Simple Info About Quickbooks P&l Report Profit And Loss Control In Management

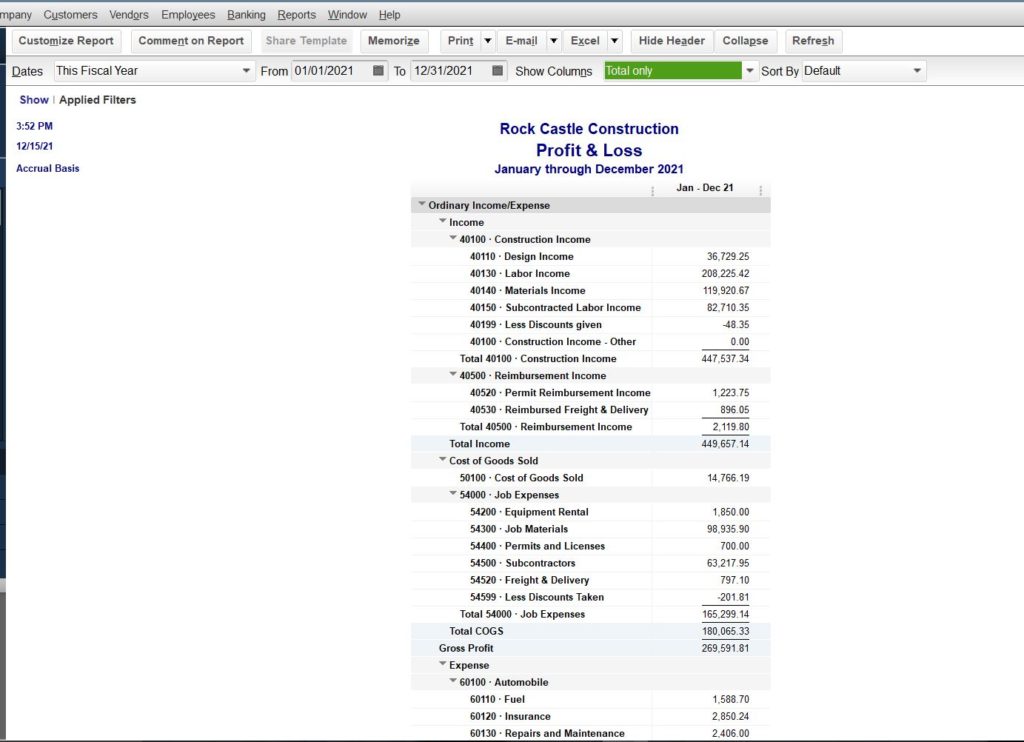

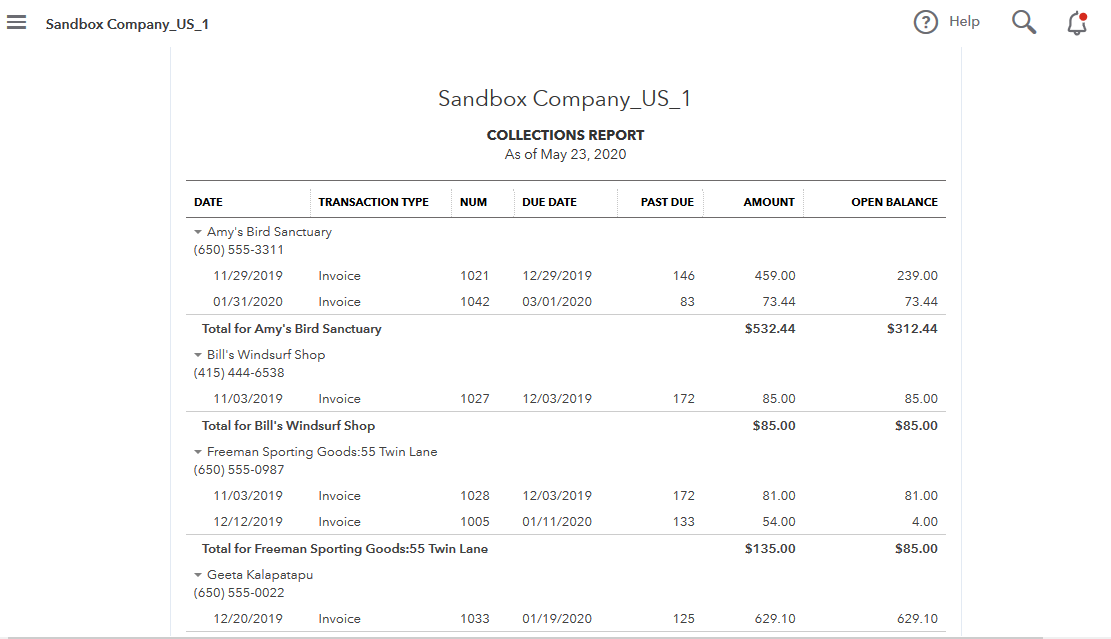

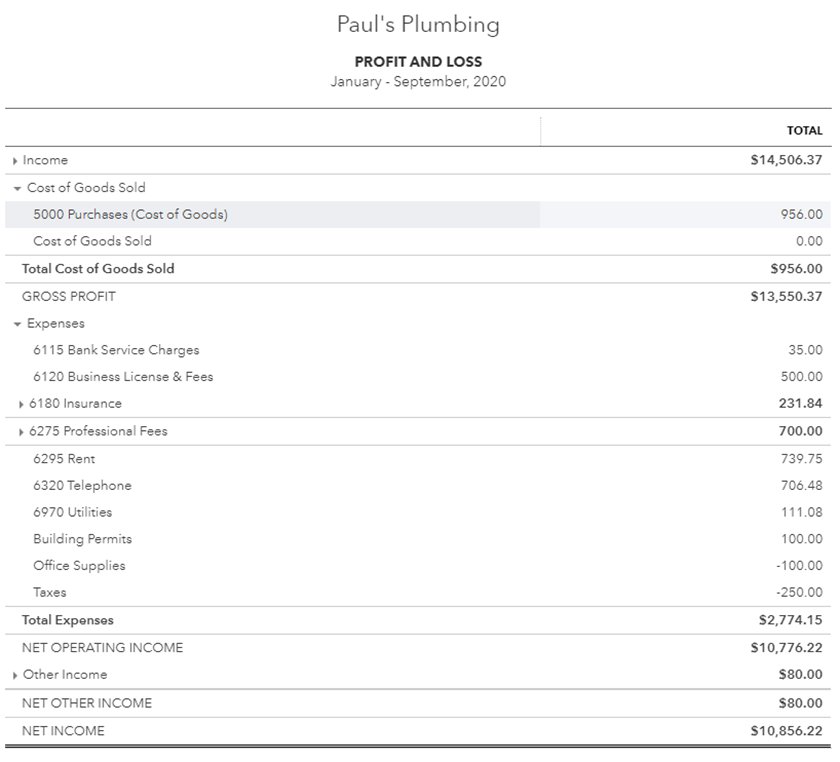

It displays a detailed report of all your income and expense transactions grouped per account.

Quickbooks p&l report. An updated version of this video is available: A p&l statement tells you how much money you’re making, and how much you’re losing. The profit & loss report summarizes your income and expenses for the year.

You can use a p&l statement to look at your profits and losses over any period you like, but they’re most commonly created for a month, quarter or year. Select the profit and loss detail report under the business overview section. Easy access to the profit & loss report is one of the main benefits to using quickbooks.

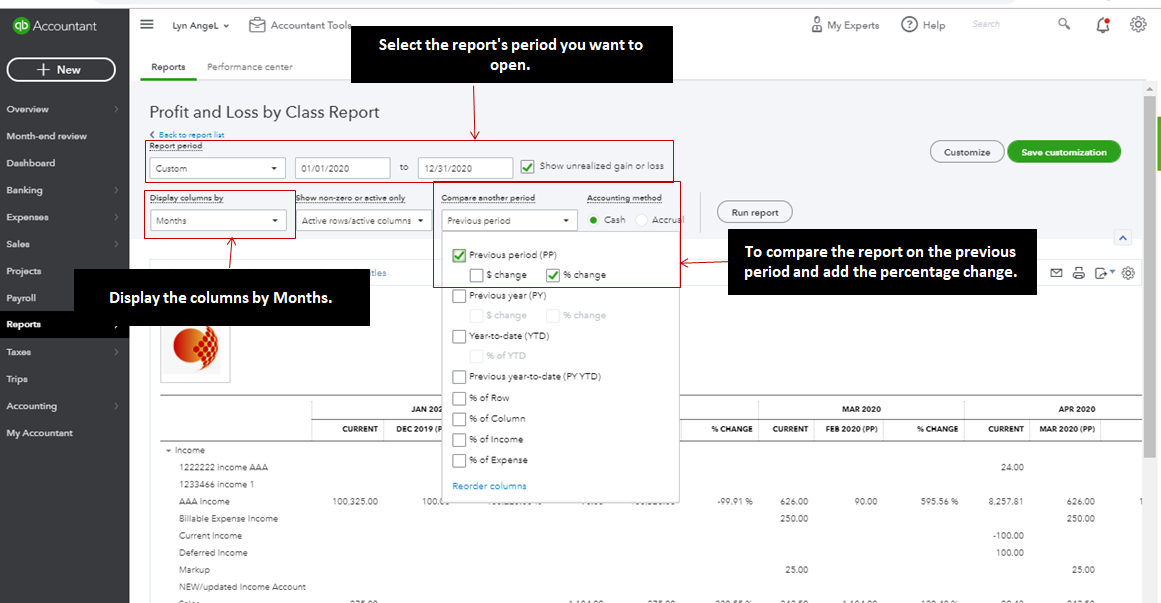

What to do if you see unapplied cash bill payment expense on your profit and loss. Scroll down to the for my accountant section. Learn how to get a profit and loss comparison report in quickbooks online and quickbooks online accountant.

Creating a detailed profit and loss report in quickbooks online is easy. In addition, quickbooks' profit and loss report is designed to simplify tax reporting by using expense categories corresponding to the schedule c tax form. The quickbooks profit & loss report provides a snapshot of your business for a designated period of time.

Click anywhere to refresh the report. By quickbooks• 1611•updated september 08, 2023. Go to the reports menu.

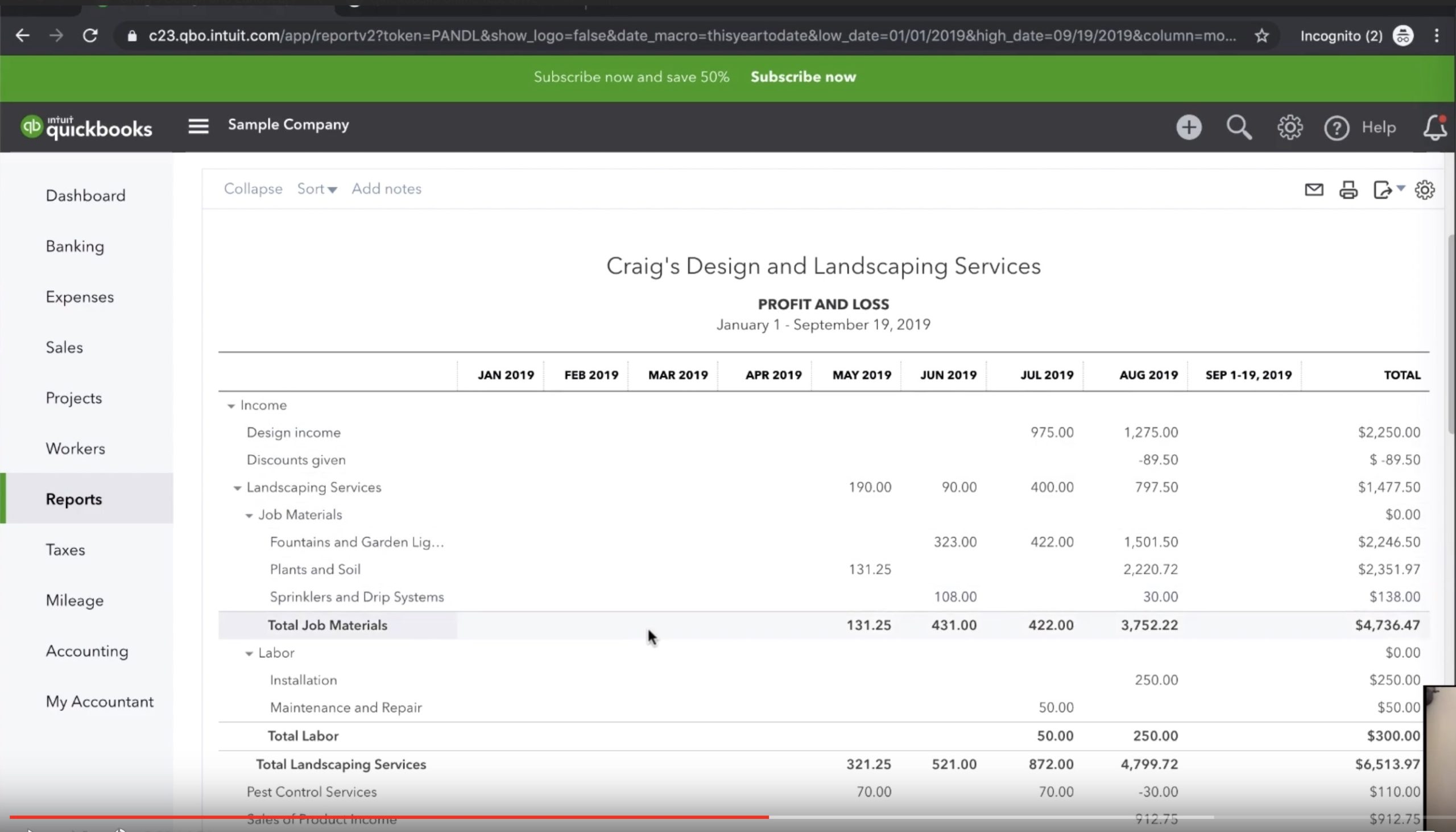

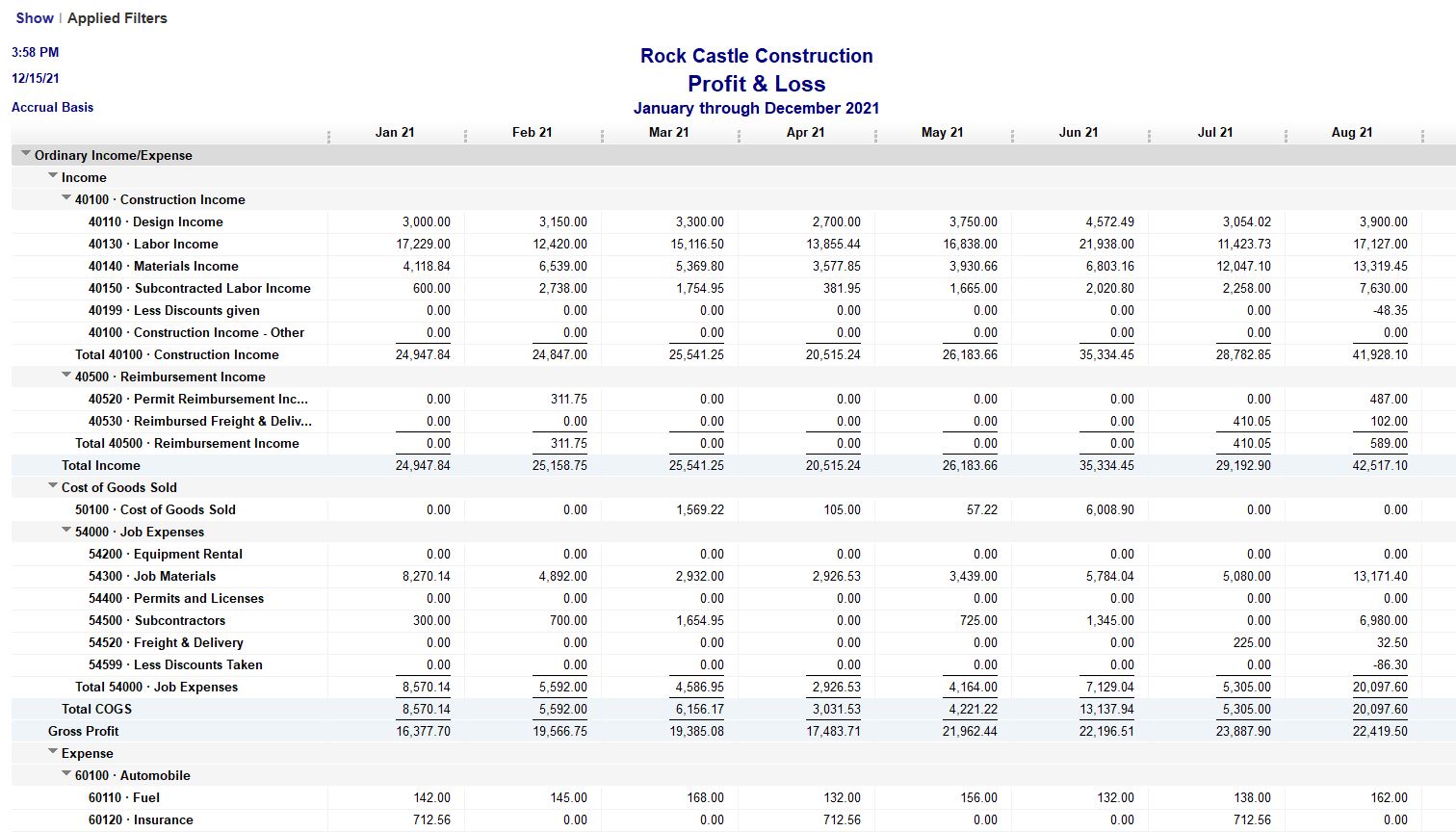

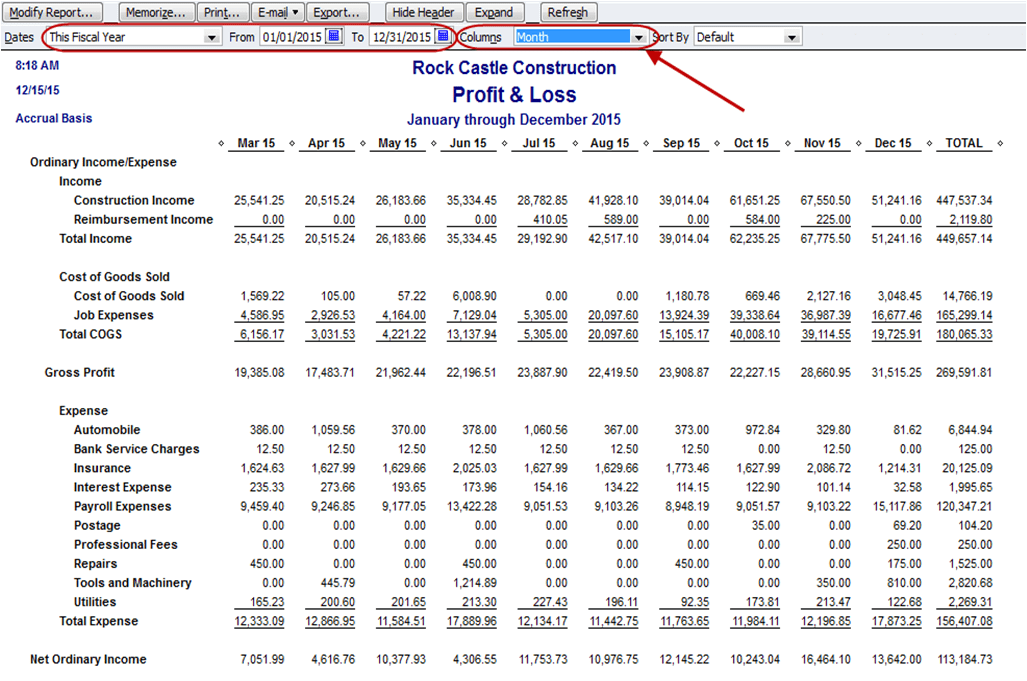

To see your p&l broken out by week, month, or quarter, choose the date of this month or this fiscal year. Business owners use the p&l to assess the company's profitability—how much money a company makes. Create the standard profit & loss report (reports > company & financial > profit & loss standard).

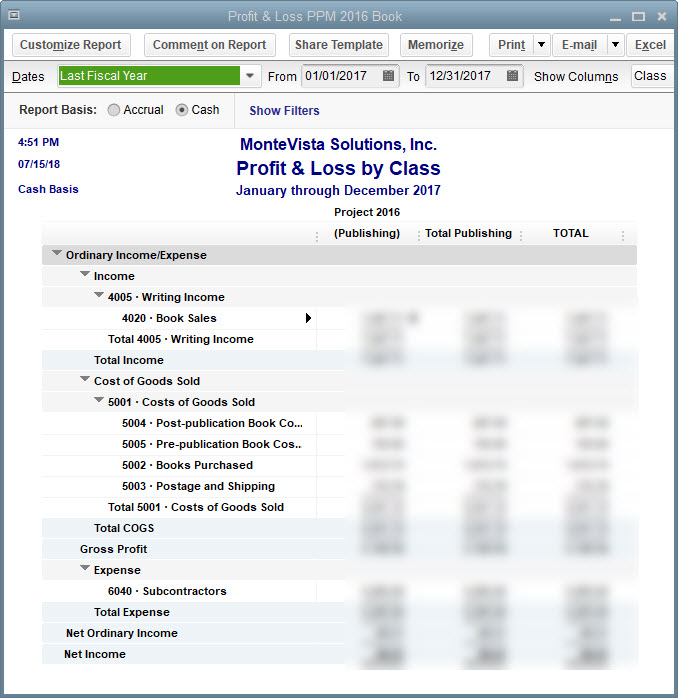

Quickbooks will create your profit and loss report in a column format by the various classes you have created for your business. Use profit and loss comparison reports to compare your income and expenses for different time periods. In this video, our certified public bookkeeper, tasha yao.

Standard reports are separated into 10 groups, so open the business overview group and click on profit and loss, as shown in the gif below. It only showed one taxes and licenses transaction, for my $68 business license fee. With quickbooks profit & loss reports, you can see if your business is operating at a loss or profit.

Why is a profit and loss statement important? The p&l report lists revenue, expenses and other information to provide insight into the company's performance. Let’s go over the reports center in quickbooks online and how to run.

A profit and loss (p&l) statement is the same as an income statement. Change the dates to the year desired (for a calendar year from january 1 to december 31 for the year desired) 3. In this video, you'll learn how to run a profit and loss report that shows you your income by month in quickbooks desktop.

![[QODBCDesktop] How to run a Profit and Loss By Class Report in QODBC](https://support.flexquarters.com/esupport/newimages/ProfitAndLossByClass/step3.png)

![[QODBCDesktop] How to run a Profit and Loss Standard Report in QODBC](https://support.flexquarters.com/esupport/oneadmin/_files/Image/Screen Dump Upload Folder/ProfitandLossCollapse1.JPG)