Out Of This World Tips About Repayment Of Notes Payable Cash Flow Company Account Statement

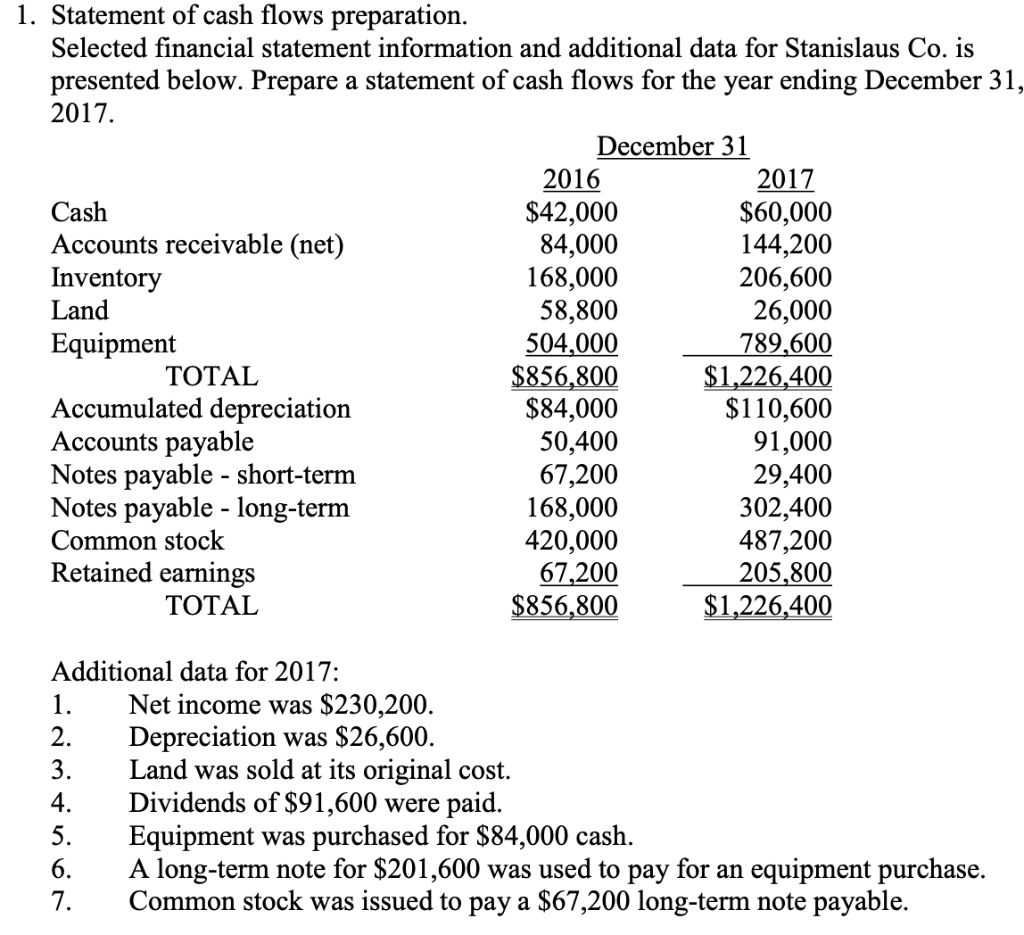

A note payable affects the cash flow statement by reducing the amount of cash that a company has available, as payments must be made to repay the loan.

Repayment of notes payable cash flow. Including notes payable in financial statements helps companies monitor and manage their cash flow effectively. Notes payable, however, can be classified into two types: This kind of notes payable requires you to repay the lender the principal amount you borrow and the interest they charge you in.

They are typically offered by banks and other. Most companies are required to produce this. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the.

Similar to accounts payable, notes payable is an external source of financing (i.e. If a debtor runs into financial difficulties and is unable to pay, or fully repay, the note, the estimated impaired cash flows become an important reporting disclosure for the lender. Notes payable is a debt to a lender with specific repayment terms, which can include principal and interest.

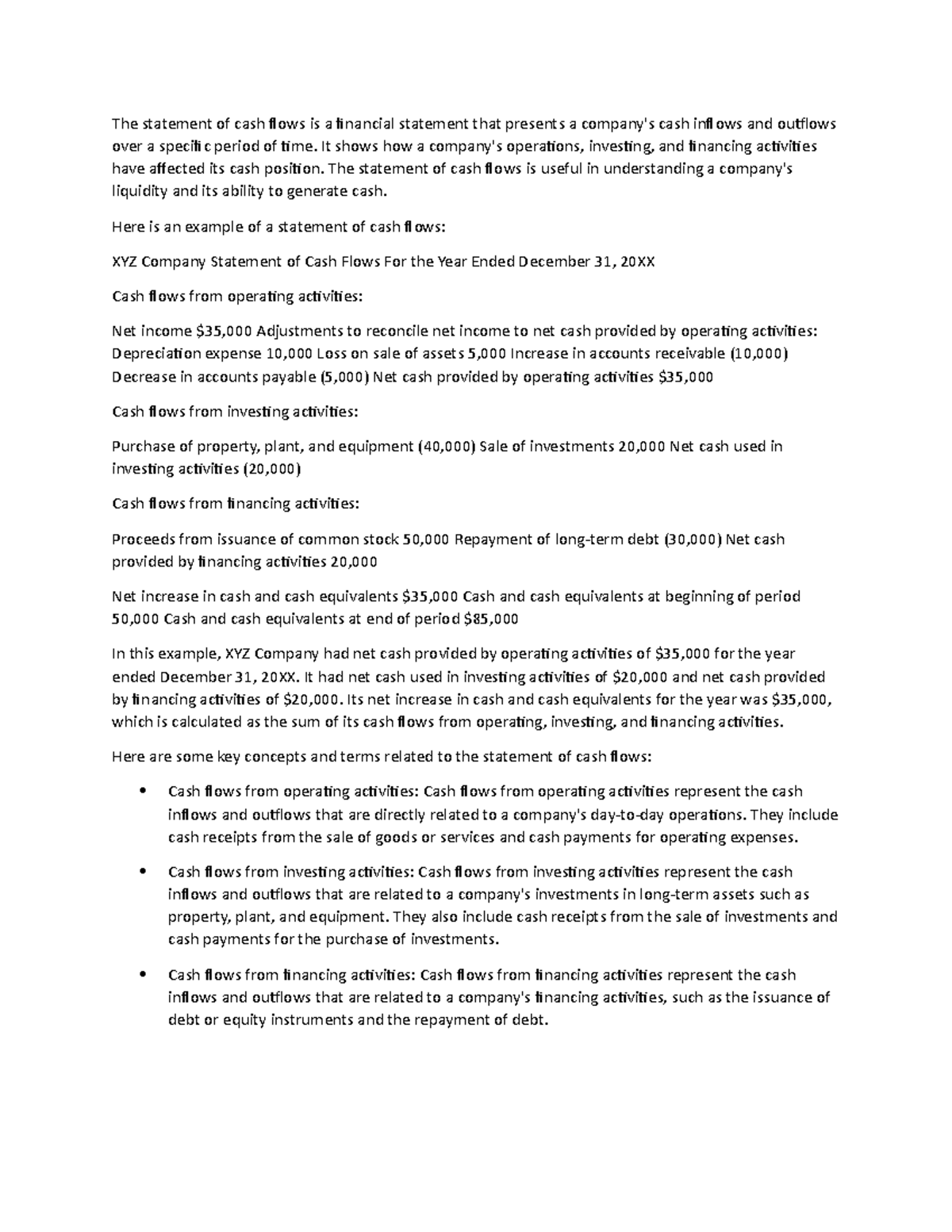

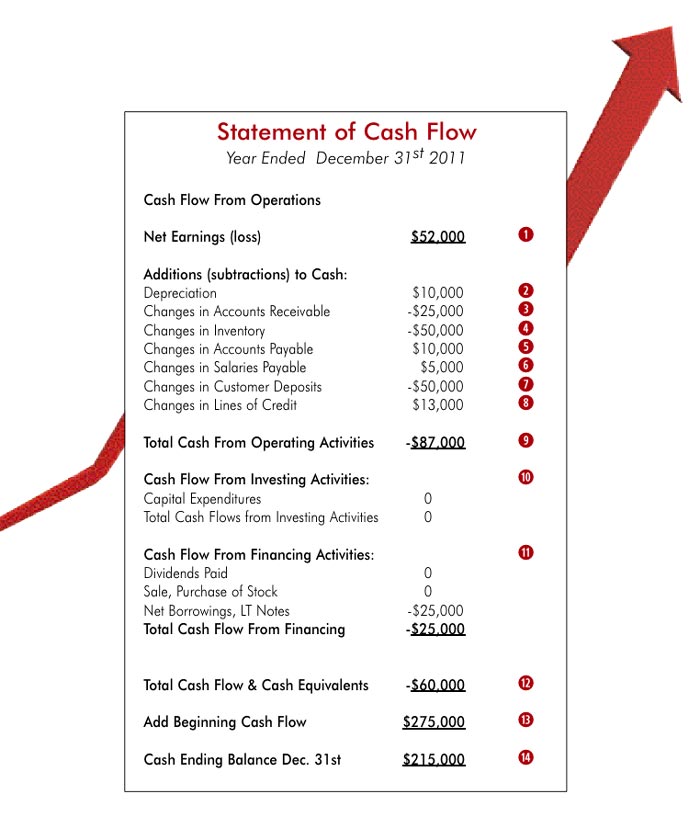

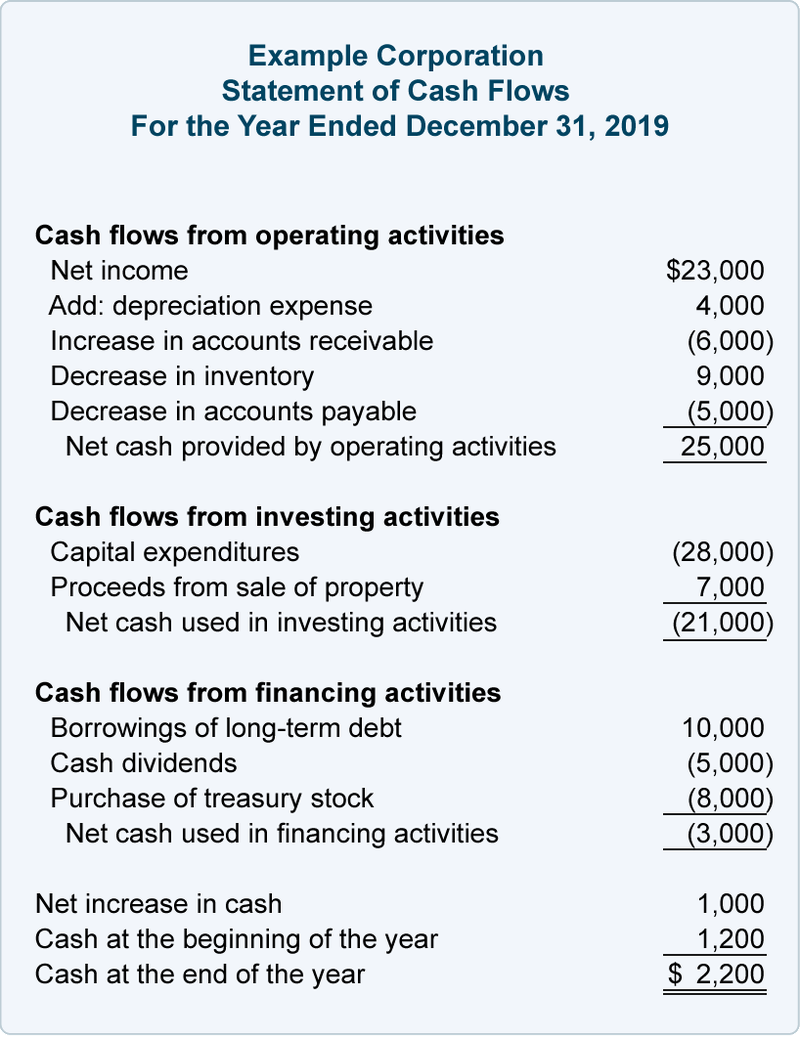

Increases in net cash flow from financing usually arise when the company issues share of stock, bonds, or notes payable to raise capital for cash flow. Cash flow statements (cfs) provide a summary of the cash that a company brings in and spends in a given time period, also called cash inflow and cash outflow. A common error when preparing the cash flow statement is to present the repayment of €40,000 of the note payable as an outflow of $48,000 (the amount of the debt.

Accounts payable are typically short. Cash flow management: Propensity company had one example of an increase in cash flows, from the issuance of common stock.

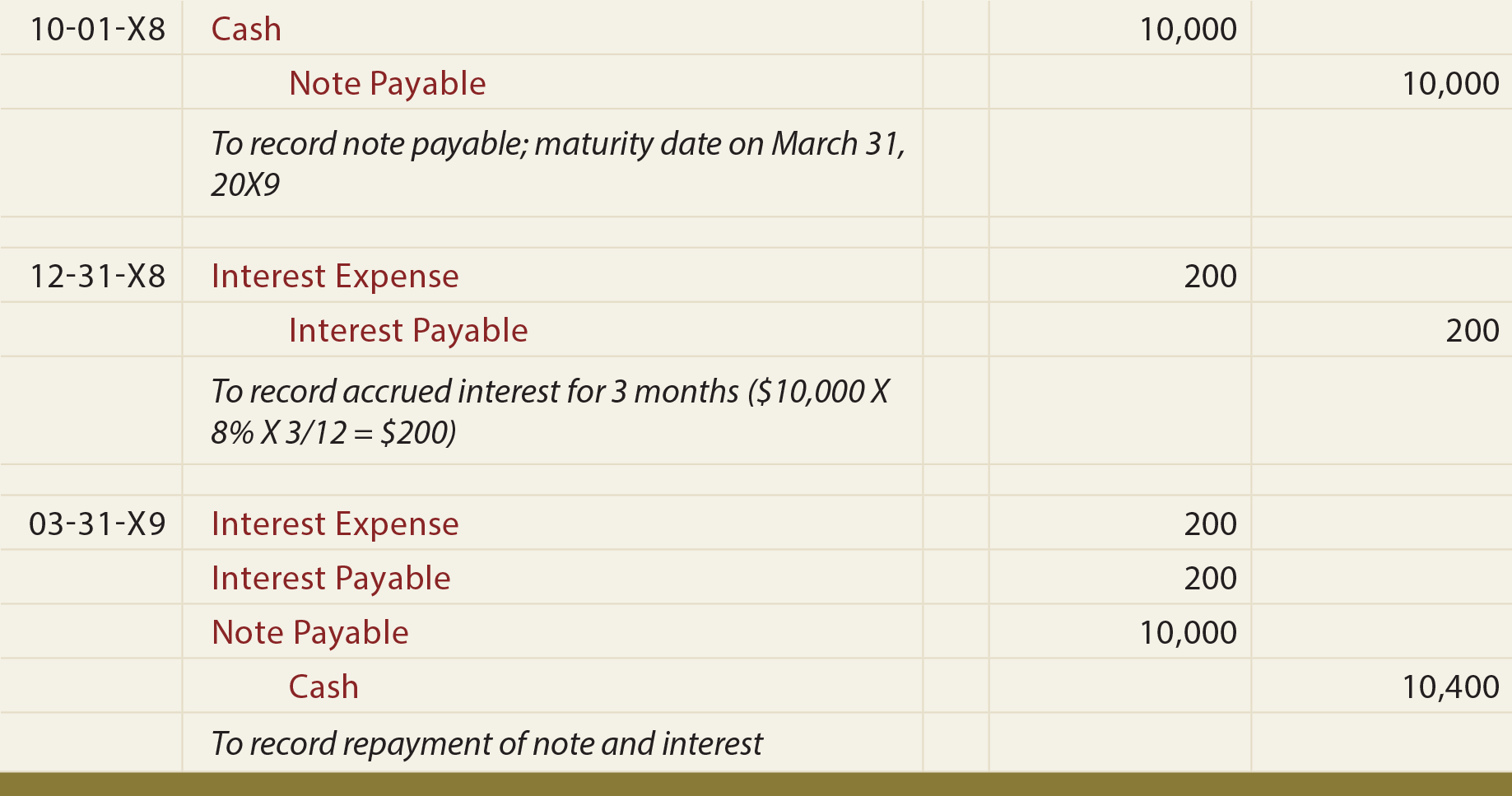

The amount borrowed is recorded by debiting cash and crediting notes payable: If a debtor runs into financial difficulties and is unable to pay, or fully repay, the note, the estimated impaired cash flows become an important reporting disclosure. These have repayment terms of less than one year.

By contrast, accounts payable is. When the note is repaid, the difference between the carrying amount of the note and the cash. Cash inflow until the date of repayment).

Usually this means the amount incurred (not the amount paid) under the accrual basis of. Determine net cash flows from operating activities using the indirect method,. Interest accrued can be computed with the annual interest rate,.

They are often used for working. Highlights the statement of cash flows is prepared by following these steps: The interest on a note payable is reported on the income statement as interest expense.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)