Awesome Info About Property Income Statement Prepare The Financial Report

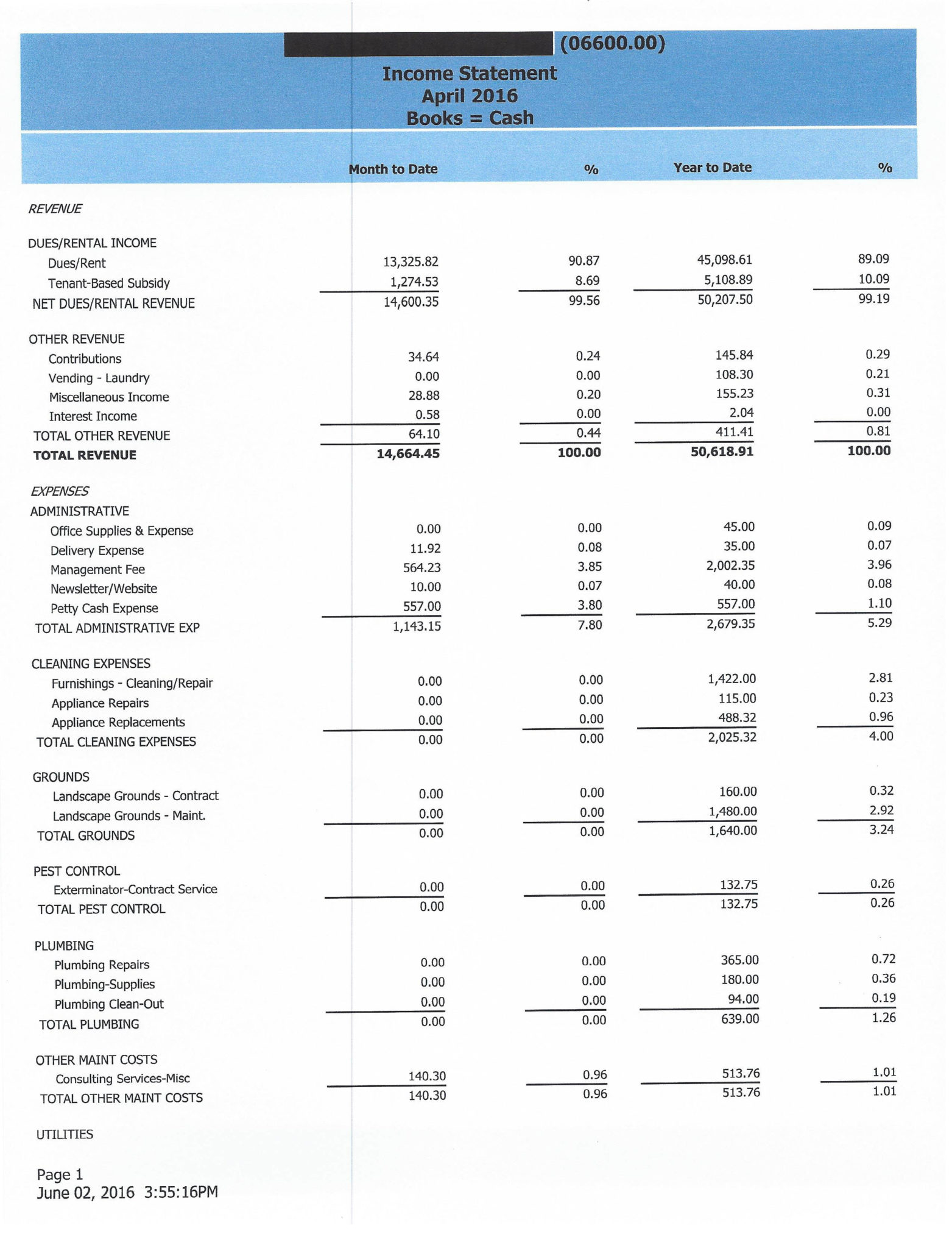

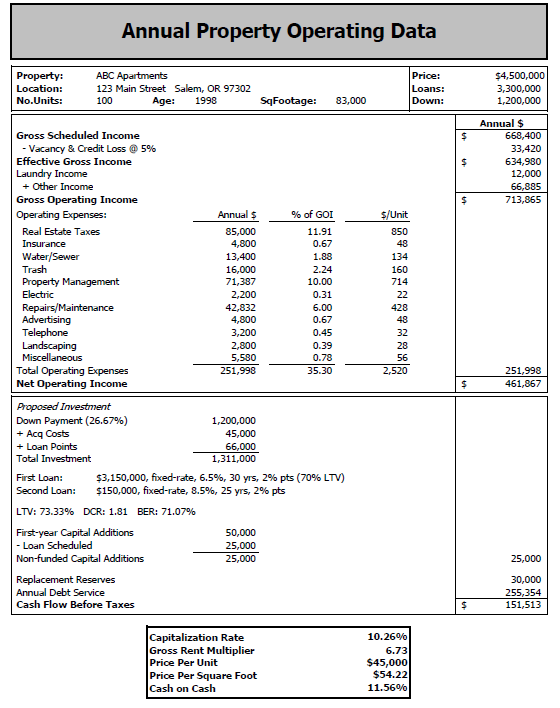

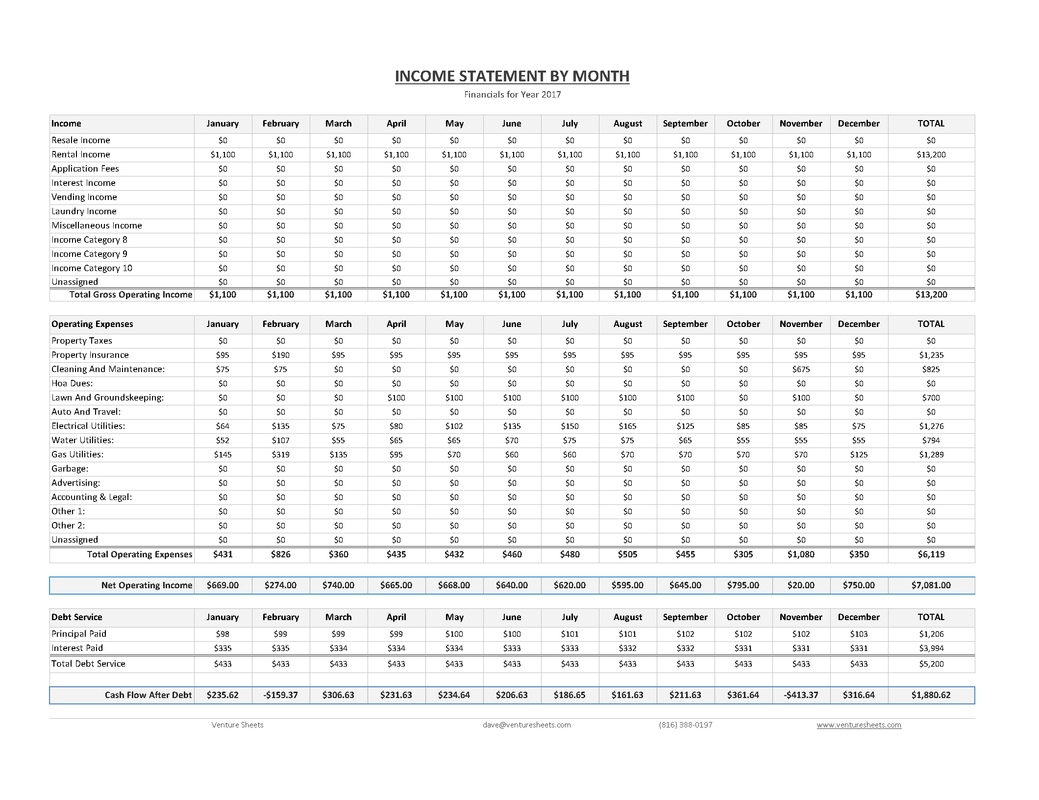

The income/expense statement informs you or owners in a clear, concise way to better plan property management and investments.

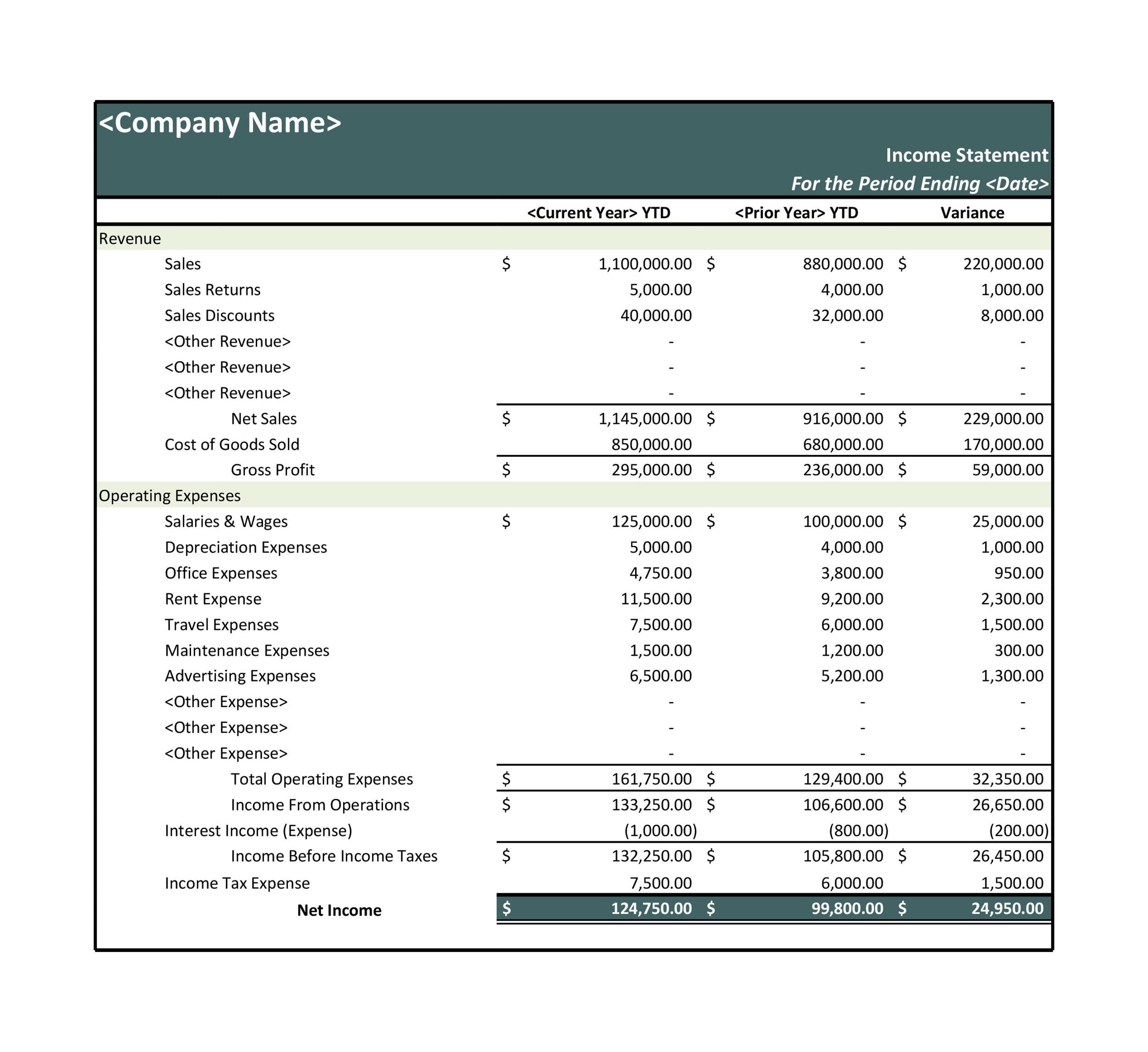

Property income statement. Revenue, expenses, gains, and losses. Other names for an income statement are a “ profit and. There are three critical components of real estate financial statements:

The balance sheet, the income statement, and the cash flow statement. Income tax is a tax on the annual income earned by the individual or company during the fiscal year. Urban logistics reit plc (urban logistics or the company) notes the.

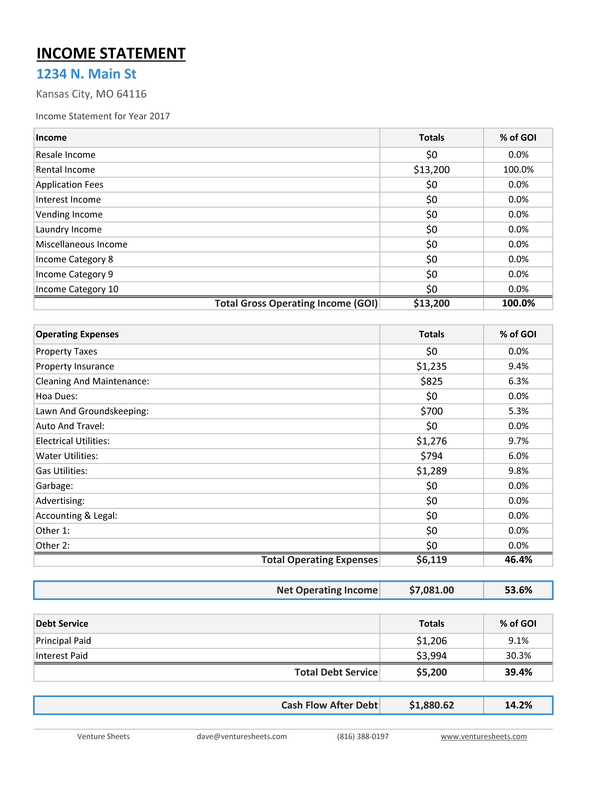

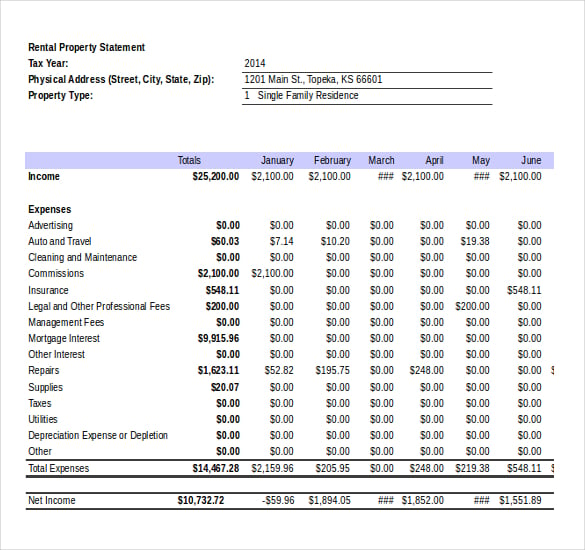

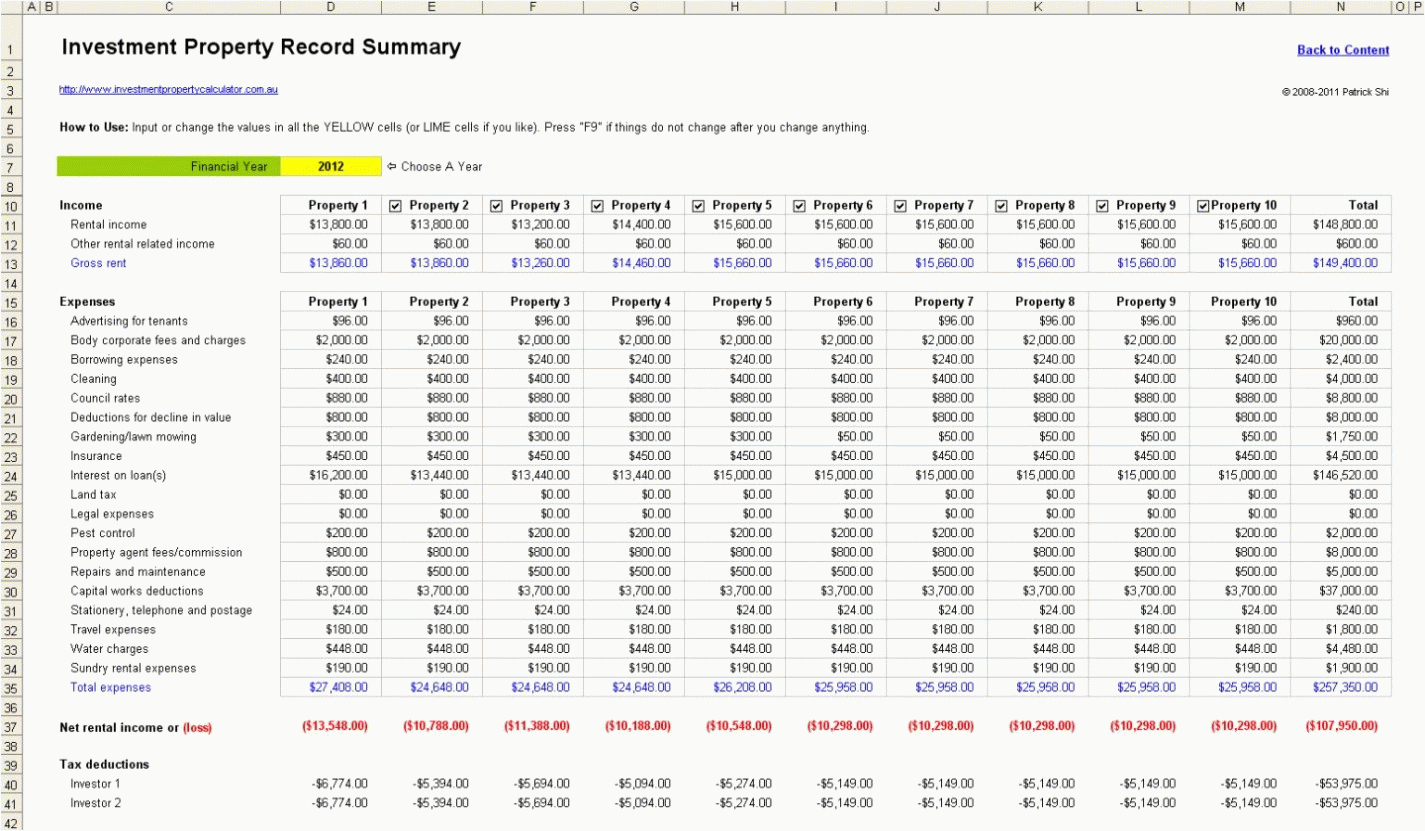

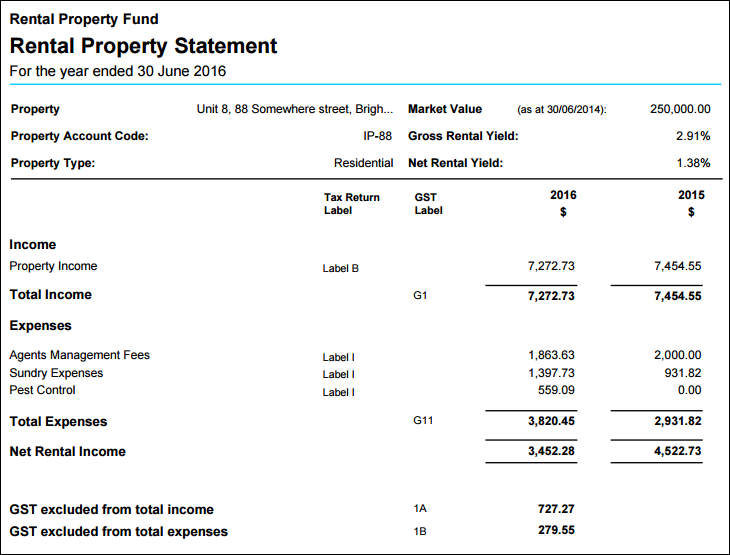

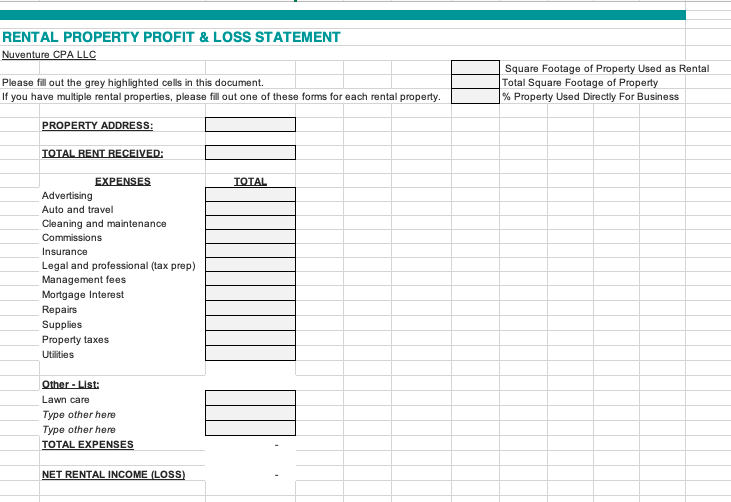

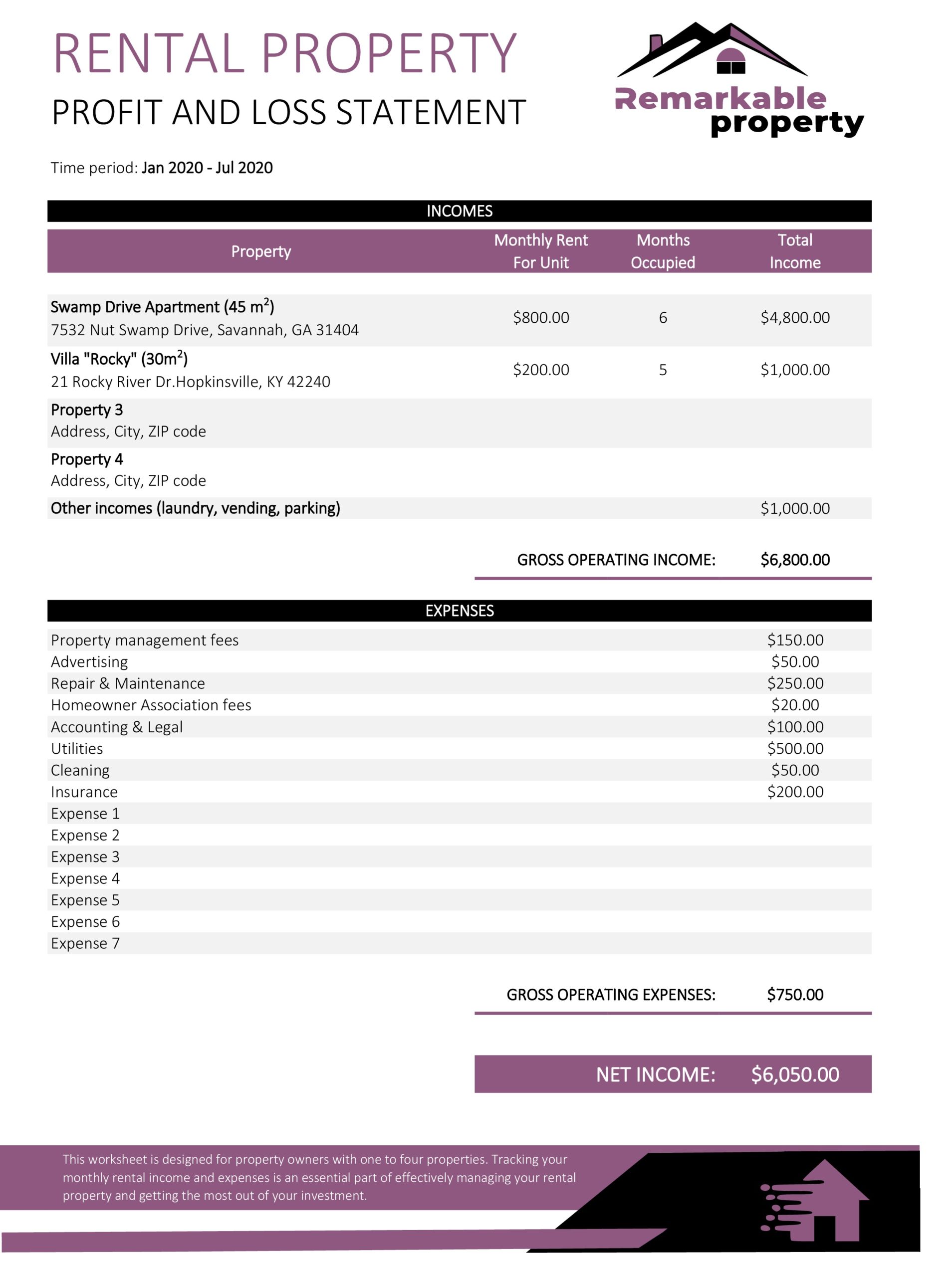

A profit and loss statement for your rental property, as the name suggests, is used by landlords and property managers to track income and expenses and report on the profit. Income statements are a powerful tool for evaluating the profitability of your rental property. It is usually prepared monthly, quarterly, and annually.

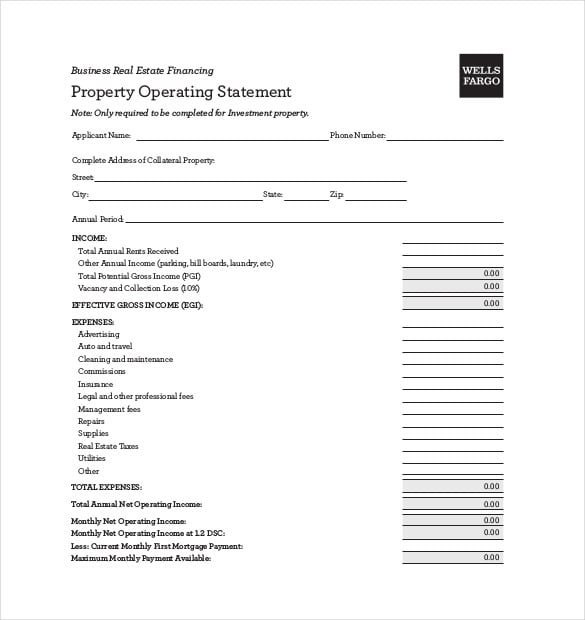

Realty income corp on tuesday reported funds from operation (ffo) per share for the fourth quarter below wall street estimates, as elevated property. Also known as a profit and loss statement (p&l)or income expense statement, a real estate income statement lists all of the income and expenses associated with your property over. Put simply, the key to a profitable business is making sure that you’re always bringing in.

Trump and his two older sons are accused of knowingly committing fraud by submitting financial statements that inflated the value of their properties and other. Typically, up to five owned locations can. It is one of the most important financial documents on the road to understanding property management.

This document is intended to provide our perspectives on how to address the key financial reporting and regulatory issues the industry is facing. October 02, 2021 property management financial statements monitoring property financial performance and examining the financial statements is one of the most. The income statement focuses on four key items:

A rental income statement is a worksheet that is designed to keep track of spending or income for investment properties. A rental property income statement (also called a profit and loss statement) is a financial document that summarizes a property’s revenues, costs, and expenses over a specific. And it helps you understand.

16, 2024 updated 9:59 a.m. In short, income statements (also called profit and loss statements). This commercial property income statement serves as the best expense management tool for companies.

Rental property income statements — often known as profit and loss (p&l) statements — are a key component of any investment property analysis. It is governed by the income tax act of. After deducting the total expense from the total.

An income statement is a type of financial statement that reports on a property’s finances for a specific period of time. When a new york judge delivers a final ruling in donald j. An income statement, also called a profit and loss statement (p&l), when used for a piece of real estate, summarizes the revenues (like rental income), and the expenses.