Simple Info About Current Ratio Calculation Analysis Excel

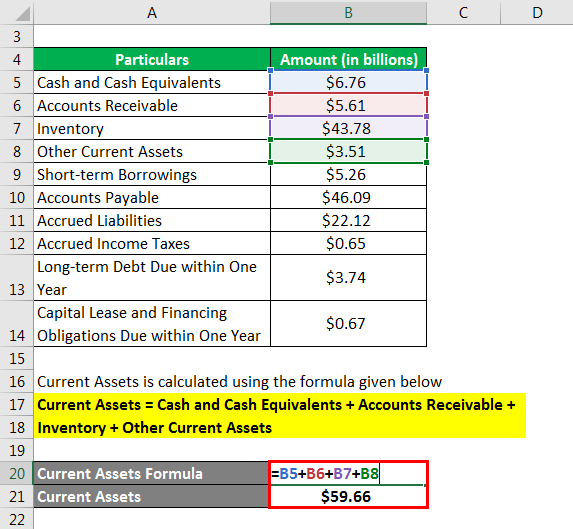

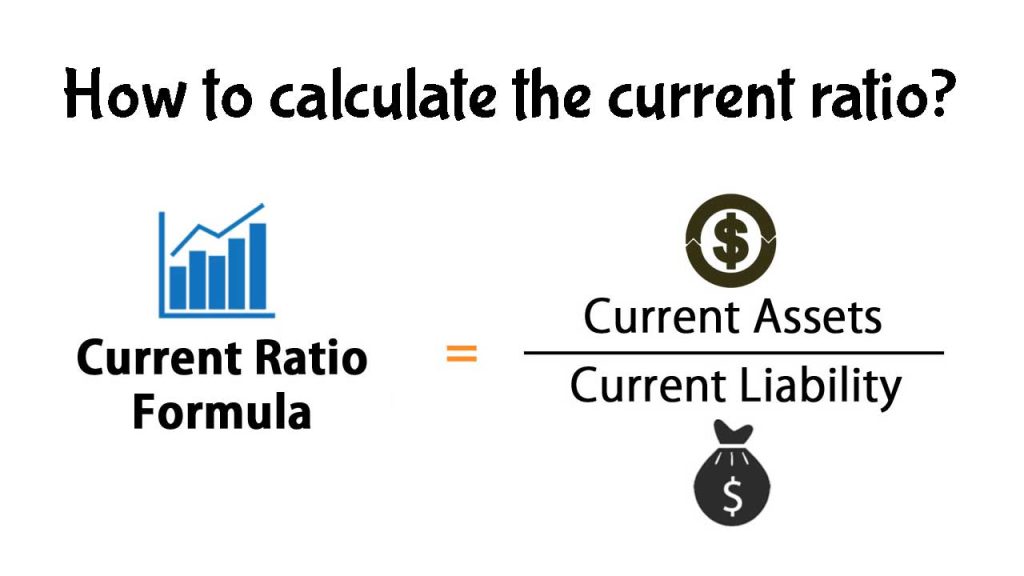

The current ratio is calculated as the current assets of colgate divided by the current liability of colgate.

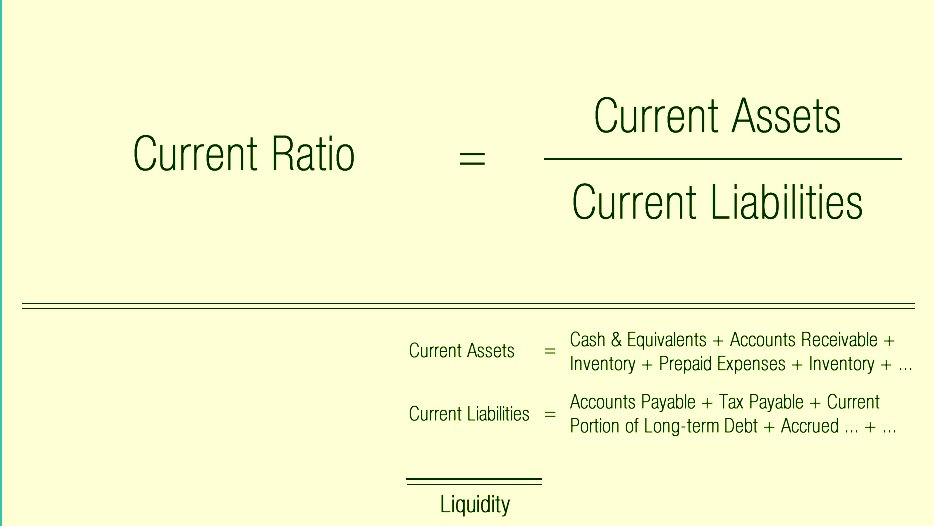

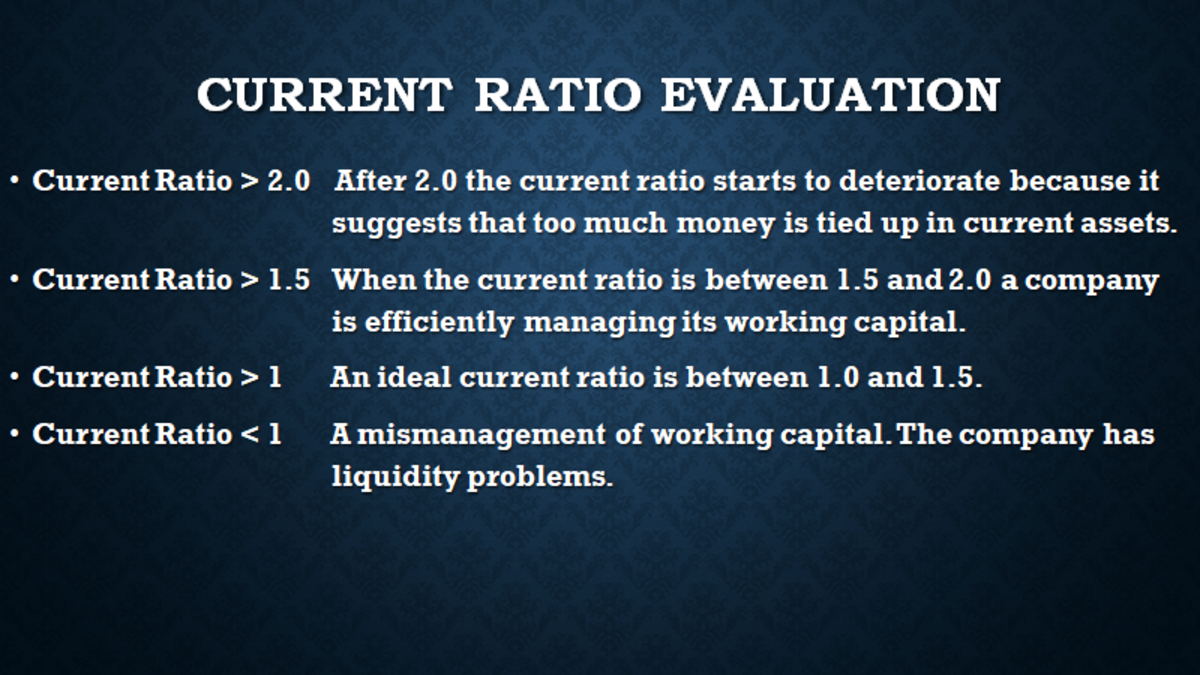

Current ratio calculation. 1.59 worth of assets to pay back every re. Current assets → cash and cash equivalents, marketable securities, accounts receivable (a/r), inventory current liabilities → accounts payable (a/p), accrued expense,. A current ratio of one or more is preferred by investors.

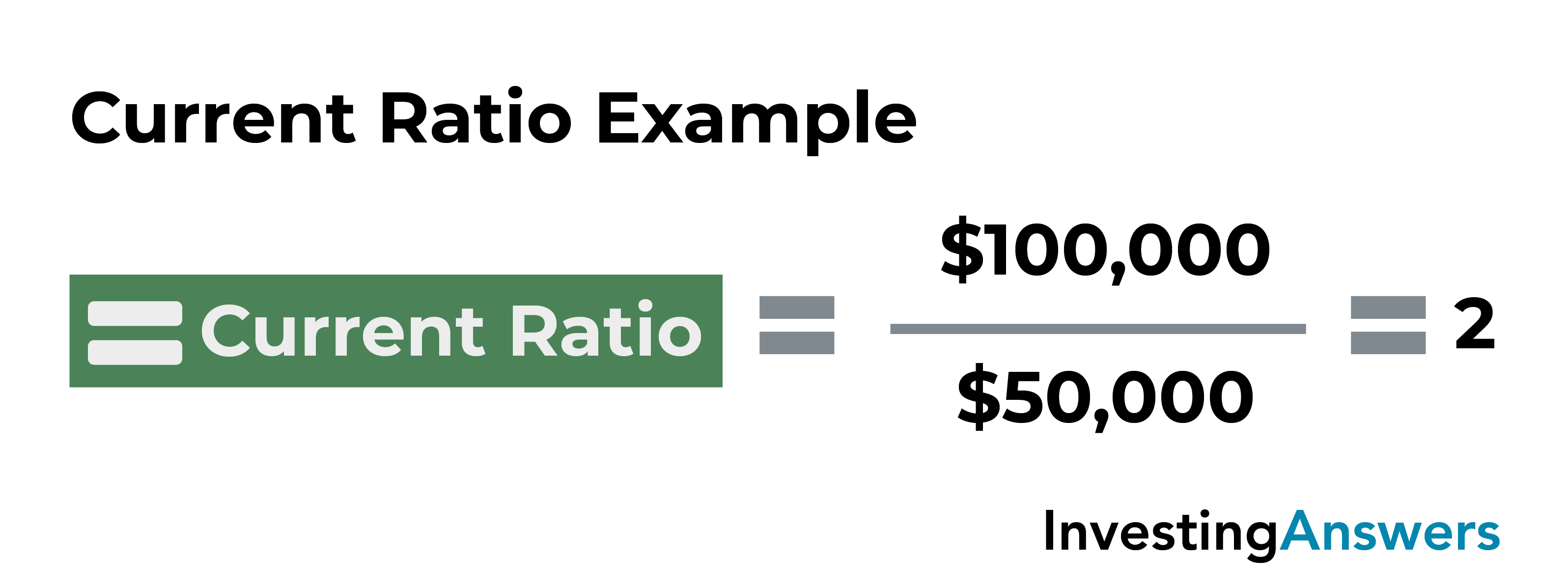

This relationship can be expressed in the form of following formula or equation: The calculator will then provide you with the trends and a graph using your financial year on year metrics. For example, in 2011, current assets were $4,402 million, and current liability was $3,716 million.

Our current ratio calculator will allow you to calculate not only the current ratio but also the historical financial ratios as well as the year on year ratio changes. Gaap requires that companies separate current. Likewise, we calculate the current ratio for all other years.

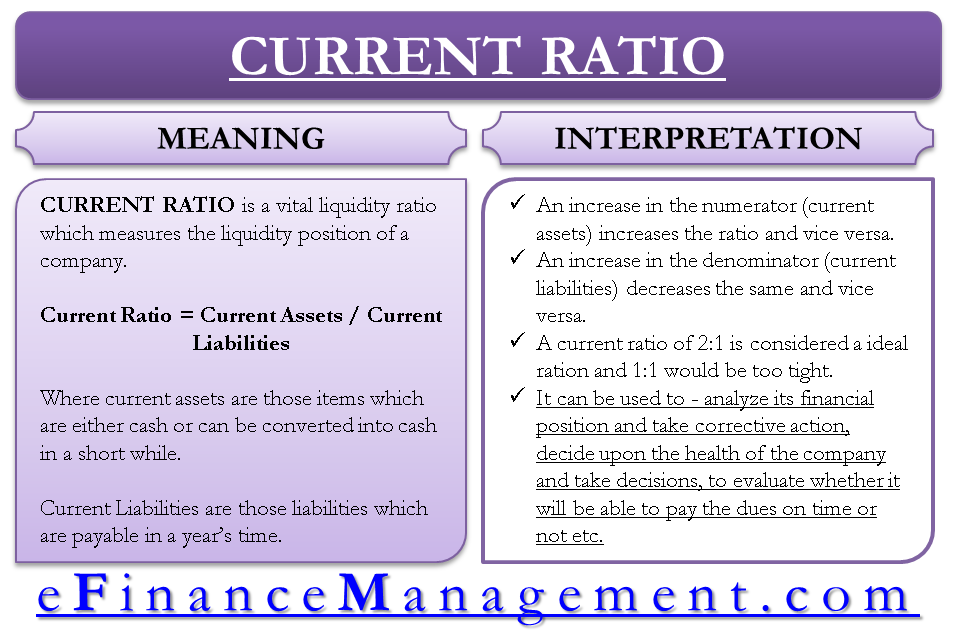

The current ratio is calculated simply by dividing current assets by current liabilities. Thus, the current ratio of shine enterprises is 1.59:1. The resulting number is the number of times the company could pay its current obligations with its current assets.

Current ratio formula. The current ratio is a simple measure that estimates whether the business can pay debts due within one year out of the current assets. The current ratio includes inventory and prepaid expenses in the total current assets calculation within the formula.

Calculate your current ratio with bankrate's calculator. This is easy to set up on a balance sheet template using tools like excel or google sheets. This ratio is stated in numeric format rather than in decimal format.

Heloc rates today, february 19, 2024: To calculate current ratio, you’ll need the firm’s balance sheet and the following formula: \text {current ratio}= \frac {\text {current.

The average rate for home equity lines of credit hit 9.44%, to hold steady. How to calculate current ratio? Above formula comprises of two components i.e.,.

This implies that the firm has rs. The formula for calculating the current ratio is as follows: Example of the current ratio formula.

Current ratio is computed by dividing total current assets by total current liabilities of the business. Let's look at the balance sheet for company xyz: First of all, you have to check the financial statement of the analyzed company.

:max_bytes(150000):strip_icc()/Current_Ratio-eb91b25d3dcb46439d4f733dc19d0a0f.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)