Marvelous Tips About Fifo Income Statement Ifrs 17 Balance Sheet Example

The other two key statements are.

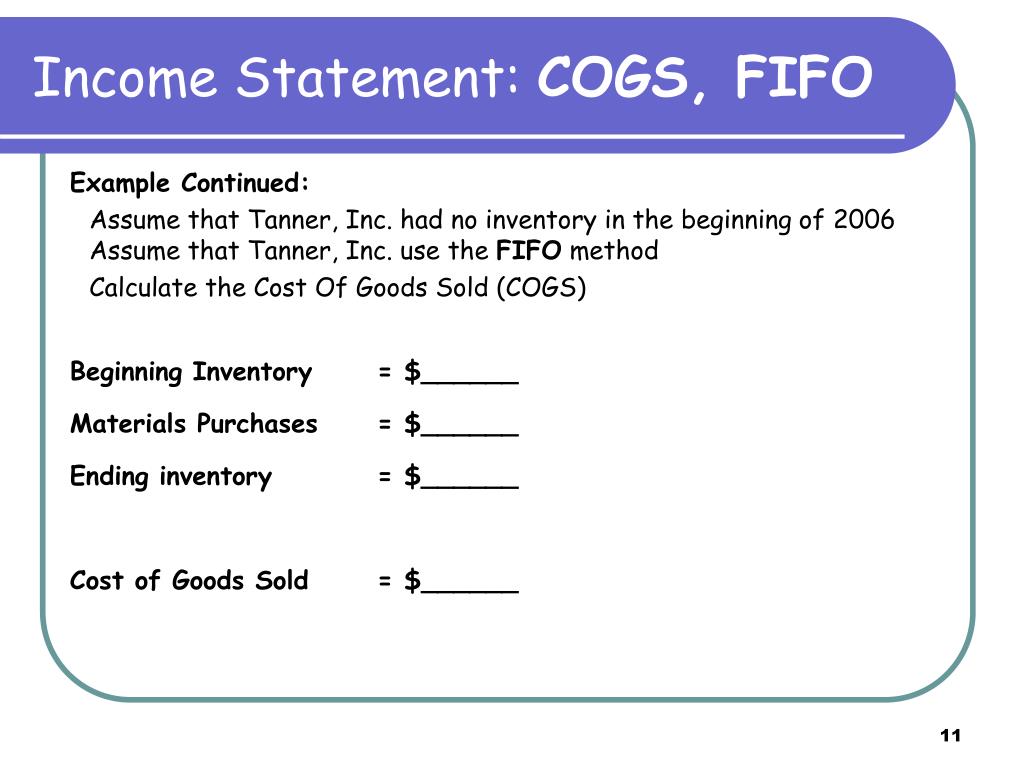

Fifo income statement. The company will report the oldest costs on its income statement, whereas its current inventory will reflect the most recent costs. It is reported annually, quarterly or monthly as the case may be in the business entity's income statement/profit & loss account. Sales = 3,000 units @ $20 each:

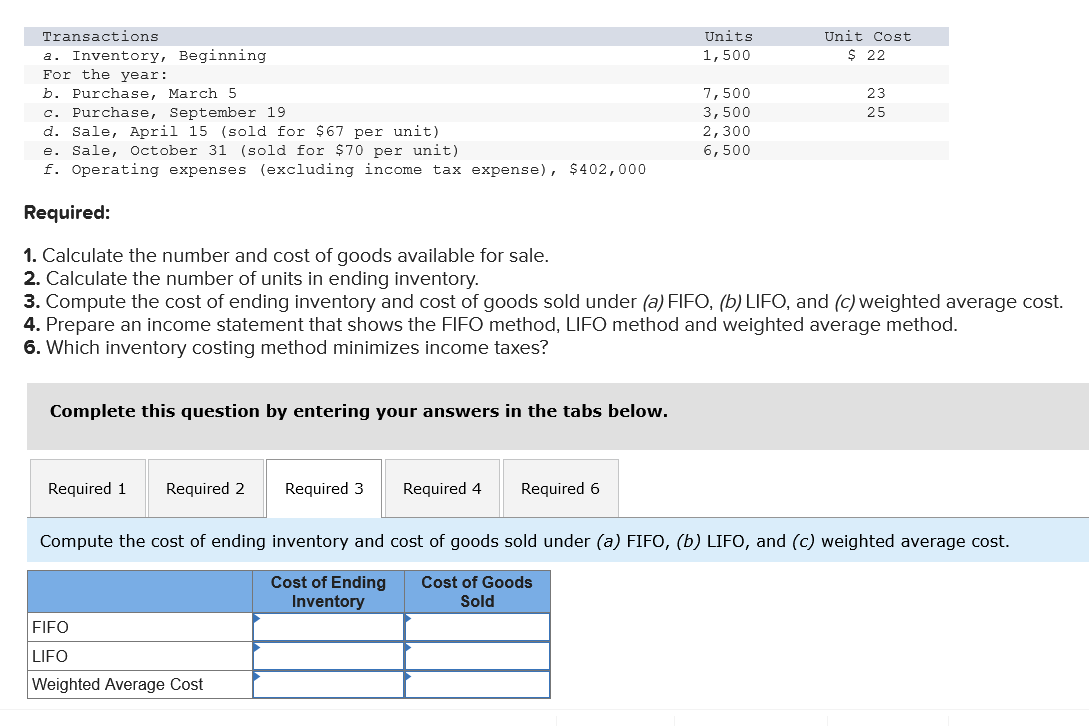

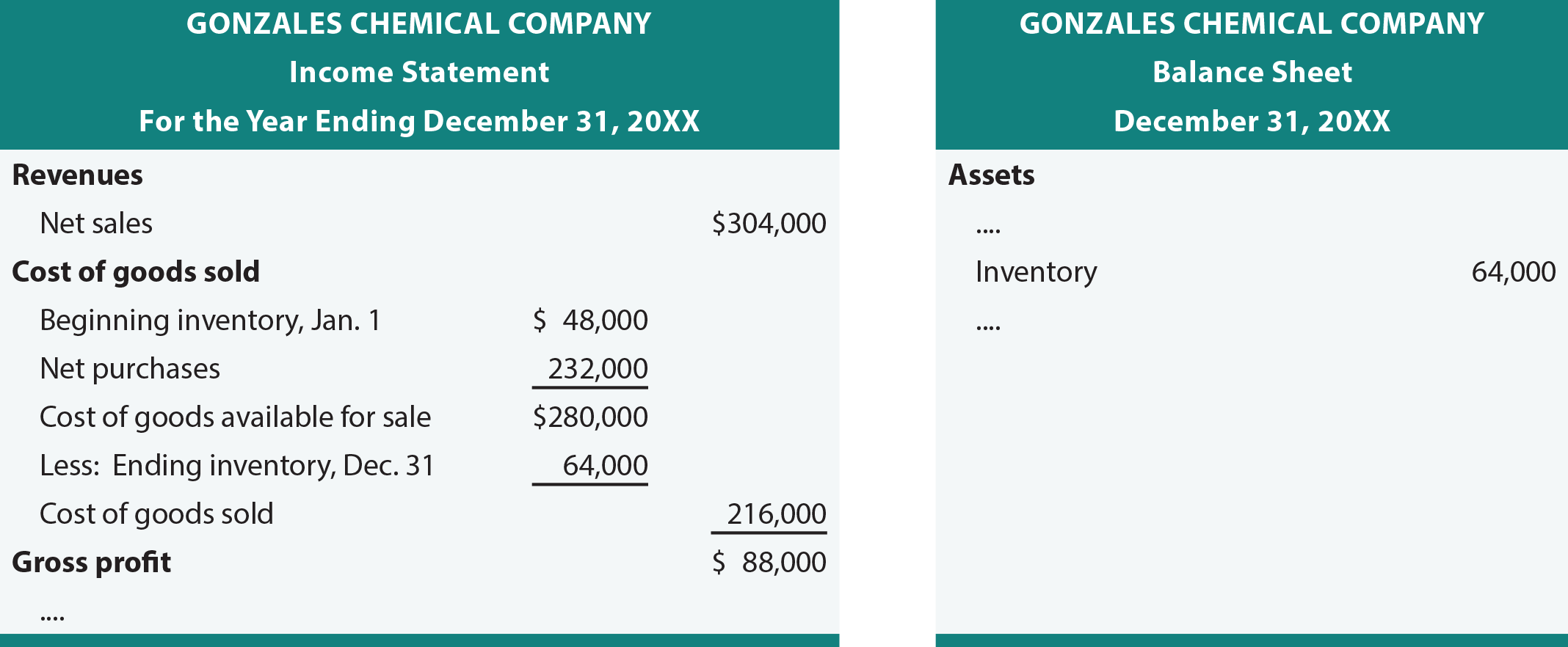

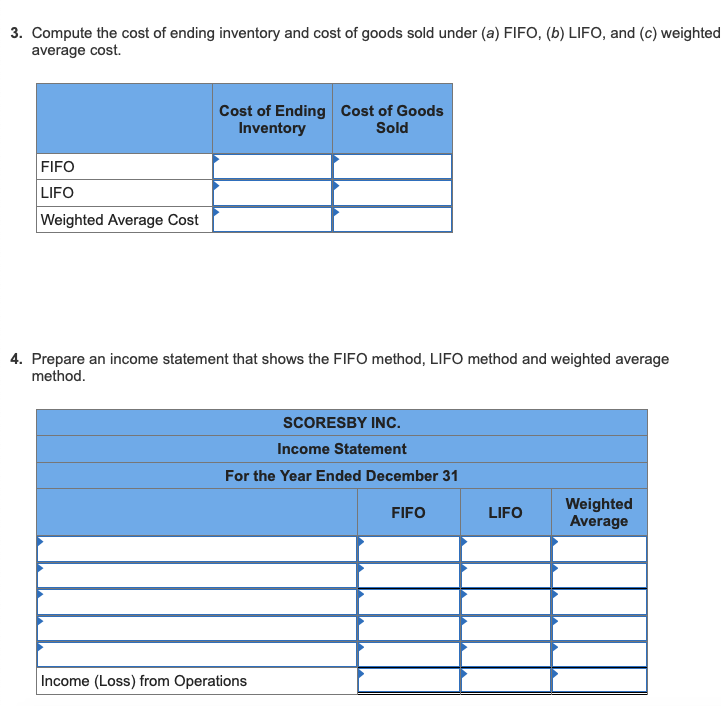

Under the fifo cost flow assumption, the first (oldest) costs are the first costs to leave inventory and be reported as the cost of goods sold on the income statement. This information helps a company plan for its future. 3 how do fifo and lifo affect your balance sheet?

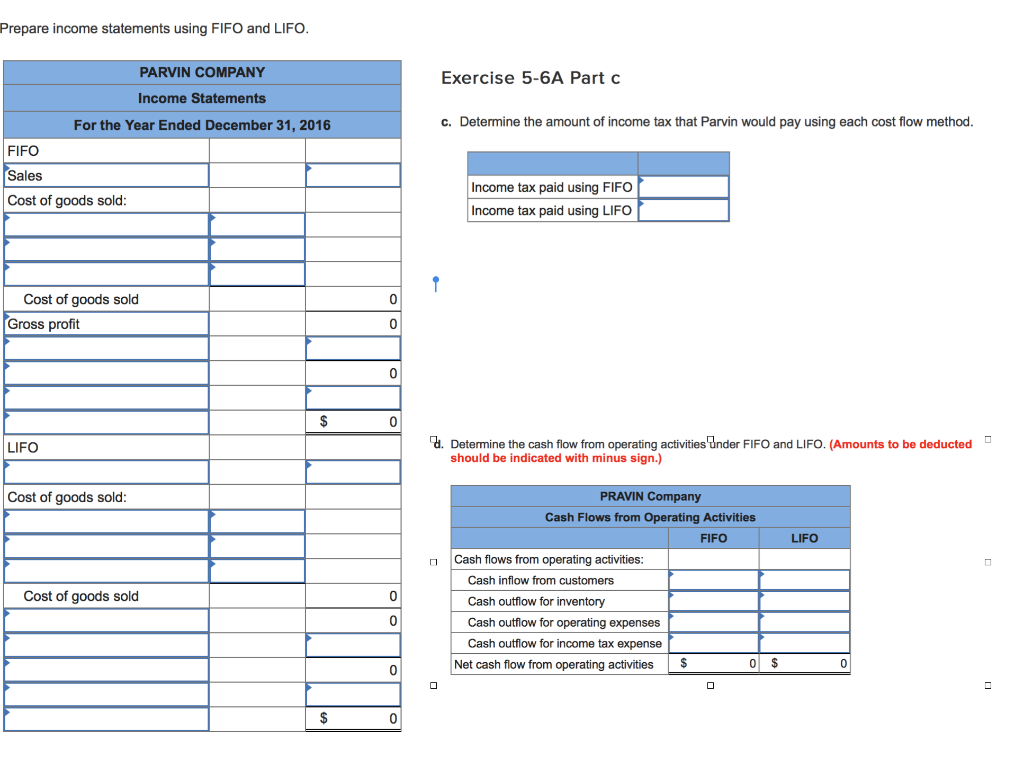

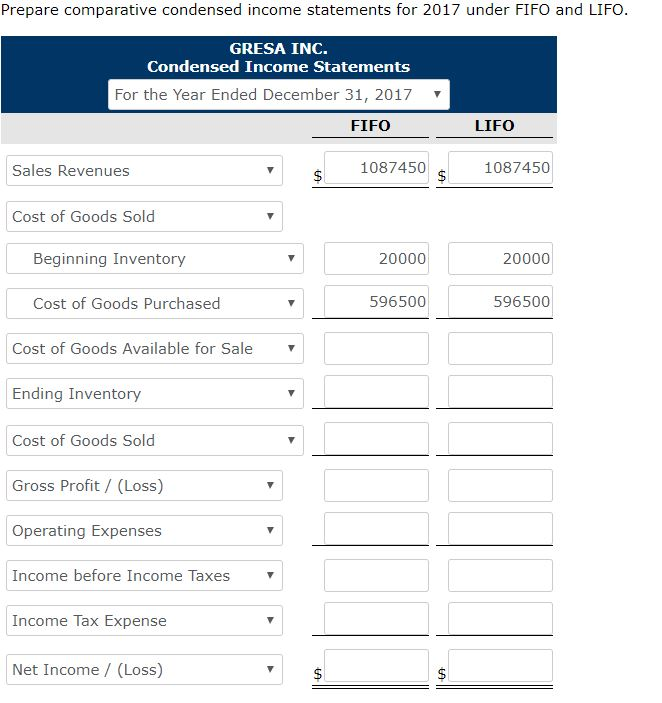

When a company uses lifo, the income statement reports both sales revenue and cost of goods sold in current dollars. Accounting for inventory, financial accounting Example bike ltd purchased 10 bikes during january and sold 6 bikes, details of which are as follows:

Of all the current assets on a firm's balance sheet, it is likely that inventory is the largest asset category in terms of value. The fifo method can result in higher income tax for a business to pay, because the gap between costs and profit is wider (than with lifo Along with it lowering taxable income, lifo supporters argue that its use also leads to a better matching of costs and revenues:

Inventory plays a critical role in a business firm's financial management. What is lifo (last in first out)? Table of contents differences between fifo and lifo definitions of fifo and lifo methods what is fifo (first in first out)?

Fifo is a good method for calculating cogs in a business with. The income statement shows the reader an overview of the company's revenues, cost of goods sold and general and administrative expenses. By ken boyd october 29, 2021 inventory is often the most significant asset balance on the balance sheet.

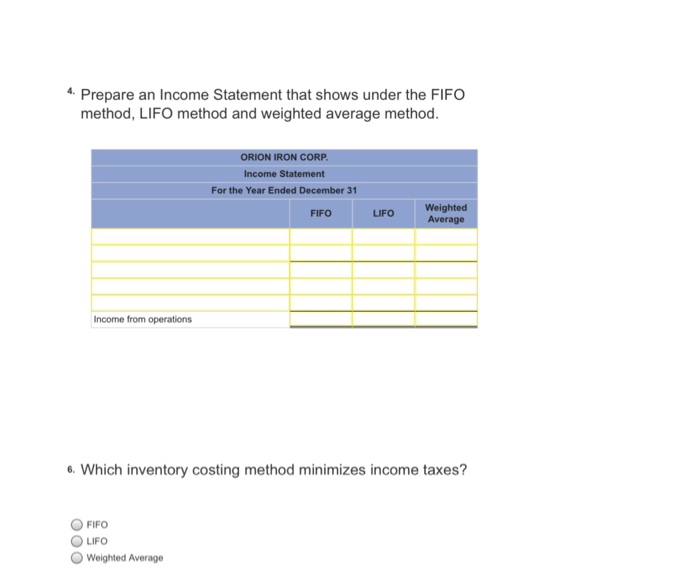

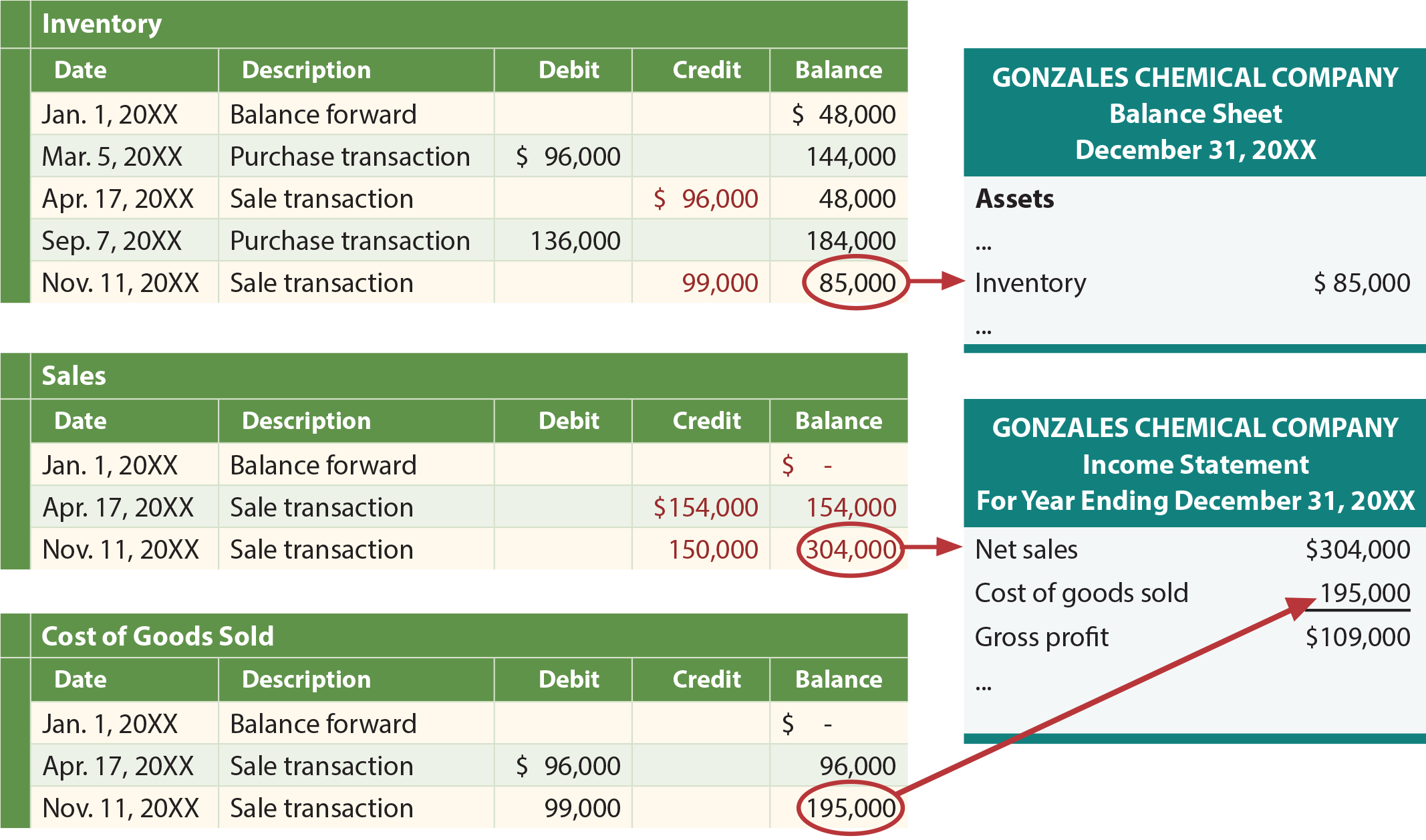

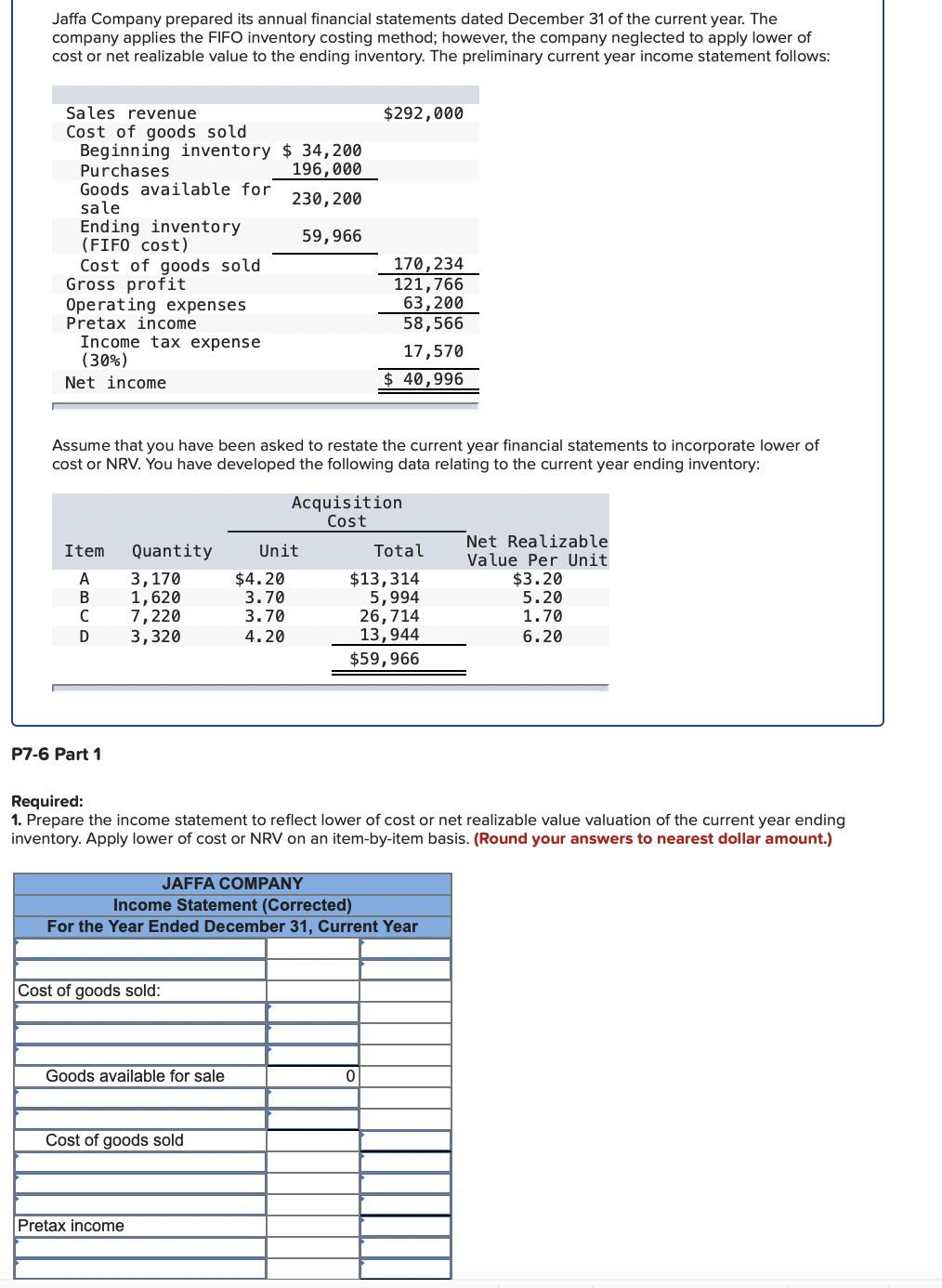

The resulting gross margin is a better indicator of management’s ability to generate income than gross margin computed using fifo, which may include substantial inventory (paper) profits. The firm uses fifo inventory accounting. The canton corporation shows the following income statement.

Be the first to add your personal experience 2 how do fifo and lifo affect your income statement? Canton corporation income statement for 20x1 $ 126,000 73,500 $ 52,500 sales cost of goods sold gross profit selling and administrative expense depreciation operating profit taxes (30%) aftertax income 7,560 12,700 $ 32,240 9,672. Fifo makes it difficult to manipulate the reported income in financial statements which is a great advantage.

The first in, first out. When an item is sold, inventory value must go down.

The question is, by how much? The remaining inventory assets are matched to assets most recently purchased or. When it comes time for businesses to account for their inventory, they typically use one of three different primary accounting methodologies: