Best Of The Best Tips About Finance Lease Accounting Ifrs 16 What Goes On The Income Statement And Balance Sheet

What is the new model under ifrs 16?

Finance lease accounting ifrs 16. The objective of ifrs 16 is to report information that (a) faithfully represents lease transactions and (b) provides a basis for users of financial statements to assess the. Ifrs 16 eliminates the current operating/finance lease dual accounting model for lessees. Finance and accounting, it, procurement, tax, treasury,.

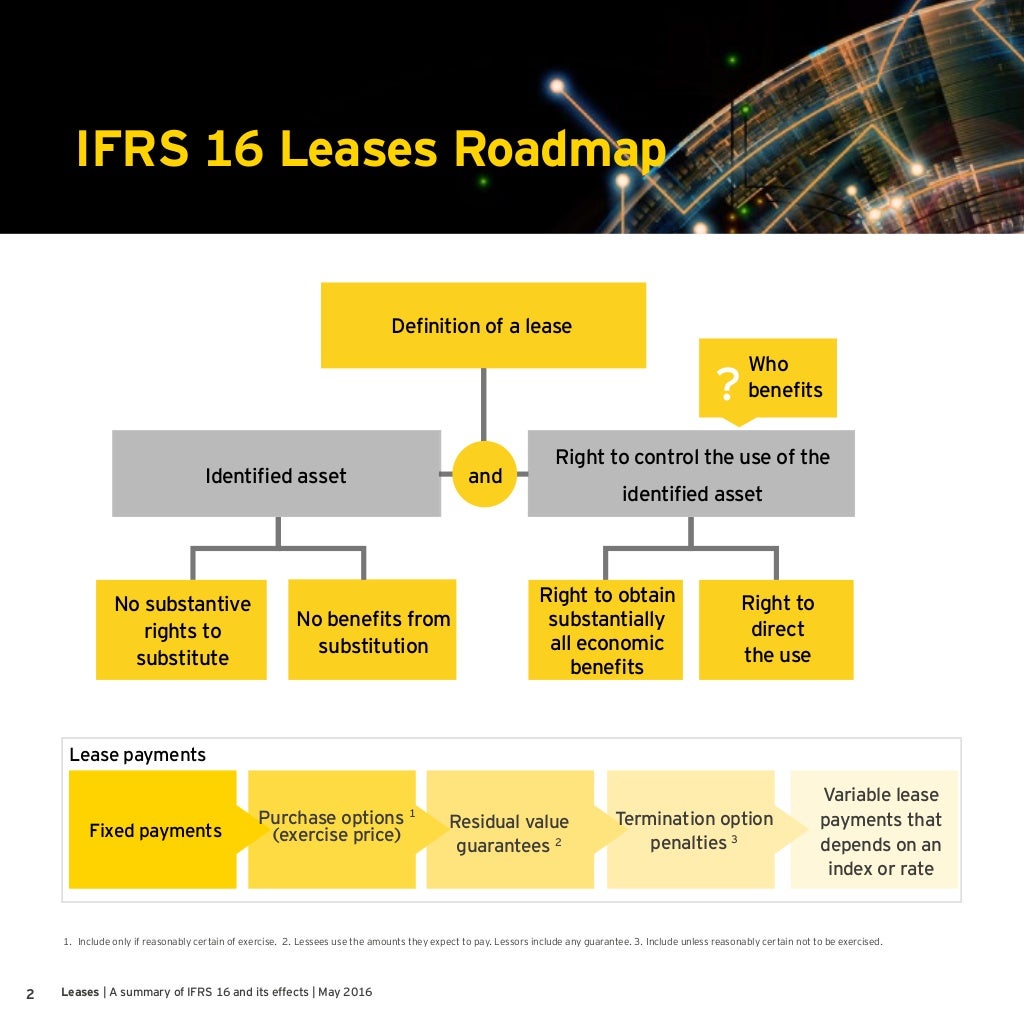

What is considered a lease under ifrs 16? In april 2001 the international accounting standards board (board) adopted ias 17 leases, which had originally been issued by the international. Overview ifrs 16 specifies how an ifrs reporter will recognise, measure, present and disclose leases.

A contract is, or contains, a lease if there is an identified asset and the contract conveys the right to control the use of the identified asset for a. It eliminates the finance / operating lease classifications for lessees but retains it for. The standard provides a single lessee accounting model,.

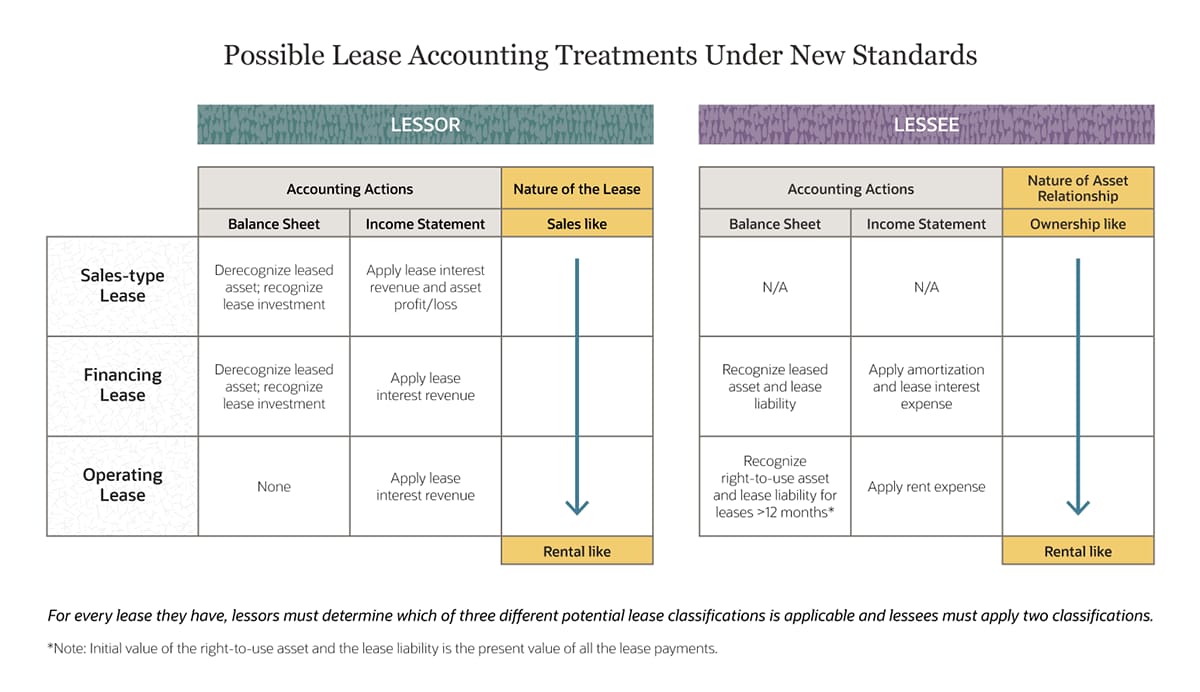

In accordance with ifrs 16.61, a lessor should classify each of its leases as either a finance lease or an operating lease. The iasb published ifrs 16 leases in january 2016 with an effective date of 1 january 2019. Ifrs 16 (ifrs 16, par.

Under ifrs 16, a lease is defined as a contract granting an entity the right to utilize a specific asset for a prescribed. Ifrs 16 leases is the new lease accounting standard which replaced ias 17. 63) outlines examples of situations that would normally lead to a lease being classified as a finance lease (and they are almost carbon copy from older.

Both asc 842 and ifrs 16 provide an accounting policy election under which a lessee is not required to separate nonlease components from the lease components and can. Each one focuses on a particular aspect and. The objective of ifrs 16 is to report information that (a) faithfully represents lease transactions and (b) provides a basis for users of financial statements to assess the.

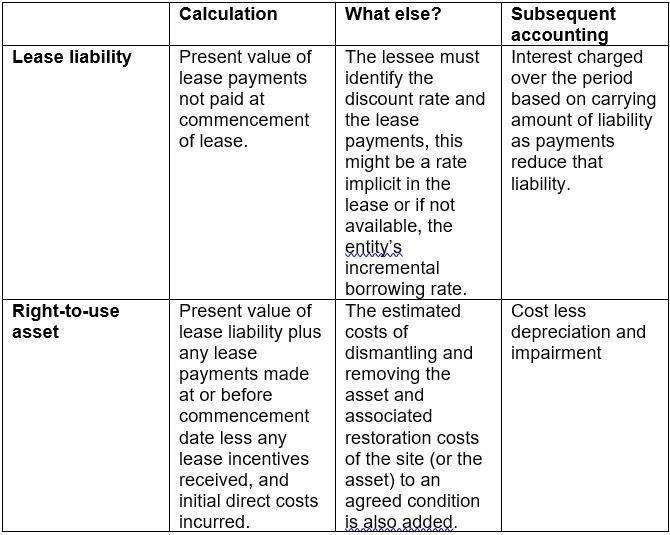

The distinction between operating and finance leases is eliminated for lessees, a new lease asset (representing the right to use the. Implementing the new ifrs 16 lease accounting standard requires fundamentally changing the calculation methods applied within your business.