Can’t-Miss Takeaways Of Tips About Enron Off Balance Sheet Income Tax Profit And Loss Statement

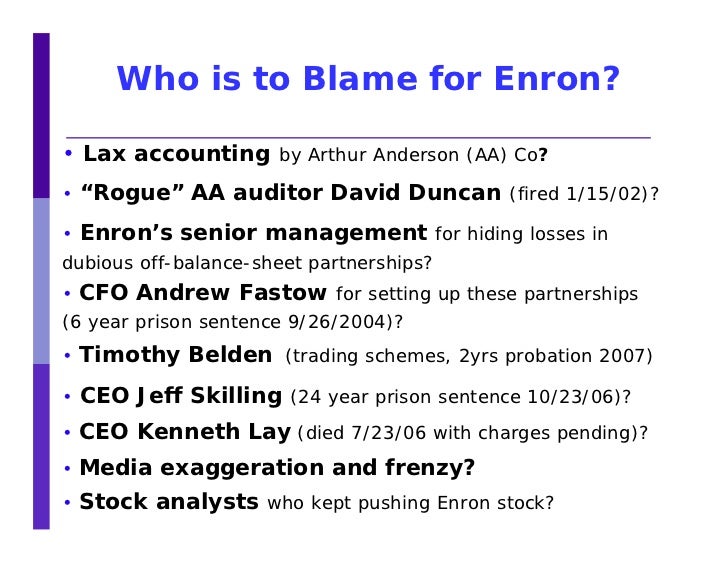

Conflicts of interest abounded:

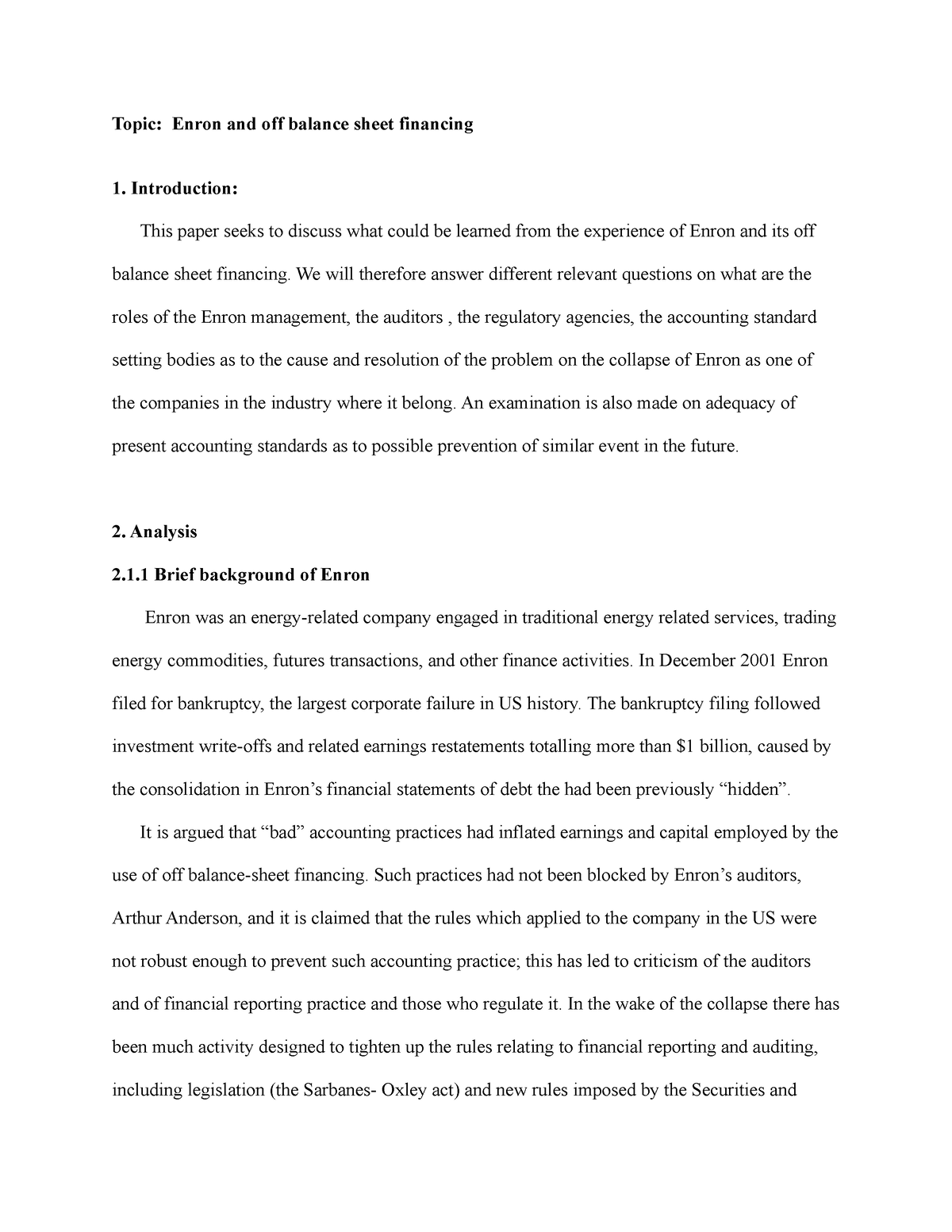

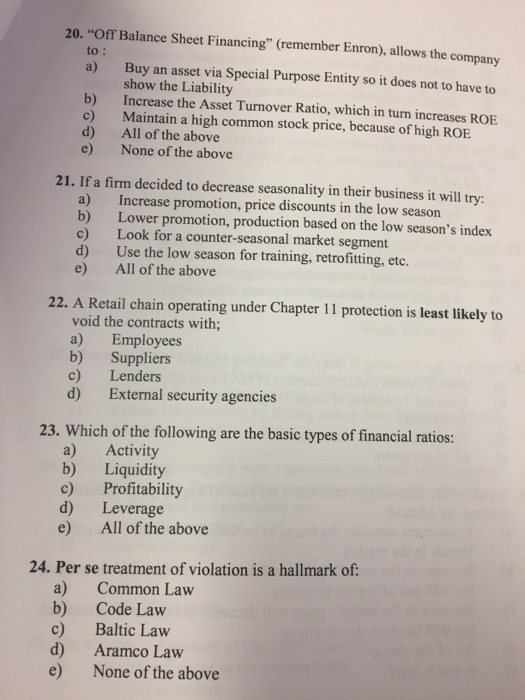

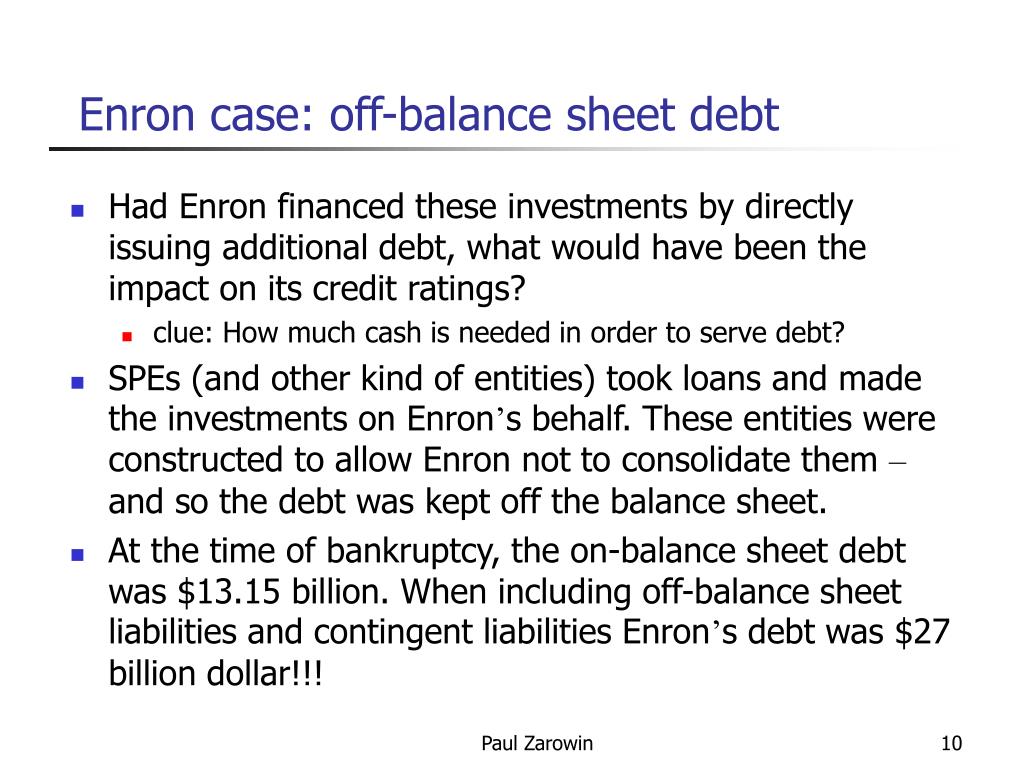

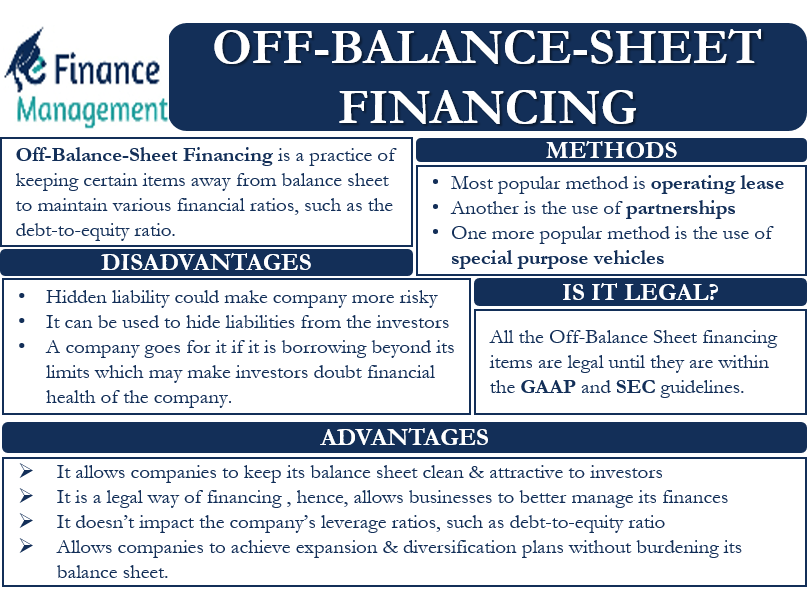

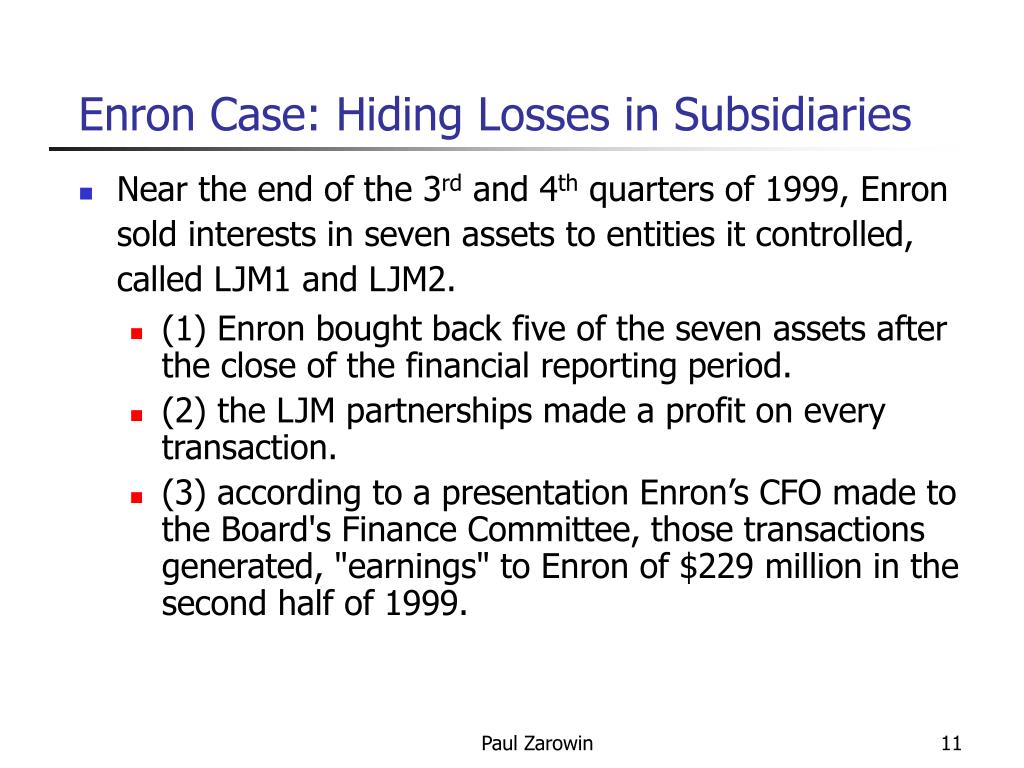

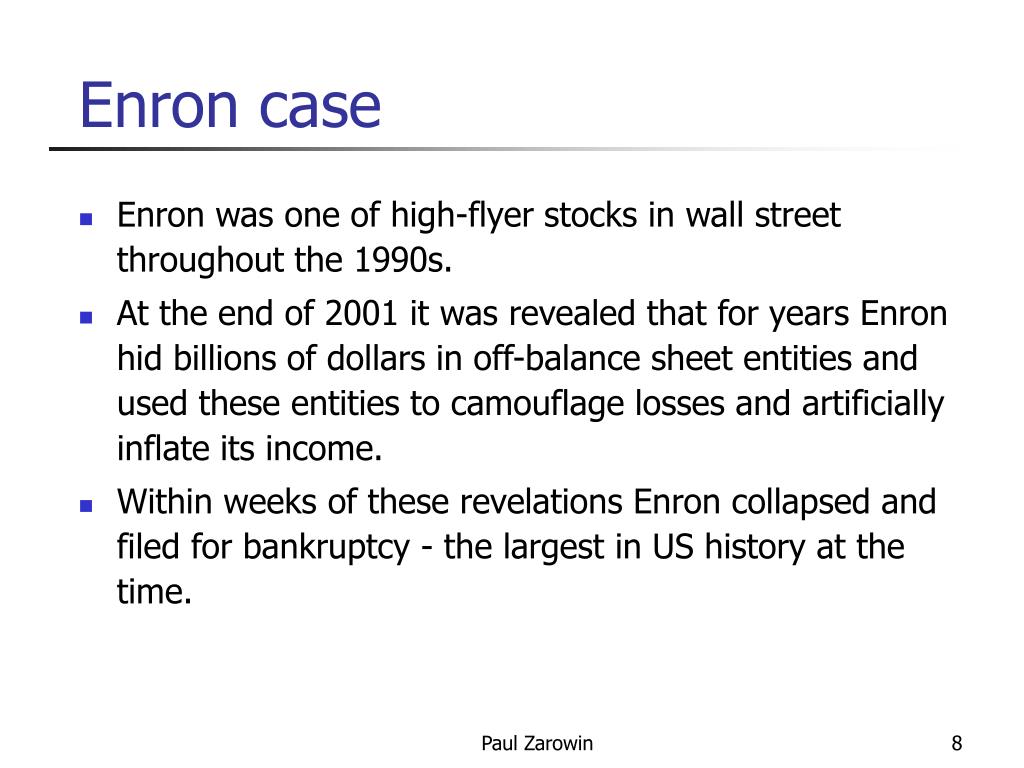

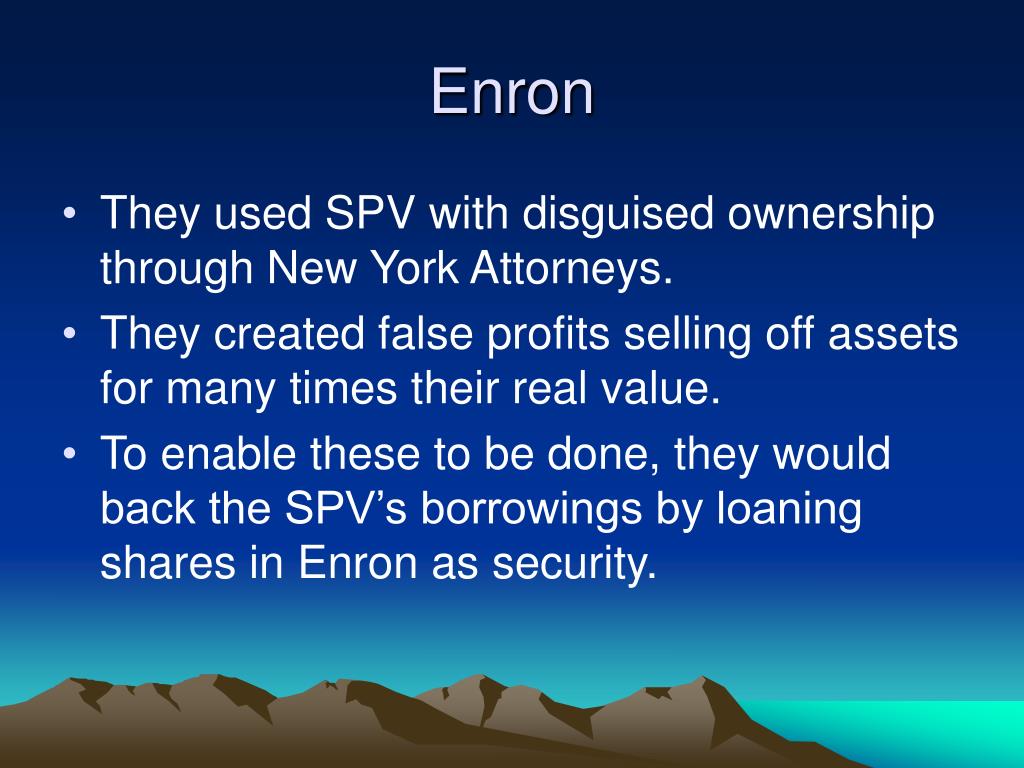

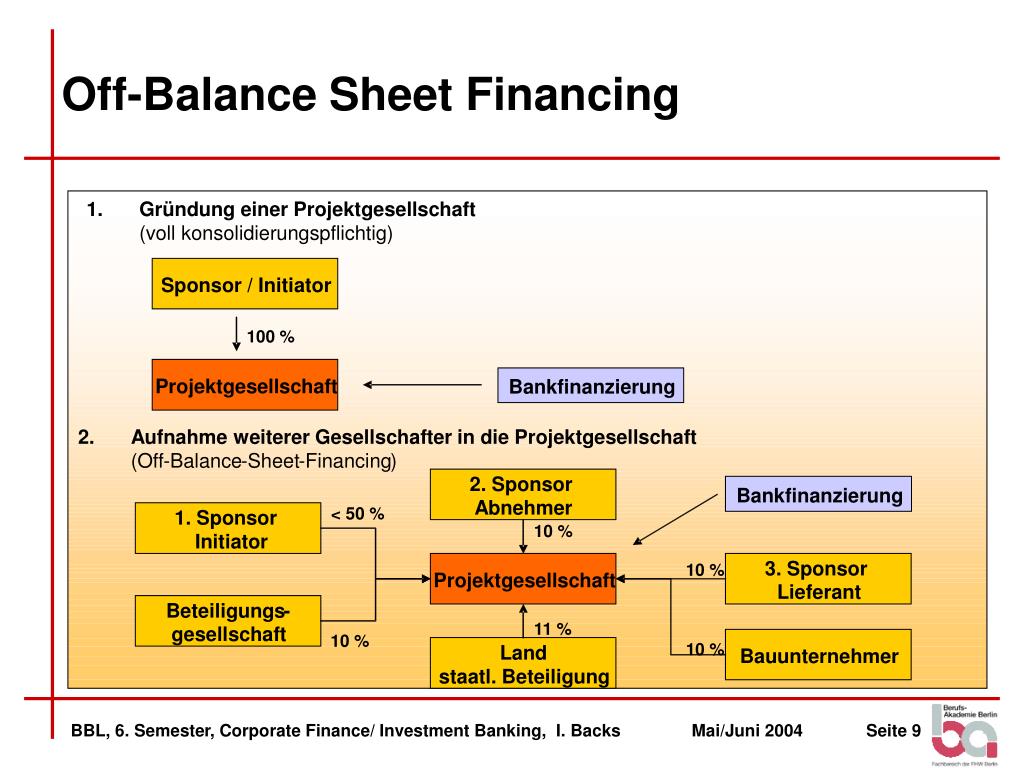

Enron off balance sheet. The purpose of this article is to summarize preliminary observations about the collapse, as well as changes in financial reporting, auditing and corporate governance that are. Enron would transfer some of its rapidly rising stock to the spv in exchange for cash or a note. As the company began to implode, enron’s board commissioned a special committee to investigate the implicated.

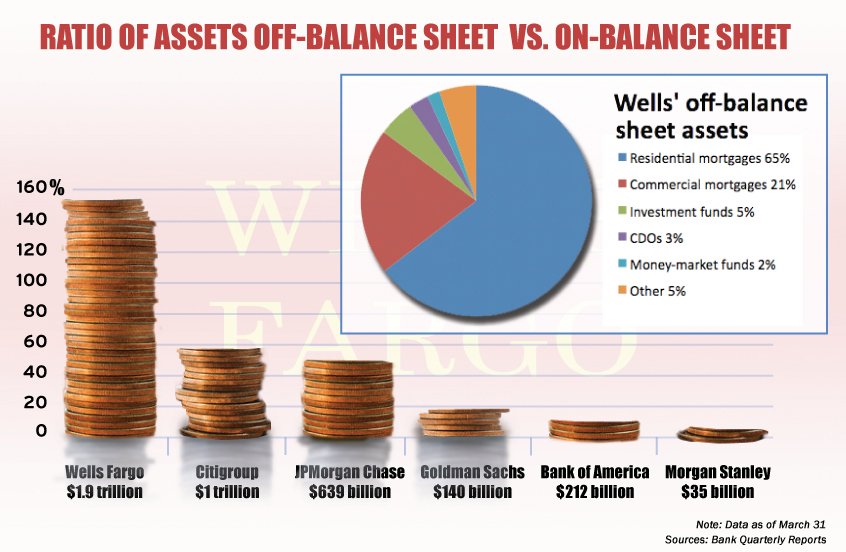

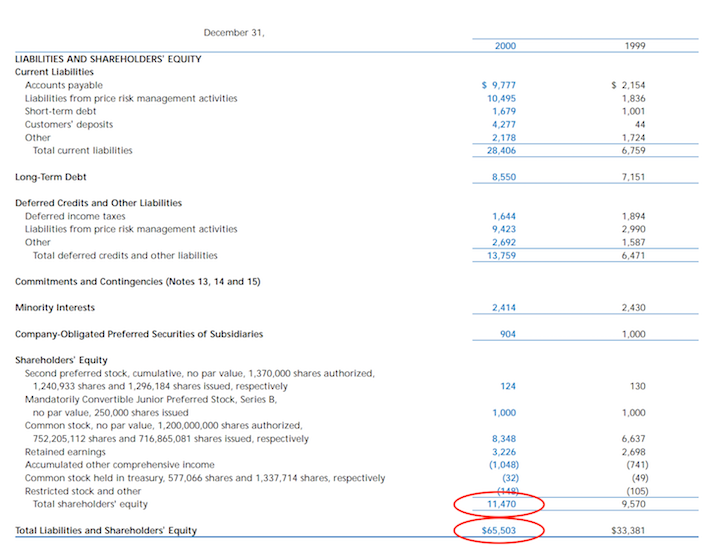

The collapse of enron, which held more than $60 billion in assets, involved one of the biggest bankruptcy filings in the history of the united states, and it generated. The critical importance of board oversight. Although not recorded on the balance sheet, they are still.

The bill passed in 2002 and has been. Heisler said about 40% of deloitte’s revenue comes from the audit and tax side of its business. An enron employee leaves the company’s headquarters in houston.

[3] many executives at enron were indicted. By martha lagace the train wreck that was enron provides key insights for improving corporate governance and financial incentives as well as organizational. Investors use balance sheets to understand a company's.

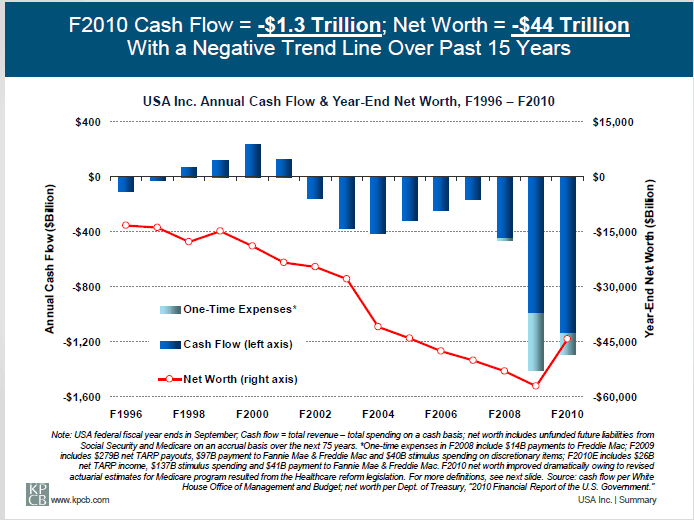

The off balance sheet transactions and complex reporting methods created information asymmetry, and also disrupted the efficient market hypothesis for enron. History until the worldcom scandal the following year. The remaining 60% comes from advisory and consulting.

Although they may not be. The scandal that followed enron's failure to disclose billions of dollars of debt held by off‐balance‐sheet entities (obses) prompted investor interest in these entities.