Simple Info About Directors Loan Account Balance Sheet Calculating Net Profit

As fixed assets age, they begin to lose their value.

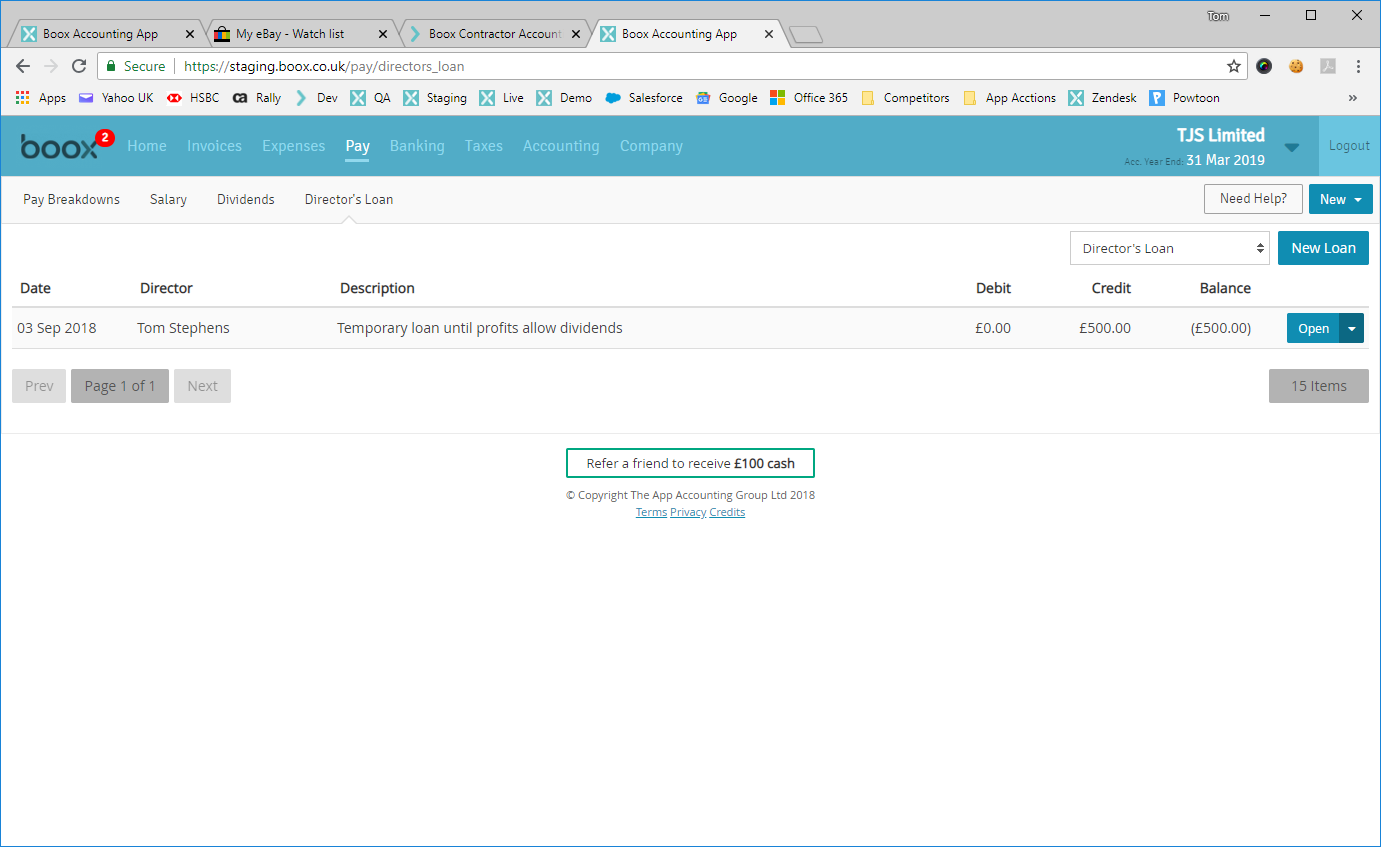

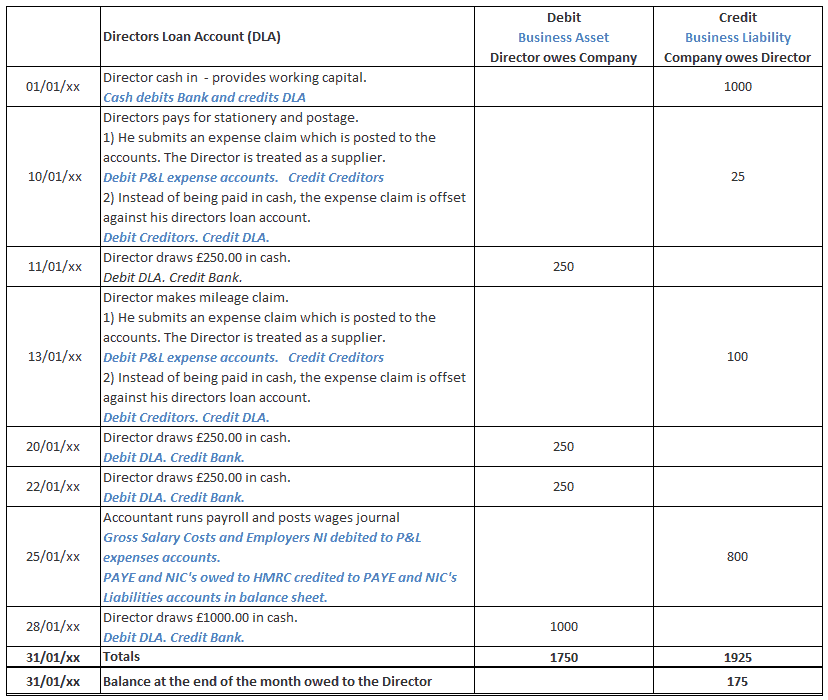

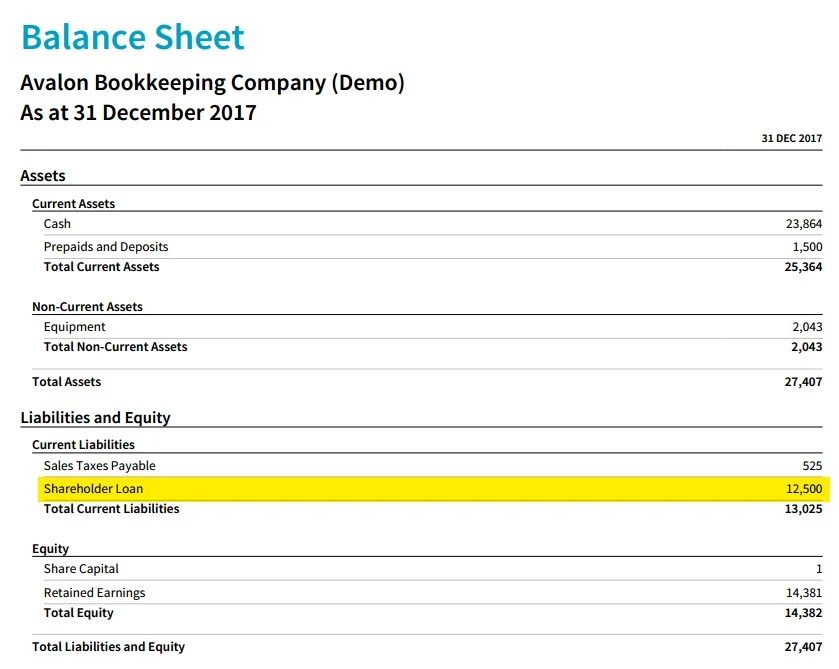

Directors loan account balance sheet. Learn what a director's loan is, how to record it, and how to tax it. A director’s loan is when you take money from your company that is not salary, dividend or expense repayment. You must keep a record of any money you.

The director’s loan account (dla) is used to keep track of what you have borrowed from, or lent to, your company. The balance sheet is one of the financial. The short answer is no.

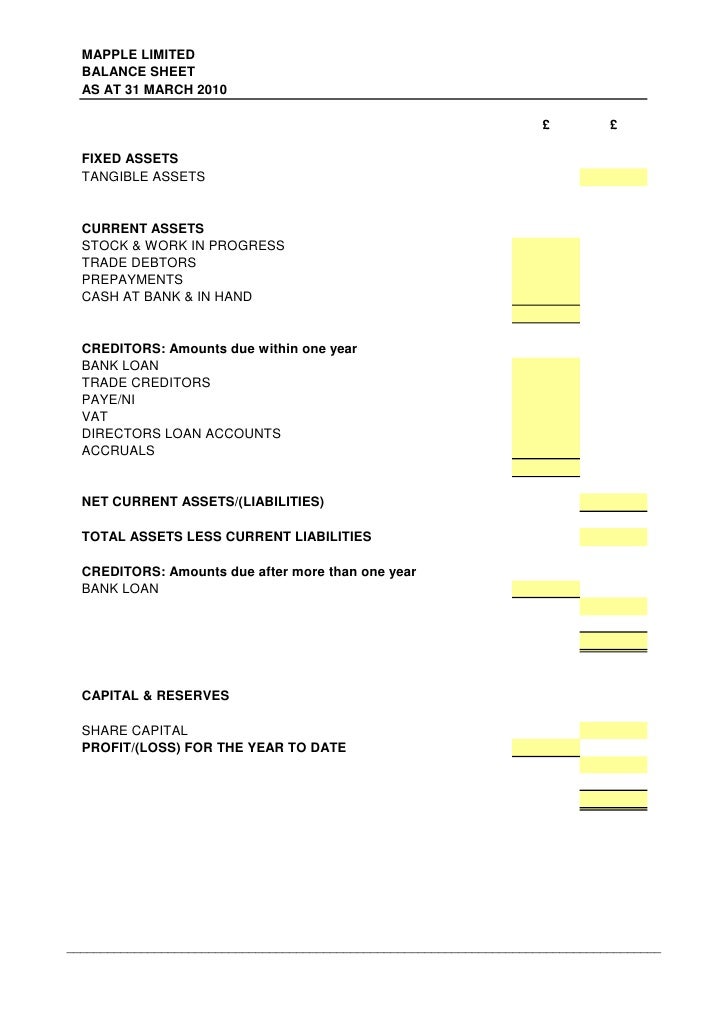

From a practical perspective, the loan account balance must be shown on supplementary pages of the company’s corporation tax return (ct600) and the s455. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. April 15, 2021 director’s loan accounts are one of the most common topics we get asked about from clients and prospective clients alike.

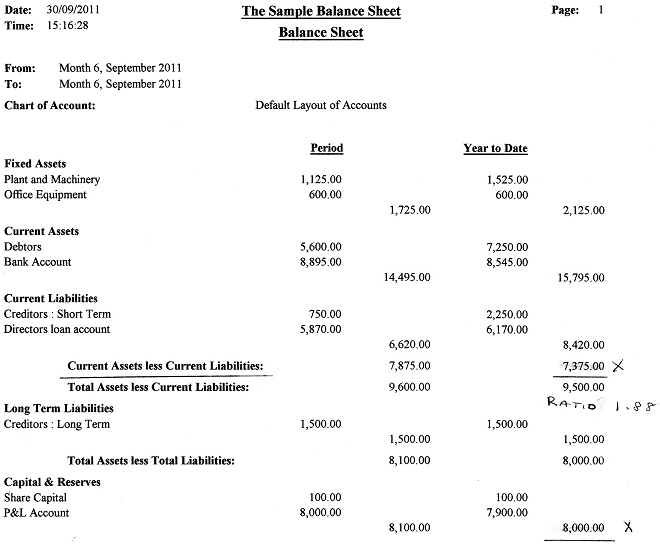

An asset is created where the. If a director is lending a company more than is being taken. In the company accounts the dla is a balance sheet entry, and therefore does not affect the company’s profit and loss.

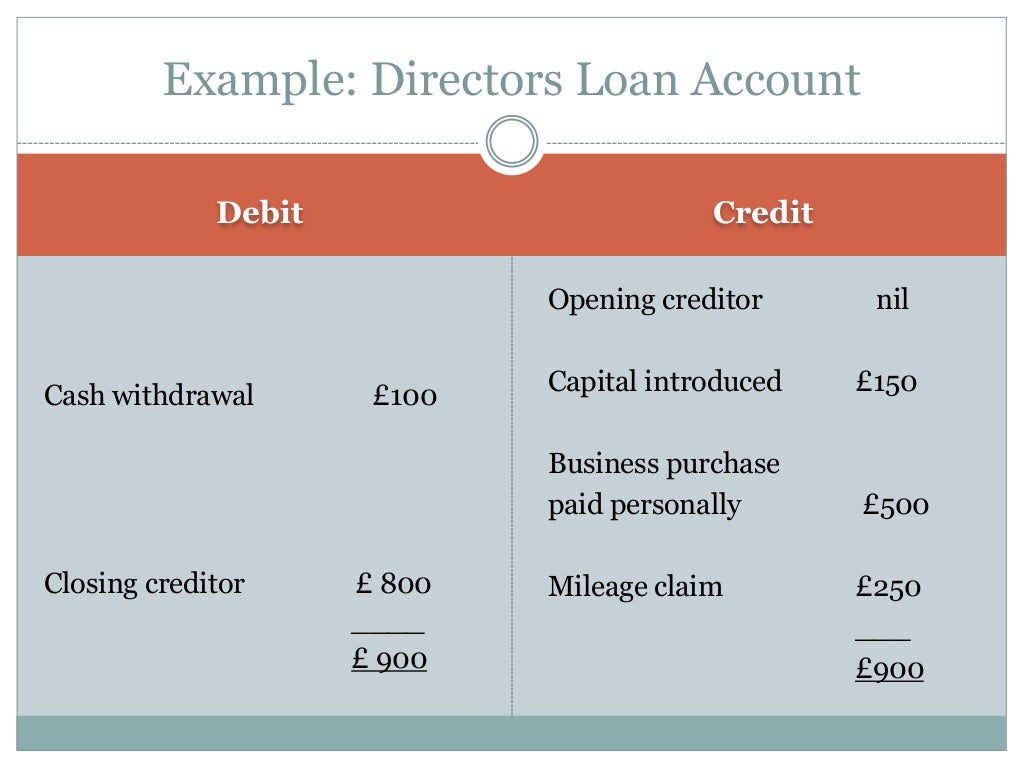

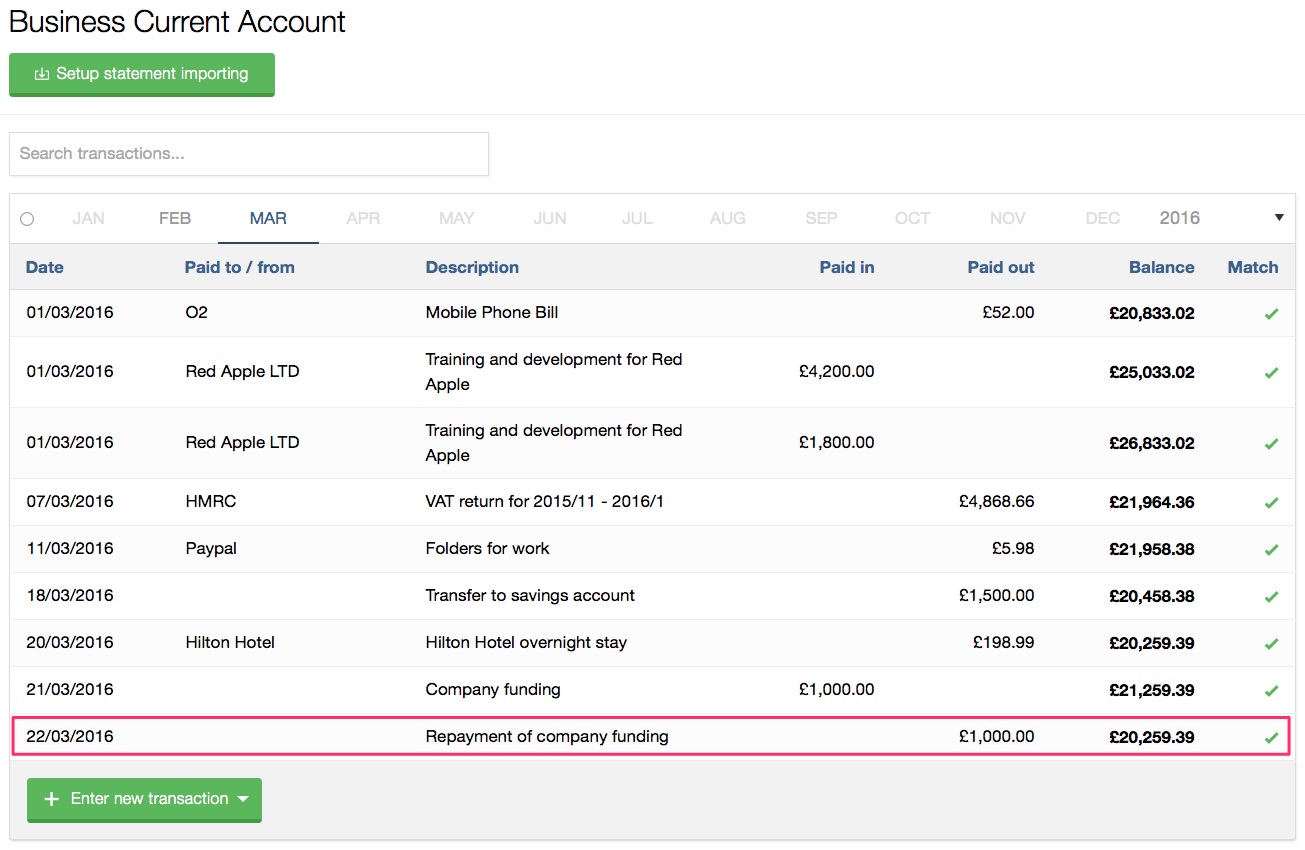

So what actually goes in and out of a director’s. Find out how to include it on the balance sheet and the annual accounts of your company. It’s one of those slightly tricky accounting.

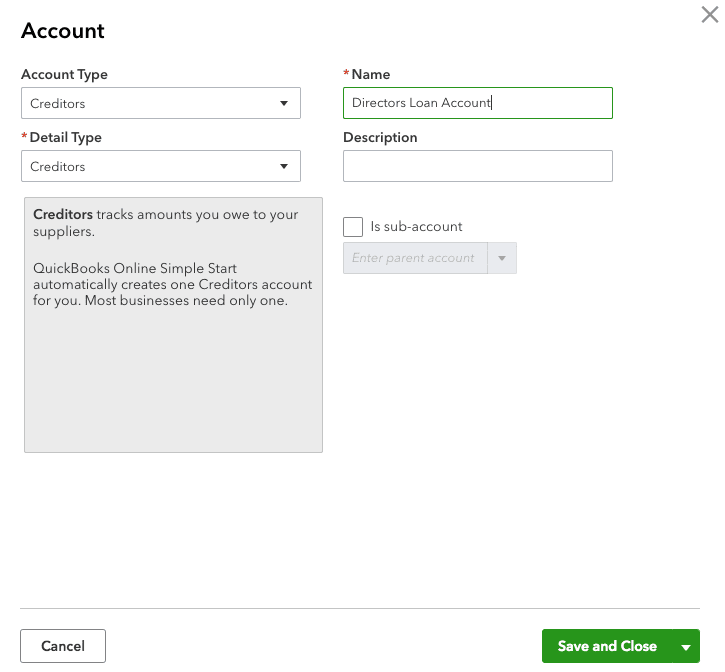

It is simply an account in the balance sheet that summarises the transactions between a company director and the company. It records all transactions between directors and the. At the end of the financial year, the directors loan account balance is recorded in the balance sheet as either an asset (money owed to the company by the.

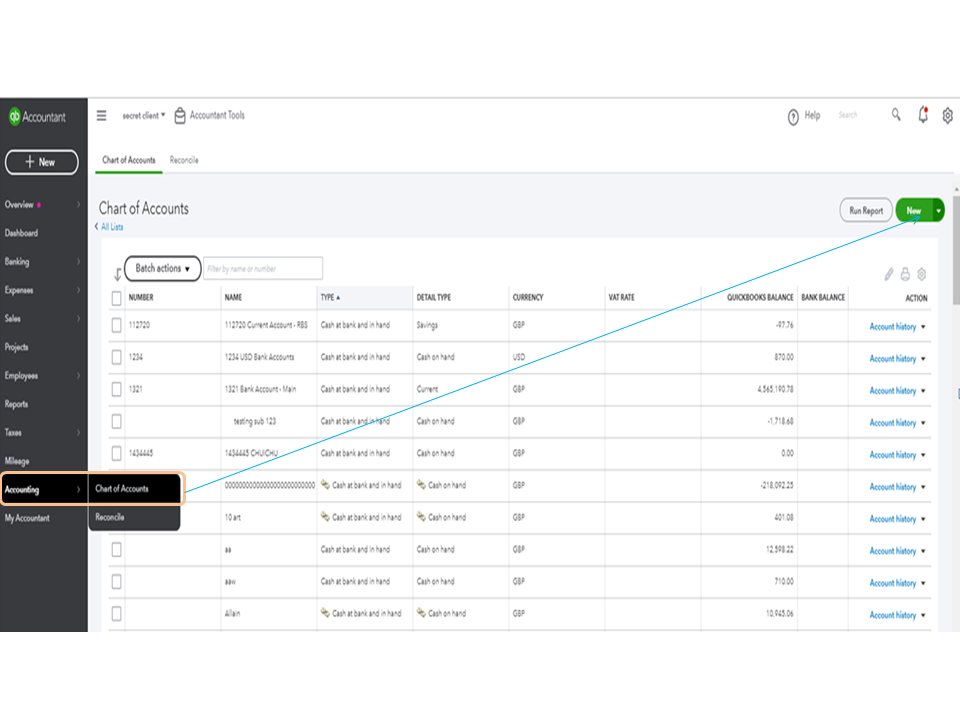

Learn about director's loan accounts, the records of money you borrow from or pay into your company, and the law that requires you to keep them. The transactions which directors enter into with their own company are identified separately via a “special account” for that purpose. The director’s loan account (dla) is part of the balance sheet.

There are tax consequences to having an overdrawn balance which we will touch on below. This toolkit is aimed at helping and supporting tax agents and advisers by providing guidance on the errors we find commonly occur in relation to directors’ loan accounts. At the end of your company’s financial year, depending on the position of your dla, you’ll either owe the company money or the company will owe you money.

Direcroes loan seems to be in the wrong place on a balance sheet. Tomorrow it’s another new month and we’re getting ever closer to the dreaded tax return deadl. The directors’ loan account is a compulsory account on your limited company’s balance sheet.

This account is called a. The director’s loan account and the balance sheet. I was reviewing a set of accounts prepared by another accountant for a new client.