Simple Tips About Interpreting Balance Sheet Additional Paid In Capital On

Assets have declined by about $1.3 trillion since june 2022.

Interpreting balance sheet. It is the first thing investors and banks want to see if you’re looking to raise additional capital, and typically what they rely on heavily to give you money. It is just like your bank balance. The group, posting results that showed operating profit hit a record last year, said its leverage ratio fell to 1.2 in the fourth quarter from 1.5 a year earlier, and launched a share buyback.

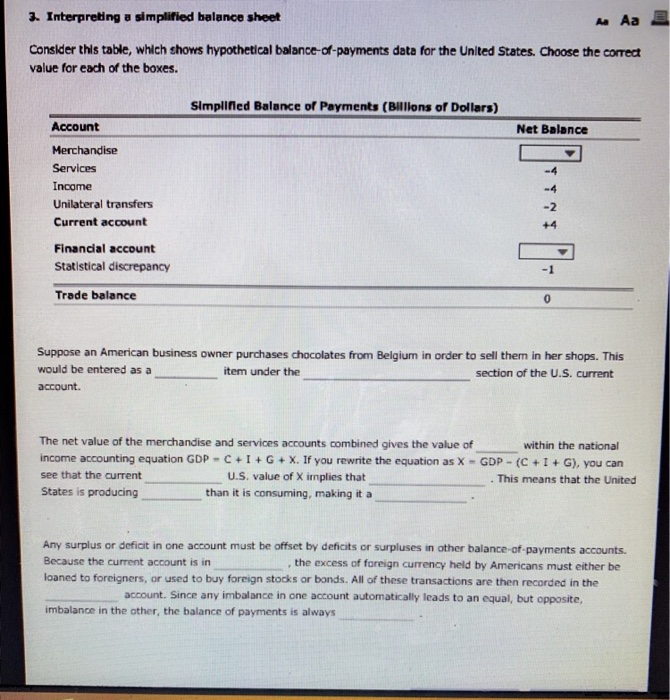

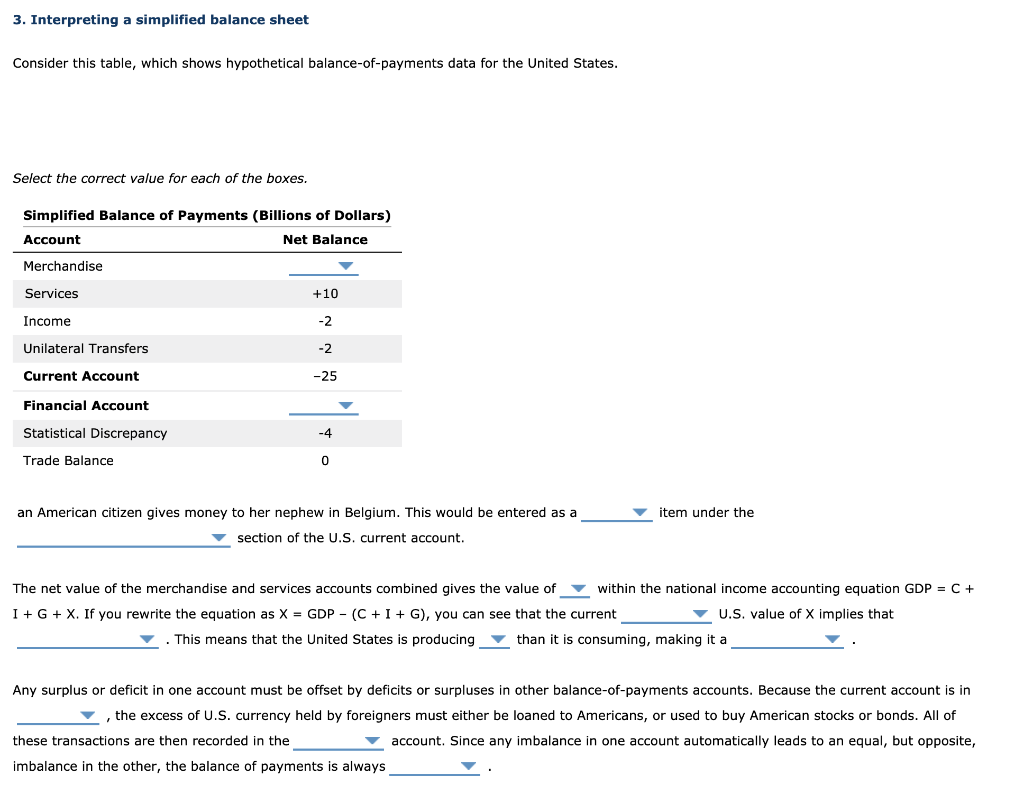

The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time. It is called a balance sheet because it adheres to the basic accounting equation: Based on provisional unaudited data.

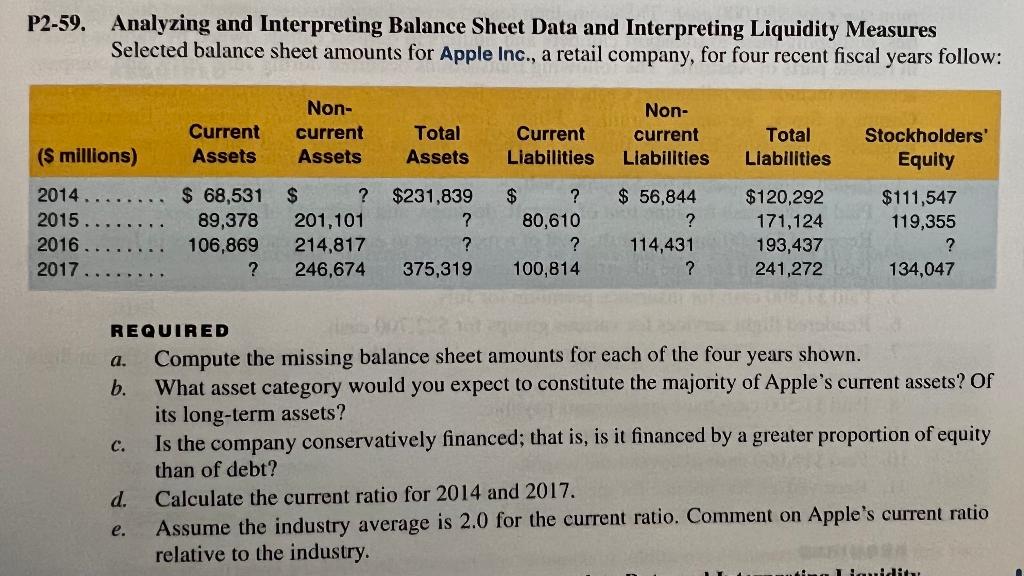

While all three contain important information, the balance sheet provides a balanced view of the company’s assets, liabilities, and equity. Keep in mind that just like with many other financial statements, it is often helpful to view and compare balance sheets from. 4 minutes in your company’s annual report, you’ll find a particularly dense section of numbers and tables.

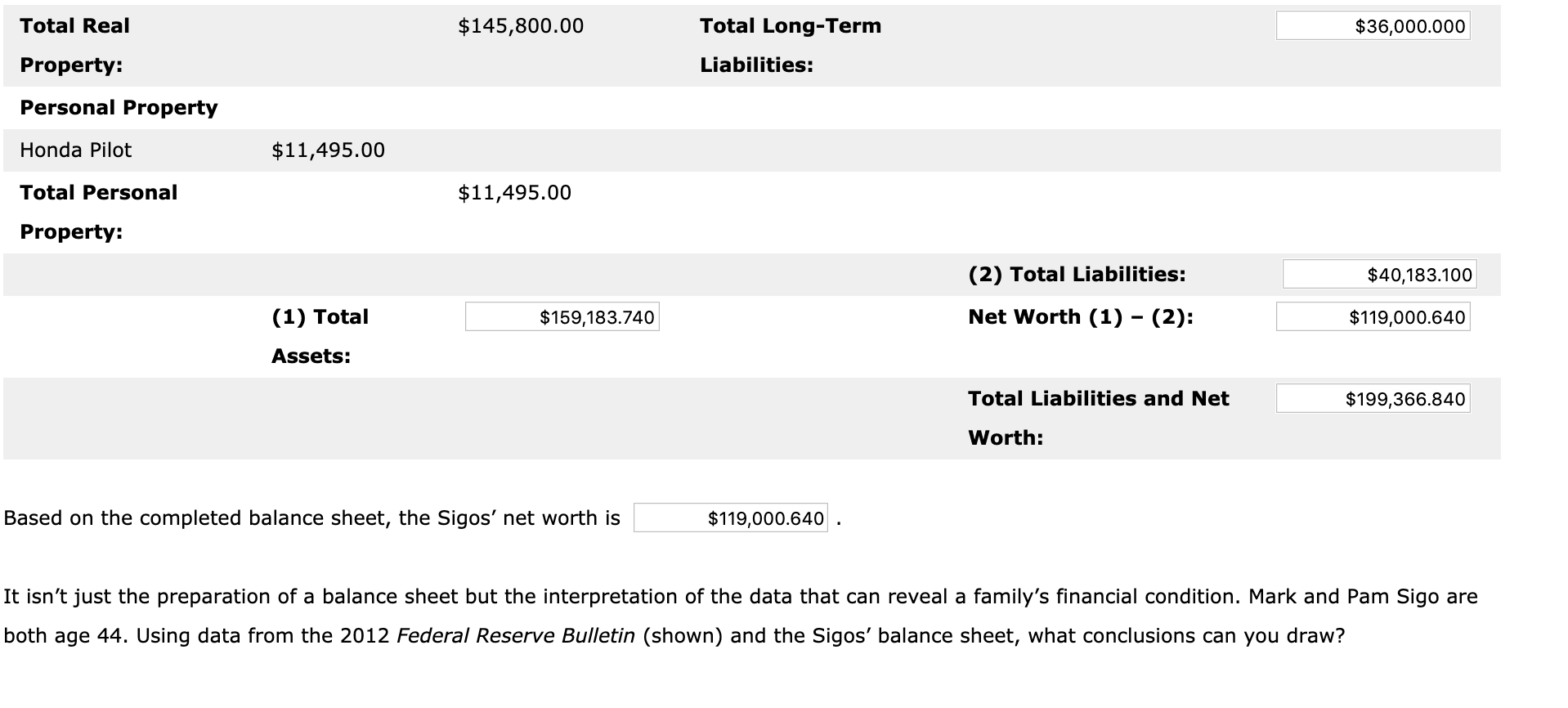

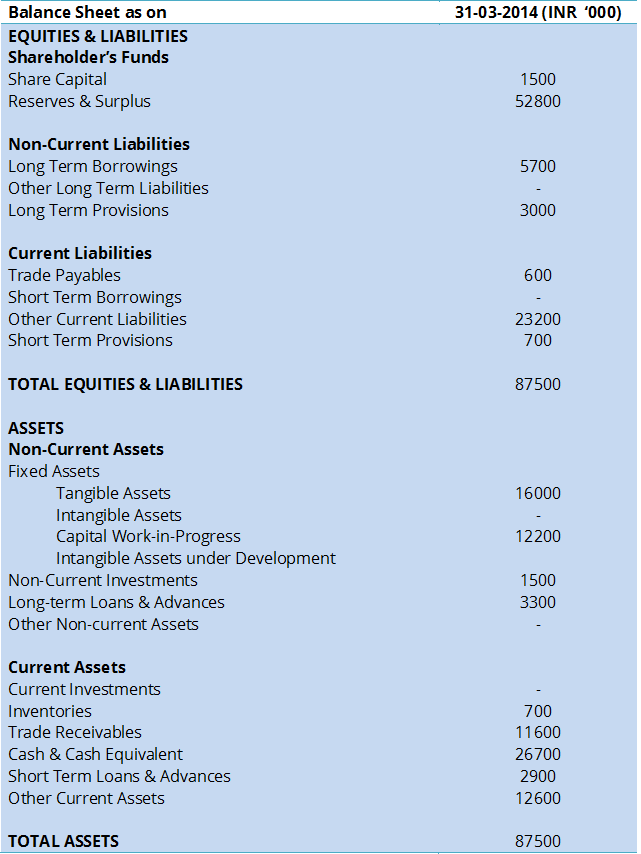

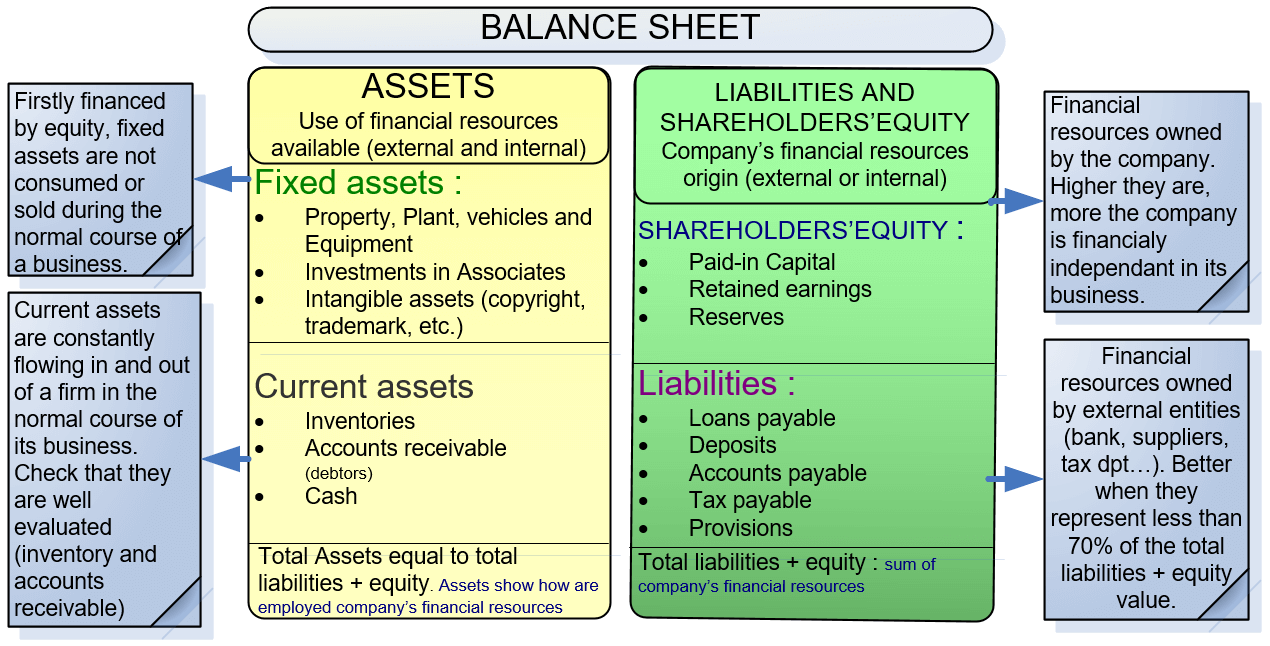

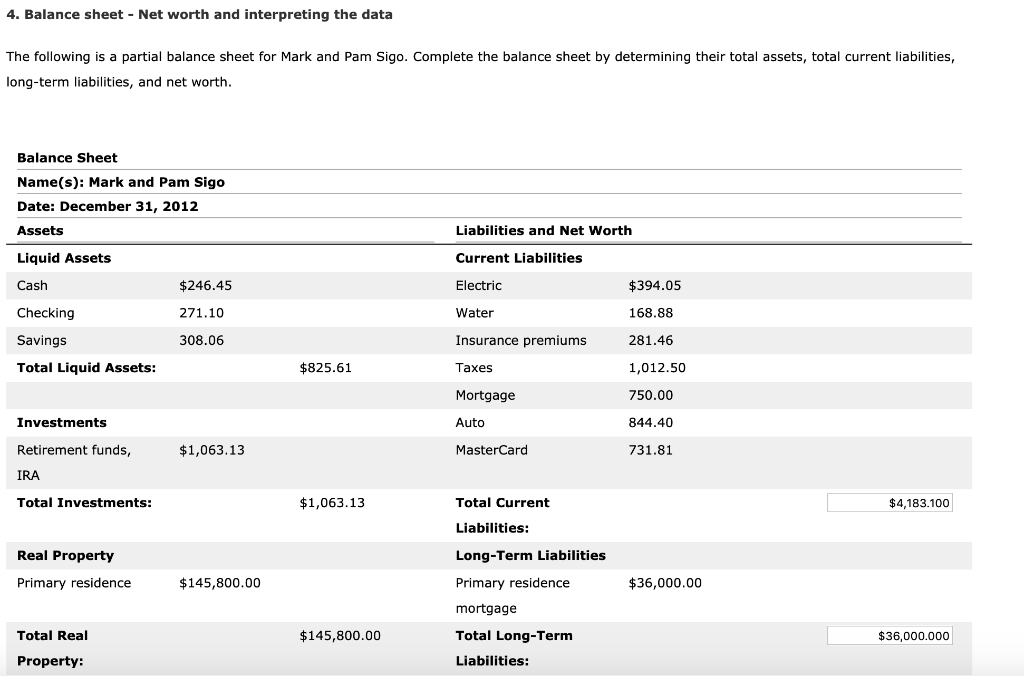

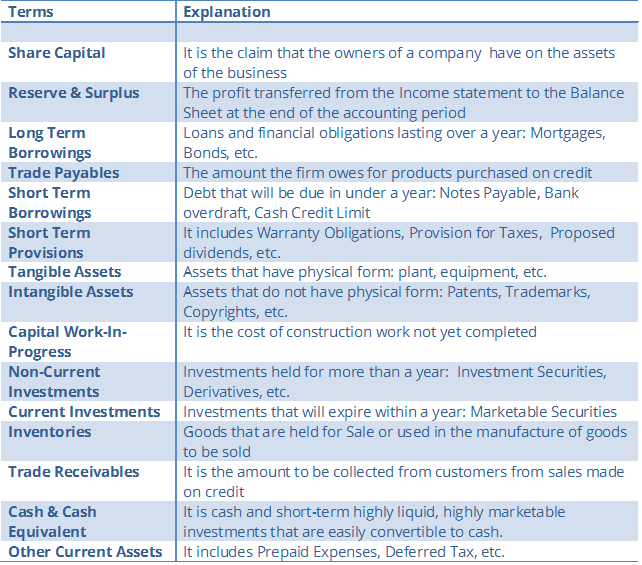

A balance sheet is a fundamental financial statement that provides a snapshot of a company’s financial health at a specific point in time. A company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth). Reading and understanding the balance sheet of the company includes consideration of the accounting equation, which states that the sum of the total liabilities and the owner’s capital is equal to the company’s total assets, knowing different types of assets, shareholders’ equity, and liabilities of the company and analyzing the balance sheet us.

A balance sheet lists the value of all of a company's assets, liabilities, and shareholders' (or owners') equity. Assets = liabilities + equity. Omission of certain intangible assets;

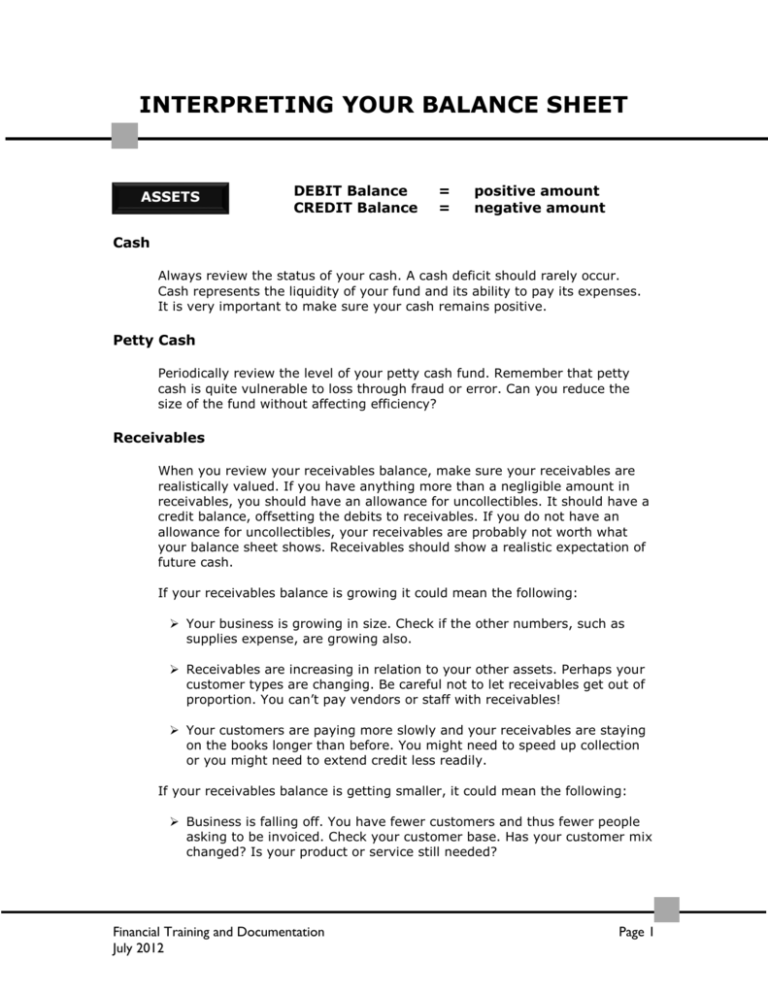

A balance sheet provides the financial snapshot of your business. The balance sheet, together with the income. Your balance sheet tells you how much value you have on hand ( assets) and how much money you owe ( liabilities ).

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. This ratio is shown below: It allows you to see what resources it has available and how they were financed as of a specific date.

Policymakers said slower qt could ease shift to ample. Balance sheets provide the basis for. Interpreting the balance sheet.

The income statement, the statement of cash flows, and the balance sheet. This equation ensures that both sides of the balance sheet. A statement released by a company to report its financial health at a given point in time.it is important for accountants and business owners to know how to read and interpret the balance sheet and act on it.

D/e ratio = total debt / shareholders' equity. This short revision video introduced and outlines the main features of a standard balance sheet. It can also be referred to as a statement of net worth or a statement of financial position.

![[Solved] Interpreting balance sheet changes Exhibi SolutionInn](https://s3.amazonaws.com/si.question.images/image/images4/65-B-A-B-S-C-F(433).png)

![[Solved] Interpreting balance sheet changes Exhibi SolutionInn](https://s3.amazonaws.com/si.question.images/image/images4/65-B-A-B-S-C-F(432).png)