Who Else Wants Info About Difference Between Balance Sheet And Statement Of Financial Position Service Business

Net worth, or equity capital, equals total assets minus total liabilities.

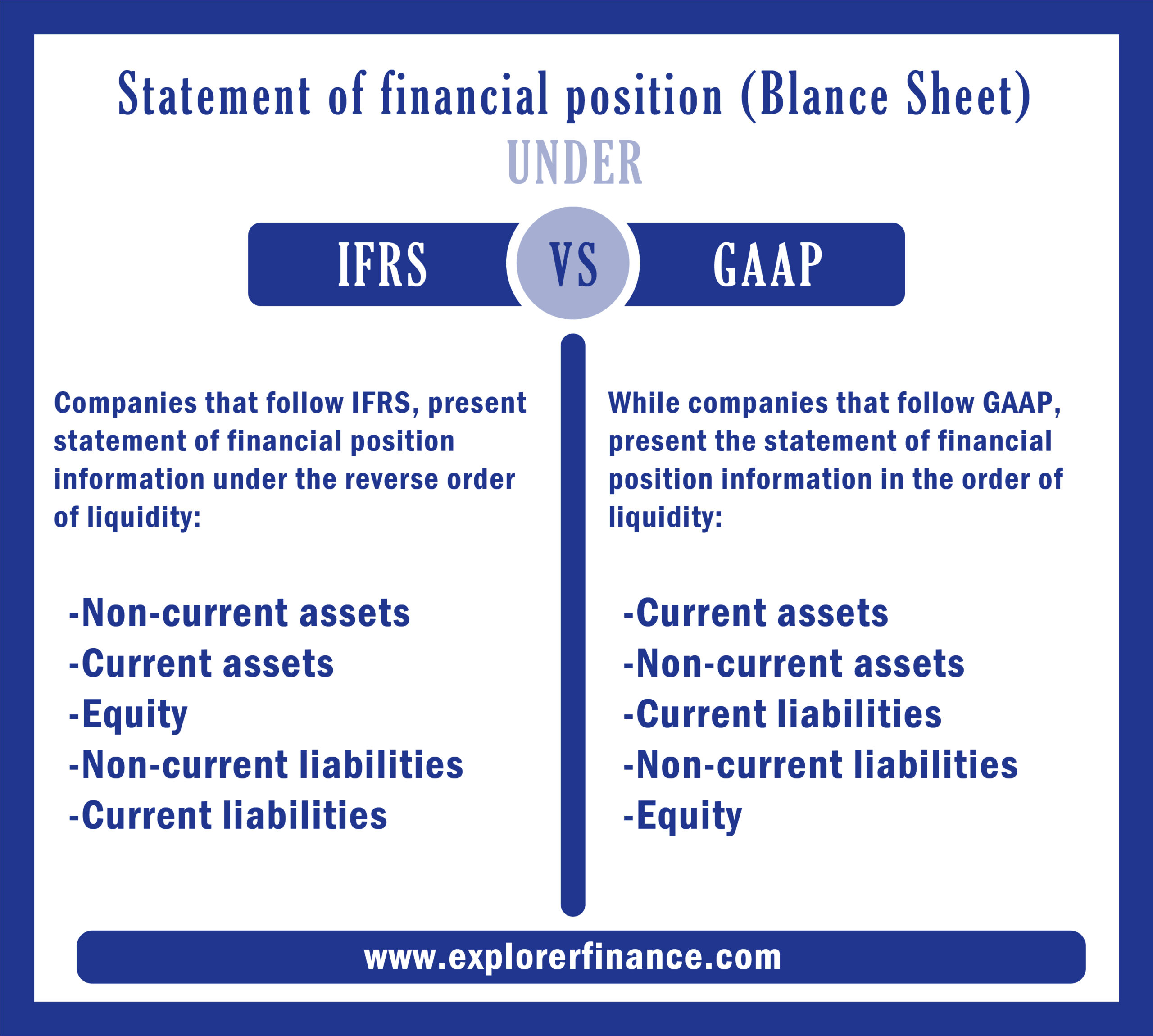

Difference between balance sheet and statement of financial position. Both, balance shelf and statement of financial position, are financial statements that offer certain overview of the manner to. The biggest difference between a financial statement and a balance sheet is the scope of each. A balance sheet has a narrower scope, as it is only one part of a financial statement.

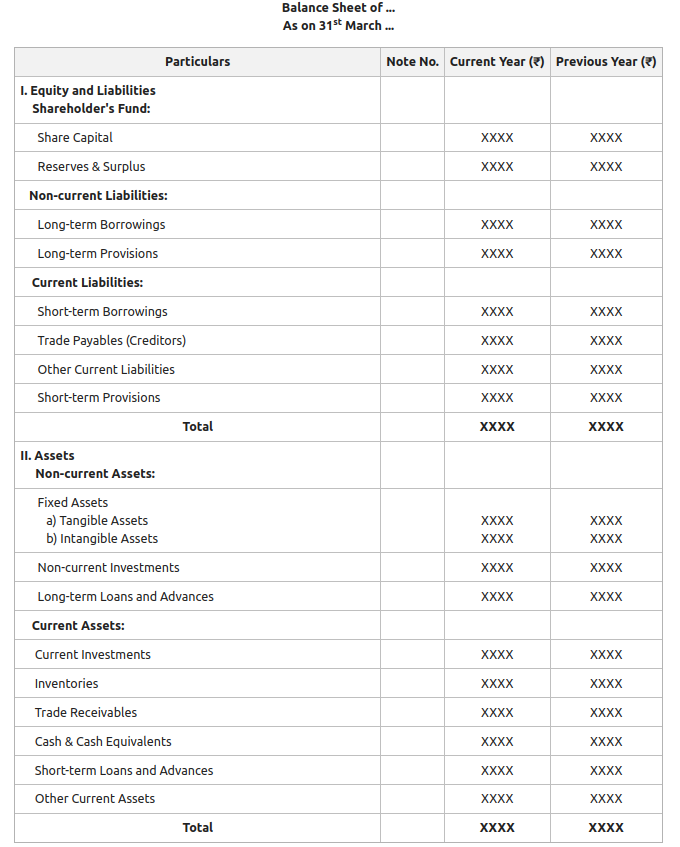

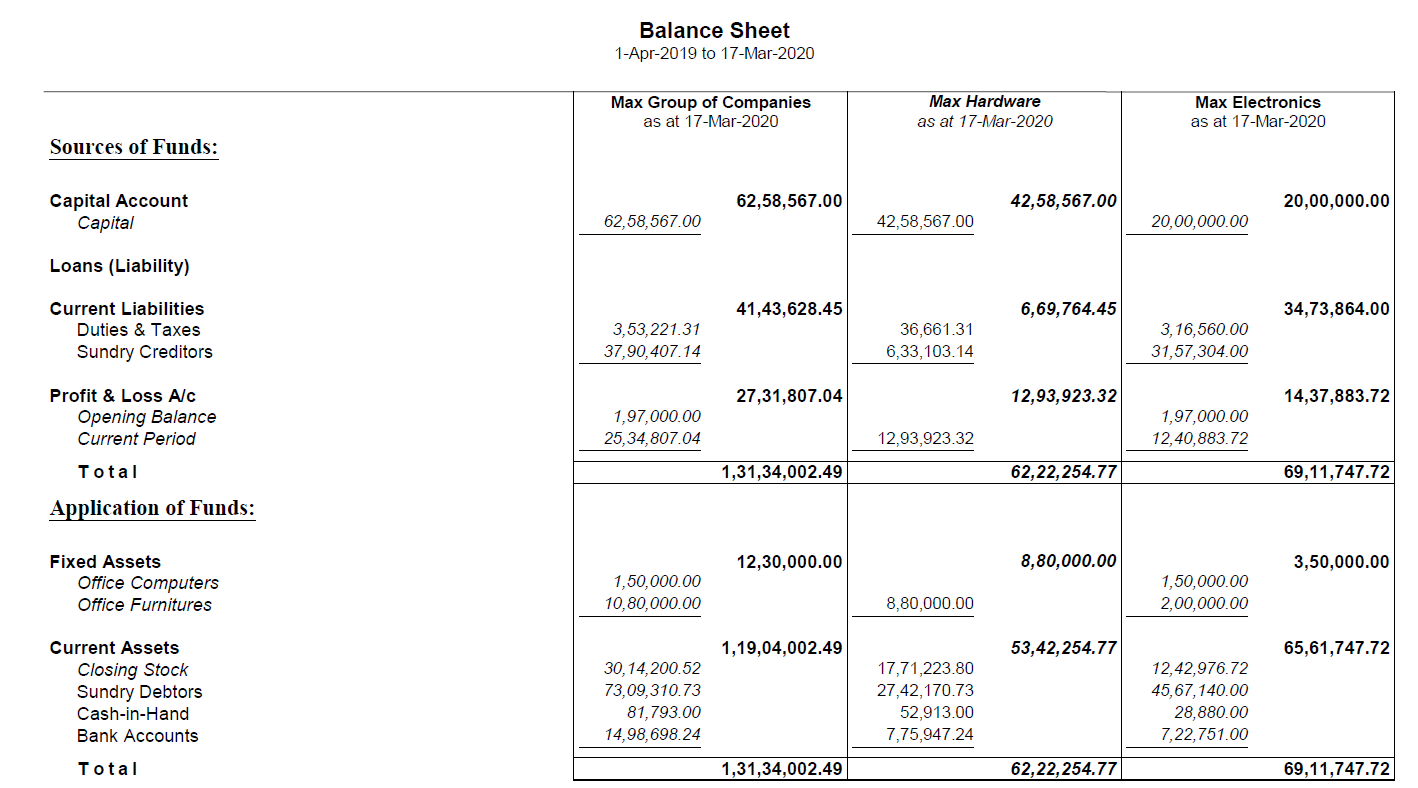

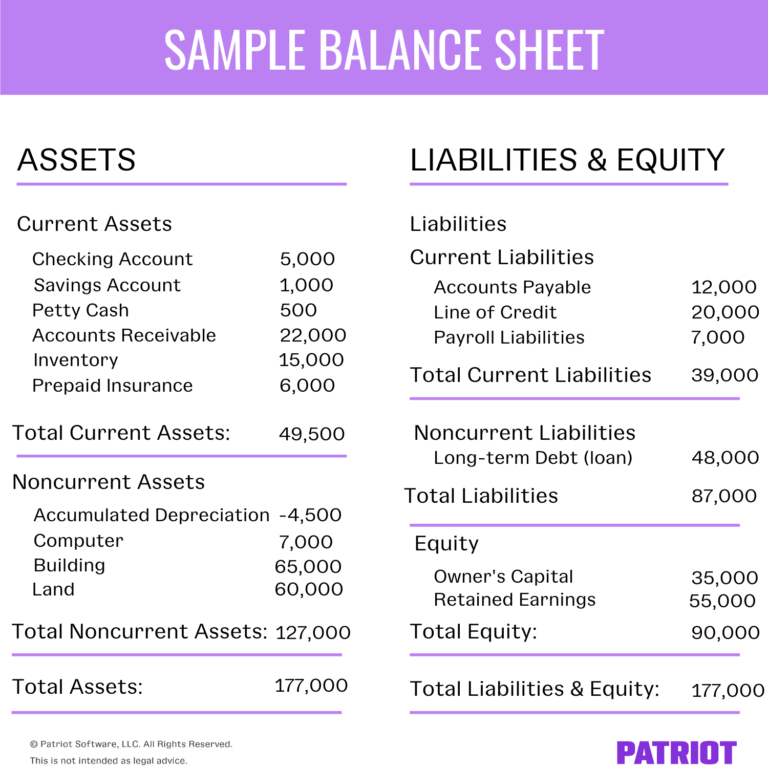

A balance sheet is a precise representation of the assets, liabilities, and equity of the entity, whereas, a financial statement is a representation of a formal record of the financial activities of an entity. It provides information on a company’s assets, liabilities, and equity. While a balance sheet helps businesses evaluate their assets, details from the entire financial statement are necessary to give this information context.

Here's the main one: To provide a snapshot of company's assets owned and liabilities owed to its. By evan tarver updated february 10, 2022 reviewed by margaret james fact checked by suzanne kvilhaug balance sheet vs.

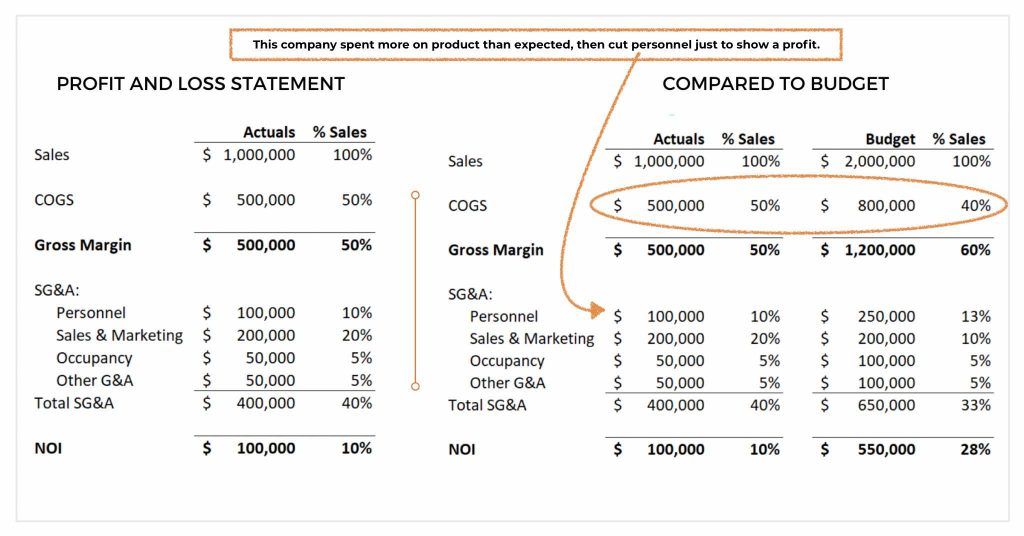

Balance sheets and statements of financial position are comparable since they both provide a summary of a firm’s financial position at the end of the year. The balance sheet shows a company’s total value while the income statement shows whether a company is generating a profit or a loss. Overview of the three financial statements

A statement that represents the financial position of the company is known as balance sheet. The balance sheet and statement of financial position are perplexing by many to be the same thing, but on are, however, a number regarding differences between balance sheet and statement of financial position. A statement that tracks the financial activities of the business is known as financial statement.

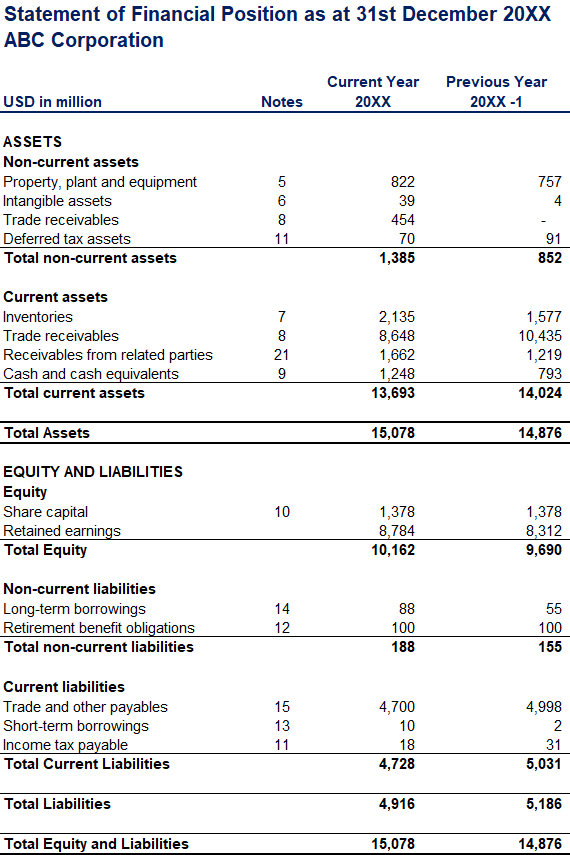

The balance sheet, also known as the statement of financial position, is one of the five essential financial statements that provide crucial financial information about an entity at the end of the balance sheet date. A company owns or controls assets such as cash, investments, inventory, property, and equipment. Basis for comparison balance sheet financial statement;

And the difference between how much it owns and how much it owes is called owners’ equity. In other words, it lists the resources, obligations, and ownership details of. While a balance sheet provides a snapshot of a company’s financial position at a specific point in time, a financial statement presents a comprehensive overview of a company’s.

One key difference between the balance sheet and the statement of financial position lies in the terminology used. An overview the balance sheet and cash flow. Key differences between balance sheet and financial statement.

The balance sheet reports the assets, liabilities and shareholder equity at a specific point in time, while a p&l statement summarizes a company's revenues, costs, and. A balance sheet is a specific component of a financial statement. First, it can help you better understand a company’s financial position.

Key highlights the three core financial statements are 1) the income statement, 2) the balance sheet, and 3) the cash flow statement. These three financial statements are intricately linked to one another. Statement of financial position what's the difference?

![[Ultimate] Difference Between Balance Sheet and Cash Flow Statement](https://i.pinimg.com/originals/eb/78/b7/eb78b7fc2d01a284c36cc4ca3ca7bace.png)

.png)