Outrageous Tips About Operating Cash Flow Finance Accounts Not For Profit Organisation

Total current liabilities = $30 million + $15 million + $10 million = $55 million.

Operating cash flow finance. The cfo strategy for artificial intelligence. A company’s operating cash flow shows whether it can regularly generate enough cash to continue and grow its operations. Operating cash flow ratio components a company generates revenues—and deducts the cost of goods sold.

It indicates a company’s health and potential success, so it’s important for companies to know about it. Fostering data integrity in your fp&a reporting. Record adjusted ebitda margin fourth.

After entering our two metrics into the formula from earlier, the calculated operating cash flow ratio is 2.5x, meaning the company’s operating cash flow can cover its current. ($950 million of gross debt and $220 million cash on hand) financial. Free cash flow is the cash that a company generates from its business operations after subtracting.

First, you want to see whether operating cash flow is positive. This financial metric shows how much a company earns from its operating activities, per dollar of current liabilities. Here are more details on operating cash flow:

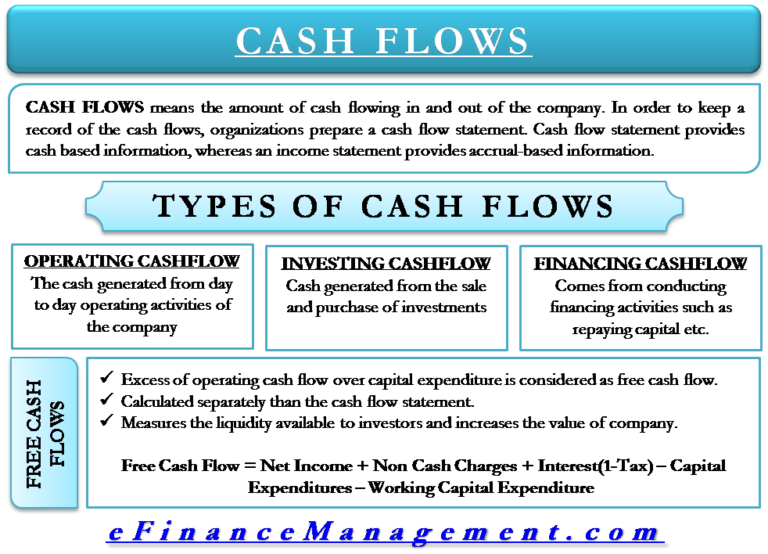

Free cash flow 3 of $294 million. It's widely used to evaluate a company’s. Abbreviated as ocf, operating cash flow is the amount of cash generated by the operating activities of a business.

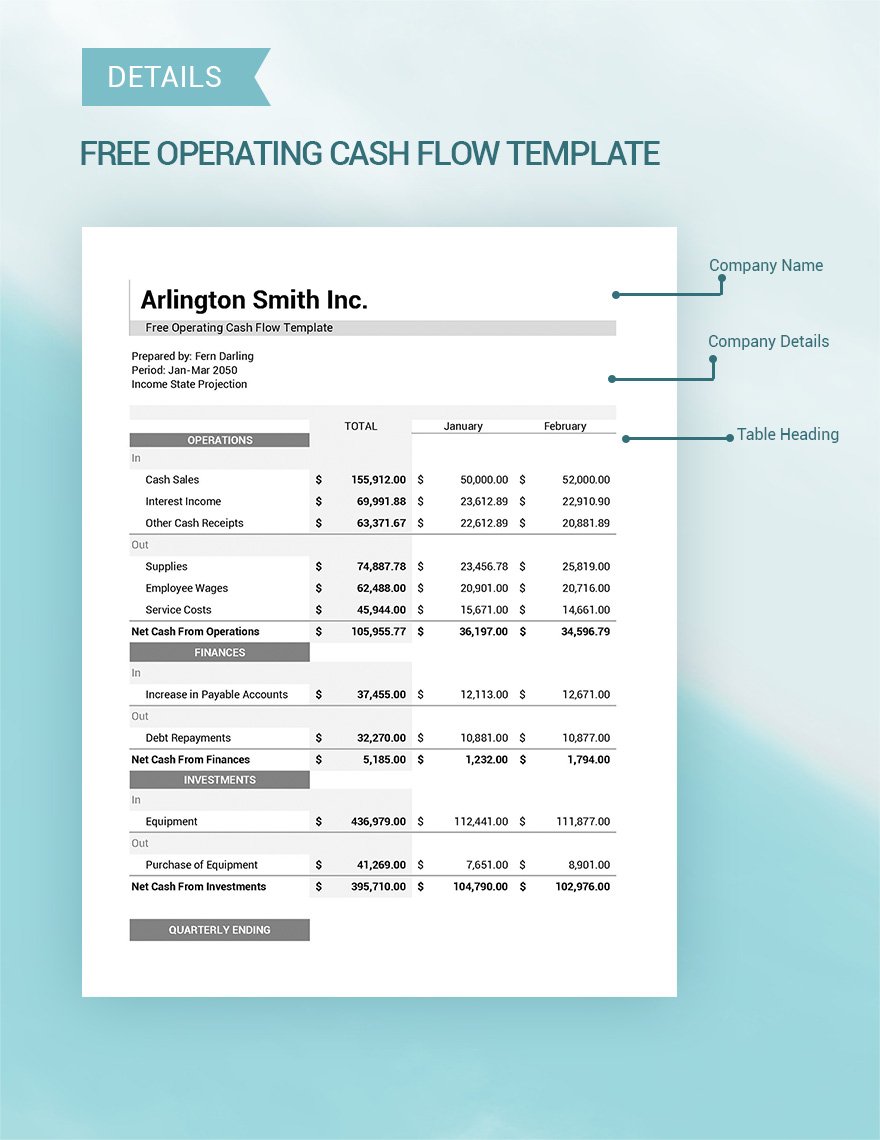

The operating cash flow serves as the first section of your company’s cash. Operating cash flow is the net amount of cash that an organization generates from its operating activities. Operating cash flow definition of operating cash flow.

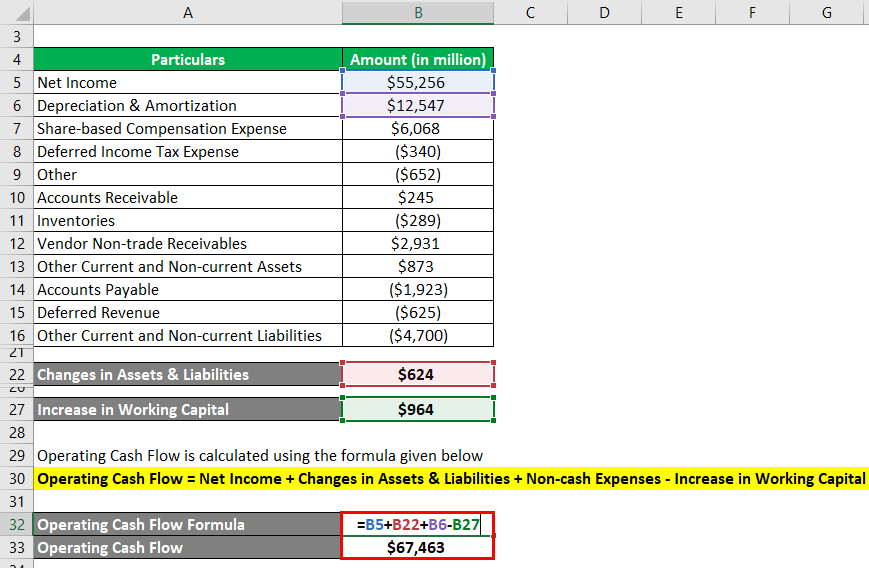

The operating cash flow ratio, a liquidity ratio, is a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business operations. Cash provided by operating activities from continuing operations of $504 million. It’s calculated like this:

This information is used to determine the viability of the core operations of a business, since positive cash flow is needed to maintain and grow a firm’s operations. Carrefour , europe's largest retailer, said on tuesday it was confident about this year as it reported record cash flow of 1.62 billion euros ($1.8 billion) for 2023 and operating profit up 18.5%. Operating cash flow:

Operating cash flow, also known as operating cash or ocf, is a critical financial metric that measures the amount of cash generated from a business's core operations.businesses of all sizes need to understand and monitor operating cash flow, as it can provide insight into a company's financial. What operating cash flow tells you about your company’s financial health. Operating cash flow (ocf), also known as cash flow from operations (cfo), is the net amount of cash generated from a company's normal operations during a specific time frame.

Operating cash flow (ocf), often called cash flow from operations, is an efficiency calculation that measures the cash that a business produces from its principal operations and business activities by subtracting operating expenses from total revenues. Operating cash flow measures cash generated by a company's business operations. Cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.financial statement users are able to assess a company’s strategy and ability to generate a profit and stay in business by assessing how much a company.

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)