Simple Tips About T5013 Statement Of Partnership Income Free Cash Flow In

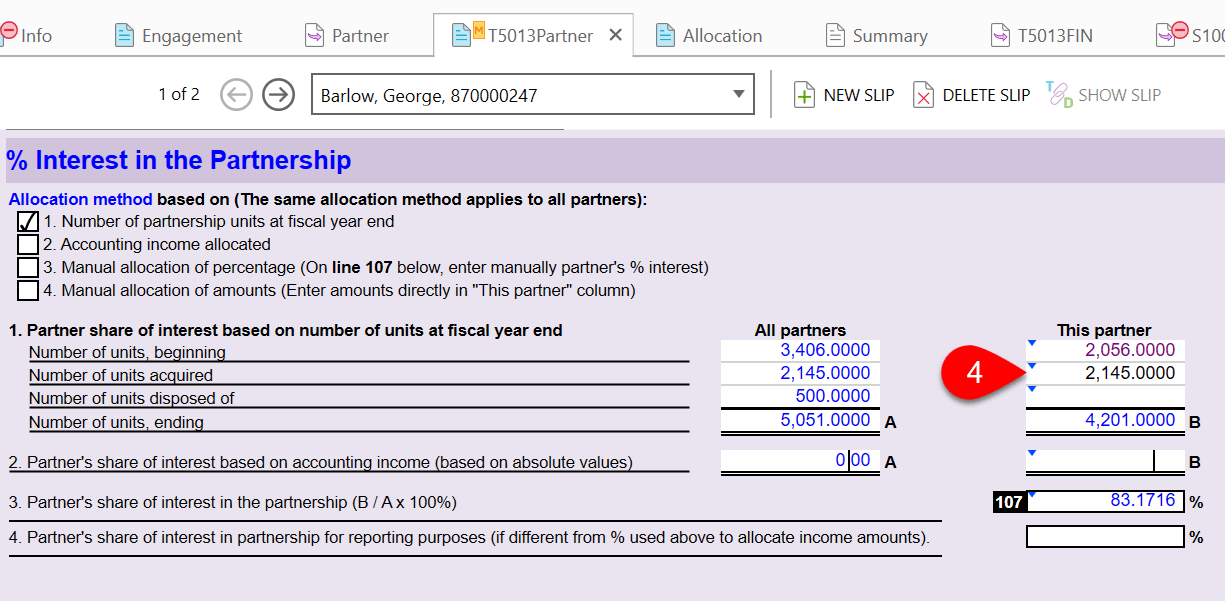

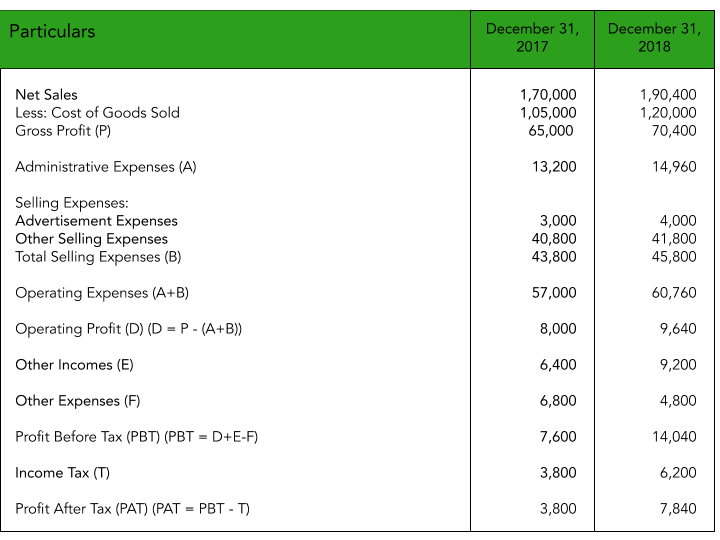

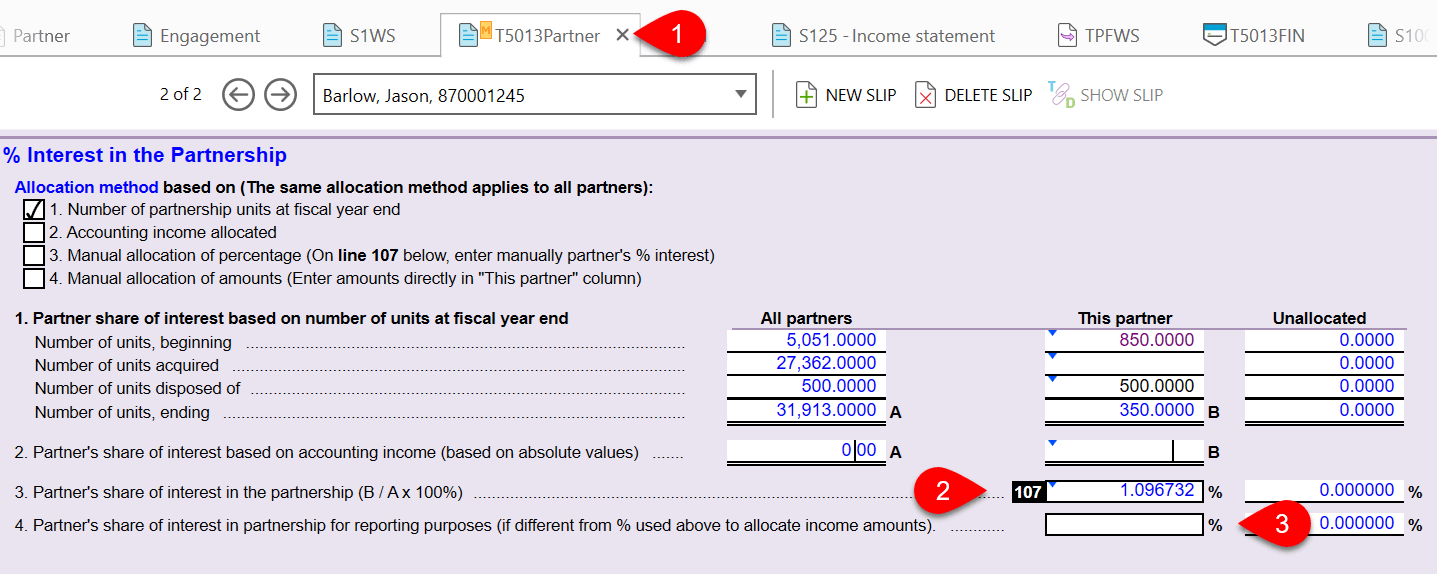

Partnership’s net income (loss) for income tax purposes.

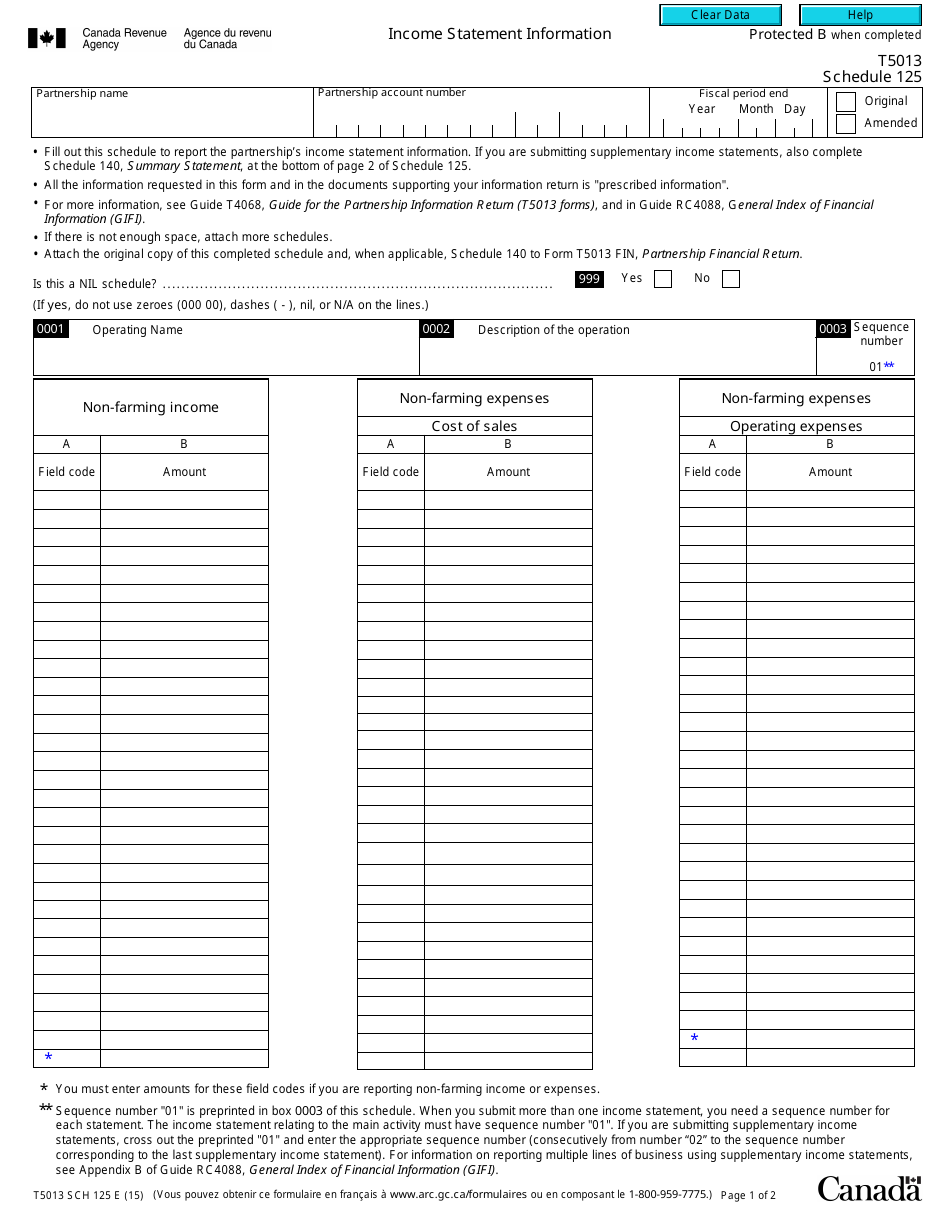

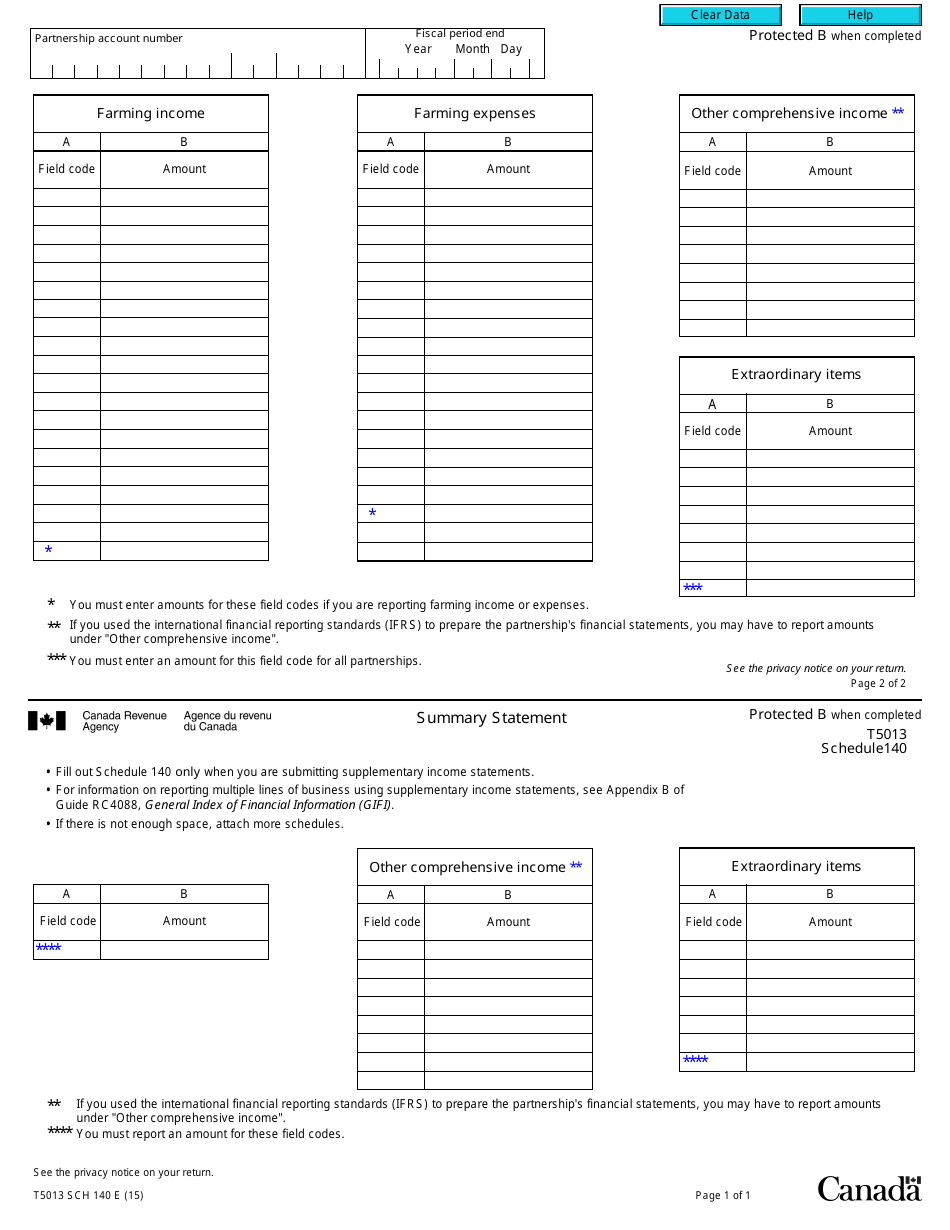

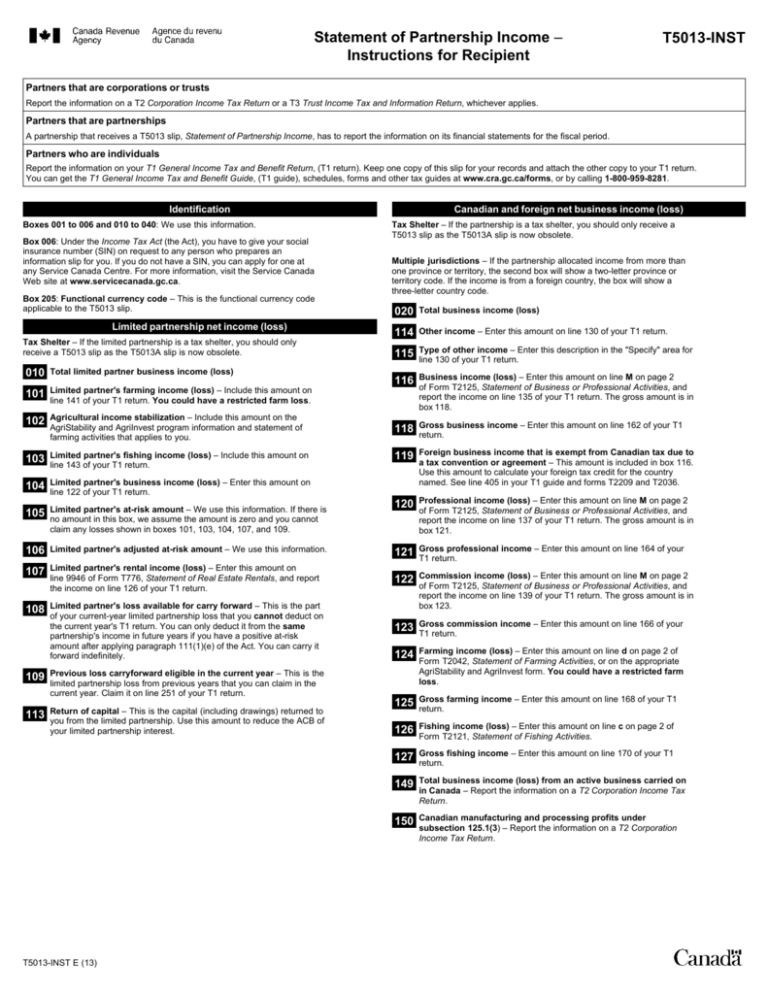

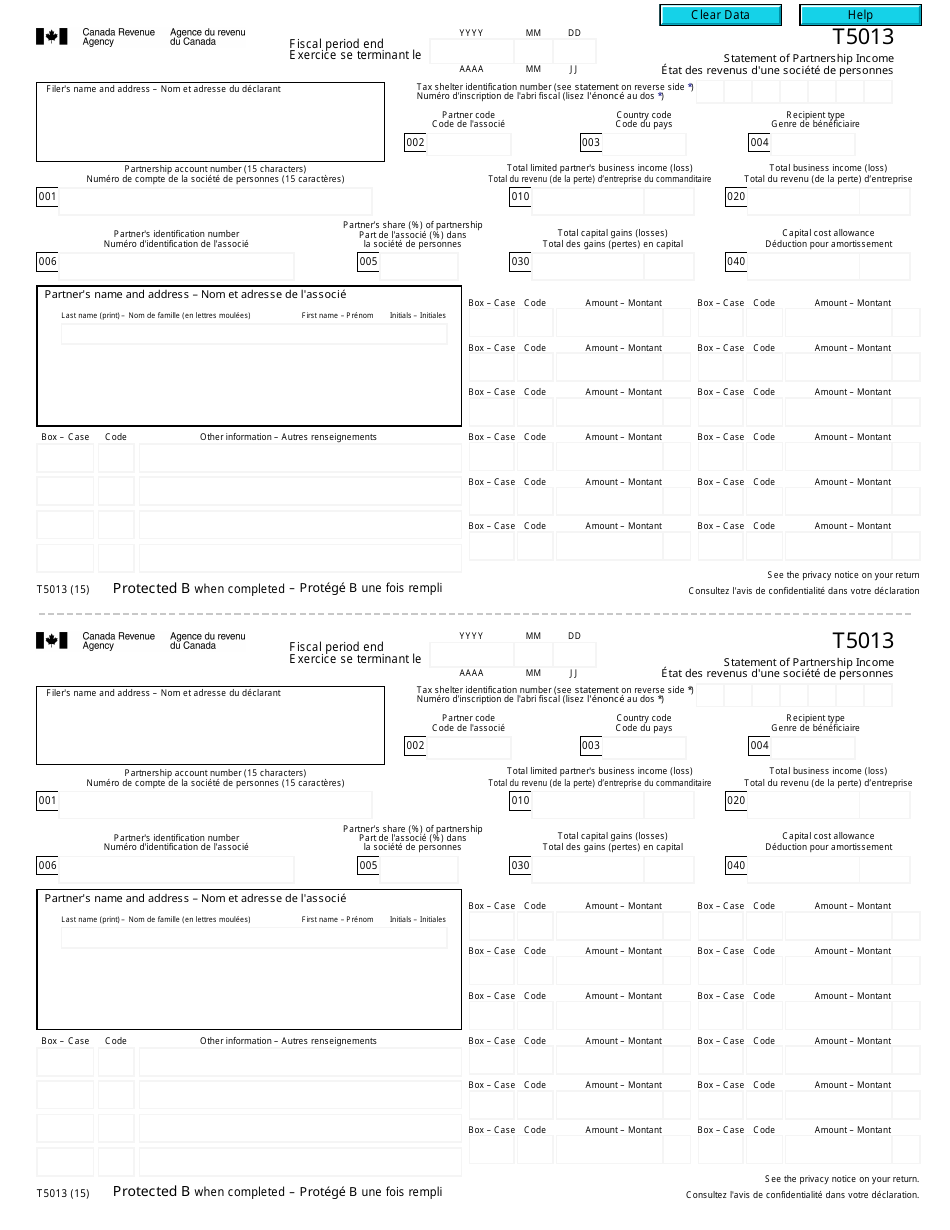

T5013 statement of partnership income. Ways to get the form download. A partnership that receives a t5013 slip, statement of partnership income, has to report the slip information on its financial statements for the fiscal period. T5013 statement of partnership income.

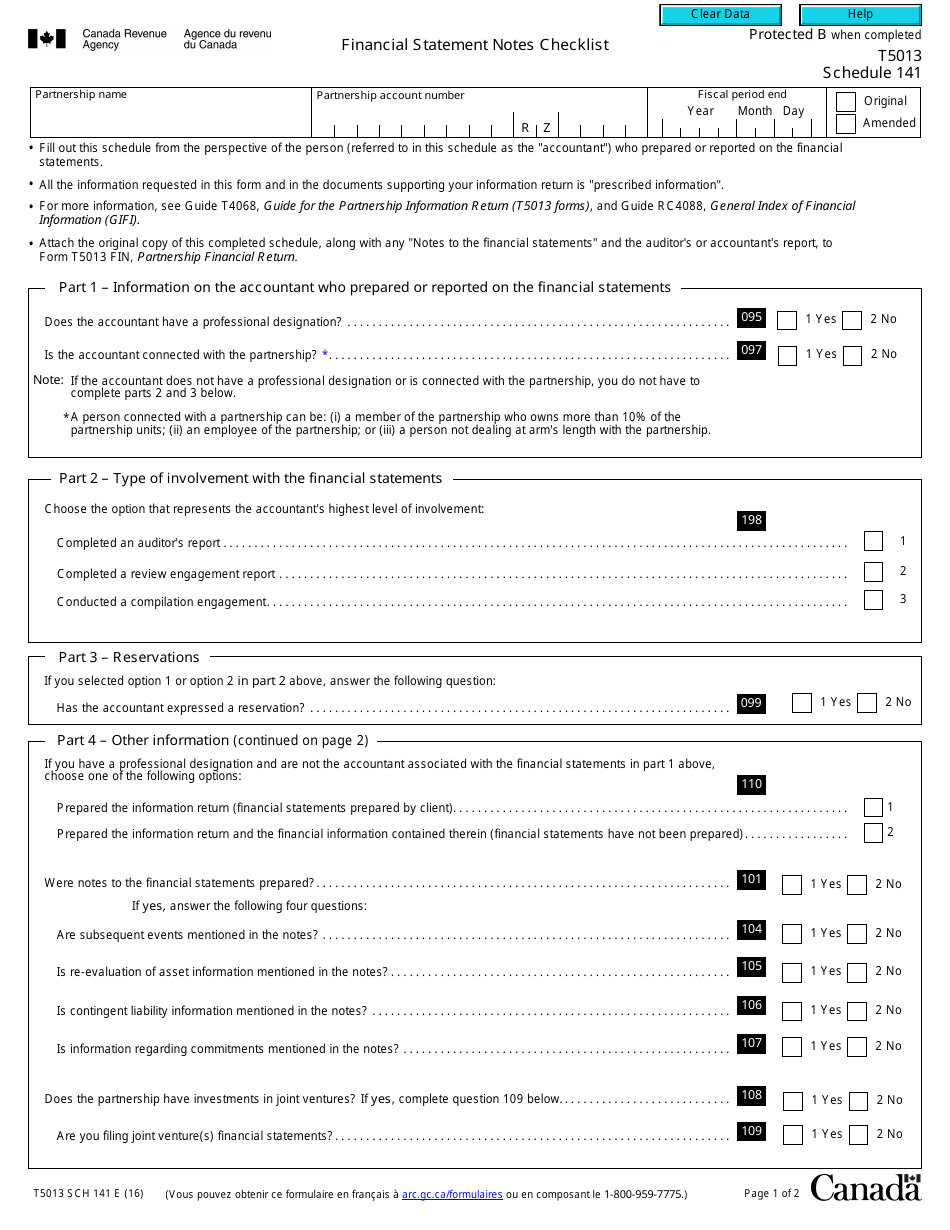

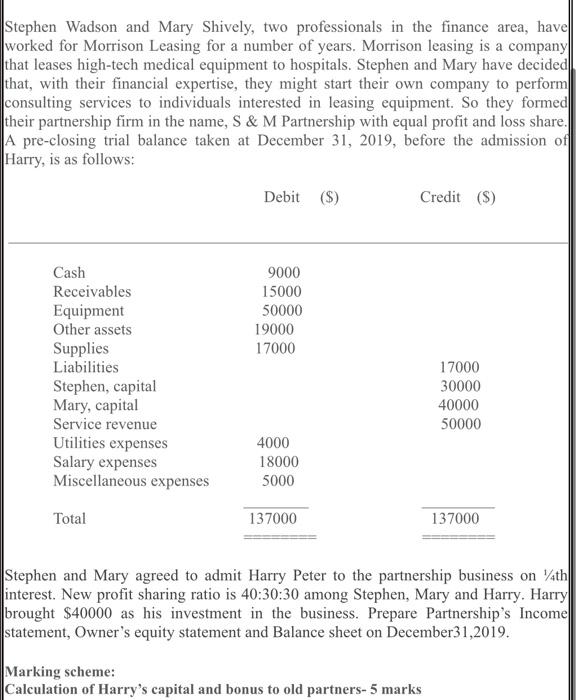

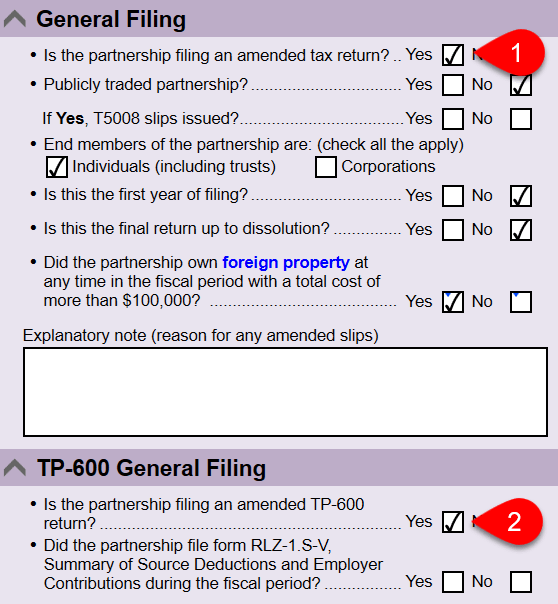

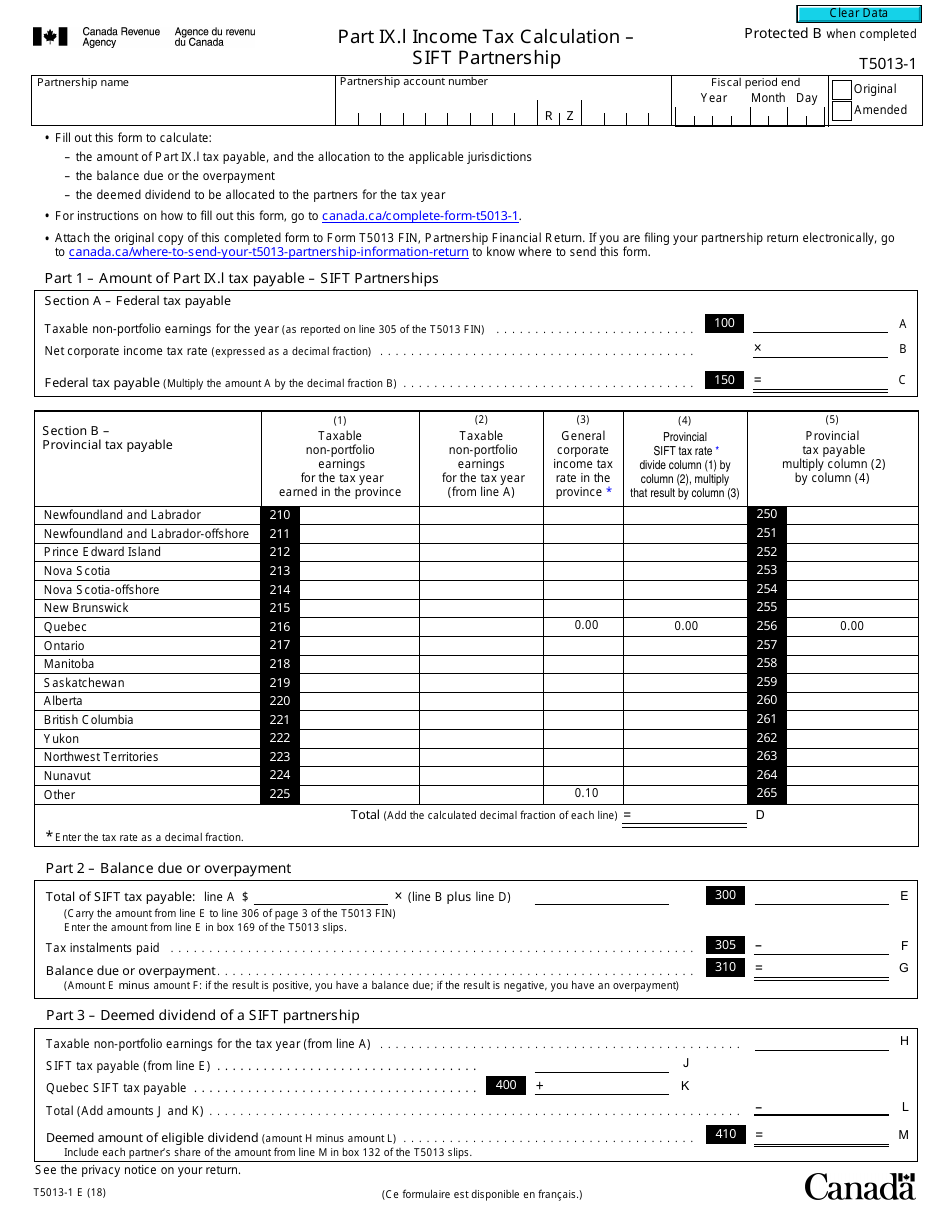

Form t5013, or the statement of partnership income, is a document that partnerships use to report their financial status to the canada revenue agency (cra). Prepare the t5013, statement of partnership. Information slip for the authorized member of a partnership to report to each partner their share of income for the fiscal period that the partner has to report on the appropriate income tax return for the year.

Statement of partnership income slip from your partnership which reports your share of the partnership income. Also known as the statement of partnership income, professional partnerships use the t5013 slip to report basic information about their business to the. A partnership information return, or t5013, is a tax form that’s used to report how a partnership allocated its net income, losses, and other revenue or.

A partnership that receives a t5013 slip, statement of partnership income, has to report the information on its financial statements for the fiscal period. Canadian tax form t5013, also known as the statement of partnership income, is a form that partnerships in canada use to report basic financial information. Canadian tax form t5013, also known as the statement of partnership income, is a form that partnerships in canada use to report basic financial information.

A partnership that receives a t5013 slip, statement of partnership income, has to report the information on its financial statements for the fiscal period. Partners that are partnerships a partnership that receives a t5013 slip, statement of partnership income, has to report the information on its financial statements for the. The t5013 statement of partnership income tax slip reports income from units held in a limited partnership, such as any of the md platinum™ pools (global private credit,.

The minister of national revenue asked in writing for a completed form t5013, statement of partnership income *to determine if a partnership exceeds the $2 million threshold,. Form t5013, statement of partnership income; This includes box 105, where.

If you’re a member of a partnership, you’ll receive a t5013: