Underrated Ideas Of Info About Financial P&l Statement Monthly Cash Flow Example

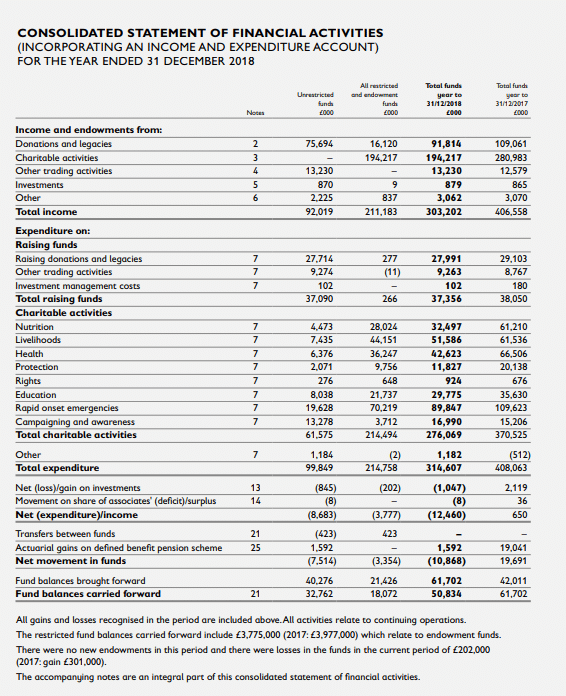

It offers a comprehensive overview of a company’s revenues, costs, and expenses, enabling stakeholders to evaluate its.

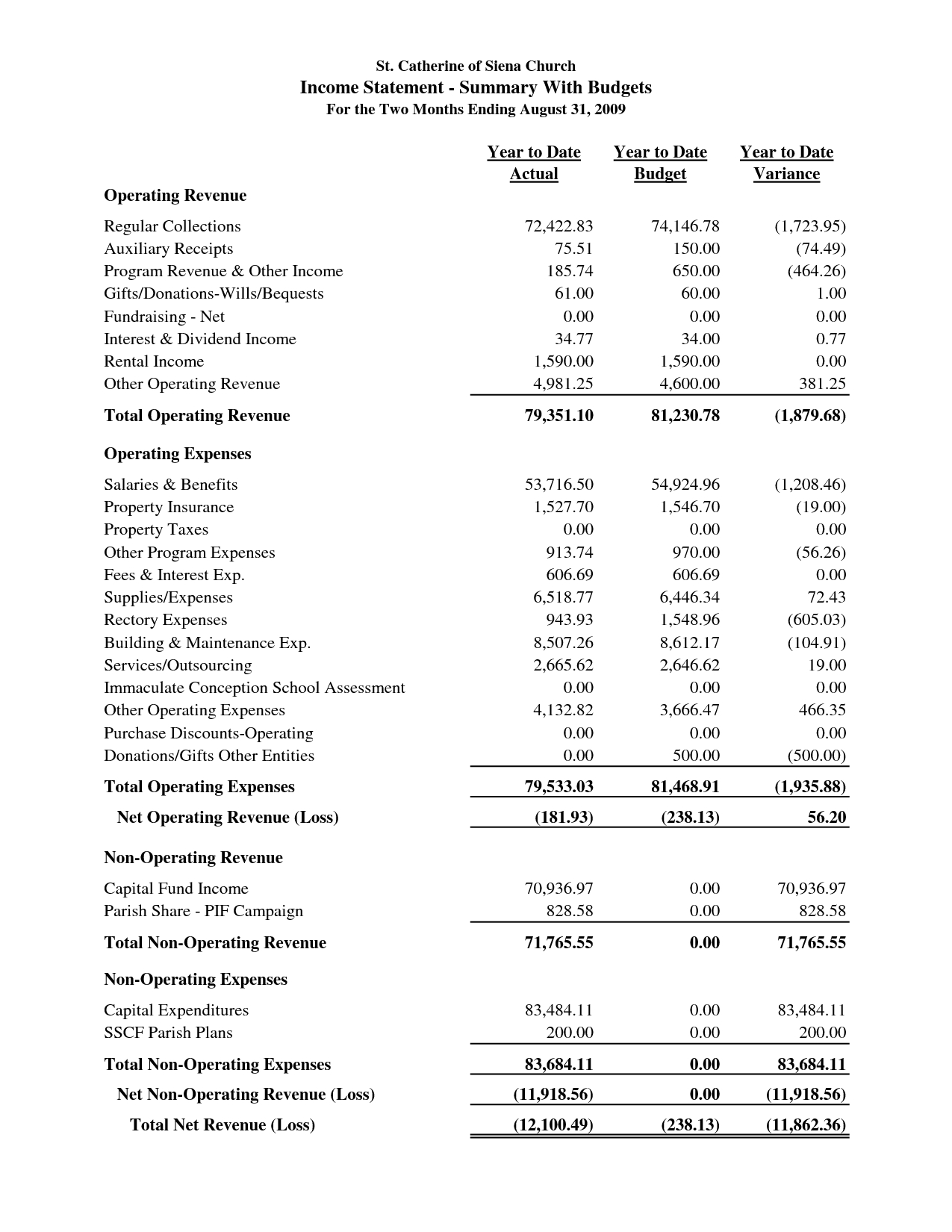

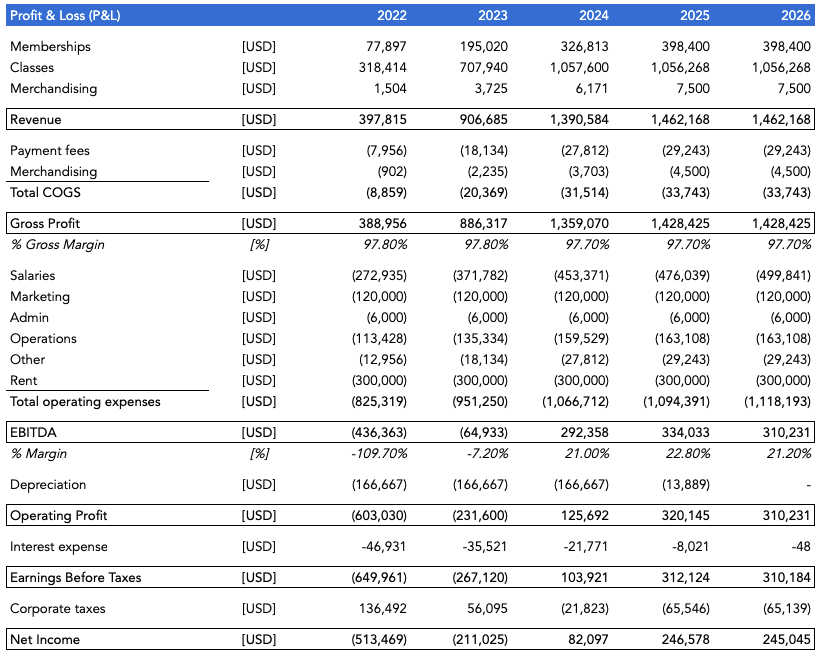

Financial p&l statement. A profit and loss (p&l) statement, also known as the income statement, is one of the three financial statements that companies prepare. It shows your revenue, minus expenses and losses. The p&l gives investors an overview of a company’s profitability and is one of the most important.

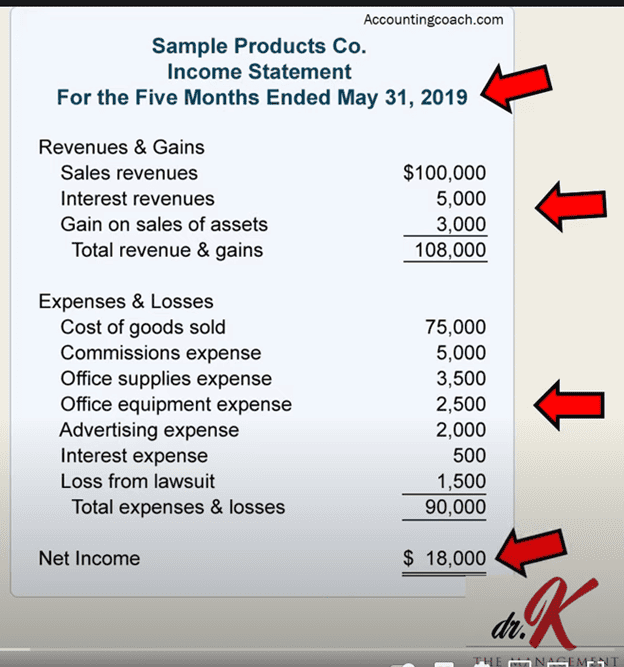

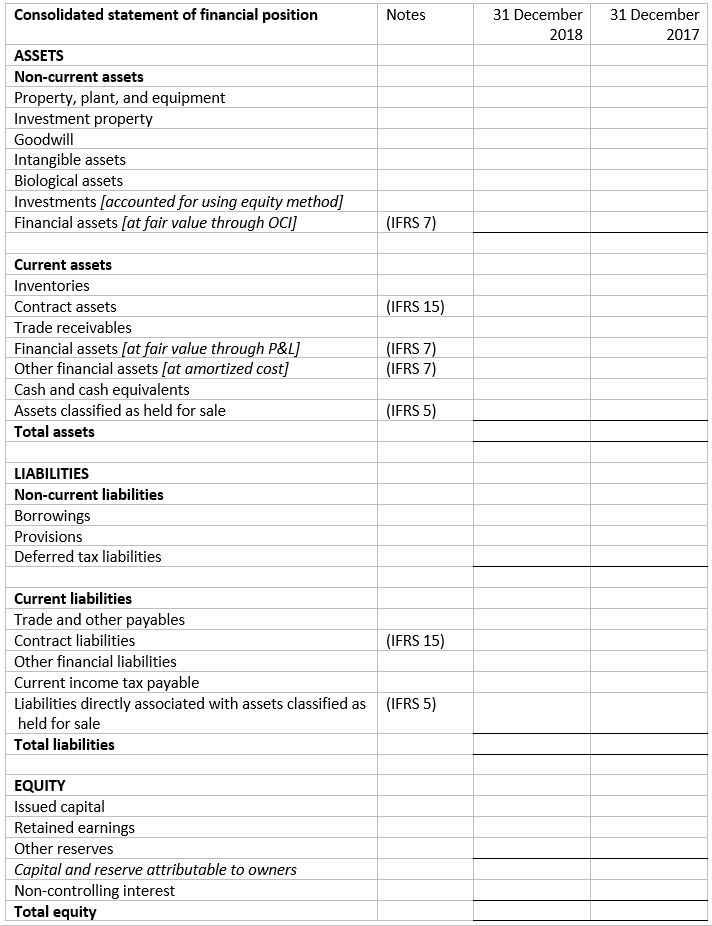

The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. A profit and loss statement, also called an income statement or p&l statement, is a financial document that summarized the revenues, costs, and expenses incurred by a company during a specified period.

A profit and loss (p&l) statement is the same as an income statement. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. A p&l statement, also known as an “income statement,” is a financial statement that details income and expenses over a specific period.

Such statements provide an ongoing record of a company's. Profit and loss are two financial terms that are probably the most common in the world of finance and business. It is a common financial statement included in a business plan and indicates how much loss or profit was generated by a business.

A p&l statement, also known as a profit and loss statement or income statement, is a financial document that explains a company’s financial health for a given accounting period. It contains information pertaining to a company’s revenue and expenses over a given period. A profit and loss (p&l) statement, also known as an income statement or statement of earnings, is a vital financial document that provides insights into a company’s financial performance during a specific period.

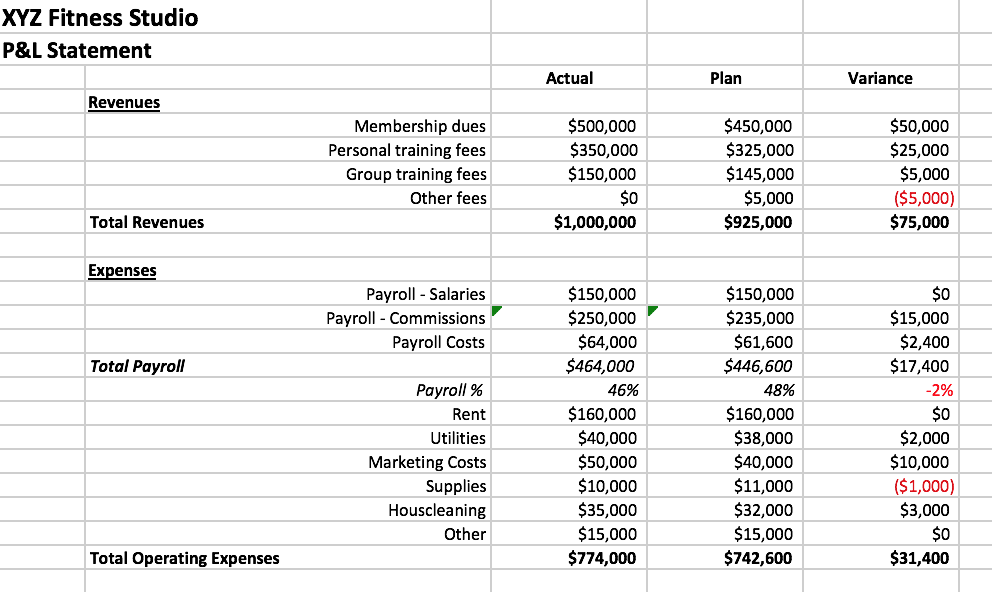

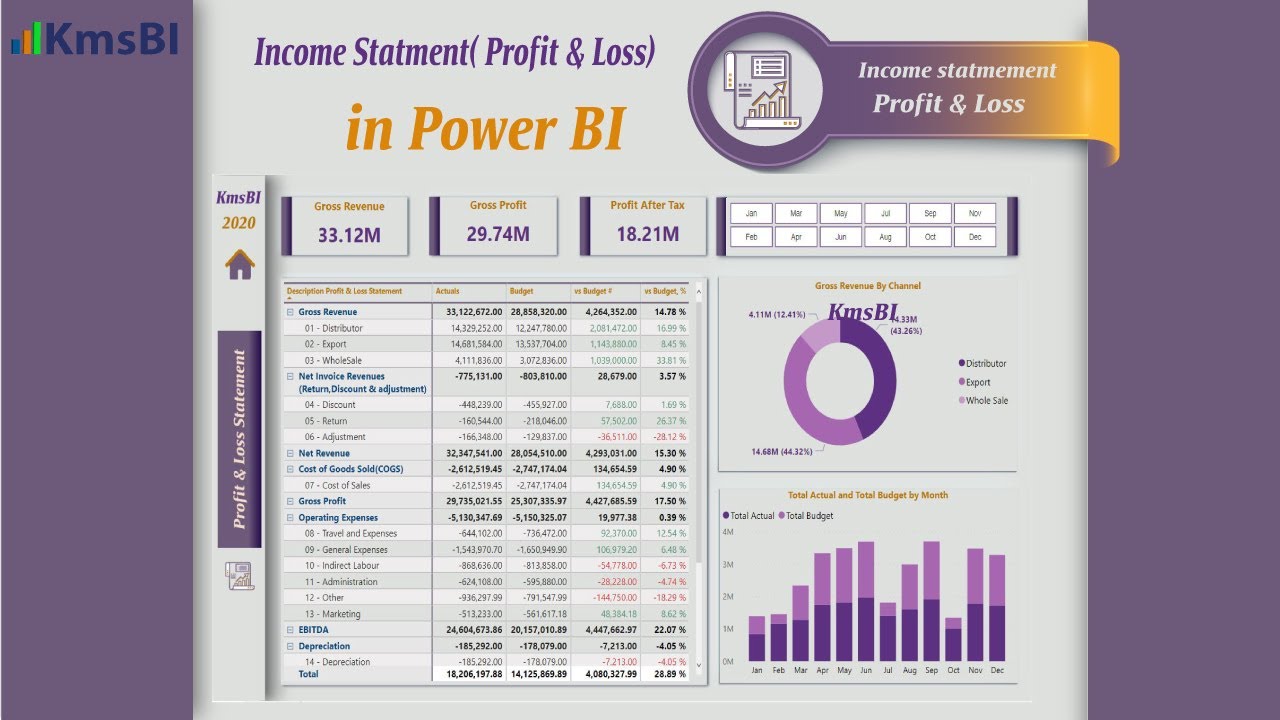

Below is a screenshot of the p&l statement template: Then, it subtracts the costs of making those goods or providing those services, like. A p&l statement is an indicator of the financial health of your company based on its.

But short of understanding what a p&l is (and how to read one), how do you actually use this financial statement to inform business. The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly. The outcome is either your final profit or loss.

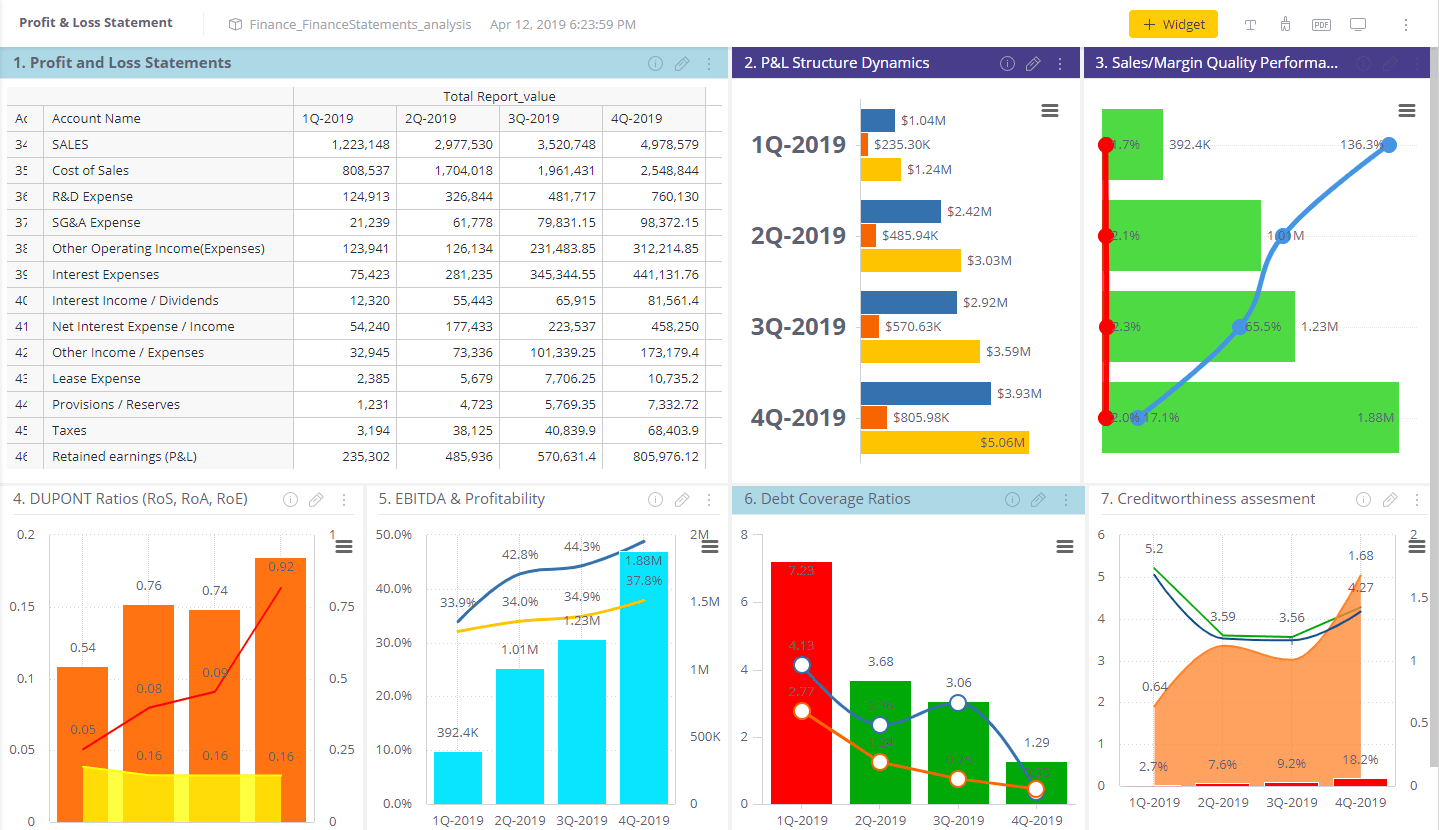

An income statement, also known as a profit and loss (p&l) statement, summarizes the cumulative impact of revenue, gain, expense, and loss transactions for a given period. A profit and loss (p&l) statement is a type of financial report that summarizes your company’s revenue, expenses and net income or losses over a particular period of time. This report helps you understand what’s behind a company’s profitability by categorizing revenues and expenses.

A profit and loss statement helps you see exactly how money flows into your business, where you spend that revenue, and what adjustments you need to maximize profit. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Together, alongside the cash flow statement (cfs) and balance sheet , the p&l statement provides a detailed depiction of the financial state of a company.

The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. These three statements together show the assets and liabilities of a business. In particular, the p&l statement shows the operating performance of the company as well as the costs and expenses that impact its profit margins.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)