Sensational Info About Operating Lease Expense On Income Statement Reasons For Increase In Net Profit Margin

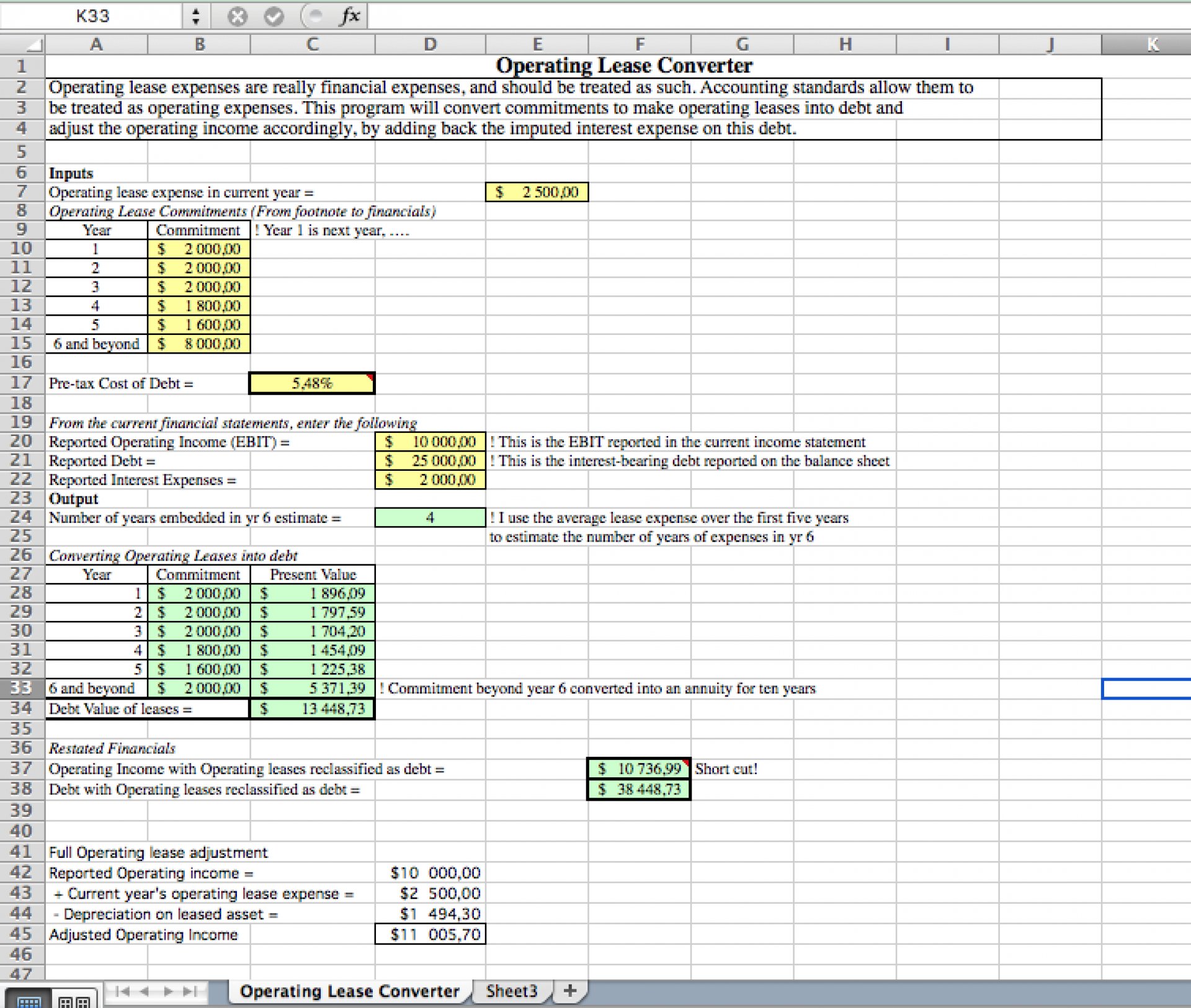

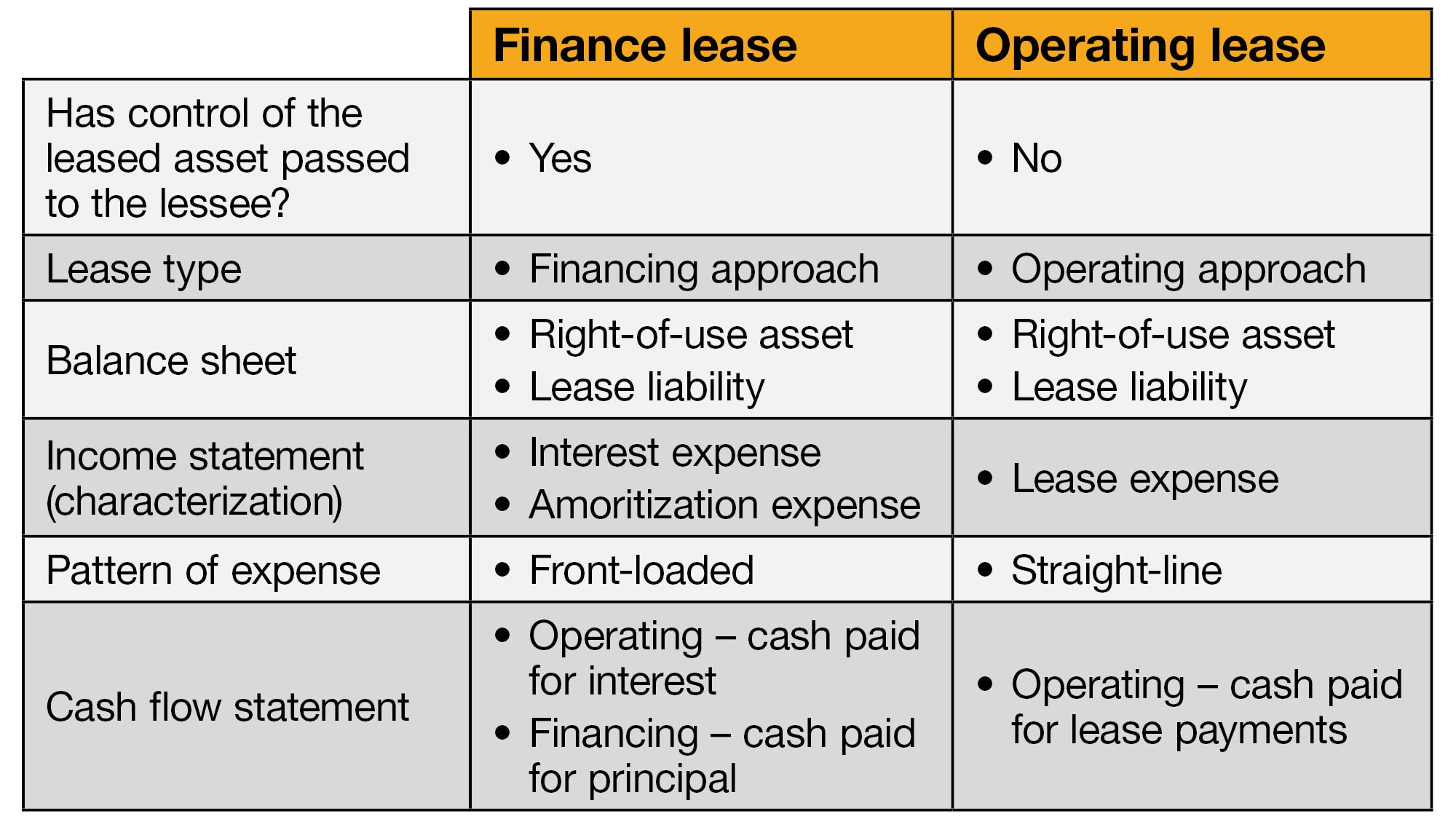

For both finance and operating leases, the.

Operating lease expense on income statement. If you have an operating lease, you record the payments you make to the lessor as a lease expense on the income statement, along with amortization. A lessee reporting a lease as an. These leases allow businesses to use the asset.

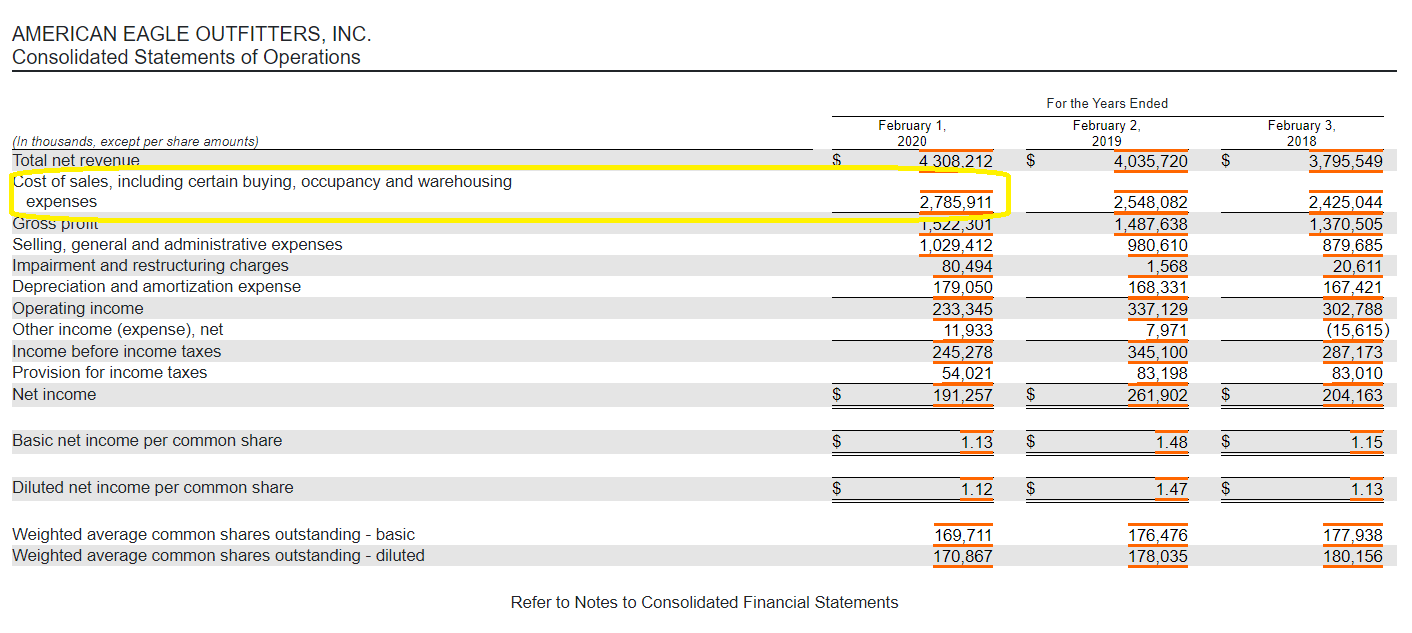

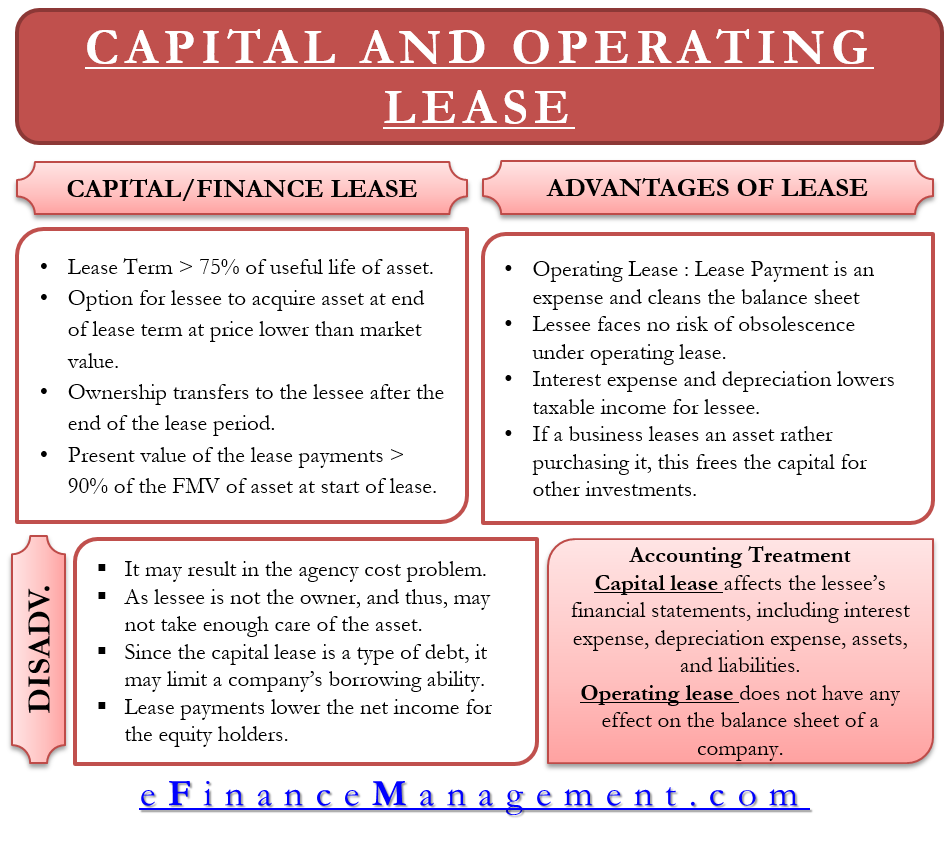

An operating lease is different from a capital lease and must be treated differently for accounting purposes. Determine the total lease payments under gaap step 3: The income statement shows an expense of the cash payment to the lessor within operational expenses.

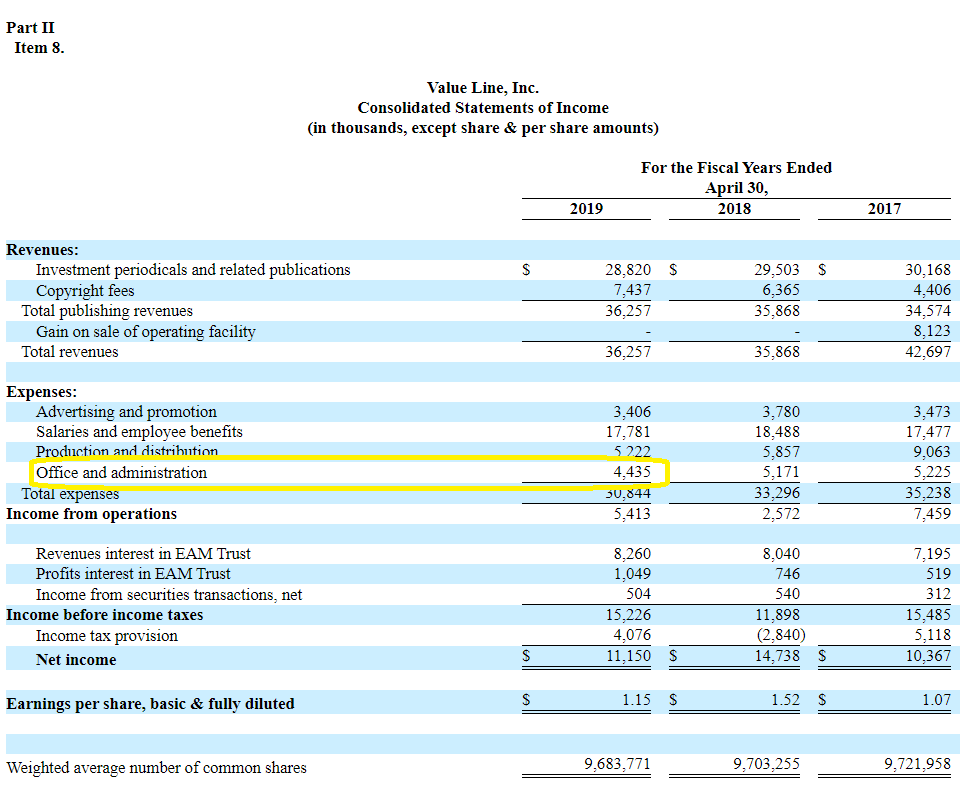

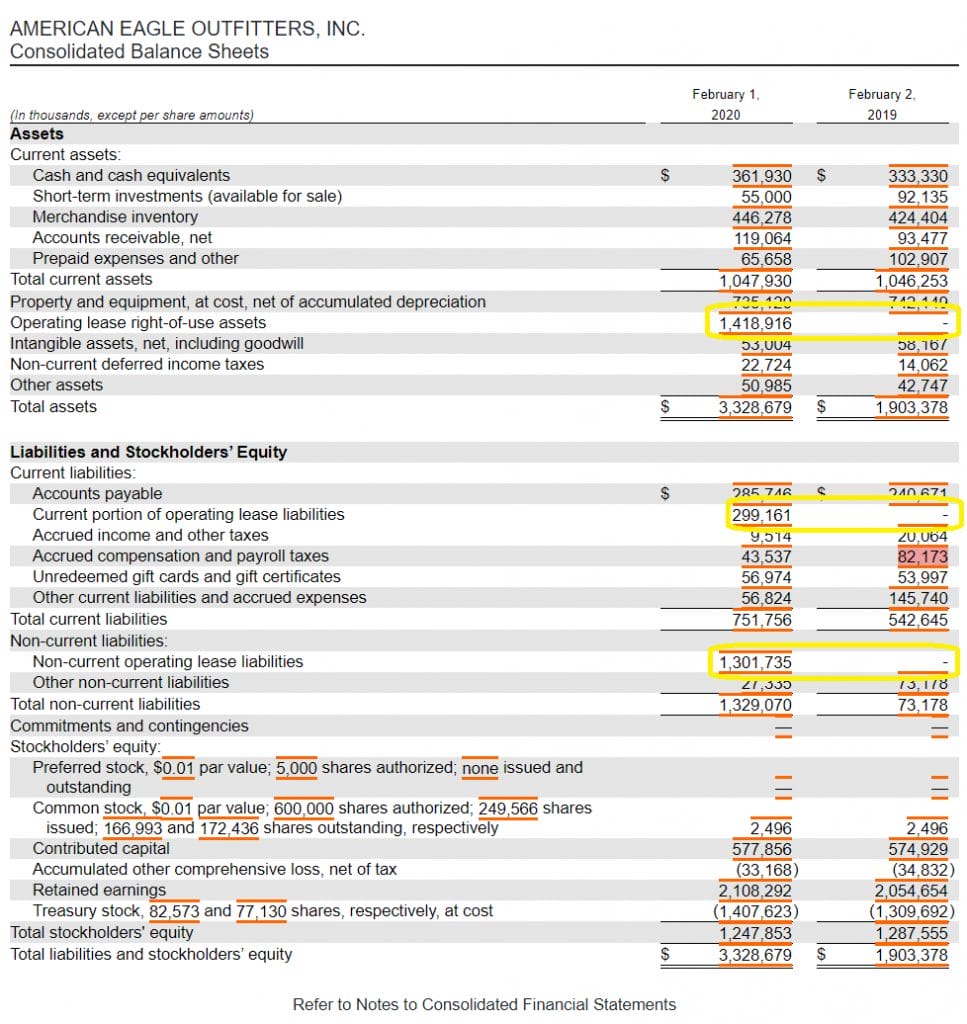

Under ifrs 16, operating lease expenses have moved down the income statement from selling, general, and administrative expenses (sg&a) and will be split. Gaap), which went into effect in 2019, companies now treat leased assets (e.g., buildings and equipment they are. For accounting purposes the rental payments are simply treated as operating expenses in the income statement on a straight line basis.

Almost all types of retail, office, or general commercial real estate leases include various forms of a dditional rent. In operating leases, the lessee records a lease expense on its income statement during the period it uses the asset. No interest expense or depreciation is shown in the.

Leases are recorded as liabilities on the balance sheet and as operating expenses on the income statement. Under an operating lease, a single lease cost, generally allocated on a straight line basis over the lease term, is presented in the income statement. According to the rules under ifrs 16 (asc 842 in u.s.

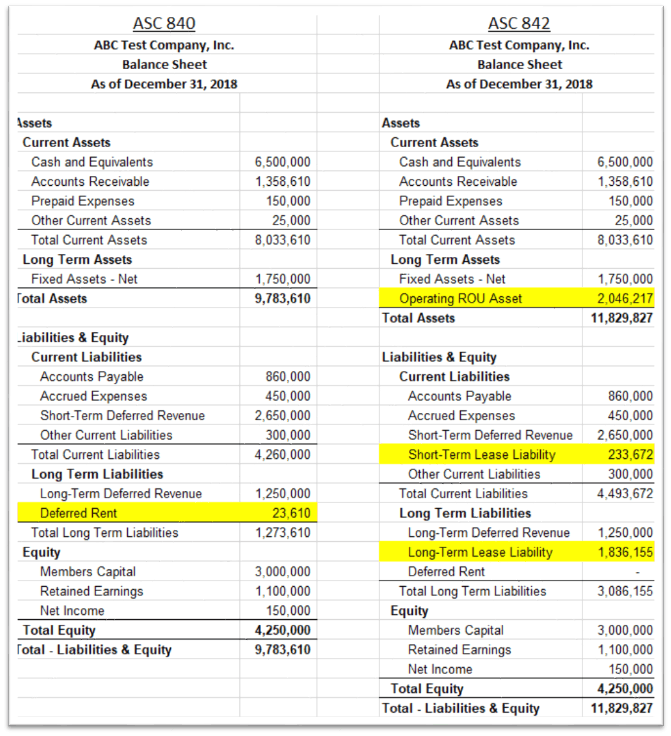

The primary difference between finance and operating leases is how the lease is recognized on the income statement. Operating lease accounting under asc 842 vs. Historically, for operating leases under asc 840,.

Operating expenses—preliminary concepts. Lease expense is presented as a single line item in operating expense in the income statement (within continuing operations). Under a finance lease, we.

Under an operating lease, the lessee enjoys no risk of ownership,. An operating lease is a contract that allows for an asset's use but does not convey ownership rights of the asset.