Fun Tips About Managerial Accounting Income Statement Spreadsheet

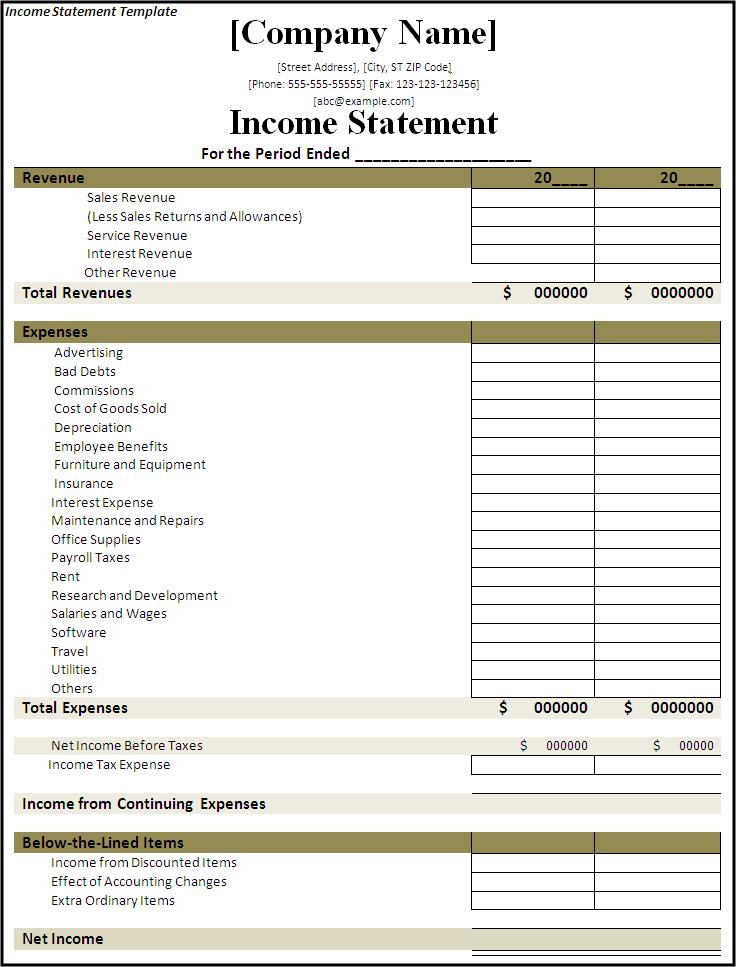

An income statement is one of the three important financial statements used for reporting a company’s financial performance over a specific accounting period.

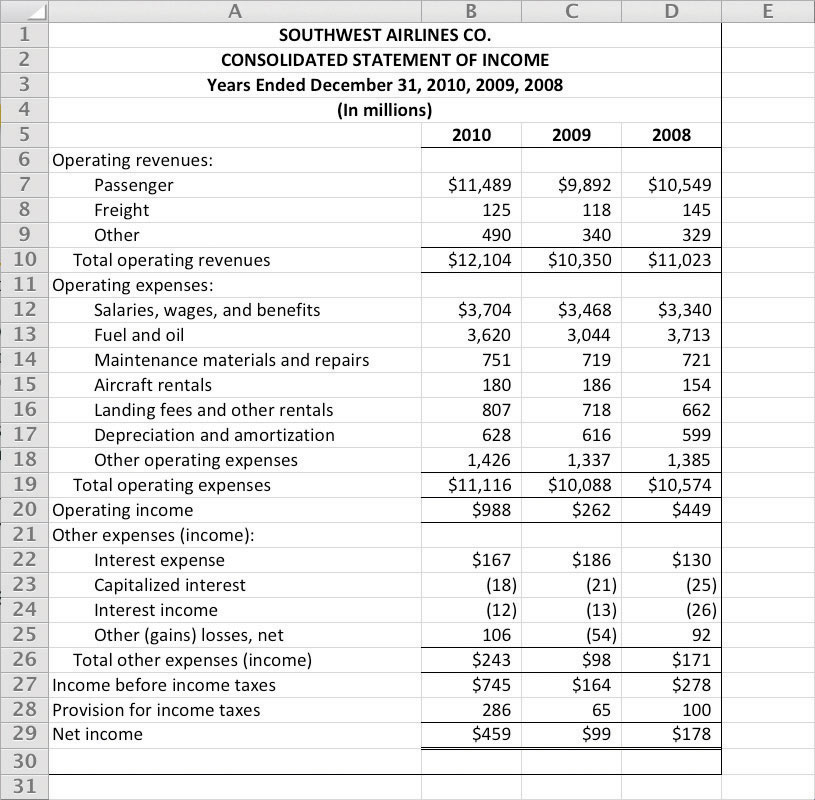

Managerial accounting income statement. Companies that provide services, such as ernst & young (accounting) and accenture llp (consulting), do not sell goods and therefore have no inventory. It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually. This pro forma income statement is based on the sales budget that projected volume to increase by 5% each quarter, reflecting higher demand due to increased marketing and a selling price for each seat set at $34, which is not scheduled to be increased during the budget period (year):

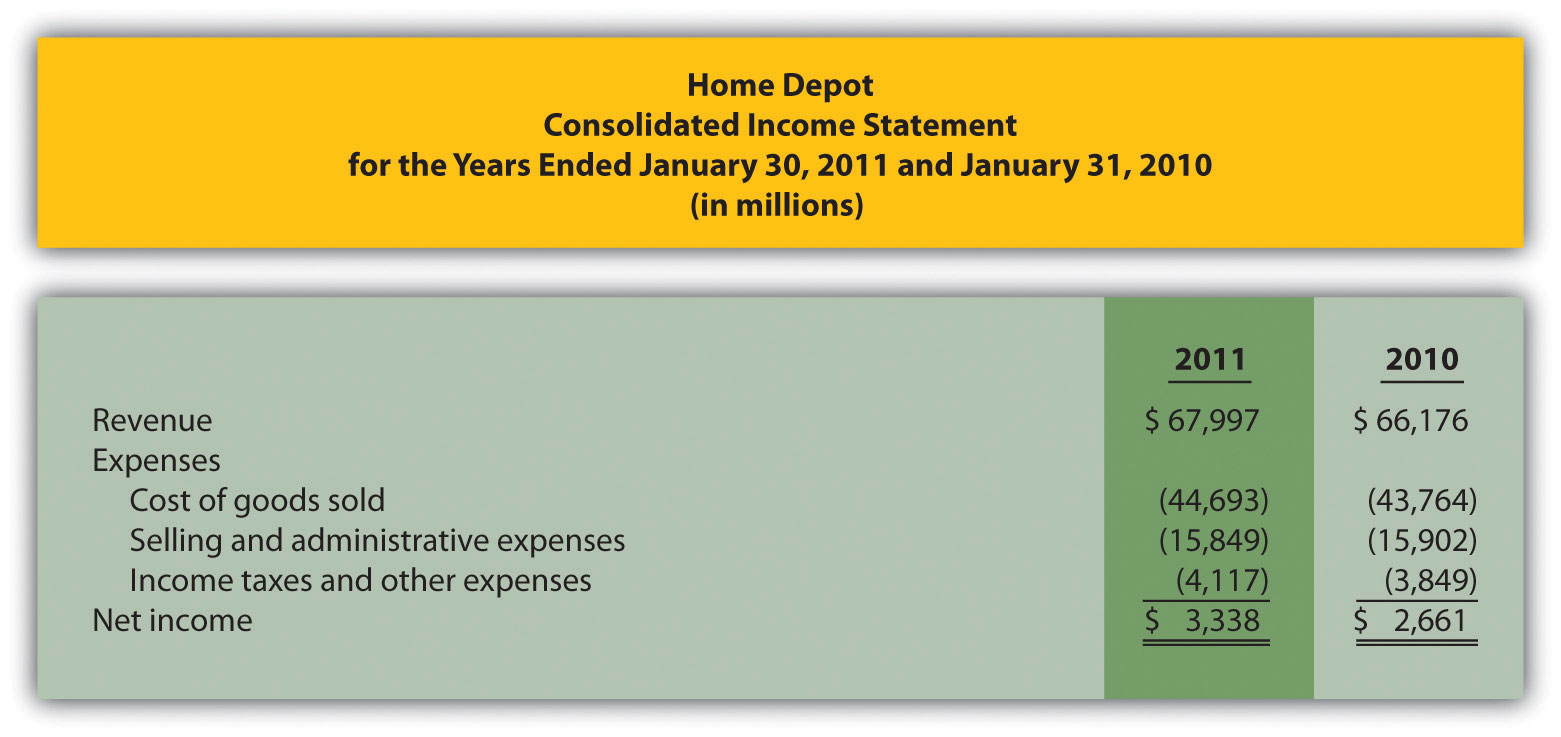

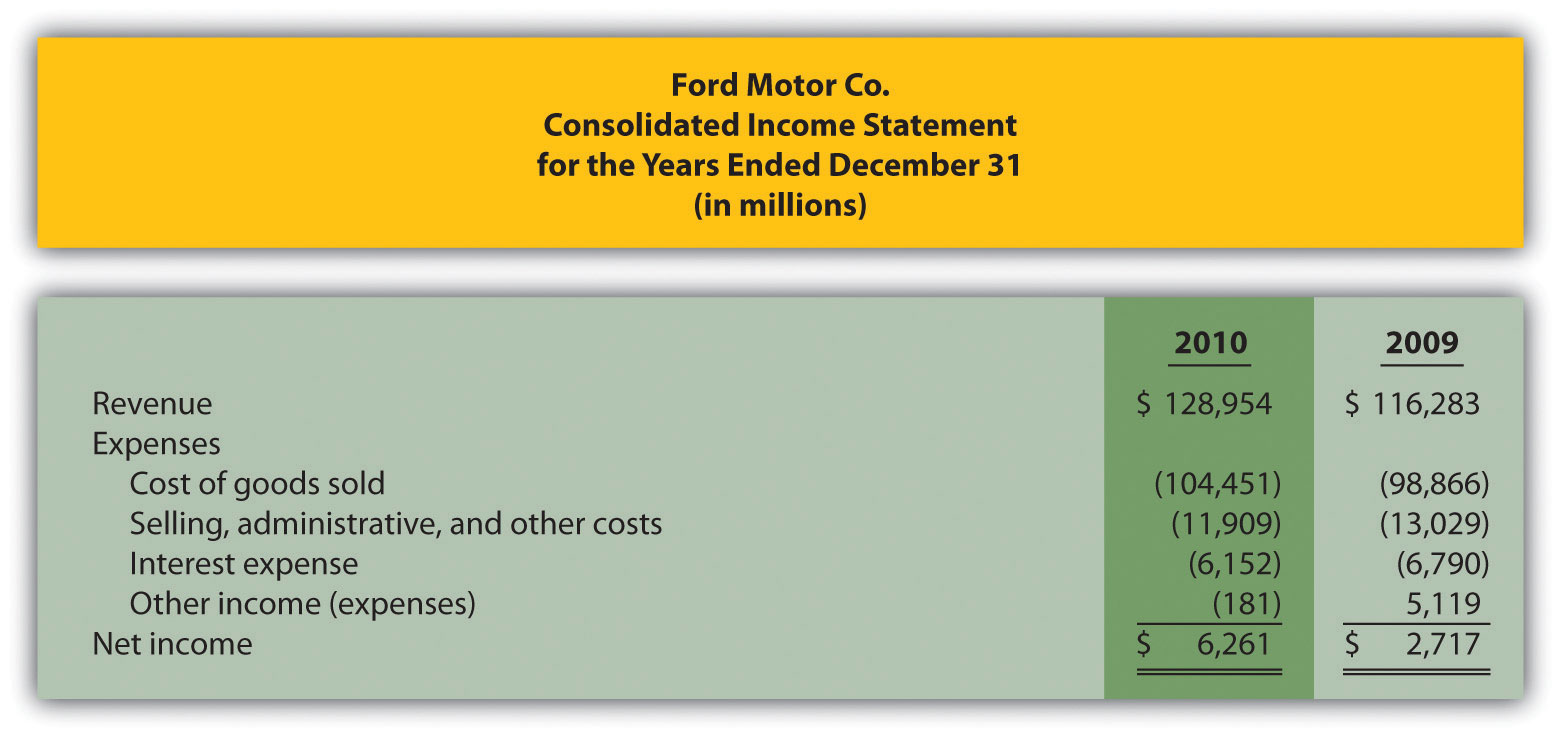

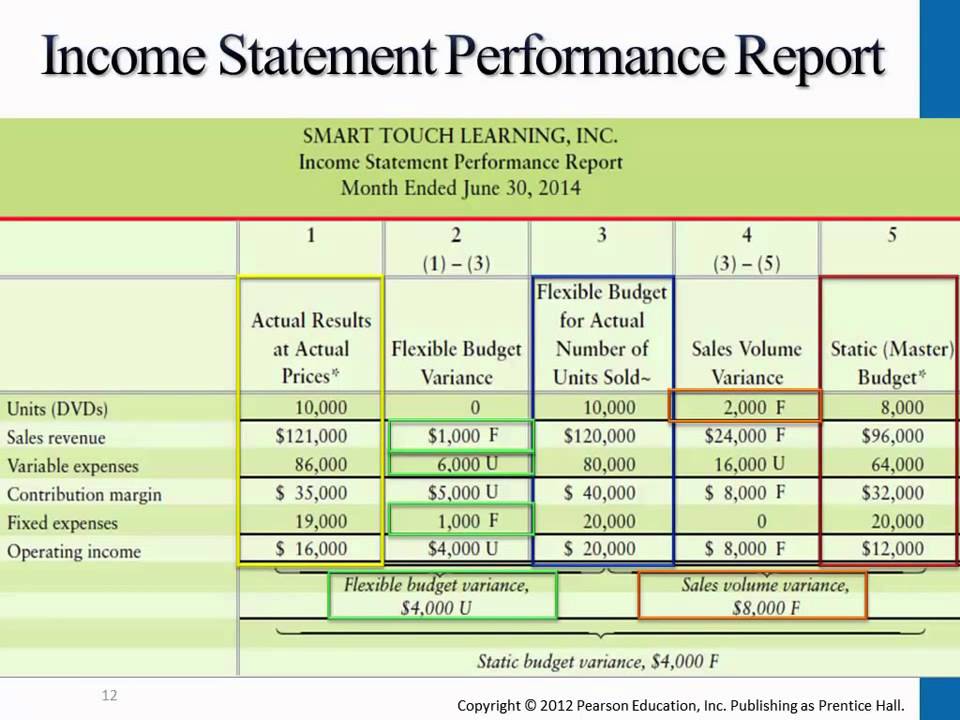

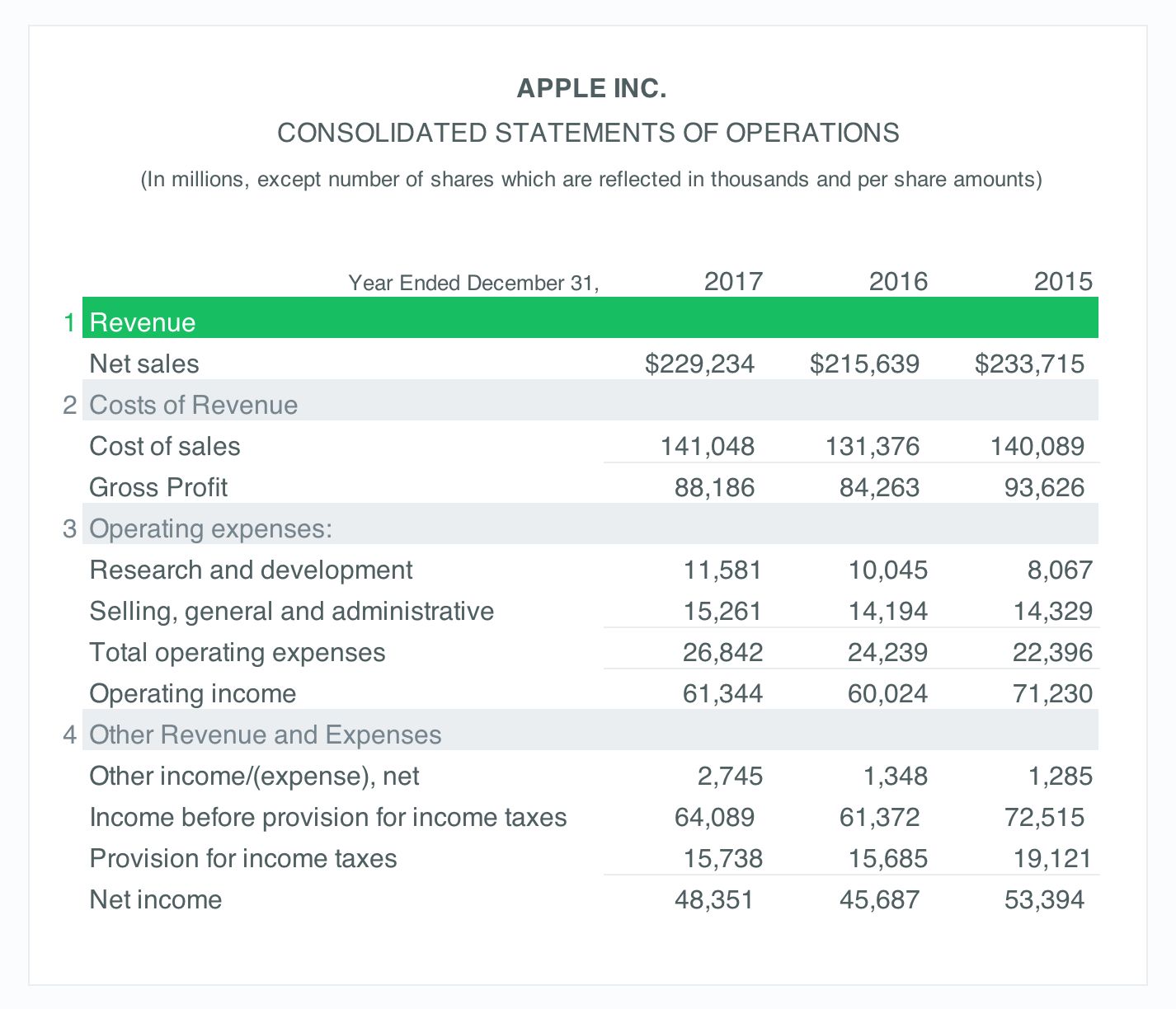

In contrast, financial accounting reports are highly regulated, especially the income statement, balance sheet, and cash flow statement. The income statement, statement of retained earnings, balance sheet, and statement of cash flows, among other financial information, can be analyzed. This income statement looks at costs by dividing costs into product and period costs.

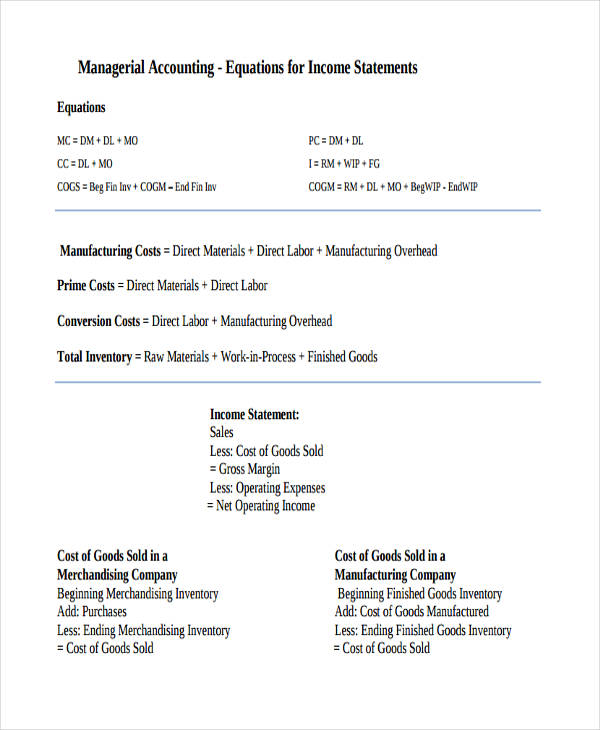

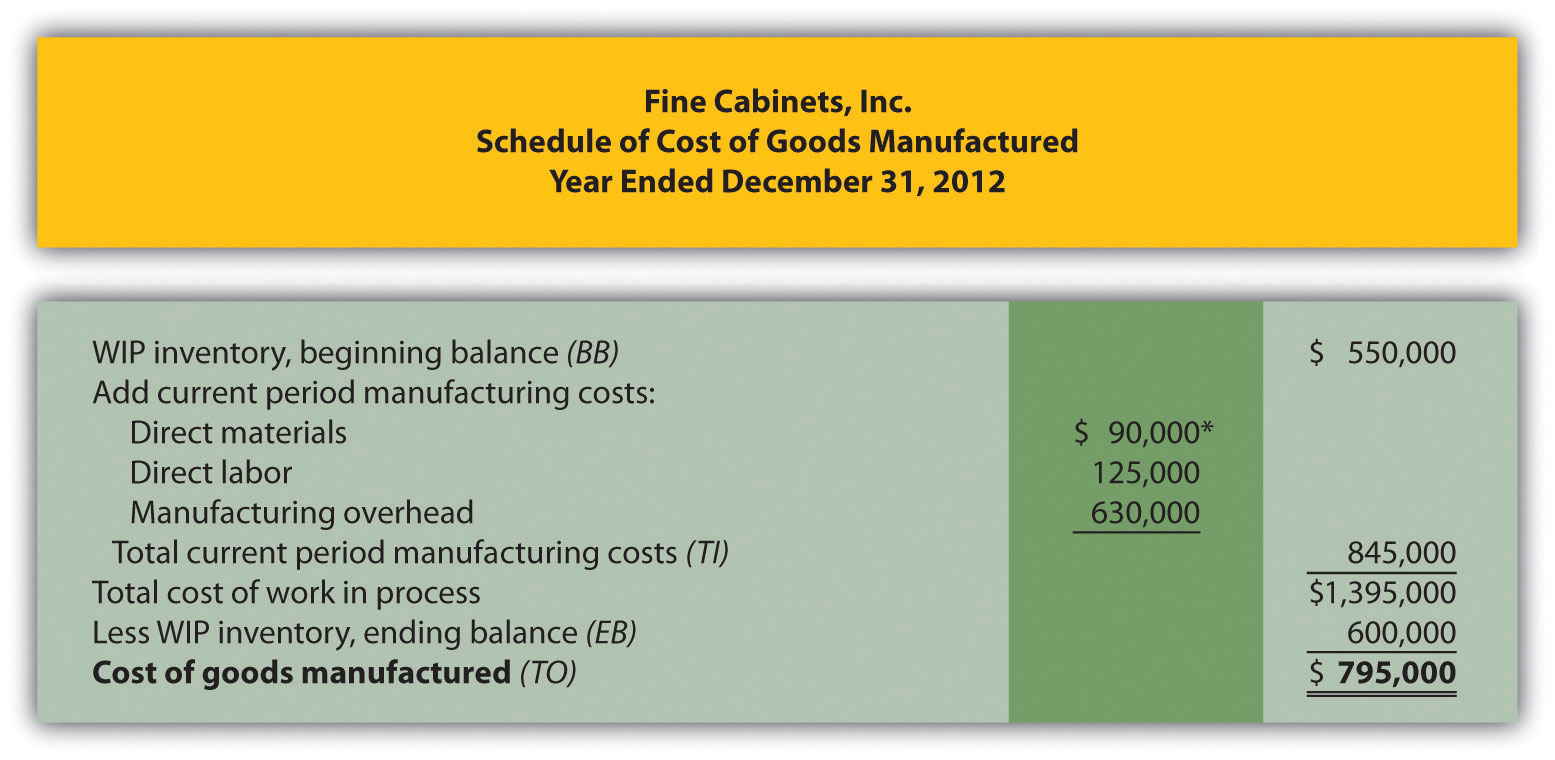

Managerial accounting is the practice of identifying, measuring, analyzing, interpreting, and communicating financial information to managers for the pursuit of an organization's goals. Learning objective describe how to prepare an income statement for a manufacturing company. An income statement provides information regarding the results of operations of a business, or otherwise known as financial performance.

Accounting is like a financial toolbox with various specialized tools. Income statements for manufacturing companies. While both these types of accounting deal with numbers, managerial accounting is strictly for internal use.

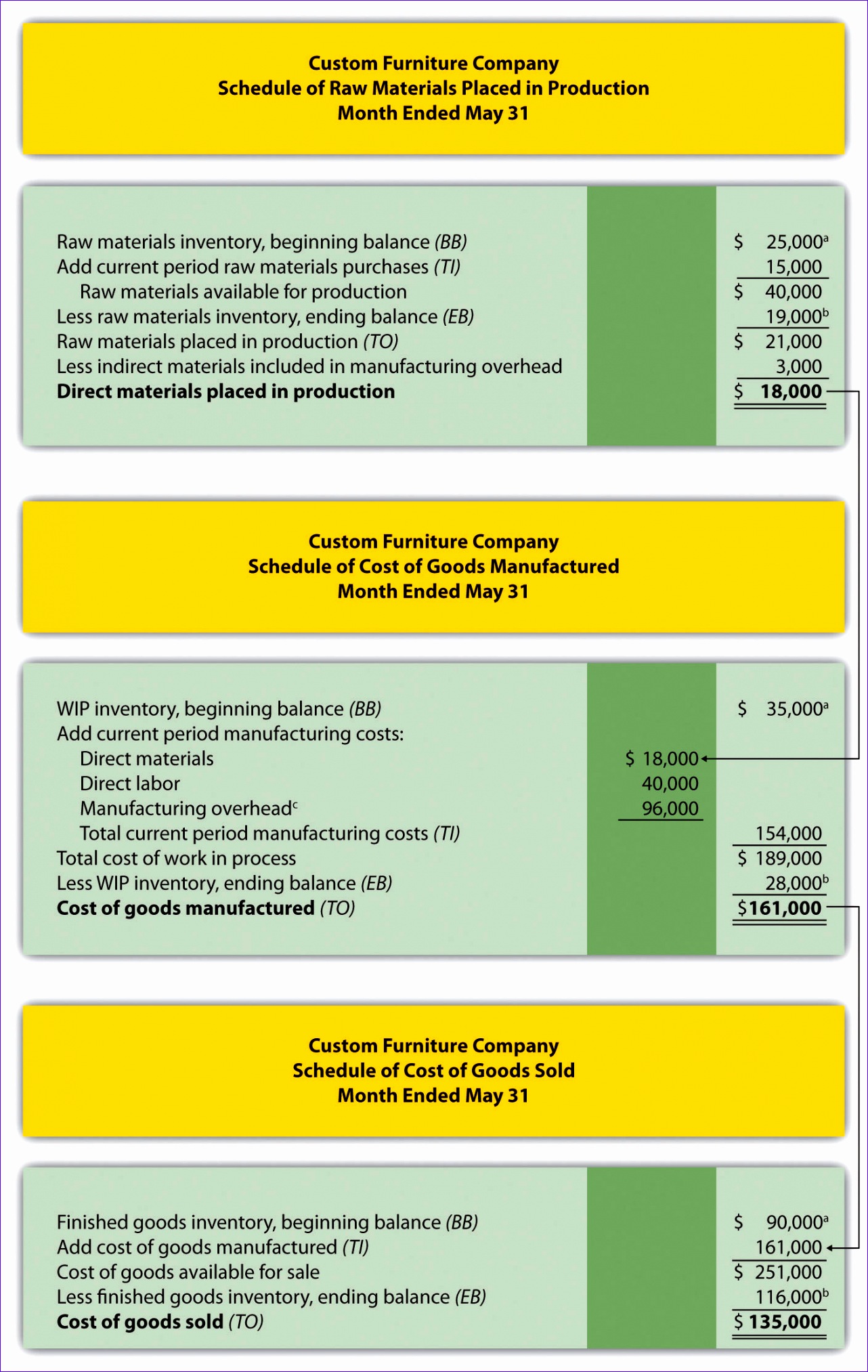

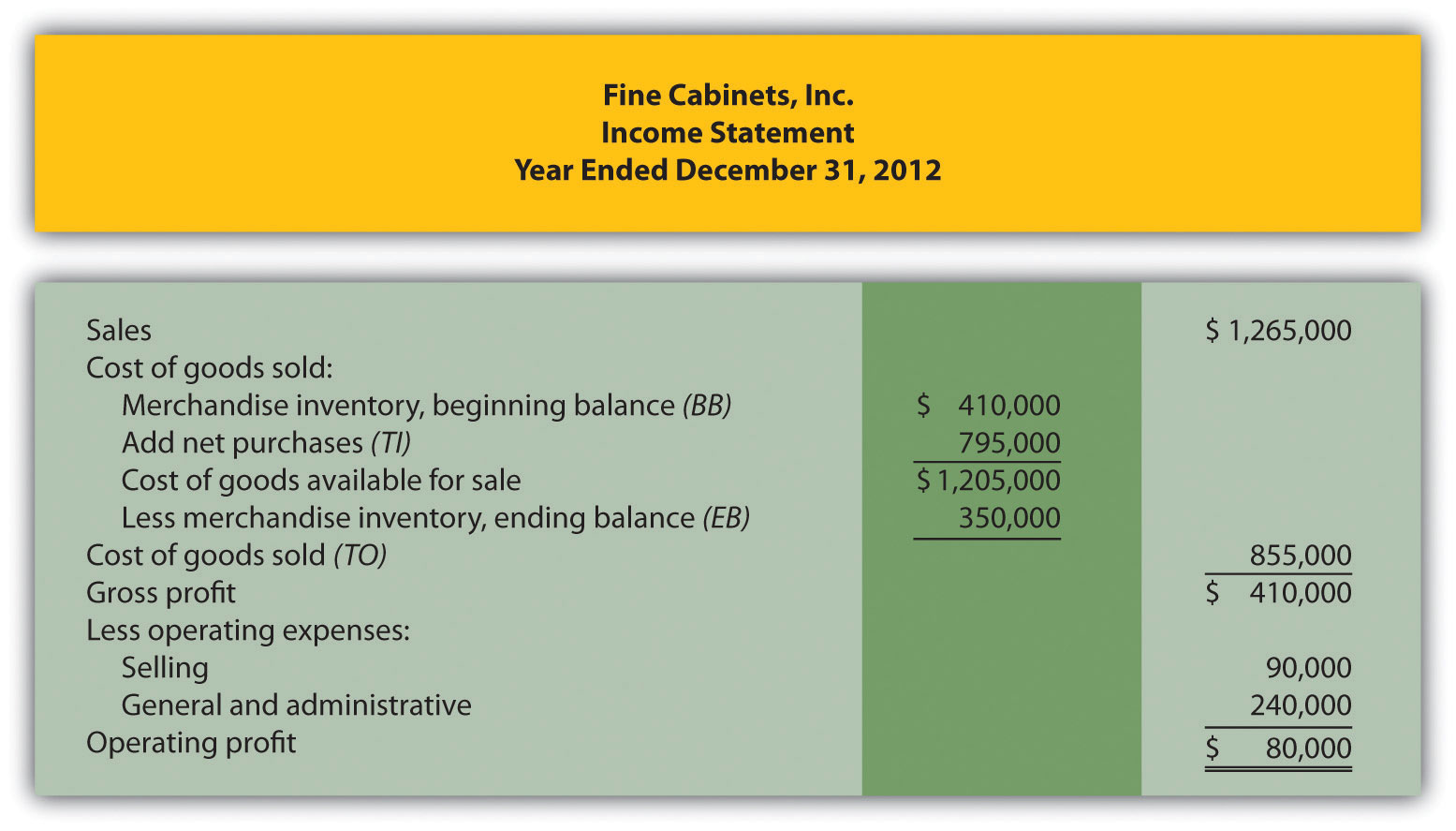

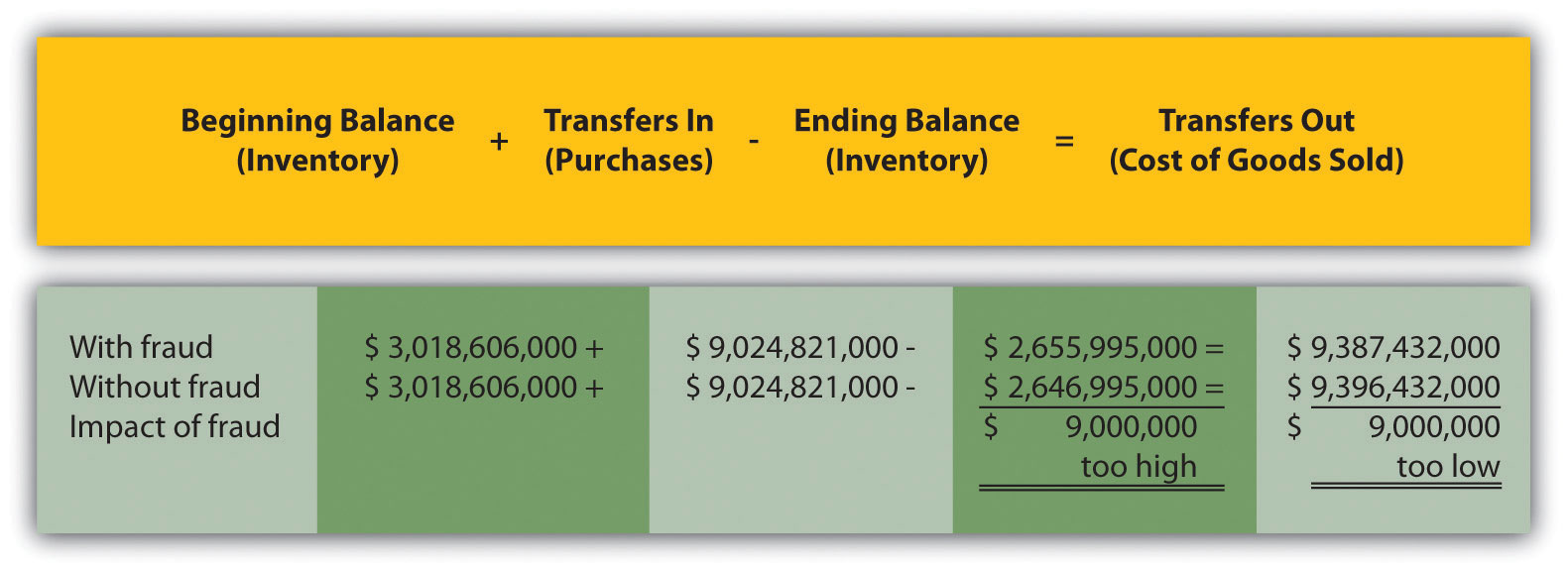

Accountants need all these amounts—raw materials placed in production, cost of goods manufactured, and cost of goods sold—to prepare an income statement for a manufacturing company. Since this information is released for public. Discussion of a merchandising company and the income statement;

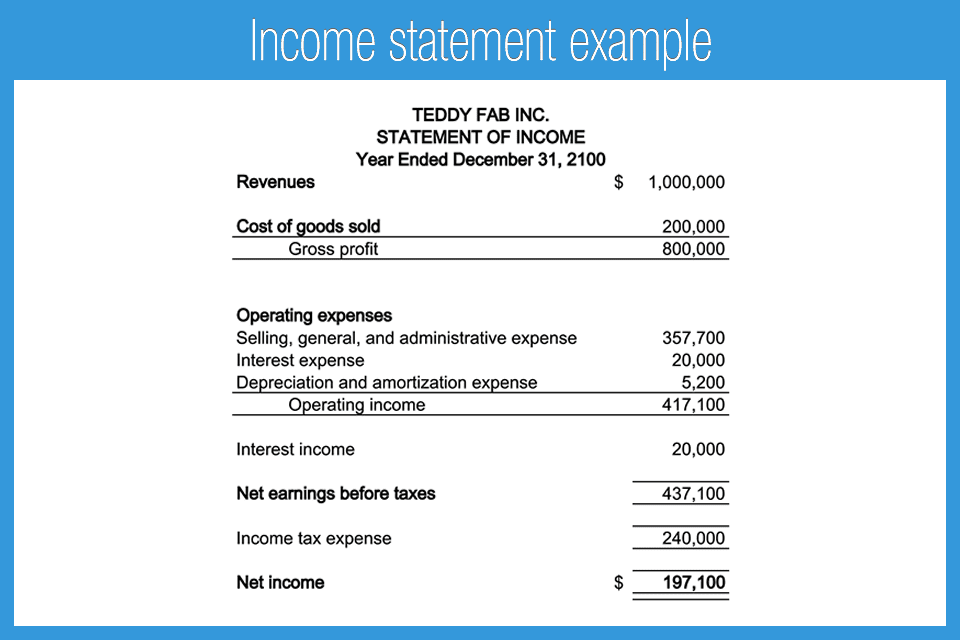

Income statements for service companies introduction / by kristin / 4 comments service companies have the most basic income statement of all the types of companies. Accounting is like a financial toolbox with various specialized tools. To help accountants prepare and users better understand financial statements, the profession has outlined what is referred to as elements of the financial statements, which are those categories or accounts that accountants use to record transactions and prepare financial statements.

9.6 segmented income statements concepts used in segmental analysis to understand segmental analysis, you need to know about the concepts of variable cost, fixed cost, direct cost, indirect cost, net income of a segment, and contribution to indirect expenses. An income statement is a financial report detailing a company’s income and expenses over a reporting period. In order to complete this statement correctly, make sure you understand product and period costs.

Income statements depict a company’s financial performance over a reporting period. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. Key finance and accounting personnel.

The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. To make the manufacturer’s income statement more understandable to readers of the financial statements, accountants do not show all of the details that appear in the cost of goods manufactured statement. We describe how to calculate these amounts using three formal schedules in the following order:

Ethical issues facing the accounting industry. There are three main types. a&i financials on instagram: The accounting process and income statement for service companies are relatively simple.