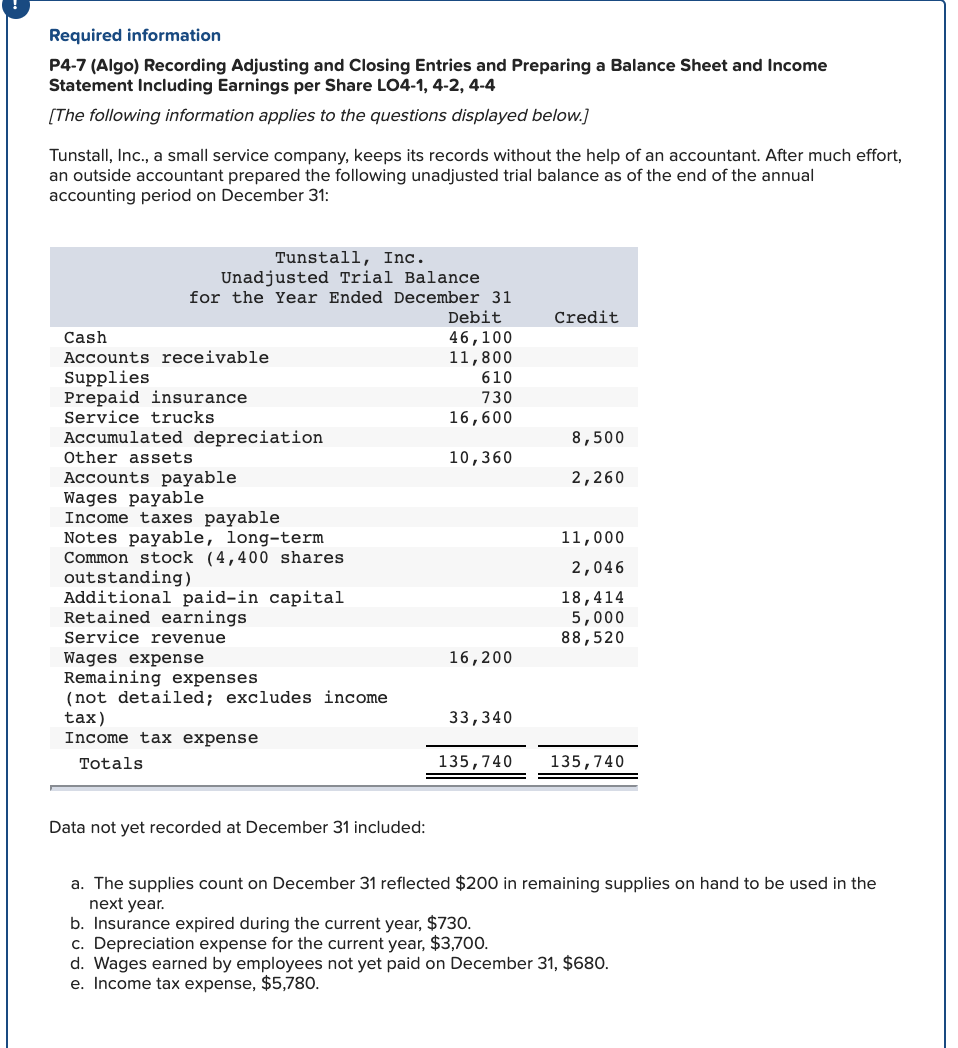

Prepaid inventory on balance sheet. Inventories grow with cost of goods sold (cogs). As the benefits of the expenses are recognized, the related asset. Recommended articles key takeaways a prepaid expense is an amount paid in advance for the goods or benefits that are to be received in the upcoming period.

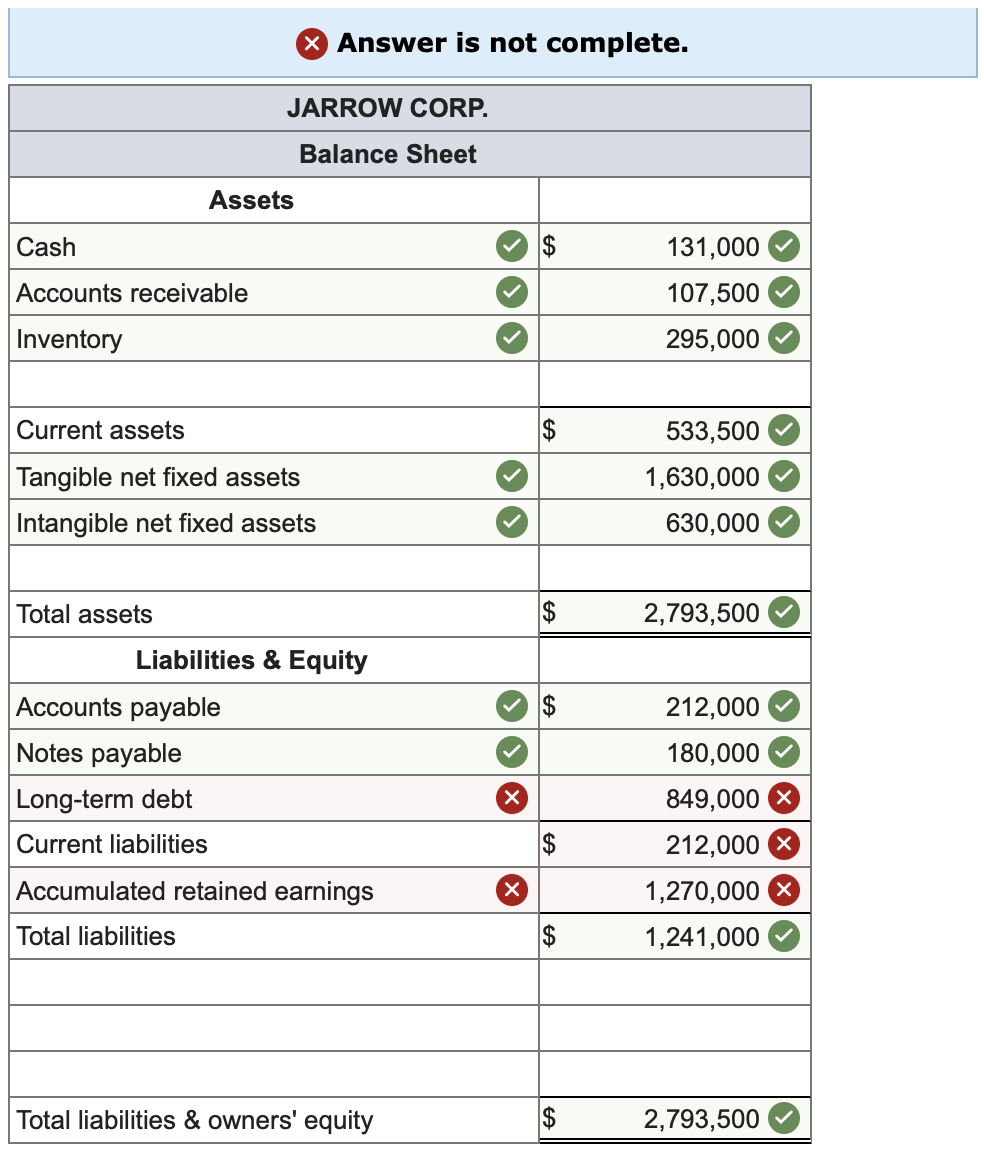

Inventories are the assets that are held for sale. Set the report basis to accrual. The inventory to sales ratio provides a big picture on the balance sheet and can indicate whether a more thorough analysis of inventory is needed.

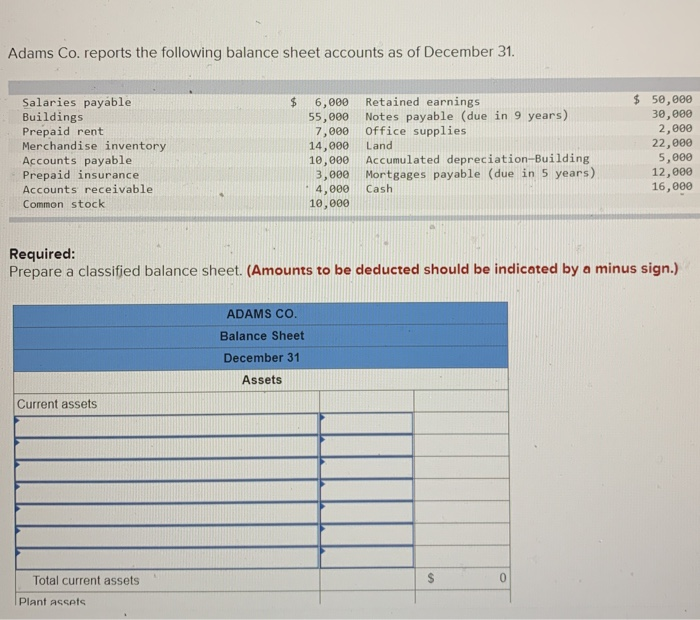

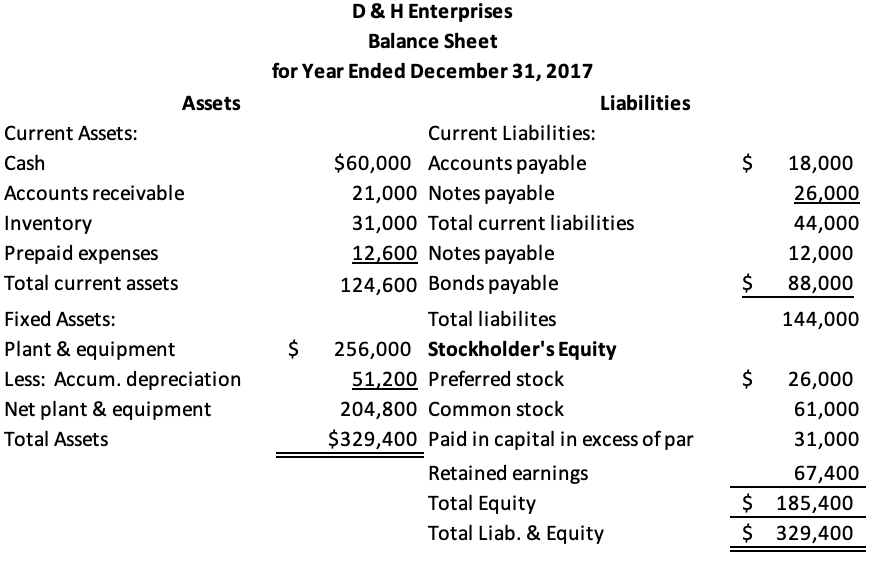

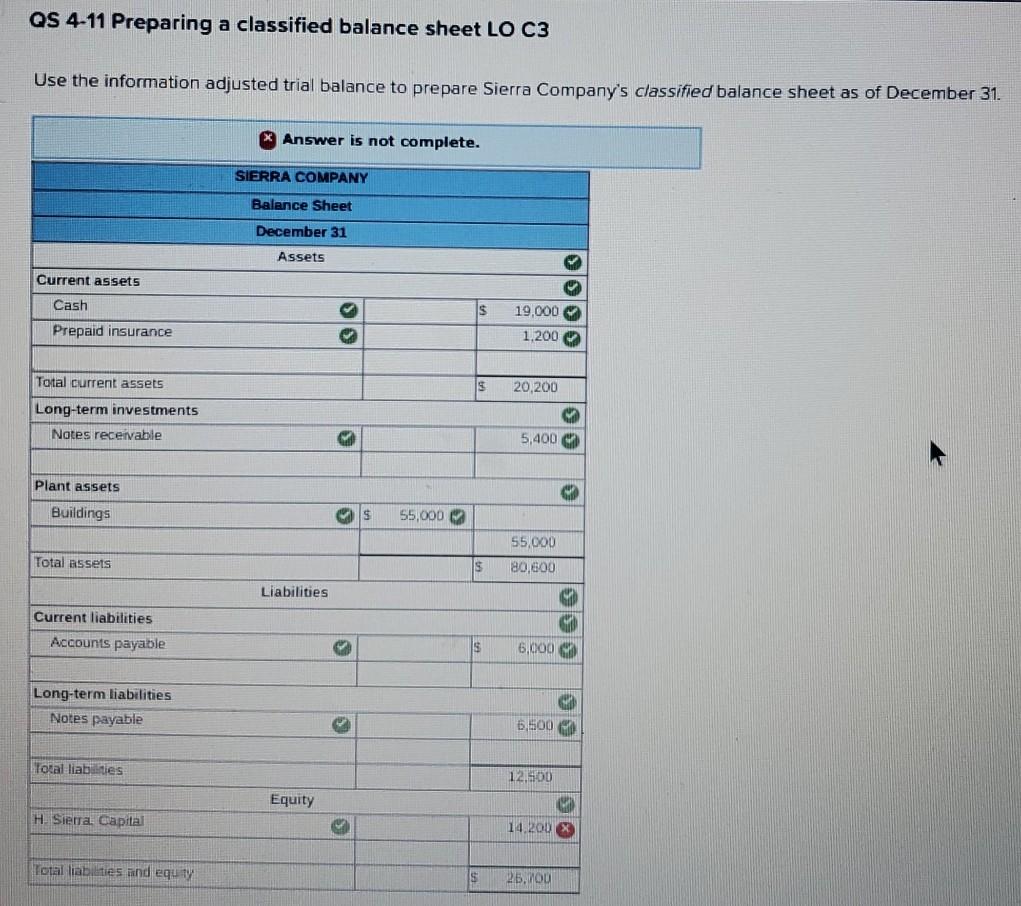

In general, a balance sheet can reveal your company’s financial health by weighing its assets against its liabilities. Prepaid expenses are presented on the balance sheet as assets. After each physical inventory, adjust the general ledger inventory balance to the physical “actual” inventory balance.

Cash, accounts receivable, office supplied, prepaid insurance, equipment,. 6.2 compare and contrast perpetual versus periodic inventory systems; Prepaid inventory means and includes goods, as identified under the prepaid inventory line of borrower’s balance sheet, that borrower acquires outside of the borders of the.

Instead, prepaid expenses are first recorded on the balance sheet. Presentation of prepaid expenses on the balance sheet. You have made a prepayment for it and as such it should be recognized as a part of assets on the balance sheet.

It is in the form of materials consumed during the production process or. When you make prepayments for future expenses, they are recognized as prepaid expenses on a separate line under current assets on the balance. They are typically listed under.

January 1st 2020 to december 1st 2020 (beginning of each month next year) 1. When the inventory arrives, remove $1,000 from the. Prepaid expenses, or prepaid assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset.

As mentioned earlier, prepaid expenses are mentioned on the balance sheet as a current asset. Difference between prepaid expenses and other current assets. If your vendor applies the deposit to the invoice, you debit inventory for the full amount, credit vendor discounts for the deposit amount and credit cash for the.

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. But, as the benefit of the prepaid expense is realized, or as the expense is incurred, it is.

How to analyze inventory on a balance sheet. How to find prepaid expenses on the balance sheet? Adjusting the general ledger inventory balance.