Glory Tips About Cost Of Goods Sold Income Statement Prior Period Adjustment Note Disclosure Example

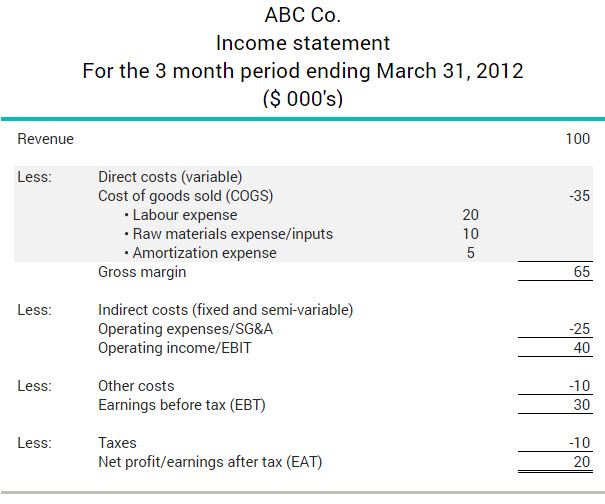

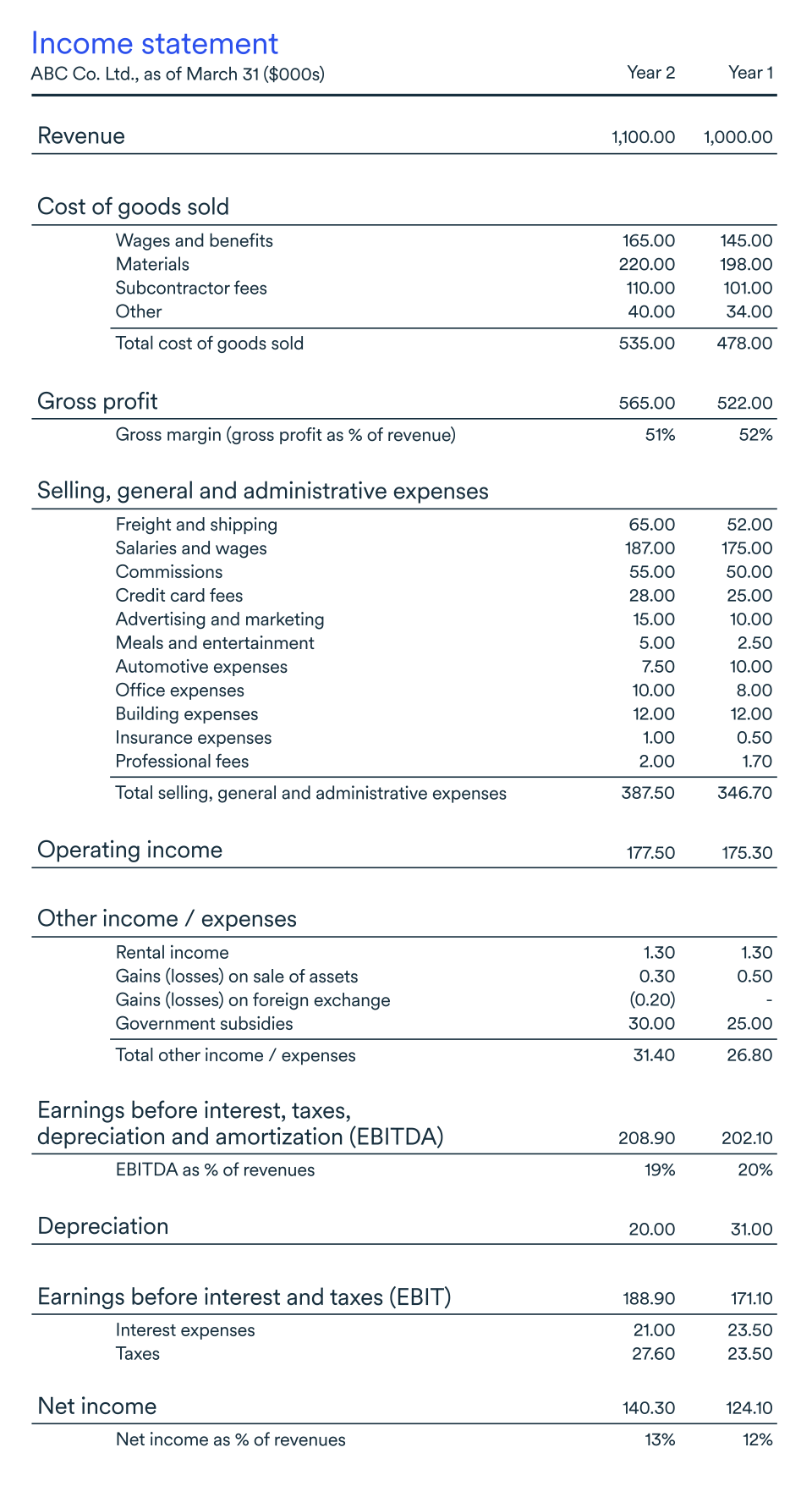

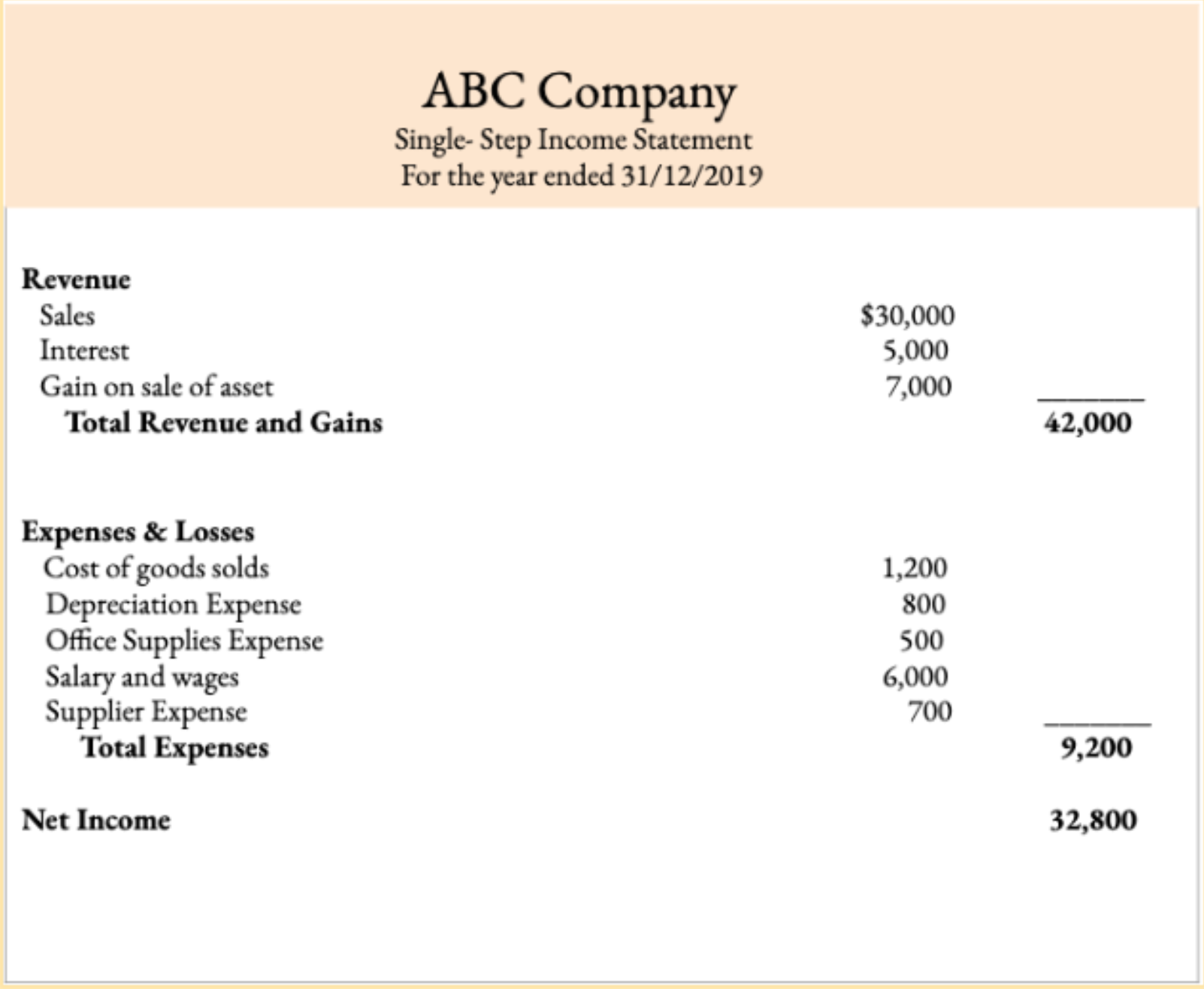

The cost of goods sold (cogs) is a significant part of a business income statement and plays an essential role in calculating the net income for a business.

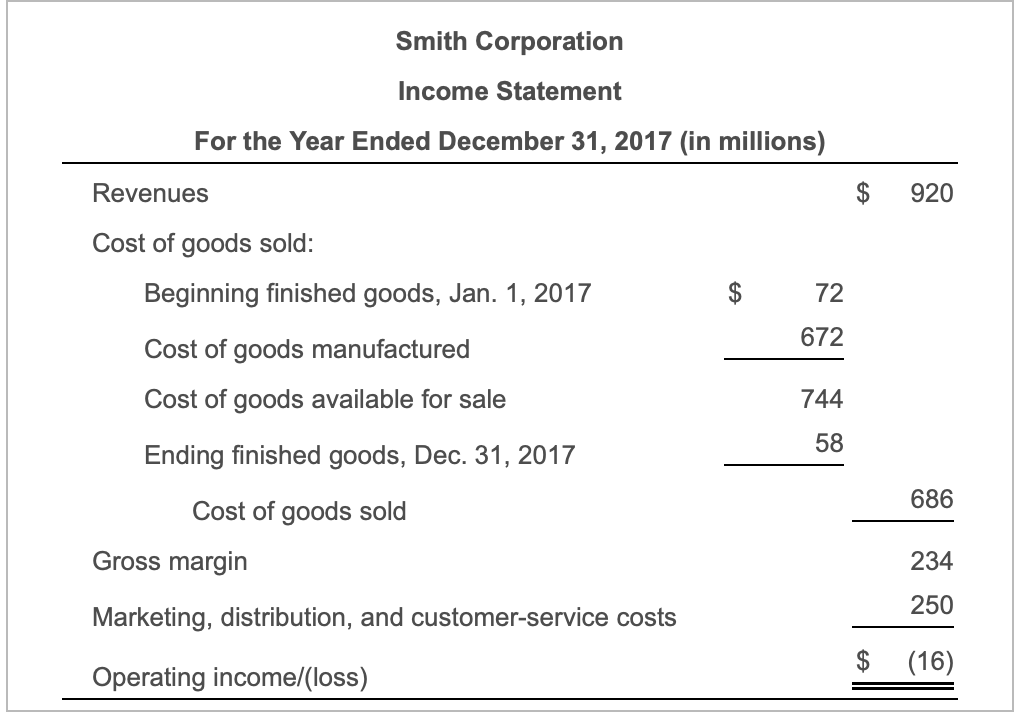

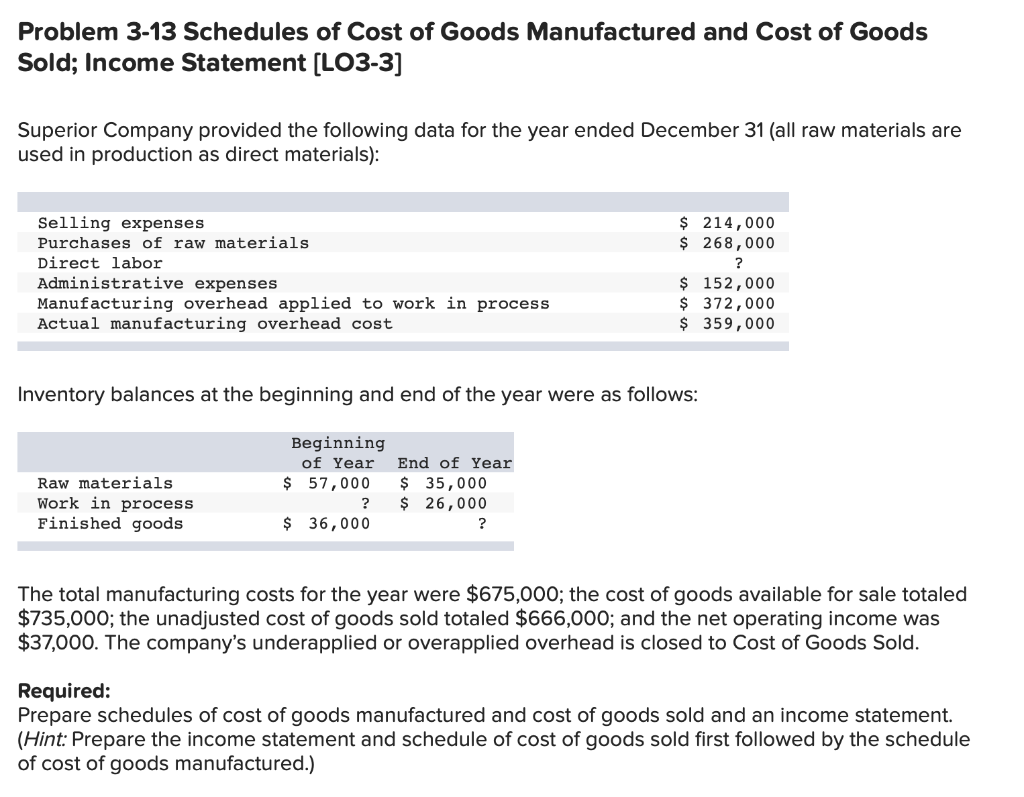

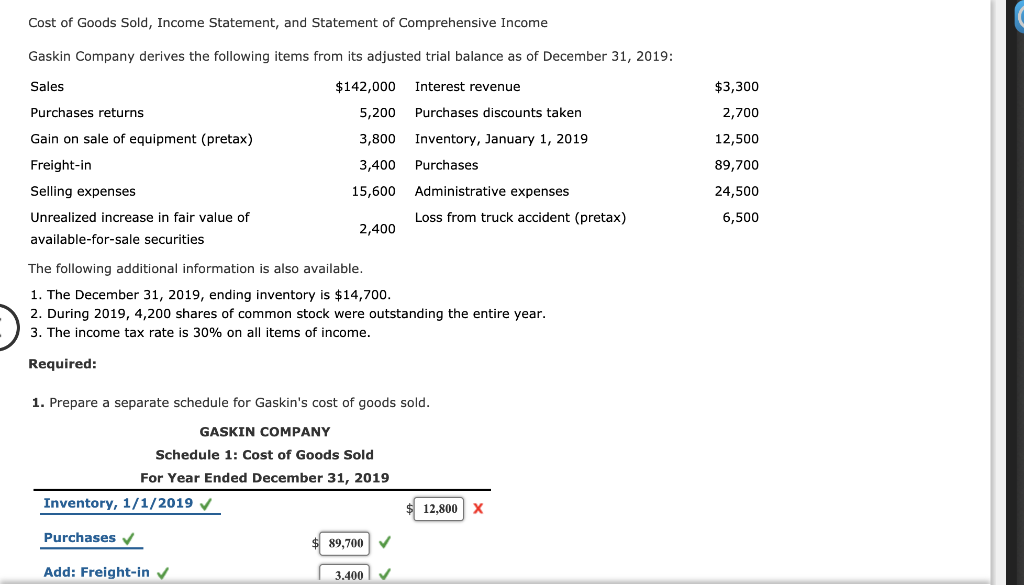

Cost of goods sold income statement. On the income statement, cogs is deducted from total revenue to calculate a company's gross profit. Cost of goods sold are the costs of all goods sold during the period and includes the cost of goods manufactured plus the beginning finished goods inventory minus the. For the year ending on december 31st, 2018, is $14,000.

An income statement details your company’s. Financial analysis of an income statement can reveal that the costs of goods sold are falling, or that sales have been improving, while return on equity is. The cost of goods sold amount on the income statement is determined by considering the changes in the three inventory account balances during the period.

It includes the costs of the materials, storage and manufacturing labour, but not indirect costs such as distribution, marketing and management salaries. Accounting for cost of goods sold. Some of those income sources or costs could be listed as separate line items on the income statement.

Cost of goods sold (cogs) is an essential accounting term used to calculate the cost associated with producing and selling a product. Gross profit, in turn, is a measure of how efficient a company is at managing its operations. How to calculate cost of goods sold.

The cost here refers to costs or expenses. This amount includes the cost of the materials used to create the good and the direct labor. This number is vital for the company.

You can find your cost of goods sold on your business income statement. Cogs are the direct costs attributable to the production of goods sold by a company. The cost of goods sold is the costs of goods or products sold during a specific period by the entity to its customers.

Cost of goods sold is deducted from revenue to determine a company's gross profit. Also called net earnings, is sales minus cost of. It represents the direct costs associated with producing and selling goods or services.

Overview of cost of goods sold on the income statement. On most income statements, cost of goods sold appears beneath sales revenue and before gross profits. A cost of goods sold statement compiles the cost of goods sold for an accounting period in greater detail than is found on a typical income statement.

Cogs includes all the direct costs. Cost of goods sold is an important figure for investors to consider because it has a direct impact on profits. To calculate cogs, take the cost of initial inventory and add additional direct costs during the period you are measuring.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)