Inspirating Info About Cvp Income Statement Equation Cecl Ey

The first two tell you how much revenue you.

Cvp income statement equation. To summarize, the most important assumptions underlying cvp analysis are: Cost behavior is how a cost reacts to changes in production or sales quantity. It typically is calculated by comparing the sales revenue generated by the sale of one item versus the variable cost of the item:

Key equation s = selling price per unit The formula for calculating contribution margin is sales. There are four formulas in all.

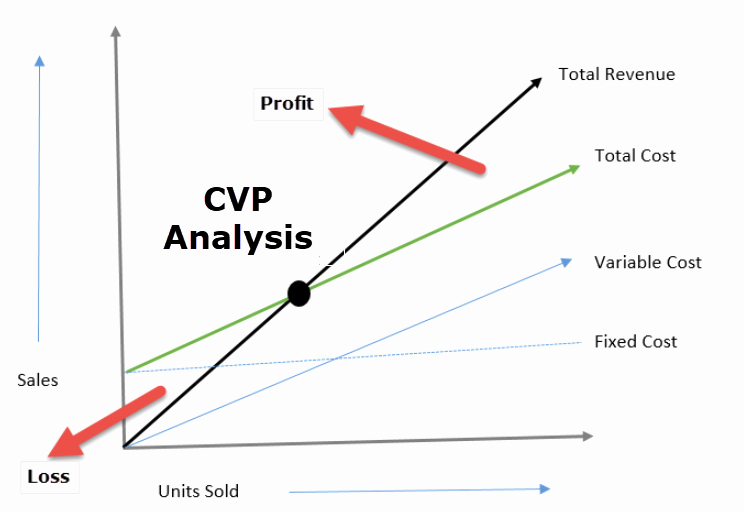

Selling prices sales volume unit variable costs total fixed costs mix of products sold cost volume profit (cvp) analysis using a contribution margin income statement cost volume profit analysis is based on cost behavior. Explain how changes in activity affect contribution margin and net operating income. According to the profit equation:

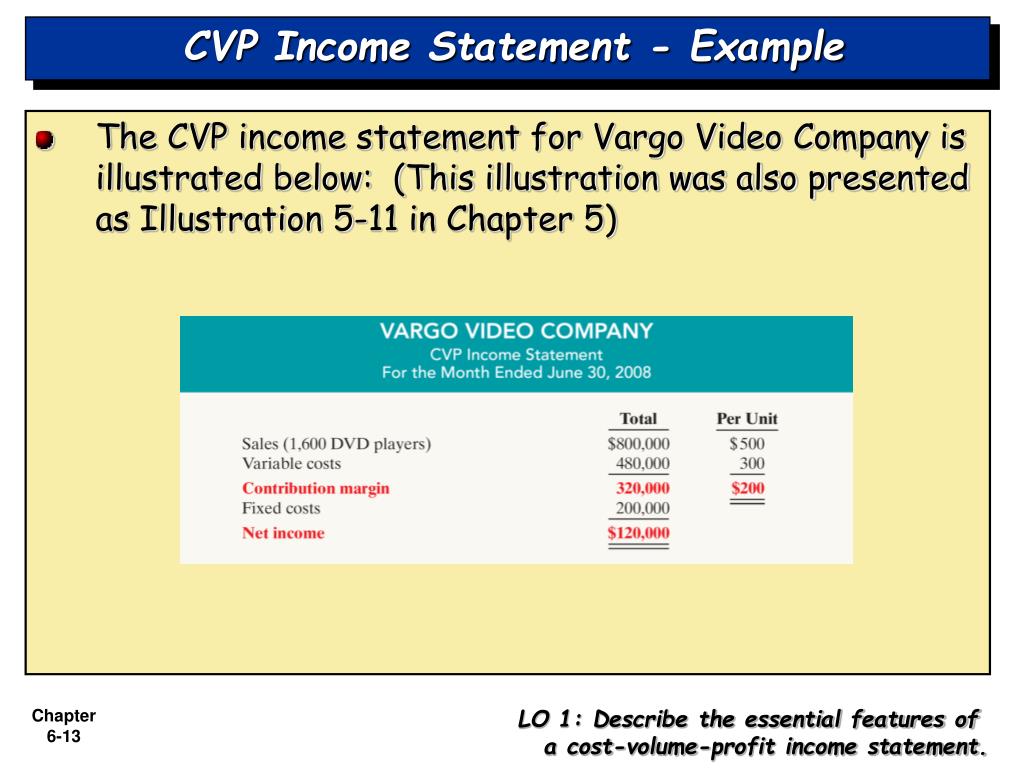

Generally speaking, the cvp formula is the following: Sales price per unit is constant. The regular income statement follows the order of revenues minus cost of goods sold and gives gross margin, while revenues minus expenses lead to net income.

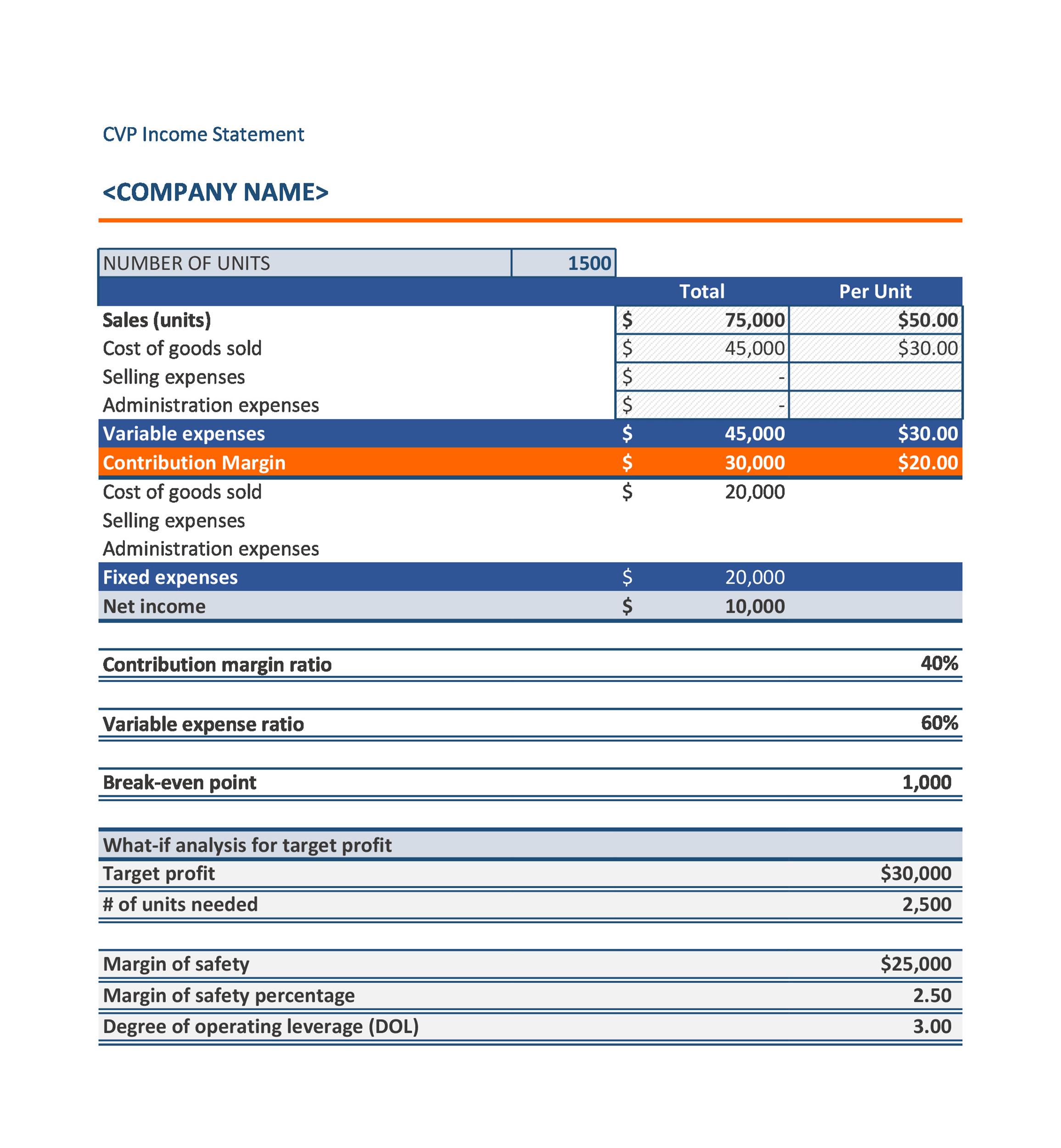

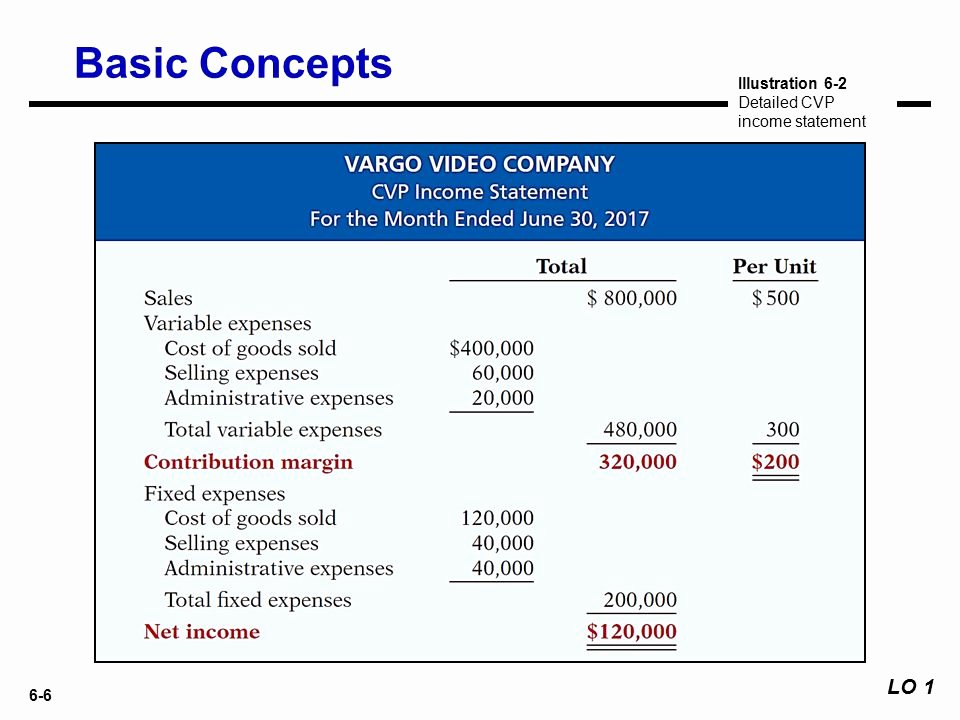

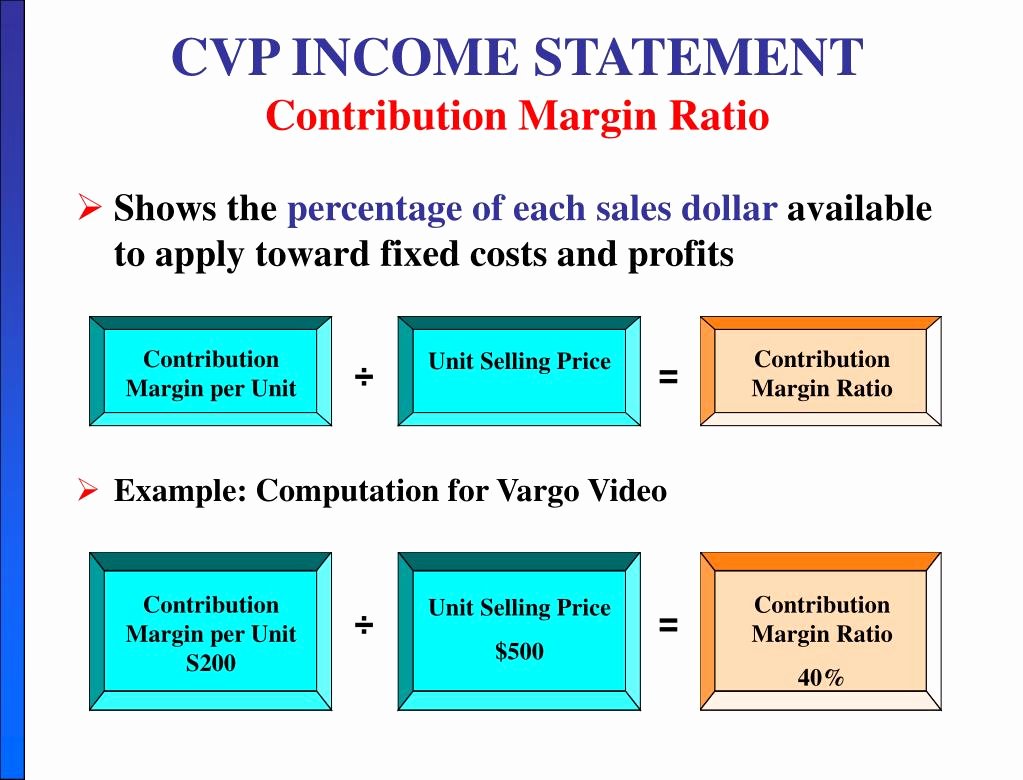

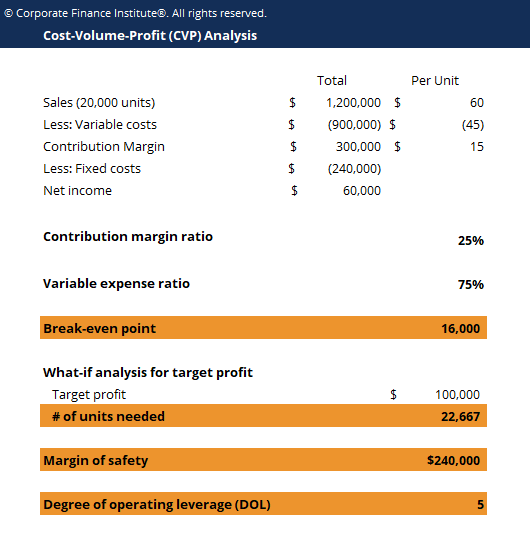

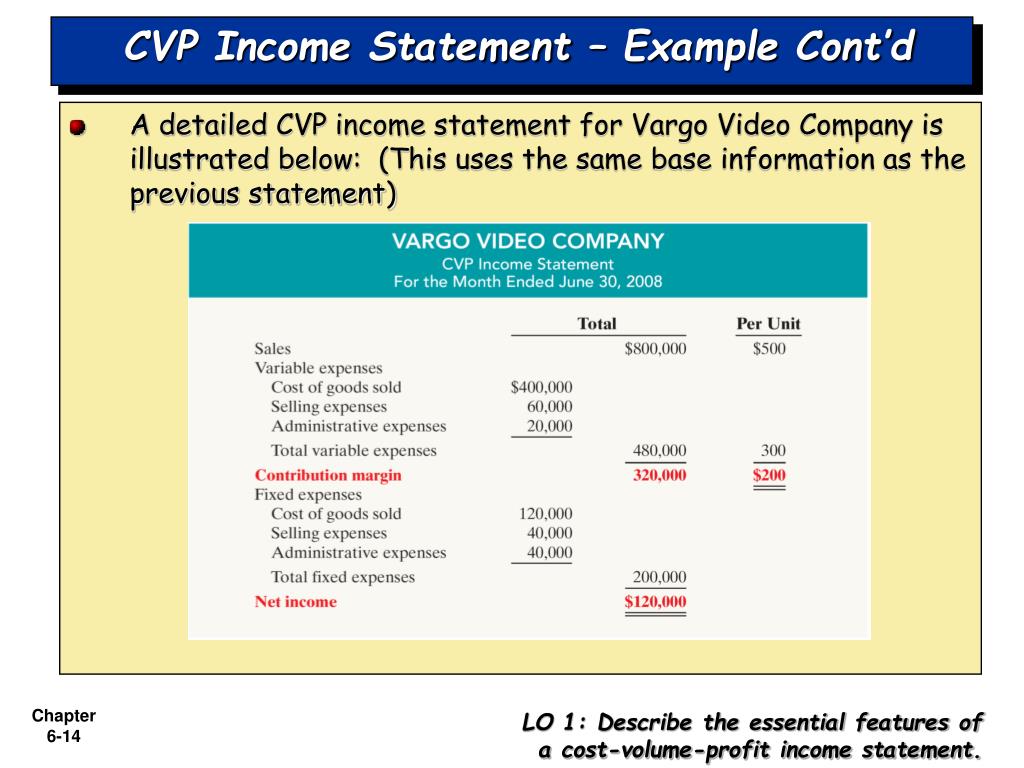

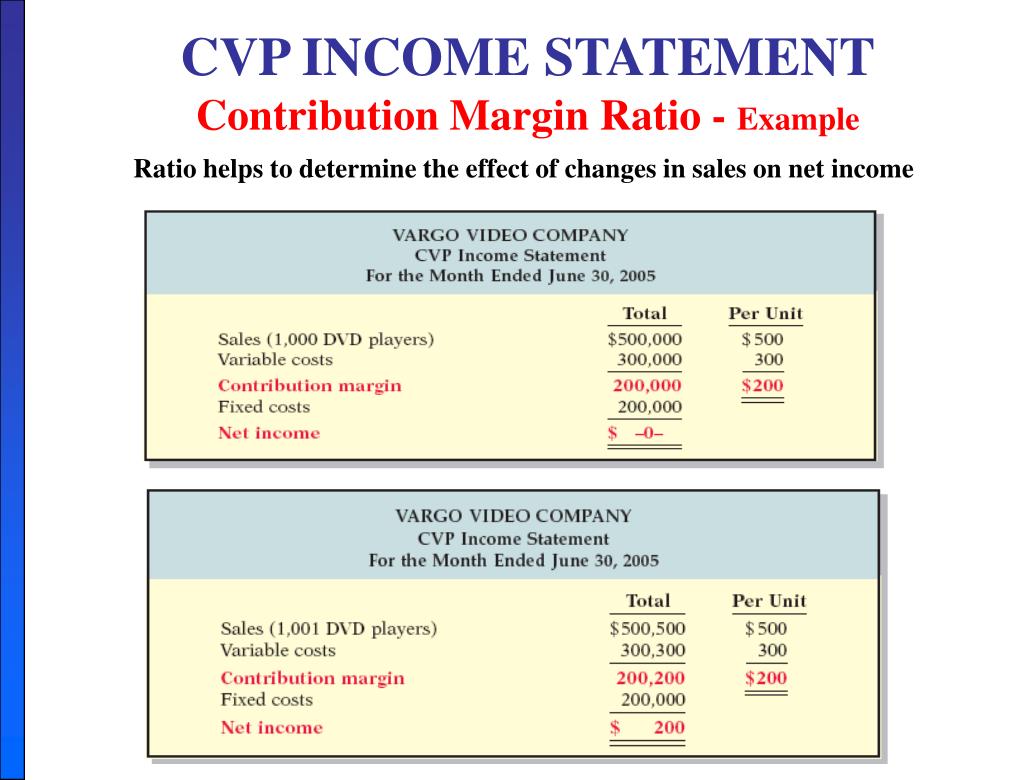

Contribution margin and ratio the contribution margin ratio and the variable expense ratio can help you evaluate your company’s profitability with respect to. Unit contribution margin ÷ unit selling price = contribution margin ratio now we’re ready for some cvp formulas. A contribution margin income statement follows a similar concept but uses a different format by separating fixed and variable costs.

The cvp chart above shows cost data for video productions in a relevant range of output from 500 to 10,000 units. A cvp analysis is how you make sure your business is making money and work out the impact of production expenses and sales numbers on your earnings. This means that a company can sell more or fewer units at the same price and that the company has no change in technical efficiency as volume changes.

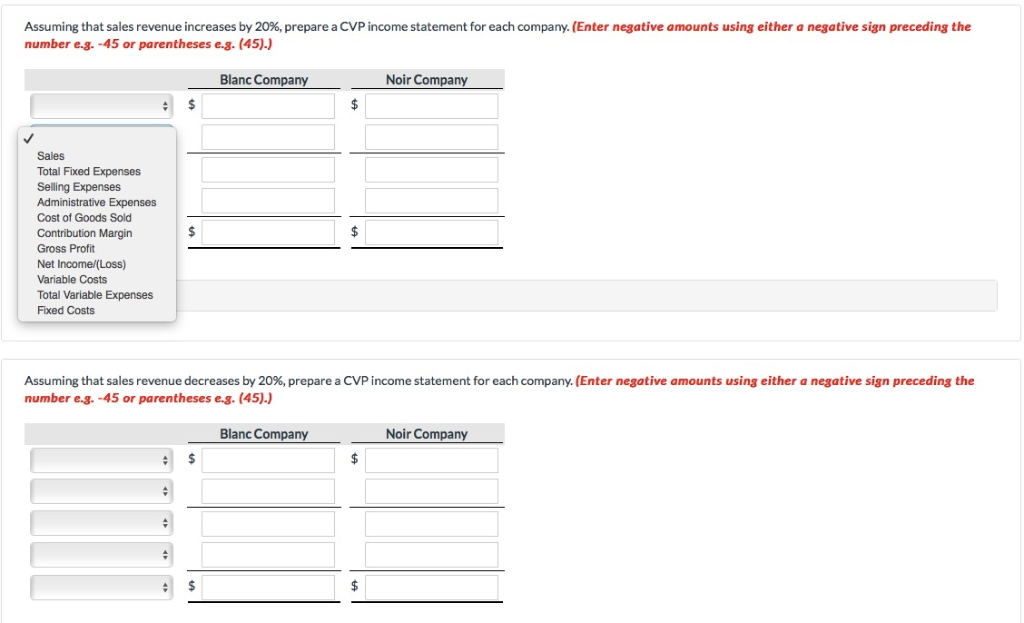

Cost behavior is discussed in detail in chapter 1. Cost volume profit (cvp) analysis is based on cost behavior. To allow for a mathematical approach to performing cvp analysis, the contribution margin income statement is converted to an equation using the following variables:

To recap, cost behavior is classified as variable, fixed, or mixed. Key equation s = selling price per unit v = variable cost per unit f = total fixed costs q = quantity of units produced and sold In our example, the sales revenue from one shirt is $15 and the variable cost of one shirt is $10, so the individual contribution margin is $5.

Use the contribution margin ratio (cm ratio) to compute changes in contribution margin and net operating income resulting from changes in sales volume. To find the contribution margin per unit, you subtract all. Net income = $ 120,000 − $ 72,000 − $ 40,000 net income = $ 8,000.

Sales = units sold x price per unit. The first equation above can be expanded to highlight the components of each line item: For video productions, the profit equation looks like this: