Stunning Info About Journal Entry For Salary Payable Exxonmobil Financial Ratios

This journal entry is made to recognize the liability (salaries payable) that the company has obligation to fulfil in the new future as well as to record the expense (salaries.

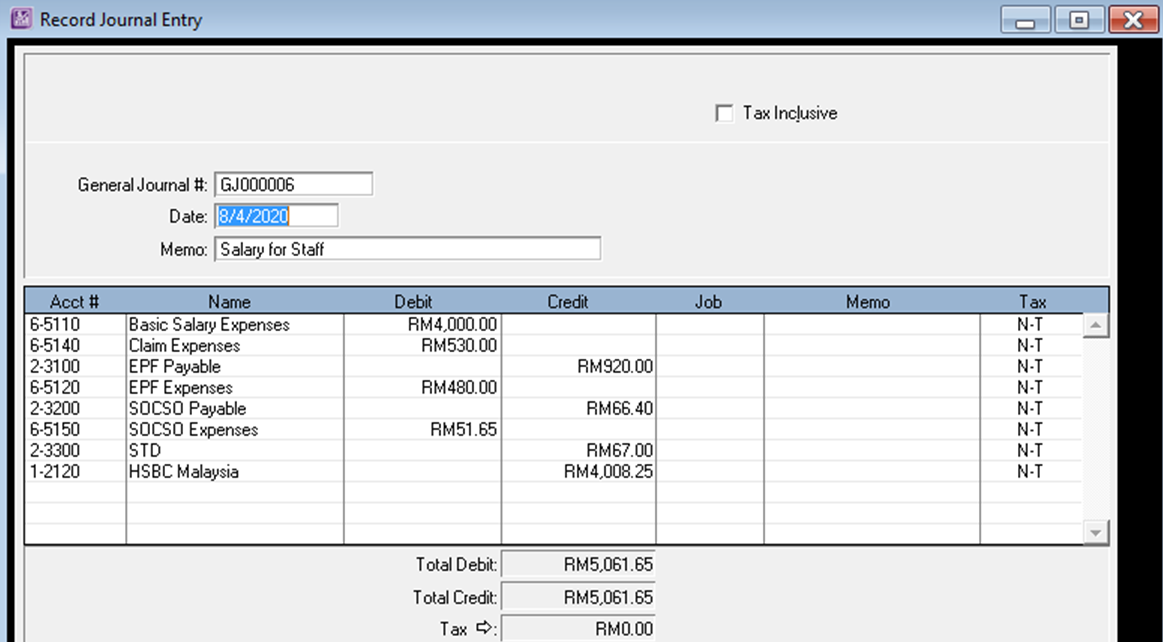

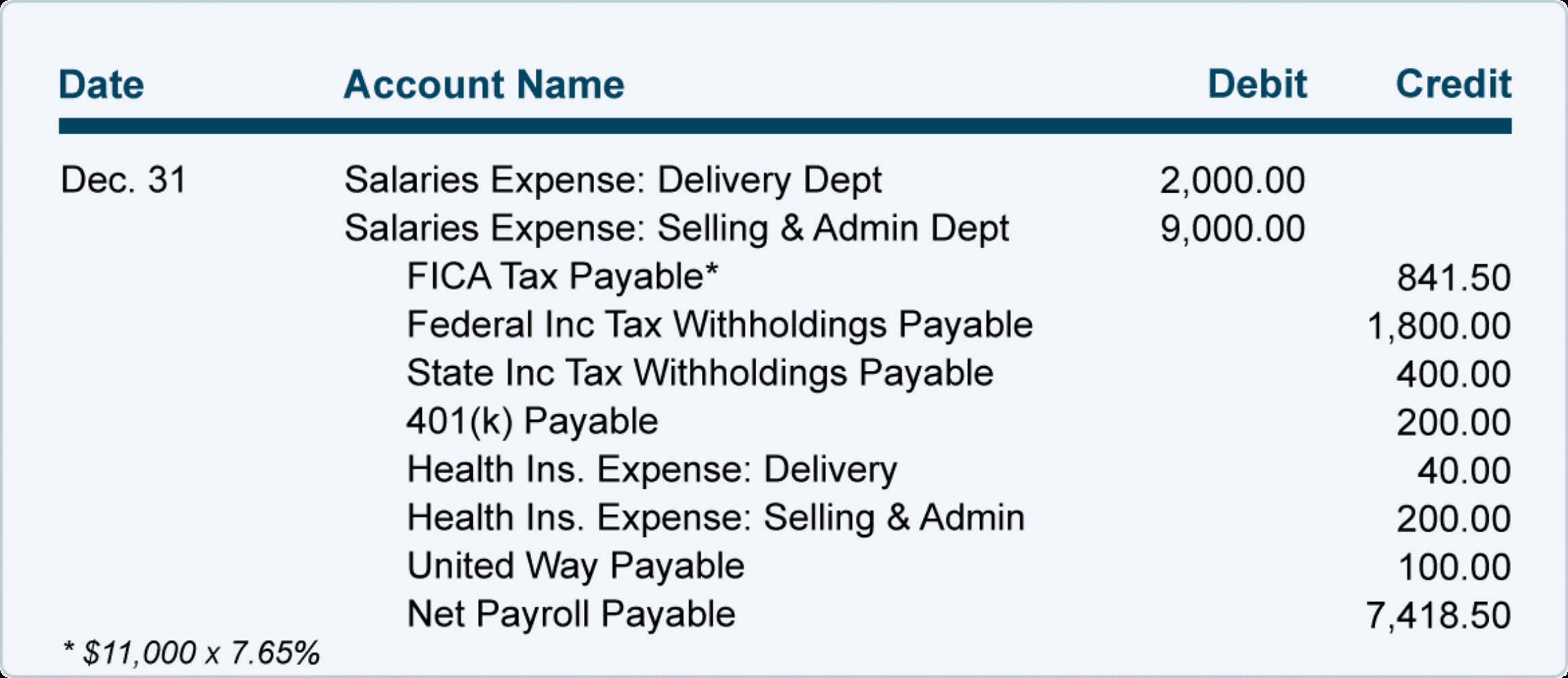

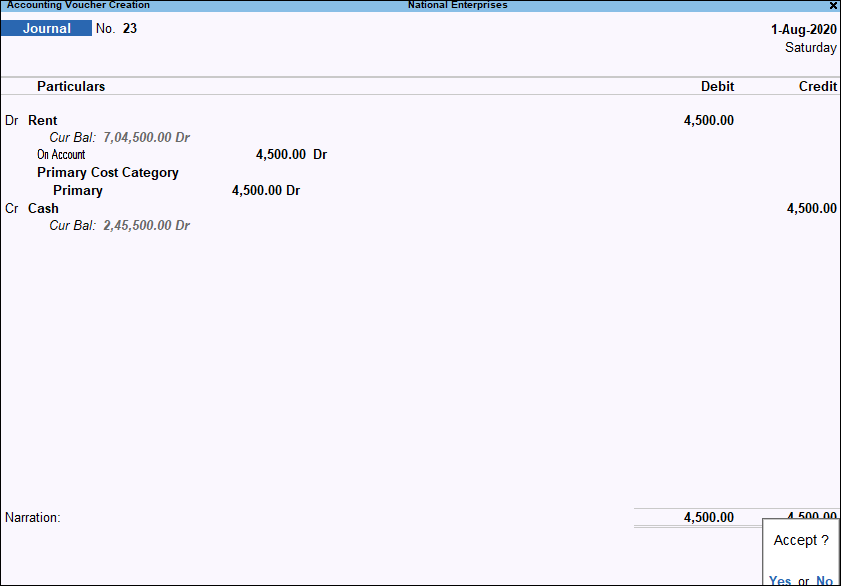

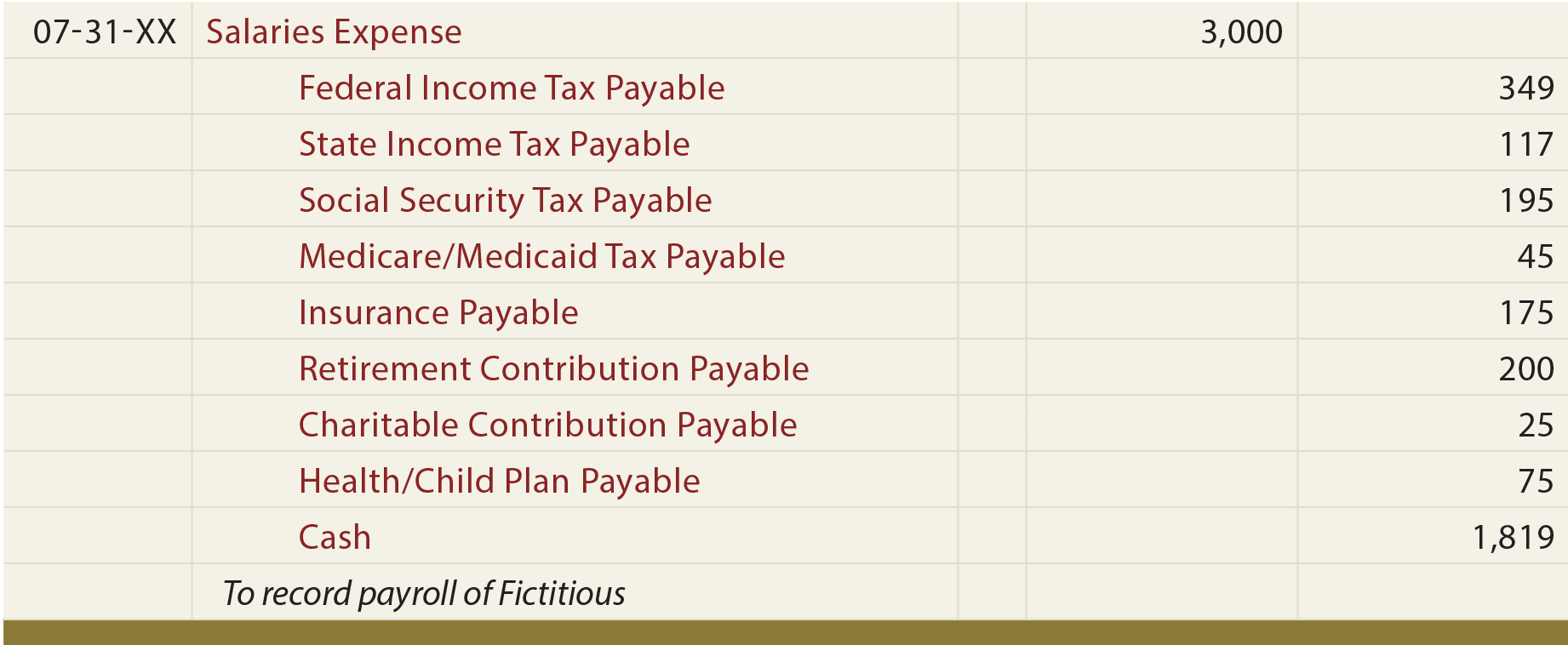

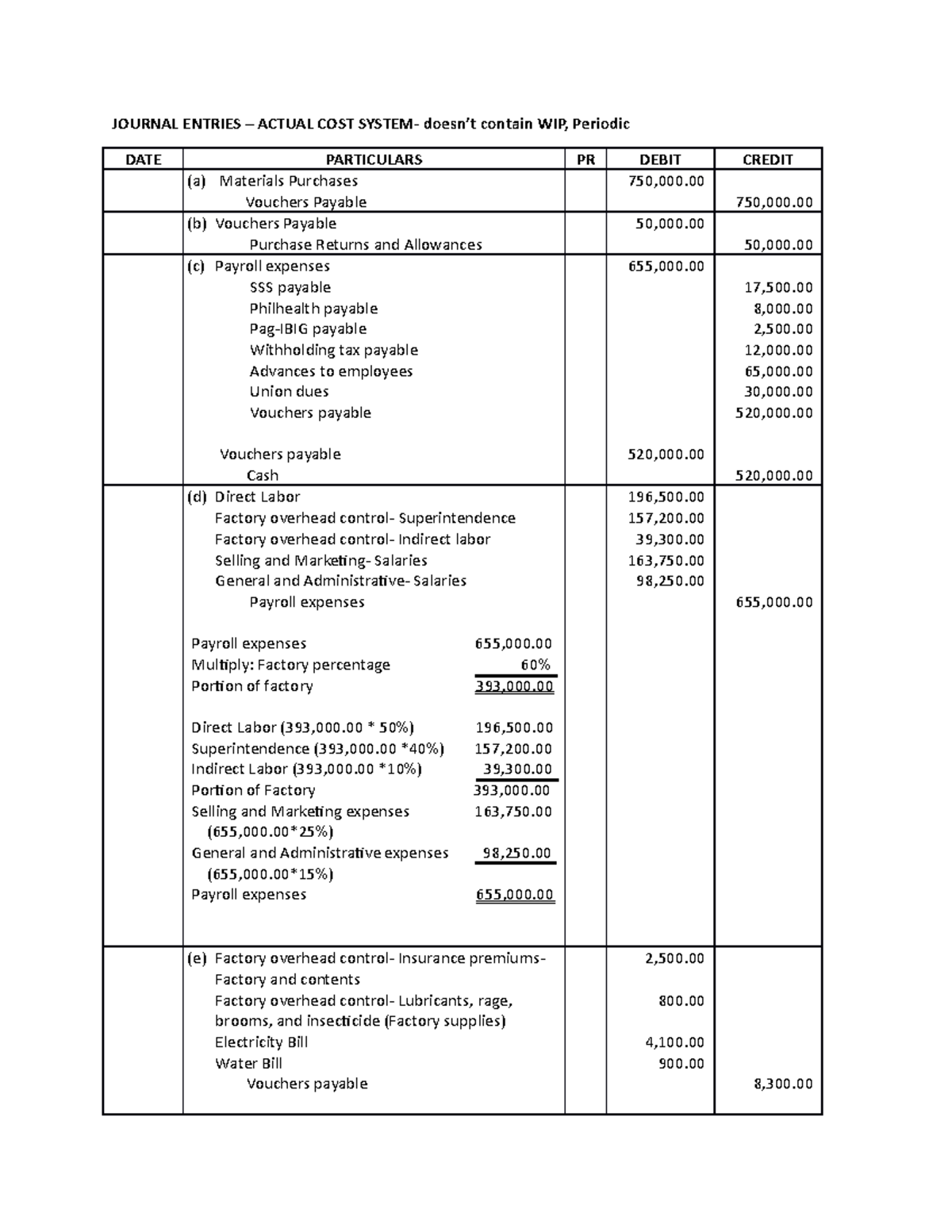

Journal entry for salary payable. Two journal entries are necessary to record salaries payable. The accounts payable journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry. Salaries paid journal entry is passed to.

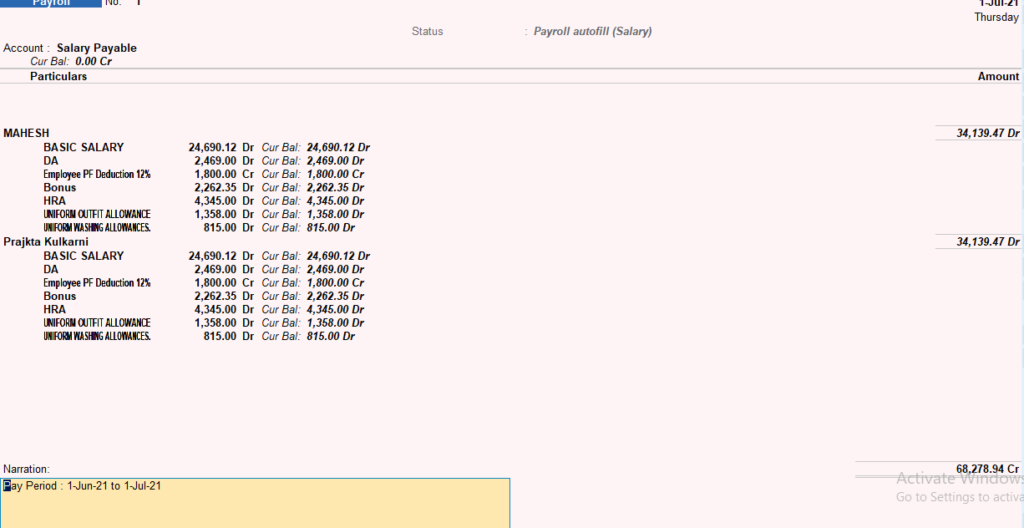

A payroll journal entry is an accounting method to control gross wages and compensation expenses. However, the company may pay the. Keeping accurate payroll records is important.

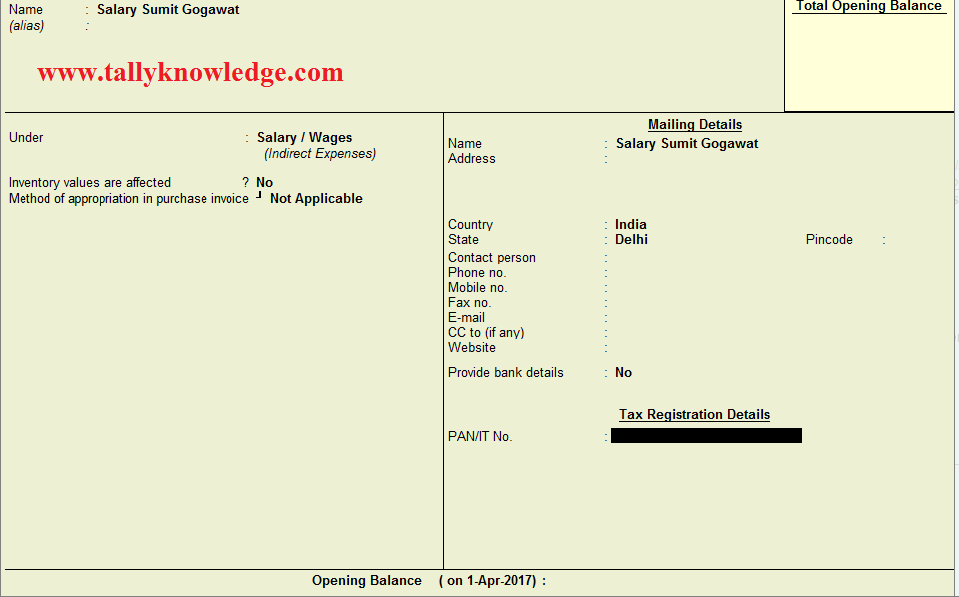

The journal entry for income tax payable is a debit to the income tax expense account and a credit to the income tax payable account. Journal entry for salary: It is paid as a consideration for the efforts undertaken by the employees for the business.

Accounts receivable clerk. It increases the accounts payable liability, which is reported on. A salaries payable entry will tell you exactly how much money you owe to your employees for services performed.

A payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. Salary is an indirect expense incurred by every organization with employees. Salary payable is the amount of liability or payment of the company towards its employees against the services provided by them but not yet paid at the end of the.

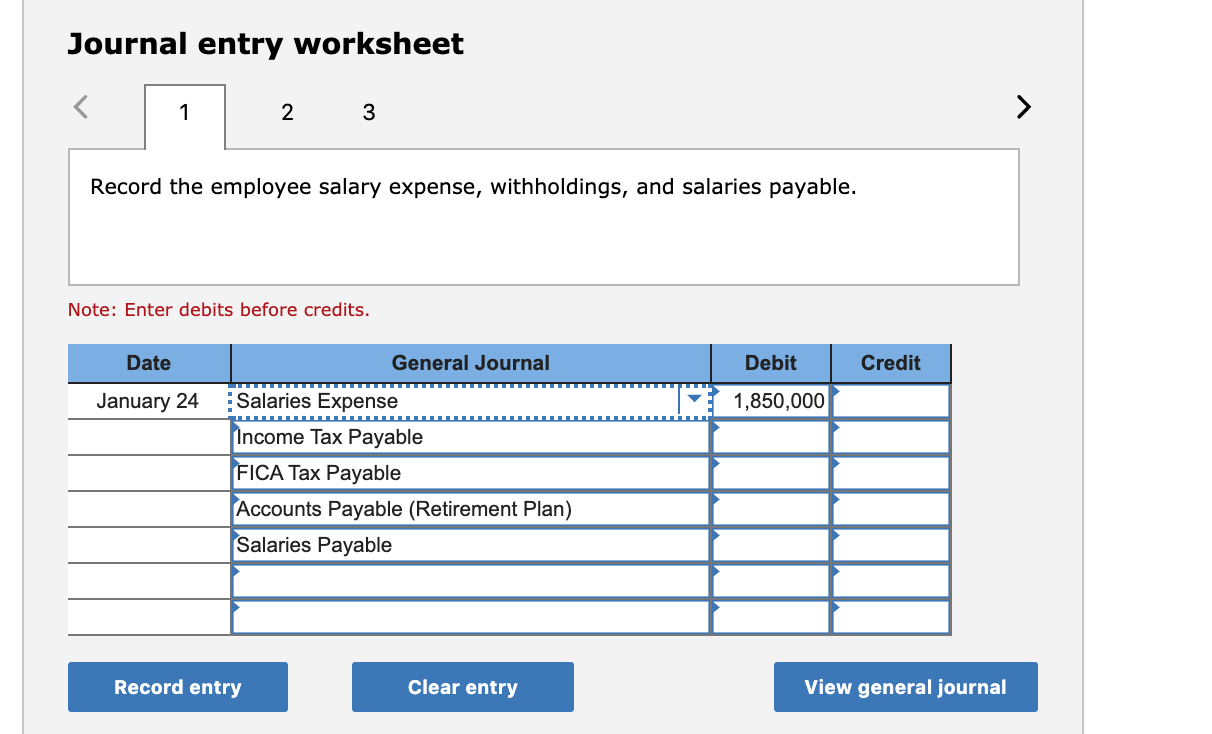

There shall be a minimum of one debit and credit account to balance the. The journal entry is debiting salary expense and crediting salary payable. First, a company will record a debit into the salaries expense for the gross.

This journal entry is an. That way, you can look back and see details about employee. After subtracting some of the most common payroll taxes, the employee’s wages payable or.

The salary expense will be recorded on the income statement as the expense which will reduce the. Accounts payable journal entries refer to the accounting entries related to amount payable in the company’s books of creditors for the purchase of goods or services. Salaries are the monetary remunerations the business gives to its employees in exchange for their services.

Salary paid in advance journal entry. Accounts payable journal entry is the method of recording payables data in the general ledger. An accounts payable journal entry impacts the financial statements as follows:

An accounts receivable clerk is responsible for tracking and handling all the. Tds on salary journal entry. Journal 1 shows the employee’s gross wages ($1,200 for the week).