Ace Tips About Financial Reporting Principles Cash Flow Forecast For Small Business

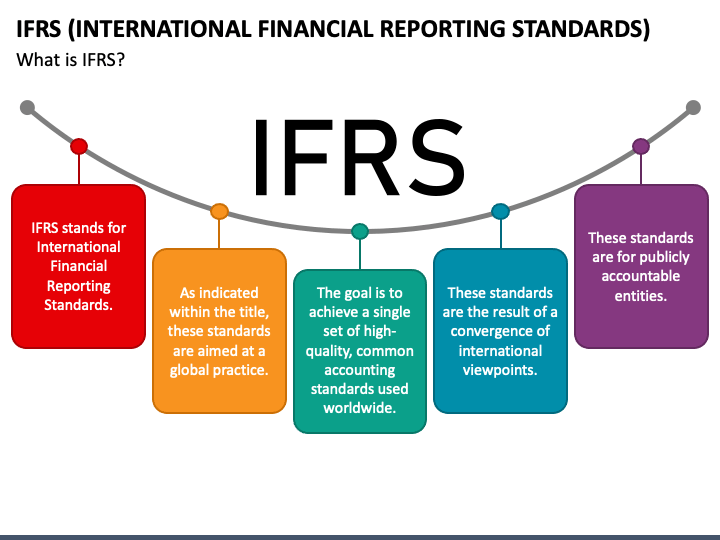

Unless otherwise noted, all financial figures are unaudited, presented in canadian dollars (cdn$), and derived from the company’s condensed consolidated financial statements which are based on canadian generally accepted accounting principles (gaap), specifically international financial reporting standards (ifrs) as.

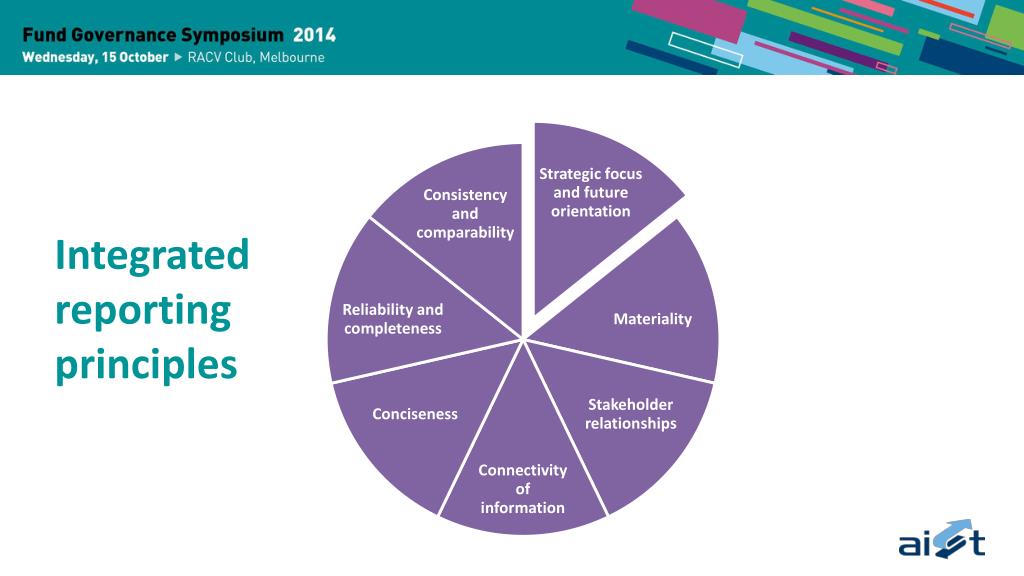

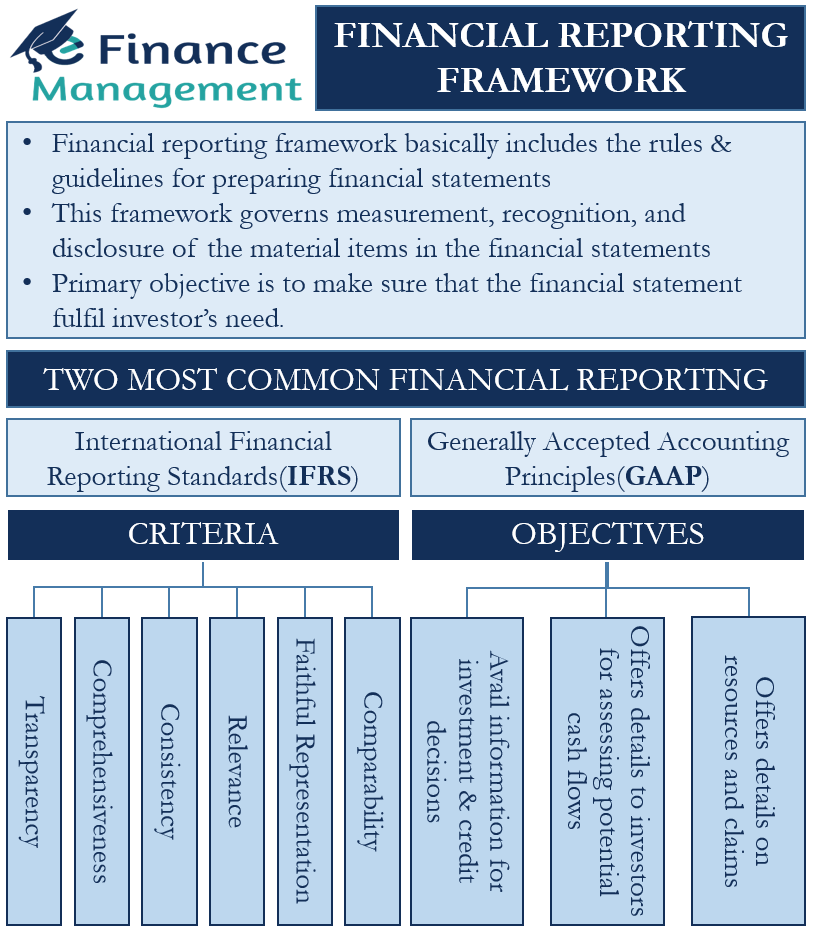

Financial reporting principles. Financial reporting is an accounting process that communicates financial data to external and internal stakeholders, such as shareholders, lenders and senior company management. The ra expects its registered auditors and audit principals to ensure that all audit work carried out by them is performed diligently, competently and. However, ias 1 also states that financial statements must report the information needed to fairly present a company’s financial performance, financial

Cash flow cash flow —the broad term for the net balance of money moving into and out of a business at a specific point in time—is a key financial principle to understand. Objective, usefulness and limitations of general purpose financial reporting financial reporting financial reporting information about a. Which accounting principles are used depends on the regulatory and reporting requirements of the business.

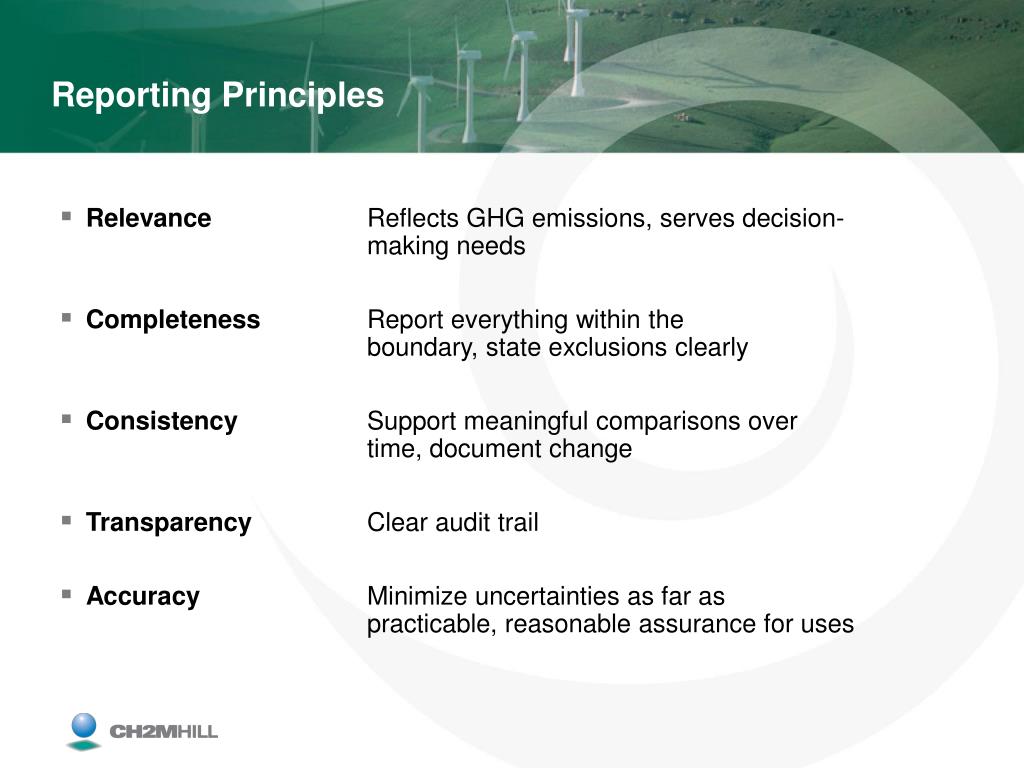

These three statements together show the assets and liabilities of a business. External financial reporting requirements are different for public and private companies, but the reports are universally required by law for tax reporting. Financial reporting standards provide principles for preparing financial reports and determine the types and amounts of information that must be provided to users of financial statements, including investors and creditors, so that they may make informed decisions.

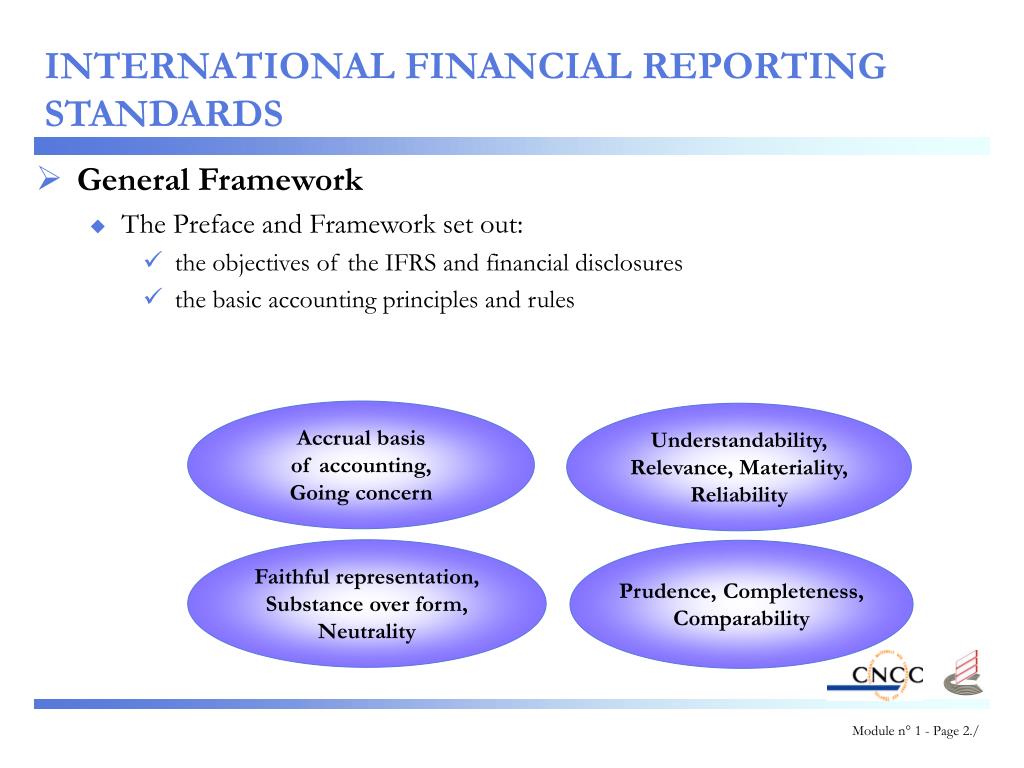

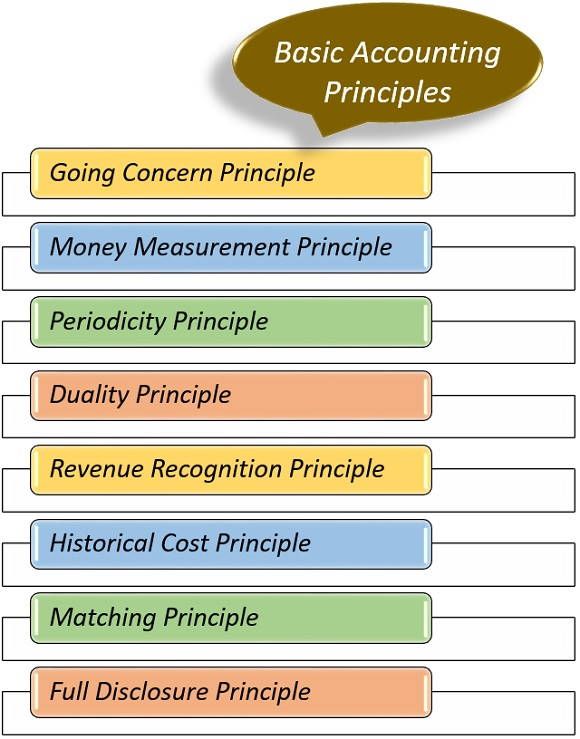

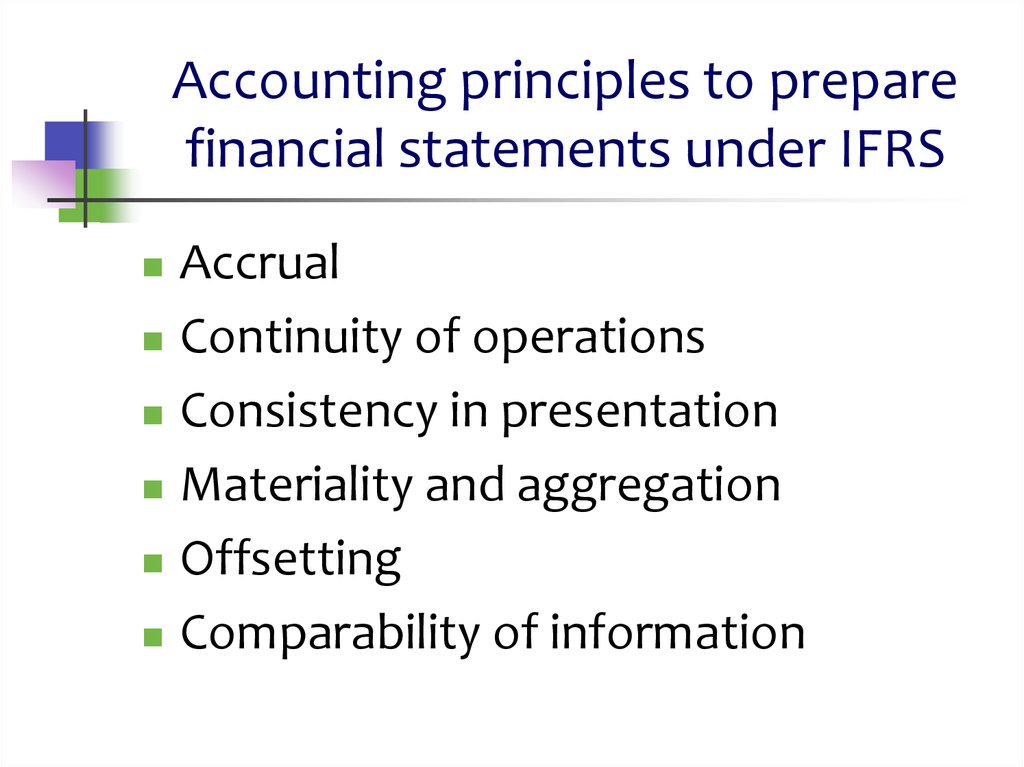

What is gaap? They form the basis upon which the complete suite of accounting standards have been built. International financial reporting standards (ifrs) are a collection of accounting guidelines for public firms' financial statements that are designed to make them uniform, transparent, and simple to compare globally.

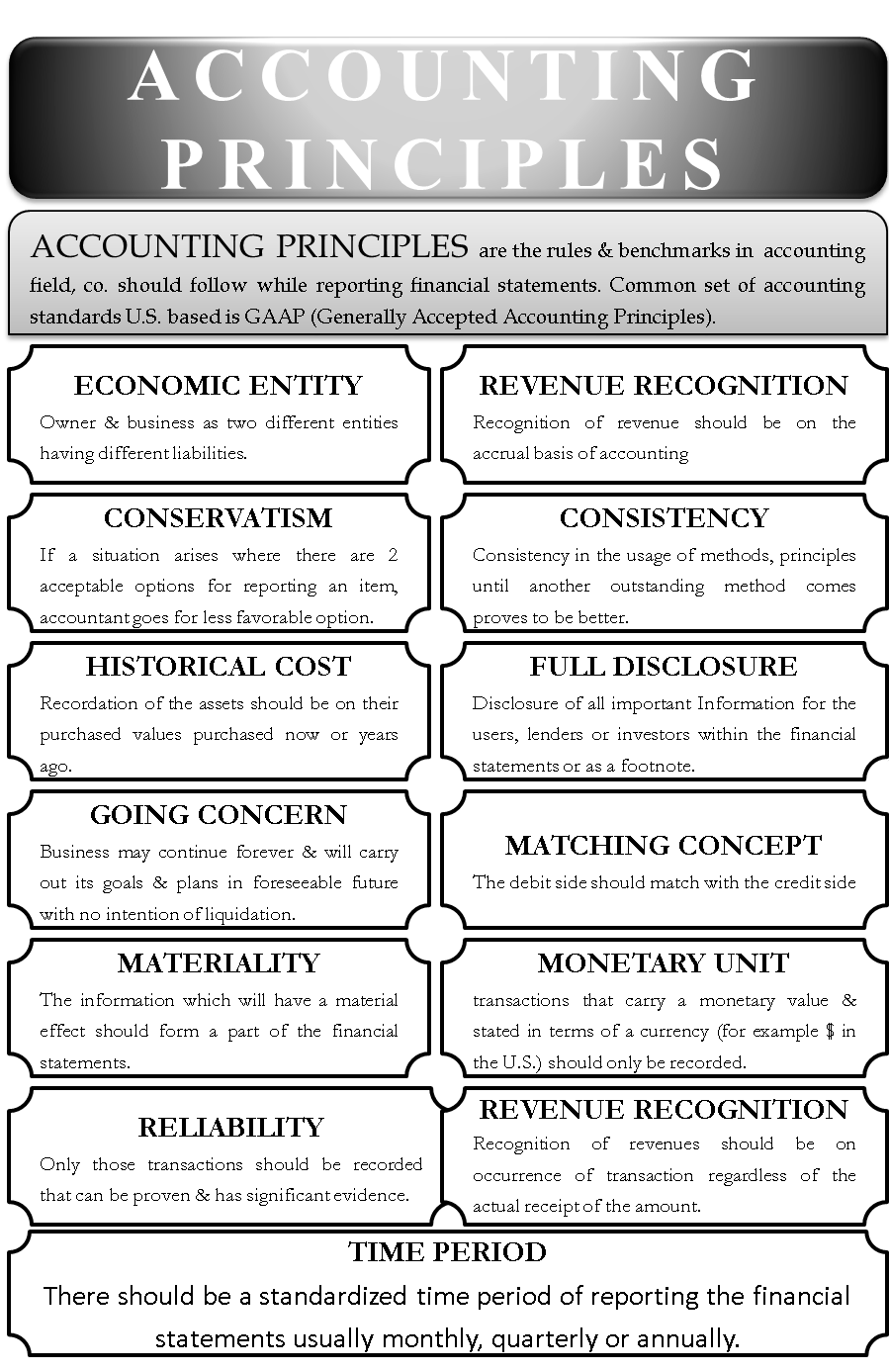

Accounting principles, commonly known as gaap, are an essential aspect of financial accounting policies and practices. Consistent standards are applied throughout the financial reporting process. Accountants should perform and report with basic honesty and accuracy.

All reporting of financial data is to be factual, reasonable, and not speculative. Returned $1.1 billion to shareholders; Accounting principles are the rules that an organization follows when reporting financial information.

Introduction objective, usefulness and limitations of general purpose financial reportingfinancial reporting. The net cash generated from normal business activities Accounting principles are the rules and guidelines that companies and other bodies must follow when reporting financial data.

Read more and the international financial reporting standards. Accountants and auditors are direct users. Principle of consistency:

They use the four gaap principles to prepare financial statements and documentation. Historically, there have been locally accepted accounting regulations. There are several types of cash flow:

It is used to communicate the financial performance, position, and cash flows of an organization to stakeholders. The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. These principles provide guidance on how accounting transactions should be recorded and reported, ensuring transparency and consistency in financial reporting.