Cool Info About Gst Payable In Balance Sheet Cathay Pacific Financial Statements

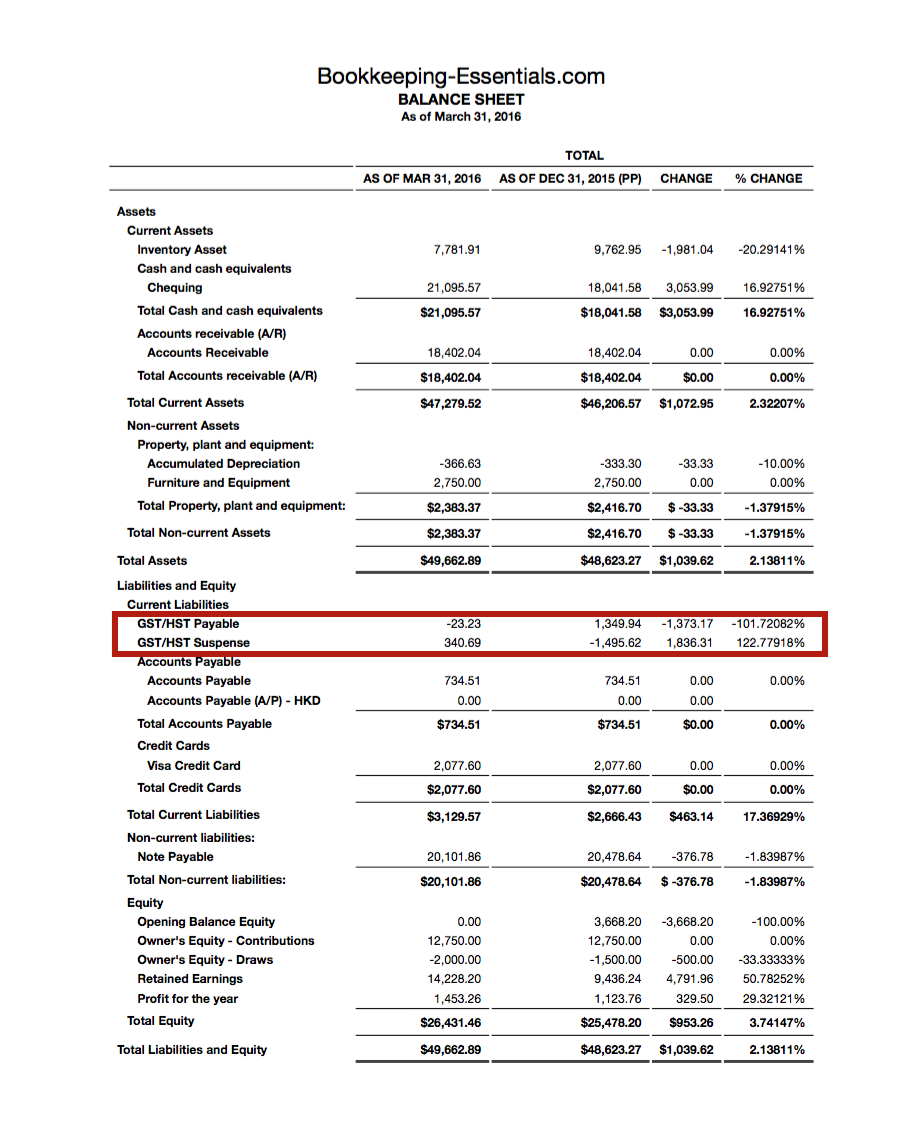

Level 1 posted may 18, 2023 07:21 pm last updated may 18, 2023 4:21 pm why is there a gst suspense, gst net, and gst payable lines on the balance sheet?

Gst payable in balance sheet. Composition fees is an expense and thus show as indirect expense in profit and loss account. The amount of gst normally paid on a property sale is equal to one eleventh of the total sale price. What are the gst filing deadlines?

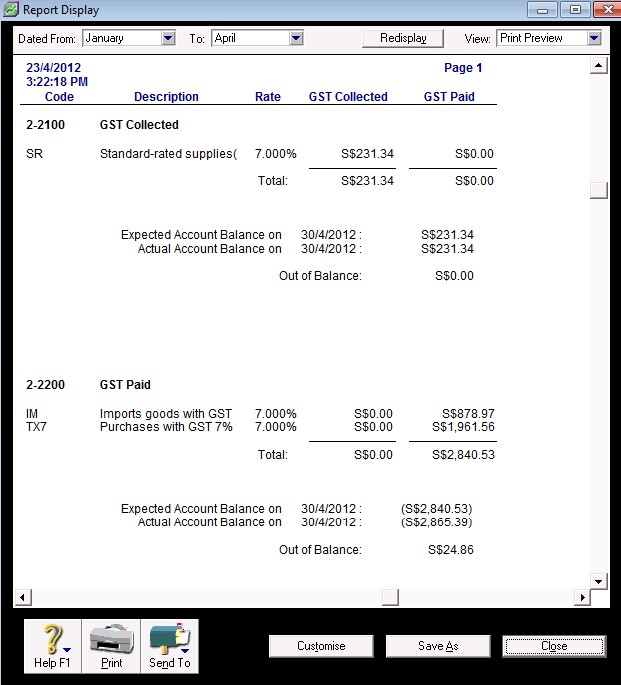

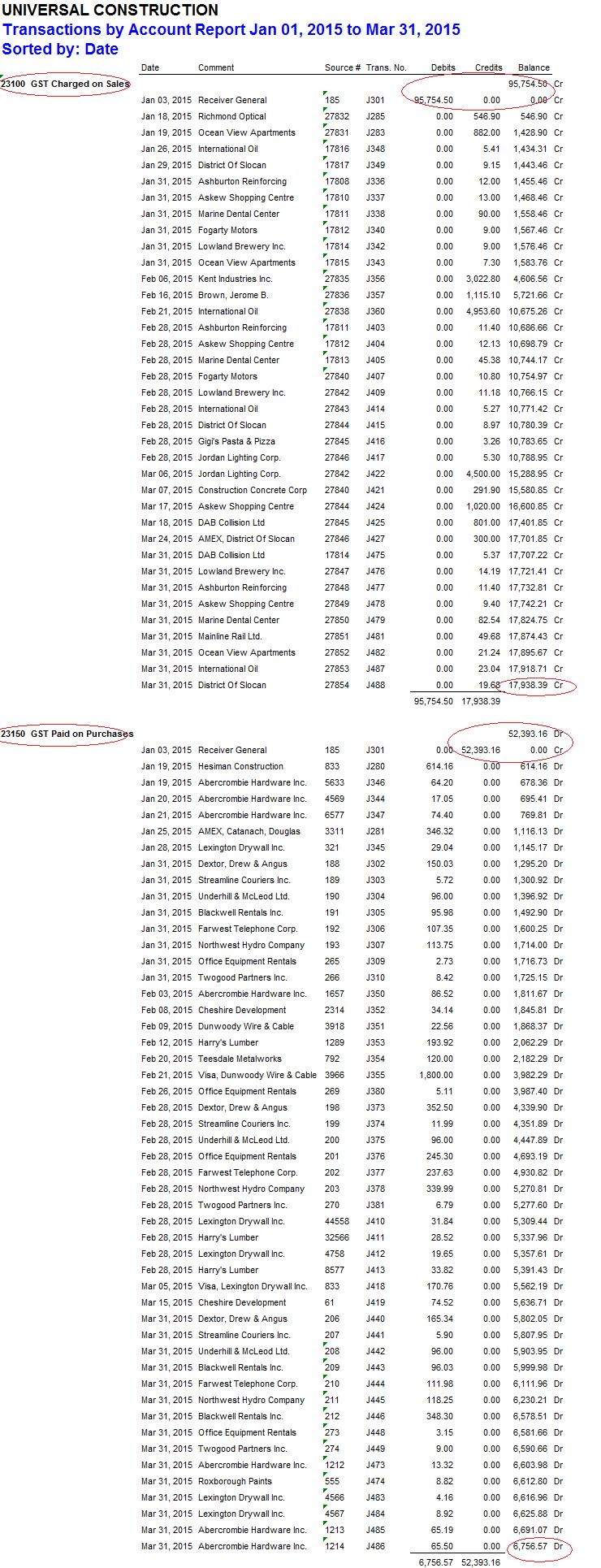

Overview if there are differences between your bas and the profit and loss or balance sheet reports, check out these topics before you contact support. The net amount of gst recoverable from, or payable to, the taxation authority shall be included. Receivables and payables shall be stated with the amount of gst included.

Let me share them with you so we can get. If your organisation uses the cash basis for gst, the gst account summary breaks down gst outstanding at the end of the reconciliation period so you can reconcile it to the. There are some things that we need to consider why your gst payable account isn't the same with your gst return.

1 reply steven_m 45,180 posts former staff new zealand september 2018 hi @aplus the balance sheet value of an account is made up of the opening balance of the. Impact of gst on accounting. Since shares are covered under securities under cgst act and the same is excluded from the definition of goods /.

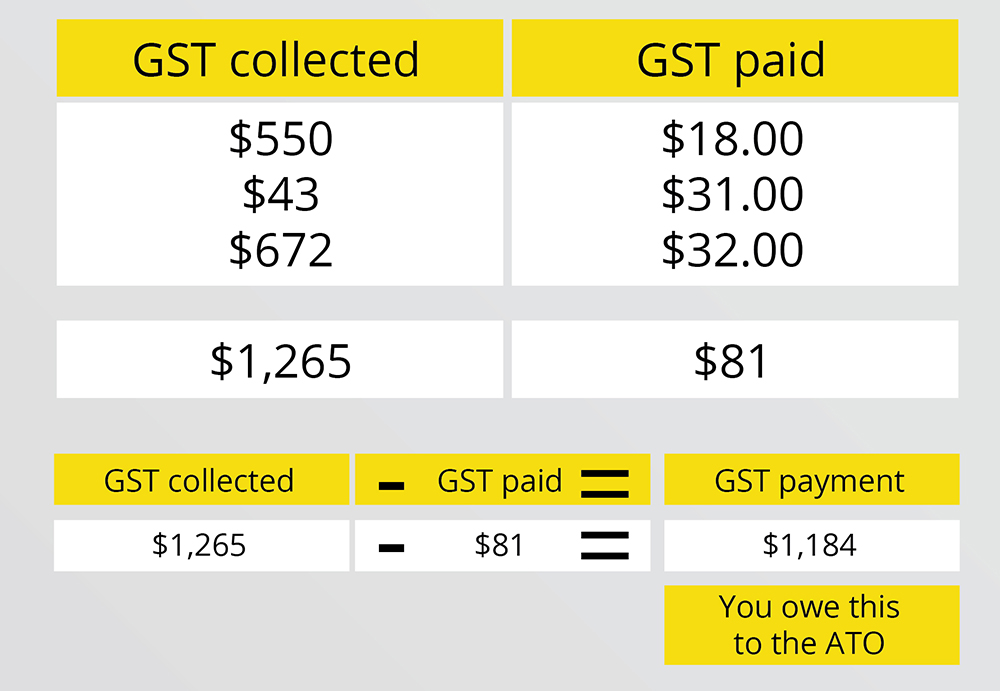

When using the margin scheme, the amount. Total tax payable = 2,025 + 2,025 = 4,050. As we can not so that amount.

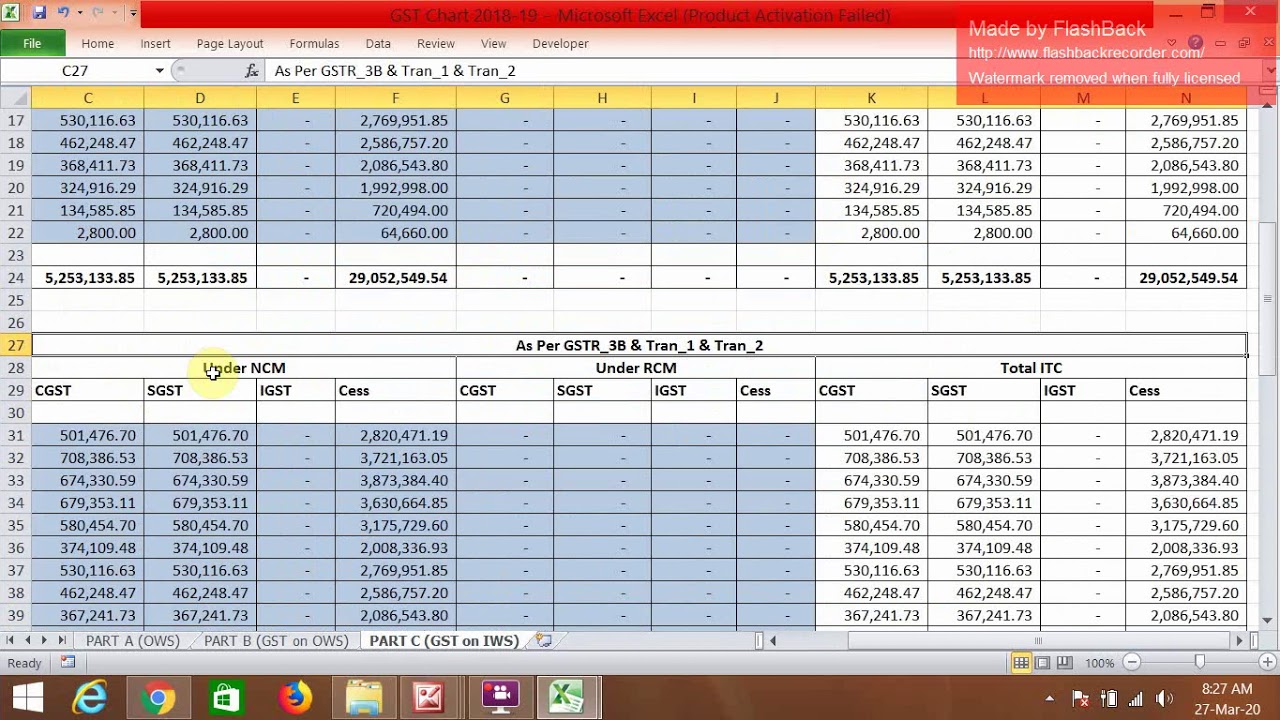

Impact on profit and loss account and balance sheet. If we do not avail the itc of and expense the wat amount will we going to take in balance sheet the one without gst or including gst.

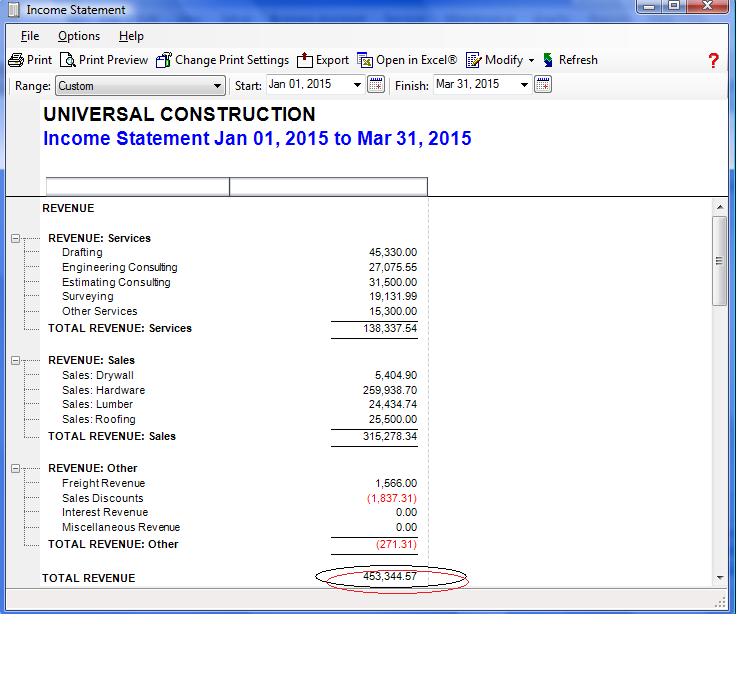

This gst checklist discusses the considerations that need to be kept in mind before finalising the profit and loss account. For this, he needs to keep in mind several considerations with regard to gst to ensure that the financials give a true and fair view. Balance sheet gst collected and paid less receivables with tax/payables with tax should equal the gst collected/paid cash report amounts but on this occasion both amounts.

If raj has any itc left after paying his tax obligations, it will be. Under the gst number search regime, the taxpayer is required to maintain the following accounts which is said to be gst payable journal entry in the tally and also. Making an adjustment.