Divine Tips About Formula For Retained Earnings Profit And Loss Form Pdf

It serves as the starting point for the calculation.

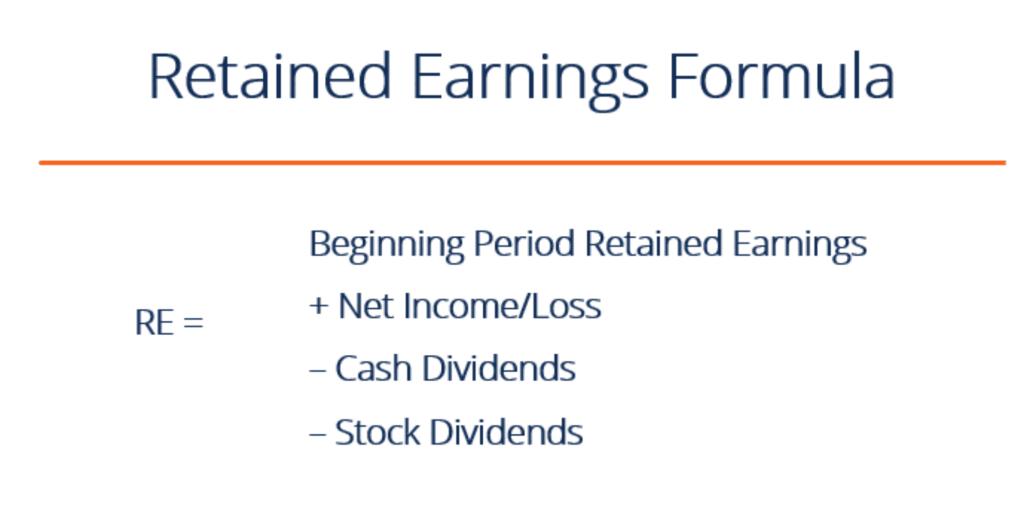

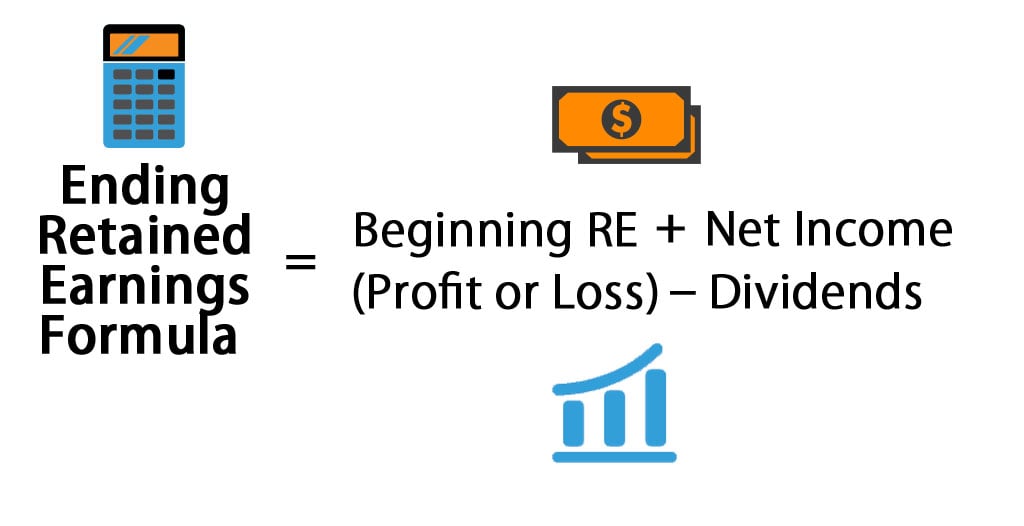

Formula for retained earnings. Retained earnings formula and calculation. Here’s the basic formula for calculating retained earnings: What is the retained earnings formula?

This article explains how to find your company's. Cash dividend , if paid any, can be figured out from financing activity from cash flow statements. Steps to prepare a retained earnings statement

Reviewed by dheeraj vaidya, cfa, frm full bio follow what are retained earnings? Finally, subtract the value of net dividends paid to shareholders. Subtract any dividends paid out of that net income.

The retained earnings formula provides a way to calculate a company's retained earnings at the end of a specific period: Retained earnings are calculated by subtracting distributions to shareholders from net income. The retained earnings calculation is as follows:

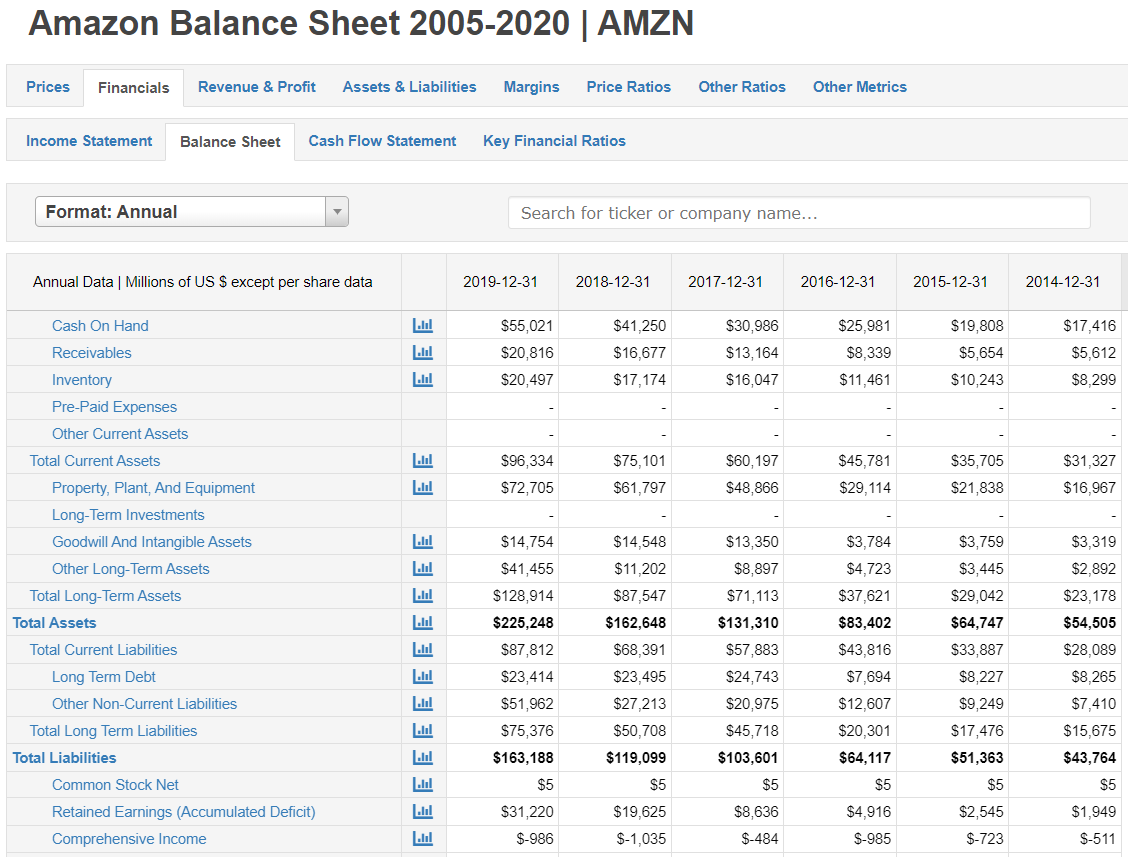

Retained earnings formula example below is an example n how to calculate retained. To calculate retained earnings subtract a company’s liabilities from its assets to get your stockholder equity, then find the common stock line item in your balance sheet and take the total stockholder equity and subtract the common stock line item figure (if the only two items in your stockholder equity are common stock and retained earnings). Since late october, a2 has grown its market share of chinese and english label infant formula in the country from 4.9% to 6.4%.

Do you have a firm grasp on the retained earnings formula? The retained earnings are calculated by adding net income to (or subtracting net losses from) the previous term’s retained earnings and then subtracting any net dividend(s) paid to the. Here is the retained earnings formula:

Put in equation form, the formula for retained earnings in a stock dividend is: You can use the following formula to calculate retained earnings: Each category on the balance sheet can be divided into smaller subcategories.

Example of a stock dividend calculation. On the assets side of your balance sheet, you should find a line for items like cash, accounts receivable and other current assets. Let’s say that in march, business continues roaring along, and you make another $10,000 in profit.

Retained earnings (re) are created as stockholder claims against the corporation owing to the fact that it has achieved profits. Determine the net income or earnings. Ending retained earnings:

This amount gives companies clarity on how much money their business has after paying off all their dues, including the share of the investors. This means that on april 1, retained earnings for the business would be $14,000. Start with the beginning balance of your retained earnings.