Impressive Info About Secured Loan Comes Under Which Head In Balance Sheet Cash And Equivalents Accounting Standard

:max_bytes(150000):strip_icc()/secured-loans-2386169_final-cbd3a613da25474fa240c59185879183.jpg)

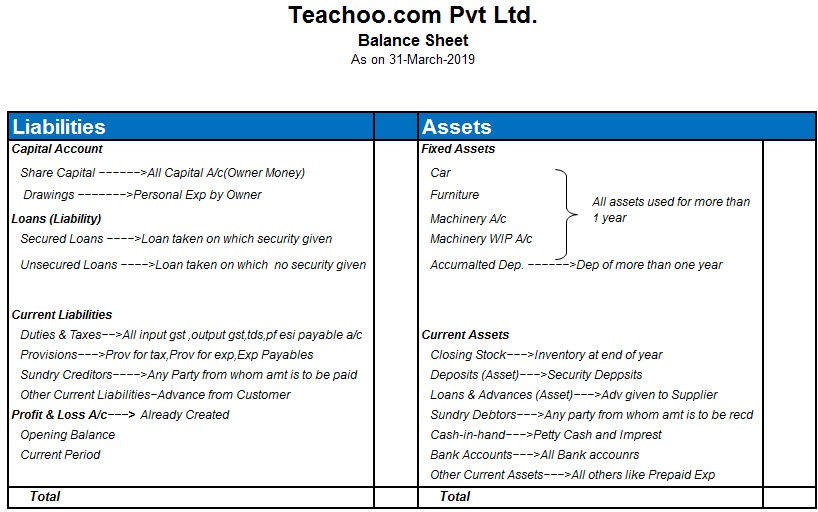

In balance sheet where we can show under (a) (1) from banks or (b) (1) loan repayable on demand secured a term loans i from banks ii from other parties b.

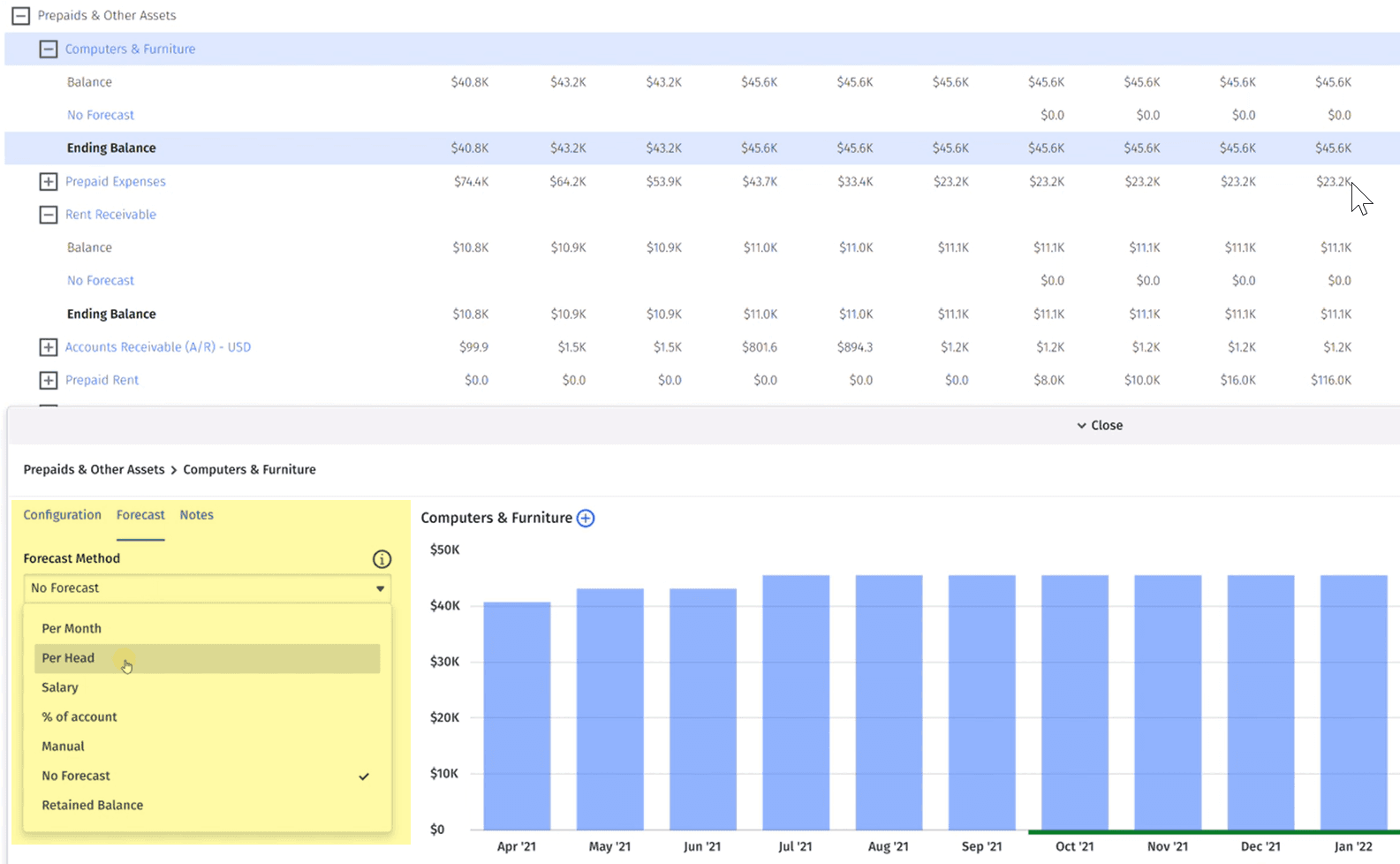

Secured loan comes under which head in balance sheet. Assets which are likely to be collectible in the short term (usually within 12 months) are considered a current asset, while anything owed by the. Associated notes give us the split between secured and unsecured loan; Check out balance sheet format & company balance sheet format, its components and explanation with example.

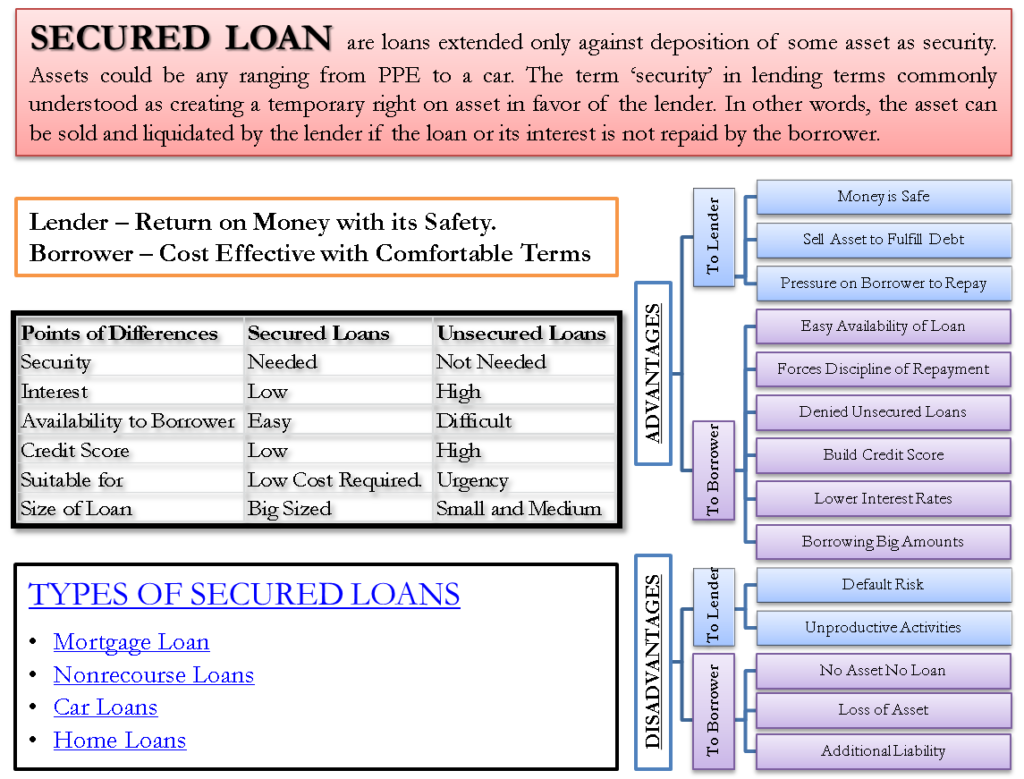

Any party to whom we gave loan like loan given to friends relatives/related companies any party to whom we gave advance like advance to. Secured debts are those for which the borrower puts up some asset to serve as collateral for the loan. The secured loans lower the amount of.

According to the iasb framework, liability is defined as, a liability is a present. Under what heads the following items on the equity and liabilities side of the balance sheet of a company will be presented : The secured borrowing model maintains financial reporting symmetry between the two parties.

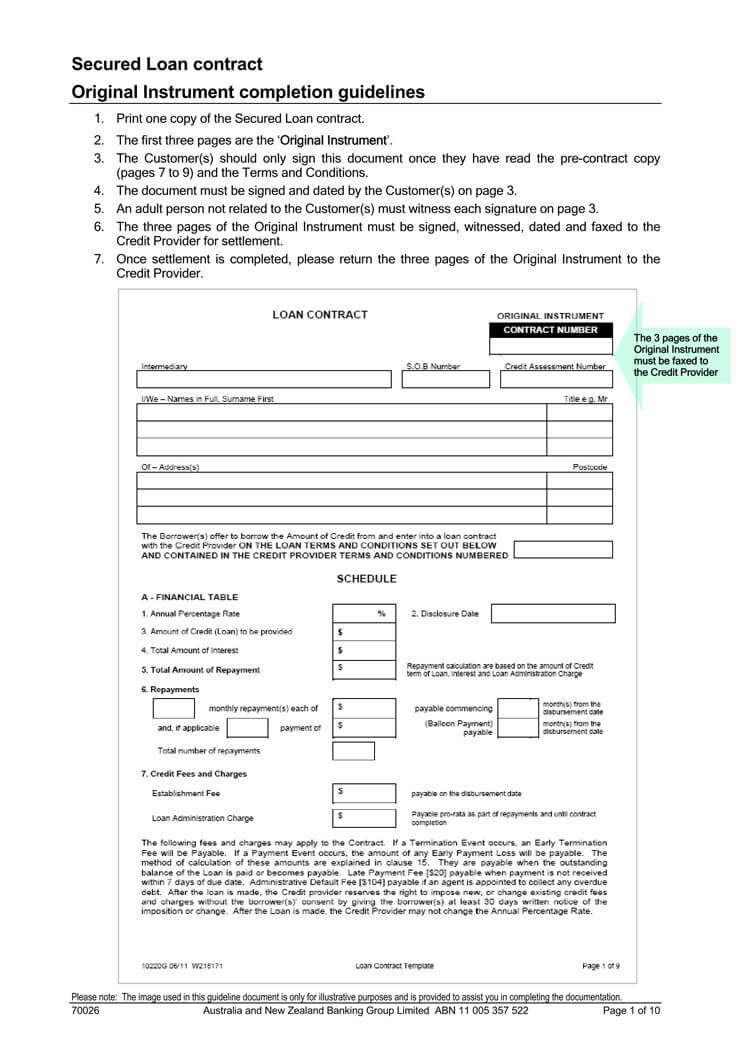

The balance sheet shows the financial position i.e. Details of secured/ unsecured loans: Balance sheet loans are secured loans that require collateral, usually in the form of assets listed on the borrower’s balance sheet.

The amortization of loans is done by paying a sum of principal and interest for. The balance sheet gives us the overall debt; We have to show this amount in liability side of balance sheet.

An unsecured loan is one that is obtained. (i) proposed dividend (ii) unpaid/unclaimed. The transferred assets remain on the books of the transferor,.

Secured loan definition a loan from a bank or other lender in which the borrower has pledged an asset as collateral in case the loan cannot be repaid in full. 31 may 2022 us loans & investments guide reporting entities that present a classified balance sheet should see fsp 2.3.4 and fsp 9.4.1 for information on the. Major heads of balance sheet :

We should be very cautious about this amount because. How can liabilities and shareholders’ funds appear on the ‘liabilities’ side of the balance sheet? Bank loans are secured loans as they are often taken by pledging an asset of the business.

Balances of assets, liabilities on balance sheet, and capital of an entity at the end of the financial year. An unsecured loan is a loan that is issued and supported only by the borrower's creditworthiness, rather than by any type of collateral. Debt can be secured or unsecured;

:max_bytes(150000):strip_icc()/what-difference-between-secured-and-unsecured-debts.asp-final-c2040f78625b44d98372ea024fa51697.png)