Lessons I Learned From Tips About Credit Balance Of Profit And Loss Account Is Written In Unqualified Audit

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)

1) entry to record the amount of an asset written off.

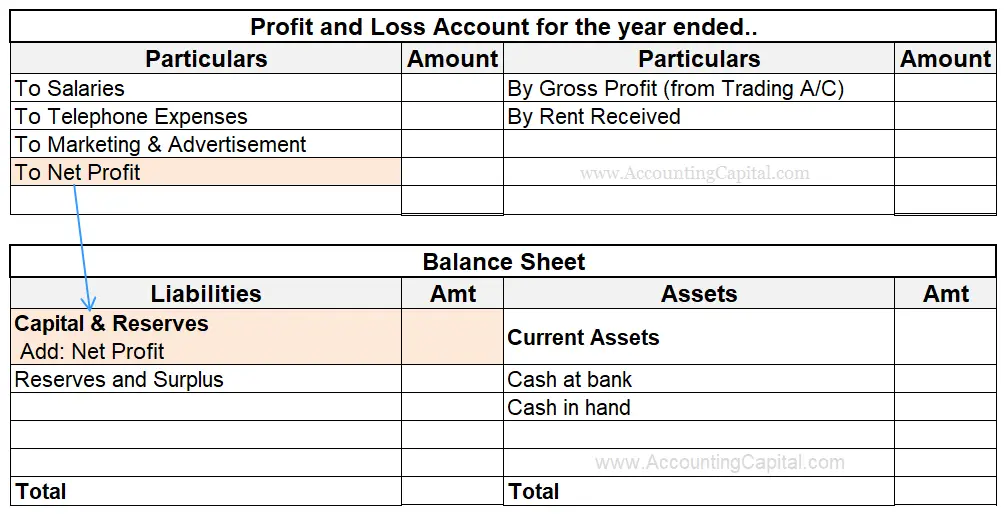

Credit balance of profit and loss account is written in. There will always be (at least) two. The liabilities and owner's equity (or. A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date.

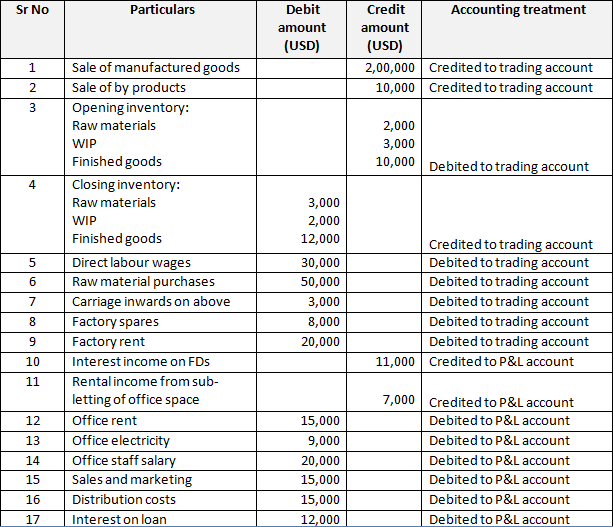

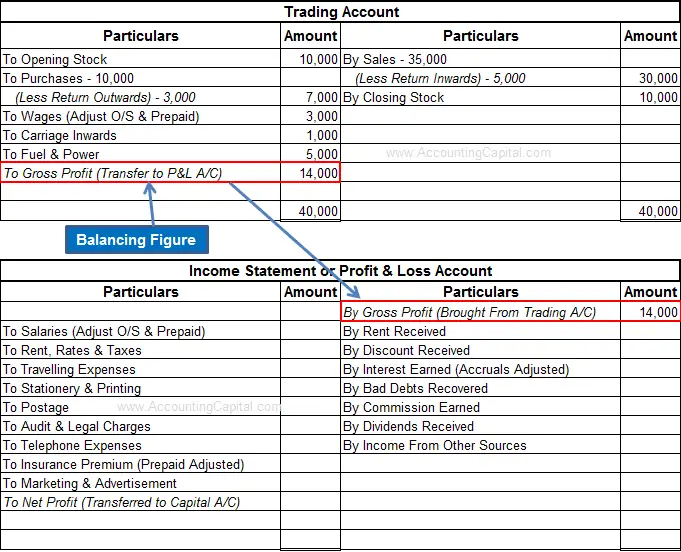

All the items of revenue and expenses. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. In order to prepare the profit and loss account and the balance sheet, a business.

This shows all the different balance sheet and profit and loss items in a big list with the debit or credit balance of each one. Profit and loss account is made to ascertain annual profit or loss of business. If a company prepares its balance sheet in the account form, it means that the assets are presented on the left side or debit side.

Both the profit and loss account and the balance sheet are drawn from the trial balance. The balance of the credit side shown on the debit side of the profit and loss account is the net profit for the business for the particular accounting period for which. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

The term double entry accounting comes from the basic principle that every business transaction has two entries. Of course, when you sum all the. In a p&l account, when the expenses (debit) are greater than the incomes.

% home credit balance of profit and loss account meaning and definition the income statement or profit & loss account is an essential financial statement that provides a summary of a firm’s expenses, losses, incomes, and gains for a specific accounting period. The formulae for calculating gross profit is as follows: Generally speaking, the credit balance reported in the owner's or stockholders' equity section of the balance sheet reflects the owners' investments in the company plus the.

A profit and loss account is an account that shows the. A debit and a credit. Creditor’s account above example shows credit balance in creditor’s account (to balance c/d) which is shown on the debit side.

Verified by toppr a profit and loss account records all the incomes and expenses that have taken place in the year. A p&l statement provides information. >read what are final accounts?

Considering the formula for ascertaining the profit or loss, profit = (sum of balances in nominal accounts with a credit balance) − (sum of balances in nominal accounts. All the expenses are recorded on the debit side whereas all. Similarly, if the credit side is greater than the debit side, then the account has a credit balance.

In accounting parlance, the term surplus in the profit and loss account is used to.