Nice Info About Prepare A Statement Of Cost Goods Manufactured Apple Financial Statements 2018

The two most important numbers on this.

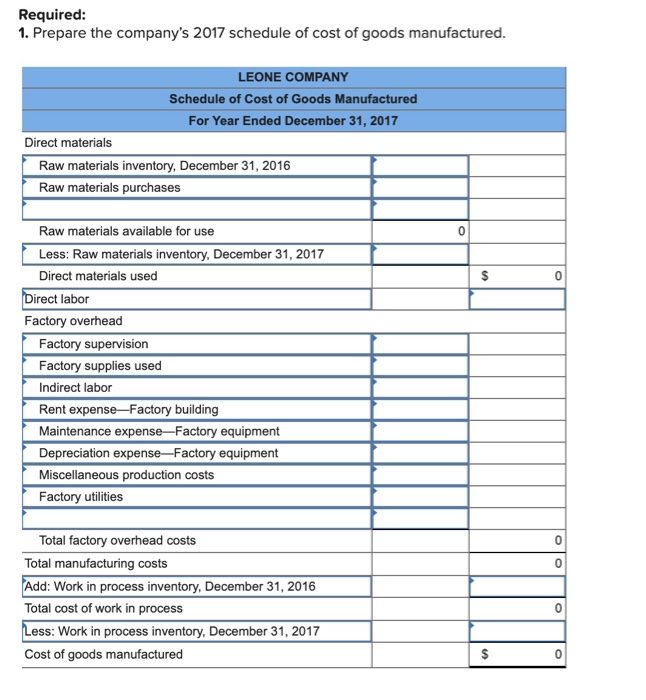

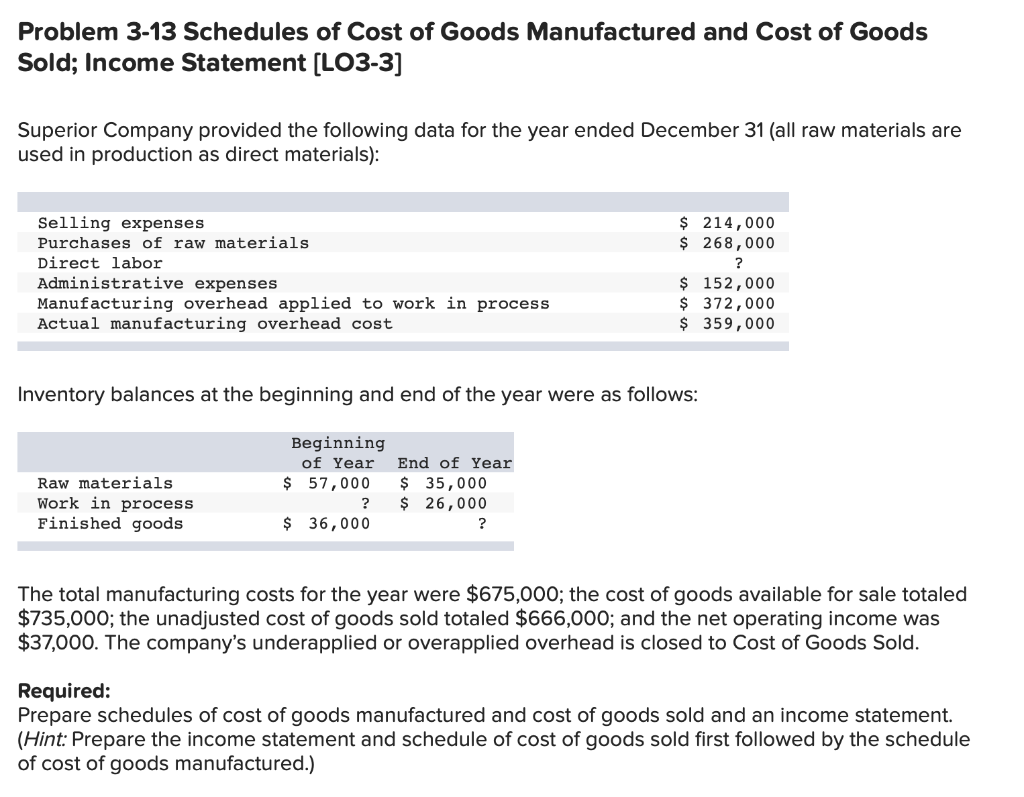

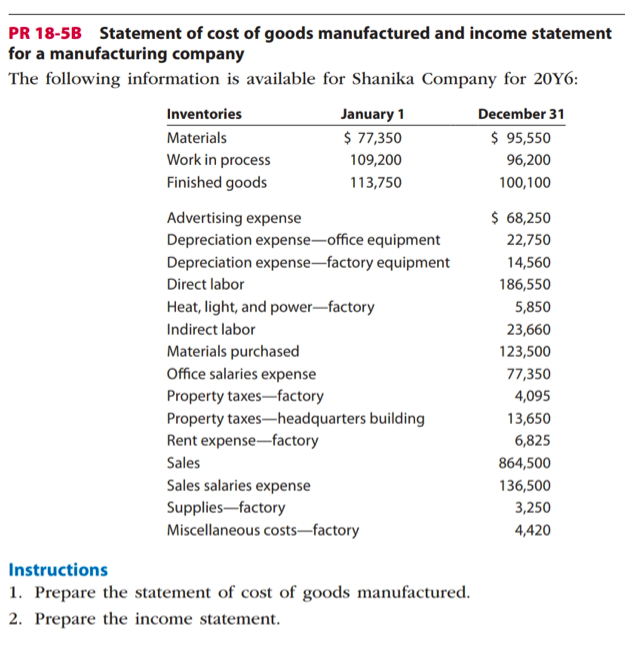

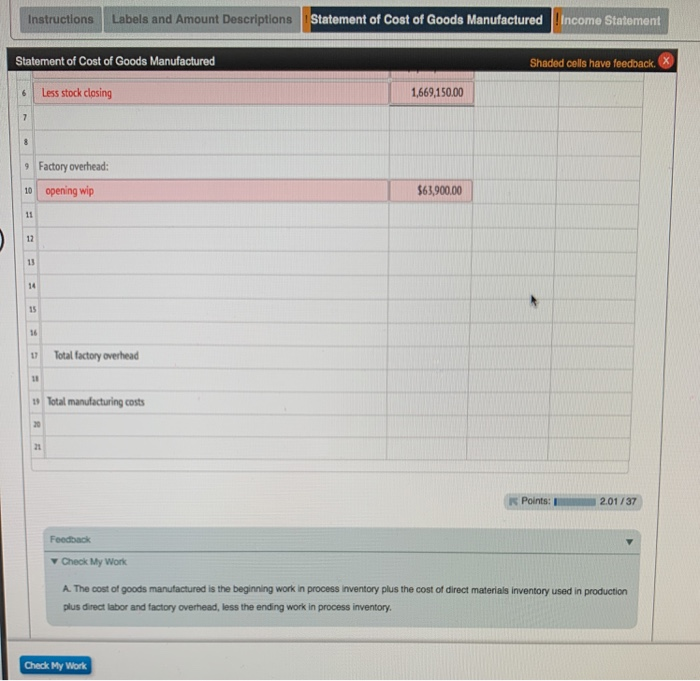

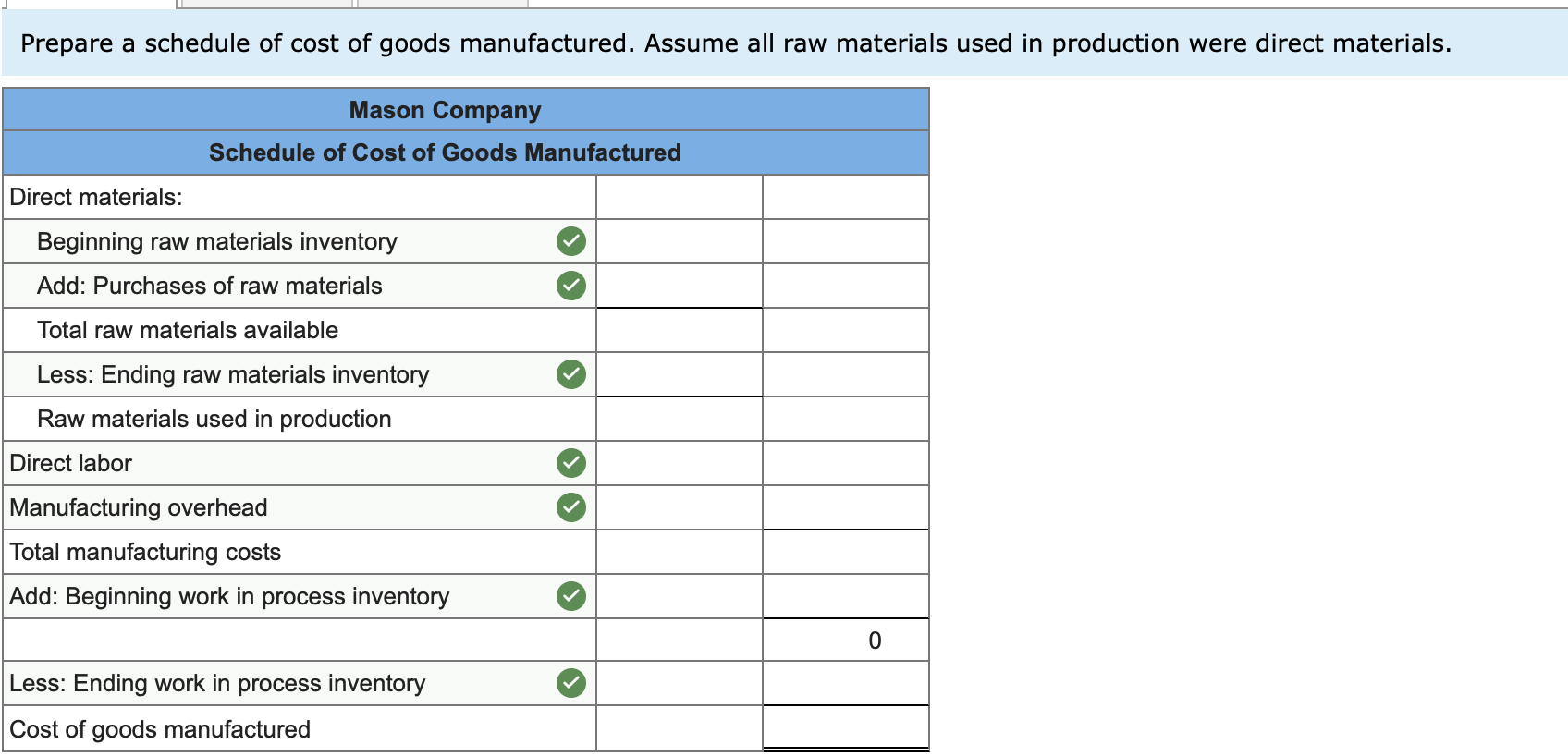

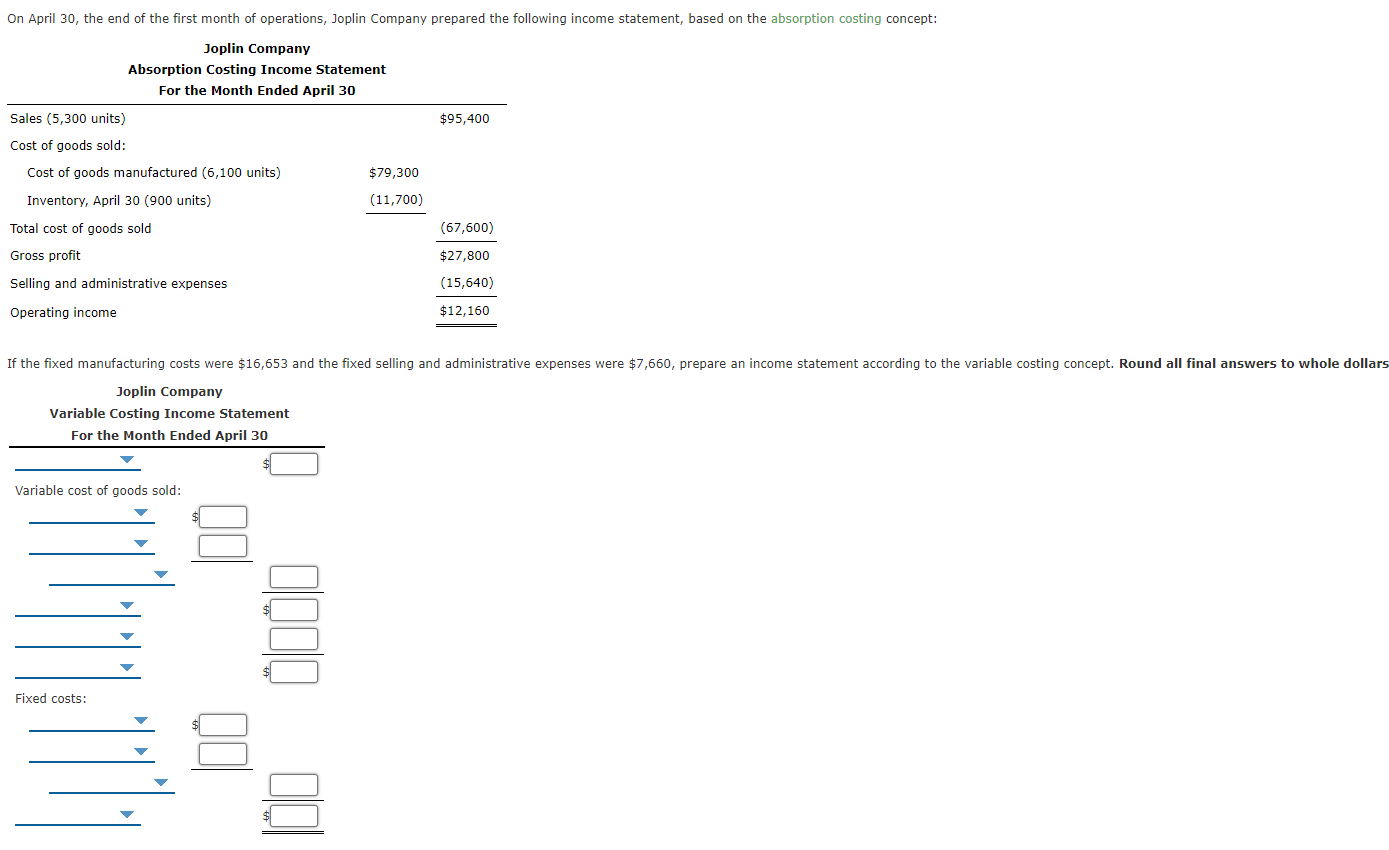

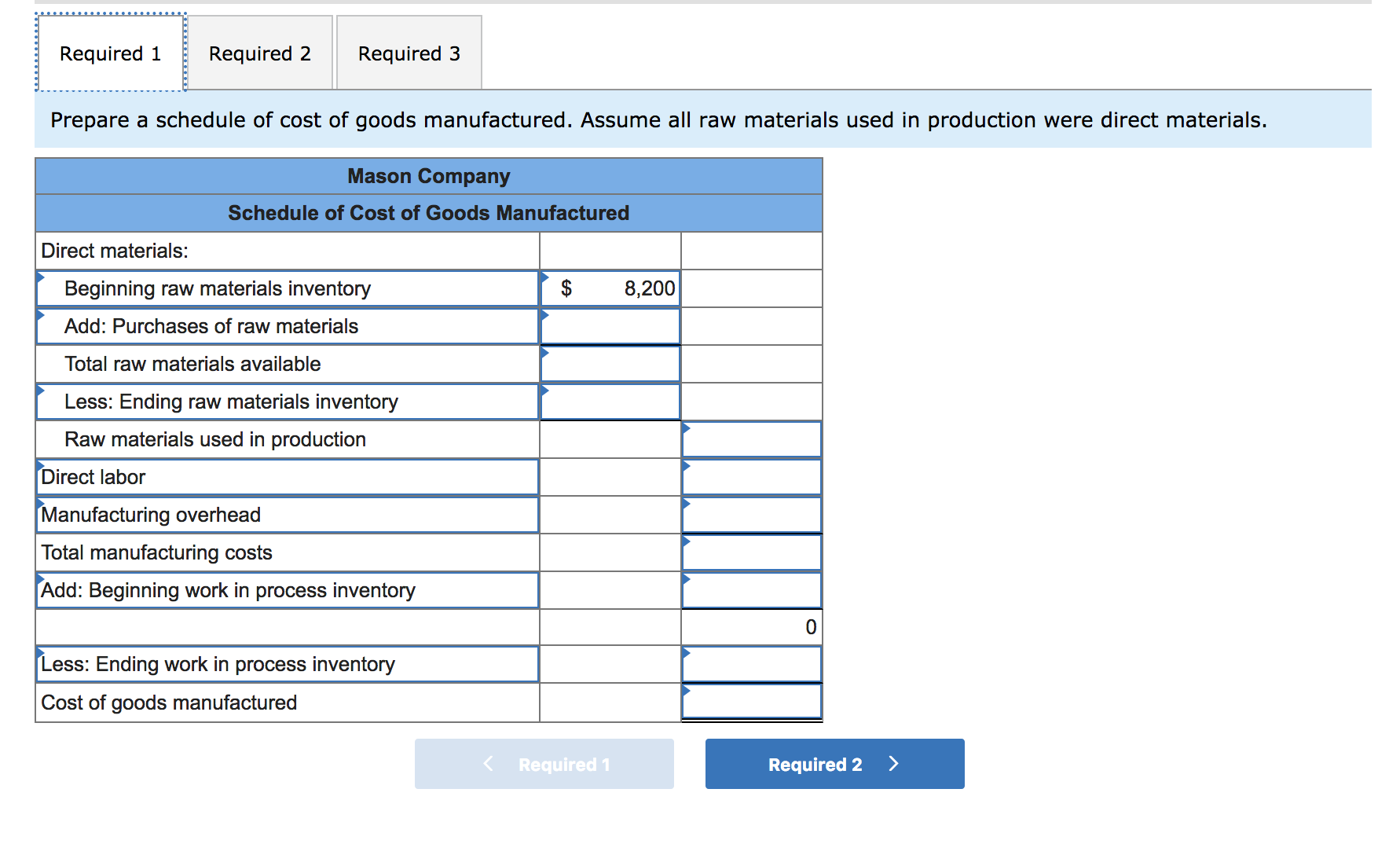

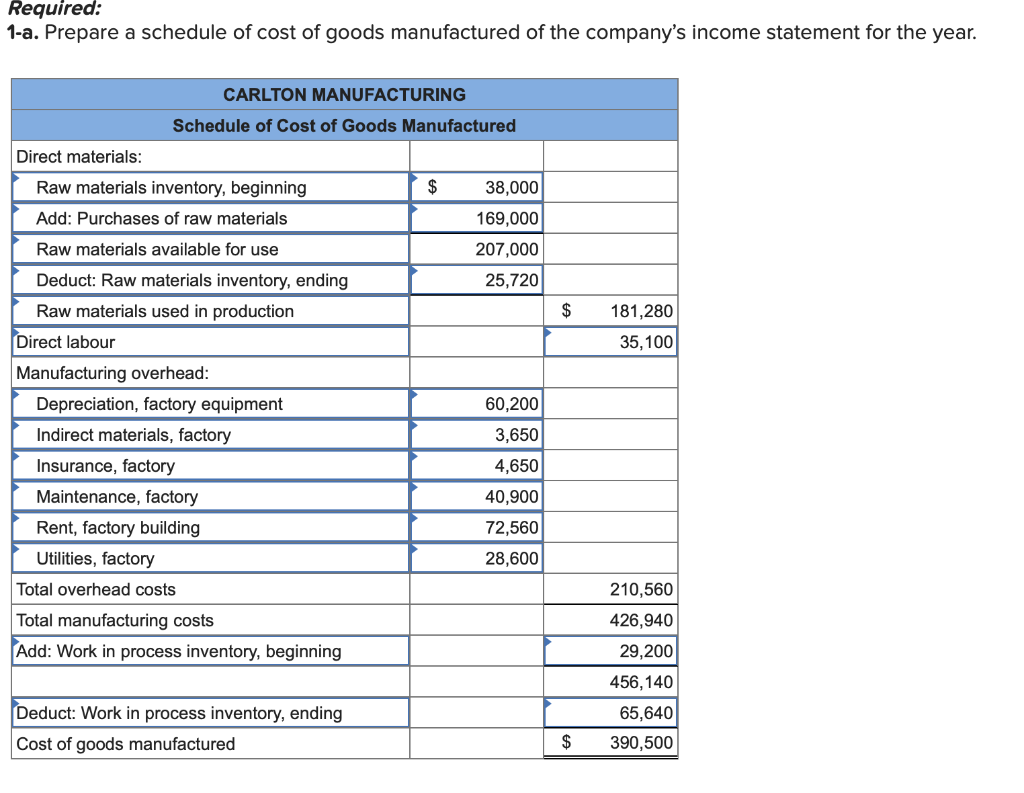

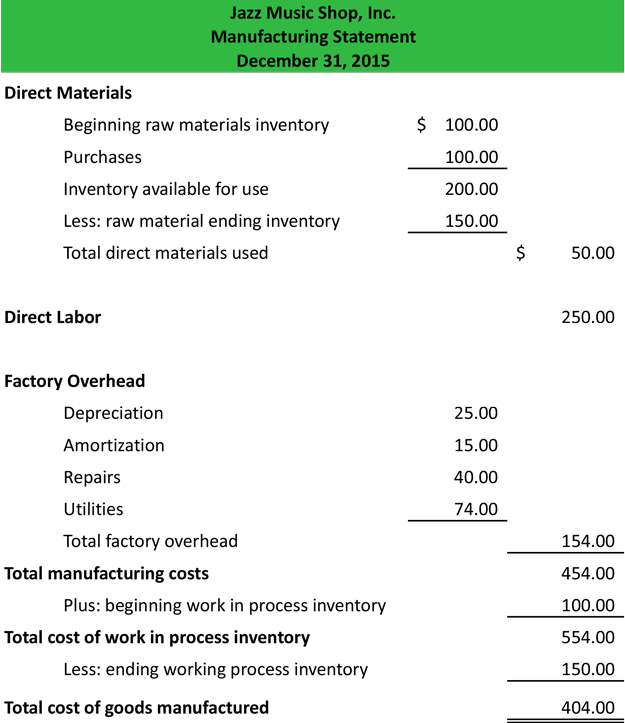

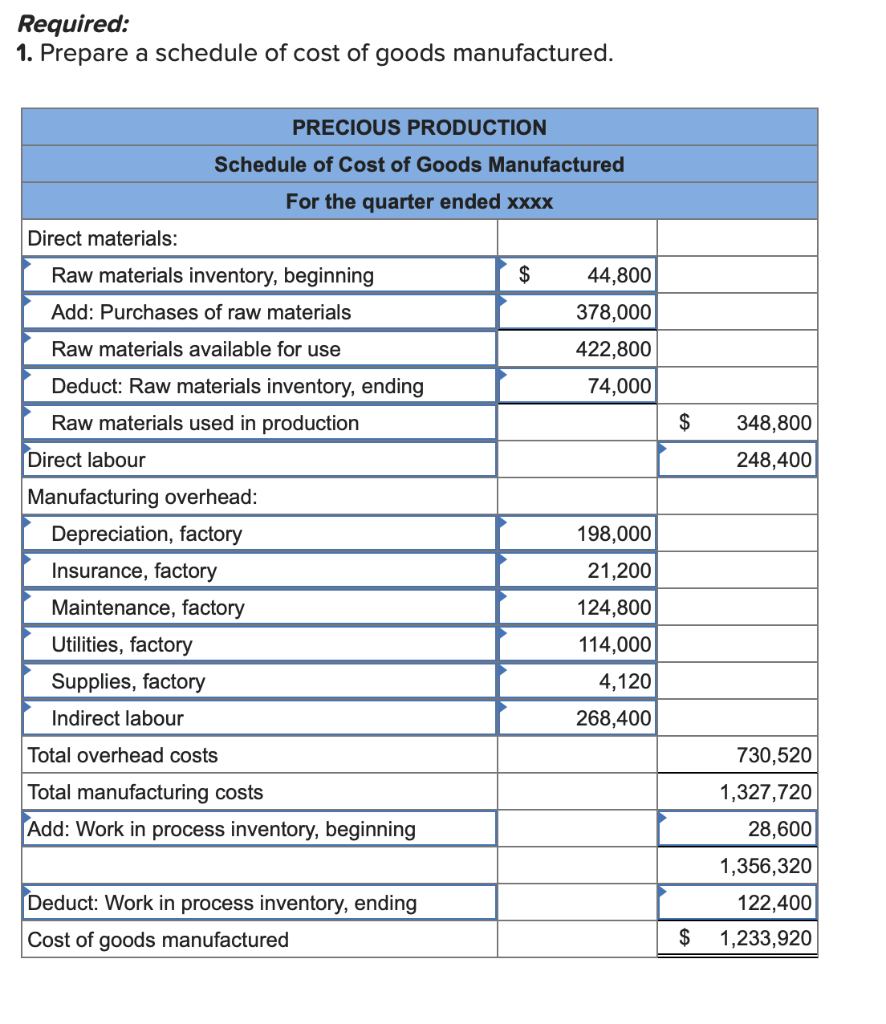

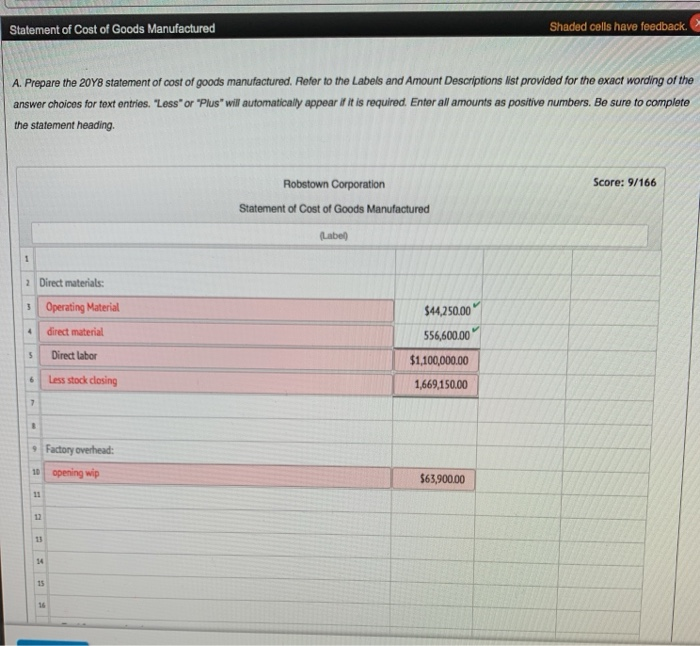

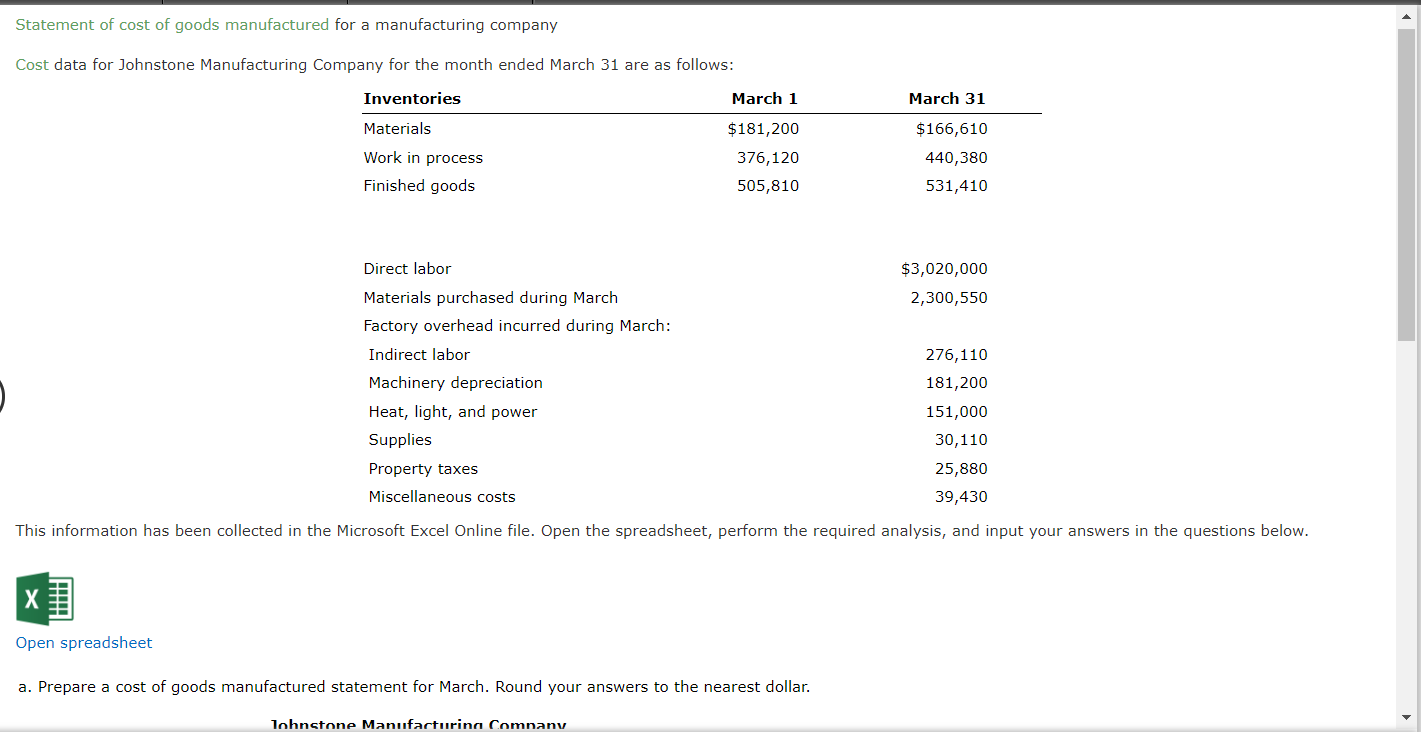

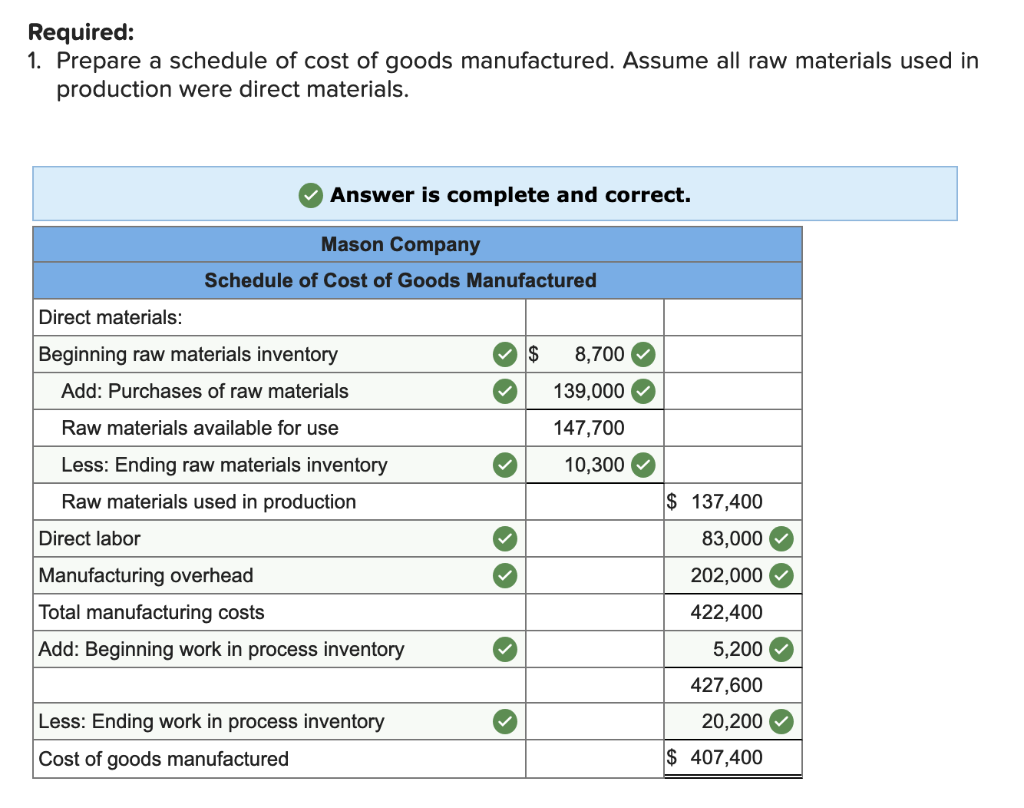

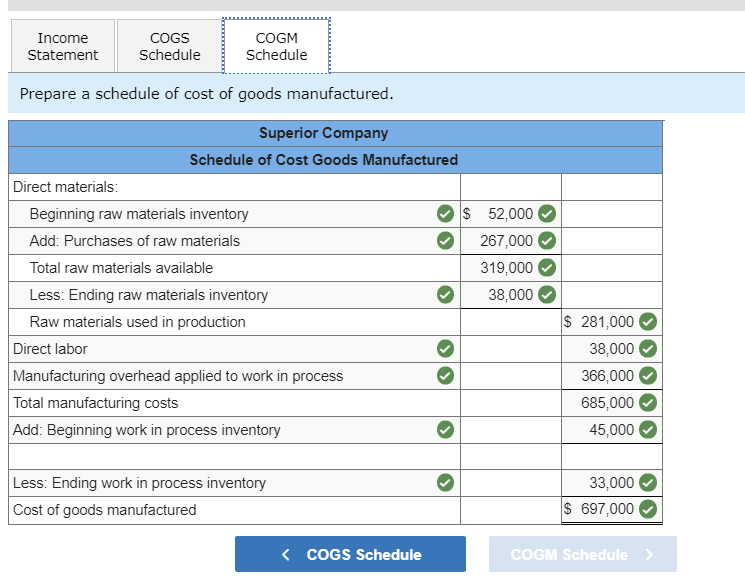

Prepare a statement of cost of goods manufactured. The schedule (or statement) of cost of goods manufactured follows: Accountants need all these amounts—raw materials placed in production, cost of goods manufactured, and cost of goods sold—to prepare an income. Material cost = 491,250 x 100 = 49,125,000.

First, prepare a cost of goods manufactured statement. Run rate definition the cost of goods manufactured schedule calculates the cost of all items produced during a reporting period. The schedule (or statement) of cost of goods manufactured follows:

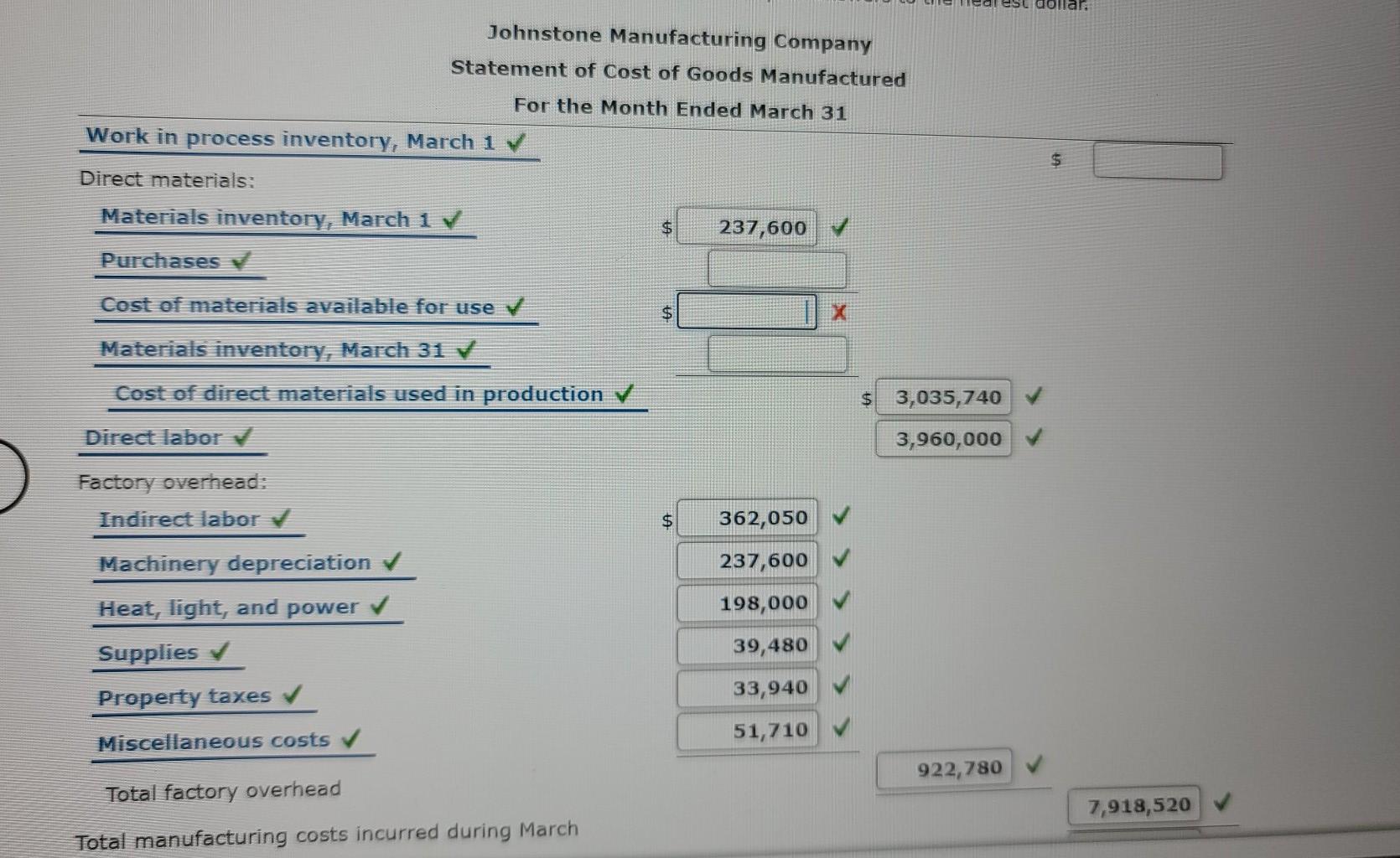

Then, prepare a cost of goods sold statement. The cost of goods manufactured schedule the cost of goods manufactured schedule is used to calculate the cost of producing products for a period of time. Labor cost = 378,000 x 100 = 37,800,000.

During the month of july, the. Prepare a statement of cost of goods manufactured and sold. The statement of cost of goods manufactured (cogm) is a financial statement that presents a comprehensive breakdown of the total manufacturing costs.

The income statement for merchandising and manufacturing companies differs in the reporting of the cost of the merchandise (goods) available for sale and sold. What is a cost of goods manufactured statement?. How to prepare a cost of goods manufactured statement (cost accounting tutorial #24) notepirate 43.3k subscribers subscribe 181k views 9 years ago cost.

Note how the statement shows the costs incurred for direct materials, direct labor, and manufacturing. Cost of goods manufactured (cogm) and cost of goods sold (cogs) are both crucial elements found on companies’ financial statements. Cost of goods manufactured (cogm) may also be expressed in the form of an equation.

Therefore, the calculation of the cost of goods. Inventories materials work in process finished goods march 1 $213,600 443,370 596,250 march 31 $196,410 519,150 626,460 $3,560,000 2,711,900. This equation is sometime referred to as cogm formula:

Note how the statement shows the costs incurred for direct materials, direct labor, and manufacturing. It is used to construct financial. Calculation of material and labor cost.