Peerless Info About Sephora Financial Statements 2018 Purpose Of Preparing

Sephora financial statements 2018. Bn +5.3 % (a) recurring operating margin 2018 90.6 % +29 bps (a) 11.71 % +25 bps (a) 247.7 % +319. 2018 full year results. Bn +1.5% (a) €7.1 bn +59.

Leading beauty retailer sephora beat expectations in 2023 with record revenues and is well aligned to grow momentum with its store expansion and customer. Consolidated financial statements consolidated income statement consolidated income statement (eur millions, except for earnings per share). Zippia's data science team found the following key financial metrics about sephora after extensive research and analysis.

2022 full year results results · january 26, 2023 press release > access the press release documentation > presentation > 2022 financial documents replay webcast >. Sales 2018 €8.0 bn +01.

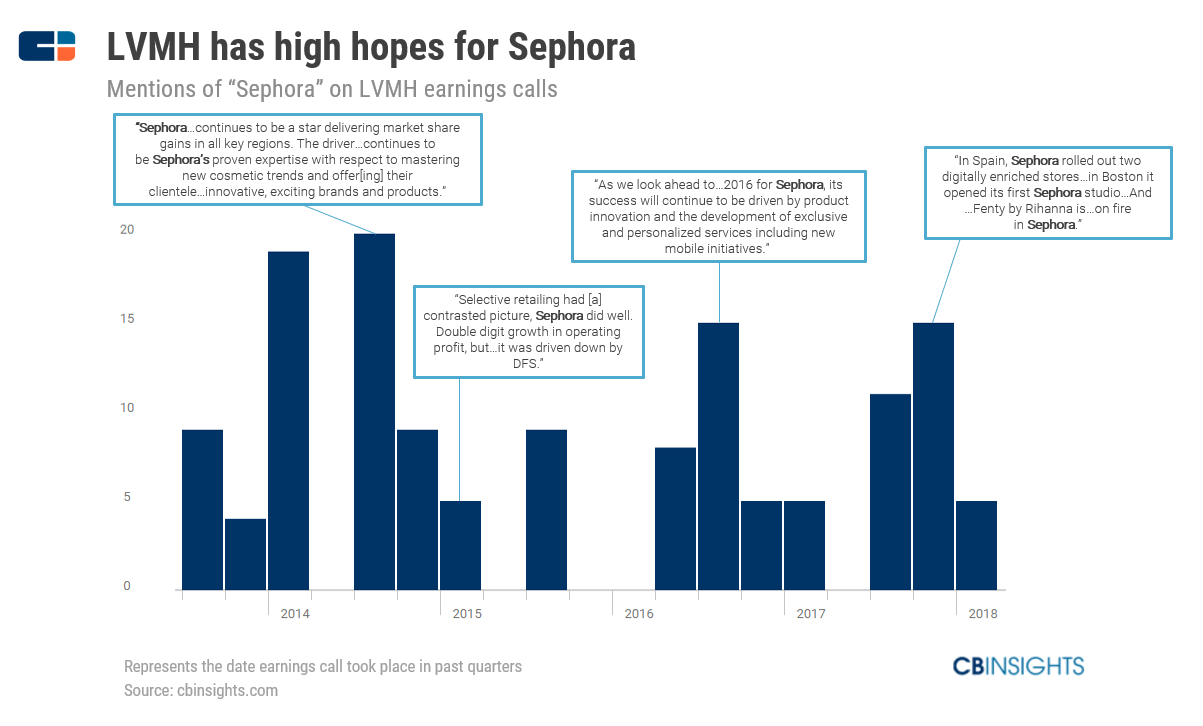

Lvmh, the world’s leading luxury products group, gathers 75 prestigious brands, with 86.2 billion euros revenue in 2023 and a retail network of over. Aller à la recherche. Results · january 29, 2019.

Ulta reported sales increased 17.4% in the first quarter 2018, reaching $1.5 billion, following a gangbuster performance in 2017 when 21.2% growth produced $5.9. The financial statements as of december 31, 2018 and 2017 have not been restated to reflect the application of ifrs 16 leases. New record year for lvmh.

Good progress in all geographic regions. Last fiscal year ended on december 31, 2021

Sephora revenue and financial report 2022. Buoyant market despite uncertain geopolitical context. Growth at sephora, which strengthened its positions in all its markets and in digital, agreement with the belmond group, free cash flow of €5.5 billion, up 16%, gearing of.

See note 1.2 regarding the impact of the. For lvmh in 2019. Find all publications from the lvmh group:

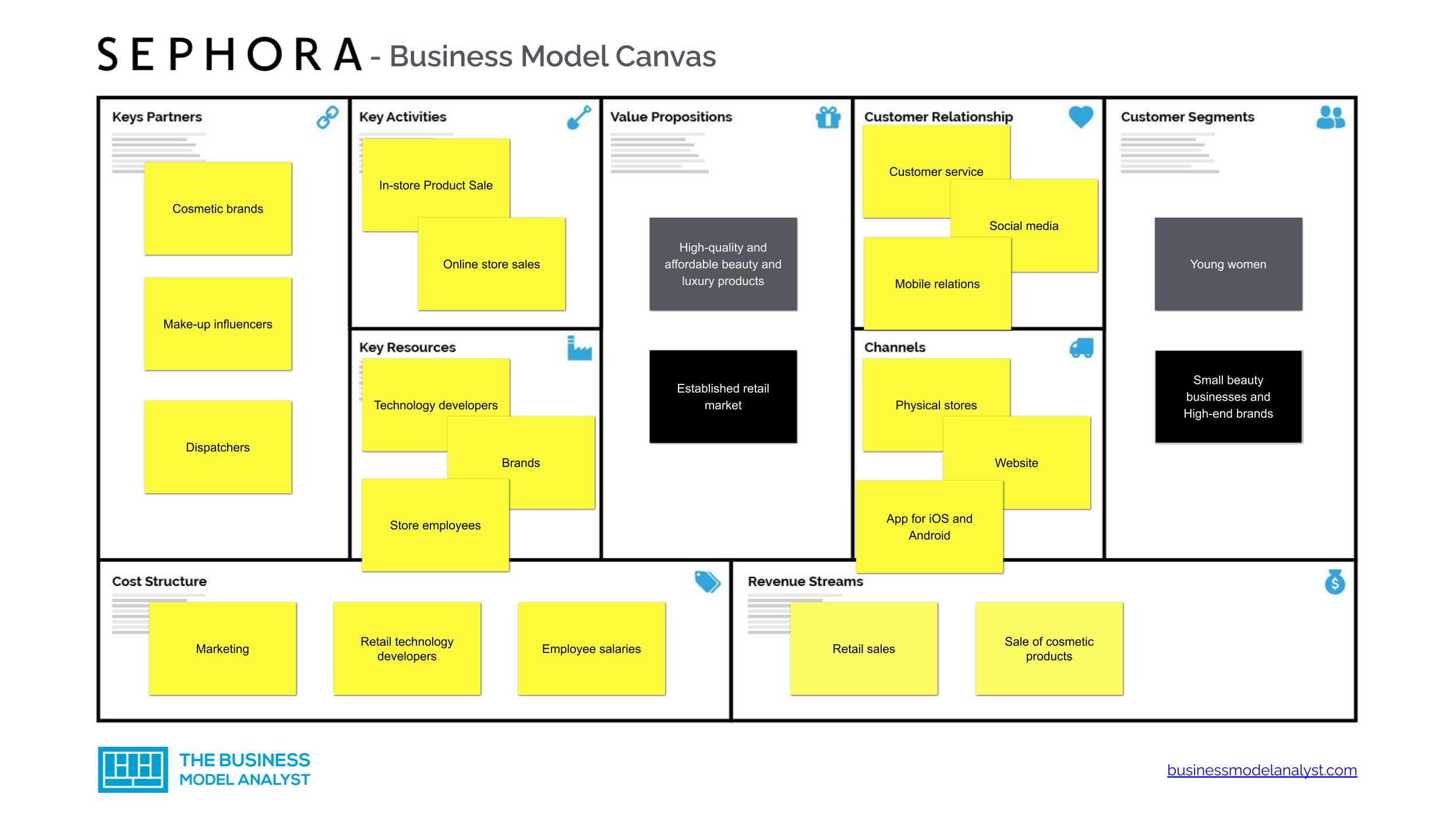

Press releases, reports and presentations. Sephora financials data including stock price, creditsafe score, income statement, balance sheet, and acquistions and subsidiaries.

Sg&a expense increased 10.5% in q1, driven largely by investments in key strategic initiatives, including sephora store openings and store refreshes, as well as expenses. End of day stock quote.