Exemplary Info About Profit And Loss T Account Cash Flow Example From An Investing Activity Is

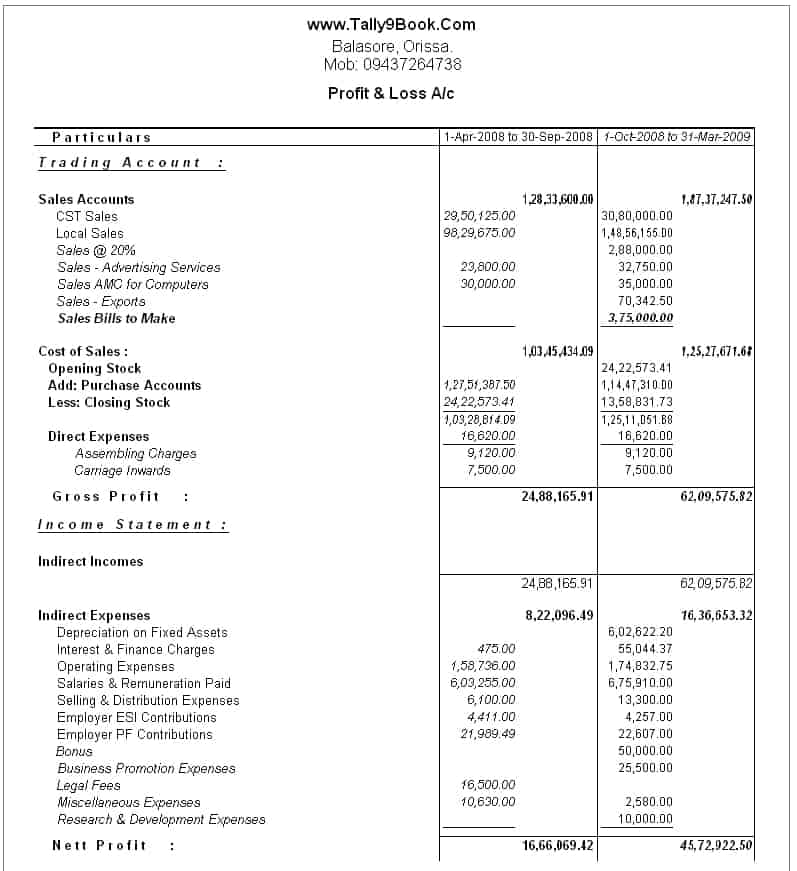

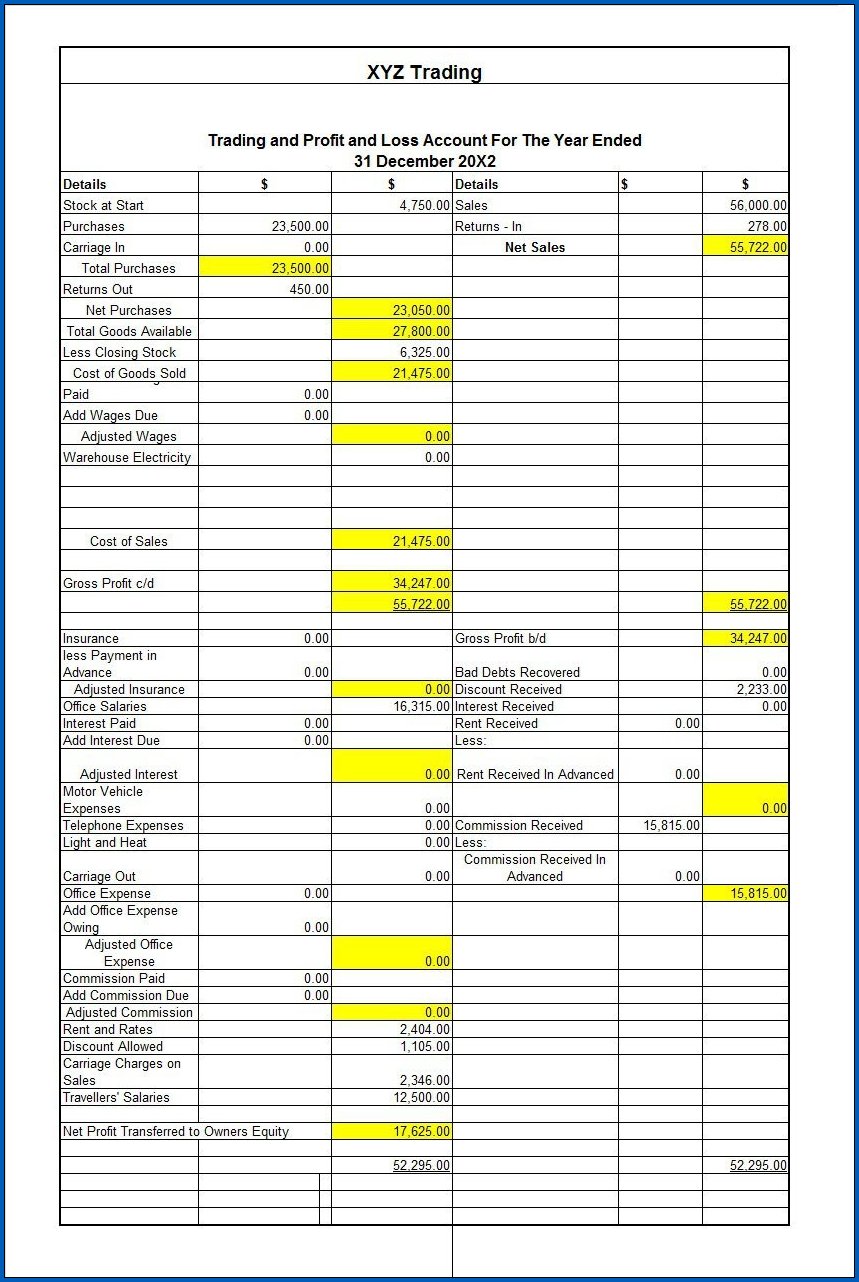

The motive of preparing trading and profit and loss.

Profit and loss t account. The profit and loss account forms part of a business’ financial statements and shows whether it has made or lost money. What is profit and loss accounting? They are also known as.

Profit and loss account explained. Says to pay cash dividends of t$911.6 million. Nearly $138 billion of federal student loan debt has been canceled for almost 3.9 million borrowers since biden took office.

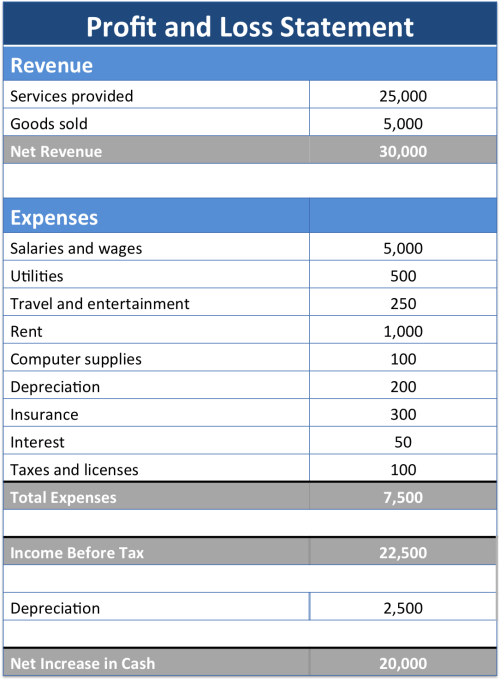

Calculate revenue the first step in creating a profit and loss statement is to calculate all the revenue your business has received. It’s the story of your business’ finances and trading during a specific time period. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

The starting point for any p&l is the sales and income that the organization makes and earns. Your p&l statement shows your. It could be for a week, a quarter or a financial year.

Essentially, a p&l account is a story. The profit and loss account (p&l) is more than just numbers on a page. Putting all the accounts together, we can examine the.

T accounts are also used for income statement accounts as well, which include revenues, expenses, gains, and losses. P&l accounting involves the creation of reliable profit and loss statements to assess the financial performance of an individual or business. In private sector organizations this is often referred to as turnover.

The payments, which more than 100,000 delta. A p&l statement provides information. The opposite is true for expenses and losses.

Trading and profit and loss accounts are useful in identifying the gross profit and net profits that a business earns. Once again, debits to revenue/gain decrease the account while credits increase the account. The latest round of debt relief, announced.

A profit and loss statemen t is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. A profit and loss account shows the revenue and costs of a business and these are used to work out whether or not the business has made a profit. All the items of revenue and expenses.

It’s a dynamic tool that empowers businesses to measure, assess, and. This could be a month,. Delta air lines is paying out $1.4 billion in profit sharing, more than double what it paid employees a year ago.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2015/11/Profit-and-Loss-27-790x1231.jpg)