Best Of The Best Tips About Cost Of Goods Sold For A Service Business Acnc Financial Statements

Can you have cost of goods sold for services?

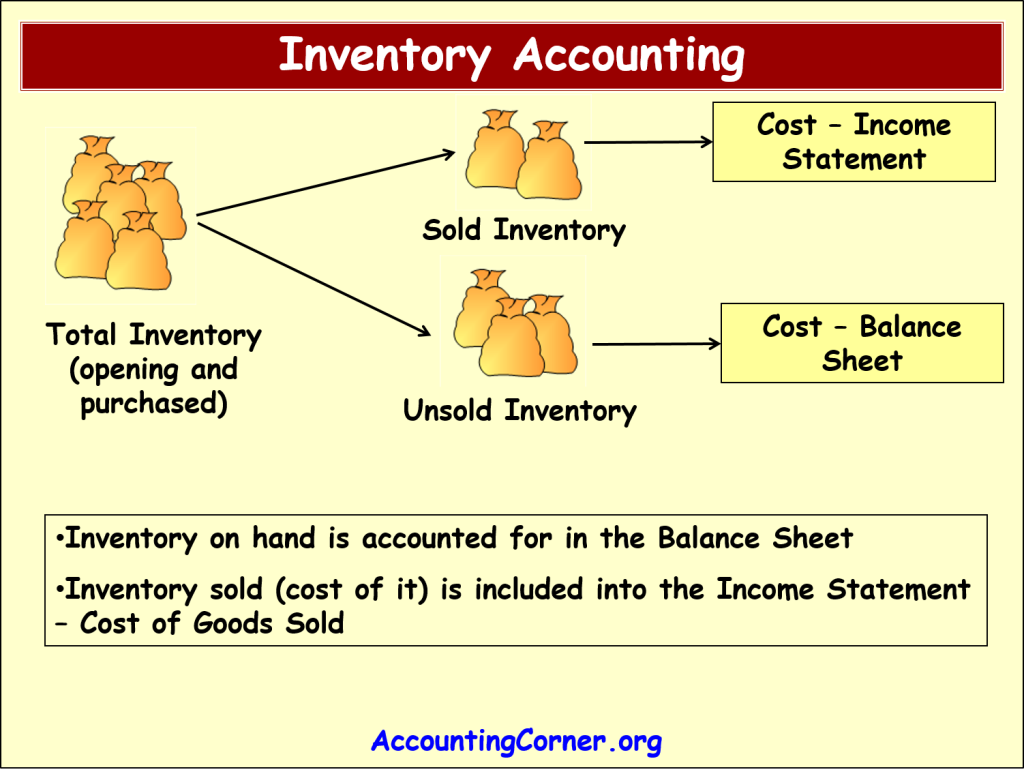

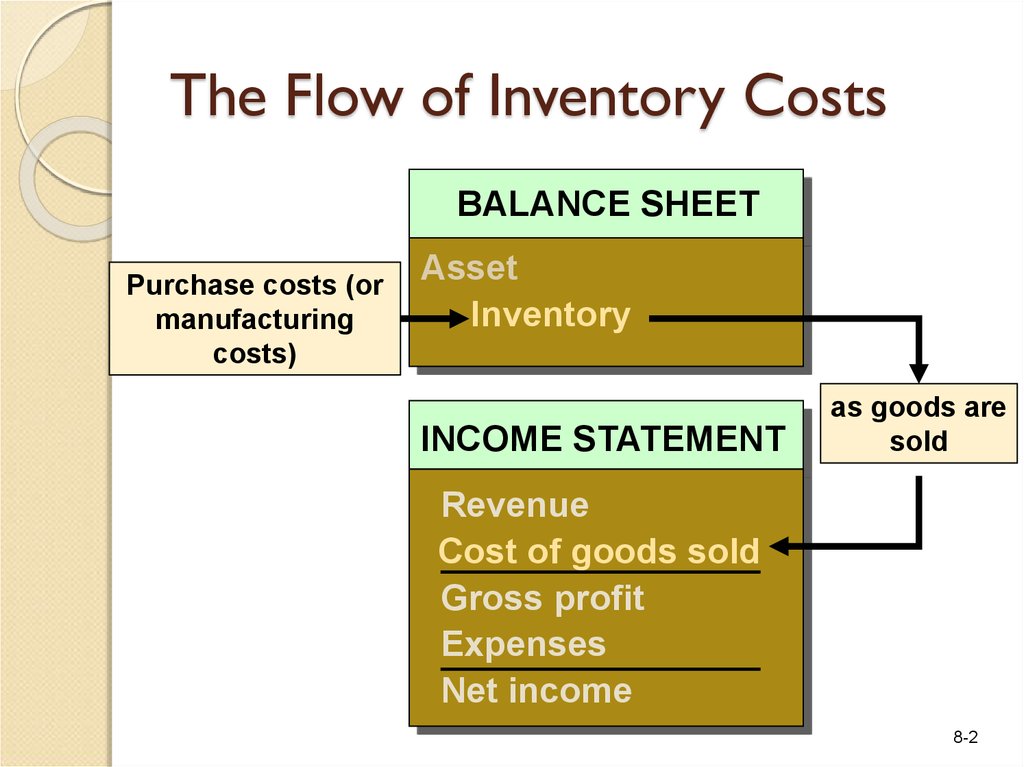

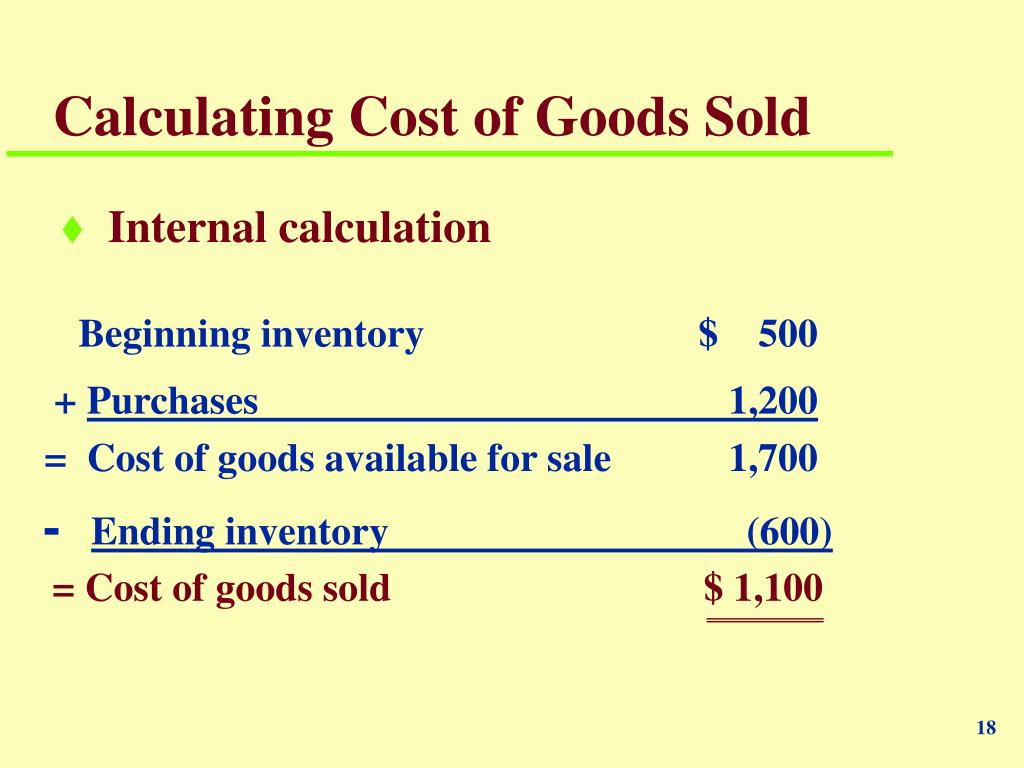

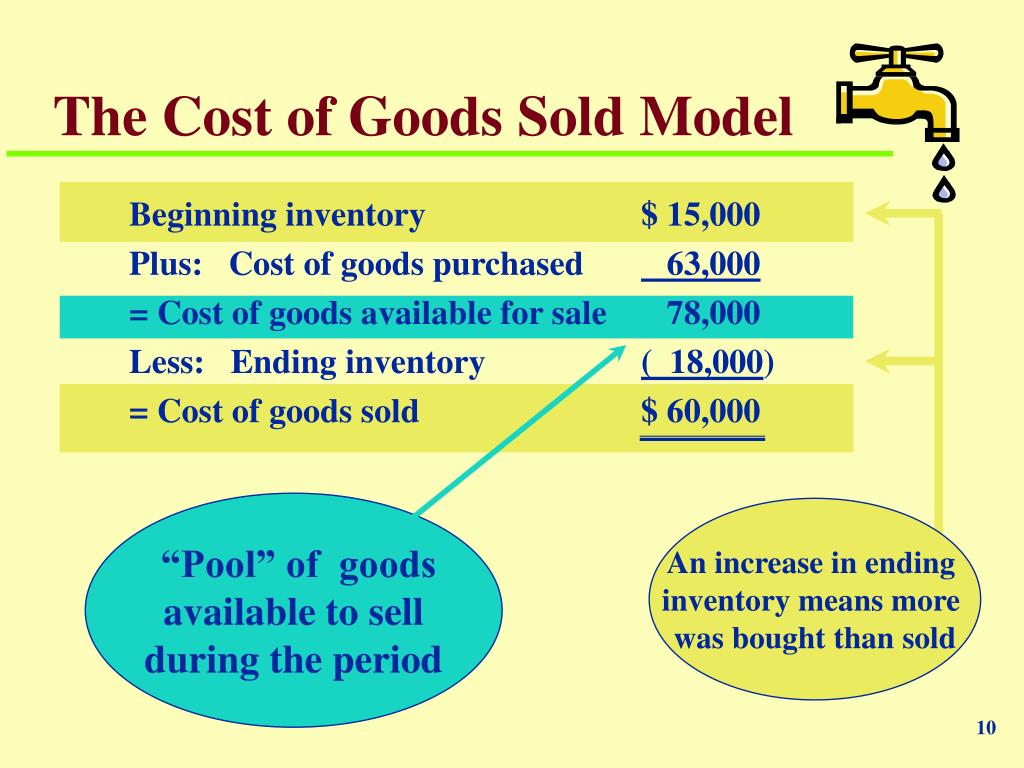

Cost of goods sold for a service business. Guidance and forms about importing and exporting goods, customs declarations, duties and tariffs. Then, subtract the value of the inventory yet to be sold. The cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company.

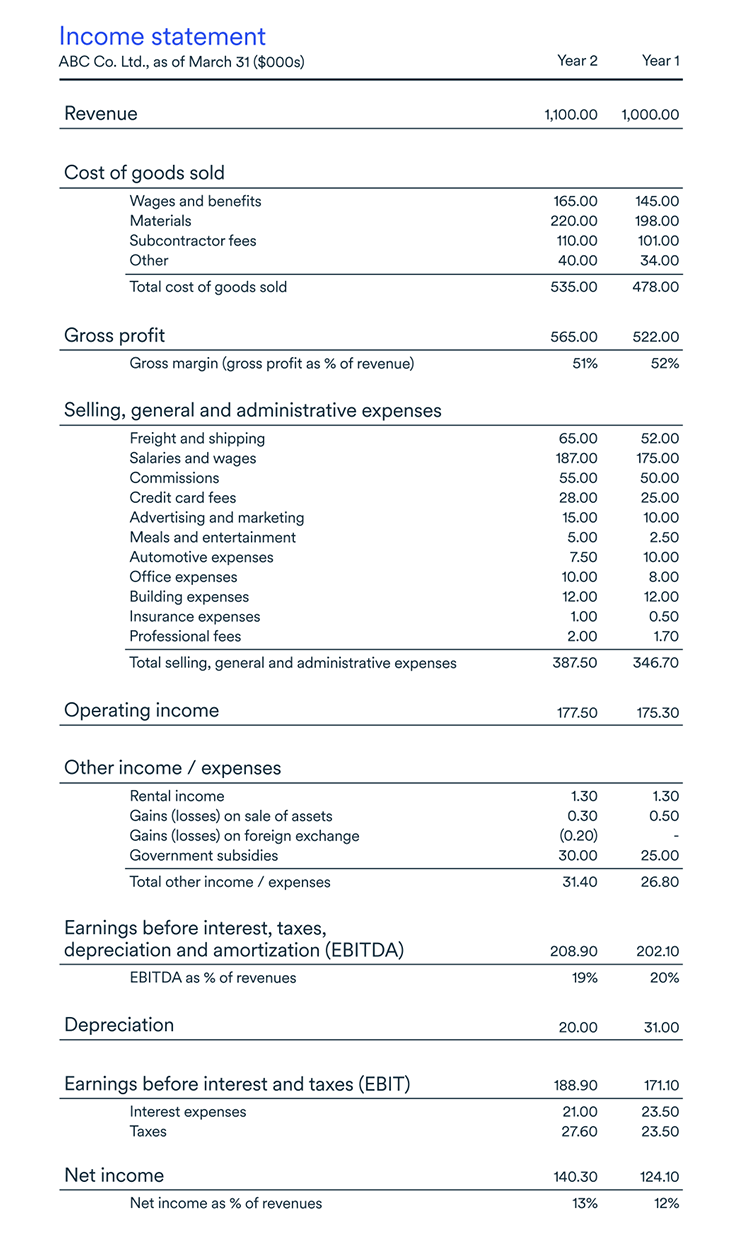

Cost of goods sold (cogs) are those expenses a business incurs in the process of providing a product or service. It represents the amount that the business must recover when selling. Cost of services = usd700,000 gross profit = usd600,000 cost of services journal entry:

Cost of goods sold (cogs) is also the same as cost of sales (cos). Finally, subtract the inventory you didn't sell at the end of that accounting period. Read on and learn about service business cogs.

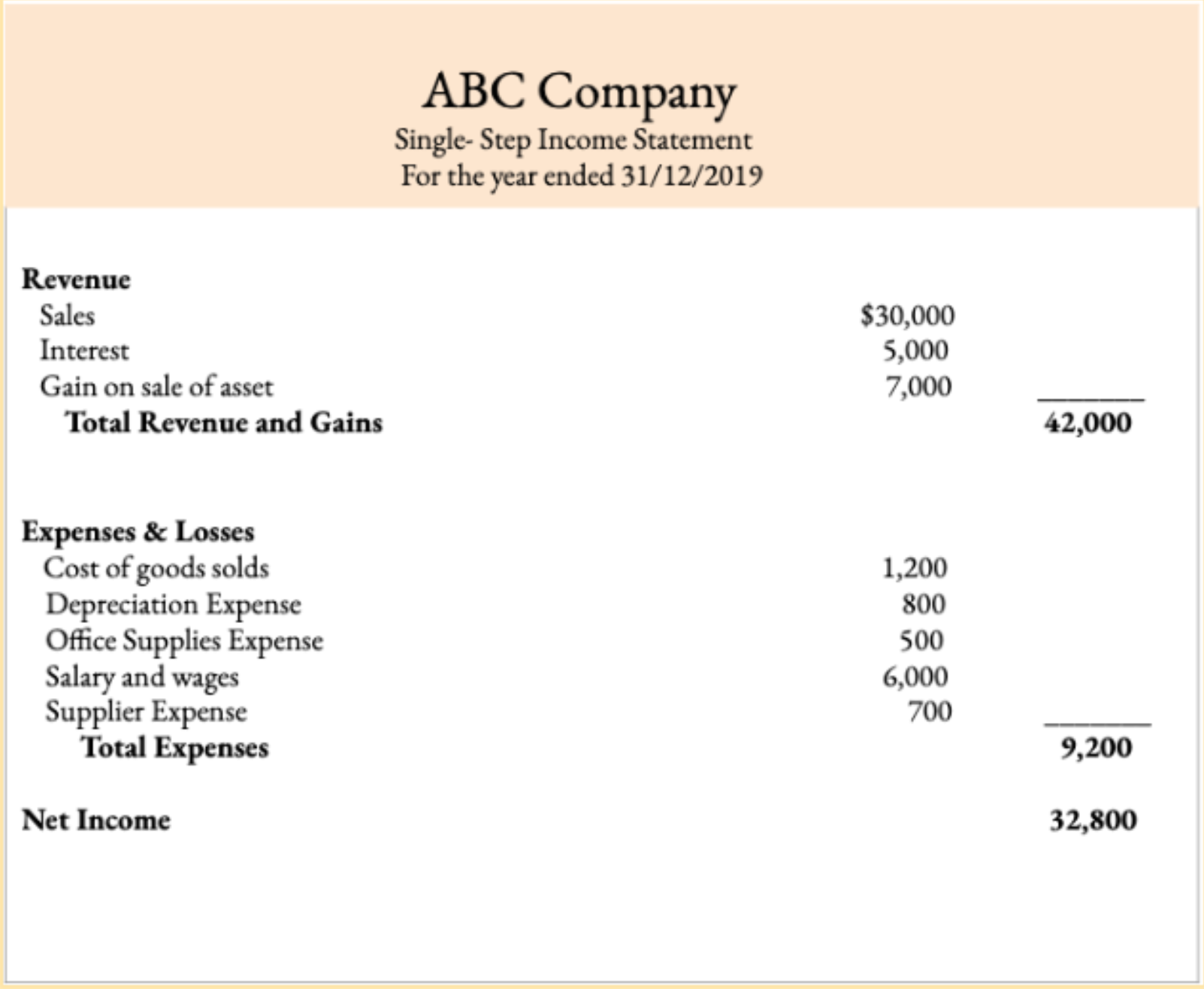

Businesses calculate their cos to comply with the matching concept of accounting, which requires them to. Cost of goods sold best practices In a service business, cost of sales is dominated by the labor provided to the customer for the company’s services.

This means that the total amount directly traceable to the shoes the store had to spend was $50,000. Cost of goods sold (cogs) is the cost of acquiring or manufacturing the products that a company sells during a period, so the only costs included in the measure are those that are directly. This end inventory cost you $25,000 to acquire.

The cogs can also inform a proper price point for an item or service. Cost of services are considered as the expenses element of the financial statements and the double tries are the same as expenses or cost of goods sold. Your employees wages is considered cost of revenue, so in this scenario you would have $90 in direct labor costs that would be included in your cost of revenue.

Knowing the cost of goods sold can help you calculate your business’s profits. Company a recorded $3.5 million worth of inventory at the beginning of the 2017 fiscal year. Knowing the cost of goods sold can help you calculate your business’s profits.

Written as a formula, it is: It includes the costs of the materials, storage and manufacturing labour, but not indirect costs such as distribution, marketing and management salaries. Cost of goods sold = $1,200,000;

Begin by identifying every expense or cost associated with providing your business's service. This encompasses various factors such as labor costs, expenses for materials, and any other directly related costs incurred in the process of providing the service. Cogs is considered a business expense and impacts your profit — the higher your.

It includes material cost, direct labor cost, and direct factory overheads, and is directly proportional to revenue. Cogs includes all of the direct costs involved in manufacturing products. It includes all the costs directly involved in producing a product or delivering a service.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)