Spectacular Info About Contribution Margin Statement Reading Of Financial Statements

In terms of computing the amount:

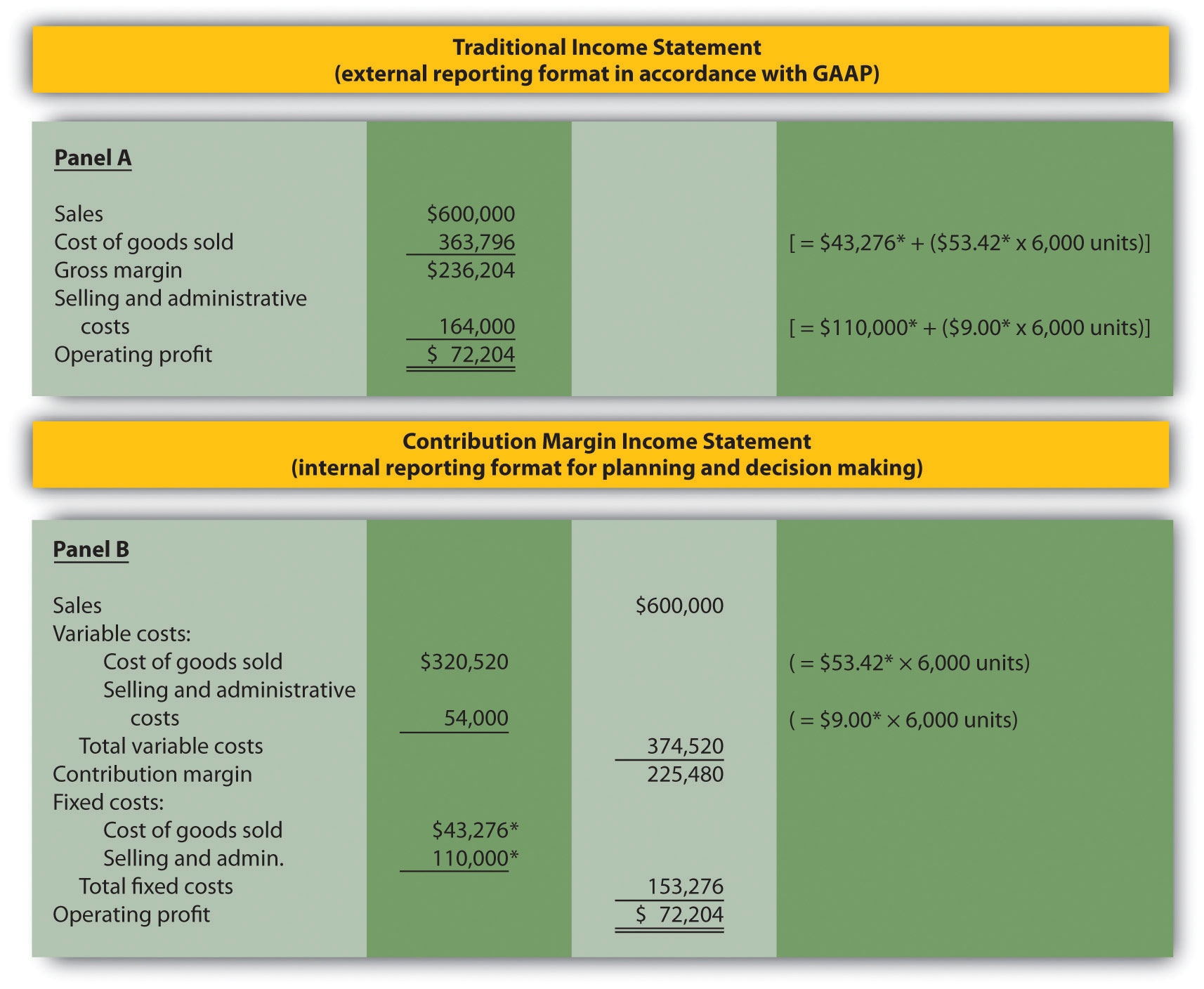

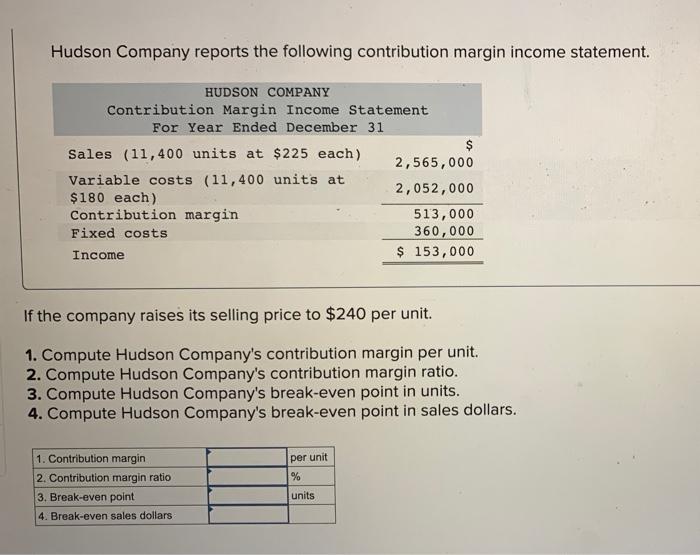

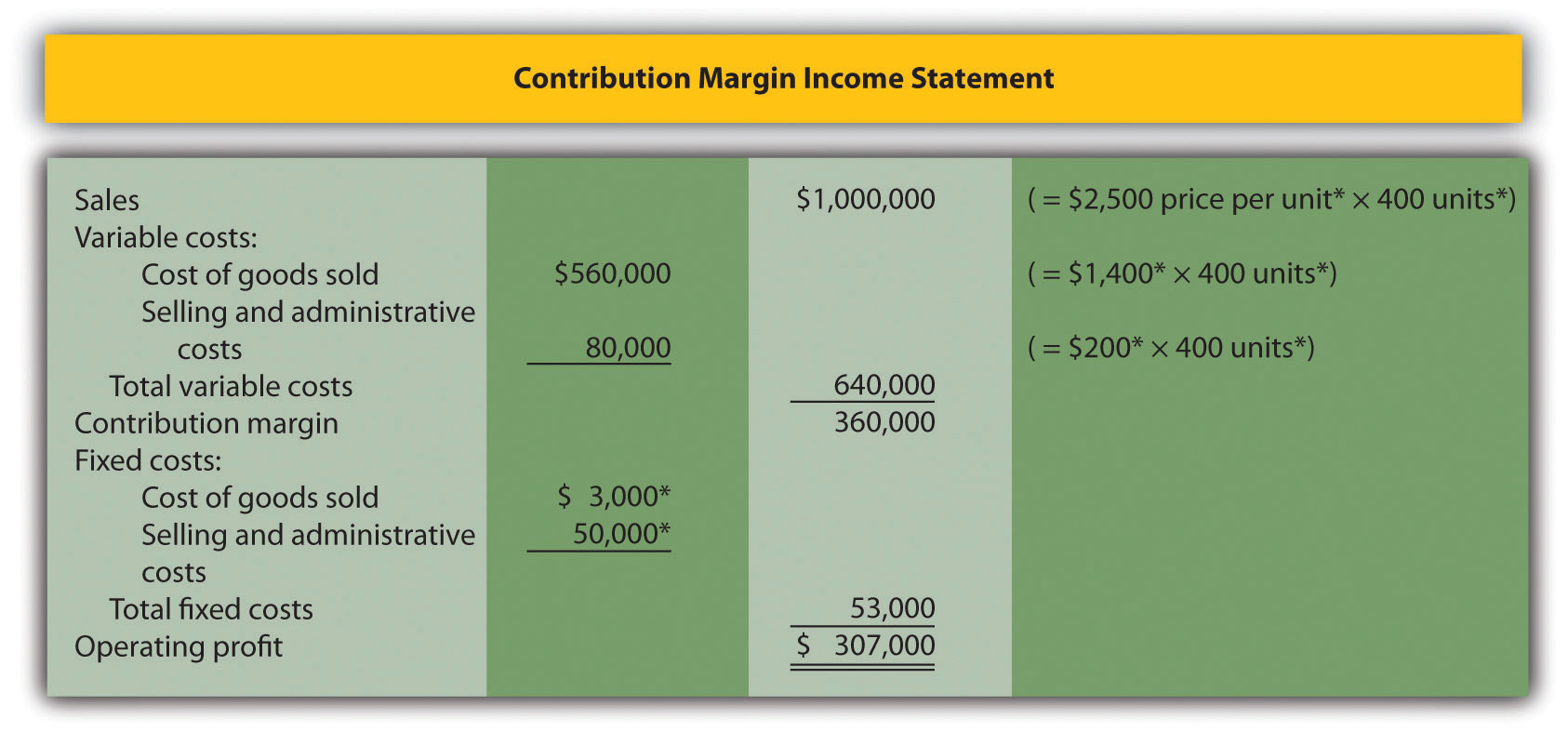

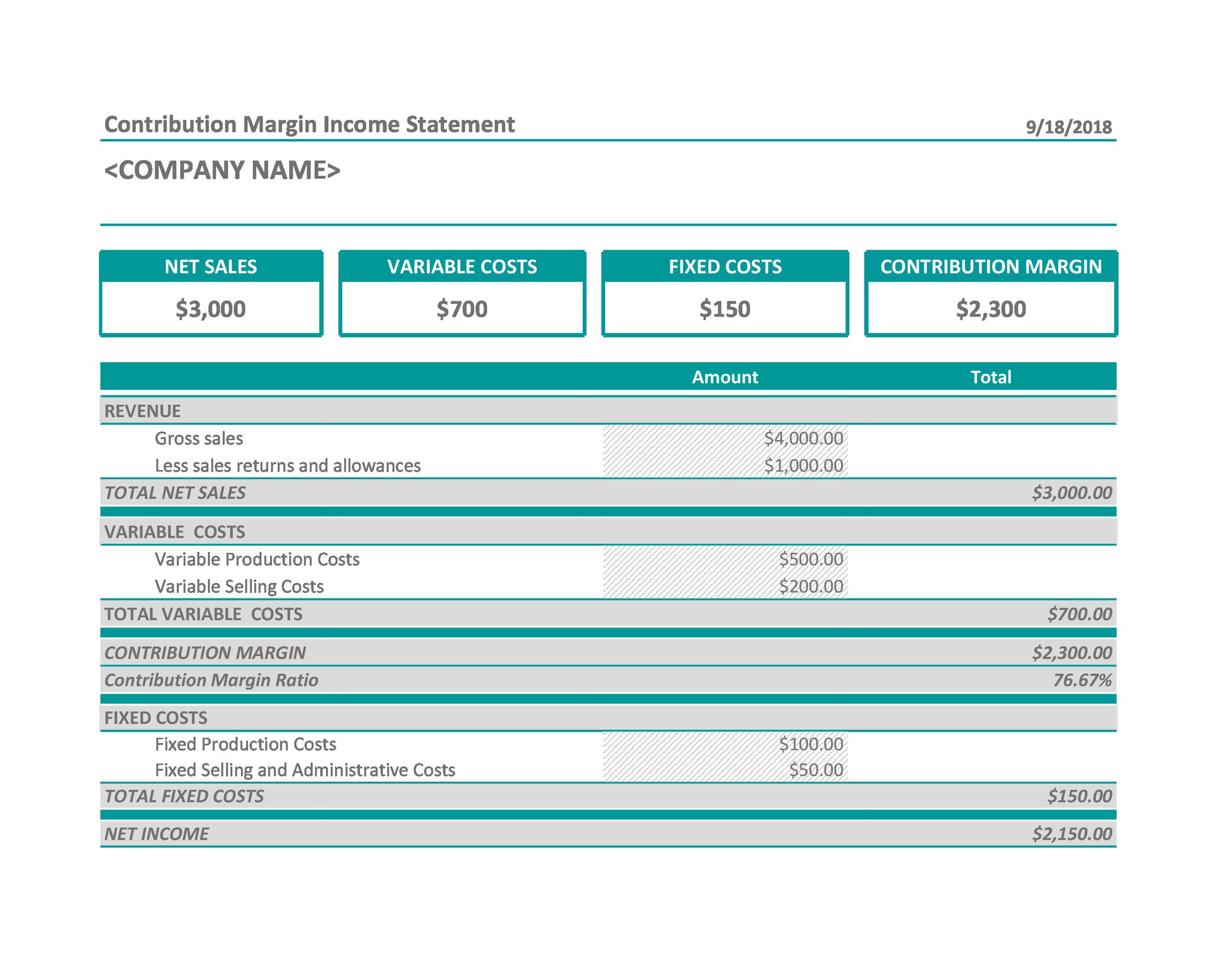

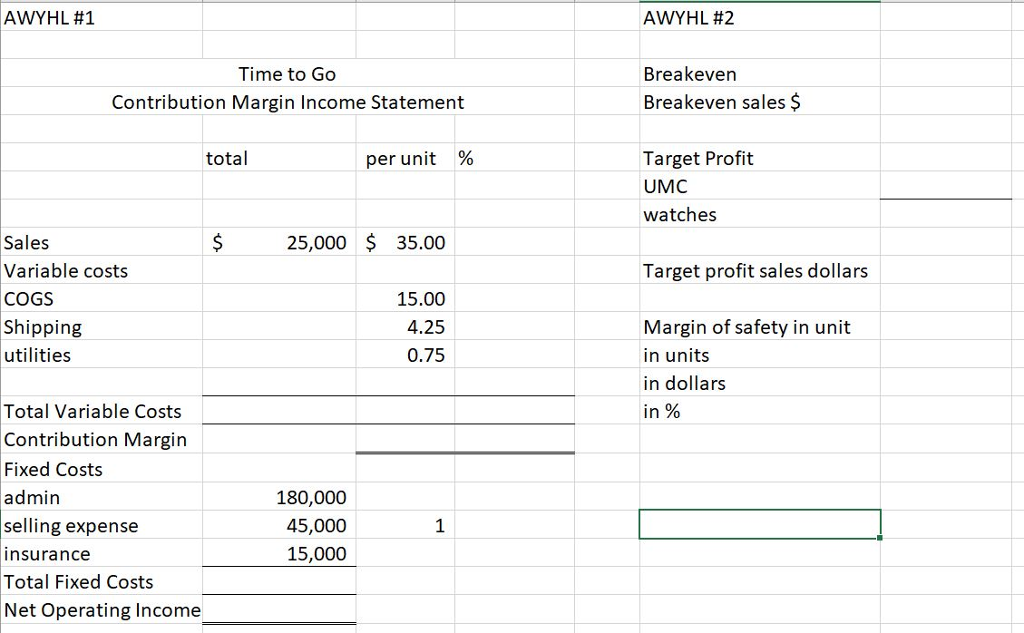

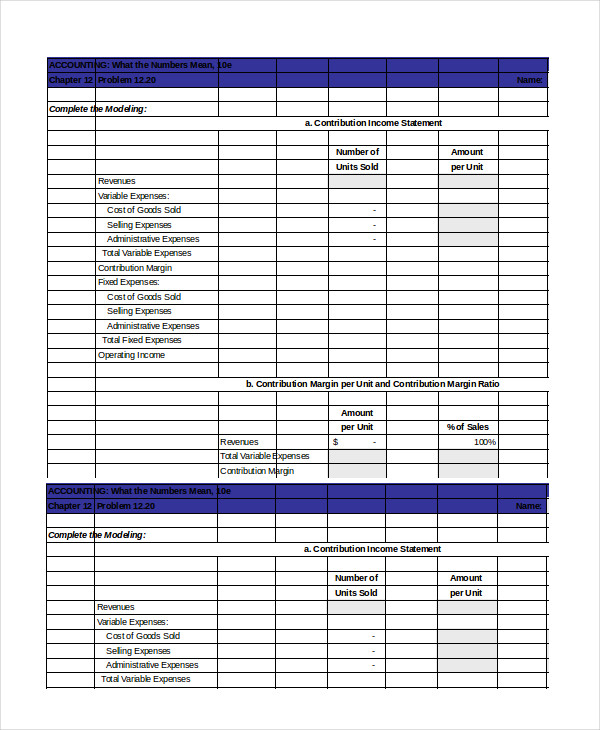

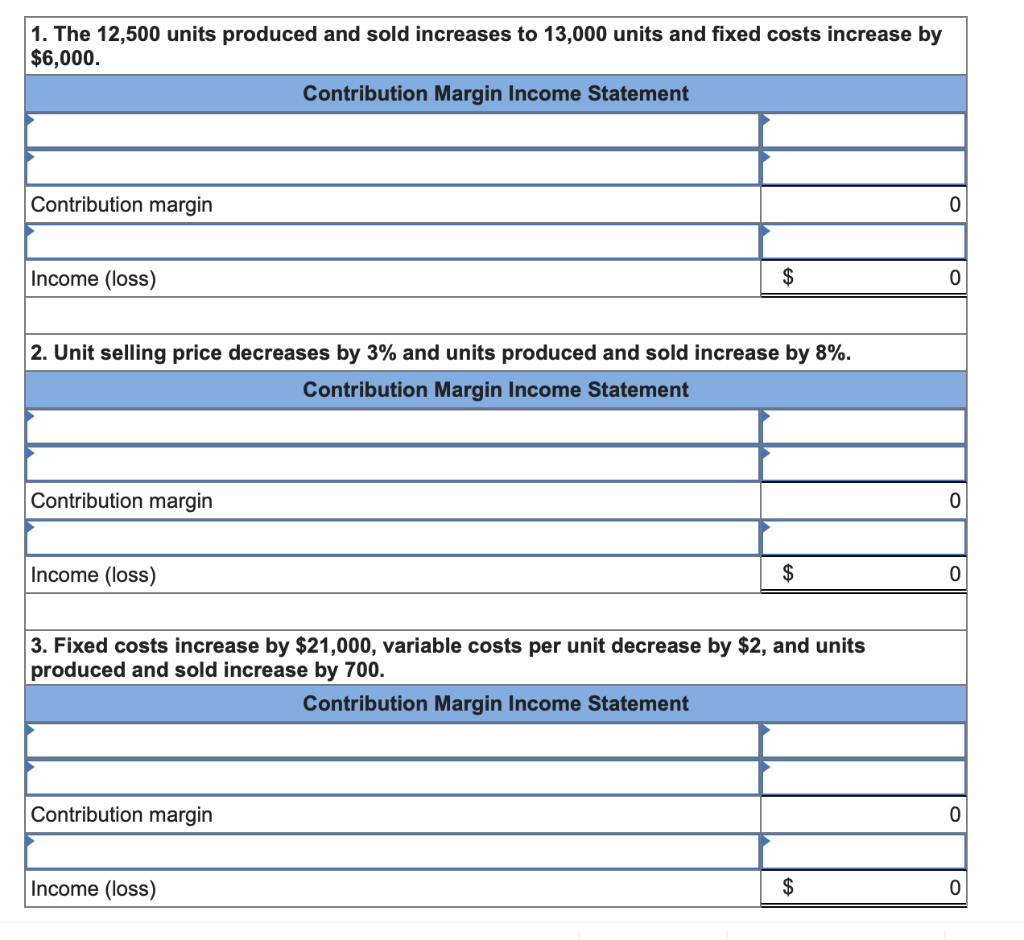

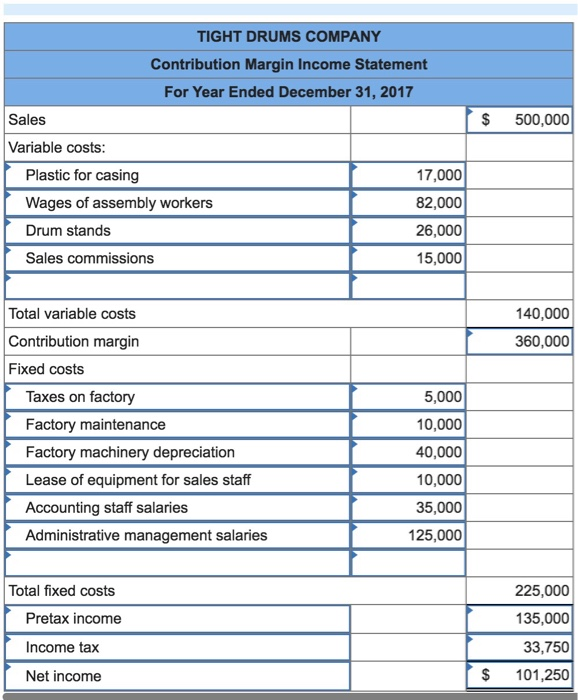

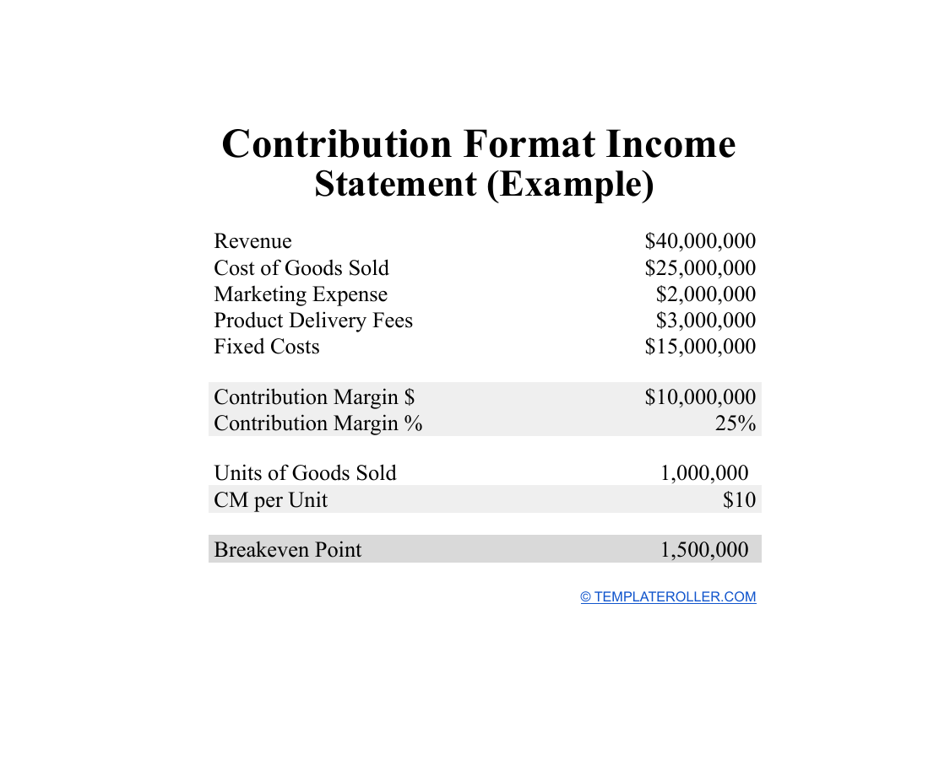

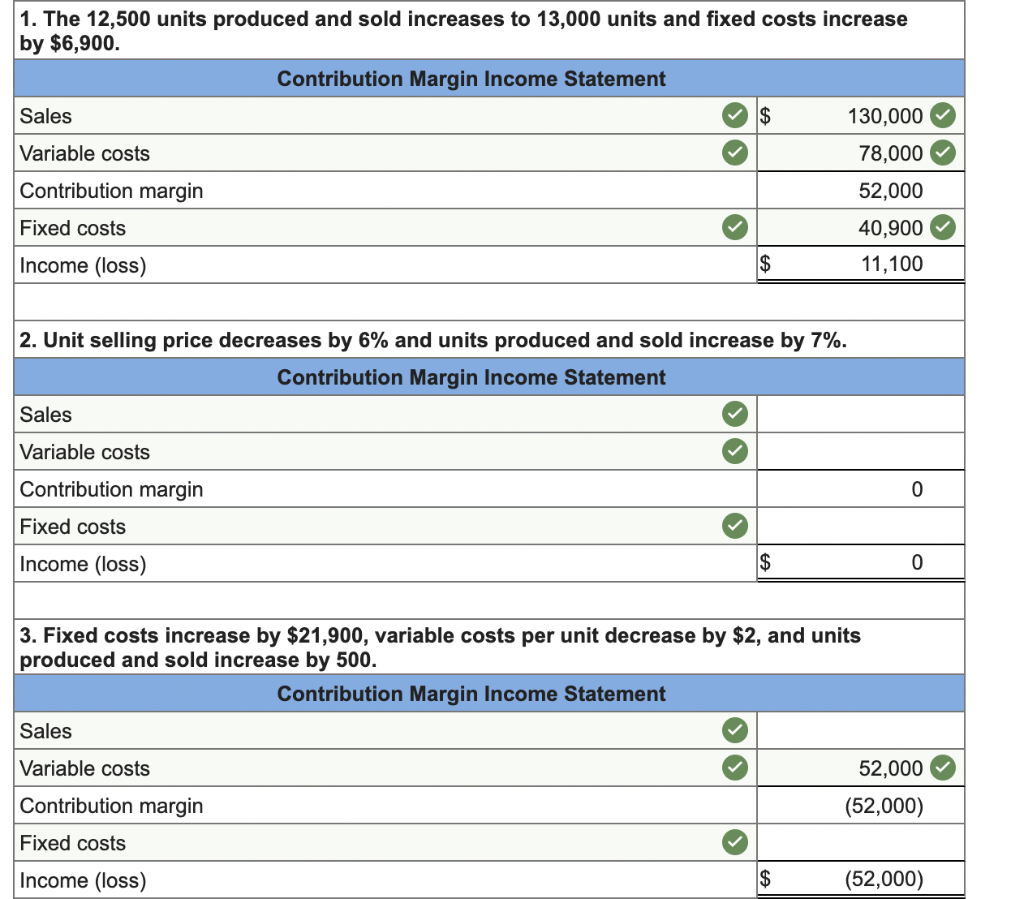

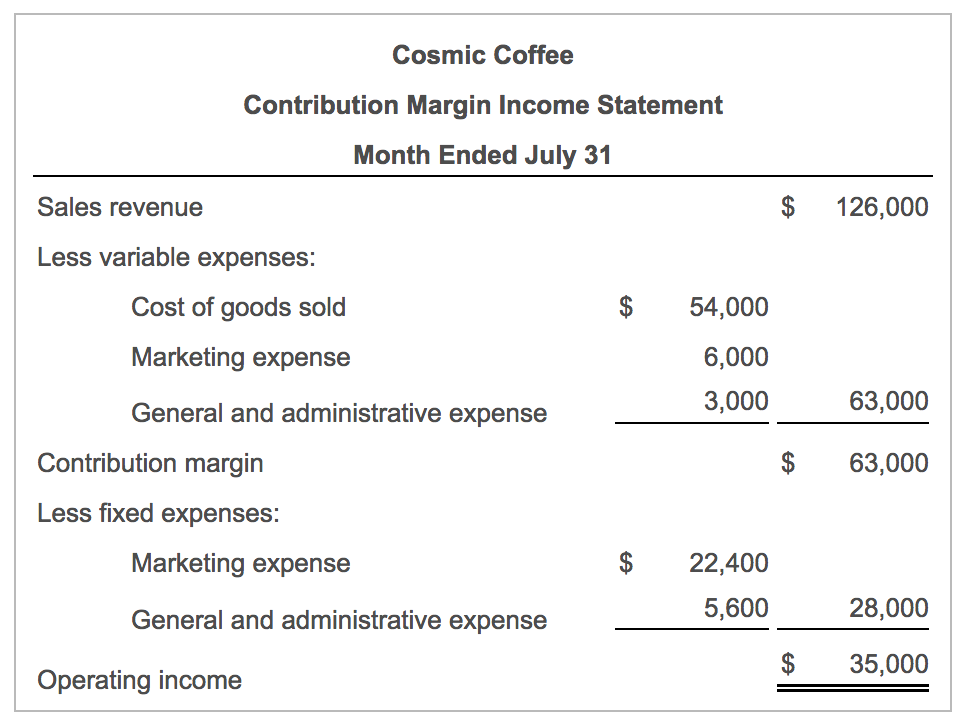

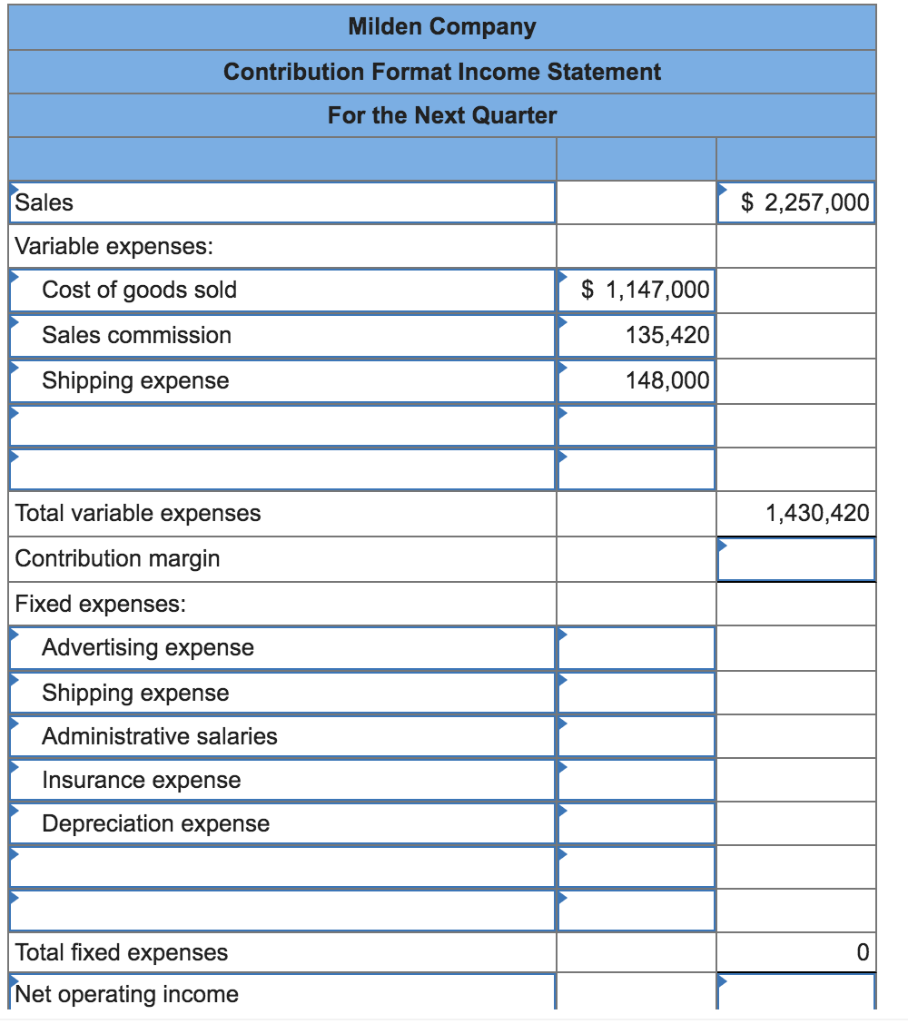

Contribution margin statement. The total contribution margin generated by an entity represents the total earnings available to pay for fixed expenses. 5 rows learn how to calculate your contribution margin income statement, a tool for analyzing the profitability of your business. Before going further, let’s note several key points about cvp and the contribution margin income statement.

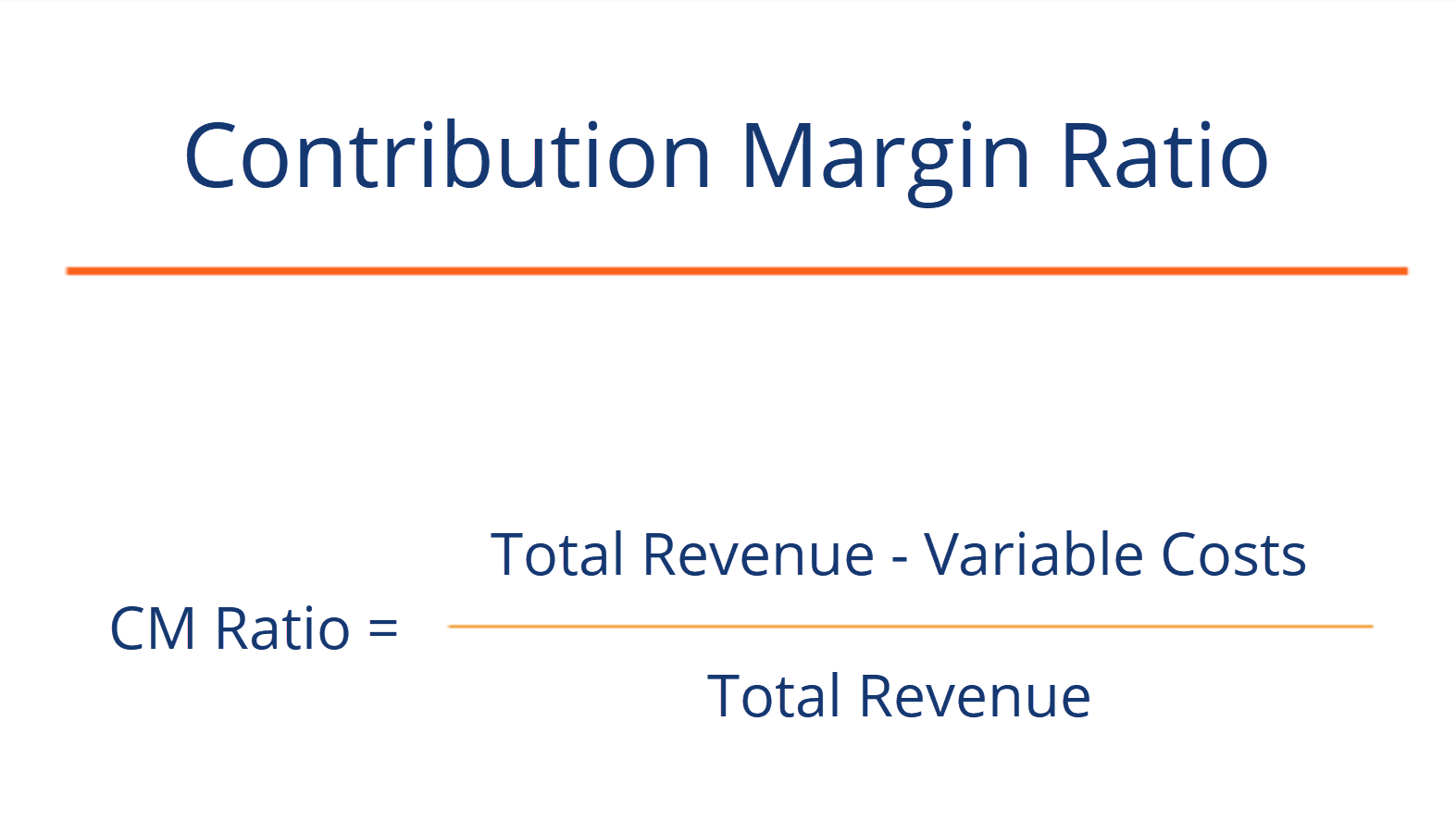

The contribution margin is a measurement through which we understand how much a company’s net sales will contribute to the fixed expenses and the net profit after covering. While a traditional balance sheet will look at the cost of goods sold to determine gross profit. For example, if your product revenue was $500,000 and total variable expenses were $250,000, your contribution margin would be $250,000 ÷ $500,000, or.

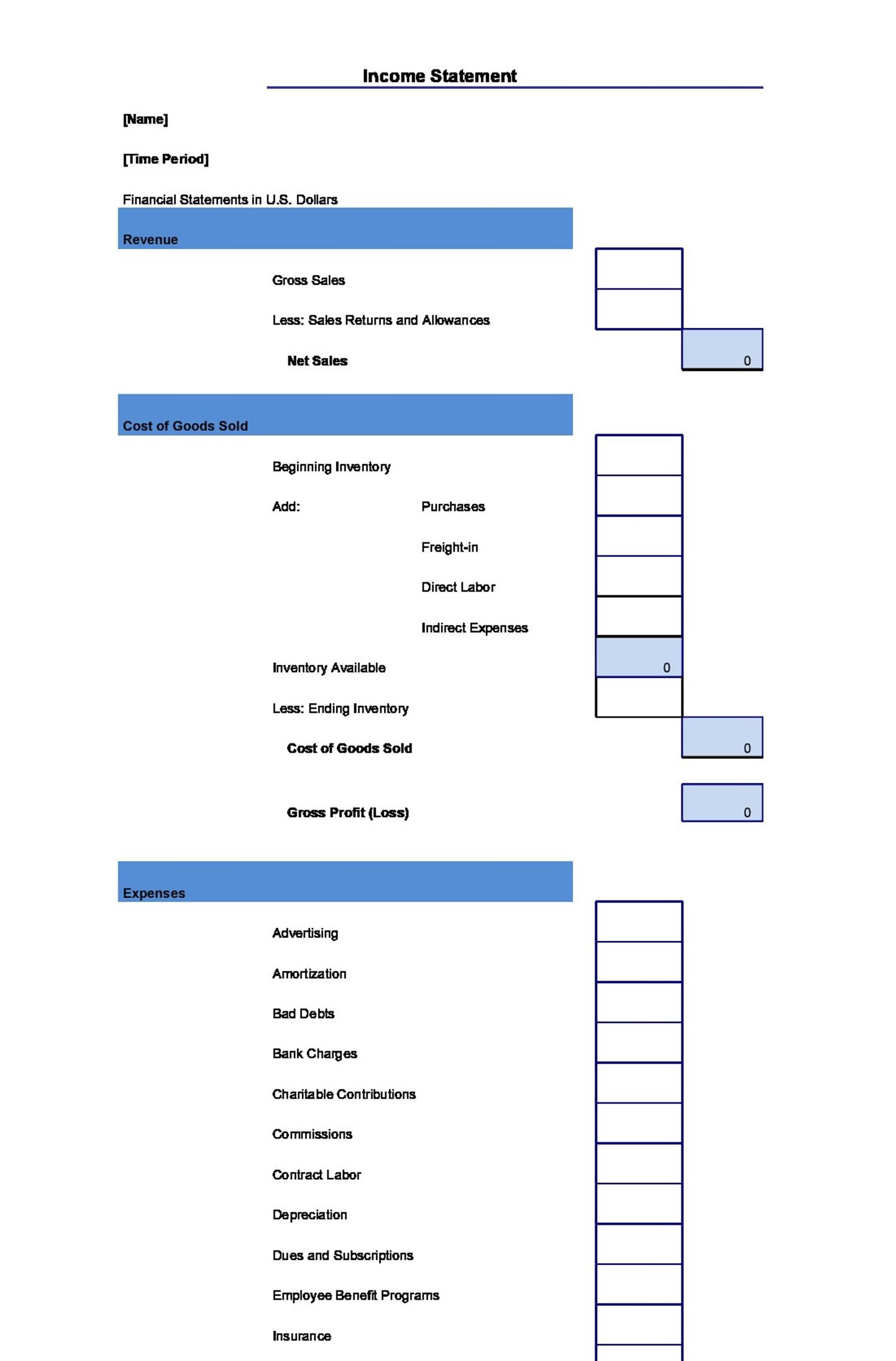

Learn how to calculate gross margin and contribution margin, two metrics that assess a company's profitability. Contribution margin income statement refers to the income statement which is used for the purpose of calculation of the contribution margin of the company. Learn how to calculate the contribution margin income statement, a superior form of presentation that shows the amount available to cover fixed costs and generate a profit or loss.

Contribution margin refers to sales revenue minus. Formula for contribution margin. Contribution margin = fixed costs + net.

It represents how much money can be generated by. The contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will. The concept of contribution margin is fundamental in cvp analysis and other management accounting topics.

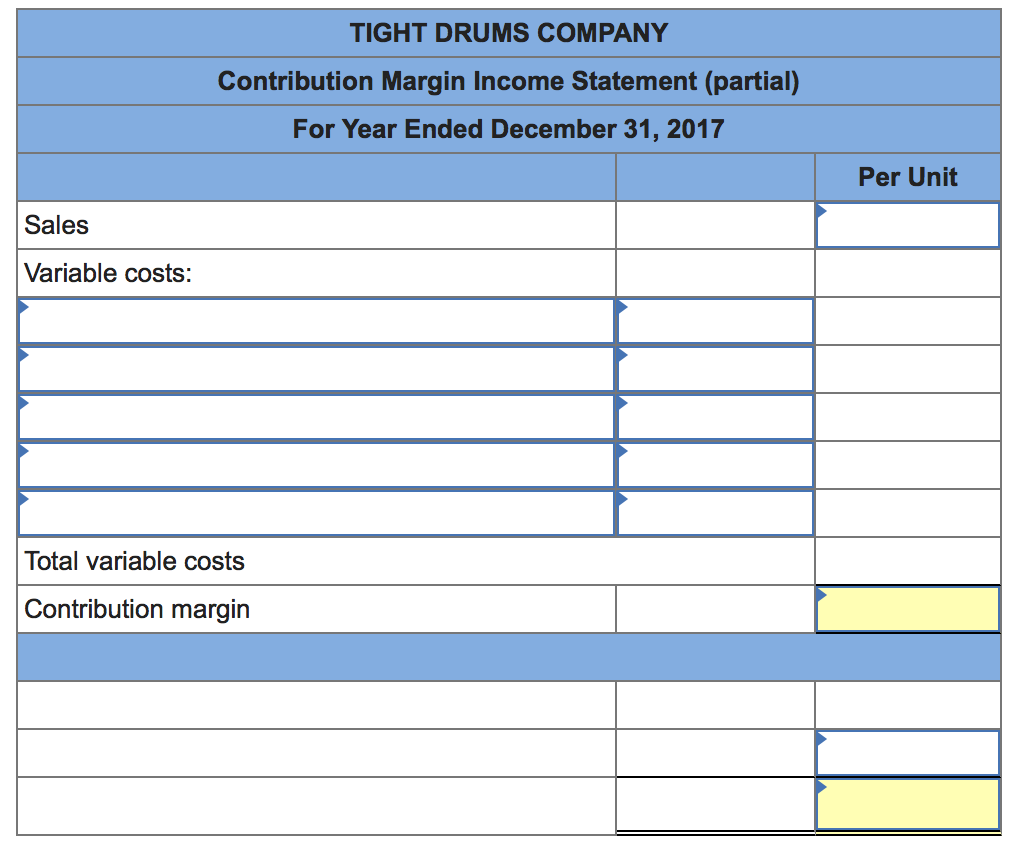

Contribution margin income statement. Contribution margins also can be expressed as ratios. Components of contribution margin income statement #1.

In accounting, contribution margin is the difference between the revenue and the variable costs of a product. Gross margin is the amount of profit left after. A contribution margin income statement is an income statement that shows the contribution margin as well as the net income of the entity for a given.

A key element of the variable costing income statement is contribution margin, which is what is left over from sales after paying variable costs. The contribution margin is the revenue from a product minus direct variable costs, which results in the incremental profit earned on each unit of product sold. Compare it with the normal income statement and the gross margin income.

All about the contribution margin income statement ☰ how cube works sync data, gain insights, and analyze business performance right in excel, google sheets, or the cube. First, the contribution margin income.