First Class Tips About Profit Reconciliation Statement Format Car Wash Financial Statements

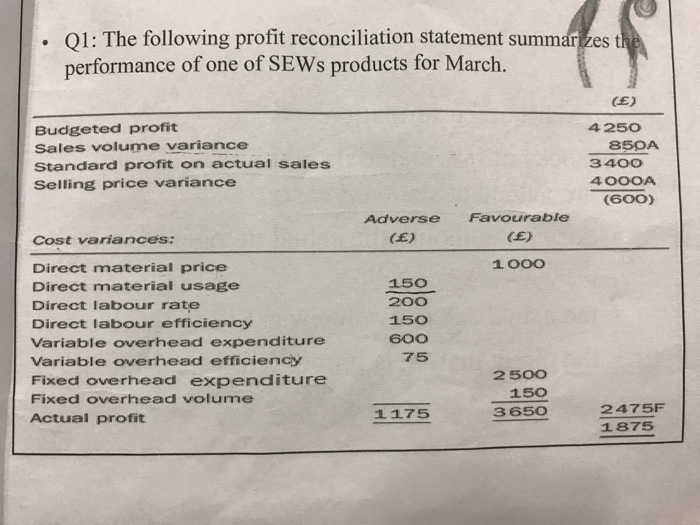

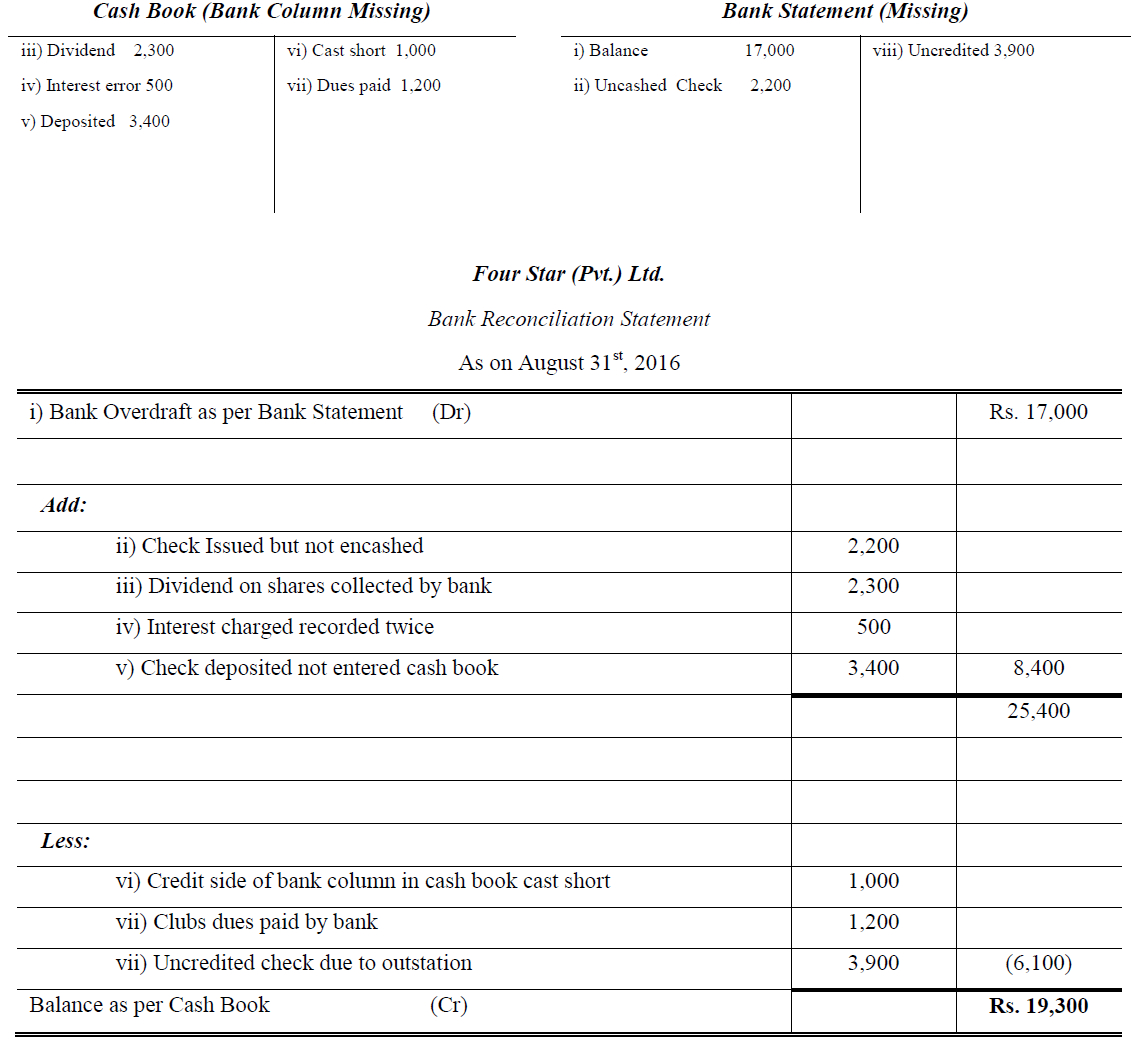

We will take profit from the absorption costing.

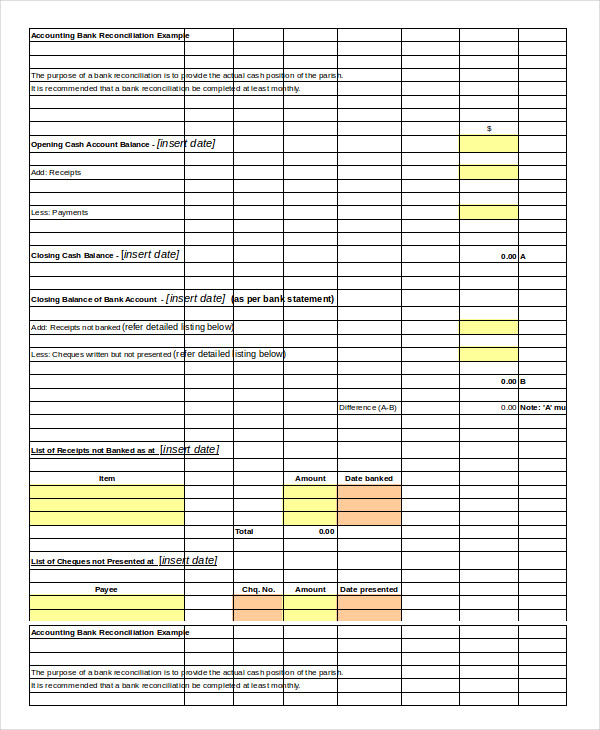

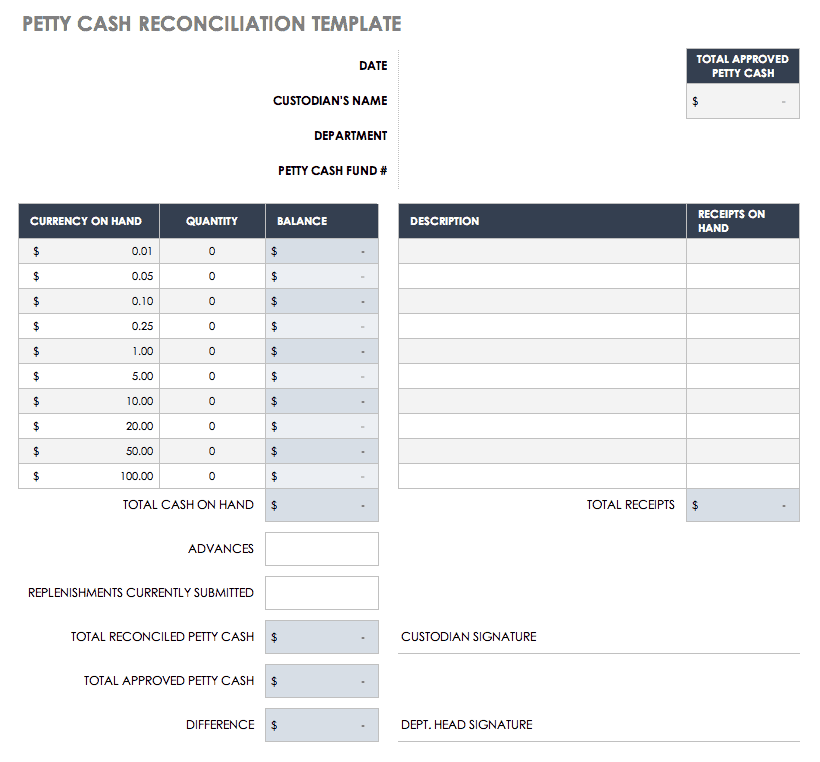

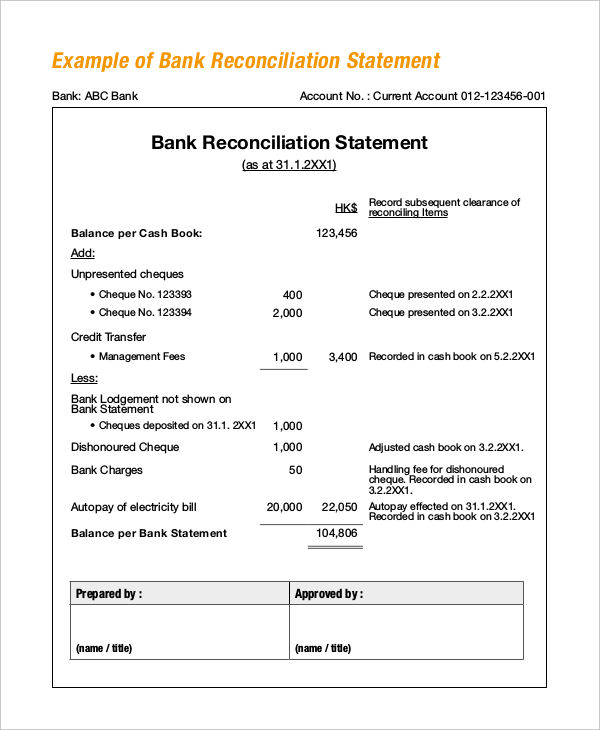

Profit reconciliation statement format. To get started, enter all of the noncash expenses shown on the. Save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Where cost accounts and financial accounts are separately maintained in two different sets of books, the profit or loss shown by one may not agree.

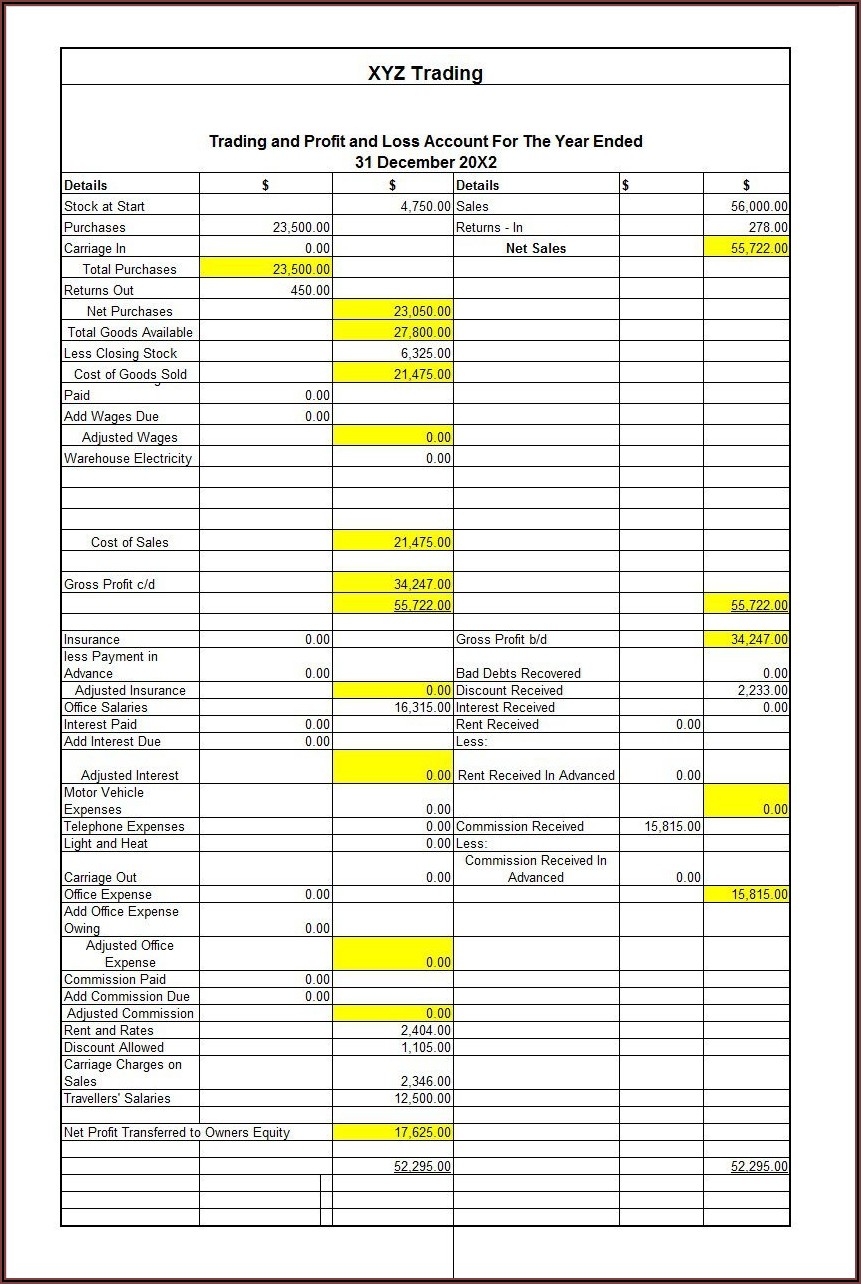

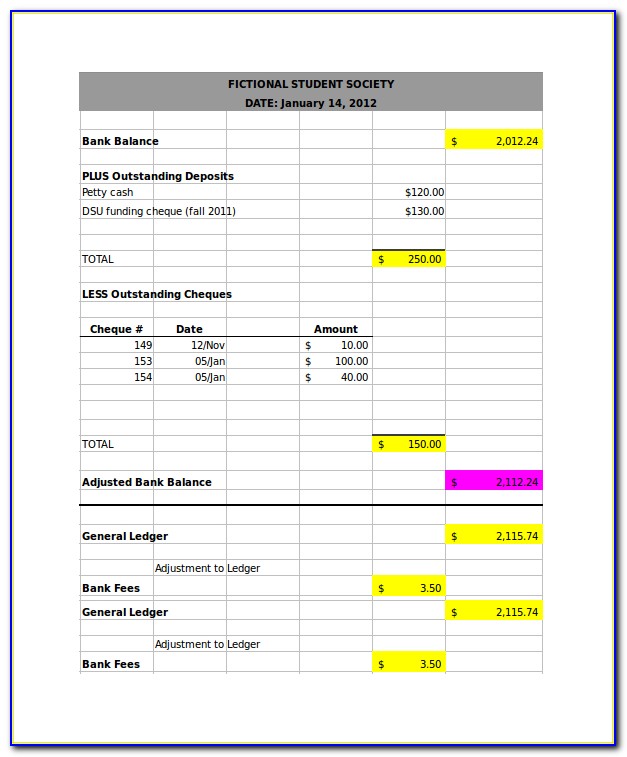

Bank reconciliation template from cfi team for excel platform: A profit and loss statement contains three basic elements: To find the reasons for disagreement of profit or loss shown both in the.

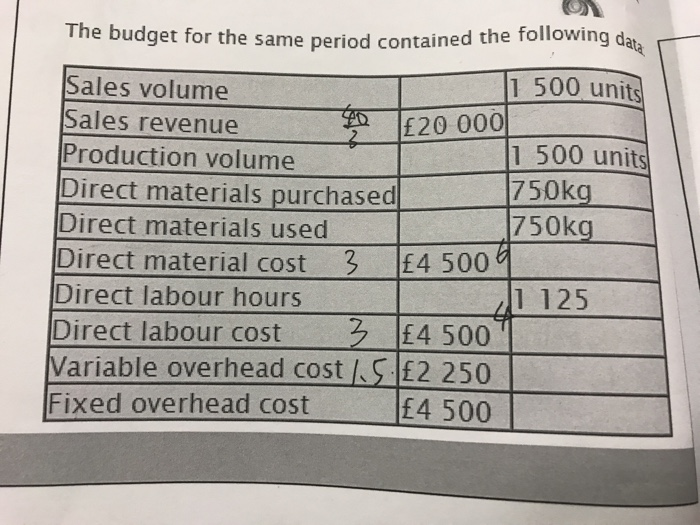

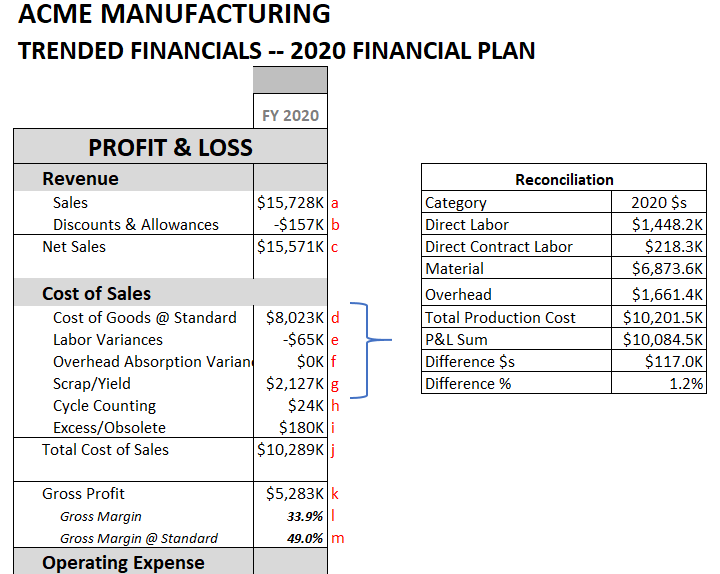

An introduction to acca ma e3b. The following are the objectives of preparing the profit reconciliation statement. A cost reconciliation statement is prepared to reconcile the differences in net profits shown by cost and financial accounts.

A reconciliation statement is a statement which is prepared to reconcile the profit as per cost accounts with the profit as per financial accounts by suitably treating the causes for. Prepare reconciliation statement. Import bank statements and automatically match them with their accounting records, reducing manual data entry.

More advanced profit and loss statements also include. It entails incorporating the adjusted cost. Analyzing and comparing the deposits altering the bank statements adjusting the cash account comparing the final balances how frequently should you reconcile with.

Reconcile profits under marginal as documented in the acca ma textbook. Reconciliation is effected at the end of a period by preparing a reconciliation statement. A vertical presentation of the.

With vyapar’s reconciliation statement format, businesses can: We may start either with profit as per cost accounts or with profit as per financial. You can customize all of the templates offered below for.

To ensure accuracy and integrity in financial statements, including the reconciled cost data after the reconciliation procedure is essential. Reconciliation can be done in two ways, begin from profits of absorption costing. A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement.

The format of the reconciliation is different under marginal and absorption costing. Revenue, expenses, and net income.

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-32-790x1022.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-18.jpg)