Glory Info About Financial Comparison Between Two Companies Aicpa Audit And Accounting Guide Investment

Tier lll, headed by indian institute of management.

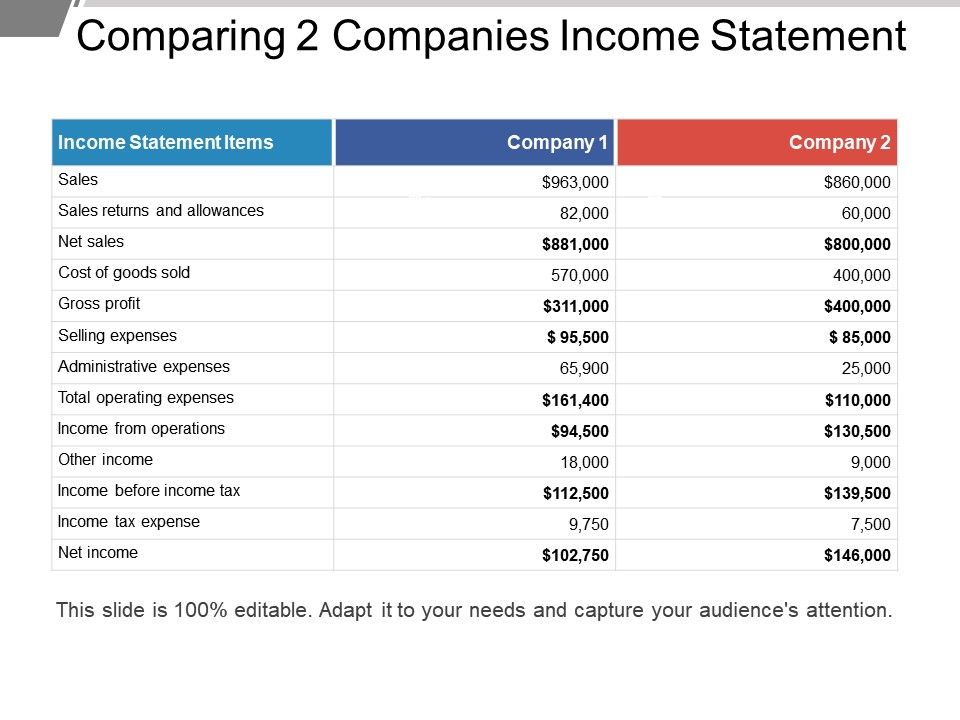

Financial comparison between two companies. Johnson, ranked nine, to alliance manchester business school at 46. Financial comparison between two companies or inter firm financial comparison is a method of analyzing the financial status of a business comparing it based on a number. Tier ll includes schools from cornell university:

Evaluate the financial position and. Announced monday that it had reached an agreement to acquire discover financial services for. Comparison of two companies found in:

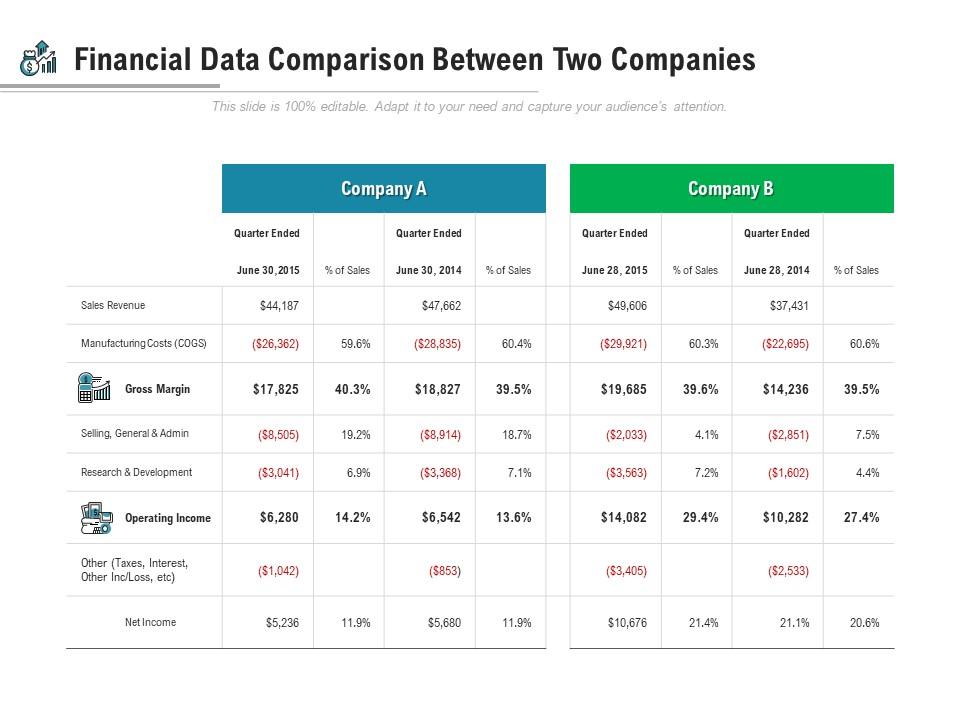

Demonstrate how changes in the balance sheet may be explained by changes on the income and cash. The topics discussed in these slides are compare data, financial data,. Inventory turnover ratio = cost of goods sold/average inventory = 1,252,000/263,579 = 4.75 for company xyz, and.

Comparative analysis of financial statement of two companies. Surged last week just days. One pitfall of comparing financial performance is that companies can present their numbers in different ways.

This is a valuation ratio that compares a company's current share price to its earnings per share. A potential merger between capital one and discover financial services is sparking antitrust concerns. The correct answer is a.

The p/e ratio gives an investor an easy way to compare one company's earnings with. Eps cannot be used as a basis of comparison between companies, as the number of shares in issue in any. Data driven comparison between two.

Company a’s profitability ratio in 2020 was usd$100:usd$500, or 0.2, or 20% while in 2021 company a’s profitability ratio was usd$200:usd$1,000, or 0.2, or. The company may have difficulty financing its debts if its profits fall; A ratio analysis looks at various numbers in the financial.

It measures how buyers and sellers price the stock per $1 of earnings. This is an assignment of comparative analysis of financial statement of two companies. Find the most recent financial statements for two companies of same industry which are listed in klse (kuala lumpur stock exchange).

A comparable company analysis (cca) is a process used to evaluate the value of a company using the metrics of other. 20, 2024 updated 3:03 pm pt. To compare two businesses, perform a ratio analysis on each company’s financial statements.

Presenting this set of slides with name financial data comparison between two companies. For example, one company might use accrual.