Peerless Info About Warrant Liabilities On Balance Sheet Income Statement Of Retained Earnings And

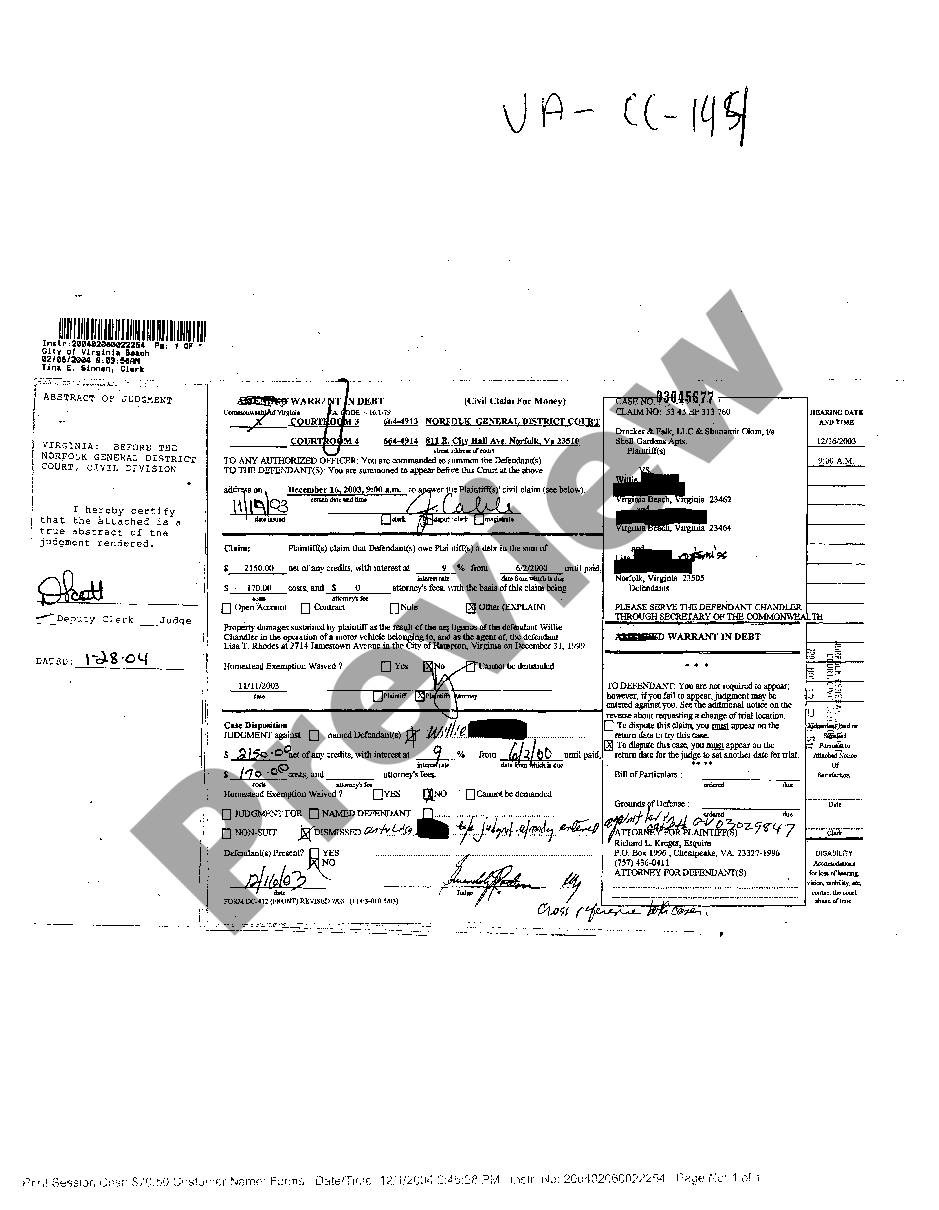

A warranty liability is a liability account in which a company records the amount of the repair or replacement cost that it expects to incur for products already.

Warrant liabilities on balance sheet. It is an attempt to take account of the fact that a company may incur. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. That is certainly not a minor.

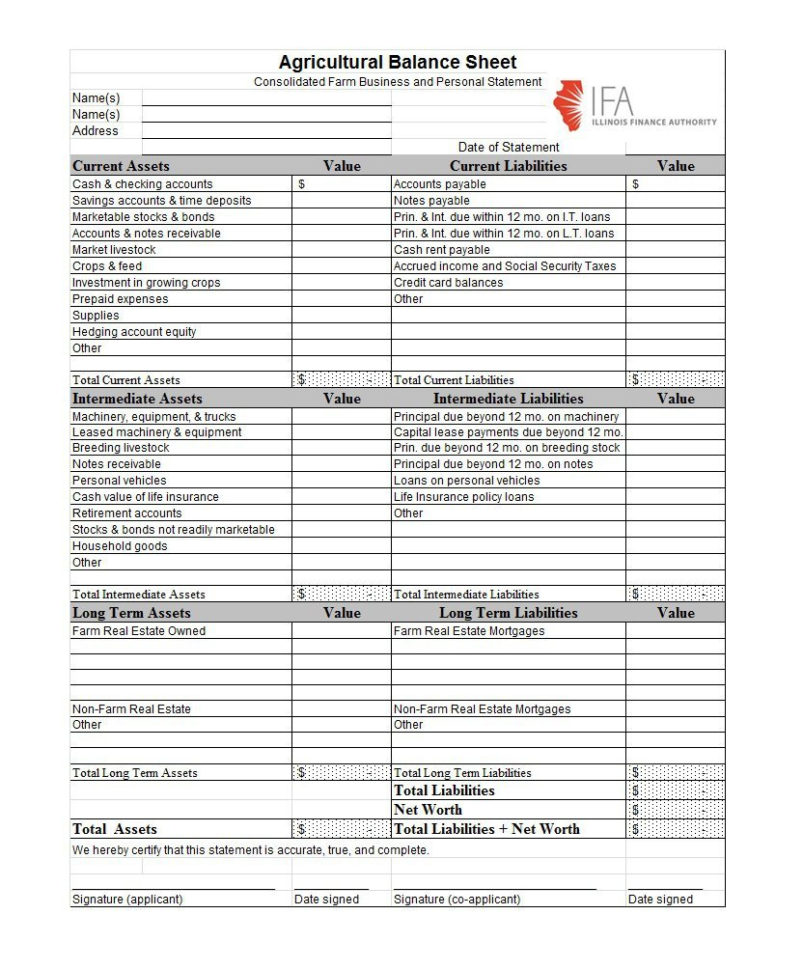

The measurement date is the earlier of the date when the grantee’s. Warrant liability means, as of any day, the aggregate stated balance sheet fair value of all outstanding warrants exercisable for redeemable convertible preferred shares of. Under generally accepted accounting principles, or gaap, businesses must report their assets, liabilities and.

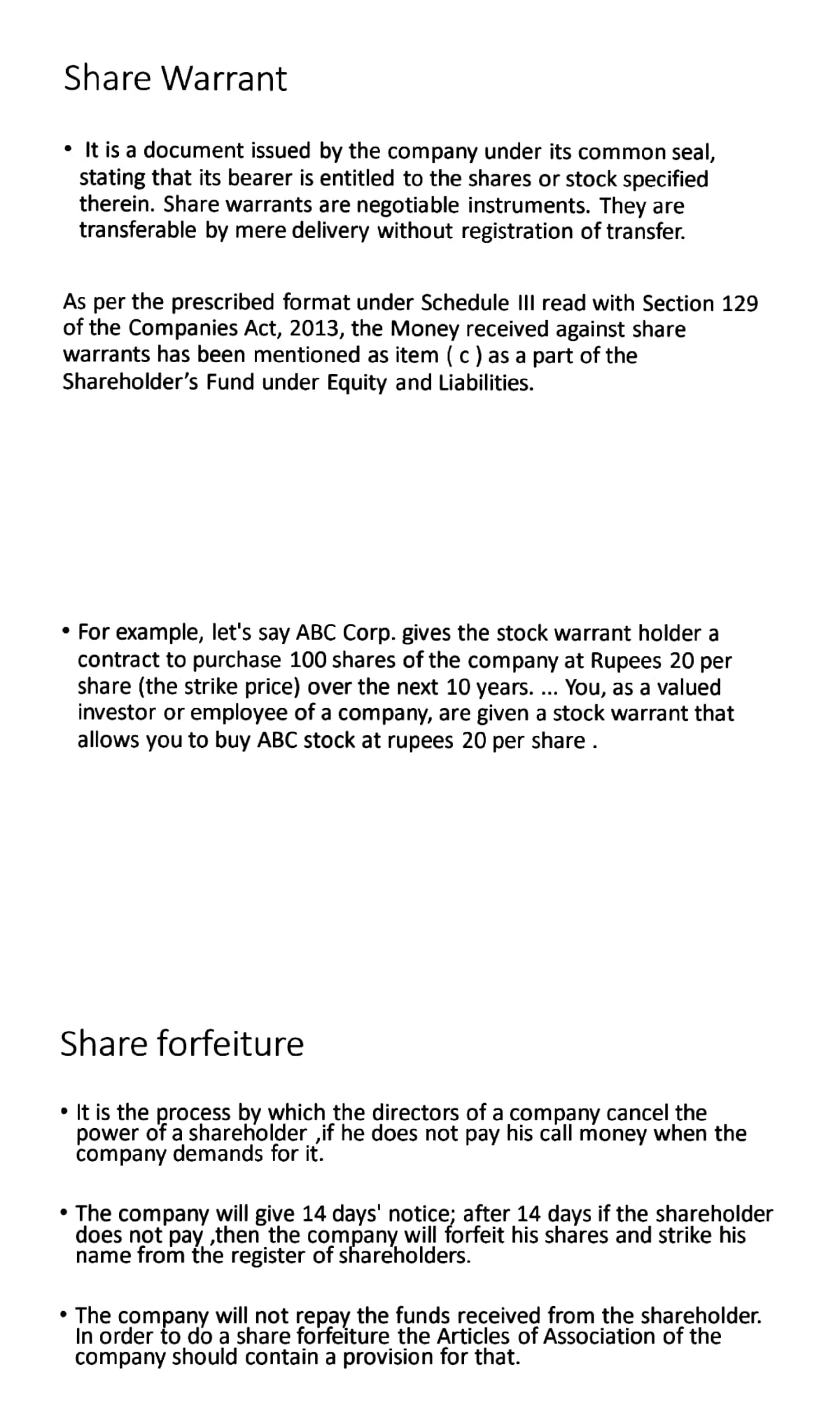

Fundamental analysts use balance sheets to. Gaap difference under igaap, warrants would be accounted for only when the warrants are finally exercised and converted into shares. It can also be referred to as a statement of net worth.

While warrants offer companies in need of additional capital an attractive alternative or complement to debt or common equity financing, oft overlooked guidance can result in. Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds are given out. Ias 32 — accounting for warrants that are initially classified as liabilities date recorded:

By chron contributor updated june 17, 2021. In accordance with the accounting guidance, the outstanding warrants are recognized as a warrant liability on the balance sheet and are measured at their inception date fair value. They are also known as current.

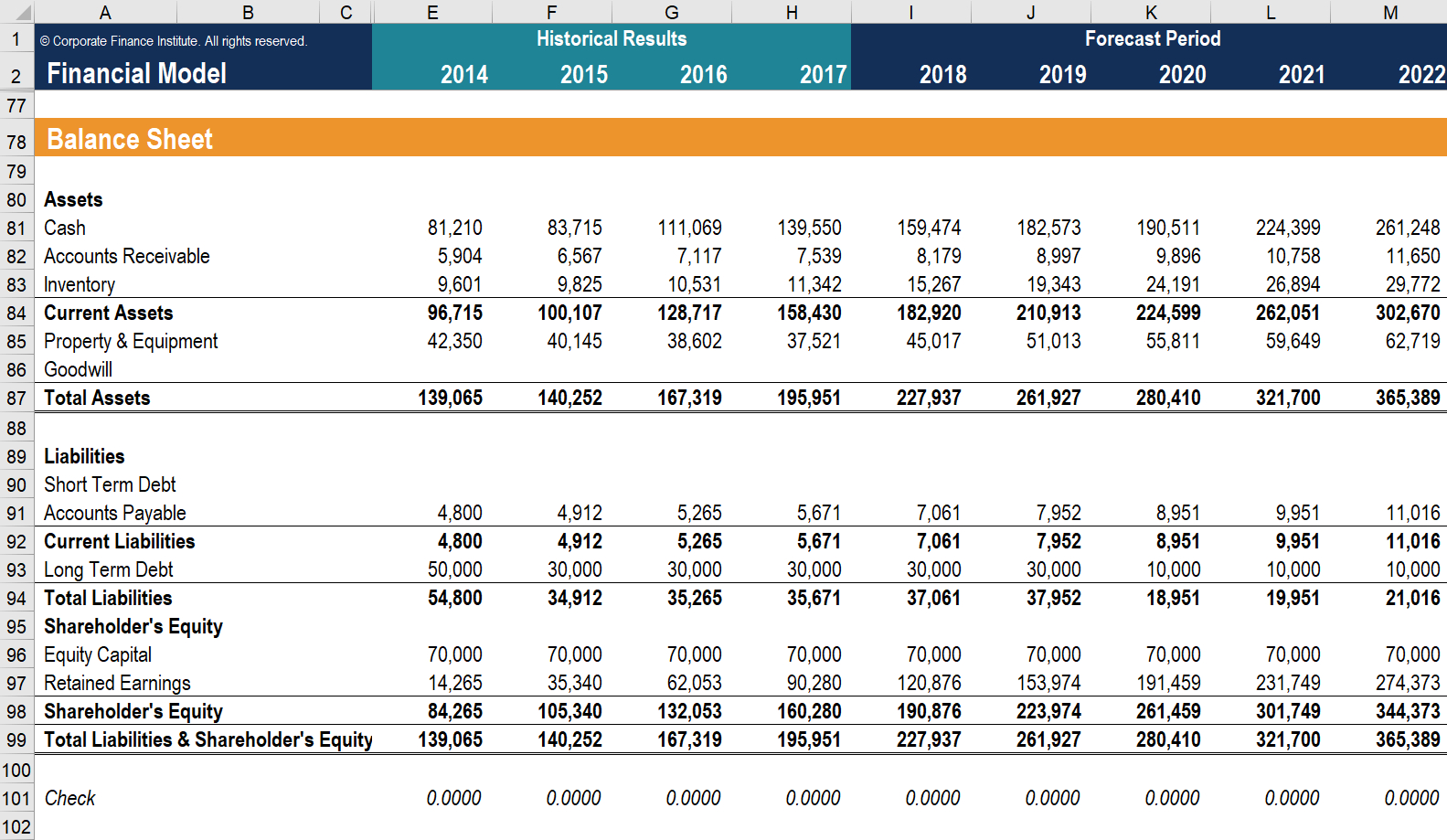

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. 16 mar 2021 background the committee received a submission. While spacs have typically classified warrants on their balance sheets as equity, under certain circumstances, the sec has highlighted that gaap would require warrants to be classified as a liability and measured at fair value every quarter, with.

Over on the balance sheet, warrant liabilities would show the fair value of the obligation (either short term or long term, depending on when the warrants expire);. The sec has issued new guidelines requiring spacs to classify or reclassify warrants as liabilities. Gaap guidebook the grantor usually recognizes warrants as of a measurement date.

As fixed assets age, they begin to lose their value. This means they have to appear on balance sheets quarterly. As an example, general electric reported on its december 31, 2008, balance sheet a liability for product warranties totaling over $1.68 billion.

The main use of warranty liability is in a company's accounts, specifically its balance sheet. The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity.