Glory Info About Preparing Pro Forma Financial Statements Net Profit On Balance Sheet

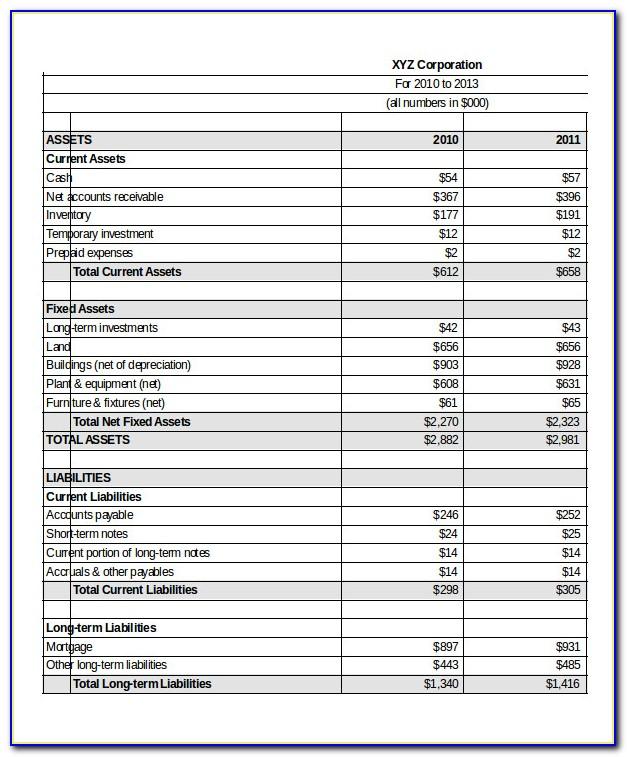

The pro forma financial statements should typically include a statement of assets and liabilities, a statement of operations, a portfolio of investments, and notes to the pro forma statements.

Preparing pro forma financial statements. Consolidated revenue of $1.48 billion, a 13% increase compared to the prior year quarter. Accountants prepare financial statements in the pro forma method ahead of a proposed transaction such as an acquisition, merger, a change in a company's capital structure, or new capital. As in, “what if my business got a $50,000 loan next year?”

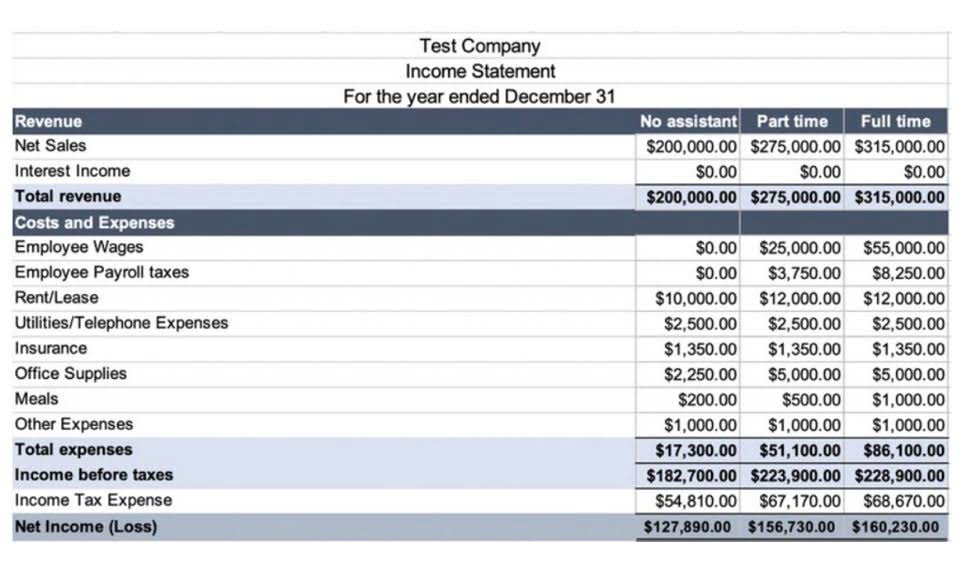

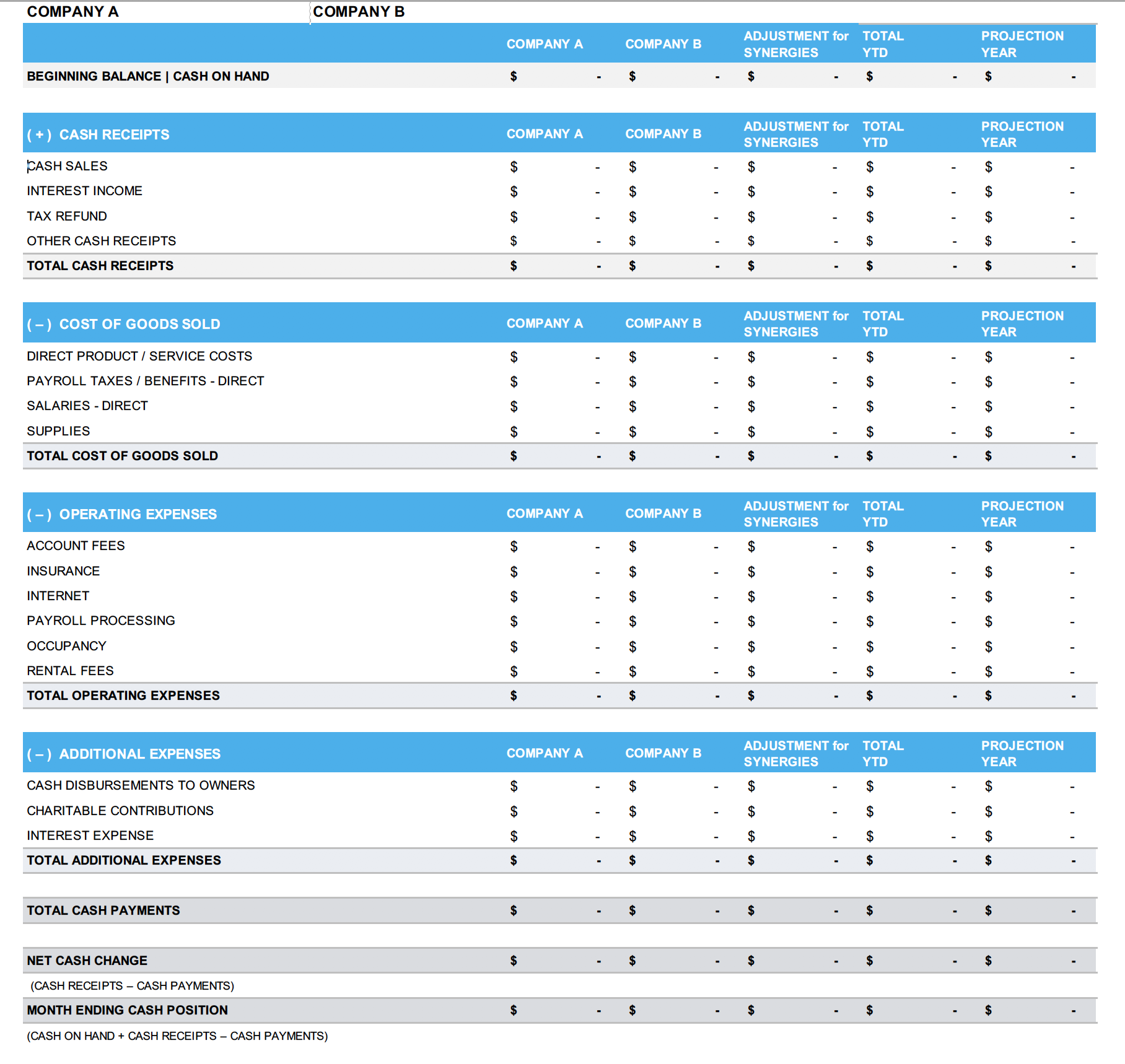

Lastly, we will create the cash flow statements. Fn 1 paragraphs.03 through.05 of as 6101, letters for underwriters and certain. There are three main types of pro forma statements:

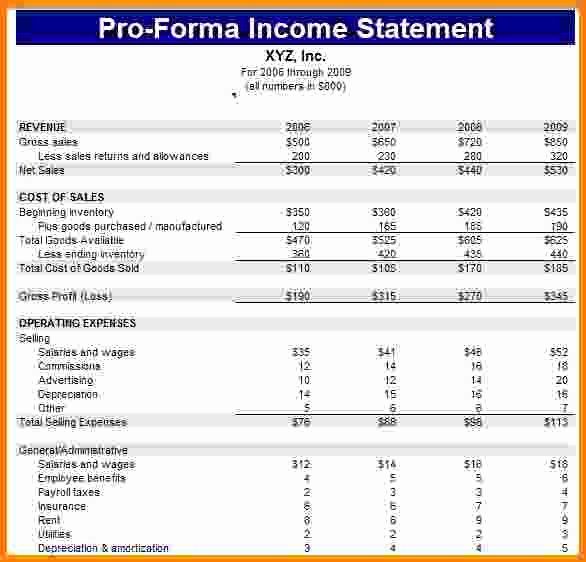

We will prepare three pro forma financial statements in excel. Learn about pro forma financial statements and understand how they are used. Operating income was $340 million, a 27% increase compared to the prior.

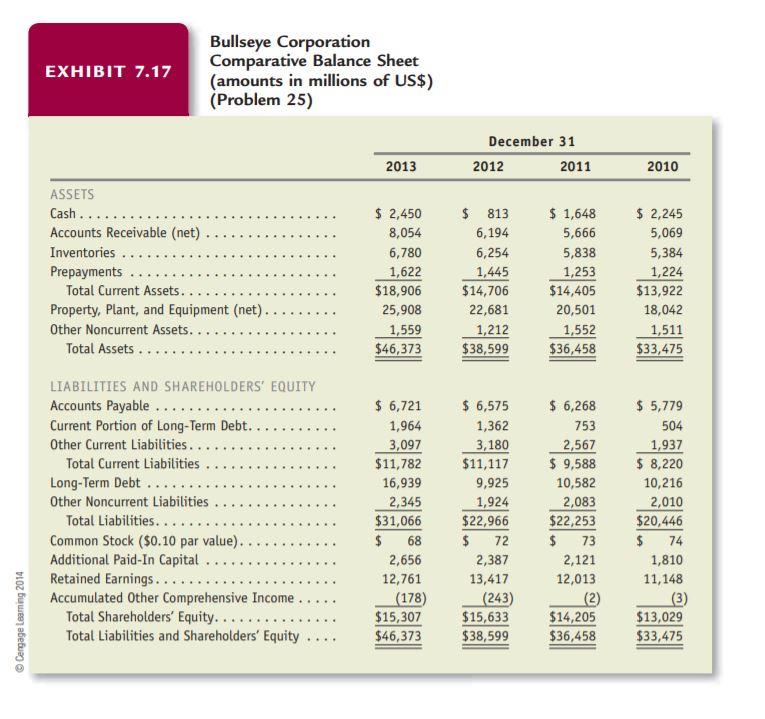

Following that, we will create the pro forma balance sheet. Process of financial analysis. How data rails helps in preparing pro forma financial statements.

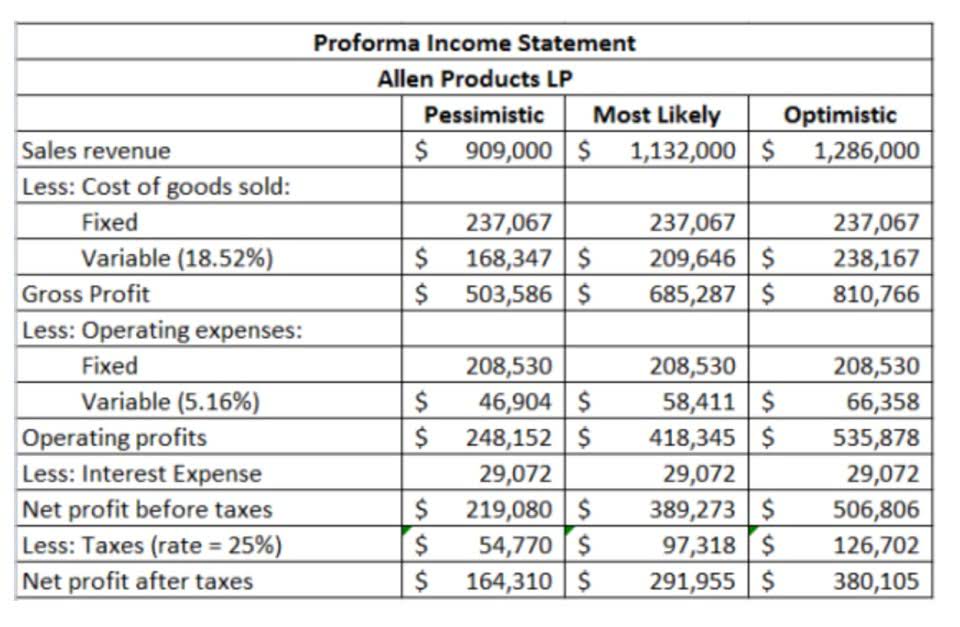

Pro forma statements can help predict cash flow, analyze risks, and secure funding. Pro forma financial statements present the complete future economic projection of a company or person. Gross margin expanded to 58.3% from 57.0% in the prior year quarter.

Adjustments for nonrecurring items suppose a company has recently gone through a substantial restructuring program. Learn about the components of pro forma statements like balance sheets, income statments and cash flow for a better. Businesses and finance professionals are always on the lookout for efficient ways to carry out accurate business and financial planning.

Footnotes (at section 401—reporting on pro forma financial information): Pro forma financial statements are forecasted financial statements of a business based on certain presumptions or projections. A pro forma statement is usually updated quarterly to reflect any changes in the company’s overall business plan and any changes in the industry as a.

Highlights for fourth quarter 2023 include: Small business owners can use pro forma statements to draft forecasted financial statements, budgets, and quotes. Often used to back up a lending or investment proposal, they are issued in a standardized format that includes balance sheets, income statements, and statements of cash flow.

Pro forma financial statements are used for many purposes such as planning and control, financial modeling or reporting. Businesses can develop pro forma income statements, balance sheets, revenue projections, estimates of costs and expenses and expectations of cash flow, such as the result of a merger or the introduction of a new product. Our team developed the entries to adjust the balance sheets of all entities, reflect thirdparty valuations, and net working capital adjustments.

Explore the process to prepare a pro forma financial statement with examples. Income sheet, balance sheet, and cash flow statement. Operating margin was 23.0% compared to 20.5% in the prior year quarter.