Brilliant Strategies Of Info About Unearned Income In Balance Sheet When Is Revenue Recognized On An Statement

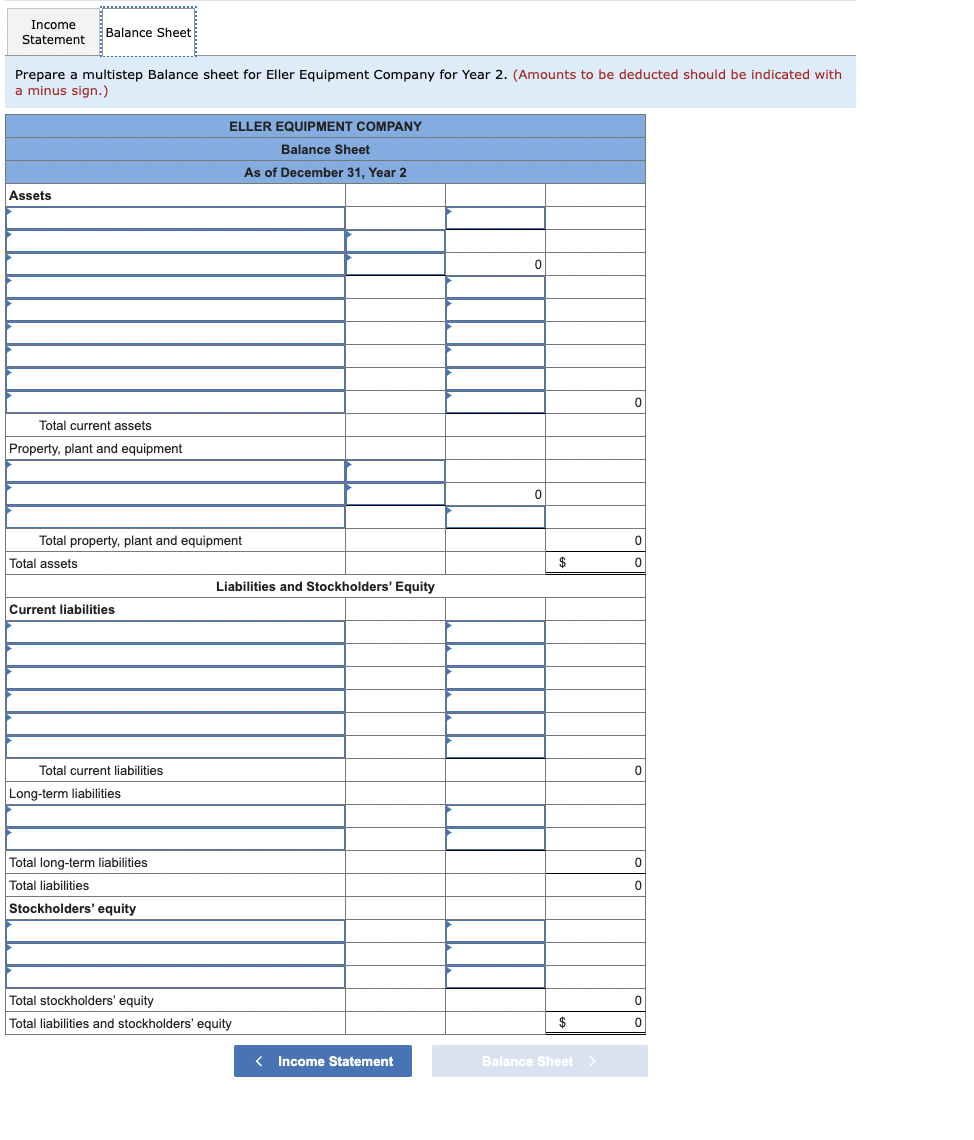

The fundamental accounting equation states that a company’s assets must be equal to the sum of its liabilities and.

Unearned income in balance sheet. The company) is the party with. In denver, for example, a. Cfi’s financial analysis course as such, the balance sheet is divided into two.

It does not initially appear on the income statement but is transferred to the. Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the balance in the revenue account (with a.

A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. Definition of unearned income. Unearned revenue or deferred revenue appears as a liability on the balance sheet.

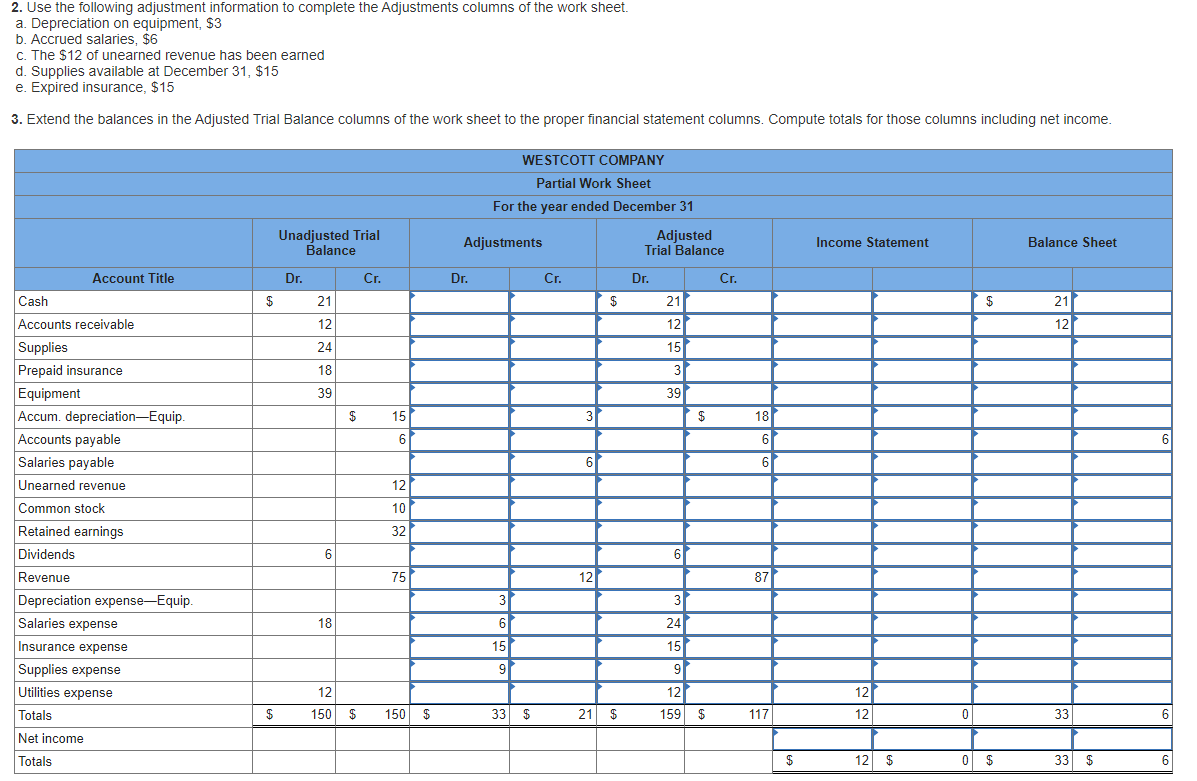

Unearned revenue is treated as a liability on the balance sheet because the transaction is incomplete. Income method under the income method, the accountant records the entire collection under an income account. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable, unearned.

The balance of unearned revenue is now at $24,000. More specifically, the seller (i.e. Funds in an unearned revenue account are classified.

Unlike earned revenue (which shows up as an asset), unearned income shows up as a liability on your balance sheet. The balance sheet is based on the fundamental equation: Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet.

What you need to know ☰ how cube works sync data, gain insights, and analyze business performance right in excel, google sheets, or the cube. However, at the end of the first month, the monthly portion of the total amount ($79/12=$6.58) will be deducted from the unearned revenue figure and recorded as the revenue. The income method approaches towards the unearned.

Within the liabilities section of the balance sheet, unearned revenue is often labeled with a descriptive title, such as “unearned revenue,” “deferred revenue,” or. In accounting, unearned revenue has its own account, which can be found on the business’s balance sheet. Unearned income or deferred income is a receipt of money before it has been earned.

In accounting, unearned revenue has its own account, which can be found on the business’s balance sheet. Assets = liabilities + equity. The same payment of unearned revenue would be treated differently if the company uses income method.

To record the journal entry for u.i., the u.i. This is also referred to as deferred revenues or. The unearned income is due but yet to be received is captured as an asset in the balance sheet.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)