Favorite Info About Income Statement Of Profit And Loss Statutory Financials

Though the profit and loss statement can be prepared monthly too, quarterly and.

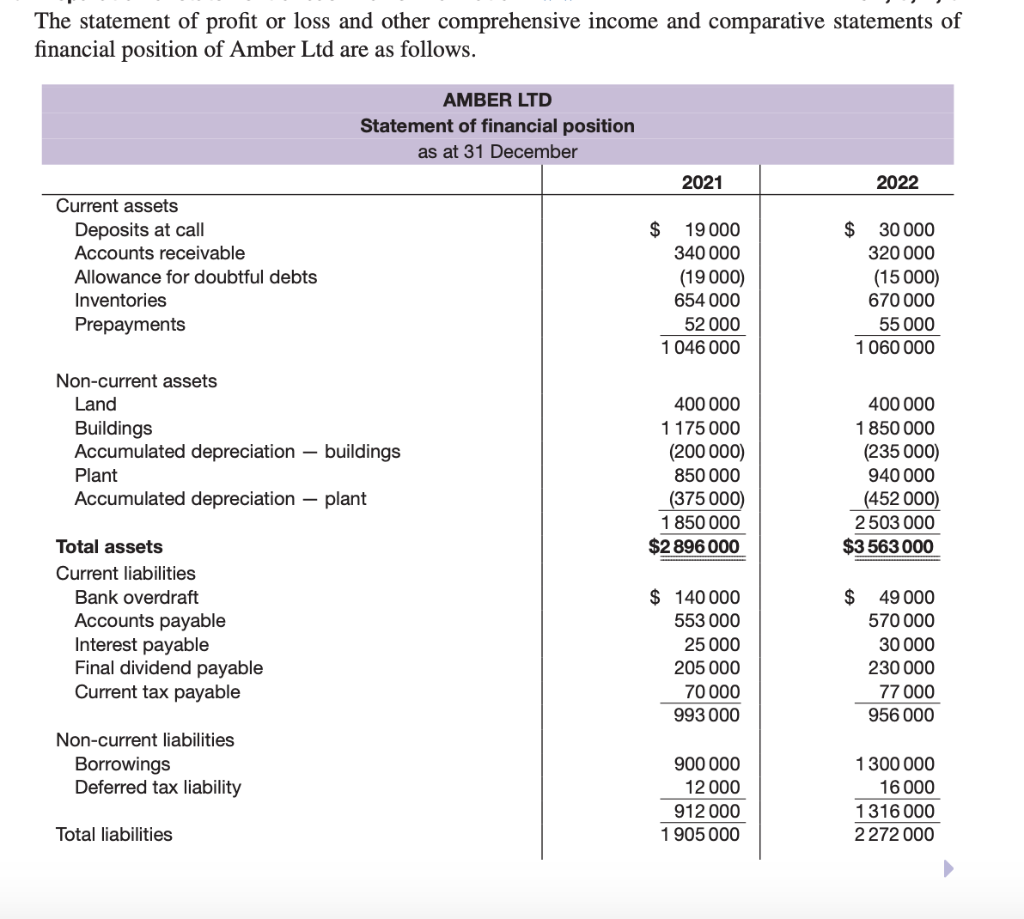

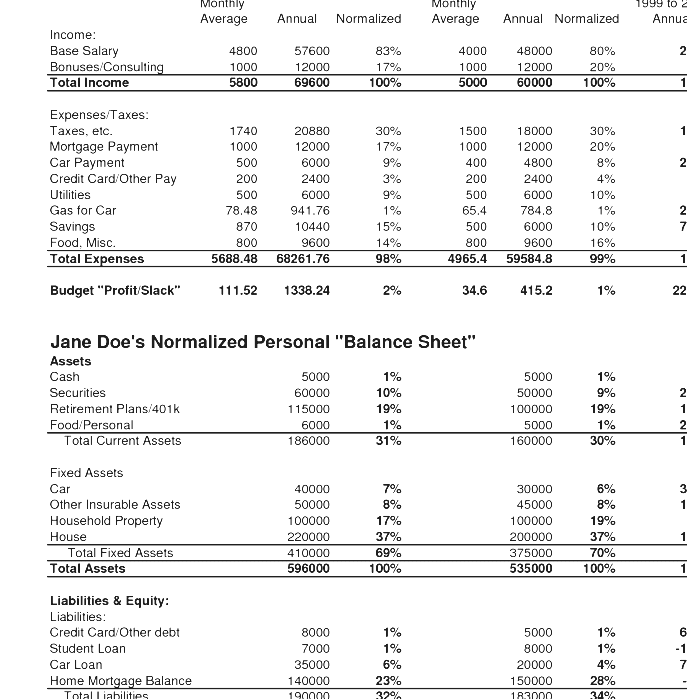

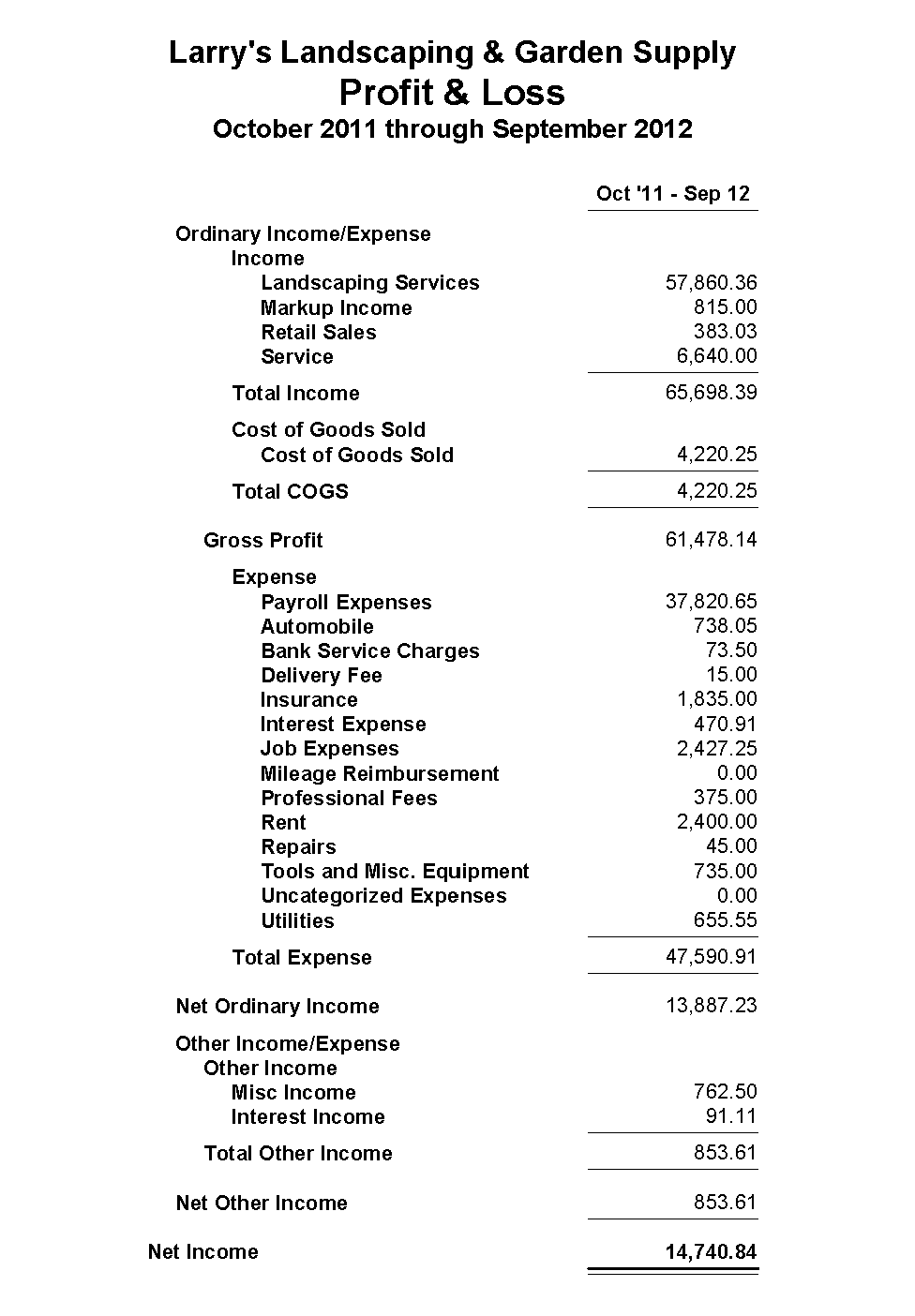

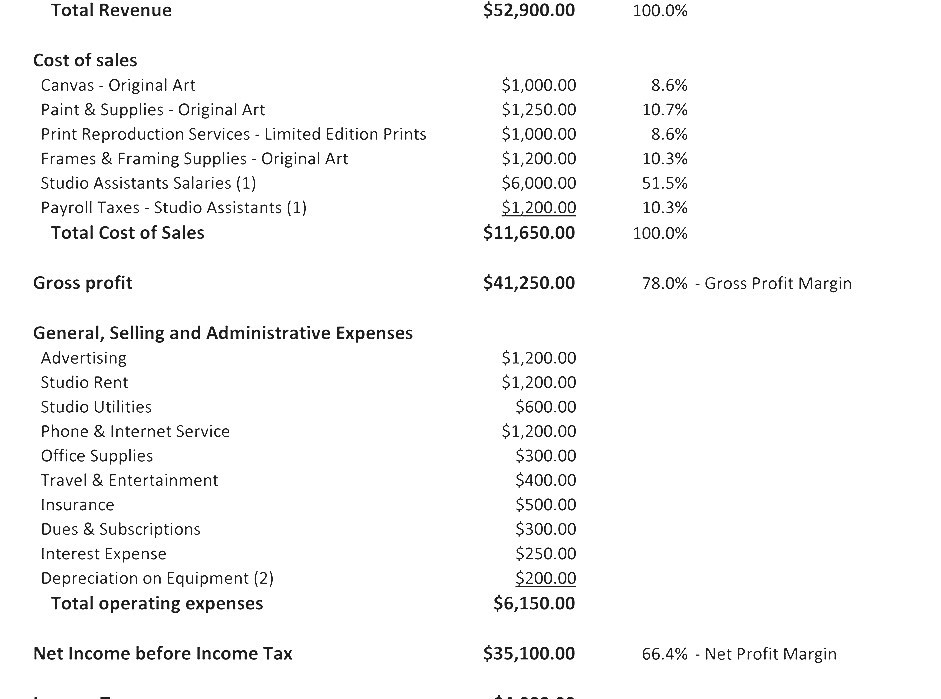

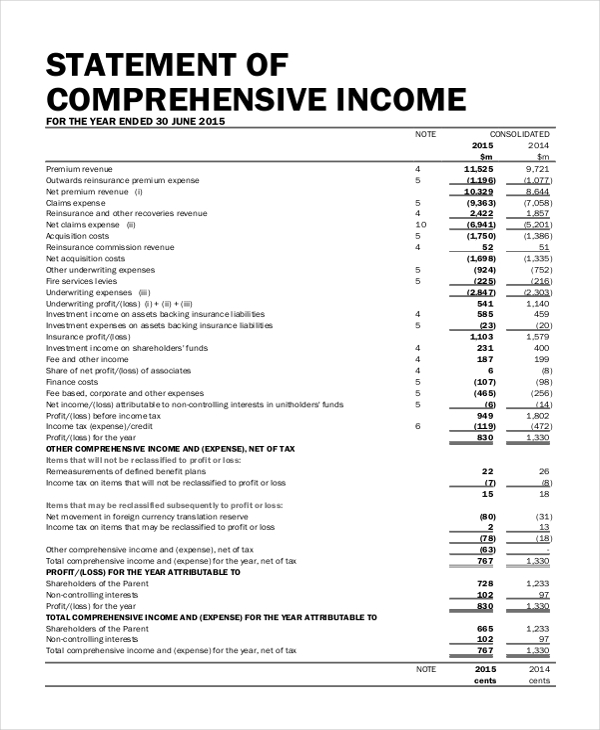

Income statement statement of profit and loss. It shows your revenue, minus expenses and losses. On the bottom of the income statement is the net profit or loss. An income statement or a profit and loss statement outline a company's earnings and expenses to determine its net income over a specific time.

Expenses are outgoings, such as the cost of buying products. The spending of the company on the rent was $6,000, on utility was $5,000, and on the salary of one staff working was $7,000. It is identical to profit/loss for the period attributable to equity owners of the parent as defined by ifrs rules.

The result is either your final profit (if. Thus during the month, the bakery shop generated a net income of $22,000 for the year. Many key fundamental ratios use information from the income statement.

A profit and loss statement (p&l) sets out your company income versus expenses, to help calculate profit. The other two statements are the cash flow statement and the balance sheet. Revenue is money a business generates through its primary activities, such as selling products.

Less cost of goods sold. There is no difference between income statement and profit and loss. A p&l statement provides information about whether a company can.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The profit and loss statement, or “p&l statement”, is interchangeable with the income statement, one of the three core financial statements that all publicly traded companies are obligated to file with the sec. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. Definition of profit and loss statement the profit and loss statement, or p&l, is sometimes used to mean a company's income statement, statement of income, statement of operations, or statement of earnings. Example of a p&l statement.

Add up all your gains then deduct your losses. An income statement is often referred to as a p&l. Finance professionals often use p&l statements in investment banking, corporate finance, accounting, and small business decisions.

Words such as “anticipates”, “believes”, “estimates”, “expects”, “intends. Then, it subtracts the costs of making those goods or providing those services, like. You’ll sometimes see profit and loss statements called an income statement, statement of operations, or statement of earnings.

To analyze the sample income statement analysis above, we can use both ways: The income statement shows a company or individual’s money. Airbus se continues to use the term net income/loss.